Upbit enters the public chain race: How big is Giwa's on-chain ambition?

TechFlow Selected TechFlow Selected

Upbit enters the public chain race: How big is Giwa's on-chain ambition?

Upbit building a chain is less of a proactive move and more a response to circumstances.

By David, TechFlow

The public chain arms race has gained another participant.

On September 9, South Korea's largest crypto exchange Upbit officially launched Giwa at the UDC 2025 conference in Seoul—a new Ethereum Layer 2 network built on the Optimism OP Stack.

Prior to its official launch, only a mysterious countdown website teased market anticipation.

The name "Giwa" is also meaningful—written as "기와" in Korean, it refers to traditional Korean roof tiles. These tiles interlock ingeniously, layer upon layer, forming a fully functional roof structure.

Upbit clearly didn't pick this name randomly—modularity and interoperability, core blockchain concepts, are embedded within the elegant metaphor of interlocking tiles.

But reality might not be as beautiful as the name suggests.

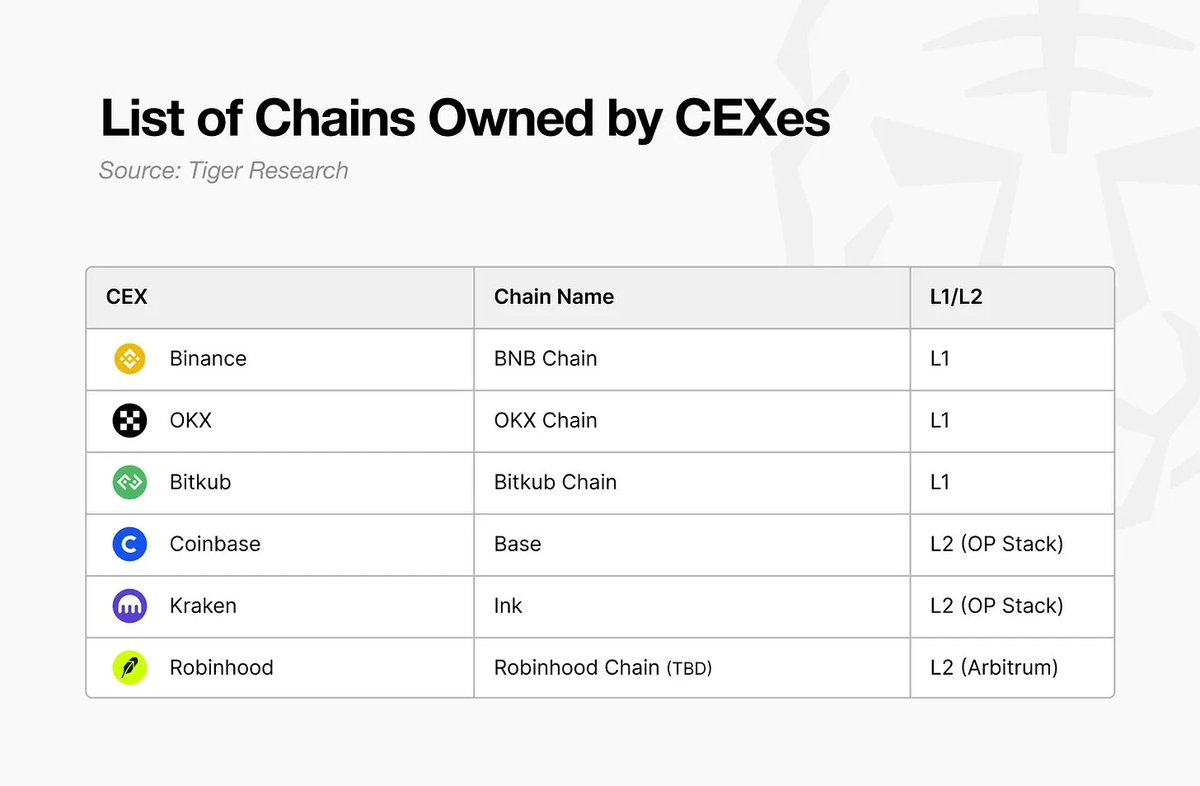

When it comes to exchanges launching their own chains, Upbit isn't early. Coinbase’s Base has been live for over a year, with TVL exceeding $8 billion, becoming a hub for social and consumer applications. Binance’s BNB Chain is an even more seasoned player, with countless ecosystem projects and CEX-integrated use cases. Even Kraken recently launched Ink, while Robinhood entered the scene by tokenizing stocks on Arbitrum.

