Sensor Tower's 2025 H1 AI App Report: Young male users still dominate, vertical apps face pressure of being "disrupted"

TechFlow Selected TechFlow Selected

Sensor Tower's 2025 H1 AI App Report: Young male users still dominate, vertical apps face pressure of being "disrupted"

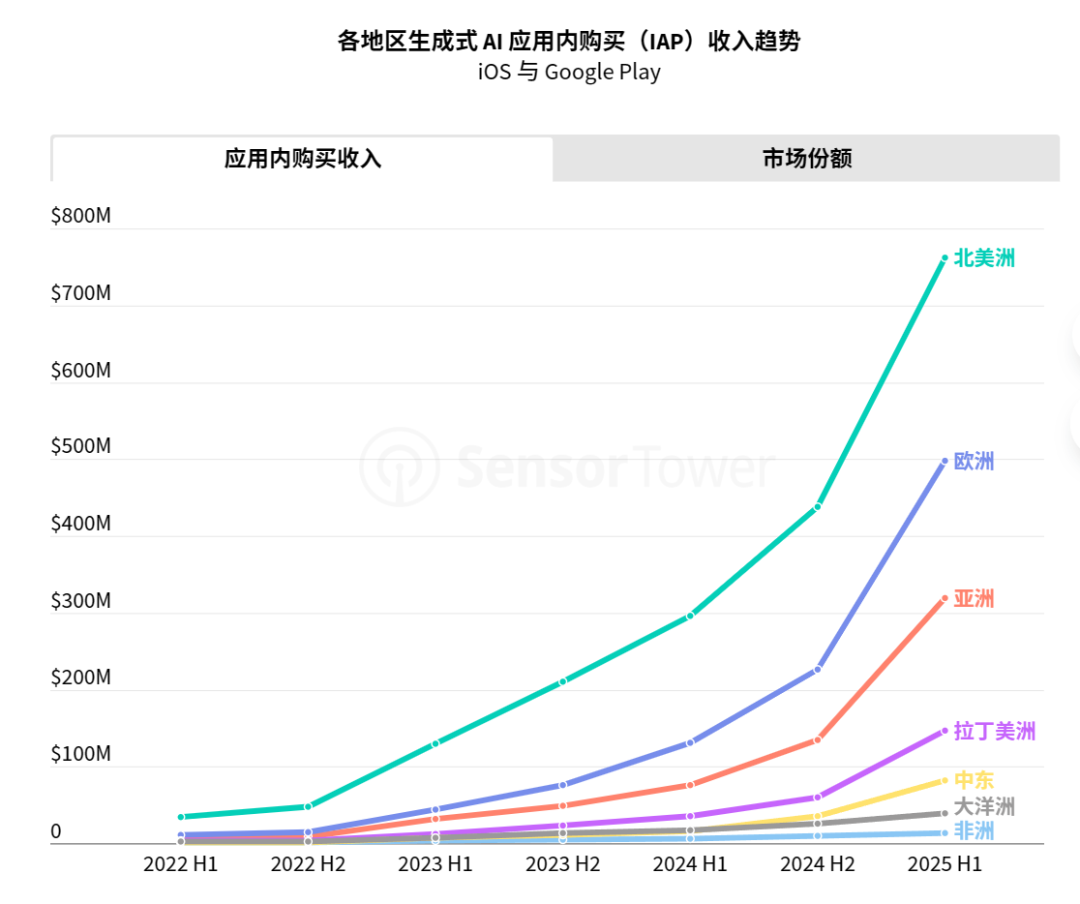

Asia is the largest download market for AI apps, while the United States leads in AI app in-app purchase revenue.

Sensor Tower, a mobile app analytics firm, has released its latest report titled "State of AI Apps Report 2025," analyzing the state of the mobile AI market. We've summarized key highlights:

-

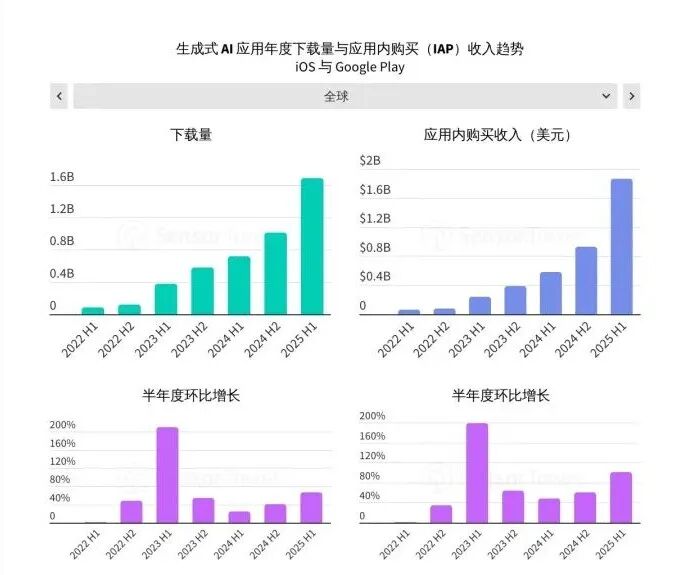

In the first half of 2025, global downloads of generative AI apps (AI assistants + AI content generators) approached 1.7 billion, with in-app purchase (IAP) revenue nearing $1.9 billion—up 67% quarter-over-quarter and doubling in revenue.

-

Asia (especially China and India) led download growth, with Asian AI app downloads increasing by 80% in H1 2025—significantly outpacing the global average.

-

Generative AI apps are expanding beyond verticals, now widely penetrating health, education, entertainment, finance, and other sectors, making AI a standard feature for enhancing user experience.

-

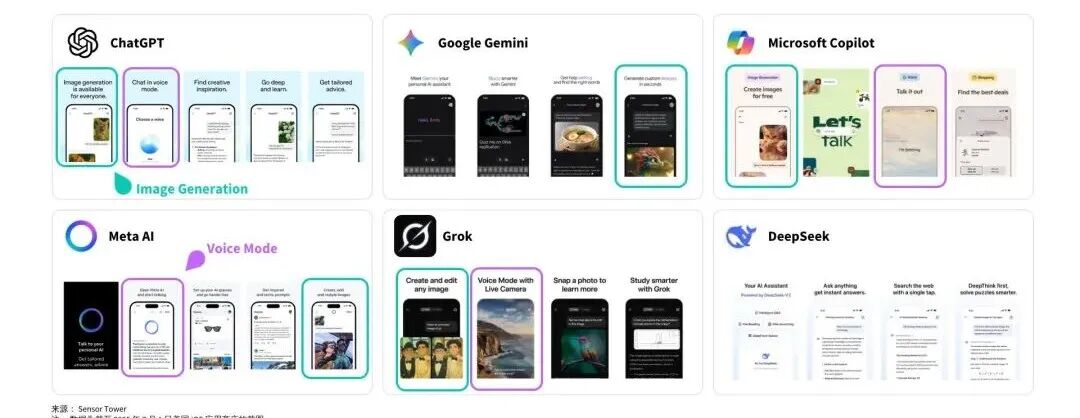

Leading AI assistants (e.g., ChatGPT, Google Gemini, DeepSeek) are adding new features such as image generation and voice chat to strengthen user engagement and differentiation.

