CoinUp 2025 Report Card: From Growth to Compliance, the Rise of Second-Tier Exchanges

TechFlow Selected TechFlow Selected

CoinUp 2025 Report Card: From Growth to Compliance, the Rise of Second-Tier Exchanges

Those platforms that truly create value for users and set benchmarks for the industry will ultimately stand in their rightful place.

Written by: TechFlow

Exchanges have always been the most fiercely contested battlefield in the crypto industry.

At the turn of the year, major exchanges have successively unveiled their report cards. While the impressive data from the big players has been widely circulated and discussed, the year-end reports from the rising stars might offer a more distinctive perspective.

To a large extent, the breakout strategies of second-tier exchanges are perhaps more aggressive and more dedicated to seizing new forces, new trends, and new directions. CoinUp, which champions the slogan "Crypto Oasis," is one such example.

Born in Silicon Valley in 2021, 2025 marks CoinUp's fourth year of deep commitment to crypto.

From a few dozen people at the start of its venture to a team now exceeding a thousand, with the long-term mission of building a "global one-stop cryptocurrency derivatives trading platform," CoinUp has navigated the past year under pressure and hope:

The market moves fast, public sentiment reverses quickly, and competitors respond swiftly. It must strive for "a step ahead in user experience" in its products while making every effort to seize each market window, manage brand reputation building, and handle public relations challenges. Precisely because of this, this report card might better reflect the survival pressures and transformation strategies faced by second-tier exchanges.

From rigorous data interpretation to concrete product iterations and vivid brand building, let's explore the core breakout logic for second-tier exchanges to "move up" through CoinUp's report card.

The "Show of Strength" Moment: A Data Perspective on CoinUp's 2025 Achievements

Examining CoinUp's key achievements in 2025 reveals not a focus on a single explosive point, but the simultaneous advancement along several critical lines: scale, security, and compliance:

- User Growth: Total user base surpassed the 10 million milestone, covering over 200 countries and regions;

