What's the most valuable thing in the 21st century? Exchange traffic anxiety

TechFlow Selected TechFlow Selected

What's the most valuable thing in the 21st century? Exchange traffic anxiety

I'm broke, so I have to keep your attention.

Author: Zuo Ye

Out of money, so I have to retain your attention.

At six PM, I go off-stream, change out of my OK-branded clothes, and head to drink a few beers after Binance's big liquidation.

At the Meme counter in the chaotic Perp mall, using Mom’s KYC to earn some referral commission.

The grand opening act of 2026: witnessing the collapse of exchange empires. Unlike past direct explosions—like mass liquidations or price spikes triggering public outrage—this time it’s different. The public simply stops caring about exchanges, evident in Binance Square and OKX Planet struggling to acquire new users.

When even the inspirational stories of beautiful live-dealer girls are ignored, exchanges are forced to step out and cry, “Look at the kids! We’ll even pay you just to watch!”

In dedication to this article, commemorating Chuanbao’s coronation one year ago—a presidential-level performance that delivered us immense emotional value.

Lie Down and Be Money

Either erupt from silence, or die within it.

Exchanges did nothing wrong in 2025—embracing Perp DEX, actively going on-chain, pushing compliance while cracking down on those earning commissions from their hospitalized moms. Just days ago, Binance Wallet still hosted a Meme trading competition, responding to OKX Wallet’s smart account system.

But in 2026, exchanges will fail at building any real product. Retail attention drives capital flow. BNB Chain’s 2 million monthly active users? Just a numbers game—like Twitter’s million-dollar contest, where success stories cool down overnight.

The wealth effect is changing hands. When people care more about $1,000 content creation rewards than 1000x moonshots, the old narratives lose relevance.

All these facts point to one thing: exchanges need people—not shiny VIPs, but disheveled contract gamblers.

You’re a VIP when placing a futures order; once liquidated, you're just trash on the roadside.

Roughly speaking, an outsider entering crypto survives about six months. A KOL influencer account lasts roughly 18 months. No matter the path, it all boils down to争夺 retail attention.

Sadly, exchanges still understand attention through a pre-AI lens—relying on KOLs. In the Vibe Coding era, both code and media are losing value exponentially. Not only is implementation cheap, but even ideas aren’t valuable anymore—engineering-driven trial and error can A/B test everything.

Only distribution power has commercial value. But recommendation algorithms aren't gods. Elon Musk’s retweet brings 100 million impressions, but that’s a liability for X. Only algorithm-tamed content generates cashflow in the new era—boosting platform DAUs and attracting advertisers.

One sentence: poetic clouds cannot diminish Li Bai’s worth; algorithms cannot iterate infinitely.

Yet exchanges still treat retail users as附属to KOLs and media. Sir, times have changed—the era where retail speaks for itself has arrived.

Let’s examine the role of content creators—they’ve always been stuck between exchanges and retail, psychologically massaging traders’ behavior while helping exchange marketing teams meet KPIs, collectively enabling the slaughter and exploitation of retail.

That doesn’t mean retail never wakes up. After each cycle, surviving “cultivated weeds” remember clearly, becoming beacons in the dark forest—evolving from fraud exposure lanes into troll factories. No one records crypto, yet crypto grows its own memory.

Retail isn’t refusing to spend—it’s realizing their attention is most valuable. It’s simple: platforms like Xiaohongshu aggressively ban crypto content to make room for digital RMB; Twitter drastically reduces crypto weight to improve user experience. Agencies obsessed with mindless posting are already fading away with Kaito.

Caption: CZ responds

Image source: @cz_binance

Under strange internal and external pressures, CZ still comforts himself by saying “I’m a small shareholder of Twitter.” That old $500 million story continues to pacify retail investors, creating the illusion that Binance is strong—while in reality, Binance Square’s user acquisition is desperate.

If Binance does it, OKX will follow. If the leader acts, Bitget and Gate will too. If KOLs don’t join, they’ll scrape content to fake ecosystem vitality and report back to their bosses: “User acquisition successful.”

