Project Crypto starts the race, ushering in the era of crypto super apps

TechFlow Selected TechFlow Selected

Project Crypto starts the race, ushering in the era of crypto super apps

When the world's largest capital market decides to make a comprehensive shift, the competitive landscape of the entire industry could be rewritten.

Author: David, TechFlow

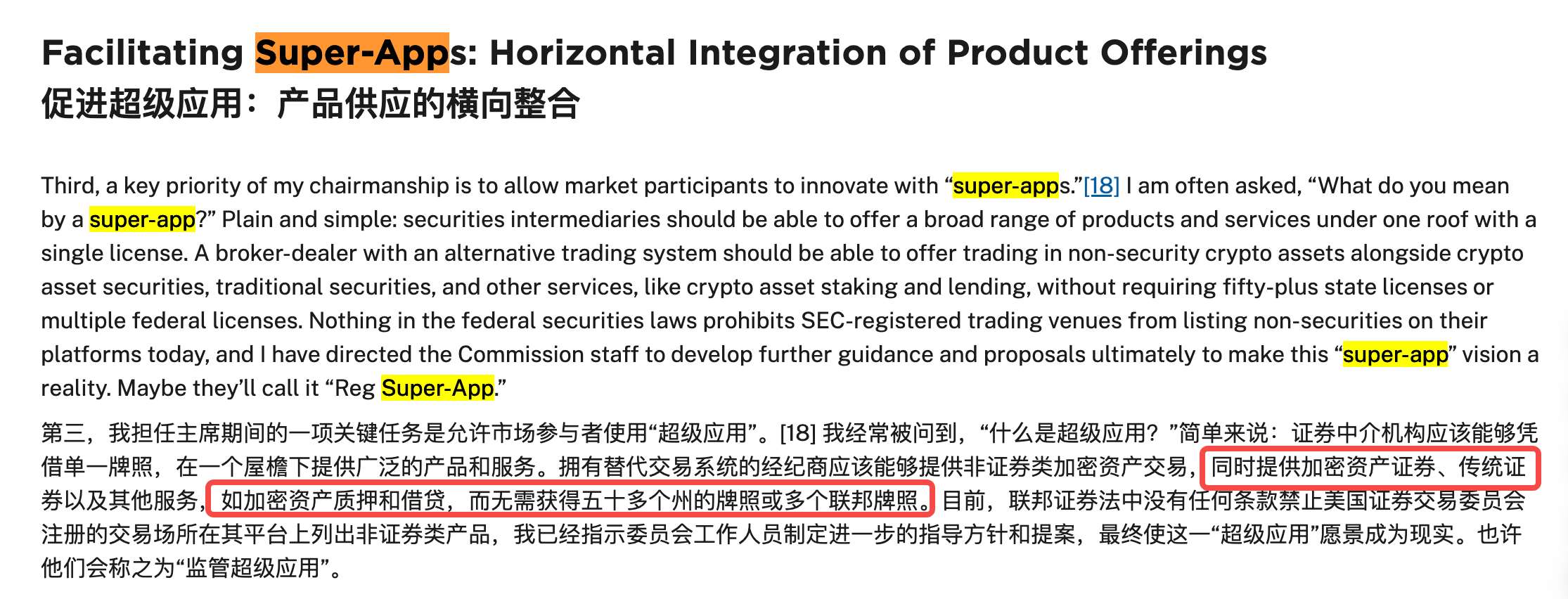

On July 31, Paul Atkins, the new chair of the U.S. SEC, delivered a speech titled "U.S. Leadership in the Digital Finance Revolution," announcing a new initiative called "Project Crypto."

This news hasn't yet made mainstream headlines, but it could become one of the most impactful events for the crypto industry in 2025.

In January, when Trump returned to the White House, he boldly declared his intention to make America the "crypto capital of the world." At the time, many dismissed this as campaign rhetoric, and the entire industry waited to see whether Trump’s promises were just empty checks.

Yesterday, the answer was revealed.

Project Crypto appears to be the first major implementation of Trump's pro-crypto policy.

There are already numerous line-by-line interpretations of this plan circulating on social media, so we won’t rehash them here. However, the author believes its most valuable aspect is that it allows financial institutions to create "super apps" that offer all financial services—traditional stock trading, cryptocurrencies, and DeFi—on a single platform.

What would it mean if JPMorgan Chase’s app could buy stocks, trade Bitcoin, and participate in DeFi yield farming?

From campaign promise to regulatory action, from "enforcement as regulation" to "embracing on-chain finance"—this shift took only six months. When the world’s largest capital market decides to fully pivot, the competitive landscape of the entire industry may be rewritten.

