Three major exchanges in the Asia-Pacific region resist "crypto treasury companies"

TechFlow Selected TechFlow Selected

Three major exchanges in the Asia-Pacific region resist "crypto treasury companies"

Multiple Asia-Pacific countries including Hong Kong, India, Mumbai, and Australia are resisting corporate hoarding of cryptocurrency.

Authors: Alice French, Richard Henderson, Kiuyan Wong, Yasutaka Tamura

Translation: Joe Zhou, Foresight News

-

Hong Kong Exchanges and Clearing (HKEX) has questioned at least five companies planning to transform into digital asset treasury firms (DATs), stating existing rules prohibit corporations from hoarding excessive liquid funds.

-

Resistance against DATs is also emerging in India and Australia. Local exchange operators share similar concerns, which could stall many cryptocurrency treasury initiatives.

-

In the Asia-Pacific region, Japan stands out as an exception. Its listing rules are relatively lenient toward digital asset treasury companies, offering them greater freedom. Yet even there, signs of friction are appearing—for example, MSCI proposed removing large crypto treasury firms from its global indices.

Three major securities exchanges in the Asia-Pacific region are resisting firms that masquerade as listed companies but primarily engage in accumulating cryptocurrencies.

According to sources familiar with the matter, Hong Kong Exchanges and Clearing (HKEX) has recently challenged at least five companies aiming to shift their core business to a digital asset treasury strategy, citing regulations that prohibit holding large amounts of liquid assets. None of these firms have been approved so far. In both India and Australia, so-called digital asset treasury companies (DATs) are encountering similar resistance.

This pushback targets both cryptocurrencies themselves and the listed corporate vehicles built around stockpiling digital assets, posing risks to the bullish digital asset market trend that has persisted through much of 2025.

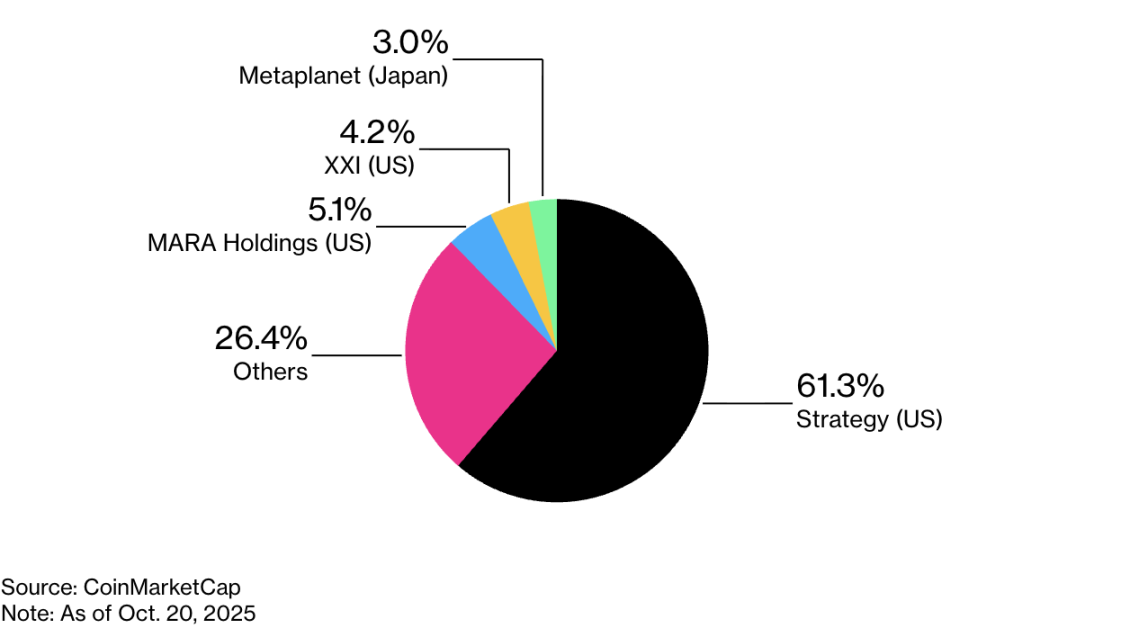

Bitcoin hit a record high of $126,251 on October 6, rising 18% year-to-date. This rally has been largely driven by a surge in companies dedicated to accumulating Bitcoin. The model pioneered by MicroStrategy—a $70 billion behemoth led by Michael Saylor—has spawned hundreds of imitators globally. Most of these companies trade at valuations exceeding the total value of their crypto holdings, highlighting strong investor demand.