-

Newcomer AI apps like DeepSeek have achieved rapid user expansion and surpassed download volumes in Asia, the Middle East, and Africa.

-

While mainstream AI assistant users remain predominantly young males, top products now attract over 30% female users, with niche use cases (e.g., entertainment, social, health) drawing more diverse demographics.

-

User monthly active days continue to rise: ChatGPT users globally averaged 13 active days per month—frequency approaching that of social platforms X (formerly Twitter) and Reddit.

-

To succeed beyond niche appeal, AI apps must deeply understand target user needs, precisely match functionality to scenarios, and improve user acquisition and conversion efficiency.

-

Over the past year, keywords related to “life and entertainment” in ChatGPT conversations increased from 22% to 35%, with health and shopping emerging as the fastest-growing use cases.

-

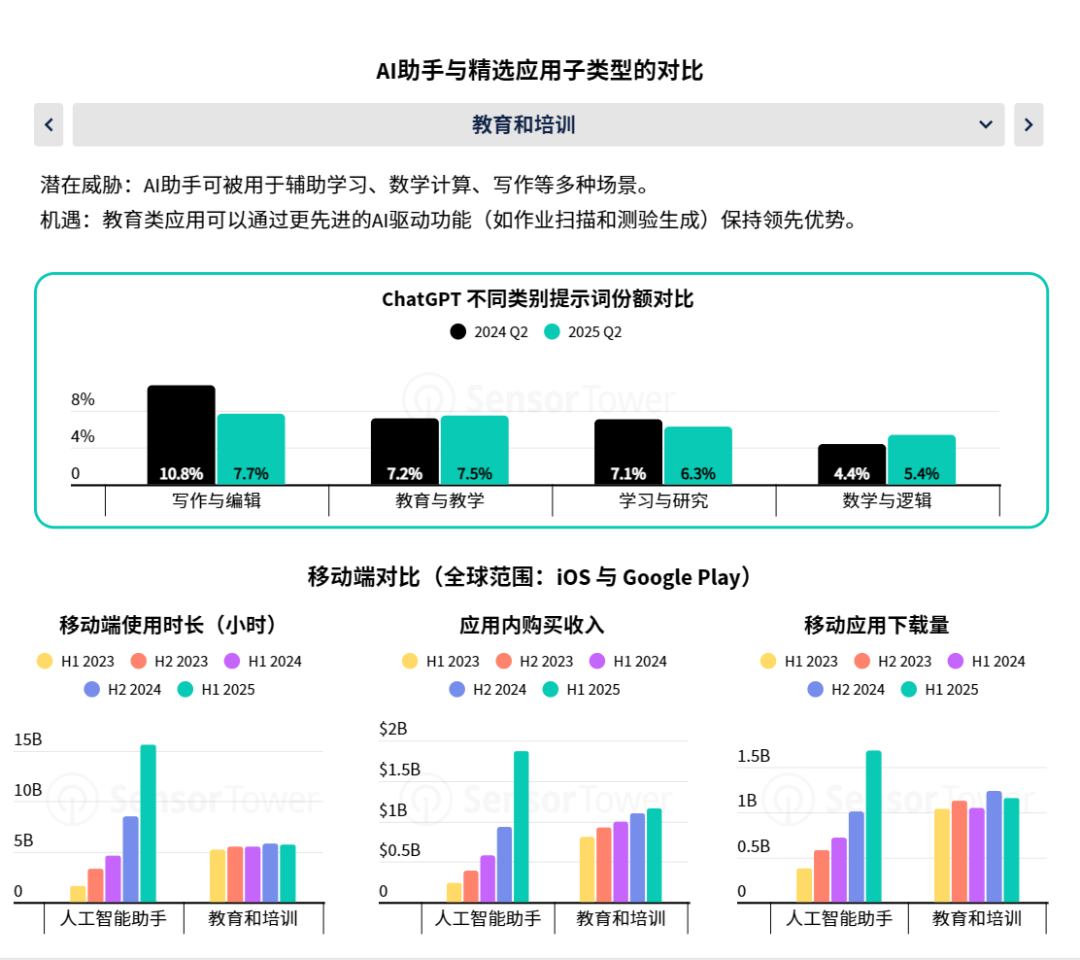

Vertical-specific apps face disruption pressure; unless they leverage finer AI capabilities (e.g., specialized recognition, vertical data integration) to deepen value, they risk being replaced by general-purpose AI—education, translation, and nutrition/diet apps should pay special attention to this challenge.

-

Incorporating “AI” into app names or descriptions drives significant download growth, with median downloads rising up to 4.1% within three months (more pronounced on iOS).

-

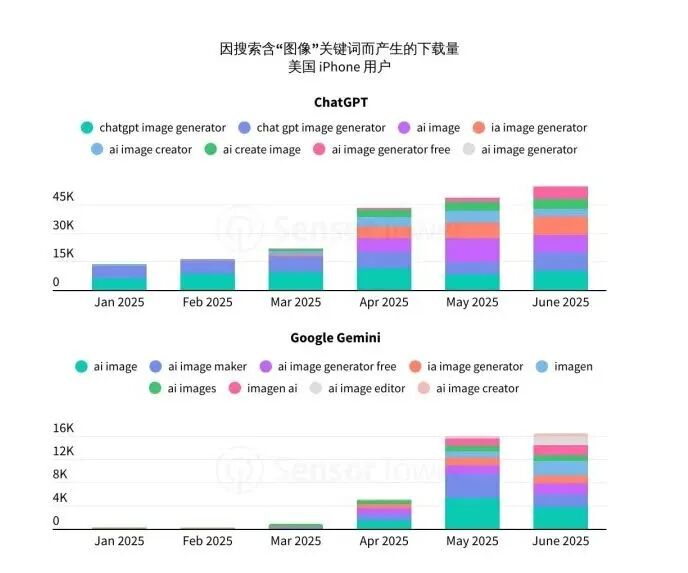

Promoting image-generation features—especially cartoon-style and playful visuals—in app screenshots and keyword campaigns has become mainstream and effectively attracts new users.

-

In verticals such as nutrition/diet, translation, note-taking, and exam prep, leading apps are widely integrating AI labels and functionalities, intensifying competition.

