450 million dollar financing for Sui treasury launch—what's the story behind this company?

TechFlow Selected TechFlow Selected

450 million dollar financing for Sui treasury launch—what's the story behind this company?

Stock price surges 300% in three days, the "Sui MicroStrategy" arrives.

Author: kkk,律动

On July 28, Mill City Ventures III, Ltd. (ticker: MCVT) announced a $450 million private placement to launch its SUI treasury strategy. Hedge fund Karatage led the round, with an equal investment provided by the Sui Foundation. Prominent institutions including Galaxy Digital, Pantera Capital, and Electric Capital also joined in support, while Galaxy Asset Management will oversee Mill City’s financial operations, further boosting market confidence.

Fueled by the news, MCVT's stock price surged from $2 to a high of $8 within three days, achieving a peak gain of up to 400%, closing yesterday at $6.65. This marks not only the entry of a traditional publicly listed financial firm into the new era of crypto infrastructure but also the official launch of another "altcoin micro-strategy." Following ETH, SOL, and BNB, SUI is now reaching its moment of institutional consensus.

Two Major Institutions Drive SUI Micro-Strategy: Karatage and Sui Foundation Step In

Non-bank lending and financial services company Mill City Ventures III, Ltd. recently announced it has signed a securities purchase agreement for a private investment in public equity (PIPE), purchasing and selling 83,025,830 shares of common stock at $5.42 per share, generating approximately $450 million in total proceeds. The offering is expected to close around July 31, 2025. The company plans to allocate about 98% of the net proceeds from the private placement toward acquiring SUI, the native token of the Sui blockchain, and approximately 2% to support its short-term lending business. SUI will serve as the company's primary financial reserve asset. This strategic shift marks Mill City’s transformation from its traditional focus on short-term loans and specialty financing into a new era centered on crypto-native assets.

This transition has been made possible through deep involvement and full support from Karatage and the Sui Foundation.

The funding round was led by London-based hedge fund Karatage. This proprietary fund, focused on digital assets and frontier technologies, was co-founded by Marius Barnett and Stephen Mackintosh. Beyond capital contribution, Karatage is directly involved in shaping Mill City’s strategic direction and governance structure—Barnett will serve as Chairman of the Board, while Mackintosh takes on the role of Chief Investment Officer, overseeing all SUI investment execution and asset management activities.

In fact, Karatage’s participation is no impulsive move but the result of long-term strategic preparation. The fund has been involved since the early stages of the Sui ecosystem, contributing to core protocols such as Walrus and Suilend, and establishing a lasting partnership with Mysten Labs, the original contributors to Sui. This experience has equipped them with extensive operational insights. Mysten Labs, founded in 2021 by former Meta-Novi R&D lead Evan Cheng and chief engineer Sam Blackshear, forms the technological backbone of the Sui Network and leads development of key infrastructure including Sui Wallet and Sui Explorer.

Karatage co-founder Stephen Mackintosh stated, “We are at a pivotal moment where institutional cryptocurrency and artificial intelligence are reaching critical scale, creating major opportunities across blockchain infrastructure. Sui offers the speed and efficiency institutions demand from large-scale cryptocurrencies, along with a technical architecture capable of supporting AI workloads while maintaining security and decentralization—making it fully ready for mass adoption.”

Thanks to this early, deep engagement and technical collaboration, Karatage brings profound understanding of Sui’s network architecture and ecosystem trajectory, providing strong credibility and executional backing for Mill City’s strategic pivot.

In addition, the Sui Foundation is also a key driver behind this strategic transformation, participating in the current financing round and continuously supporting the broader growth of the Sui ecosystem through multiple initiatives.

As an independent organization dedicated to advancing the development and adoption of the Sui network, the Sui Foundation has not only been a core early investor but also a major force behind the ecosystem’s flourishing. The Foundation actively supports the Sui ecosystem by funding developers, nurturing next-generation decentralized applications (dApps), and enhancing core infrastructure on the Sui network—including DeepBook’s centralized limit order book (CLOB), automated market maker (AMM) systems, liquid staking protocols, and lending platforms.

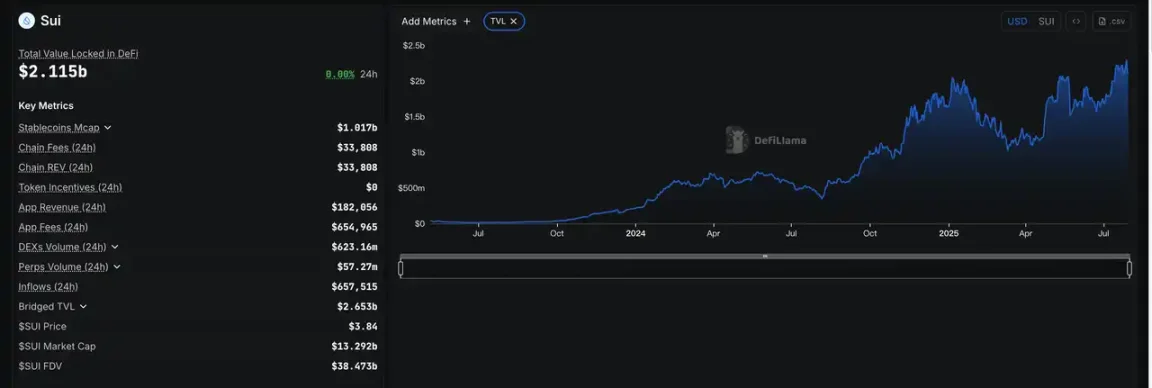

The Foundation consistently follows a "buyback and redistribution" strategy, channeling resources back into projects that drive the most network growth. At the same time, the Sui Foundation continues to incentivize top-tier DeFi protocols with SUI token rewards. Nearly all leading projects within the ecosystem have received official support, significantly increasing Sui’s TVL and real-world usage activity, driving the SUI token’s price performance steadily upward across market cycles.

As Christian Thompson, Managing Director of the Sui Foundation, put it: “Sui was built to deliver the scalability, speed, and security needed to support next-generation decentralized applications and real-world crypto use cases—for both consumers and institutions—from stablecoins to artificial intelligence, gaming, and broader finance.”

As a breakthrough Layer 1 widely regarded as “one of the most outstanding blockchain networks,” Sui is attracting growing attention and trust from developers and institutions alike, thanks to its industry-leading throughput and parallel processing architecture, becoming a key focal point for altcoin micro-strategies in the crypto world.

Summary

The Sui ecosystem is heating up rapidly, driven by momentum in artificial intelligence and decentralized finance. Currently, Sui’s total value locked (TVL) has surpassed $2 billion, setting a new record, while daily trading volume continues to climb, reflecting significantly increased ecosystem activity. On July 27, the SUI token price rose to $4.5, hitting a six-month high and emerging as one of the best-performing altcoins in recent weeks.

From Mill City’s treasury micro-strategy to the combined backing of Karatage and the Foundation, Sui is demonstrating strong capital appeal while proving that its technological architecture and ecosystem potential are gaining mainstream recognition. A micro-strategy paradigm driven by institutional momentum and ecosystem strength is gradually taking shape—Sui’s future trajectory is one to watch.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News