Layer 1 Impostor Syndrome: When More Crypto Apps Start "Associating" with Public Blockchains

TechFlow Selected TechFlow Selected

Layer 1 Impostor Syndrome: When More Crypto Apps Start "Associating" with Public Blockchains

DeFi and RWA protocols relocating to Layer 1 in pursuit of high valuations won't succeed—changing their outfits won't help if the product is lacking.

Author: Alexandra Levis

Translation: TechFlow

DeFi and RWA protocols are repositioning themselves as Layer 1s to capture infrastructure-like valuations. But Avtar Sehra argues that most DeFi and RWA protocols remain confined to narrow use cases and lack sustainable economics—and the market is starting to see through it.

In financial markets, startups have long tried to brand themselves as “tech companies,” hoping investors would value them using tech multiples. This strategy often works—at least in the short term.

Traditional institutions paid the price. Throughout the 2010s, numerous companies rushed to rebrand as tech firms. Banks, payment processors, and retailers began calling themselves fintech or data companies. Yet few achieved true tech-like valuation multiples—because their fundamentals rarely matched the narrative.

WeWork stands as one of the most iconic examples: a real estate company masquerading as a tech platform, ultimately collapsing under the weight of its own illusion. In financial services, Goldman Sachs launched Marcus in 2016—a digital-first platform designed to compete with consumer fintech. Despite early traction, the initiative was scaled back in 2023 due to persistent profitability challenges.

JPMorgan famously declared itself a “technology company with a banking license,” while BBVA and Wells Fargo invested heavily in digital transformation. Still, these efforts rarely delivered platform-level economies. Today, such corporate tech delusions lie in ruins—a clear reminder that no amount of branding can overcome the structural constraints of capital-intensive or regulated business models.

The crypto industry now faces a similar identity crisis. DeFi protocols want Layer 1-like valuations. RWA dApps aim to position themselves as sovereign networks. Everyone is chasing the “tech premium” associated with Layer 1s.