-

Speed of innovation and iteration determines survival: continuously explore new scenarios (image, voice, health, lifestyle), rapidly test emerging demands, and avoid replacement by mainstream AI assistants.

-

Focus on niche verticals: build specialized/localized solutions based on AI capabilities (e.g., customized AI nutrition tracking, medical applications) to create defensible advantages.

-

Leverage ASO and advertising opportunities: optimize app store strategies using AI-related terms, highlight innovative features in product screenshots, and invest in targeted marketing via niche channels.

Founder Park has extracted key highlights from the report. For the full report, visit: https://e.infogram.com/_/sQPY5Dm8I7WWPgu4Tt8s?src=embed

Note: Download and in-app purchase (IAP) revenue estimates in the report are compiled by Sensor Tower’s Insight team based on its mobile app intelligence platform.

Data covers January 1, 2014, to June 30, 2025, including download and IAP revenue estimates from App Store and Google Play platforms.

Asia is the largest download market for AI apps; the U.S. leads in AI app in-app purchase revenue

More than two years since ChatGPT’s launch, public enthusiasm for AI remains high, and demand for mobile AI continues to grow rapidly.

The report shows that in the first half of 2025, global downloads of generative AI apps (including AI assistants and AI content generators) neared 1.7 billion, with in-app purchase (IAP) revenue reaching nearly $1.9 billion. More notably, both download volume and IAP revenue continued to see strong half-over-half (HoH) growth. In H1 2025, downloads grew 67% compared to H2 2024—the fastest pace since H1 2023. IAP revenue also showed similar strength, with consumer spending in H1 2025 doubling compared to H2 2024.

AI app downloads in Asia surge 80%

Following ChatGPT’s release, English-speaking markets led by the U.S. were early adopters of generative AI apps, giving North America an initial share of about 20% of global downloads. However, as generative AI apps gained global traction, North America’s download share dropped to 11% in H1 2025. Despite this, download numbers in the region continue to grow.

Asia is now the largest download market for generative AI apps, with particularly strong growth in India and mainland China. From H2 2024 to H1 2025, generative AI app downloads in Asia surged 80%, significantly outperforming Europe (51%) and North America (39%) during the same period.

U.S. leads in AI app in-app purchase revenue, while other regions show stronger growth momentum

In H1 2025, IAP revenue from generative AI apps grew rapidly worldwide. North America led with $762 million in IAP revenue, achieving a 74% quarter-over-quarter growth rate. Notably, ChatGPT dominates in-app revenue, ranking #1 in all major markets except mainland China. It accounted for 63% of total generative AI app revenue in H1 2025—clearly demonstrating the vast monetization potential of generative AI apps globally. From H2 2024 to H1 2025, Latin America (+147%), Asia (+136%), the Middle East (+131%), and Europe (+121%) all saw IAP revenues more than double.