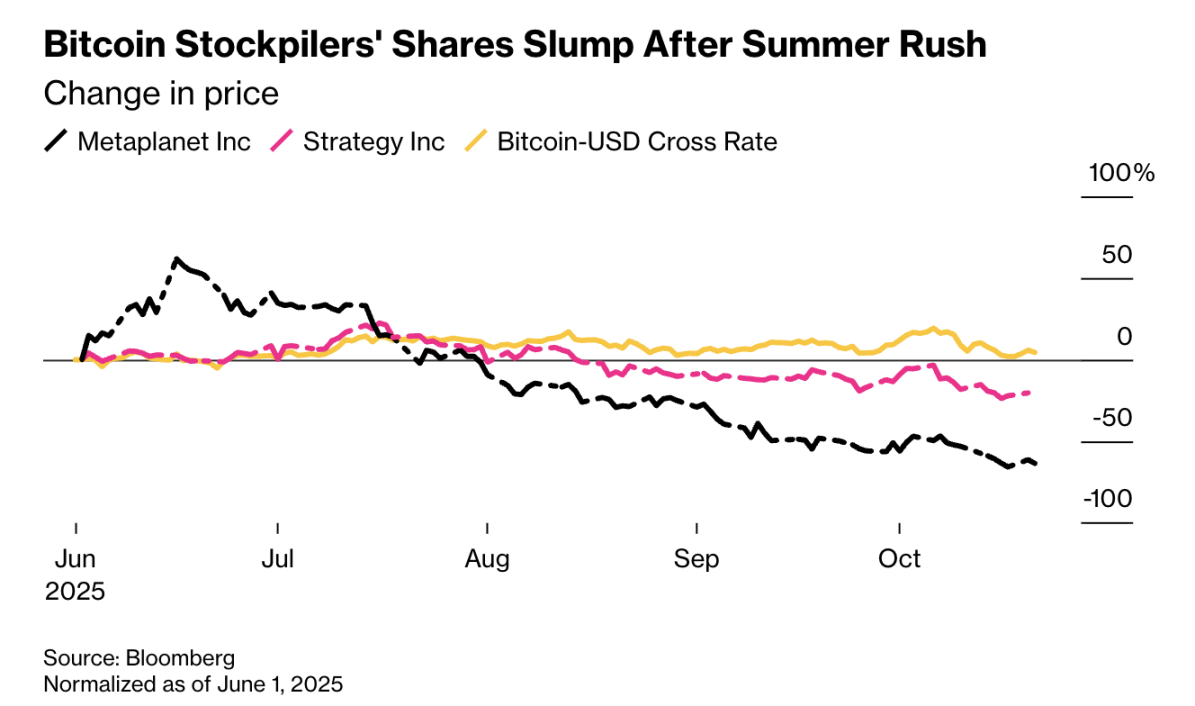

Recently, however, the pace of purchases by digital asset treasury companies (DATs) has slowed, and their share prices have declined, mirroring a sharp sell-off across the broader crypto market. A recent report by Singapore-based 10X Research estimates retail investors have lost approximately $17 billion in DAT-related trades.

In Asian markets, exchange operators' reservations could completely derail plans by crypto accumulators.

"Listing rules directly determine the speed and framework under which the crypto treasury model operates," said Rick Maeda, a crypto analyst at Tokyo-based Presto Research. He added that "predictable and relaxed" rules can attract capital and boost investor confidence, while stricter environments slow down DAT execution.

