From 0 to breakout, will Sui's ecosystem momentum trigger the next liquidity storm?

TechFlow Selected TechFlow Selected

From 0 to breakout, will Sui's ecosystem momentum trigger the next liquidity storm?

As Sui's TVL continues to grow and institutional adoption accelerates, Momentum X will become a key infrastructure in the crypto space.

By: 1912212.eth, Foresight News

Imagine a morning in 2028. You wake up, pick up your phone, open your crypto wallet with one tap, and instantly connect to the ocean of global financial flows—freely buying or selling the world’s most sought-after financial assets for investment or arbitrage. What would happen then?

This is no distant dream. Momentum is paving the path toward this future—a world where liquidity never runs dry and assets are seamlessly tokenized—enabling ordinary people to easily ride the wave of wealth.

In the crypto world, projects like NFTs, blockchain gaming, inscriptions, and social platforms emerge wildly and vanish just as quickly, soon forgotten. Amidst this churn, only innovators who truly solve real pain points survive. DeFi has witnessed numerous industry trends rise and fall: Ethereum’s journey from harsh criticism to triumphant resurgence, meme coin mania on Solana, and the quiet rise of emerging blockchains like Sui. Thanks to ecosystem community airdrops and the wealth effect of the SUI token, numerous lending, DEX, and staking protocols have sprung up on its foundation.

Amid this blue ocean, Momentum stands out—not merely as a DEX on Sui, but as the builder of an institutional-grade trading layer for tokenized assets: Momentum X.

Momentum X: Institutional-Grade Trading Layer for Tokenized Assets

If DeFi is the evergreen tree of crypto, then the current global wave of asset tokenization is one of crypto’s main arteries today.

From the early days of dollar tokenization (USDT and USDC) to today’s tokenized stocks, trillions upon tens of trillions of dollars in assets are still slowly making their way on-chain. Exchanges like Kraken, Coinbase, and Bybit have already targeted this blue ocean. On the protocol side, Ondo Finance is preparing intensively to launch tokenized stock trading within the coming months.

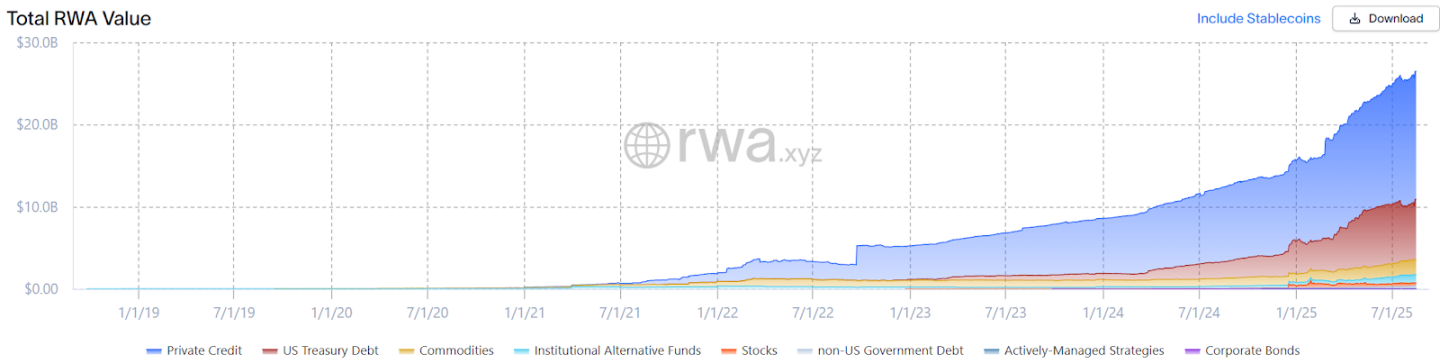

According to the latest data from RWA.xyz, the value of on-chain tokenized assets has risen to $26.48 billion, growing rapidly.

Capital outside the wall wants to flow in, while users inside seek opportunities to explore and profit from external financial assets.

