Base, Sui... The strategic value and implementation path of compliant public chains

TechFlow Selected TechFlow Selected

Base, Sui... The strategic value and implementation path of compliant public chains

Future mainstream chains must serve real-world assets and users, and must also meet regulatory requirements.

Authors: Bensha, CryptoMiao, Unai Yang, Zhao Qirui

There are two major trends in the current crypto industry. First, the industry is gradually entering a period of regulatory convergence, reshaping the previous paradigm of "technology first, regulation lagging." Second, the integration between on-chain and traditional financial sectors is becoming increasingly tight—whether it's RWA (real-world asset) issuance or the on-chain processing of stablecoins and financial derivatives—a trend that has become irreversible.

Under this backdrop, "compliant public chains" have emerged as an important topic, and a chain's "compliance capability" is becoming a core factor for traditional institutions when evaluating its integration value.

This article focuses on three key questions: why public chains need compliance, what constitutes compliance, and how to achieve it. It provides an in-depth analysis of two strongly compliant public chains—Base and Sui—and examines Robinhood Chain, which Robinhood may launch in the future, offering readers insights for public chain selection, business integration, and strategic decision-making.

1. Reasons for Public Chain Compliance

As mentioned earlier, the necessity for public chain compliance stems from two sources: regulatory requirements and user demand. Let us go further: Why do regulators require compliance? Whose interests are harmed by non-compliant chains? And why do users want to use compliant public chains? What value does using a compliant chain bring?

(1) Why Do Regulators Require Compliance?

Regulatory agencies across global jurisdictions share several top priorities: preventing financial crimes (such as money laundering, fraud, terrorist financing), maintaining financial market stability, and protecting consumers. These involve fundamental issues of trust and security in financial markets. For the United States, they also relate to national security and global hegemony.

Illicit funds can be "washed" on-chain and then flow covertly into legitimate domains. Crypto-related scams and frequent hacking incidents often lead to investors losing wealth and trigger market panic. If large-scale crypto companies or platforms suffer theft due to on-chain vulnerabilities or face penalties for violating laws, not only will massive funds be lost, but liquidity in the entire financial system could be directly affected.

In May 2022, Terra (a public chain focused on algorithmic stablecoins) saw its stablecoin UST heavily dumped and de-pegged, causing its governance token LUNA’s price to collapse, wiping out $40 billion in market cap and affecting millions of users. Subsequently, the prominent crypto hedge fund Three Arrows Capital, holding large amounts of LUNA, faced severe asset shrinkage and ultimately declared bankruptcy, impacting multiple trading platforms and triggering a systemic crisis across the industry. One can imagine that if such events recur in the future, the scale may exceed hundreds of billions of dollars, with consequences comparable to the 2008 financial crisis.

As the crypto world becomes more deeply interconnected with traditional financial systems, regulators must consider and mitigate potential negative impacts. Especially as the crypto market expands and integrates into mainstream finance, any failure in regulation could lead to catastrophic outcomes.

(2) Why Do Users Want Compliant Public Chains?

Crypto market users fall into two categories: retail investors and institutional users. Here we focus primarily on institutional needs. Institutional users refer broadly to entities participating in the crypto market not as individuals, typically including financial institutions, corporate users, government or state-owned capital-backed organizations, and Web3-native institutions.

As foundational infrastructure for the entire crypto industry, public chains are the only viable path for institutions to deploy on-chain services: BlackRock launched its first tokenized fund BUIDL on Ethereum; Visa integrated USDC settlement for merchants on Solana and Ethereum; Google provides RPC nodes for Solana and Ethereum; USDC and USDT are issued across multiple public chains; every Web3 startup team’s first question is which public chain ecosystem to join…

Just as banks would not choose to operate on the dark web, institutions won’t deploy their businesses on a chain existing in a “legal gray zone.” The prerequisite here is compliance, credibility, and auditability—otherwise, they can never truly “go on-chain,” as regulators could dismantle years of effort with a single lawsuit.

Beyond inevitable commercial decisions and regulatory pressures, compliant public chains represent the new “ticket” to the next wave of growth for institutional users.

A chain capable of meeting institutional compliance needs can support new applications such as RWA, central bank digital currencies, and enterprise financial apps, accessing multi-trillion-dollar asset markets. This would also attract massive capital from VCs, LPs, and banks, expanding the collective pie. Meanwhile, modules like “selective privacy,” “on-chain identity,” and “on-chain credit” will evolve into new infrastructure layers as regulations mature, providing stronger foundations for Depin, SocialFi, and GameFi. These areas, long struggling without breakthroughs, might eventually achieve mass adoption like stablecoins.