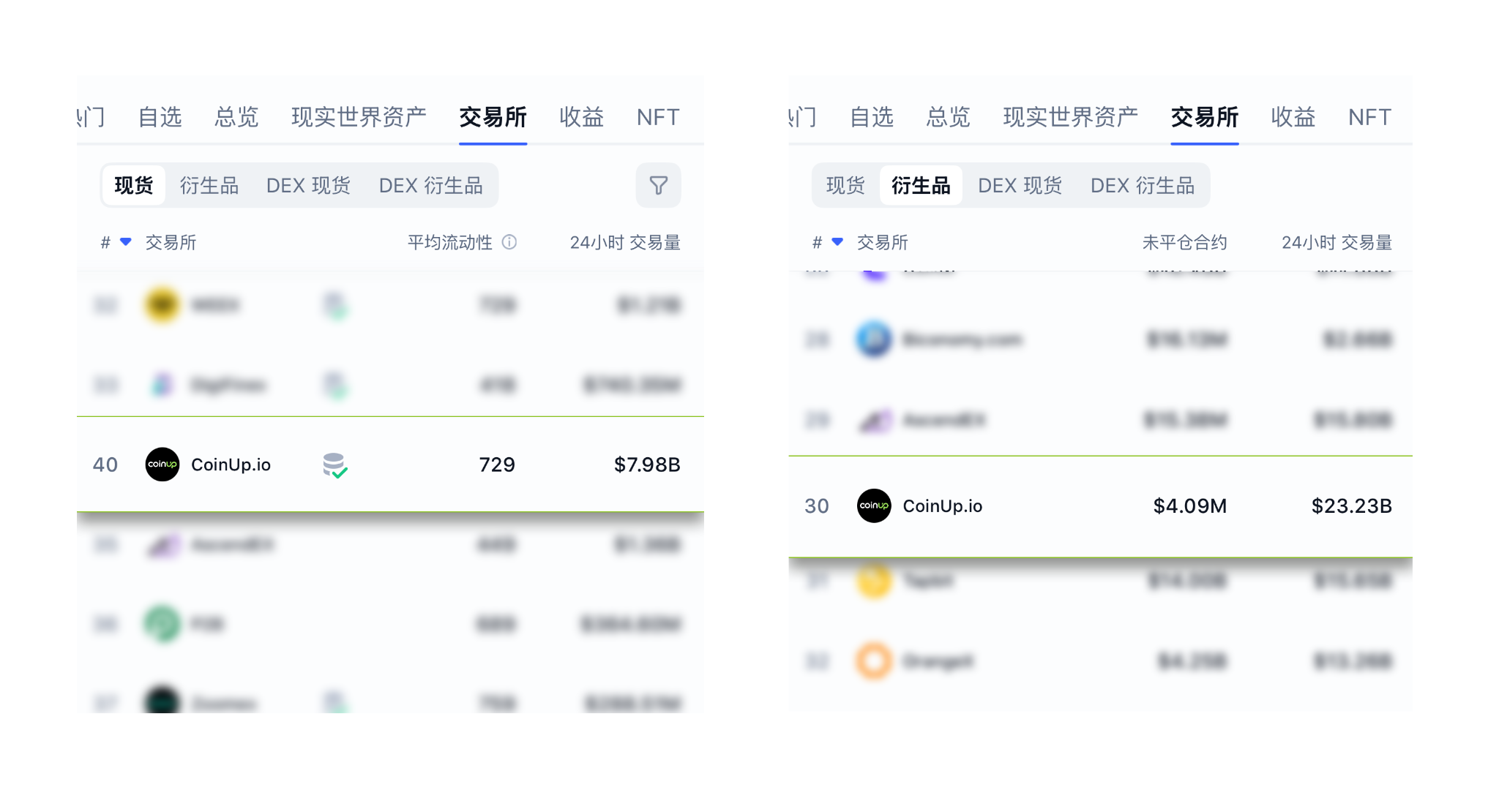

- Trading Volume Activity: Peak daily trading volume reached $5 billion, with average daily trading volume exceeding $3 billion. Supports 700+ spot trading pairs and 100+ contract/derivative trading currencies, entering CoinMarketCap's derivatives exchange rankings at position 30;

- Net Capital Inflow & Platform Revenue: Average daily net capital inflow approximately $80-120 million, average daily revenue approximately $1.2-1.8 million;

- Compliance Breakthrough: Following previous acquisitions of the Canadian FINTRAC license and US MSB license, in 2025 CoinUp achieved another significant breakthrough in global compliance layout, completing the filing of a Form D exempt offering application submitted to the US SEC, signifying that CoinUp has formally passed the SEC's comprehensive compliance review.