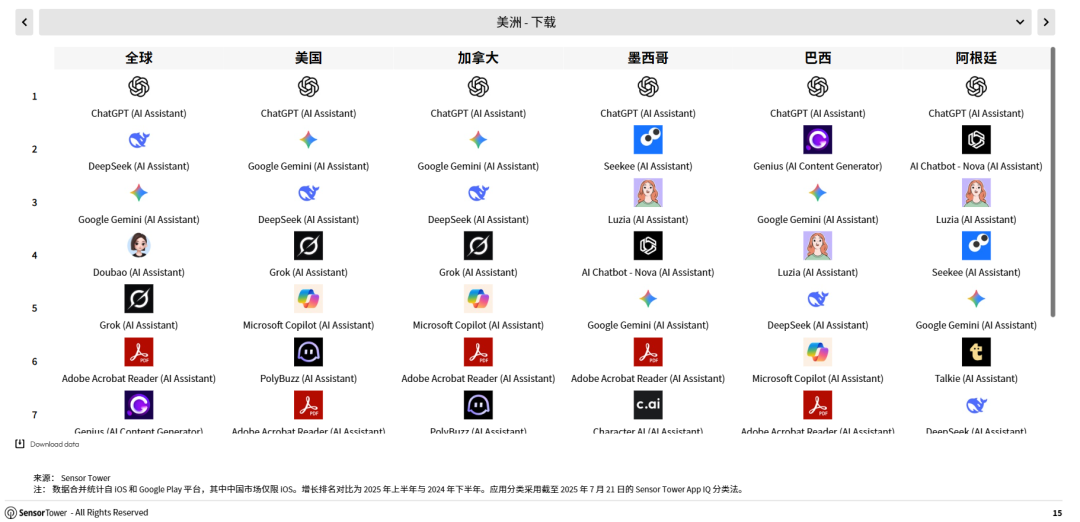

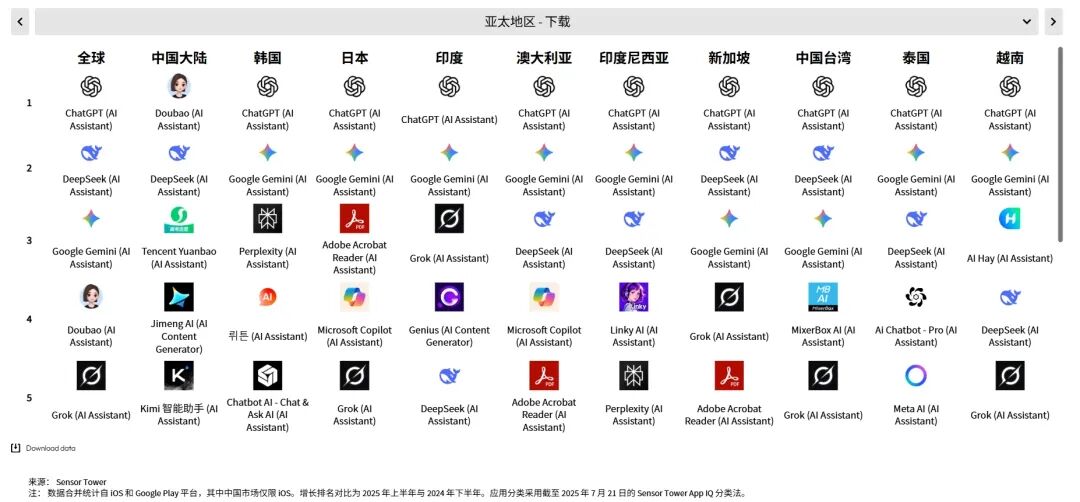

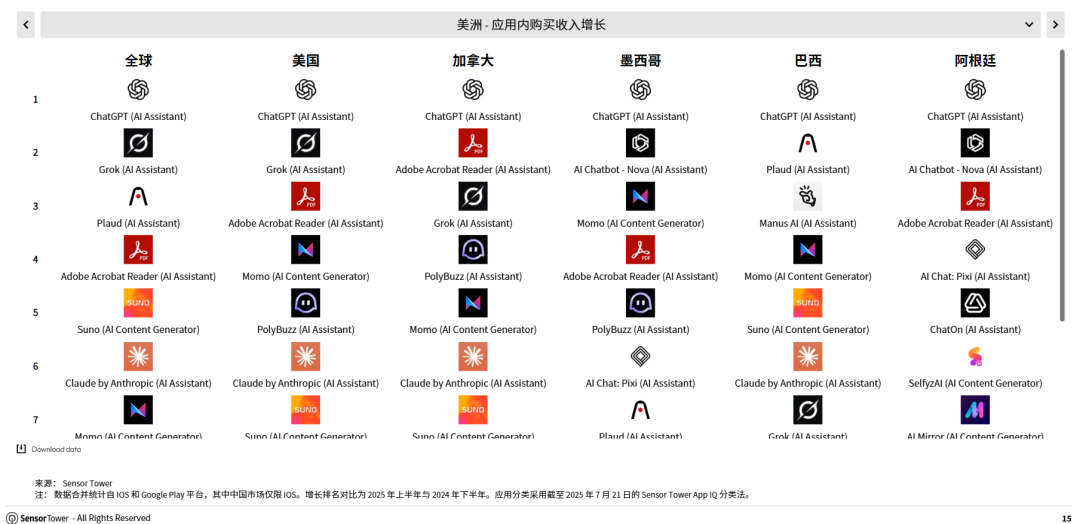

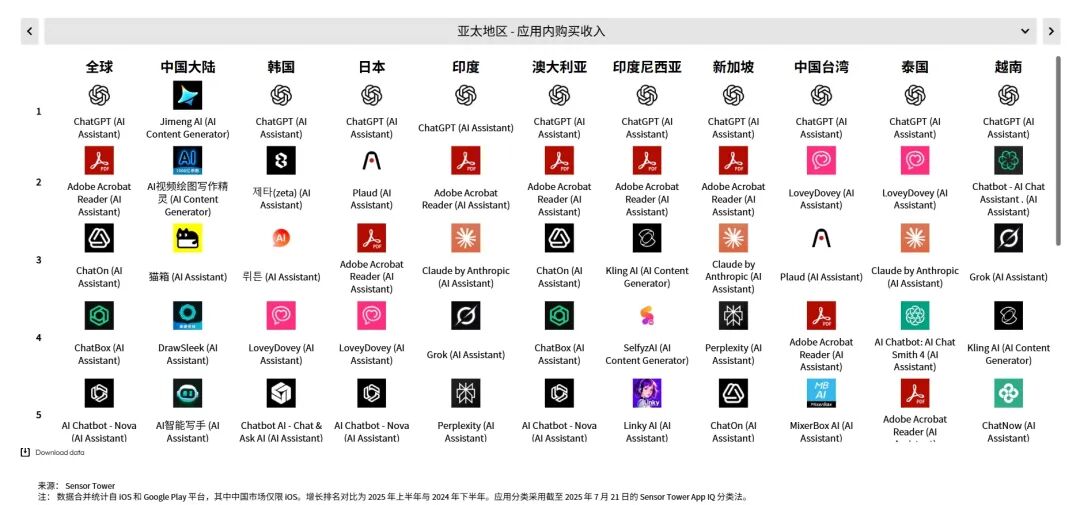

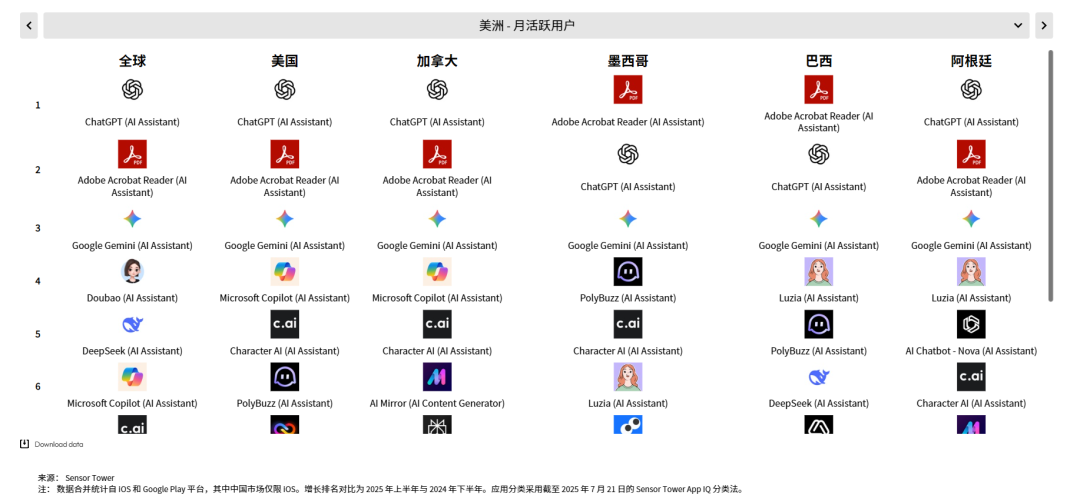

H1 2025 generative AI app market rankings

Sensor Tower analyzed H1 2025 generative AI app market rankings, showing trends in downloads, in-app purchases, and monthly active users across regions and countries. Data is sourced from iOS and Google Play platforms.

Download volume and download growth rankings

In-app purchase revenue and growth rankings

Monthly active users and growth rankings

ChatGPT's user stickiness grows rapidly; health and shopping are its fastest-growing use cases

The report finds that consumer adoption of AI assistants continues to rise, with ChatGPT’s cross-platform user engagement climbing steadily.