Multi-functionality of Super Apps

The concept of a super app mentioned in Atkins’ speech immediately brings WeChat to mind: messaging, payments, investment, insurance, even loan applications—all within a single app.

This experience, commonplace in China, has been impossible in the U.S., despite its free-market reputation.

The reason is simple: regulatory barriers.

In the U.S., payment services require a payment license, securities trading requires a brokerage license, lending requires a banking license—and each state has different requirements.

Project Crypto breaks this deadlock for the first time.

Under the new rules, a platform holding a broker-dealer license can simultaneously offer traditional stock trading, cryptocurrency transactions, DeFi lending, NFT marketplaces, and stablecoin payment functions—all under a single, unified licensing framework.

In the crypto industry, this unified framework has the added benefit of aligning with the composability of many products.

You could use stock profits to automatically buy Bitcoin, use an NFT as collateral to borrow stablecoins, then deploy those stablecoins into DeFi for yield—all actions completed within one interface, with assets freely flowing on-chain.

When users can seamlessly navigate across services on a single platform, a Web3 super financial platform no longer seems out of reach.

The SEC’s decision is effectively the starting gun for an arms race.

Three Types of Players, Diverging Fates

With the starting gun fired for Project Crypto, participants on the track face vastly different fates.

Existing crypto giants must shift from coasting to fighting mode.

Coinbase CEO Brian Armstrong is likely experiencing mixed emotions. On one hand, relief from SEC lawsuits is immense; on the other, the days of dominance may be ending.

Over the past few years, under Gensler’s strict regulation, Coinbase gained an edge through compliance, becoming the default choice for U.S. users.

Now that the gates are open, this "regulatory moat" is disappearing. More critically, Coinbase must rapidly transform—from a pure exchange into a full-service financial platform. This means developing stock trading (competing with Robinhood), banking services (against traditional banks), and DeFi integration (against decentralized protocols). Each area has powerful incumbents.

Kraken and Gemini face similar challenges but are in a more precarious position.

They lack both Coinbase’s scale advantage and the resources needed for rapid expansion. The most likely outcomes? Either acquisition or focusing on niche markets.

If native crypto firms are on defense, traditional financial giants are preparing for a full-scale offensive.

JPMorgan is no longer skeptical about crypto. Its JPM Coin processes billions in transactions daily, and its Onyx blockchain platform has been running for years. Now, it can officially launch crypto services for retail customers.

Goldman Sachs, Morgan Stanley, Bank of America—each is eager to enter. They possess what crypto firms dream of: massive user bases, deep capital reserves, mature risk controls, and most importantly—user trust.

When an American grandmother wants to allocate part of her retirement fund to Bitcoin, will she trust the bank app she’s used for 30 years, or an unfamiliar crypto exchange?

But turning giants isn't easy. Bureaucratic structures, outdated tech stacks, and conservative corporate cultures could become fatal weaknesses. For them, this policy is both opportunity and challenge.

Beyond these, Uniswap, Aave, Compound—the position of DeFi protocols is the most delicate.

Project Crypto explicitly protects "pure code publishers," which theoretically benefits DeFi.

But when Coinbase can directly integrate Uniswap’s functionality, and JPMorgan launches its own on-chain lending product, what remains of a decentralized protocol’s value proposition?

One possibility is a clearer separation between "protocol layer" and "application layer." Uniswap continues as an underlying liquidity protocol, while various "super apps" build user interfaces and value-added services on top. This resembles the internet’s TCP/IP protocol—critical but invisible, content to play a supporting role.

A more radical possibility: some DeFi protocols may choose to "centralize." Form companies, apply for licenses, accept regulation—in exchange for broader market access.

Aave is already exploring an institutional version; Uniswap Labs is already a company. Decentralized ideals are noble, but when competitors can legally reach billions of users, ideals might just become slogans.

In the end, DeFi may split into two camps: "protocol fundamentalists" who uphold decentralization, and "pragmatists" who embrace regulation for growth. Both have room to survive, but they’ll serve entirely different user groups.

Three types of players, three fates. But one thing is shared: comfort zones are gone.

Under the new policy, everyone must redefine their place in the emerging ecosystem.

Four Dimensions of Competition

When everyone rushes into the same race, what determines victory?

First is licensing.

Historically, compliance was a money-burning black hole. Now, it may become the most important moat.

Project Crypto appears to lower barriers, but actually raises standards. A "super app" license means meeting regulatory requirements across securities, banking, payments, and crypto. This isn’t a game small companies can afford.

The real value of a license lies in network effects. When users can fulfill all financial needs on one platform, switching costs skyrocket. It’s like bank licenses decades ago—seemingly open to all, yet only a few built empires.

