Who Is the "Most Genuine in Crypto"? In-Depth C2C Review of Binance, OKX, and Huobi

TechFlow Selected TechFlow Selected

Who Is the "Most Genuine in Crypto"? In-Depth C2C Review of Binance, OKX, and Huobi

The most sincere thing in the crypto circle isn't an advertisement, but clearly explaining the risks.

Who is the "most sincere" C2C platform in the crypto space? In an industry known for its complexity, only sincerity wins trust.

Especially as November's market slid from its peak, with endless cries of "bear market here," more and more people are realizing—one thing matters most: whether your money can actually return to you.

Yet in the world of crypto C2C, risks never diminish with market cycles: frozen assets, disputes, merchants fleeing, no way to appeal... any single failure can make your assets "instantly disappear" within the real-world system.

So this long-form article isn’t about taking sides. It aims to answer one critical question: when risk truly strikes, which platform better protects its users?

This article evaluates the most mainstream and widely used platforms in the Chinese-speaking community—Binance, OKX, and HTX—from three perspectives: security, compensation systems, and user experience with risk controls. Information sources include: official announcements from all three platforms; feedback from KOLs and real Twitter users; and personal usage experience. For your reference and comparison.

1. Security: Avoiding freezes is 100x more important than compensation

In C2C, there’s only one truly devastating incident: asset freezing.

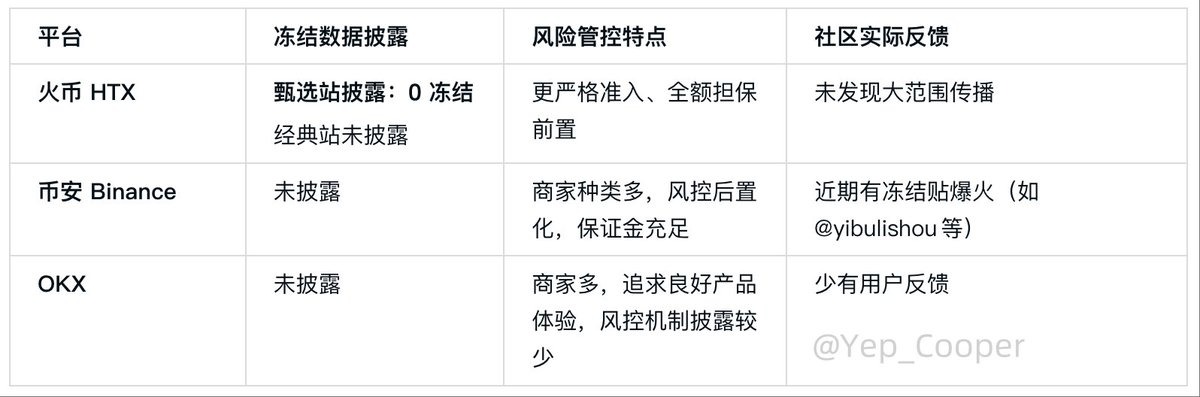

Below is a summary table comparing the three platforms on "freeze-related data and transparency":

Image via Twitter user @Yep_Cooper

The message is clear: avoiding freezes ≫ resolving freezes. One freeze is enough to make a user leave a platform forever. Among the three, HTX was the first to publicly disclose "0 freezes" data.

This act alone sets the industry standard for transparency.

For any platform, as trading volume grows and merchant ecosystems become more complex, risk control difficulty increases exponentially. Mechanisms can be continuously optimized, but if "freeze risk" cannot be effectively mitigated upfront, user experience will always hang in uncertainty.

2. Compensation Systems: All claim 100%? Surface-level uniformity masks huge differences

The rules of these platforms are as complex as credit card terms. Below is a clear, comprehensive review of each platform's compensation mechanism, ordered by launch date.

① HTX (first to launch 100% full compensation)

-

Launch date: Premium Zone launched April 7, 2025; 100% full compensation launched August 20, 2025

-

Public, transparent, no transaction amount limits

-

Labeled merchants = 100% compensation (single transaction cap: 10,000 USDT)

-

Apply within 30 days after judicial freeze

-

No additional fees required from users

② OKX

-

Launch date: August 27, 2025

-

Also offers up to 100% compensation

-

Rules are relatively clear

-

User interface and operations are friendly

-

Compensation limits for regular users are relatively low

③ Binance

-

Launch date: Tested Premium Zone on July 29, 2025; announced 100% compensation upgrade on September 15, 2025

-

Premium Zone: up to 100% compensation (Shield Merchant cap: 50,000 USDT)

-

Standard Zone: small amounts 100%, large amounts only 10%, cap at 3,000 USDT

-

Merchant margin requirement: 100,000 USDT

-

Compensation application: for judicial freeze orders occurring within 30 calendar days after transaction completion

-

Shield Merchants pay nearly 0.1% fee, costs passed on to listing prices, ultimately borne by users

At first glance, all offer 100%, but coverage varies greatly. Binance’s Premium Zone serves less than 5% of users; Standard Zone rules are significantly weaker. For simple structure and minimal learning curve, refer to HTX, which launched the first C2C Premium Zone.

3. The essence behind the rules: What is each platform really thinking?

To translate complex rules into what truly matters to users, here are the core philosophical differences among the three:

① HTX: Prevention > compensation

HTX was an early pioneer in C2C, so its philosophy is: "preventing incidents is more important than fixing them afterward."

The "0 freezes" data from its Premium Zone reflects this. Though the experience still has room for optimization and occasional page lag, its security is perceptible, rules simplest, labels clearest, and merchant vetting extremely strict. Most importantly, its compensation mechanism is transparent, with no "tiered treatment."

② Binance: Strong fallback, but complex mechanisms, leaning toward reactive

Binance is massive—the world’s largest exchange—so its approach resembles: "open first, secure later."

No public freeze data; vast number of merchants; Shield system maturing gradually, but standard user compensation clearly weaker than Premium Zone. Fees nominally borne by merchants, but ultimately passed to users.

Binance excels if you're a high-volume trader who can identify Premium merchants—then you’re well protected. But for regular users, the learning curve is extremely steep.

③ OKX: Best experience, slightly weaker risk control

OKX has the smoothest product logic in the industry, but lags behind others in "compensation transparency" and "freeze data disclosure." Its compensation coverage is also relatively limited, making it suitable for users who prioritize experience and trade frequently.

4. How should we rank these three platforms?

Based on all information reviewed, here are three clear conclusions:

-

If avoiding freezes is your top concern → choose HTX

Reason: only platform disclosing freeze data, consistently reporting "0 freezes," most proactive risk control, most user-friendly for average users

-

If you're a high-volume trader who can identify merchants → choose Binance Premium Zone

Reason: strong protection for large traders, highest compensation cap

-

If you prioritize trading experience → OKX labeled merchants suffice

Because product experience comes first, with moderate risk

In conclusion: The most sincere in crypto isn't about ads, but clarity on risks

From HTX launching its Premium Zone in April, testing full compensation in May, officially rolling out 100% compensation in August, to OKX and Binance following with similar mechanisms—the industry has indeed become healthier due to this "transparent competition."

HTX took the first step; OKX refined user experience; Binance raised compensation to the industry’s highest level.

This is healthy competition—and great news for all users. As a brutally realistic industry saying goes: The end goal of Web3 isn’t getting rich quick—it’s safety. Bringing your money home is the highest value.

The most sincere in crypto: what wins users?

The answer remains the same: transparency + risk control + responsibility.

May every serious trader safely bring home every hard-earned dollar.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News