The arrival of crypto super apps: Coinbase and others are reshaping the one-stop financial ecosystem

TechFlow Selected TechFlow Selected

The arrival of crypto super apps: Coinbase and others are reshaping the one-stop financial ecosystem

Bringing all financial services under one roof.

By: Nishil Jain

Translated by: Luffy, Foresight News

Last week, Coinbase launched a new product touted as the "future of finance." One app delivers five capabilities: 5×24 stock trading, centralized and on-chain cryptocurrency trading, futures and perpetual contracts, prediction markets, and an AI-powered financial analyst. All features are accessible via mobile, with a single account balance allowing instant switching across asset classes.

Not long ago, Robinhood had already moved ahead: launching tokenized stock trading in Europe, 5×24 futures trading, crypto yield services, and planning to roll out its social trading feature, Robinhood Social, by 2026.

The dominant narrative on X interprets this trend as the evolution of the "super app," but people have overlooked a crucial point: this is not merely about adding features—it’s about breaking down artificially created boundaries between financial asset classes imposed by regulation and technical limitations.

After a decade of fragmentation, why is the financial application space now seeing a wave of consolidation? And what does this mean for users and platforms involved? Let's dive in.

The Pain of Fragmentation

Over the past decade, fintech apps have proliferated, yet most cover only a single slice of financial services—stock trading, cryptocurrency, payments, savings—all scattered across different apps.

While this model offered more choice and allowed companies to focus on refining specific solutions, it created significant practical issues.

Want to sell stocks and buy crypto? You'd execute the stock trade on Monday, but settlement (T+1) wouldn’t complete until Tuesday. Then you initiate a withdrawal, which takes 2–3 days to reach your bank account. Transferring funds to Coinbase adds another 1–2 days. From “deciding to reallocate capital” to “funds actually available,” the entire process takes about five days. During that time, the investment opportunity you identified may have vanished, while your capital sits idle in bureaucratic limbo.

For example, you might have wanted to buy Bitcoin at $86,000 on December 18, but due to delays, ended up paying $90,000 five days later. For more volatile opportunities like meme coins, initial coin offerings (ICOs), or initial public offerings (IPOs), such delays can result in even greater losses.

The problem isn't limited to one region. An Indian investor wanting to buy NVIDIA stock must undergo multiple KYC verifications, open an account with a broker supporting Indian access to U.S. equities, and deposit additional funds—just to buy a single stock.

We’ve all experienced this friction—but only recently has the necessary infrastructure emerged to solve it.

The Foundation of Change: Maturing Infrastructure

Three structural shifts have made integrated financial platforms possible.

Tokenization Breaks Time Barriers

Traditional stocks trade only during NYSE hours (9:30 AM to 4:00 PM ET, five days a week), while cryptocurrencies operate 7×24. Tokenizing stocks on Layer 2 networks proves that, with the right technical design, stocks could theoretically be traded around the clock.

Today, Robinhood’s tokenized stocks in Europe already support 5×24 trading, and Coinbase plans to follow suit.

Regulatory Frameworks Are Clarifying

In recent years, spot Bitcoin ETFs were approved, stablecoin legalization has advanced, tokenization regulations are under review, and prediction markets received green lights from the U.S. Commodity Futures Trading Commission (CFTC). While the regulatory landscape remains imperfect, it’s now clear enough for platforms to confidently build multi-asset products without fear of abrupt shutdowns.

Mobile Wallet Infrastructure Has Matured

Embedded wallets can now seamlessly handle complex cross-chain operations. Privy, acquired by Stripe, lets users create wallets using just their email—no seed phrases required. The newly launched crypto trading app Fomo enables non-crypto users to trade tokens on Ethereum, Solana, Base, and Arbitrum without manually selecting networks. It supports Apple Pay deposits, automatically handling all backend complexity—users simply tap “Buy Token” and complete the transaction.

The Core Logic of Liquidity Integration

The driving force behind this shift is simple: capital spread across fragmented apps is essentially idle capital.

In an integrated model, users maintain a single account balance. After selling stocks, funds can instantly be used to buy crypto—no waiting for settlement windows, withdrawal approvals, or bank intermediaries. The five-day opportunity cost vanishes entirely.