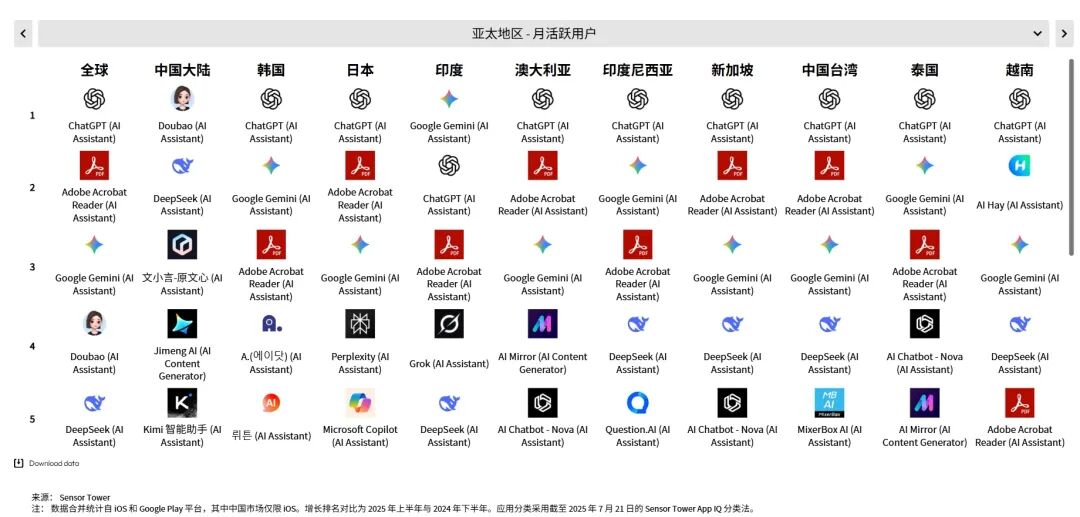

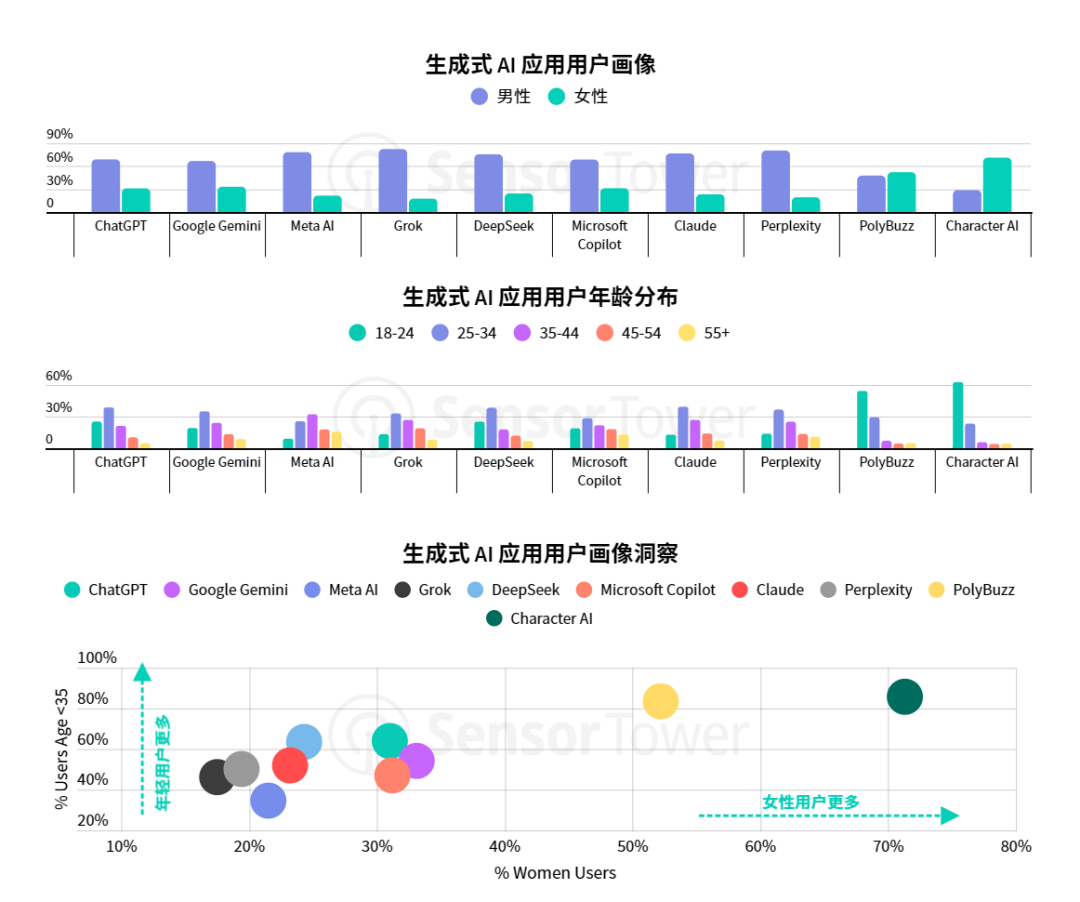

AI assistant user profile: young males still dominate

Although the user base for generative AI apps is expanding, the audience remains heavily skewed toward young males. Even highly popular apps like ChatGPT—among only 15 non-preinstalled apps globally with over 500 million monthly active users—show this trend. In the U.S., nearly 70% of ChatGPT users are male, with 64% under age 35. Analysis of generative AI app user profiles reveals a diverse audience structure. While most AI assistants—including DeepSeek, Claude, and Grok—still skew male, top-tier apps like ChatGPT, Microsoft Copilot, and Google Gemini have broadened their user base to achieve relatively balanced gender distribution, each exceeding 30% female users. Meanwhile, entertainment-focused AI apps like PolyBuzz and Character AI have attracted young female users through their unique positioning. This indicates that as AI functions and use cases diversify, so too does the user demographic.

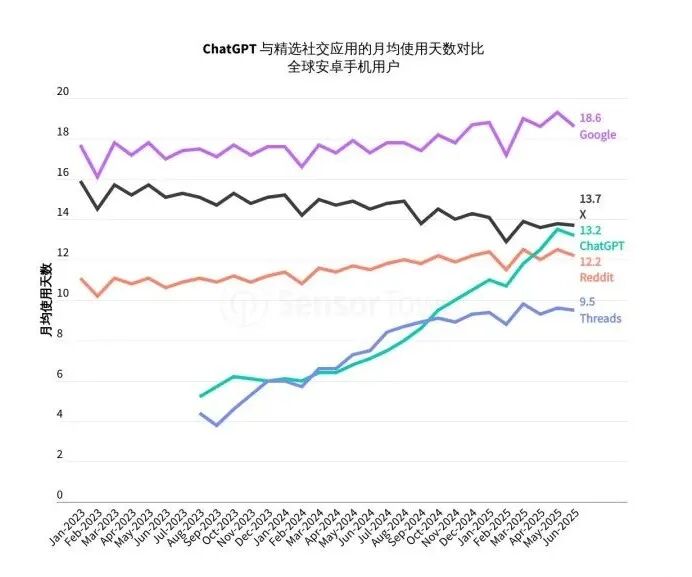

ChatGPT’s user stickiness grows rapidly, usage frequency rivals X and Reddit

Data shows ChatGPT’s user engagement is increasing rapidly, with users averaging 13 active days per month—on par with social platforms like X and Reddit. In contrast, Threads, launched around the same time, averages only 9–10 active days per month. Nevertheless, Google remains the "gold standard" for mobile information retrieval. Data from June 2025 shows users accessed Google over 18 days per month on average. This suggests that in terms of sustained, high-frequency usage, ChatGPT (and AI assistants broadly) has not yet fully displaced traditional search engines like Google.