(3) What Constitutes a Truly Compliant Public Chain?

The public chain space has long lacked clear, unified regulatory standards. Regulators often apply the Securities Act and Howey Test to assess projects, introducing considerable subjectivity. During the Biden administration, Ethereum, EOS, and Ton all faced strict scrutiny—even compliance benchmark Coinbase received multiple SEC subpoenas.

With the passage of three major U.S. crypto bills and positive signals from the SEC, compliance in the crypto industry is no longer a vague, trial-and-error process. The same applies to public chains.

Although the U.S. currently lacks a dedicated, unified standard specifically for public chain compliance, multiple laws and bills are forming an increasingly clear regulatory framework. However, for a public chain to ensure lawful behavior within its ecosystem, it must possess the technical capabilities to meet these demands. The so-called “strongly compliant public chains” in this article refer to those that proactively adapt their technology to align with regulatory expectations—chains that actively transform themselves to meet regulatory preferences.

Key regulatory requirements include: the Bank Secrecy Act (BSA), the DAAMLA Digital Asset Anti-Money Laundering Act, the GENIUS Act and CLARITY Act, cross-enforcement by the CFTC and SEC, and FinCEN guidance.

To satisfy these, compliance mechanisms must be embedded at the technical architecture level—for example, identity verification (KYC/KYB), transaction auditability, and compliance controls within smart contracts. Additionally, chains should allow dApps to undergo testing and review in specific environments and permit authorized regulators access to necessary on-chain data.

Though examiners haven’t clearly defined the criteria, the answers are already apparent.

2. Current State and Implementation Paths of Strongly Compliant Public Chains

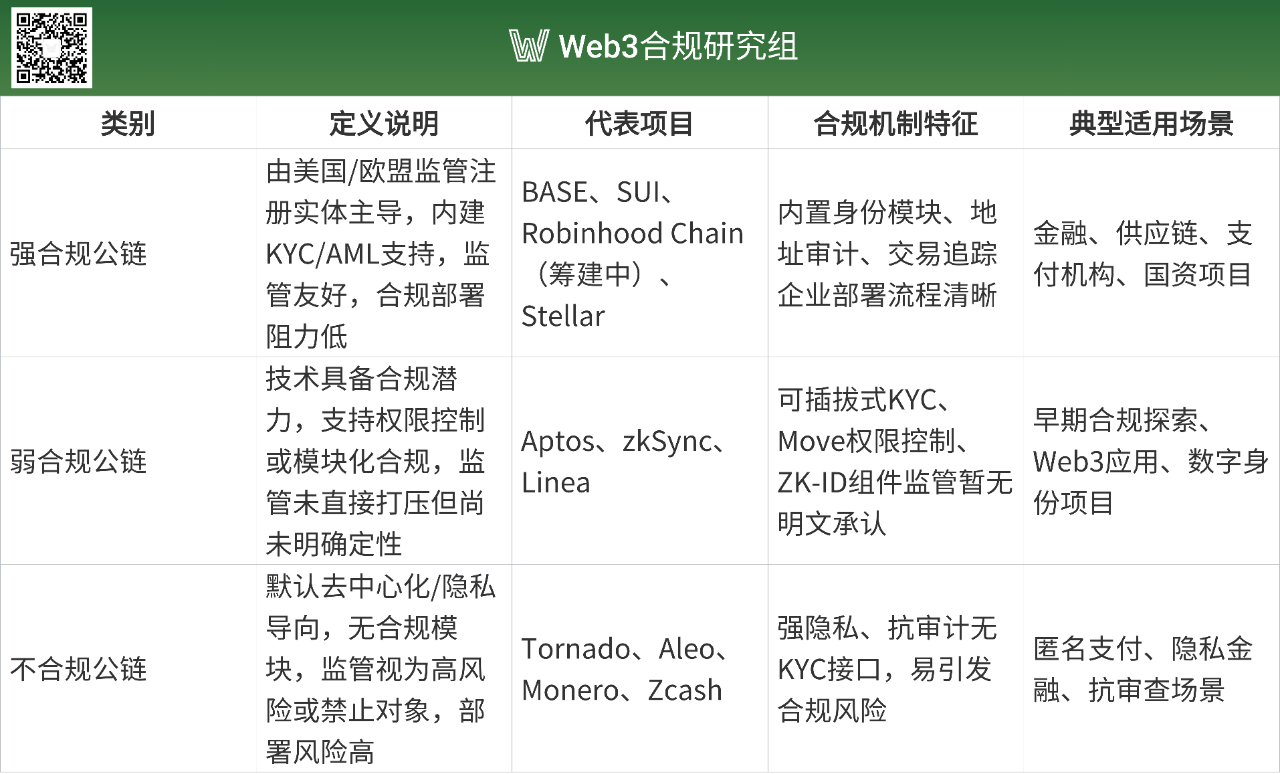

Representative projects that currently fit our definition of “strongly compliant public chains” include Base, Sui, and the upcoming Robinhood Chain. Next, we examine how far each has progressed in compliance and how they achieved it.