Platforms integrating liquidity gain efficiency advantages. With deeper liquidity pools, they offer faster execution; shared base liquidity across all trading pairs allows broader market support; they can generate yield on idle capital like banks; and reduced friction leads to higher trading volumes, increasing fee revenue.

Coinbase’s Integration Blueprint

Coinbase stands as the quintessential case of financial integration. Founded in 2012 as a simple crypto exchange supporting only Bitcoin and Ethereum, it gradually expanded into institutional custody, staking, crypto lending, and yield products—evolving into a full-service crypto platform by 2021.

Its expansion continued: launching the Coinbase Card for crypto spending, Coinbase Commerce for merchants, and building its own Layer 2 blockchain, Base.

The December 17 product launch marked the full realization of Coinbase’s “super app” vision. Today, Coinbase supports 24-hour stock trading, plans to launch Coinbase Tokenize—an institutional real-world asset tokenization service—in early next year, integrates prediction markets via Kalshi, offers futures and perpetuals, and embeds decentralized exchange trading from the Solana ecosystem. Meanwhile, the Base app has expanded to 140 countries and enhanced its social trading experience.

Coinbase is gradually becoming the operating system for on-chain finance. Through a single interface and unified account balance, it aims to meet all asset class trading needs—enabling users to perform every financial action without ever leaving the platform.

Robinhood follows a similar path: starting with commission-free stock trading, then adding crypto trading, a Gold subscription offering 3% cashback and 3.5% deposit yields, futures trading, and launching tokenized stocks in Europe.

Both platforms bet on the same core idea: users don’t want separate apps for stocks, crypto, and derivatives. They want a single account balance, unified interface, and the ability to instantly reallocate capital.

Social Trading: An Emerging Competitive Edge

Liquidity integration solves capital inefficiency, but not the user’s discovery problem.

When millions of assets are available, how should users pick investments? How do they build portfolios?

This is where social features add value. Coinbase’s Base app includes a live feed showing others’ buys; Robinhood plans to launch Robinhood Social in 2026; eToro has offered social trading since 2007, paying 1.5% of assets held by followers as commissions to top traders.