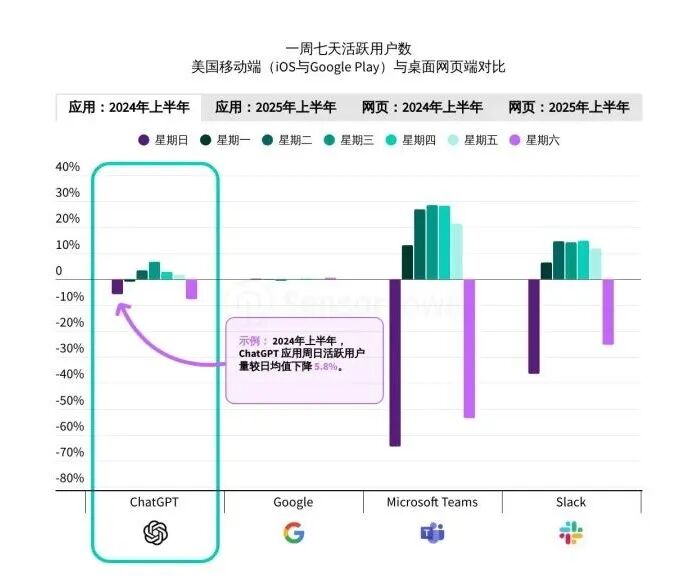

ChatGPT sees a spike in weekend usage

Typically, work-oriented apps like Microsoft Teams and Slack see clear drops in mobile and web usage on weekends. In H1 2024, ChatGPT followed a similar pattern, with higher weekday usage, albeit less pronounced. However, by H1 2025, this trend weakened significantly on mobile, and ChatGPT’s usage pattern began resembling Google’s. This suggests ChatGPT is no longer confined to work contexts but is increasingly becoming a core tool for information access during both work and personal time.

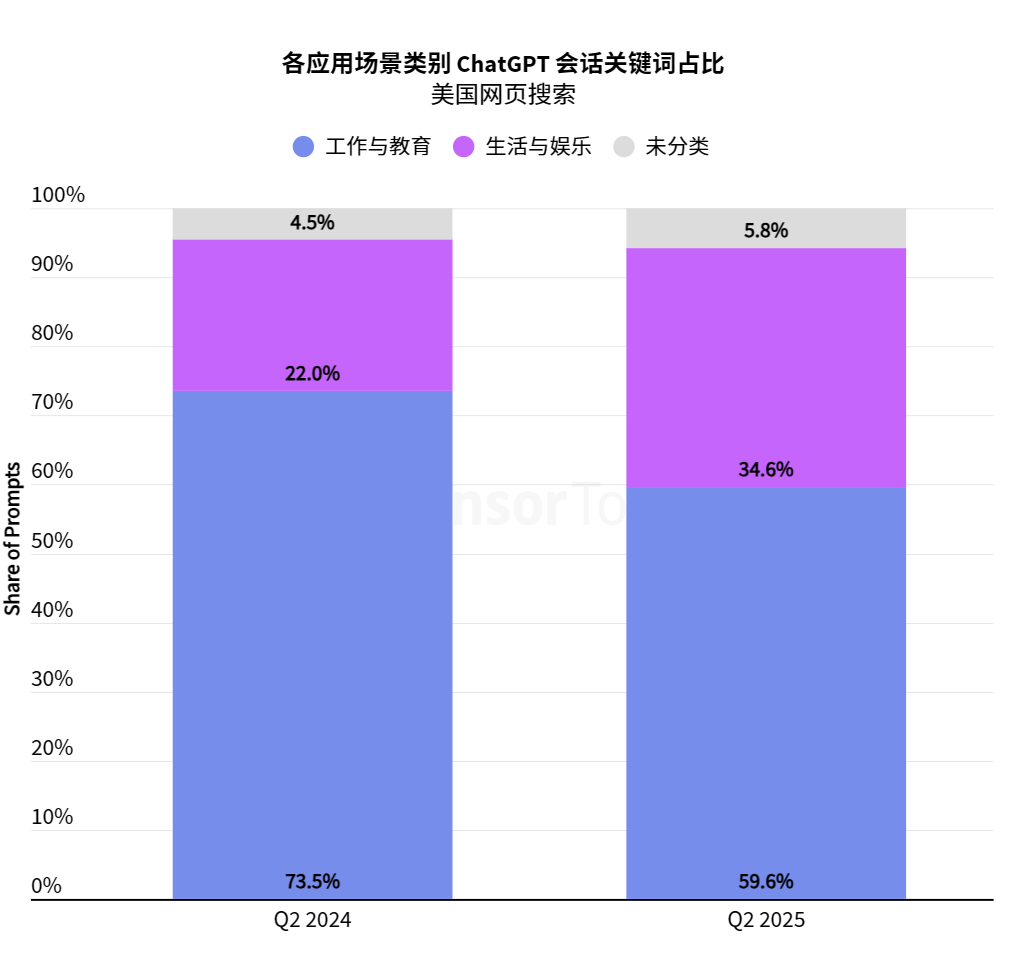

Over one-third of ChatGPT conversation keywords relate to life and entertainment

In the past year, ChatGPT’s use cases have shifted significantly—from initially being purely work- and education-focused—to rapidly expanding into life and entertainment. Data shows that keywords related to life and entertainment rose from 22% in Q2 2024 to nearly 35% in Q2 2025. Nonetheless, work- and education-related keywords remain ChatGPT’s core value proposition, accounting for nearly 60% of total keywords in Q2 2025. Although their growth rate lags behind life and entertainment categories, their absolute volume continues to increase—indicating ChatGPT’s enduring importance in work and learning contexts.

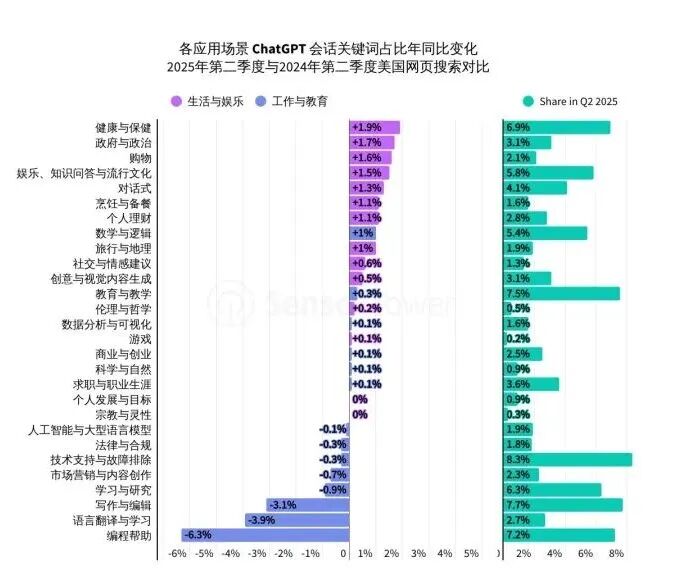

Health and shopping emerge as ChatGPT’s fastest-growing use cases

Analysis of ChatGPT conversation keywords in the U.S. market reveals growing diversity in consumer use—spanning shopping, meal planning, fun facts, and pop culture. AI usage has effectively expanded far beyond work and education.