(1) Base

Coinbase, as a leading compliant platform in the U.S. market, launched Base to build a “regulator-friendly” on-chain ecosystem, offering institutions and mainstream users a compliant, secure, and controllable Web3 environment. This complements its exchange business and forms the core of its diversified compliant service expansion. In the future, its Web3 operations in finance, identity, and asset issuance will all run through Base. Thus, compliance has been central to Base’s design from the beginning.

1. Technical Architecture

Given compliance as a core principle, regulatory-mandated functions must be considered, requiring architectural flexibility. Base’s solution is to leverage existing technologies.

Base is built on Optimism’s OP Stack—a modular, plug-and-play blockchain development framework that offers diverse components for every chain built on OP Stack.

Think of Base as a highway foundation that can flexibly install “cameras, speed limiters, and ID recognition systems.” For instance, custom compliance modules can be defined and written into the execution layer to meet specific regulatory requirements.

Coinbase acts as both a “toll booth” and “ID inspector,” serving as the critical bridge between off-chain compliance services and the on-chain world. Before entering Base, users must complete identity verification (KYC) and anti-money laundering checks (AML) on Coinbase. These compliance data aren’t exposed directly on-chain but are passed via controlled interfaces. Once verified, a user’s wallet address (Ethereum address) receives a tag confirming approval, making all subsequent on-chain activities traceable. As a result, Base addresses lose anonymity.

This model of off-chain identity with on-chain activity effectively creates a “lawful highway system.” BASE serves as infrastructure hosting various Web3 applications—you can run DeFi protocols, deploy NFT markets, or launch blockchain games. Coinbase ensures every “vehicle” (user or capital) entering this highway undergoes legal identity checks, eliminating risks like money laundering or fraud.

By reusing mature modular frameworks, Base lowers the technical barrier for implementing compliance while reserving room for adapting to future complex regulatory demands.

2. Functional Design

After solving KYC/AML, other regulatory requirements remain. Coinbase addresses these by developing corresponding compliance features.

Smart contracts remain unchanged in essence, but Base designs compliant channels for RWA and security token issuance. Its smart contracts support full-cycle supervision of asset creation, holding, transfer, and redemption. Future updates will enable response capabilities such as fund freezing and destruction as required by regulations like the GENIUS Act. JPMorgan Chase’s pilot on-chain deposit token JPMD was deployed on BASE, validating its institutional-grade compliance capability.

Audits continue as usual, but Base extends audit duration and plans to offer standardized APIs or dedicated nodes for regulators to access on-chain data in real time. These interfaces integrate with RegTech tools like Chainalysis to enable real-time risk control, anomaly detection, and address tracking.

BASE also introduces blacklists and whitelists. Blacklists automatically block sanctioned addresses, while whitelists ensure sensitive assets circulate only among pre-approved, compliant addresses. Privacy-enhancing technologies (e.g., private pools + zero-knowledge proofs) may be introduced later to balance compliance with user privacy.