Everyone understands one truth: relying solely on trading fees has a hard ceiling.

(Image source: Tiger Research)

As a latecomer using open-source tech stack, where might Giwa's advantages and opportunities lie?

Giwa Preview: Same Roots as Base, Different Paths

Choosing OP Stack wasn’t a tough decision for Upbit.

Layer 2 technology options are limited: Optimistic Rollup, ZK Rollup, and some hybrid solutions. While ZK tech is attractive, maturity remains an issue; Arbitrum’s stack is solid but relatively closed. OP Stack, being open-source, modular, and already proven by Coinbase’s successful Base, represents a validated path.

The core of OP Stack is optimistic rollup—assuming all transactions are valid by default, with challenges allowed later if issues arise.

This brings two benefits: transactions execute first and get verified later, enabling speed; verification logic is simple, keeping costs low. This suits Upbit well, given its massive daily trading volume.

An interesting comparison emerges between Base and Giwa. Despite sharing the same OP Stack foundation, the two chains are taking very different directions.

Base leverages Coinbase’s U.S. user base and champions “Onchain is the new Online,” targeting consumer-facing scenarios like social apps, gaming, and NFTs. While these narratives haven’t exploded in this cycle, earlier successes like Friend.tech on Base were closely tied to its positioning—low gas fees, smooth UX, and robust developer tools form Base’s three key strengths.

Giwa plays a different hand. Upbit’s users are primarily Korean, with distinct trading habits and regulatory environments. Korean users are more accustomed to centralized exchange experiences and have lower adoption rates for DeFi. Therefore, Giwa must deliver a CEX-like user experience while maintaining decentralization.

Based on currently available information, Giwa may focus on several strategic areas:

First, native support for the Korean won stablecoin is likely a top priority. Allowing users to pay gas fees directly in a Korean won stablecoin would significantly lower barriers. This requires protocol-level modifications and regulatory coordination—not something solved by simply deploying a contract.

In July, reports indicated that Dunamu, Upbit’s parent company, confirmed cooperation with Naver Pay to advance Korean won stablecoin payment services—likely part of laying the groundwork for Giwa.

Second, compliance features may be built directly into the chain. Given Korea’s strict regulations, KYC and AML requirements are unavoidable. Instead of leaving each project to handle compliance individually, Giwa could offer standardized on-chain solutions such as identity systems and transaction monitoring mechanisms.

Lastly, performance optimization priorities may differ from Base. While Base optimizes for high-frequency, small-value transactions suited for social apps, Giwa may prioritize efficiency and security for large-value transfers—commonplace on Upbit, where trades often reach hundreds of thousands of dollars.

In addition, cross-chain bridges are critical. Most user assets reside on Upbit’s centralized ledger—how can they be securely and conveniently migrated to Giwa? Without a seamless bridging experience, everything else becomes irrelevant. Upbit may develop a dedicated bridge solution, possibly integrating it directly into the exchange interface similar to Binance’s approach.

Of course, these remain educated guesses based on current information.

Yet technological choices reflect strategic intent. By choosing OP Stack, Upbit signals its goal: rapid deployment, reduced risk, and leveraging its existing CEX-integrated ecosystem.

Transformation, Again and Again

Upbit launching a chain feels less like proactive strategy and more like necessity driven by circumstances.

