South Koreans have turned cryptocurrency trading into an e-sport

TechFlow Selected TechFlow Selected

South Koreans have turned cryptocurrency trading into an e-sport

Making money means leveling up; losing money means dropping ranks.

Author: Uda

Why Koreans Stopped Trading

Over a month ago, I came across a video online.

The familiar dark stage lighting, combined with deafening cheers from the audience, made it seem like an offline esports match for League of Legends.

But when the camera zoomed in, I realized something was off—the wall didn’t display a game, but rather a K-line chart!

Indeed, Koreans have turned cryptocurrency trading into an esports event.

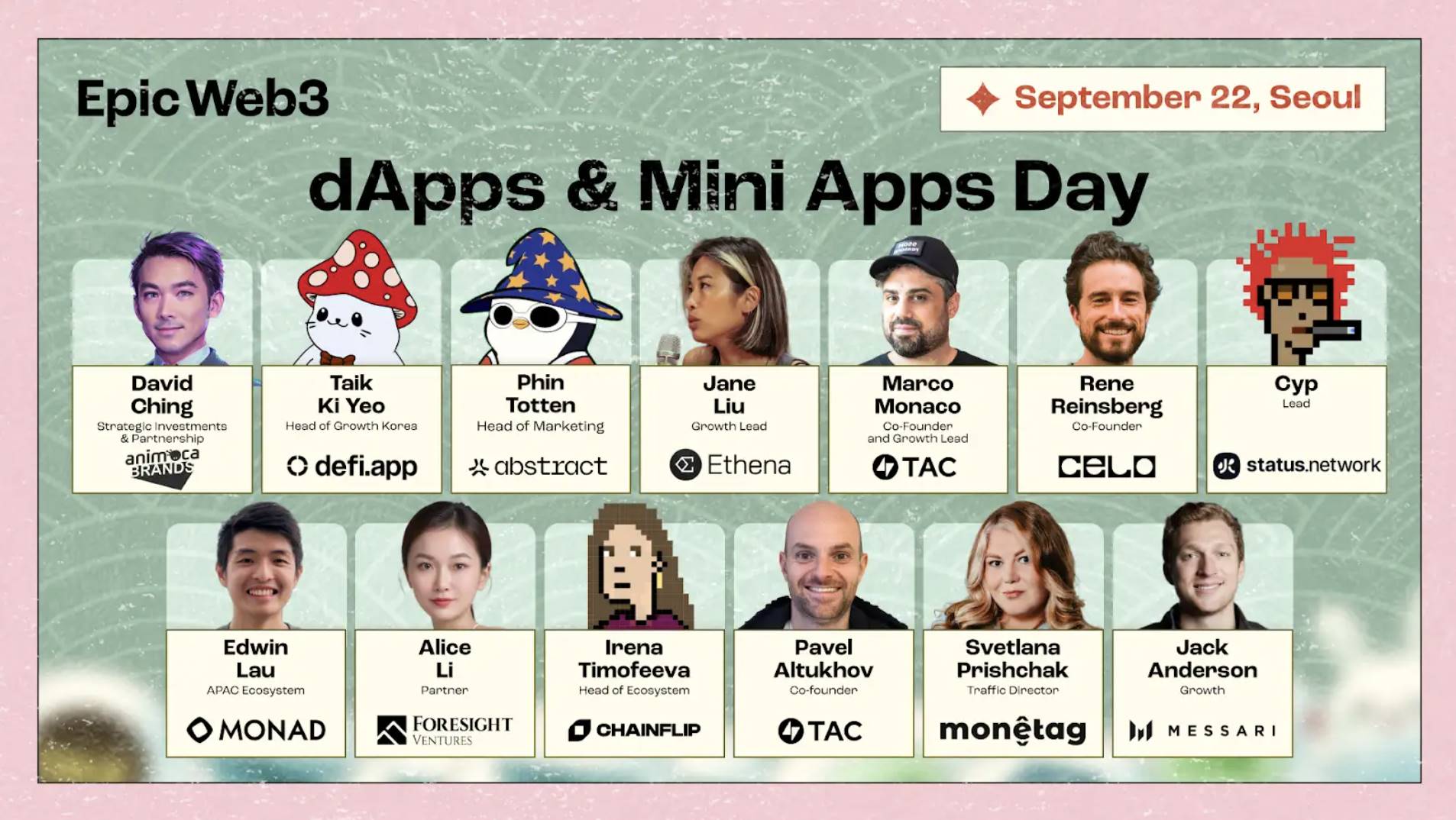

This video was from Perp-DEX Day 2025, an official side event during Korea Blockchain Week this year.