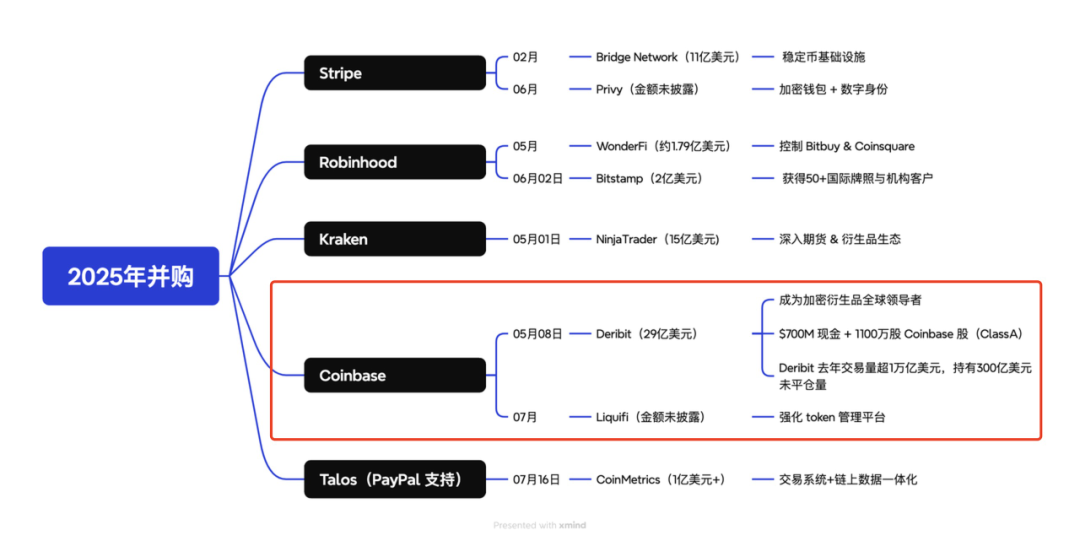

3. Acquisitions and Integration

Additionally, Coinbase has acquired several key teams and projects in recent years to strengthen BASE’s on-chain compliance and data infrastructure:

-

Liquifi: Enables compliant asset issuance, completing pathways for securities and stablecoins;

-

Spindl: Enhances user behavior tracking and ad attribution;

-

Deribit equity investment: Gains access to key derivatives market data, strengthening risk monitoring.

M&A events in fintech companies in 2025

This series of integrations covers the full stack—from enterprise services to protocol layer to data interfaces—providing BASE with a standardized, replicable template for building compliant L2s.

In short, BASE embeds compliance into system design rather than relying on external governance post-launch. From architecture choice → feature development → acquisition-driven enhancement, the entire pipeline meets essential compliance requirements. This design approach positions BASE as one of the public chains most aligned with mainstream compliance standards in the future Web3 world.

(2) Sui

Sui, launched in May 2023, has quickly gained prominence in the blockchain space due to its unique technical architecture and user-friendly design. Compared to many other public chains, Sui has demonstrated remarkable resilience over nearly two years since launch, particularly in regulatory compliance and network security. To date, Sui has not faced lawsuits or accusations—an achievement that highlights the rigor of its development team in both technology and compliance, earning trust and reputation in the competitive blockchain market.

Meanwhile, Sui’s recent performance further demonstrates its market potential. With rapid ecosystem growth and rising community engagement, Sui’s market cap has surged past $13 billion, ranking it among the top 13 cryptocurrencies globally. This valuation reflects strong market confidence in Sui’s technological innovation and application prospects, marking its significant position in the public chain landscape.

So how has Sui managed to grow rapidly, maintain compliance, and stand firm amid intense competition?

1. Language Advantage

While both aim for compliance and flexibility, unlike Base’s reliance on existing architecture, Sui’s flexibility is “innate.”

Sui uses the Move programming language, emphasizing high transaction speed and low latency, prioritizing fast and secure execution—ideal for real-time applications like gaming and finance. Compared to the widely used EVM language, Move offers more advanced advantages suited to modern blockchain development.

Move’s modular design allows developers to organize code into reusable modules, sharing resources and functionality, simplifying upgrades and composition, thus enhancing developer experience.