Transparency, immutability, and global accessibility enable traditional financial assets such as real estate, stocks, bonds, and commodities to circulate on-chain as tokens, enabling 24/7 trading and fractional ownership.

In the future, investing will become incredibly easy. As a retail investor, you can sit in a café and buy tokenized Apple shares with one click via Momentum X. Free from time zone constraints or intermediaries, transactions settle instantly on the Sui blockchain, 24/7. Fractional ownership allows you to participate in major investments with just $100, opening doors to countless wealth opportunities.

Despite its optimistic prospects, asset tokenization still faces pressing real-world challenges.

The Triple Challenge Facing Retail and Institutions

Currently, different issuers operate independent KYC processes, interfaces, and compliance logic. Even when backed by the same real-world assets, tokens across different chains are often treated as non-interchangeable standalone instruments, fragmenting the market, reducing efficiency, and preventing the formation of a truly deep, unified market—leading to fragmented liquidity for tokenized assets. Tokenized assets on Base and Solana often cannot interoperate.

Additionally, some markets suffer from insufficient order book depth, occasionally resulting in absurd situations. On July 3, a user attempting to buy approximately $500 worth of Amazon token AMZNX briefly pushed its price up to $23,781.22—over 100 times Amazon’s previous day closing price.

Off-chain compliance remains largely dependent on intermediaries rather than being directly enforced by smart contracts, creating loopholes exploited by malicious actors. On August 13, user Caroline had 6.2 million USDT frozen on the decentralized RWA trading platform MyStonks. Despite submitting extensive verification documents, the issue remains unresolved, keeping market trust costs high.

Insufficient liquidity, price anomalies, and asset security are three major obstacles standing before ordinary users today.

What about institutions—with their resources and influence? They face their own share of unspoken struggles.

Fidelity, a Wall Street giant managing over $10 trillion in assets, routinely trades stocks, bonds, funds, and other traditional financial products. Yet it still encounters thorny issues when handling large volumes of corporate bonds.

Take Fidelity purchasing hundreds of millions of dollars in U.S. corporate bonds for pension or hedge funds. The traditional transaction process includes:

Liquidity fragmentation: Bond markets are highly fragmented, with disconnected liquidity across exchanges or OTC platforms, causing price volatility and execution delays.

Inefficient settlement: Settlement takes 2–3 days post-trade, involving multiple intermediaries that increase costs and risks (e.g., counterparty default).

Compliance barriers: Cross-border transactions must comply with regulators like the SEC and FINRA, alongside KYC/AML requirements, limiting access to global liquidity.

How can we bridge these institutional pain points—achieving instant settlement and global liquidity for tokenized assets on blockchain while ensuring institutional-grade security and compliance?

In the crypto era, traditional financial institutions like Fidelity need an institutional-grade bridge to truly bring traditional assets “on-chain.”

Wallet + Identity: Unlocking Trillion-Dollar Wealth Markets

This is precisely the core problem Momentum X aims to solve: serving as an institutional-grade trading and settlement layer for tokenized assets, providing not just trading functionality, but also solving the “last mile” problem for RWA.

Momentum X builds a unified RWA ecosystem framework, embedding compliance, auditing, and logic directly into the token layer, supported by Sui’s dedicated architecture.

-

Unified identity layer: Leverages ZK technology through Walrus and encrypted Seal permissions to enable one-time KYC/AML verification;

-

Issuer interoperability: Tokenized RWAs from different issuers are interchangeable and tradable;

-

Programmable compliance: Investor rights, jurisdictional rules, and trading restrictions are embedded directly at the asset level;

If you're a professional institution, Momentum X’s native DeFi integration allows you to provide market-making or stake tokenized bonds without off-chain operations. Cross-chain liquidity bridges the fragmented multi-chain landscape, enabling EVM assets to deploy on Sui within hours. High throughput ensures zero congestion. Pension funds use automated Vault strategies to dynamically adjust positions and capture market fluctuations, while real-time compliance tools attract more TradFi giants, accelerating RWA’s transformation from tens of billions to trillions.