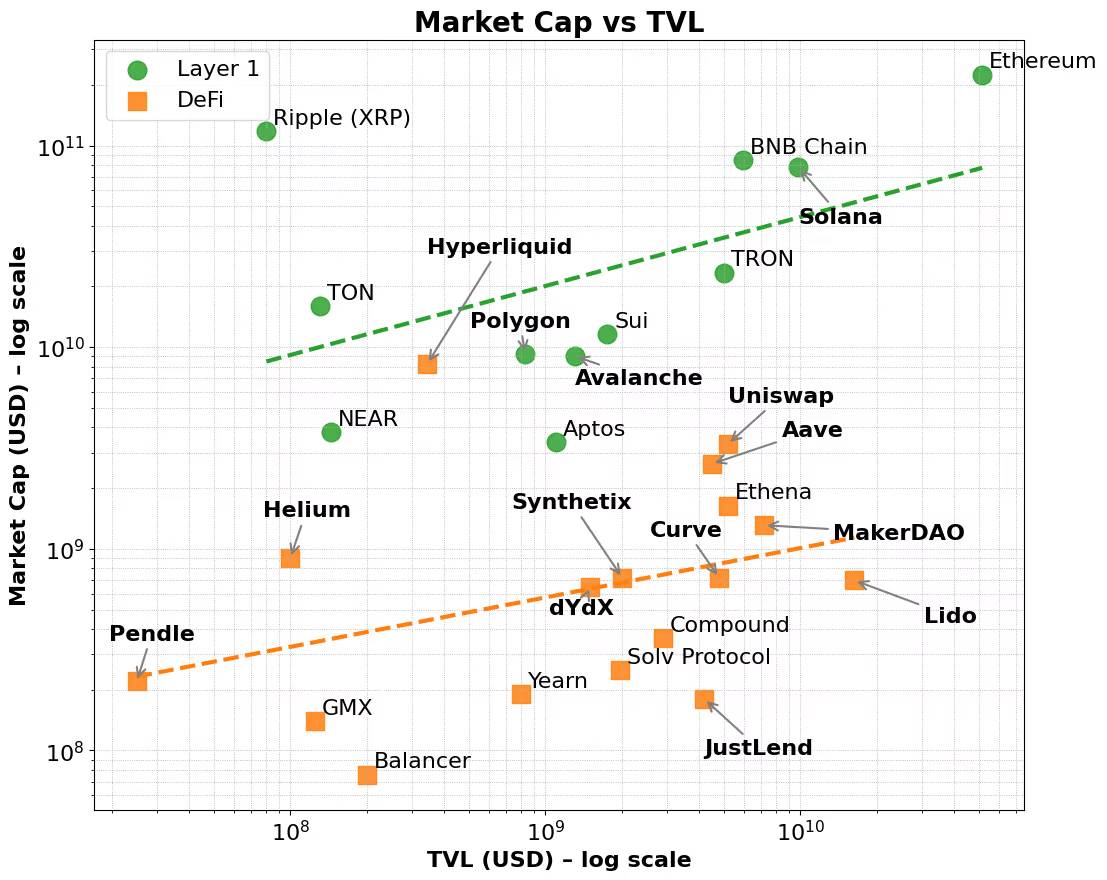

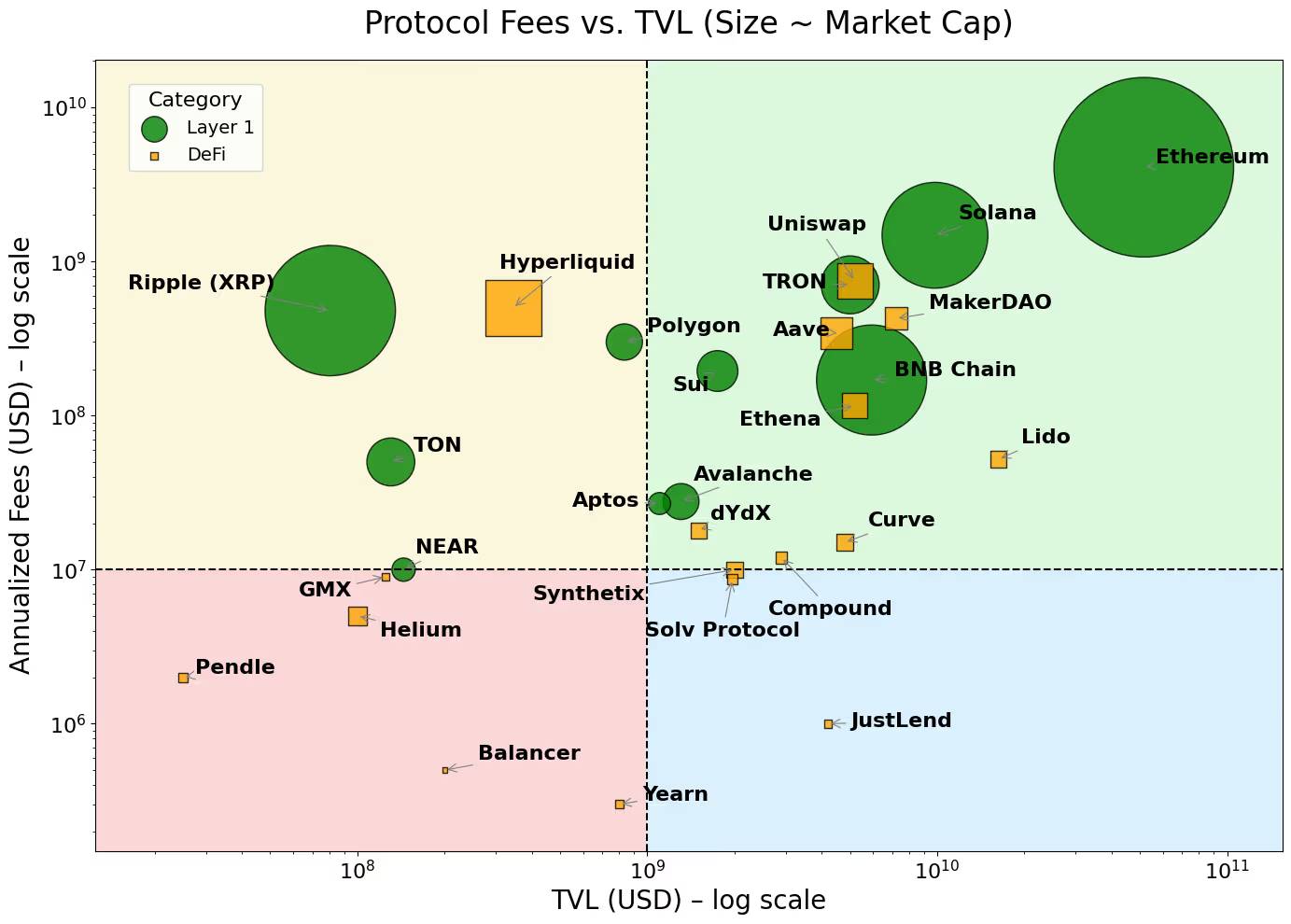

Fairly enough, this premium does exist. Layer 1 networks like Ethereum, Solana, and BNB have consistently commanded higher valuation multiples relative to metrics like total value locked (TVL) and fee generation. These networks benefit from broader market narratives—one favoring infrastructure over applications, platforms over products.

This premium persists even when controlling for fundamentals. Many DeFi protocols demonstrate strong TVL or fee generation yet still struggle to reach Layer 1-level market caps. In contrast, Layer 1s attract early users through validator incentives and native tokenomics, then expand into developer ecosystems and composable applications.

Ultimately, the premium reflects Layer 1s’ broad native token utility, ecosystem coordination capacity, and long-term scalability. Moreover, as fee volumes grow, these networks often see disproportionate market cap expansion—indicating investors price in not just current usage, but future potential and compounding network effects.

This layered flywheel mechanism—from infrastructure adoption to ecosystem growth—explains why Layer 1 valuations consistently exceed those of decentralized applications (dApps), even when underlying performance metrics appear similar.