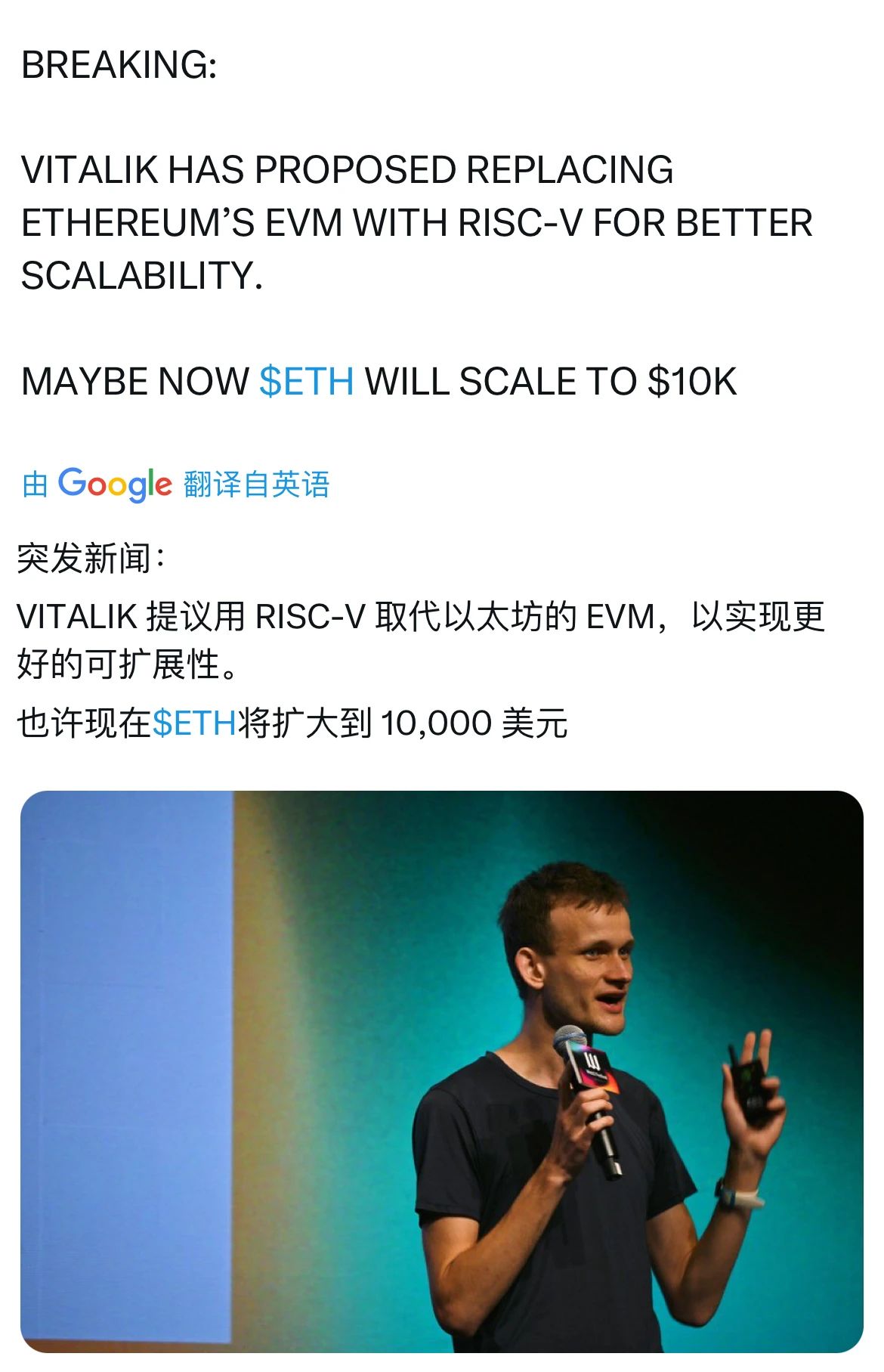

Recently, Ethereum (ETH) co-founder Vitalik Buterin proposed replacing the Ethereum Virtual Machine with RISC-V. RISC-V shares many similarities with Move, especially in modularity and extensibility. Both emphasize modular, scalable designs supporting custom instruction extensions, enabling adaptation to diverse use cases and facilitating broader blockchain applications. This further underscores Move’s technical superiority.

This foundation provides Sui with a solid base for compliance implementation.

2. Empowering Developers / Partnerships / Third-Party Integration

Sui Blockchain has taken multiple steps to ensure regulatory compliance.

First, compliance tools are packaged as “modules” for developers to invoke as needed. Sui itself, as a decentralized blockchain, does not directly enforce AML or KYC, but provides projects building on it with necessary tools and infrastructure to meet regulatory standards. Through various tools, it helps developers self-regulate and ensure compliance—such as geographical restrictions. For example, Sui partnered with Netki to launch DeFi Sentinel, a compliance oracle offering automated tools including real-time KYC/AML, wallet screening, and transaction monitoring. These help dApps verify user locations, allowing access only to users in compliant regions. For instance, the gambling project Doubleup is accessible only to users in regulated gambling jurisdictions.

Naturally, for potentially illicit projects or individuals slipping through, Sui includes legal cooperation obligations in its terms of service: funds can be frozen or access restricted per legal requests, providing a legal interface for compliance review. If a $1.46 billion hack like Bybit occurred on Sui, stolen funds could potentially be frozen under these terms.

Second, seeking partner support. Due to its decentralized nature, Sui cannot directly implement AML/KYC like traditional financial institutions, but through transparent transaction records and partner tools, it enables projects to meet regulatory needs. For example, Sui collaborates with Ant Digital, leveraging its ZAN platform to provide KYC and AML tools for compliant RWA tokenization. As an RPC node operator on Sui, ZAN seamlessly communicates with Sui’s infrastructure, enhancing scalability and security.

Third, third-party integration. Through its community-driven Sui Guardian program, Sui partners with third parties like Chainalysis to enhance compliance. Sui Guardian tracks scams and phishing sites, while Chainalysis’ analytical tools monitor and analyze on-chain transactions, identifying addresses or patterns linked to known illegal activities. By analyzing transaction patterns, Chainalysis can detect potential phishing victims, helping exchanges and users take preventive measures. This helps Sui comply with global AML and KYC regulations such as the EU’s 5th Anti-Money Laundering Directive (5AMLD) and the U.S. Bank Secrecy Act (BSA).

