Hong Kong financial influencer involved in criminal case: What compliance implications for crypto KOLs?

TechFlow Selected TechFlow Selected

Hong Kong financial influencer involved in criminal case: What compliance implications for crypto KOLs?

"Decentralization" does not mean "no regulation"; technological innovation must go hand in hand with investor protection.

Summary of the Incident

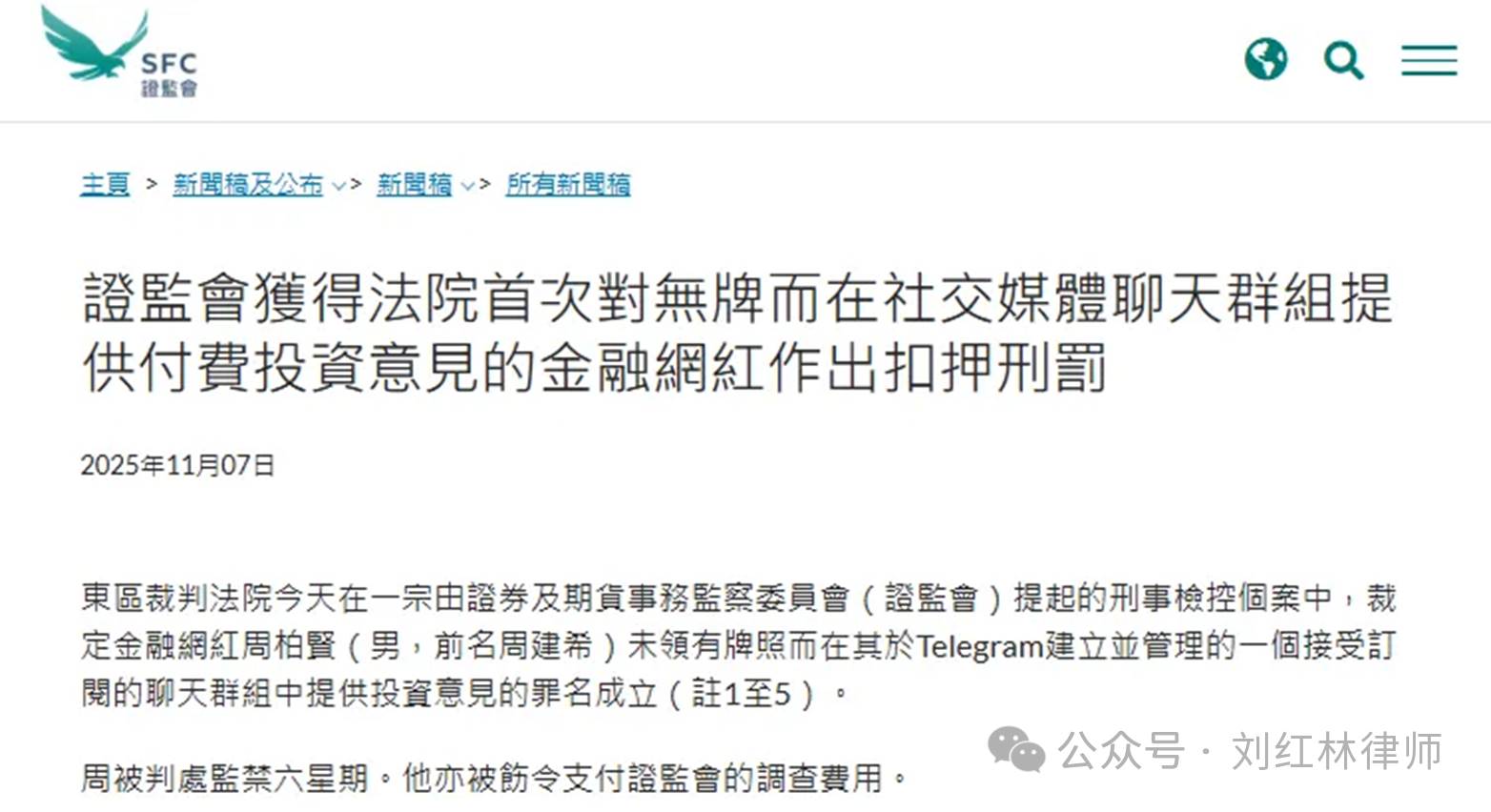

On November 7, 2025, the Eastern Magistrates' Court in Hong Kong ruled that financial influencer Chow Pak-yin (formerly known as Chow Kin-hei) was guilty of providing investment advice through a paid Telegram group without proper licensing. He was sentenced to six weeks in prison and ordered to cover the investigation costs incurred by the Securities and Futures Commission (SFC). This case marks the first criminal prosecution of an unlicensed financial influencer in Hong Kong, signaling the end of the "wild growth" era for social media-based investment advice.

The ruling is based on Hong Kong's Securities and Futures Ordinance, under which "providing advice on securities" falls within Type 4 regulated activity and requires prior licensing from the SFC. The determination involves three key criteria:

-

Profit motive: Conduct carried out for profit, such as charging subscription fees, constitutes a commercial activity;

-

Continuity: Regular publication of analysis or responses to specific queries;

-

Specificity: Offering clear recommendations on particular securities (e.g., Nasdaq stocks), going beyond general opinion sharing.

Chow operated a Telegram subscription group named "Futu Zhen. Cai Zi Private Group" under the identity of a "major shareholder of Futu." Without holding an SFC license, he provided Hong Kong subscribers with specific stock commentary, target price forecasts, and Q&A services, earning HK$43,600 illegally via monthly fees (USD 200 or HKD 1,560), meeting the legal definition of "providing advice on securities."

This case also highlights two compliance principles regarding unlicensed financial influencers in Hong Kong: first, the platform is not an excuse—whether using Telegram, Discord, or any emerging social platform, any activity constituting investment advice requires a license; second, jurisdiction is determined by audience—if the target users are Hong Kong investors, the activity falls under Hong Kong regulation, even if servers are located overseas.