It mirrors how equity markets differentiate platforms from products. Infrastructure providers like AWS, Microsoft Azure, Apple’s App Store, or Meta’s developer ecosystem are more than service providers—they are ecosystems. These platforms enable thousands of developers and businesses to build, scale, and interoperate. Investors assign them higher valuation multiples not just for current revenue, but for enabling future use cases, network effects, and economies of scale. In contrast, even highly profitable SaaS tools or niche services struggle to achieve comparable valuation premiums—due to limited API composability and narrow utility.

Today, this pattern is repeating among large language model (LLM) providers. Most vendors are racing to position themselves as AI application infrastructure, not just chatbots. Everyone wants to be AWS, not Mailchimp.

Crypto’s Layer 1s follow similar logic. They are not merely blockchains, but coordination layers for decentralized computation and state synchronization. They support wide-ranging composable applications and assets, with native tokens accumulating value from underlying activity—gas fees, staking, MEV, and more. Crucially, these tokens also serve as mechanisms to incentivize developers and users. Layer 1s benefit from self-reinforcing cycles—interlocking users, developers, liquidity, and token demand—while enabling both vertical and horizontal expansion across industries.

In contrast, most protocols are not infrastructure, but single-purpose products. Adding a validator set doesn’t make them Layer 1s—it simply creates a justification for higher valuations by dressing up a product as infrastructure.

This is precisely where the appchain trend emerges. Appchains integrate application, protocol logic, and settlement layer into a vertically integrated tech stack, promising better fee capture, user experience, and “sovereignty.” In rare cases—like Hyperliquid—these promises hold. By owning the full stack, Hyperliquid delivers fast execution, superior UX, and significant fee generation—without relying on token incentives. Developers can even deploy dApps atop its underlying Layer 1, leveraging its high-performance DEX infrastructure. While still narrow in scope, it demonstrates some degree of broader scalability potential.

Yet most appchains are little more than rebranded protocols—lacking real usage or deep ecosystem support. These projects often face a two-front battle: trying to build both infrastructure and product, without sufficient capital or team strength to succeed at either. The result is a blurry hybrid—neither a high-performance Layer 1 nor a category-defining dApp.

We’ve seen this before. A robo-advisor with a sleek UI is still wealth management; an open-API bank remains a balance-sheet-driven business; a coworking firm with a polished app is ultimately leasing office space. Eventually, as market heat fades, capital reevaluates these ventures.

RWA protocols now fall into the same trap. Many attempt to brand themselves as tokenized finance infrastructure, yet lack meaningful differentiation from existing Layer 1s or sustainable user adoption. At best, they are vertically integrated products without genuine need for independent settlement layers. Worse, most haven’t achieved product-market fit in their core use case. They bolt on infrastructure features and rely on inflated narratives, hoping to prop up valuations their economics cannot support.

So what’s the way forward?

The answer isn’t pretending to be infrastructure, but clearly defining your role as a product or service—and executing it exceptionally well. If your protocol solves real problems and drives meaningful TVL growth, that’s a solid foundation. But TVL alone won’t make you a successful appchain.

What matters is real economic activity: TVL that generates sustainable fees, retains users, and creates clear value accrual for the native token. Moreover, if developers build on your protocol because it’s genuinely useful—not because you claim to be infrastructure—the market will reward you. Platform status is earned, not declared.

Some DeFi protocols—like Maker/Sky and Uniswap—are moving along this path. They’re evolving toward appchain-style models to improve scalability and cross-network access. But they do so from positions of strength: mature ecosystems, clear monetization, and proven product-market fit.

In contrast, the emerging RWA space has yet to show lasting appeal. Nearly every RWA protocol or centralized service is rushing to launch appchains—often backed by fragile or unproven economic models. Like leading DeFi protocols transitioning to appchains, the optimal path for RWA projects is first to leverage existing Layer 1 ecosystems, accumulate user and developer traction, drive TVL growth, demonstrate sustainable fee generation, and only then evolve into purpose-driven appchain infrastructure models.

Therefore, for appchains, the underlying application’s utility and economic model must be validated first. Only after these foundations are proven does a move to an independent Layer 1 become viable. This contrasts sharply with general-purpose Layer 1s, which can initially prioritize building validator and trader ecosystems, where early fee generation stems largely from native token trading. Over time, cross-market expansion brings in developers and end users, eventually driving TVL growth and diversified revenue streams.

As the crypto industry matures, narrative fog is clearing and investors are growing more discerning. Terms like “appchain” and “Layer 1” no longer command attention by name alone. Without a clear value proposition, sustainable tokenomics, and a defined strategic roadmap, protocols lack the necessary foundation to transition into true infrastructure.

The crypto industry—and especially the RWA space—doesn’t need more Layer 1s. It needs better products. Projects focused on building high-quality offerings will be the ones that truly earn market rewards.

Figure 1. Market Cap vs. TVL for DeFi and Layer 1

Figure 2. Layer 1s cluster in high-fee areas, while dApps cluster in low-fee areas

Note: The views expressed in this column are the author’s and do not necessarily reflect the views of CoinDesk, Inc. or its owners and affiliates.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News