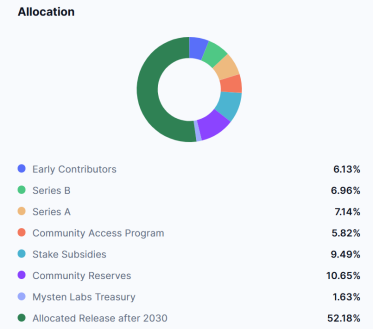

These aspects are also reflected in community incentives. Sui’s token distribution model allocates three portions to support ecosystem development: Community Access Program (5.82%), Stake Subsidies (9.49%), and Community Reserves (10.65%). Tokens allocated for ecosystem support total 26%, representing 54.37% of the released supply (47.82% by 2030) and over half of the total circulating supply. The Community Access Program supports project incentives and on-chain development, while the 10.65% Community Reserves focus on long-term ecosystem building—funding Move-based DApp development, supporting community governance, or reserving funds for future expansion, guiding compliant ecosystem growth.

Thus, Sui achieves both compliance and risk isolation.

In blockchain ecosystems, public chains typically serve as base layers. Users interact with DApps through smart contracts developed by project teams, with main stakeholders being project teams and users. Most legal disputes involve project teams and participants. Unless a public chain has a major vulnerability directly causing user losses, it rarely becomes a defendant.

For example, Sui recently announced a partnership with xMoney and xPortal to launch a digital Mastercard supporting SUI tokens in Europe. Sui, as a technical platform, focuses on infrastructure and asset ecosystem development, while payment processing is handled by licensed entity xMoney and user experience managed by xPortal.

3. Data Compliance

Sui is among the few public chains explicitly designed with GDPR (General Data Protection Regulation) compliance capabilities. Using three native technical tools, it has established a compliance framework tailored for strictly regulated markets like the EU:

Through this mechanism, Sui users can access Web3 applications via Web2 login methods without exposing private keys or leaking identities—enhancing both user experience and compliance simultaneously.

We see that Sui also internalizes compliance into architecture and product design, but compared to Base, Sui’s solution strikes a balance between compliance and decentralization.

From inception, Sui has integrated compliance into its top-level architecture, meeting global regulatory demands while building a vibrant, robust ecosystem through community incentives, key project development, and offline initiatives. Its concrete measures in user compliance, partner support, and project-level actions—such as partnering with third parties for KYC/AML tools and adopting innovative technologies for GDPR compliance—demonstrate foresight and execution in addressing regulatory challenges.

Public chain development should start holistically, aligning bottom-up logic with future directions. Projects cannot plan from a single-project perspective but must anticipate diverse application scenarios and trends, preparing accordingly. Managing a chain is like governing a nation—only with comprehensive infrastructure, leadership in high-investment projects, and rational incentive allocation can more developers and users be attracted, gradually cultivating a rich on-chain ecosystem.

(3) Robinhood Chain

Robinhood, an internet brokerage that pioneered retail trading, later embraced crypto by listing multiple coins and launching its own wallet app. In late June, it announced tokenized U.S. stocks, gaining widespread attention. Yet Robinhood once faced hardship: in 2020, it was fined $70 million for “payment for order flow”—making it one of the highest-fined brokers in U.S. history and reinforcing its awareness of deeply embedding compliance into product design. Today, Robinhood is essentially a compliance-first fintech company, with its business model rooted in “compliant innovation.”

1. From Arbitrum to Robinhood Chain

Robinhood’s tokenized stocks launched in late June are issued on the Layer 2 chain Arbitrum, offering lower gas fees and higher throughput than Ethereum’s mainnet. However, Arbitrum doesn’t meet our definition of a strongly compliant public chain. This choice was thus a strategic compromise, limiting tokenized U.S. stocks to European users—not its home market, the U.S.

As Web3 enters the phase of industrial integration, Robinhood’s next strategic move is launching its own compliant public chain, Robinhood Chain—a platform for asset issuance, on-chain settlement, and data custody—aiming to bring traditional financial assets (like stocks and ETFs) fully on-chain, enabling 24/7 trading, disintermediated circulation, and deep integration with DeFi infrastructure. This marks Robinhood’s critical leap from a “Web2.5 compliant exchange” to a “Web3 compliant financial infrastructure.” Given this strategic importance, achieving U.S. market compliance will be the top priority. Unlike Arbitrum, a key focus in developing Robinhood Chain will be “compliance modules.”