"Perp" stands for perpetual contracts, the most thrilling leveraged trading method in crypto circles, while "Dex" refers to decentralized exchanges—platforms operating via smart contracts without a corporate entity.

What Perp-DEX Day does is bring this high-leverage on-chain trading offline, turning it into a live audience event: a real-time speculative trading competition.

My first reaction upon seeing such an event was shock, but knowing it happened in Korea, it somehow felt unsurprising.

After all, Korean youth's obsession with crypto trading has seemingly never changed.

Korean media once summarized it perfectly: "In Korea, trading crypto isn't a hobby—it's a symptom of the times."

Yet what I never expected was:

While I casually equated "Korea =疯狂 trading," mulling over that event from over a month ago,

a recent news story suddenly hit me with a counterintuitive blow.

Data from Upbit, South Korea’s largest cryptocurrency exchange, is undergoing a historic collapse—transaction volumes have plummeted over recent months, with stablecoin trading down by as much as 80%.

Even more striking, it’s not just Upbit’s volume declining—search interest in cryptocurrencies among Korean youth, community discussion levels, and retail activity are all dropping simultaneously.

All signs point to one conclusion: Koreans are exiting the market.

Has the country that treated crypto trading like a life mission finally started to cool down?

From nationwide frenzy to today’s freezing point—what exactly did this generation of Korean youth go through?

Why Were Korean Youth So Obsessed With Crypto Trading?

If you mapped global crypto enthusiasm as a heat map, South Korea would undoubtedly be the brightest spot.

Anyone familiar with crypto knows about the “Kimchi premium,” a near-mythical phenomenon where the same coin trades 5% to 20% higher on Korean exchanges than the global average.

This shows Koreans were genuinely willing to pay top dollar to get in early.

There’s endless online content describing Korea’s intense societal pressure—“Seoul housing prices are crushing people,” “Koreans aren’t having kids,” “Seoul has one of the highest suicide rates globally”...

While these issues are real, many countries face similar social challenges. These reasons can explain why people everywhere want money—but they don’t explain why Korean youth specifically chose *crypto trading*.

In my view, Korea surged so aggressively into the crypto world not because their lives were particularly “hard,” but because Korean society’s pace, cultural habits, and youth psychology perfectly aligned with the mechanisms of the crypto world.

This created a strange—and even dangerous—chemical reaction.

Since 2017, when countless crypto altcoins entered public awareness, Korean society—like dry tinder—met its destined spark, igniting instantly and uncontrollably.

Korean youth possess several almost “innate” traits that make them more susceptible to crypto market mania than others.

First, Korea is a society obsessed with “immediate feedback.”

If you’ve been to Korea, you understand this unique “rhythm.”

Take Seoul’s ubiquitous iced Americanos, nightlife that only kicks off after midnight, and the average six hours of sleep per night.

This isn’t just about efficiency—it’s a deeply embedded cultural fast pace.

Even K-pop culture feels perpetually on fast-forward, with breakneck K-drama pacing and tightly edited variety shows—all showcasing a lifestyle of relentless stimulation, rhythm, and feedback.

Growing up in this environment, Korean youth are almost reflexively sensitive to speed, excitement, and instant rewards.

And what is the crypto world?

Precisely the place best at delivering instant feedback.

When these two collide, the result is nothing short of dry tinder meeting fire.

A second reason Korean youth easily fall into crypto is that Korean society operates under a uniquely “gamified” structure.

Life for Korean youth resembles playing a ranked video game from start to finish.

School has rankings, job hunting has rankings, company performance has yet another ranking system—even fitness and vocabulary apps feature national leaderboards.

In other words, Korean youth live a daily “real-life RPG” existence.

So when they trade crypto, they naturally interpret it as a game narrative:

Making money means leveling up; losing money means dropping ranks.

Using leverage is like activating a powerful skill at a critical moment; if you’re liquidated, it’s simply “team wipe.”

When a society runs long-term on gamification mechanics, people naturally gravitate toward “instant stimulation + visible achievements.”

The crypto world is exactly such a place—a “real-life Squid Game” with even higher stimulation density than reality.

This also explains why an event like Perp-DEX Day, turning crypto trading into an esports show, feels completely natural in Korea.

For Korean youth, this isn’t a “financial event”—it’s more like a MrBeast-style “live-action Squid Game” spectacle.

When a society’s pace, entertainment, and storytelling habits all chemically react to one phenomenon, there’s only one word to describe it: madness.