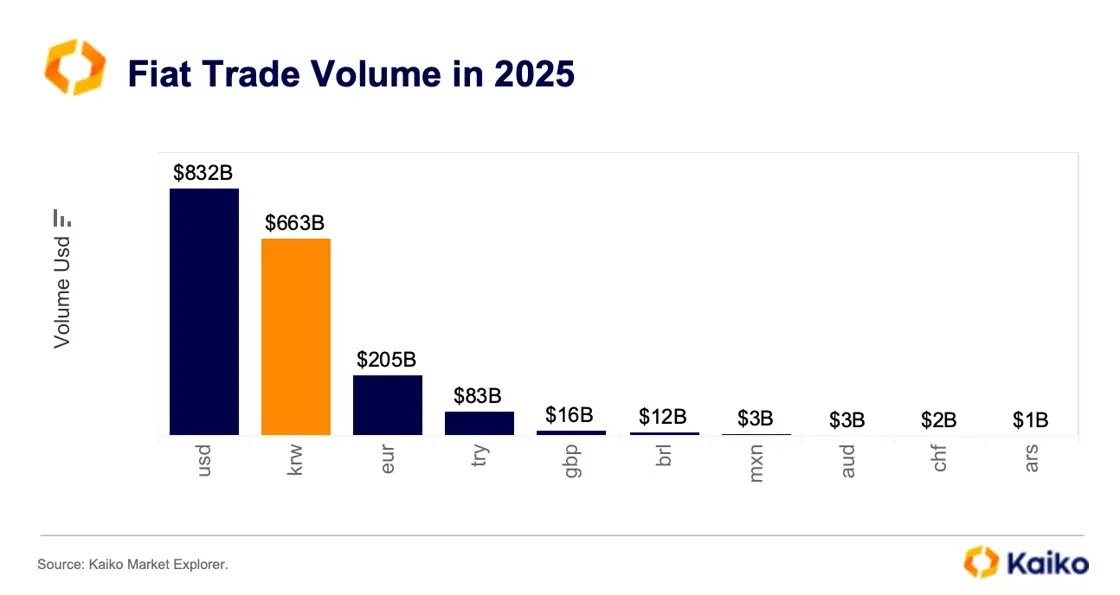

In 2025, Upbit appears to be doing well on the surface: commanding 80% of the South Korean market, frequently ranking among the world’s top three exchanges by daily trading volume. But growth is plateauing. South Korea is a limited market—most who want to trade crypto already do. Where will new users come from?

This anxiety has spread across the global crypto industry over the past one to two years. Exchanges worldwide are seeking second growth curves—and the answer is strikingly consistent: build a chain.

Coinbase’s Base has proven this model works—not only generating gas fee revenue but, more importantly, capturing pricing power over the ecosystem. When breakout apps like Friend.tech took off on Base, Coinbase captured not just trading fees but broader value chain spillovers.

More crucially, beyond exchange operations, Coinbase has extended its value chain through ecosystem development. Transitioning from a “trading platform” to an “infrastructure provider” fundamentally diversifies revenue streams.

The unique nature of the Korean market makes this transformation even more urgent. The so-called “Kimchi premium”—where Bitcoin trades at higher prices on Korean exchanges—might seem like a moat, but it actually reflects market isolation and inefficiency.

International arbitrageurs can’t easily enter, and Korean capital struggles to exit. This isolation won’t last forever. Once international exchanges find compliant ways into Korea, Upbit’s dominance will be threatened.

Herein lies an opportunity: the Korean won stablecoin. Since Terra’s collapse, no one has filled the stablecoin void in Korea. There’s real demand among Koreans for local currency stablecoins—used for remittances, hedging, and daily payments. Public data shows South Korea’s annual cross-border remittance market reaches $15 billion.

(Image source: Tiger Research)

Yet there’s a catch: South Korea’s Virtual Asset User Protection Act prohibits exchanges from listing tokens issued by themselves or affiliated parties.

By building Giwa and enabling partner Naver Pay to issue a Korean won stablecoin on the chain, Upbit provides the infrastructure—navigating regulatory constraints while retaining control over the ecosystem.

Besides, pressure from capital markets and tightening competition further accelerate Upbit’s transformation.

Another domestic exchange, Bithumb, plans to go public in the second half of 2025. Dunamu (Upbit’s parent) likely has similar ambitions. As multiple global crypto exchanges have gone public, capital markets may have grown tired of the “exchange story.” In contrast, “Web3 infrastructure” sounds far more appealing.

Of course, launching a chain carries risks. Klaytn’s failure remains fresh in memory. Even with Kakao’s massive conglomerate backing, it failed to gain traction. The issue wasn’t technology—it was the ecosystem. Without applications and users, a chain risks becoming an empty shell.

But for Upbit, the risk of *not* trying may outweigh the risk of trying.

From the vantage point of September 2025, launching a chain has shifted from “innovation” to “standard practice.” Coinbase has Base, Binance has BNB Chain, and now Upbit has Giwa.

The endgame of this arms race may not be about whose chain is technically superior, but who can pioneer a new business model first. In this sense, Giwa’s launch is merely the first step in Upbit’s transformation. The real test has just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News