In previous similar cases involving Hong Kong financial influencers, licensed representative Wong Mou-chung had his license suspended for 16 months for operating a paid group under personal capacity. However, this case marks the first use of criminal penalties, underscoring Hong Kong’s intensified regulatory stance toward unlicensed investment advice by financial influencers.

The verdict aligns with global trends of tightening oversight on "financial influencers." As financial markets evolve, regulators worldwide are increasingly focused on investor protection and market integrity, particularly vigilant against risks of misleading content on social media.

The UK Financial Conduct Authority (FCA) has established a clear regulatory framework for financial promotions, especially those related to cryptocurrencies and financial influencers. It mandates pre-approval for all investment promotions on social media, prohibits financial institutions from promoting "inappropriate" investment behaviors, and emphasizes that financial promotions must be "fair, clear, and not misleading." Violations may result in criminal penalties and fines.

The U.S. Securities and Exchange Commission (SEC) strictly enforces actions against unauthorized financial promotions, imposing fines on companies and individual influencers who violate rules or engage in market manipulation. Penalties can reach millions of dollars. For example, the SEC fined an asset management firm $1.75 million for failing to disclose the role of a social media influencer in promoting its exchange-traded fund (ETF), including the influencer’s compensation structure tied to the fund’s growth.

In mainland China, cyberspace administration and other regulators continue to crack down on illegal stock recommendation activities and financial misinformation online, taking legal action against accounts and websites spreading false capital market information, conducting unauthorized stock tips, or promoting cryptocurrency trading.

It is evident that financial influencers and their promotional activities are now being brought into a stricter, more internationally aligned regulatory scope, requiring all participants to pay closer attention to compliance risks.

Implications for Crypto KOLs

Although this case directly concerns traditional securities investment advice, the regulatory signal it sends will also impact the crypto asset sector.

Firstly, the judgment is rooted in the principle of investor protection—an equally critical concern in the more complex risk environment of virtual assets.