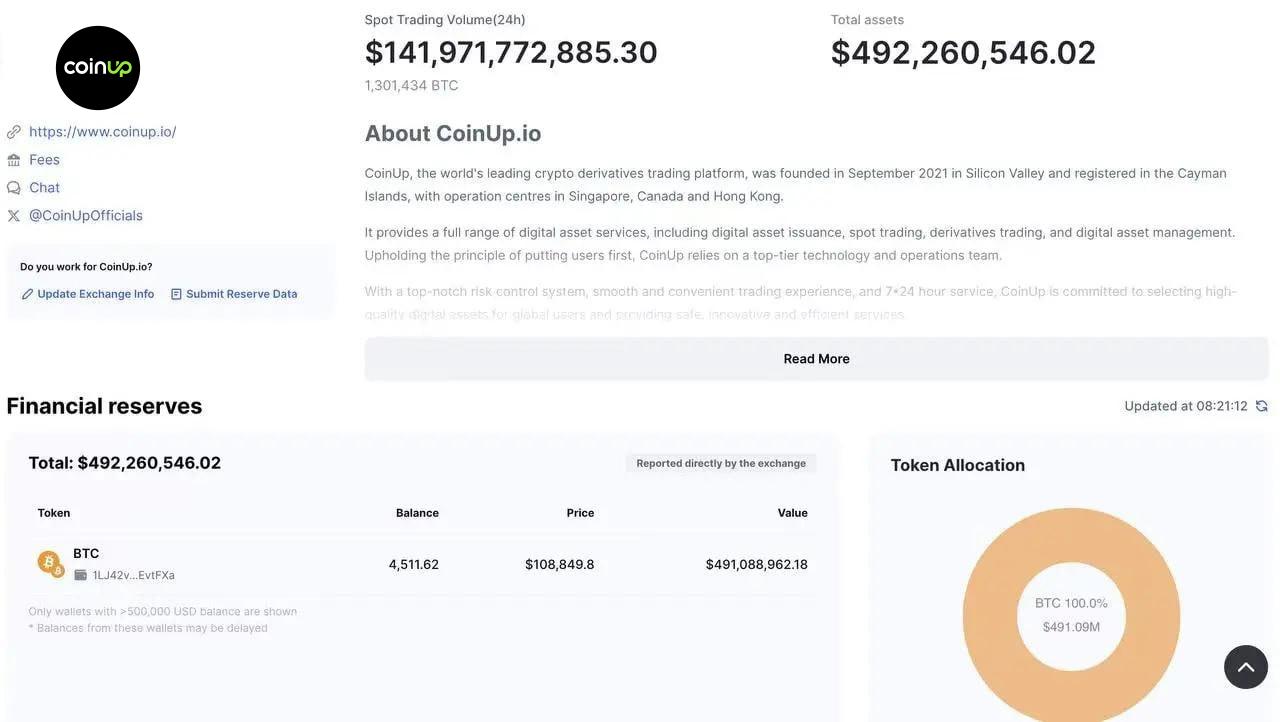

- Security Progress: CoinUp's $500 million asset reserve passed the Proof of Reserves (PoR) audit certification by the independent third-party institution CER, with a 100% coverage rate for core asset reserves, no misappropriation or leverage operations, continuing the record of "no major security incidents in 4 years since establishment";

- Team Expansion: Expanded from previously under a hundred to nearly a thousand personnel, establishing operational centers in key global cities including Japan, Hong Kong, Malaysia, and Abu Dhabi.

These data points collectively outline CoinUp's 2025 report card: from a solid user foundation to explosive trading scale and enhanced capital confidence, laying the necessary groundwork for CoinUp to move beyond the second tier of exchanges and sprint towards the first tier in the future.

Only by Solidifying Product Fundamentals Can One Stay at the Table Long-Term

The basic competitive principle for exchanges: products must be user-friendly to retain users.

As a global one-stop cryptocurrency derivatives trading platform, derivatives trading volume accounts for over 80% of CoinUp's total, reflecting user recognition of CoinUp's derivatives module. Therefore, refining the core trading functionality of derivatives to be more user-friendly was a major focus of product iteration over the past year.

But upon closer observation, you'll notice: this year, CoinUp didn't seem to deploy any flashy, gimmicky major moves, yet it still maintained an iteration frequency of at least once per month.

Beyond supporting leverage up to 125x, CoinUp iterated many new features in 2025: the contract leaderboard allows top traders to stand out; the copy trading system aligns the interests of lead traders and followers to create a win-win situation; and the contract experience fund function, further optimized in the recent App 6.0.5 version update, further stimulated user enthusiasm for contract trading, among others.

Beyond features, more tools to make trading smarter are continuously being improved: In 2025, CoinUp added an AI market analysis function, allowing users to trigger AI analysis with one click on the K-line chart page during contract trading, quickly obtaining multi-dimensional market insights including trend judgment, support/resistance levels, intraday strategy references, etc. Other intelligent tools include AI contract prediction, smart leverage, and more, coupled with AI-driven trading bots and market-making systems, helping investors of different levels improve efficiency and lower barriers.

There are also numerous smaller optimizations regarding trading fees, trading thresholds, and user benefits, which may not be eye-catching, but traders can feel the difference when using them.

From the product iteration style, we also glimpse a prominent characteristic of the CoinUp team: a pragmatic focus on diligently honing product fundamentals.

Features may not necessarily be stunning, but the experience becomes increasingly stable. Each upgrade aims to make users feel that "CoinUp has become much better to use." Through this progressive layering of experience, an impression is ultimately built in users' minds: for crypto trading, CoinUp is really convenient to use.

Furthermore, an absolutely unignorable move by CoinUp in 2025 was: the launch of CP Chain and the platform token $CP.