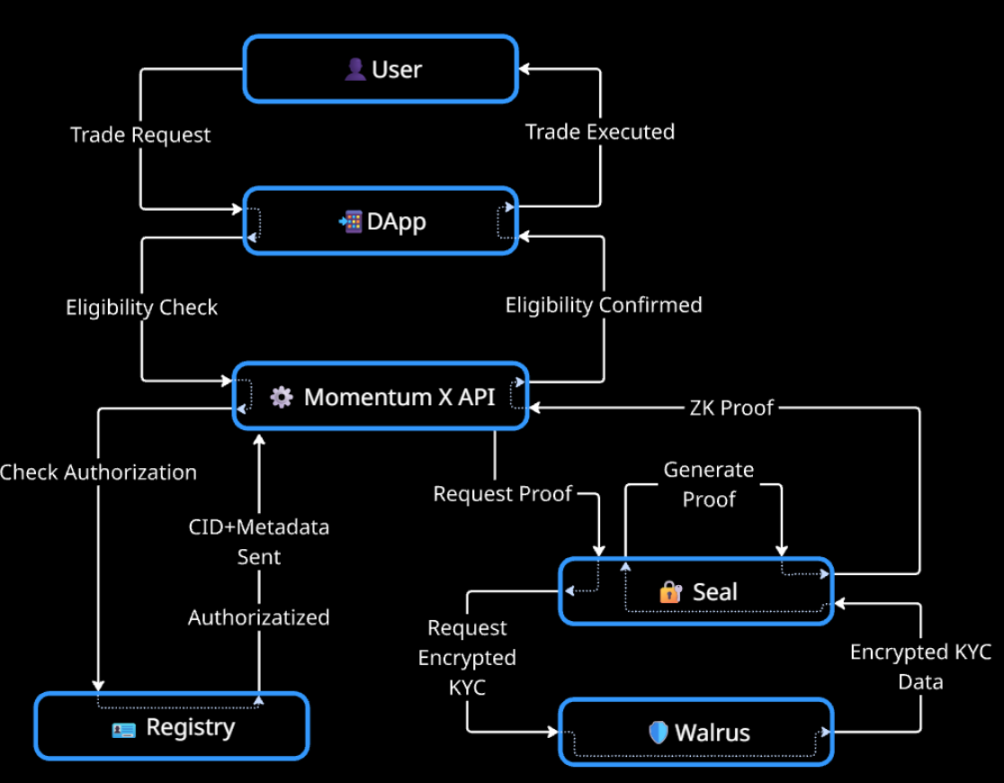

A typical operational flow works as follows:

When you initiate a transaction via a DApp, the system sends an eligibility verification request to Momentum X’s API. The API confirms whether the requesting app is authorized to perform identity verification. Using Seal technology, the system retrieves encrypted identity data from the storage layer Walrus, decrypting only what's necessary to prove compliance with the asset’s rules—such as jurisdictional requirements, accreditation status, or transfer limits.

The verification proof is then returned to the requesting application. If the user meets the criteria, the transaction is approved in real time. This approach ensures regulatory compliance, protects user privacy, and delivers a seamless trading experience for both institutional and retail users.

In short, Momentum X enables a single address and a single identity to overcome all barriers to accessing the trillion-dollar on-chain market. Sui’s high performance and throughput provide the underlying technical foundation, while Walrus and ZK technology safeguard privacy—allowing users to navigate global financial markets effortlessly and efficiently on Momentum X.

In the future, once you’ve completed identity verification on Momentum X, you’ll be able to swiftly purchase desired financial assets via your on-chain verified address on platforms like Fidelity, Robinhood, or any other on-chain exchange—without repeatedly submitting cumbersome documentation every time you log in.

Ordinary users’ lives will also be transformed: in the future, you could stake tokenized stocks on Momentum X, earn token rewards, maintain liquidity, and lend them out to generate passive income—all in one place. Future expansions will include additional asset classes such as private equity, with institutional-grade staking strategies enabling large funds to participate seamlessly.