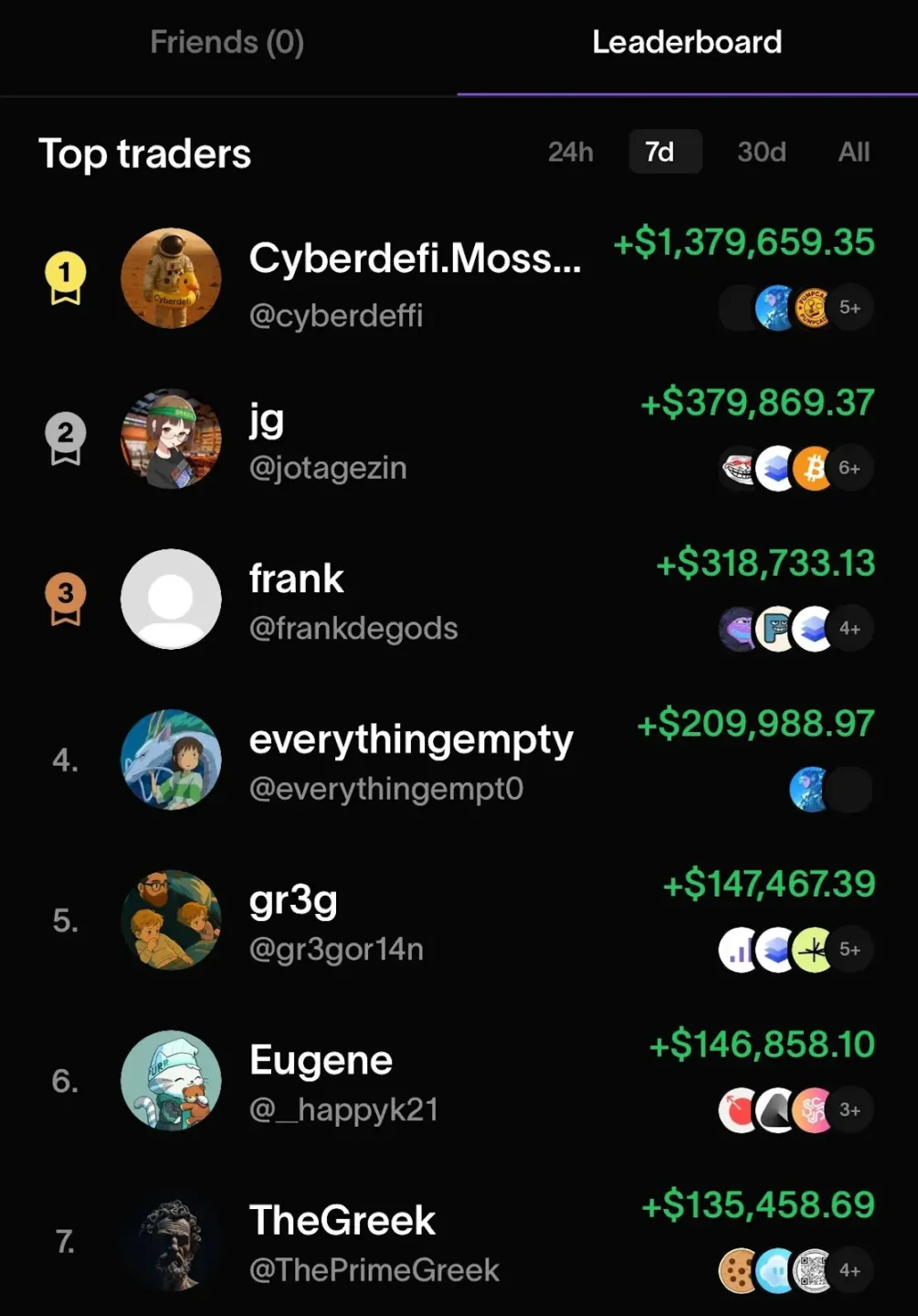

New applications exploring social trading have also emerged in the on-chain space, such as Fomo, 0xPPL, and Farcaster. These let users see friends’ investments, follow them, and copy trades with one click.

Fomo’s leaderboard page

Social trading allows users to view others’ actions in real time and replicate them instantly—drastically reducing decision friction. No need for independent research; just follow strategies you trust. Once a platform builds a stable community—where users follow top traders and build reputations—it becomes extremely difficult to leave, creating strong competitive moats and high user stickiness.

Centralized exchanges introduced copy trading back in 2022, but adoption has remained below 2%. Mobile-first platforms now bet that superior UX can boost usage. Whether they’re right will determine if social trading becomes a true differentiator—or just another checkbox feature.

Pessimistic View: Risks and Controversies

Let’s be honest: the original promise of cryptocurrency was financial decentralization—removing intermediaries and giving users control over their assets.

Yet today we’re rebuilding centralized platforms: Coinbase controls custody, trade execution, and social graphs; Robinhood holds private keys to embedded wallets. Users must trust these platforms are solvent, secure, and sustainable—introducing counterparty risk at every level.

Robinhood’s tokenized stocks are essentially price-tracking derivatives, not actual shares. If the platform fails, users hold nothing more than IOUs.

The dangers of gamification are also growing: 7×24 trading means impulsive decisions at 3 a.m.; social feeds trigger FOMO when you see others profiting; push notifications alert you to every market fluctuation. This is casino-style psychology, meticulously optimized by designers who know exactly how to stimulate dopamine.

Is this progress toward financial democratization—or just a repackaged exploitation system? That’s a philosophical question worth pondering.

The Essence Behind the Phenomenon

We spent ten years dismantling financial services under the assumption that fragmentation would foster competition and choice.

But fragmentation also bred inefficiency: idle capital, scattered liquidity, and users forced to keep excess funds on hand due to cumbersome transfer processes. A new era is changing that.

Coinbase and Robinhood are evolving into new kinds of banks: they hold your salary, savings, investments, and spending data; they control trade execution, custody, and access—inserting themselves into every transaction. Compared to traditional banks, their only differences are a prettier interface, 24/7 markets, and deposit rates 50 basis points higher.

Whether we’re achieving financial democratization through lower barriers and greater efficiency—or merely swapping gatekeepers while preserving the gates themselves—one thing is clear: the fragmented era is over. In the coming years, we’ll find out whether financial integration built on open underlying technology delivers better outcomes than the traditional banks we once sought to escape—or simply replaces their logos while locking us in anew.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News