As CoinUp's on-chain DeFi testing ground, CP Chain features 1000+ TPS, 0.5-second confirmation, EVM compatibility, and represents a significant step in CoinUp's transformation into an integrated financial ecosystem covering both CeFi and DeFi. $CP, as the sole utility and governance token within the CoinUp ecosystem, possesses multiple utilities including trading fee discounts, participation in Launchpad/Launchpool, staking, governance, payments, and more.

Although $CP experienced price volatility in 2025, based on its multiple utilities + buyback and burn mechanism, coupled with CoinUp's continuous construction and layout under a long-term vision, perhaps a rebound opportunity for $CP is brewing in 2026.

Building a Crypto Oasis: Making Traders Feel Secure, Professional, and Warm

Unconsciously, the "competition" among exchanges has progressed through multiple stages: "competing on technological breakthroughs → competing on product experience → competing on humanistic care."

This is a contest of comprehensive strength, where technological hard power is important, but brand soft power is even more indispensable.

In 2025, you might have already seen CoinUp's core brand vision in many settings: Crypto Oasis.

An oasis symbolizes vitality and conveys a reassuring sense of hope. Within this oasis, CoinUp hopes:

- Global traders can execute efficient, smooth transactions in a more stable, secure, and compliant trading environment;

- Builders can engage in construction and innovation more steadfastly with the support of the two ecosystem pillars: the CoinUp Foundation and CoinUp Research Institute;

- And CoinUp, as the platform, driven by more active users and a more innovative ecosystem, will continuously evolve towards the "Crypto Oasis" vision.

To make this brand concept more perceptible, CoinUp also created a more intuitive brand expression by launching mascots CC and PP: two adorable sea otters conveying the brand philosophy of "making trading safer, faster, and more stable," accompanying users as they explore the crypto oasis.

Over the past year, this vibrant green unique to CoinUp, alongside mascots CC and PP, has indeed stepped onto a broader world crypto stage: Singapore TOKEN2049, CoinUp's 4th Anniversary Celebration DJ Night, Turkey Blockchain Week, Consensus 2025 Hong Kong, Web3 Future Night, New York Times Square Nasdaq Billboard, Abu Dhabi Global Blockchain Show… From Asia to Europe and America, at every unmissable crypto event, you could capture the active presence of CoinUp.

By establishing closer communication channels with project teams, investment institutions, KOLs, and media from around the world, CoinUp further brings its platform's security capabilities, product roadmap, and long-term vision to be tested in a broader international environment. Simultaneously, CoinUp's "Crypto Oasis" vision further transforms from a slogan into a tangible, perceptible real experience for users.

2026: The Road May Be Long, But Progress Will Be Made

Looking back allows for better summarization of the past and is also dedicated to better envisioning the future.

Amid the overall trend of the crypto industry transitioning towards institutionalization and standardization, the breakout of exchanges, especially second-tier exchanges, faces multiple practical challenges.

On one hand, fierce exchange competition brings immense invisible pressure: top platforms continuously squeeze survival space, while exchanges in the same tier watch intently; on the other hand, as global crypto regulation becomes clearer, embracing compliance often means greater effort and cost.

Although the 2025 report card is "substantial," it is now in the past. Looking ahead to 2026, CoinUp will continuously refine itself:

- Explore functionalities for trading in more traditional financial derivative markets such as commodities, forex, US stocks, indices, etc., further becoming a global trading gateway covering multi-asset investment;

- Target emerging markets like Southeast Asia, the Middle East, and Europe as key growth drivers;

- Accelerate the application for licenses in more regions including the EU, Dubai, etc., while building a more comprehensive security and risk control system;

- Continuously advance work in product and service optimization, user growth and community building, as well as revenue and commercialization.

Of course, challenges remain significant, whether it's the traffic monopoly of top platforms, continuous optimization of product features and experience, ongoing investment in regulatory compliance, or the value reconstruction of $CP. Each tests CoinUp's strategic resolve and execution capabilities.

But it is precisely these challenges that spark more curiosity about the implementation results of CoinUp's 2026 plans.

In the historical process of the crypto industry moving towards institutionalization and standardization, those platforms that truly create value for users and set benchmarks for the industry will eventually stand in their rightful place.

And CoinUp's path of competitive breakout for exchanges, carrying the "Crypto Oasis" vision, continues to unfold.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News