The convergence of DeFi and TradFi is accelerating—you’ll browse RWA like shopping in a supermarket, with global capital flowing freely. Borders and time zones will gradually fade.

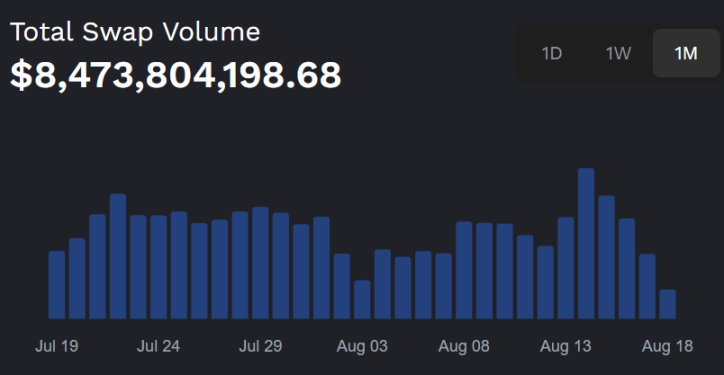

DEX Total Trading Volume Surpasses $8 Billion, TVL Over $180 Million

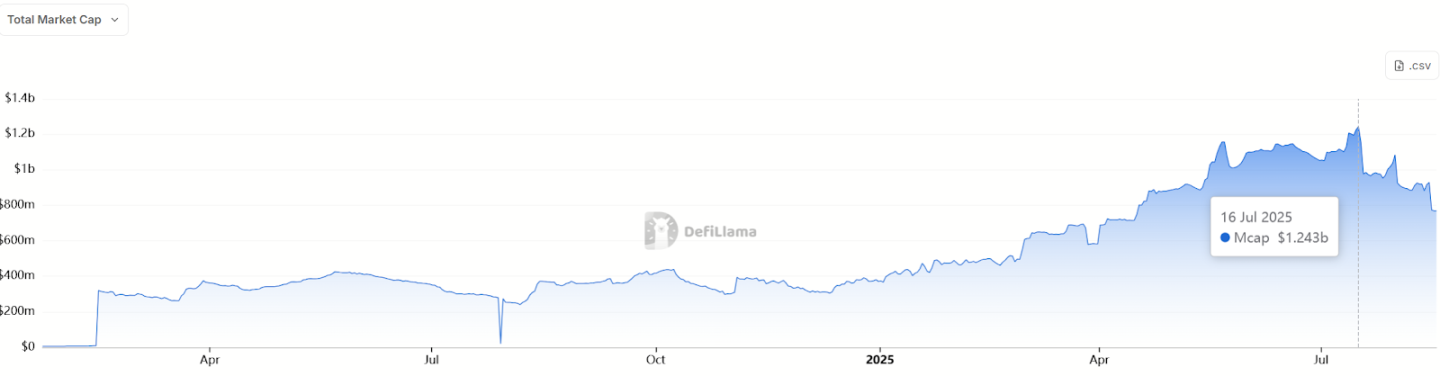

In 2023, Mysten Labs launched the Sui public chain, attracting developers with its unique Move language and optimized throughput and low latency. Between 2024 and 2025, Sui’s stablecoin supply surged from $5.4 million to a record high of $1.243 billion on July 16 this year.

On the ecosystem front, DeFi TVL once peaked at around $2.25 billion, with DEX daily trading volume exceeding $300 million—reaching over $746.69 million in a single day on August 15. Lending protocols benefited as well, with monthly DEX volume nearing $15 billion, reflecting strong user adoption and capital inflows.

However, Sui’s biggest early challenge was insufficient liquidity depth: users wanted to trade but struggled with shallow markets and high slippage. If slippage losses cannot be contained within acceptable bounds, even the wealthiest whales hesitate to make large purchases.