Second is technical architecture.

The standard for on-chain financial UX is: Web2 smoothness + Web3 sovereignty. This is an extremely high technical bar.

Traditional institutions must build crypto infrastructure from scratch, while crypto firms must achieve bank-grade stability.

Even more complex is cross-chain interoperability—can your system securely complete a transfer of assets from Ethereum to Solana for DeFi participation within three seconds? When markets swing violently, can your risk control system respond in milliseconds?

Technical debt could be fatal.

Coinbase spent ten years optimizing its system for a single function; transforming it into an all-in-one platform won’t be easy. Legacy systems at banks are worse—some core systems still run on COBOL. How do you connect that to blockchain?

Third is the perennial issue of liquidity.

In finance, liquidity is everything. In the super app era, this truth is magnified.

Users expect instant execution for any asset, at any time, at any scale. This requires access to all major trading venues, aggregation of global liquidity, and best-price execution. Even more crucial is capital efficiency—how efficiently can the same funds flow between stocks, crypto, and DeFi?

Finally, there’s user experience.

This may be the most underestimated competitive dimension. When features converge and fees are similar, experience decides everything.

The challenge lies in serving vastly different user bases. You need to satisfy crypto veterans (who demand self-custody and on-chain data visibility) while reassuring traditional users (who don’t even know what a seed phrase is). One app, two languages—this tests product managers’ balancing skills.

Overall, Project Crypto presents a challenge: Licensing determines what you can do, technology determines how well you can do it, liquidity determines how big you can grow, and experience determines how far you can go. In this multi-dimensional chess game, every move could reshape the battlefield.

Potential Winners and Losers

Under the new Project Crypto policy, you probably want to know which companies and assets stand to gain the most.

But predicting the future is risky; nothing is certain yet. We can only see early signs. Winners in the era of crypto super apps won’t follow a single mold. Instead, we may see three distinct yet equally successful models.

First, the "Alliance" model.

The smartest players already realize that collaboration beats solo efforts.

Take Fidelity, a giant managing $11 trillion in assets. It launched a digital assets division back in 2018 but has remained lukewarm in retail crypto trading.

What if Fidelity deeply integrates with a tech-leading crypto firm (like Fireblocks)? Fidelity’s 200 million clients get seamless crypto access, while the partner gains the rarest resource in traditional finance—trust and users. The outcome may not be a merger, but such "1+1 > 2" partnerships will proliferate.

Second, the "Arms Dealer" model.

During gold rushes, the most stable business is selling shovels.

In the super app era, "shovels" are key infrastructure providers. Take Chainalysis: whoever wins the super app war will need its compliance tools. These companies thrive because the more diverse their clients, the stronger their position. They don’t need to pick sides—everyone needs them.

Third is the "Specialist" model.

Not everyone needs a Swiss Army knife. What if there’s a financial platform dedicated to DAOs, or a vertical app focused solely on NFT finance? While giants build comprehensive platforms, specialists may capture long-tail value in niches.

Winners will likely follow one of these paths. As for losers, they’re probably mid-tier institutions and speculators stuck in limbo.

Consider regional U.S. banks: they lack JPMorgan’s resources for large-scale tech investment, yet lack the agility of small fintech startups. When customers can get full crypto services at big banks, these mid-sized institutions will see their survival space shrink dramatically.

As for speculators, over the past few years, many projects evaded regulation through complex legal structures—registered in the Caymans, operated via DAOs, claiming "full decentralization."

Project Crypto’s clear rules mean these gray areas will vanish. You either go truly decentralized (accepting limitations in liquidity and UX) or fully compliant (bearing regulatory costs). Fence-sitters will have nowhere to hide.

From a competitive standpoint, the window of opportunity is closing fast.

First-mover advantage in winner-take-all platform economies could be decisive. Whoever builds a complete ecosystem in the coming months may become the next crypto finance giant.

The iPhone Moment?

In 2007, when Jobs unveiled the first iPhone, Nokia executives scoffed—a phone without a keyboard couldn’t succeed. Eighteen months later, the entire mobile industry’s rules were rewritten.

Project Crypto might be crypto finance’s "iPhone launch moment."

Not because it’s perfect, but because it’s the first time mainstream financial institutions see the possibility: financial services can be delivered this way, traditional and crypto assets can be integrated like this, compliance and innovation can be balanced like this.

But remember, the iPhone didn’t truly change the world in 2007—it was after the App Store emerged. Project Crypto is just the beginning. The real revolution will erupt once the ecosystem forms.

When millions of developers start innovating on the new platform, and billions of users grow accustomed to on-chain finance—that’s when the good times begin.

It’s too early to draw conclusions now.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News