From Q2 2024 to Q2 2025, nine of the top ten fastest-growing keyword categories fell under life and entertainment, with health and wellness showing particularly strong growth. This trend not only reflects a broadened user base for ChatGPT but also shows consumers are increasingly comfortable applying the tool across diverse scenarios.

In contrast, the categories with the largest decline in keyword share include programming assistance, language learning and translation, and writing and editing.

While these remain ChatGPT’s core use cases, their relative decline suggests users are actively exploring more creative ways to leverage AI for broader information and support.

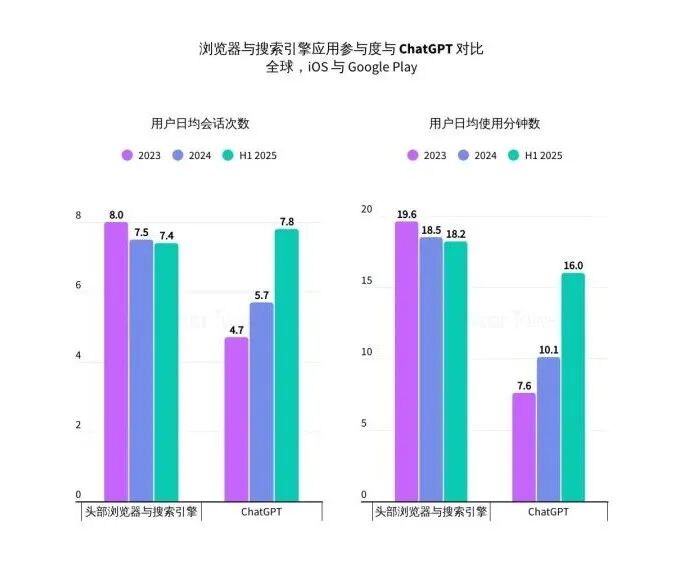

ChatGPT’s usage patterns increasingly resemble those of search engines

ChatGPT is showing strong potential to disrupt traditional search. In recent years, its user engagement metrics have soared, rivaling top-tier search engines and browser apps. Data shows that in H1 2025, ChatGPT users averaged 7.8 daily sessions—up 37% from 2024—slightly surpassing the average for leading search engines and browsers. While daily session duration still lags slightly, the gap is narrowing rapidly: users spent an average of 16 minutes per day in H1 2025, a 58% increase from 2024. The dual growth in session count and daily usage time strongly indicates that ChatGPT is becoming a go-to tool for consumer information seeking.

"AI+" becomes standard in vertical apps; note-taking and nutrition/diet apps frequently mention AI

The report finds AI’s influence in the mobile app ecosystem extends far beyond chatbots. Currently, the term “AI” appears over 100,000 times in app descriptions on iOS and Google Play.

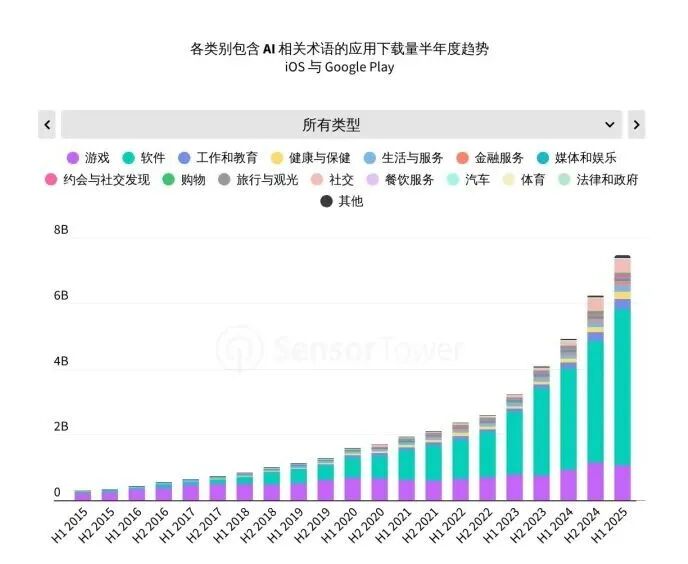

In H1 2025, apps with integrated AI functionality recorded 7.5 billion downloads—about 10% of total app downloads during the same period. Compared to the previous year, downloads of these AI-enhanced apps grew 52%.

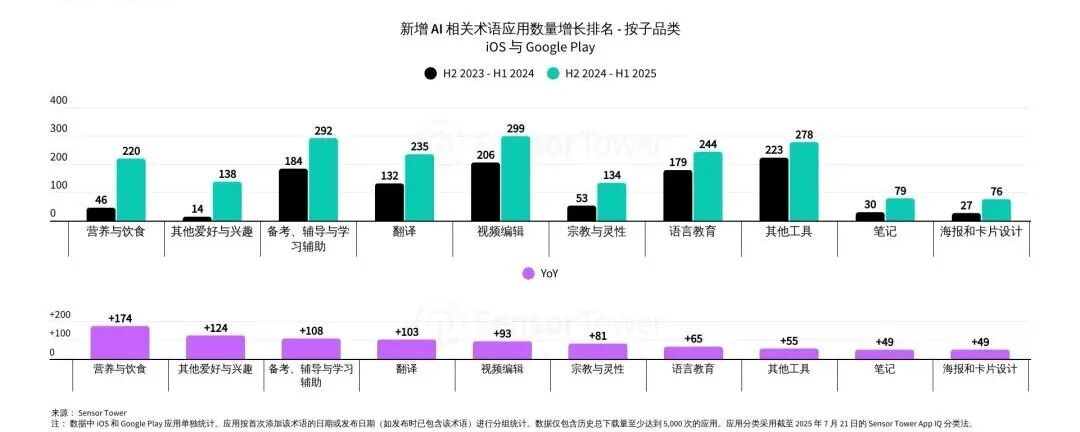

At a more granular level, certain subcategories are driving this rapid growth. For example, in health and wellness, AI-powered nutrition and medical tracking apps that mention AI in their descriptions are seeing significant download increases.