2. Three Steps to Compliance

It must be noted that Robinhood has not yet disclosed its public chain’s technical roadmap. However, based on its official “Tokenization Memo” (hereinafter “Memo”) and compliance filings with the SEC, we speculate that Robinhood Chain will likely adopt the following compliance technologies:

First, “on-chain + off-chain identity binding.” Like Base, Robinhood adopts “off-chain KYC + on-chain authorized address binding,” explicitly stated in its SEC compliance letter. Thus, all activities from addresses bound to Robinhood accounts will be traceable, while unbound addresses will be prohibited from transferring tokens.

Second, smart contracts. Similar to Base, beyond KYC, the Memo mentions mandatory trading management rules and jurisdiction-specific regulations. These can all be translated into logical conditions within smart contracts—essentially if/else statements added to transfer or mint functions—enabling automatic enforcement of regional restrictions, blacklists, and position caps without manual review.

Third, compliance API support. In its letter to the U.S. SEC, Robinhood stated that its tokenized stocks and bonds must be custodied by licensed brokers (such as Robinhood itself or regulated third parties) to ensure asset safety and prevent theft or misuse. These brokers will manage users’ private keys, record transaction ledgers, and undergo regular audits. Although these assets are on-chain, they should still allow trading via traditional channels (like OTC or ATS). Moreover, on-chain transactions must interoperate with traditional financial systems (like the DTC clearing system) to ensure consistency between on-chain and off-chain data.

To support this, Robinhood Chain will embed a standardized “regulatory interface”—a technical module similar to an API. Through these interfaces, regulators can view transaction records, freeze risky addresses, or retrieve individual transaction histories, ensuring on-chain behavior complies with regulations.

3. Future Possibilities

Robinhood CEO Vlad Tenev mentioned in a livestream that he deeply respects Coinbase. In the Web3 landscape, Coinbase moved first by launching Base, providing a reference model for Robinhood’s own chain. Future Robinhood Chain will follow a similar compliance path as Base, learning from each other while developing independently.

In choosing a compliance path, Robinhood and Base are nearly identical: flexible underlying architecture, self-built compliance modules, and regulator-accessible API interfaces. This represents the most common approach for U.S.-market compliant public chains.

3. Exploring the Middle Ground: Compliance vs. Privacy-Focused Public Chains

Chains like Base, Robinhood Chain, and Sui were designed with legal compliance in mind, making them suitable for adoption in traditional finance. Others, such as ZKsync and Stellar, also emphasize compliance but face some controversy in regulatory recognition—falling into the “weakly compliant” middle ground. Some chains remain in open conflict with regulators and are entirely rejected by mainstream institutions.

(1) Weakly Compliant Public Chains

Plasma is an Ethereum-based Layer 2 public chain whose defining feature is using USDT as a native asset. Precisely because of its association with Tether (USDT) and other stablecoins, its compliance status is widely questioned. Tether has faced repeated scrutiny over compliance issues, such as insufficient reserve transparency and inadequate AML measures. Although the Plasma team has actively adjusted strategies—attempting to meet regulatory expectations through technical improvements like enhanced data availability or audit mechanisms—it has not yet gained formal recognition from mainstream regulators.

ZKsync, an Ethereum ZK-rollup scaling solution, has drawn attention from traditional financial institutions. Deutsche Bank is developing its Project Dama 2 on ZKsync, aiming to build a compliant financial chain connected with Singapore’s MAS and granting auditors access. While ZKsync shows willingness to compromise and engage in compliance-oriented use cases, its foundation remains a public, freely accessible protocol without built-in mandatory KYC or transaction restrictions. It is still under regulatory investigation by the U.S. SEC and Treasury Department and lacks official regulatory endorsement.

Aztec is an Ethereum Layer 2 focused on private transactions and smart contracts, combining anonymity with programmability. Built on zero-knowledge proof (ZKP) technology, it features Noir, a dedicated language for executing private smart contracts. Though it promotes research on privacy + compliance in academic and technical communities, it hasn’t been clearly classified or recognized by mainstream regulators. While Aztec seeks balance between compliance and privacy, its core focus remains privacy-first. Its compliance depends on whether future ecosystems adopt “optional compliance modules,” while the protocol itself lacks mandatory KYC/AML interfaces.

(2) Non-Compliant Public Chains

If weakly compliant chains merely lack sufficient compliance but show intent to conform, non-compliant chains completely ignore regulatory demands.

In January 2025, the U.S. SEC formally sued Nova Labs, alleging that three of its tokens—Helium Network Token (HNT), Helium Mobile Token (MOBILE), and Helium IoT Token (IoT)—were involved in the illegal sale of unregistered securities. The SEC also accused the company of misleading investors by falsely claiming partnerships with major firms like Nestlé and Salesforce without proper authorization or agreements.