Momentum addressed this by allowing LPs to provide liquidity within custom price ranges, releasing deep liquidity exactly where it’s needed most—improving traders’ execution experience and boosting returns for liquidity providers.

After launching its beta version at the end of March this year, Momentum’s steep growth curve revealed its explosive potential. Within just four months, its TVL climbed to $180 million, hitting a new all-time high.

As of August 7, official data showed over 1 million wallet address users—an insane doubling in just two weeks. If TVL is just one key metric, trading volume better reflects user trust and stickiness. On August 18, according to its official tweet, Momentum’s DEX total trading volume surpassed $8.4 billion.

All this happened barely two months after the Cetus protocol hack on Sui. Contrary to pessimistic predictions of a devastating blow, Sui demonstrated remarkable resilience and systemic vitality. While many projects collapsed due to hacks or liquidity collapse—and even veteran DEXs like Cetus saw sharp TVL drops—Momentum actively responded, pledged fund recovery, and quickly restored its own liquidity.

Notably, Momentum originated as MSafe, which launched on Aptos in late 2022 and migrated to Sui in 2023. It was the first multi-sig treasury management and token vesting solution in the Move ecosystem. Its multi-sig management mechanism (mmmt platform) uses multi-party signatures to ensure treasury assets avoid single points of failure.

With greatly enhanced security, large capital feels safe participating in liquidity pools—benefiting the entire ecosystem and creating a positive cycle.