In recent years, investor protection issues in the crypto space have become increasingly apparent. A 2025 VISTA study showed that 58% of Gen Z (born 1995–2009) and Millennials (coming of age in the 21st century) prioritize self-directed investing. However, many lack the expertise to assess risks associated with unregulated investment advice and are easily drawn to aggressive or misleading promotions. This has led to a surge in speculative trading, with some investors losing their life savings by using leveraged products like contracts for difference (CFDs) or investing in unregistered crypto tokens. In several incidents, including the Hong Kong JPEX case, investors reported losses due to exposure to online marketing and social media investment opinions.

The JPEX virtual asset platform fraud is the largest cryptocurrency scam in Hong Kong in recent years, involving over HK$1.6 billion and affecting more than 2,700 victims. JPEX personnel used advertising, social media, OTC exchanges, and influencer/KOL promotion to attract investors by claiming the platform was "legally compliant, celebrity-endorsed, low-risk, and high-return." They ultimately transferred customer funds into cryptocurrency wallets for money laundering and exit scams. In this case, police invoked for the first time the provision in the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (effective 2023) on "fraudulently or recklessly inducing others to invest in virtual assets," charging several involved influencers. This case highlights both the vulnerability of investors to online propaganda and influencer influence, and the authorities’ growing emphasis on curbing improper promotional practices in the virtual asset space.

Secondly, Hong Kong is steadily advancing its virtual asset regulatory framework, emphasizing tokenized asset compliance and building a licensing regime to regulate virtual asset-related services. In the future, Hong Kong may adopt regulatory standards similar to those applied to stock market commentators, requiring virtual asset KOLs to meet higher professional and disclosure standards when offering investment advice—preventing disorderly promotion and misinformation, maintaining market order, and protecting investor interests.

Given current regulatory trends, financial influencers and content creators in the virtual asset space must pay special attention to potential legal compliance risks. With the SFC proposing that brokers conduct due diligence and ongoing monitoring of KOLs they collaborate with, the operational costs and compliance barriers across the entire KOL industry could significantly rise.

Under this backdrop, market participants may face two main choices:

First, participants can adjust their communication styles to carefully avoid their content being classified as investment advice. For instance, they may shift toward educational content such as blockchain technology analysis, macro trend interpretation, or risk management, avoiding references to specific buy/sell levels or price targets for tokens. By carefully managing content boundaries and clearly disclosing risks and conflicts of interest, they can stay clear of the regulatory red line on "investment advice."

Second, participants can proactively pursue compliance by partnering with licensed institutions. For example, they could collaborate with licensed virtual asset platforms like HashKey or OSL, or traditional licensed financial firms, bringing their content creation within a regulated framework.

While these adjustments may enhance overall compliance, they could also bring structural changes. Channels for investors to access investment advice may become limited, and the cost of professional advisory services may rise. Some market players unable to bear compliance costs may downsize operations or relocate to jurisdictions with lighter regulation. However, in the long run, establishing clear regulatory frameworks will support the orderly development of the virtual asset market. On one hand, it enhances market transparency in the crypto space, better protecting retail investors from "pump-and-dump" schemes and boosting confidence among compliant institutional investors. On the other hand, it may drive content creation toward greater professionalism and value orientation, achieving a more balanced path between investor protection and industry growth.

Conclusion

The Chow Pak-yin case serves as a mirror, reflecting Hong Kong’s commitment to financial safety and retail investor protection. For Web3 KOLs, it is a clear warning—compliance obligations apply equally in the decentralized space.

"Decentralization" does not mean "unregulated." Technological innovation must go hand in hand with investor protection. As Hong Kong continues refining its virtual asset regulatory framework, only those participants who can capture market opportunities while adhering to compliance standards will thrive in the new era.

Whether Hong Kong can strike a balance between fostering Web3 innovation and upholding market integrity will depend on the joint efforts of regulatory wisdom and industry self-discipline—and this ruling is undoubtedly a significant milestone in that journey.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News