Seven Centralized Exchanges Deep Comparison: Who Is the True Money Printer for Investors?

TechFlow Selected TechFlow Selected

Seven Centralized Exchanges Deep Comparison: Who Is the True Money Printer for Investors?

Risk Control and Listing Policies.

Author: Lucida

Introduction

In the wave of wealth within the crypto world, we're always searching for that perfect platform to let us "sit back and win." In our previous issue, we analyzed the profit potential of major exchanges. However, behind high returns often lies even higher risk. A truly outstanding exchange should not merely be a fleeting creator of "get-rich-quick" myths, but rather the steadfast "night watchman" guarding your assets.

So, who can remain calm amidst the market frenzy and accurately defuse risks for you? And who possesses a hound’s sense of smell, always one step ahead in capturing the next breakout trend?

To answer these questions, LUCIDA deepens its evaluation perspective this time, conducting a data-driven "comprehensive health check" on mainstream exchanges across two core dimensions — risk control capability and listing capability. We move beyond subjective reputation, using quantifiable hard metrics such as "odds," "delisting rate," and "halving rate" to cut through the fog and see clearly who safeguards your capital, and who might be putting you at risk.

At the same time, we tracked the listing timelines of multiple star tokens across popular sectors, revealing each exchange's "sense of timing": Who always lets you get in first, and who consistently arrives late when the rally is already ending? Thus, we arrive at Part Two of our CEX comparison — Risk Control & Listings.

I. Risk Control Capability

Behind high returns often lurks the fang of high risk. A good exchange is not just a "wealth factory," but also the first line of defense for your assets. We must not only assess how much upside it can deliver, but also whether it has the ability to help you "defuse landmines" and protect your principal.

We quantify an exchange's risk control strength from three dimensions: odds, delisting rate, and percentage of coins that have halved in value. Let us cut through the data to reveal who is swimming naked and who is providing real protection.

1. Odds: How many "traps" must you step on to catch a "dark horse"?

The formula for calculating odds is shown below:

Press enter or click to view image in full size

Where nCEX,i represents the number of tokens on a given CEX in the i-th backdrop that achieved over 500% growth; mCEX,i represents the number of tokens on a given CEX in the i-th backdrop that dropped over 50%.

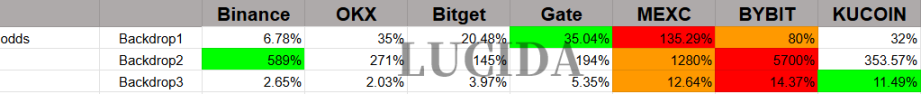

This metric measures, from a probability standpoint, the risk-reward ratio of "how many severely declining tokens you must endure per high-growth token gained." Simply put, it shows how many "crashes" you may need to withstand for one "explosive gain." The specific calculation results are shown in the table below:

Press enter or click to view image in full size

The data clearly shows that across all three observation periods, MEXC and Bybit consistently rank in the top tier in terms of odds. In other words, here you have a better chance of catching those rocketing assets with lower "trial-and-error cost."

2. Delisting Rate: New listings no longer a "blind box"

Delisting is every new-token investor’s deepest fear. We use it to measure an exchange’s ability to vet new token valuations. The formula is as follows:

Press enter or click to view image in full size

BCEX,i indicates the number of delisted tokens on a given CEX in the i-th backdrop; NCEX,i indicates the total number of newly listed tokens on a given CEX in the i-th backdrop.

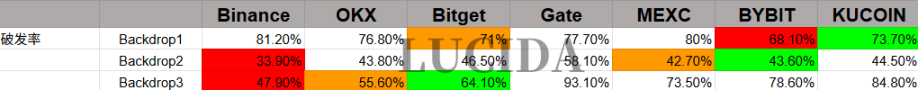

The delisting rate reflects the proportion of newly listed tokens that fall below their initial offering price within that backdrop. To better reflect real costs, we use the next day’s opening price as the benchmark. The results are shown in the table below:

The results show Binance demonstrates elder-brother-like stability in controlling delisting rates, usually maintaining the lowest levels. Bitget and Bybit also perform reliably. Gate failed to rank in the top three in all three evaluations, requiring extra caution from new-token investors.