Liquidity and Innovation

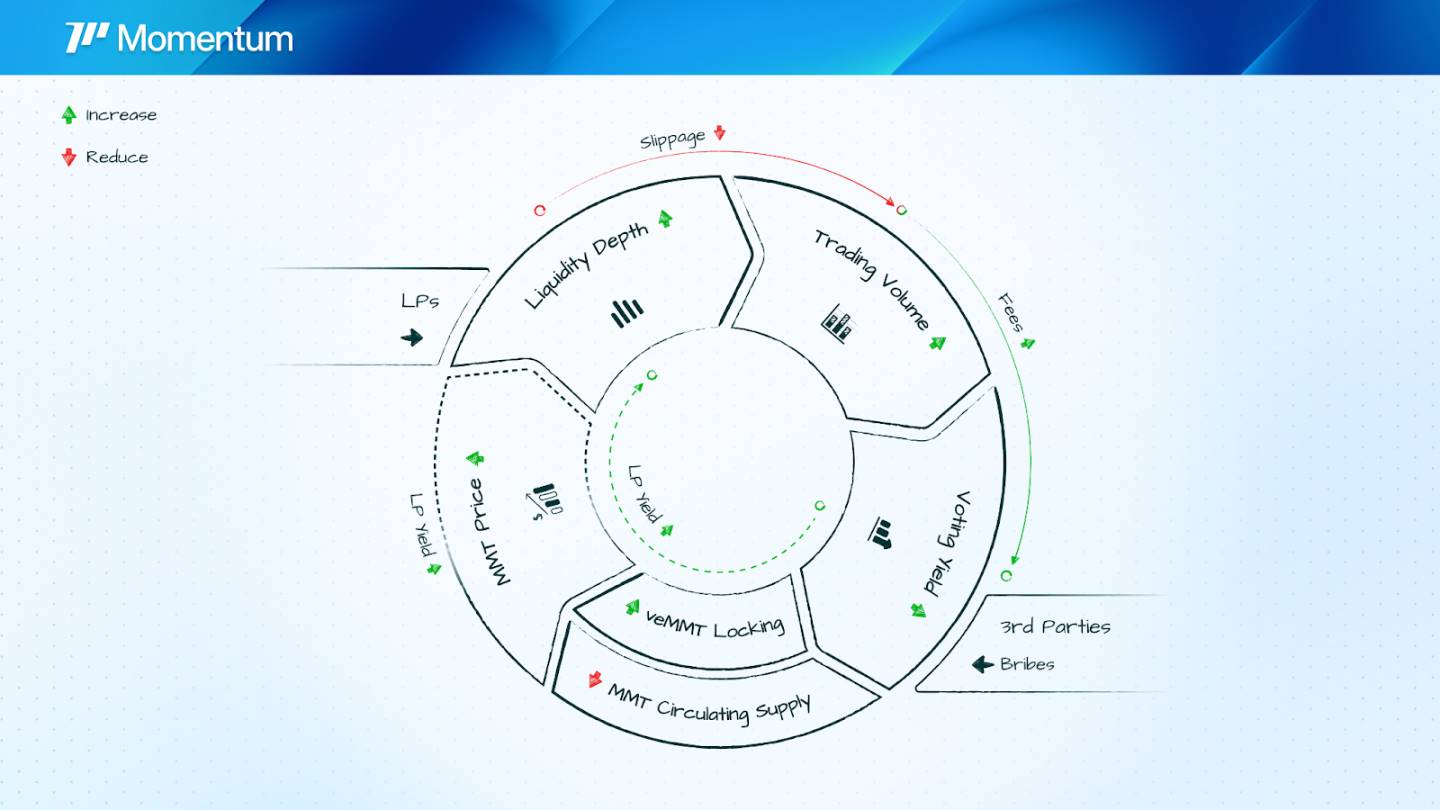

Diving deeper into Momentum’s product suite reveals it far exceeds the scope of a traditional DEX. At its core is the ve(3,3) mechanism: users lock MMT tokens to obtain veMMT voting power, used to determine reward distribution. Unlike Curve’s veCRV, Momentum’s (3,3) emphasizes tripartite win-win outcomes: traders enjoy low slippage, LPs earn high APRs, and holders receive protocol fees.

In short, the ve(3,3) mechanism allows both token holders and deeply engaged liquidity providers to participate confidently, without constant worry over price volatility or impermanent loss. Currently not yet live, official tweets indicate the model will reduce trading fees by 80% and boost LP returns by 400%. After mainnet launch, the flywheel effect of ve(3,3) could drive annual protocol revenue to $60 million.

Recently, Momentum launched AI Vaults. If you previously found parameters like impermanent loss confusing and didn’t know how to participate, this feature transforms DeFi from a game for experts into a passive income tool for average users—lowering the barrier to entry.

Momentum also introduced the Token Generation Lab (TGL), evolving from a simple trading platform into a Sui incubator to create wealth effects. xSUI is Momentum’s composable, yield-maximized, capital-efficient liquid staking token for SUI.

Now, if you’re a SUI whale or a power user, you can find your own way to earn through staking yields, AI strategy management, and new token launches.

Prestigious VC backing and a founder with an impressive resume further strengthen confidence in Momentum’s development.

In 2023, Momentum raised $5 million in seed funding led by Jump. In March 2025, it secured $10 million in funding led by Varys Capital, with participation from the Sui Foundation. Even as VCs grow increasingly cautious, Momentum closed a strategic round in June this year at a $100 million valuation, led by OKX Ventures, with participation from Coinbase Ventures and others.

The core team consists largely of Move language experts. Co-founder and CEO ChefWEN holds a Ph.D. in Computer Science from UC Berkeley, spent seven years at Meta (formerly Facebook), served as a core engineer on the Libra/Diem project, and directly contributed to the development of the Move language.

Conclusion

Momentum X will expand RWA listings to cover more asset classes, such as tokenized private equity, and launch new institutional-grade staking and Vault strategies. Additionally, Momentum X will introduce institutional-grade DeFi tools for compliant capital, including one-stop services like automated KYC portals, real-time risk dashboards, and cross-chain settlement APIs—propelling the RWA market from tens of billions to a trillion-dollar scale.

Retail users build wealth through passive income; institutions profit from efficient settlement.

Like a global financial playground, it empowers everyone to roam freely. DeFi is no longer an elite game—it’s a future within everyone’s reach. As Sui’s TVL continues to grow and institutional adoption accelerates, Momentum X will become critical infrastructure in the crypto space, driving the next peak of the liquidity storm.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News