From Zhima Credit to Intelligent Wealth Score: Bluwhale's New Order of Financial Intelligence

TechFlow Selected TechFlow Selected

From Zhima Credit to Intelligent Wealth Score: Bluwhale's New Order of Financial Intelligence

When AI meets Web3, Bluwhale is building an intelligent wealth profile for everyone on Sui

Media Introduction

In the traditional financial world, we rely on "Zhima Credit" to measure creditworthiness and reputation;

In the era of Web3 and AI convergence, Bluwhale aims to reshape this logic with a new "Intelligent Wealth Score."

By integrating AI, blockchain, and multi-ecosystem data, it builds a composable, portable, and user-owned intelligent financial layer (Intelligence Layer), enabling every user to truly understand and control their wealth potential.

1. From "Zhima Credit" to "Intelligent Wealth Score"

In China, almost everyone is familiar with Alipay's "Zhima Credit Score."

It represents an individual's credit status, affecting scenarios such as renting, loans, travel, and consumption. However, this scoring system still belongs to traditional financial logic:

It records debt and performance, but overlooks users' assets and creativity in the digital world.

Meanwhile, although DeFi can read on-chain assets, it is completely disconnected from real-world finance, unable to identify cash flows, income sources, or even basic risk preferences.

In other words, whether in Web2 or Web3, we still lack an intelligent system capable of truly depicting "personal wealth health."

Bluwhale was created precisely for this purpose.

It aims to become a financial intelligence layer connecting reality and the decentralized world,

enabling everyone to view a real-time, multidimensional, dynamic "Intelligent Wealth Score (Whale Score)" just like checking Zhima Credit.

2. Bluwhale: The Intelligent Financial Layer for Web3

Bluwhale is an intelligent execution layer focused on AI × Web3 integration.

By combining artificial intelligence, blockchain, and user behavior data, it consolidates fragmented financial information into a computable, analyzable "unified intelligent graph."

Bluwhale's core goal is to make financial intelligence portable, composable, and user-owned—

turning users' financial behaviors and asset data into genuine digital assets that belong to them, rather than being fragmented by closed financial systems.

Currently, Bluwhale supports 37 blockchains and serves over 3.6 million users, offering integrated management of on-chain and off-chain assets.

Through an AI-driven Agentic Layer, the system can deliver real-time predictions, personalized insights, strategies, and risk analysis.

This is not merely a data dashboard, but the foundational architecture of the next-generation Open Financial Intelligence Economy.

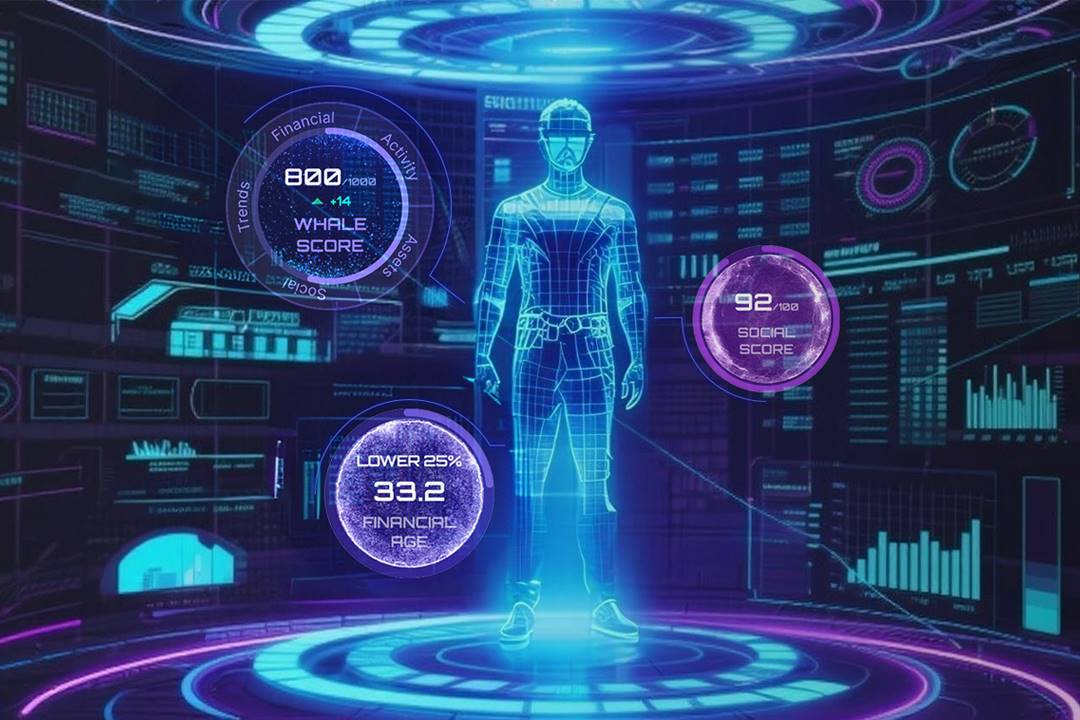

3. Whale Score: Redefining Financial Health

Whale Score is one of Bluwhale’s key innovations.