But it’s all fake. Retail attention is infinitely generous toward KOLs, media, and exchanges. KOLs and media need it to survive via traffic monetization. Exchanges need retail headcounts to maintain momentum and appearances. Office luxury dens, platform prices sky-high.

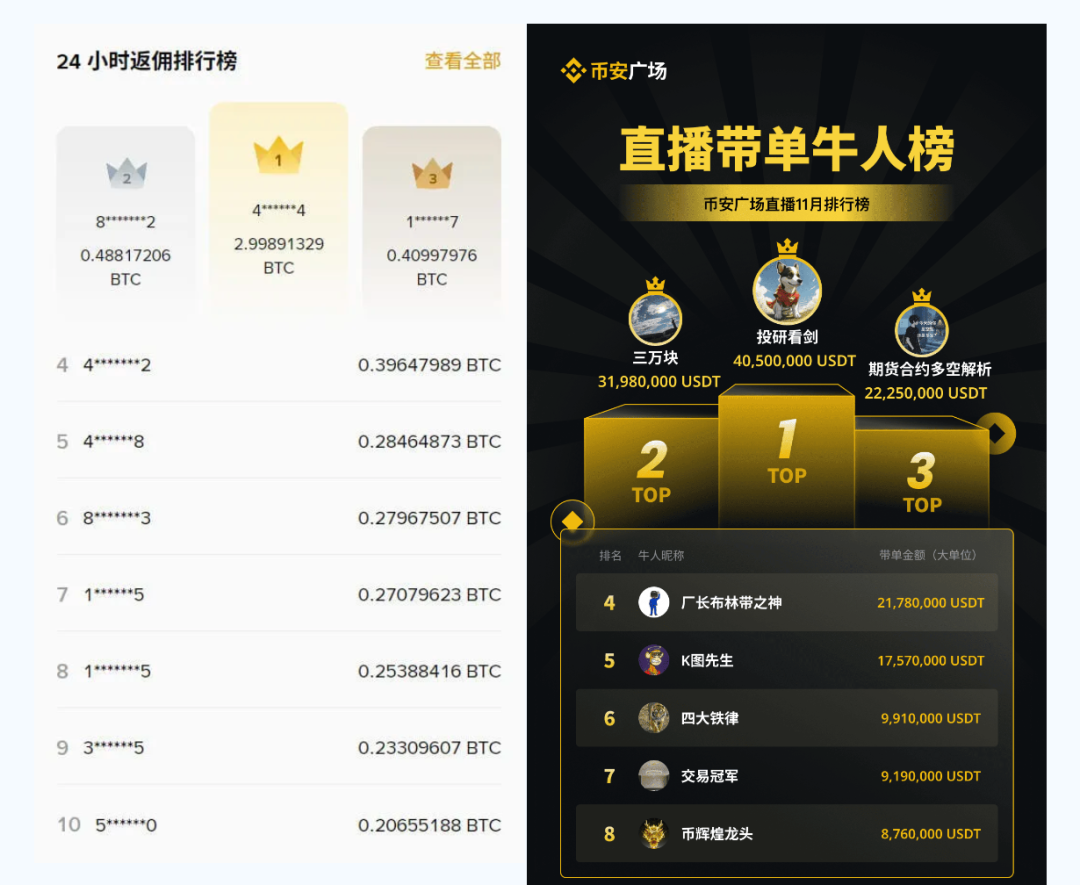

Caption: Commission era ends, livestreaming begins

Image source: @binancezh

Outside Twitter, on Douyin, lies the public traffic exchanges truly crave. They were among the first to awaken. Countless comment sections emphasize: viewers aren’t passive numbers, but living souls.

- In Cute Cat’s comment section, users know video views determine tonight’s cat food quality—they willingly lie down as cat food;

- In Tyrant Egg Boss’s comment section, users appreciate the painstaking effort behind perfect egg videos, deciding the fate of years-long accounts—they willingly lie down as hens;

- In Widower Solitude’s comment section, users actively like and boost streams supporting good deeds, prioritizing actions over intentions—they willingly lie down as rice and flour.