'Cash Companies' Among Listed Firms

Under Hong Kong exchange rules, if a listed company's assets consist primarily of cash or short-term investments, it may be classified as a 'cash company,' and its shares could be suspended. The aim is to prevent shell companies from treating their listing status as a tradable commodity.

Simon Hawkins, a partner at law firm Latham & Watkins, said approval for companies seeking to accumulate crypto hinges on whether they can "demonstrate that acquiring digital assets is a core part of their business operations."

Sources said pure-play crypto accumulation firms currently cannot transition into such a model in the former British colony.

An HKEX spokesperson declined to comment on specific cases under review but stated its framework "ensures all companies applying for listing—and those already listed—have viable, sustainable businesses with substance."

In a similar case, last month the Bombay Stock Exchange rejected Jetking Infotrain’s application to list a preferential share issuance, after the company disclosed plans to allocate some proceeds to cryptocurrencies. A filing shows the company is appealing the decision. Neither BSE nor Jetking responded to requests for comment.

In Australia, the Australian Securities Exchange (ASX Ltd.) prohibits listed firms from allocating 50% or more of their balance sheets to cash or cash-like assets. Steve Orenstein, CEO of software firm Locate Technologies Ltd., said this makes adopting a crypto treasury model "almost impossible." According to a spokesperson, the company—which shifted from software to buying Bitcoin—is relocating its listing from Australia to New Zealand, where NZX Ltd. welcomes digital asset treasury companies (DATs).

An ASX spokesperson said companies shifting toward investing in Bitcoin or Ethereum are "advised to consider structuring their investment product as an exchange-traded fund (ETF)." Otherwise, they "would likely not be considered suitable for inclusion on the official list."

The spokesperson added that ASX does not ban the crypto treasury strategy outright but cautioned that potential conflicts with listing rules must be carefully managed.

Japan's 'Hodlers'

Japan stands out significantly in the Asia-Pacific region. It is common for listed firms there to hold large amounts of cash, and listing rules are relatively relaxed for digital asset treasury companies (DATs), giving them considerable leeway.

Hiromi Yamaji, CEO of Japan Exchange Group, said at a press conference on September 26: "Once a company is listed, if it makes appropriate disclosures—for example, announcing it is buying Bitcoin—it would be quite difficult to immediately deem such actions unacceptable."

According to data from BitcoinTreasuries.net, Japan has 14 publicly traded Bitcoin buyers—the most in Asia. These include Metaplanet Inc., a hospitality firm that was among the early adopters of the DAT model and now holds about $3.3 billion worth of Bitcoin. Since beginning its transformation in early 2024, the company’s share price surged to a peak of 1,930 yen in mid-June before falling more than 70%.

Japan has also seen some unusual Bitcoin purchase plans: Convano Inc., a Tokyo-based manicure salon operator listed on the stock market, announced in August plans to raise about 434 billion yen ($3 billion) to buy 21,000 Bitcoins. At the time, the company’s market cap was only a fraction of that fundraising target.

Even for Japan’s crypto accumulators, signs of friction are emerging. MSCI, one of the world’s largest index providers, recently proposed excluding large digital asset treasury companies (DATs) from its global indices following an investigation into Metaplanet’s $1.4 billion international equity offering in September. Metaplanet joined the MSCI Japan Small Cap Index in February and stated it would use most of the proceeds to buy Bitcoin, later adding another 10,687 tokens. Metaplanet did not respond to requests for comment.

In a statement, MSCI said digital asset treasury companies (DATs) "may exhibit characteristics similar to investment funds" and therefore do not meet eligibility criteria for inclusion. MSCI recommends barring companies where crypto assets make up 50% or more of total assets.

Japanese equity analyst Travis Lundy wrote in a Smartkarma report that exclusion from indices would cut off passive fund inflows from index-tracking funds. He added, "This could destroy the argument for their premium price-to-book valuations."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News