It shifts from traditional "credit scoring" to "intelligent scoring," comprehensively measuring an individual's asset structure, earning capacity, spending habits, and liquidity within a 0–1000 range.

Think of it as a "wealth health tracker":

Whenever income streams change, wallet connections update, or DeFi exposures adjust, Whale Score refreshes in real time.

Unlike traditional credit systems that only focus on repayment risk, Bluwhale's scoring emphasizes wealth potential and opportunity capture capability.

For the first time, users can visualize their financial health like managing physical health, receiving targeted optimization suggestions powered by AI.

4. Agentic Layer: Your AI Wealth Coach

Bluwhale's intelligence layer consists of an AI-driven "Agentic Layer."

Each user has a dedicated agent capable of learning, reasoning, and making decisions based on wallet activity, spending patterns, and asset allocation.

When the system detects risk concentration, idle funds, or imbalanced returns, the Agent proactively suggests rebalancing;

when portfolio structures change, AI highlights viable staking or liquidity opportunities.

This personalized intelligent collaboration not only helps users manage digital assets more efficiently but also transforms financial intelligence from passive recording to active empowerment.

5. Building the AI Financial Infrastructure on Sui

Bluwhale is built on Sui Network—a high-performance public chain centered around objects.

This is a decision rooted deeply in engineering logic.

Sui’s parallel execution model and object-centric architecture enable simultaneous processing of massive transactions and computational requests, avoiding global locks while maintaining low latency and high throughput.

This is crucial for Bluwhale to achieve real-time financial computation and seamless interaction with AI agents.

As the first AI token project in the Sui ecosystem, Bluwhale fully leverages its composability to build a modular AI economy on Sui.

Agents, nodes, and models can be independently upgraded while continuing to operate cohesively within a unified framework.

This design gives Bluwhale's financial intelligence layer high scalability, security, and composability, laying the foundation for future AI-native economies.

6. Team and Technical Pedigree

Bluwhale was co-founded by two technical experts with strong backgrounds in AI and systems engineering:

- Han Jin (CEO), graduated from UC Berkeley’s Department of Industrial Engineering and Operations Research, previously founded Lucid VR—an immersive media company powered by machine learning—recognized in Forbes 30 Under 30 and Golden Globee AI Startup Awards;

- Adam Rowell (CTO), PhD in Electrical Engineering from Stanford University, specializing in neural network quantization and mobile AI, architect of Bluwhale’s decentralized computing and data privacy infrastructure.

Together, they bring a dual perspective of AI engineering and system optimization, delivering a robust, enterprise-grade yet user-friendly technical foundation for Bluwhale.

7. Ecosystem and Partnership Network

Bluwhale’s ecosystem is rapidly expanding, with its intelligent graph covering over 800 million wallet addresses.

Beyond individual users, an increasing number of financial platforms, exchanges, and dApps are integrating Bluwhale’s intelligent financial capabilities into their own systems.

Key strategic partners include:

- Sui Foundation: providing core support for decentralized computing power and interoperability;

- Arbitrum, Tezos, Cardano, Movement Labs: advancing cross-chain Whale Score visualization;

- SBI Holdings, UOB, Decima (Animoca, Gumi, MZ Crypto): bringing AI-driven intelligent insights into institutional financial services.

All partnerships revolve around a shared goal—empowering users to derive value directly from their financial data.

8. BLUAI: Fueling the Intelligent Economy

Bluwhale’s ecosystem is powered by the BLUAI token, serving as the system’s operational fuel.

Whether for AI queries, Agent execution, node rewards, or governance voting, everything is conducted using BLUAI.

Token mechanism summary:

- Total supply capped at 10 billion permanently;

- Initial circulating supply: 12.28%;

- Monthly release: 1.2–1.6%, tied to network growth;

- Distribution structure:

- 25% Node incentives

- 21% Foundation and treasury

- 10% Marketing and community

- 8.8% Operations and expansion

- 7% Team and advisors

- 23% Funding and strategic rounds

- 5% Liquidity and market making

- 25% Node incentives

With every AI interaction, BLUAI is consumed as "gas," creating inherent deflationary pressure and forming a closed-loop intelligent economy driven by usage-based value.

9. Intelligent Finance Beyond Credit Systems

Traditional credit models like FICO or on-chain protocols such as Spectral and Cred Protocol primarily assess default probability.

Bluwhale, however, focuses on intelligent potential and wealth growth.

It is not merely a "credit model," but an interpretable "financial cognition model"

that helps users understand their own wealth behaviors, investment capabilities, and future potential.

In Bluwhale’s view, the next step in financial intelligence is not risk restriction, but opportunity activation.

10. Conclusion: The AI-Powered Financial Future

The essence of finance has always been information, but the future of finance will be a competition of intelligence.

Bluwhale is leveraging AI agents and open data ownership so that every wallet, transaction, and habit becomes a signal for intelligent insight.

On Sui’s high-performance architecture, Bluwhale is reshaping a more efficient, adaptive, and human-centric financial intelligence system for global users.

In this system, wealth footprints are complete, dynamic, interpretable, and truly owned by users themselves.

As AI becomes the new productive force, Bluwhale aspires to be its trust and settlement layer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News