After intense "net-savviness" education, everyone is online, and collective god-making and god-killing has become our generation’s arena. Everyone knows their attention can be algorithmically converted into money. Everyone understands that their focus on a token equals real cash.

Yet in crypto, exchanges still treat retail as passive fools, attempting to tier pricing based on KOL follower counts. That era is over. Retail awakening will completely transform industry operations.

Psychoanalysis of Ineffective Actions

Exchange desperation isn’t new—but their anxiety over “content” is unprecedented.

This anxiety only manifests as craving emotional value, unable to convert into actual trading value. Now, retail knows their attention has worth. KOLs must adapt to shifting Twitter algorithms. But exchanges keep playing straight balls.

After Elon Musk released the Feed algorithm as promised, “human-like presence” became the most valuable behavior. Mechanical interactions and matrix accounts face short-term suppression. Now, the moderator is an endless Grok Transformer.

Caption: X interaction weights

Data source: @elonmusk

Yet exchanges still bid-rank promotions on OKX Planet based solely on KOL follower counts. Honestly, Xu Mingxing should improve market training for new hires. Employee perks alone won’t attract retail trades. Even if OKX Wallet is ten thousand times better than Binance Wallet, retail still won’t switch.

If you can’t enhance the wealth effect, at least reduce flaunting wealth.

Retail struggles so hard, yet exchange bosses live comfortably—the battle is lost before it begins. OK can’t catch Binance. Square can’t surpass Twitter. Only lonely planets remain, singing “wrong, wrong, wrong.”

Binance fears OK’s sloppy moves. Musk attacks from both sides.

If exchanges fail to deliver emotional value to retail, retail won’t give them trading value. KOLs are merely intermediaries—thinking what retail thinks, panicking what CEX panics about.

The process is simple: everyone knows KOLs making videos or articles can turn traffic into real money. The more retail watches, comments, and stays, the stronger the creator’s monetization power on platform—and thus, the better experience they provide.

Then exchanges react instantly—demanding KOLs sell their traffic directly to them, dumping retail into the market. This is the complete breakdown of market microstructure.

Binance claims 300 million users—even exceeding Twitter’s mDAU (monetizable daily active users) in 2021 by 100 million. But that means nothing. This traffic anxiety can be quantified:

- Twitter’s MAU is likely declining. Average daily usage time dropped from 34 minutes to 28. Nikita Bier noted X users read no more than 30 posts per day—confirming no significant growth.

- The U.S. and Japan host Twitter’s largest user bases—around 100 million in the U.S., ~20 million combined in Hong Kong and Singapore. Given mainland Chinese users require workarounds, we estimate Chinese-speaking crypto Twitter users peak at several million.

So why do Binance and OK chase growth from just millions, suffering exponential decay when converting to their platforms? Conclusion: attention from tens or hundreds of thousands sustains Binance’s claimed 300 million total users.

In social network theory, six degrees of separation describe information diffusion limits—information rarely spreads beyond six hops. The “three-degree influence rule” suggests individuals affect behaviors up to “friends of friends.” Assuming one KOL has 20 close connections, maximum reach is 20×20×20 = 8,000. Not the limit of reach, but the ceiling of signal-following impact.

Unfortunately, Dunbar’s number still constrains influence—150 is the cognitive limit of stable relationships. Crypto users highly overlap—you see the same KOLs and exchange operators across every group. Trust me, the retail clappers in each group are largely the same crowd.

Caption: Across mountains and miles, you’re my joy hidden in the breeze

Due to constant cross-pollination, OKX Planet can at best lure third-tier Web3 KOLs who couldn’t even enter Binance Square—Dragon Lady at least went to BNB Chain.

Remember the lifecycle of retail and KOLs? My NFT groups are already completely inactive.

Conclusion

Humility is a life attitude. Deification is a life choice.

Broadcast to the universe: every bit of our attention toward exchanges is their privilege—especially during tough industry times. It shouldn’t be a tool for exchanges to exploit users.

Exchanges now face a choice: cash in their last scraps of attention to let flashy employees please bosses and shareholders, or serve retail like gods—caring for their survival, improving content, letting traffic grow naturally.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News