3. Percentage of Halved Coins: How many "halvings" can your portfolio withstand?

A halving—a coin losing half its peak value—is a nightmare for shrinking assets. Such a drop devastates investor confidence. We calculated the proportion of "halved coins" across exchanges, directly reflecting the overall health of each exchange’s token pool.

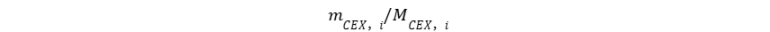

The formula for this metric is as follows:

Press enter or click to view image in full size

mCEX,i represents the number of tokens on a given CEX in the i-th backdrop that fell over 50%; MCEX,i represents the total number of listed tokens on a given CEX in the i-th backdrop.

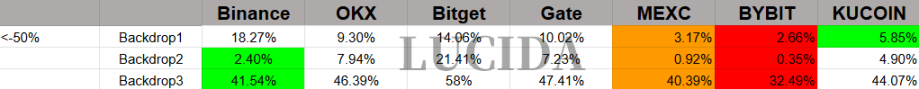

The results are shown in the chart below:

The results show Bybit and MEXC again prove their risk control prowess, maintaining consistently low halving rates, significantly reducing the likelihood of severe asset shrinkage. Binance also showed increasingly strong performance later on, demonstrating powerful late-mover advantages.

Risk Control Summary:

Top Performers in Risk Control: Bybit and MEXC. Leading in both odds and halving rates, they are the ideal choice for investors seeking a balance between safety and returns.

Safe Haven for New Listings: If you love new tokens, Binance, Bybit, and Bitget offer a safer "launchpad" thanks to their lower delisting rates.

II. High-Potential Token Listing Capability: Who Is Always One Step Ahead

In crypto, time is money. An exchange’s ability to capture trends and list promising tokens early directly determines whether you can get in before prices surge. To study this, we tracked the listing pace of multiple representative tokens across sectors—PEPE, POPCAT, FARTCOIN, GOAT, INJ, AXS—and reveal which exchange has the sharpest nose.

1. GAMEFi Sector

(1) AGLD

Gate, MEXC, and OKX were the first to list, followed closely by Binance. Bybit arrived late, completely missing the main uptrend.

(2) AXS

Users on Binance and KuCoin captured nearly all the gains. OKX and Bitget listed before the rally exploded, still offering opportunity. Users on Gate and MEXC faced downside correction risks, while Bybit listed after the rally had already ended.

2. RWA

(1) INJ

Launched first on Binance and Gate. After a deep pullback, it listed on Bybit, Bitget, and MEXC, perfectly timing the second wave of gains. OKX listed near the end of the rally.

(2) ONDO

KuCoin, Gate, and Bybit led the charge, with MEXC continuing the upward momentum. When it listed on OKX and Binance, prices had already entered a correction phase.

3. AI

(1) FET

First launched on MEXC and Binance, then began a long bull run after a dip. Gate listed at a local high, Bitget listed after a bottoming period and caught the rise, KuCoin listed just before a pullback, while Bybit and OKX positioned themselves precisely before the next rally.

(2) GOAT

MEXC was the first to list, followed by Gate, Bitget, Binance, and KuCoin during the uptrend. When Bybit and OKX listed, the party was nearly over.

(3) NMR

NMR successively listed on MEXC, Binance, OKX, Gate, KUCOIN, Bitget, and Bybit.

4. Meme

(1) PEPE

Gate and MEXC were the biggest winners, allowing users to fully capture the early explosive gains. OKX, though late, still offered a chance at the main uptrend. Binance and KuCoin listed at peak sentiment, making it easy for investors to buy at the top.

(2) POPCAT

History repeated itself—Gate and MEXC once again took the lead. Bitget, OKX, and others missed a significant post-Bybit-listing surge due to delayed listings.