AI features becoming standard in nutrition/diet apps

In the nutrition and diet app space, AI-powered calorie scanners are quickly becoming essential. At the same time, other vertical apps face intense competition from AI assistants like ChatGPT and DeepSeek. Exam prep and translation are common ChatGPT use cases, meaning vertical-specific apps must actively develop and integrate more competitive AI features to surpass what general AI assistants offer—or risk being replaced.

"Vertical App + AI Features" becomes the secret to competitiveness

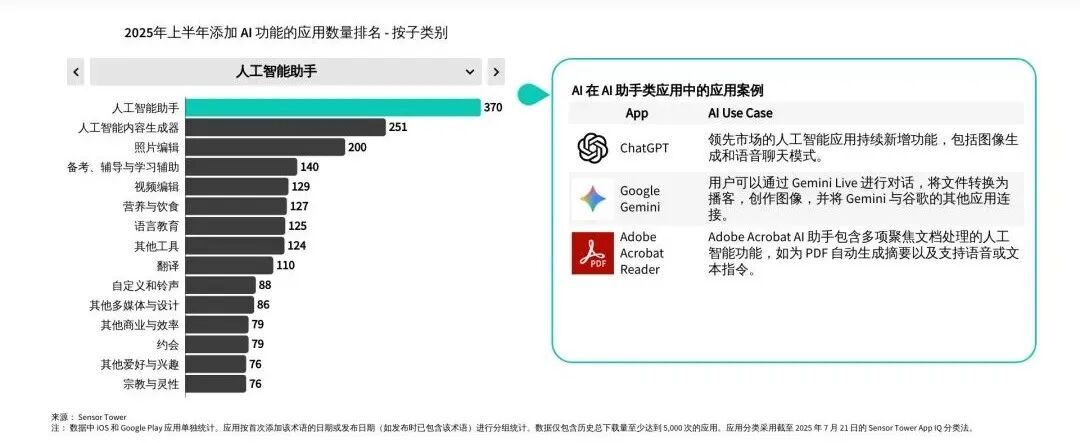

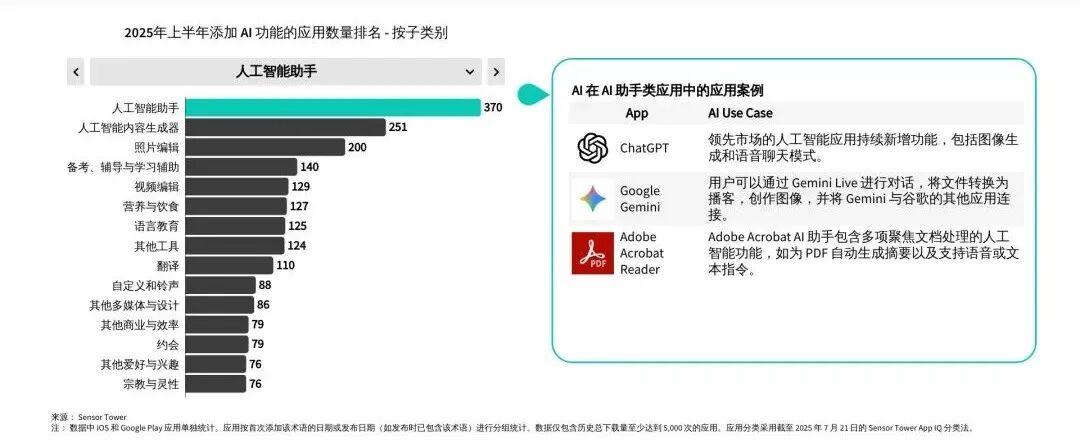

All mobile verticals are continuously launching new AI features. The report ranks the number of apps adding AI functionality in H1 2025: beyond native AI apps, photo editing, tutoring, video editing, and nutrition/diet apps are among the most active in adopting AI.

Additionally, apps that include terms like “AI” or “LLM” in their name or description see significant short-term download growth. However, performance varies by app category.

For example, job-seeking and education apps, as well as lifestyle and service apps, maintain steady download growth for three months after adding AI terms, whereas health and wellness apps see only temporary gains. Notably, dating apps appear to suffer negative effects from AI-related terminology—reflecting user skepticism toward AI when seeking authentic human connections.

Note-taking and nutrition/diet app names on app stores frequently include "AI"

Analysis across subcategories shows that on iOS, over a quarter of top apps in multiple categories explicitly include “AI” in their names.

Notably, in the photo editing category, 6 of the top 10 apps (and 37 of the top 100) include “AI” in their names.

Competition is also intensifying in translation, note-taking, and nutrition/diet niches, where emerging apps are widely integrating AI. On iOS, over 20% of the top 100 apps in these categories mention “AI” in their names—while many others incorporate AI features without explicitly labeling them.

Which verticals are being disrupted by AI?

As general-purpose AI apps like ChatGPT expand their functionality, some leading vertical apps face potential displacement. These versatile tools are being used innovatively and may directly replace certain specialized apps. However, preliminary analysis shows AI’s impact on mobile app subcategories is uneven. Some apps continue to show strong growth in key mobile performance indicators (KPIs). To survive and thrive amid this transformation, professional apps must innovate proactively, differentiating themselves from general AI chatbots. This means deeply integrating AI features tailored to subtle user needs and precise scenarios. For example, nutrition and diet apps could develop highly accurate AI-powered food logging via photo recognition—offering specialized solutions that general AI cannot match—and thus solidify their market edge.

Top AI apps focus on image generation and voice modes

By analyzing new features promoted by leading AI apps, the report finds that many top apps are emphasizing image generation and voice mode capabilities.

AI assistants promote cartoon-style image generation

Top AI assistants are using image generation as a core strategy to attract new users. Many apps are highlighting diverse image styles—particularly cartoons and animations. These fun and broadly appealing features provide new users with an accessible entry point, encouraging them to explore and experience built-in image generation capabilities.

ChatGPT and Gemini compete in image generation

As top AI assistants like ChatGPT and Google Gemini increasingly focus on image generation, their app store keyword strategies are shifting to prioritize rankings for AI image-related searches.

Data shows that in Q2 2025, in the U.S. iOS App Store, ChatGPT and Google Gemini consistently ranked #1 and #2 for the search term “ai image.” By quarter-end, both had entered the top 15 for “ai image generator,” clearly signaling their aggressive competition in image generation.

Meanwhile, promoting image generation in app descriptions has significantly boosted downloads for both ChatGPT and Gemini.

Downloads driven by image-related searches for ChatGPT and Gemini show steady growth.

Although this source represents a small share of total downloads, these precision-driven downloads have become an additional gain within both apps’ overall ASO strategies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News