Helium, a typical DePIN (decentralized physical infrastructure network), centers on IoT hotspot devices, bypassing KYC entirely and lacking any on-chain compliance modules. Its tokens circulate publicly and anonymously, making accountability difficult for regulators. Still in early litigation, the project denies all SEC allegations and currently has no compliance support mechanisms, representing a classic case of a “fully non-compliant” public chain.

Another prominent example of non-compliance is Terra. Since 2023, the SEC has sued its parent company, Terraform Labs, accusing it of using the UST stablecoin and LUNA token, along with algorithmic stabilization mechanisms, to induce investors into unregistered securities sales. Ultimately, the SEC was able to build its case due to the collapse event and the project’s lack of basic KYC/AML mechanisms, as well as missing compliance modules such as fund freezing, address restrictions, on-chain auditing, and regulatory interfaces. From inception, the project operated outside regulatory frameworks and is considered a textbook violation of securities law.

4. Trend Outlook: The Long-Term Evolution Logic of Compliant Public Chains

In recent years, many projects insisted on “building their own chains,” but reality has shown: unless you achieve excellence in performance, security, and ecosystem, the marginal benefit of building a standalone chain is far less than leveraging mainstream chains for compatibility and compliance advantages.

The real questions now are threefold:

-

Will different types of assets or data go on-chain at scale?

-

How will the market landscape of compliant public chains evolve?

-

As on-chain systems evolve and regulatory environments change, what new technologies will emerge?

The answer to the first question is obvious. BlackRock has not only tokenized U.S. Treasury ETF shares on Ethereum but also launched the first fully on-chain issued, settled, and managed private fund. Wall Street giants like Goldman Sachs and Citigroup continue exploring RWA on-chain deployment. Notably, even transaction data is gradually being “chained”—companies like BlackRock and Fidelity use public chains like Ethereum to record certain fund operations. On the other side of the Pacific, Hong Kong’s SFC has officially licensed 41 virtual asset platforms, with Guotai Junan becoming the first Chinese broker to receive such a license—clear signals that the convergence of compliant finance and on-chain assets has arrived.

At this point, choosing a public chain becomes inevitable. What institutions truly need isn’t “rebuilding another chain,” but finding one that balances sovereign compliance, on-chain autonomy, cross-chain interoperability, and secure self-custody.

Future public chain architectures will trend toward embedded “modular compliance capabilities.” New paradigms represented by Base and Robinhood Chain reveal a pattern: combining off-chain identity verification with on-chain behavior tracking, plus standardized regulatory APIs, to harmonize compliance with open ecosystems. This design will be replicated by more chains targeting institutional markets. Another technical direction is “selective compliance,” where developers or application layers freely invoke compliance modules, connect to KYC providers, and set asset management rules—as seen in chains like Sui and ZKsync.

We expect regulatory oversight to follow a dual-track model: one track enforcing increasingly strict compliance for financial assets, covering end-to-end requirements like KYC, AML, and regulatory data access; the other preserving space for innovation within decentralized architectures, particularly cautious regulation of smart contract logic, DAO governance, and ZK privacy computing.

As compliant public chains mature, a wave of “natively compliant” applications will emerge. These projects will not only consider regulatory requirements during issuance and operation but may even offer “Regulatory Technology as a Service” (RegTech-as-a-Service). Standardized interfaces for KYC, AML, risk engines, identity custody, and contract auditing will become public utilities in the on-chain ecosystem, further lowering the entry barrier for traditional financial institutions.

For example, in security, multi-sig architecture has become the standard. NexVault’s enterprise-grade multi-sig wallet supports 12 major chains, focusing on self-custody, security auditing, permission management, and inheritance logic for enterprises, family offices, foundations, and DAOs, already establishing compliant pathways in Hong Kong and Singapore.

5. Final Thoughts

As the crypto industry gradually enters the compliance era, public chain development is no longer solely about performance and cost—but treats “compliance” as a foundational design principle. From Coinbase to Robinhood, from Base to Sui, a trend emerges: future mainstream chains must serve real-world assets and users, and meet regulatory requirements.

The term “compliance” will no longer signify restriction or constraint, but a new productive tool.

By systematically understanding regulatory logic, technical architecture, and user needs, it is entirely possible to build blockchain infrastructures that are both open and compliant. The future Web3 world will not just consist of anonymous transactions and DeFi arbitrage, but a diverse ecosystem encompassing RWA issuance, identity and credit, on-chain governance, and industrial finance. Public chains will evolve from “technical labs” into “new digital platforms.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News