(3) FARTCOIN

MEXC stood alone at the top, surging immediately upon listing. Bitget followed closely. Gate, KuCoin, and others listed amid extreme volatility, greatly increasing risk.

(4) MOODENG

Again confirming MEXC’s sharpness in spotting early trending tokens.

Summary

(1) Across the four cases above, OKX and Binance tend to be more cautious in listing high-potential tokens, potentially causing you to miss early windfalls, but filtering out some junk projects. MEXC and Gate, known for speed, offer investors more opportunities for high returns.

It should be noted that speed isn’t always beneficial. Combined with earlier delisting rate data, Gate, despite fast listings, suffers extremely high delisting rates, making it a classic example of "high-risk, high-return." Therefore, this capability must be evaluated alongside risk control.

(2) In crypto, different sectors exhibit distinct breakout rhythms and listing logics. Based on the latest market data, we find an exchange’s sector sensitivity has become key to whether investors can get in early.

Meme Sector: Speed is everything, early rewards are richest

Represented by PEPE, POPCAT, and FARTCOIN, meme coins have extremely short lifecycles—the faster the listing, the higher the return. MEXC and Gate consistently act as "meme launchpads," nearly monopolizing early premieres of all star meme coins. Though Binance and OKX list later, their massive user bases still drive prices into second-wave rallies.

Investment Insight: Meme traders should focus 80% of their efforts on MEXC and Gate, entering quickly on listing day, and consider partial profit-taking when Binance and OKX list.

AI & Infra (Infrastructure): Tiered listings enable sustained value discovery

AI and infrastructure projects have high technical barriers and longer value release cycles, resulting in clear "tiered listing" patterns across exchanges. Binance is the preferred launchpad for AI projects (e.g., FET), with its Alpha platform and IDO channels showing clear preference for the AI sector. Bitget and Bybit excel at listing during the consolidation phase after initial adjustments, offering secondary entry points for investors who missed the debut.

Investment Insight: The AI sector suits "left-side positioning with staged entries." Build a watchlist during Binance’s initial listing, then increase exposure when secondary platforms like Bitget list the token at a lower price.

GAMEFi & RWA: Frequent dark horses, niche exchanges quietly rising. KUCOIN and Gate have shown remarkable foresight in GAMEFi (e.g., AGLD), repeatedly listing potential projects ahead of Binance. Bybit and Bitget demonstrate keen senses in the RWA (real-world assets) space (e.g., ONDO), timing listings precisely and capturing full rallies multiple times.

Investment Insight: In these dark-horse-heavy sectors of GAMEFi and RWA, besides monitoring top-tier exchanges, be sure to set price alerts on KUCOIN, Bybit, and Bitget.

Final Conclusion: No Best, Only Most Suitable

Through this multi-dimensional data comparison, it’s clear that no single exchange leads across all metrics. Each platform, due to differences in listing strategy, review standards, and user targeting, exhibits unique risk-return characteristics.

Our investment advice:

If you are a conservative investor: Binance and OKX are your "safe harbors." You may miss the wildest "shitcoins," but you’ll enjoy more stable returns, lower delisting rates, and a more secure trading environment.

If you are an aggressive investor: MEXC and KuCoin are your "adventure playgrounds." Fast listings, high density of "dark horses," and attractive odds make them ideal for self-reliant, risk-embracing "prospectors."

If you seek optimal risk-return ratio: Bybit stands out as a rare "hexagonal warrior." It achieves a perfect balance between risk control and profitability, making it a top choice for aggressive fund managers.

If you are a seasoned "coin hunter": Gate, with its vast token selection and lightning speed, offers the richest choices—but it’s also where "jungle law" reigns supreme, demanding top-tier independent judgment skills.

In the end, choosing an exchange is as personal as choosing an investment strategy. Understand your own risk appetite and investment goals, then pick the platform that best helps you achieve them—that will be your current "best money printer."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News