Korea’s crypto mania was an accelerated product of these conditions.

But mania can’t last forever—once any part of this narrative breaks, the entire emotional system collapses instantly.

The Cost of Going From Mania to Ice-Cold

Korean youth’s crypto frenzy was once so intense it consumed the entire society.

But tracing this mania over time reveals it wasn’t a straight path from peak to sudden crash.

Rather, it followed a trajectory resembling a volatile K-line: volcanic eruption → earthquake → brief revival → PTSD → collective braking.

At the heart of it all lies one pivotal event: the 2022 LUNA crash.

If you’re not in crypto, you might not realize how wildly popular LUNA was in Korea.

By the bull market peak, LUNA wasn’t just a crypto project—it had become a “national hope.”

Its founder, Do Kwon, was hailed by Korean media as a genius akin to Elon Musk, and countless young Koreans idolized him as an entrepreneurial role model.

△Do Kwon’s iconic pose imitates Elon Musk

Then in May 2022, the plot flipped instantly from inspirational drama to disaster movie.

Massive sell-offs of UST (TerraUSD), the algorithmic stablecoin within LUNA’s ecosystem, caused LUNA’s supply to explode and its price to plummet.

In just days, LUNA dropped from nearly $90 to less than $0.015 per token—effectively zero. The LUNA ecosystem, once worth $40 billion, vanished overnight, leaving countless investors bankrupt.

As LUNA’s home market, Korean retail investors bore the brunt of this financial catastrophe.

Angry investors surrounded Do Kwon’s residence, and Seoul saw several extreme social incidents linked to the crash.

The LUNA collapse wasn’t just an investment failure for Korean youth—it was a nationwide psychological trauma.

△Do Kwon was arrested in Montenegro in 2023 and later extradited to the U.S.

As time passed, the global crypto market gradually recovered from 2023 to 2025, with Bitcoin repeatedly hitting new highs.

Koreans returned—but their mindset was fundamentally different.

If the 2020–2021 boom saw Korean youth chasing dreams of “overthrowing the chaebols,”

their return in 2023–2025 resembled gamblers coming back to the table with fresh scars.

After the LUNA crash, crypto’s role in Korea shifted—from a “life-changing opportunity” to a recognized “high-risk competitive game.”

Once you know it’s a “high-risk game,” the only question left is who can exit faster.

This made Korean retail traders hypersensitive to market shifts.

At the slightest sign of instability, Korean traders pulled out first. At the hint of regulatory signals, users quickly reduced positions and waited.

Thus, by 2025, when the crypto market entered what should have been a “normal cooling phase,” Korean retail reactions were far more intense than elsewhere.

The result? A shocking phenomenon: transaction volume on Upbit, Korea’s largest exchange, plunged 80% in a short time.

From an outside perspective, this seems inexplicable—but within Korea’s social context, it makes perfect sense.

A group that experienced mass “zeroing out” naturally has a lower risk threshold. Even mild headwinds are enough to trigger a collective exit.

But if you believe Korea’s retail investors collectively withdrew from crypto in late 2025 due to rational self-restraint, you’re dead wrong.

The hardest thing in the world is stopping a gambler from gambling.

Korean risk appetite hasn’t diminished—they’ve simply moved to a noisier battlefield: the Korean stock market.

The clearest signal comes from data.

In 2025, the KOSPI index skyrocketed, rising over 70% for the year, repeatedly setting new monthly highs. Brokerage apps crashed from excessive trading traffic. Samsung Electronics and LG Energy Solution both doubled, while SK Hynix surged over 240% year-to-date, becoming the new “national faith” for retail investors.

Where Did All the Korean Money Go?

By this stage, the Korean stock market had fully absorbed the social sentiment once held by crypto.

With global AI and semiconductor demand surging, Korea found itself back at the center of the supply chain. Combined with government initiatives, the entire Korean stock market became unstoppable.

All the capital previously flooding into crypto now poured into Korean tech stocks.

Meanwhile, the crypto market quietly lost its last wave of eager buyers. Trading volumes on Upbit and Bithumb halved, and the altcoin sector cooled into a gray wasteland.

In short: Koreans haven’t stopped speculating—they’ve simply moved the gambling table from crypto to stocks.

They still chase high returns, still dare to use leverage—only now, instead of betting on some new meme coin, they’re backing stronger, more narrative-rich targets like Samsung and SK Hynix.

But I wouldn’t be surprised at all if, one day, when the AI hype fades, semiconductor growth slows, or when crypto brews another grand narrative,

those dormant gamblers wake up again.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News