IOSG | Tale of Two Chains: BNB Chain and Base from a Cultural Perspective

TechFlow Selected TechFlow Selected

IOSG | Tale of Two Chains: BNB Chain and Base from a Cultural Perspective

The real winners may not be a particular chain itself, but rather the applications and teams that can understand both ecosystems and seamlessly switch between them.

Author: Jiawei @IOSG

▲ Source: Jon Charbonneau

A while back, I couldn't help but laugh when I came across Jon Charbonneau's tweet. When Base is called the "white people's BNB Chain," what exactly is that joke really about?

In Haseeb’s article “Blockchains are cities,” Ethereum and Solana are compared to New York and Los Angeles, respectively. If we apply the same analogy:

BNB Chain is a port city that never sleeps, carrying massive traffic from Binance. Cargo ships come and go, markets buzz with noise, street vendors and exchanges stand side by side. It doesn’t care where you’re from—only whether you can jump in immediately. Gas fees are low, pace is fast, new projects launch daily, some make money, others exit. You don’t need to understand urban planning or subscribe to an ideology—just know where it’s lively and where opportunities lie, and you’ll survive.

Base, on the other hand, is a new city inheriting Ethereum’s values, under rapid construction. Roads are still being paved, communities forming, rules repeatedly debated. There’s no noisy congestion of ports, yet it attracts large numbers of engineers, creators, and institutions moving in early. They aren’t rushing to make quick profits, but asking: if truly mass-market on-chain applications emerge over the next decade, where should they be born?

The same crypto world is now diverging into different cities, different residents, different lifestyles.

Understanding the differences between these two cities may matter far more than arguing which chain is better.

Two Parallel Cultures

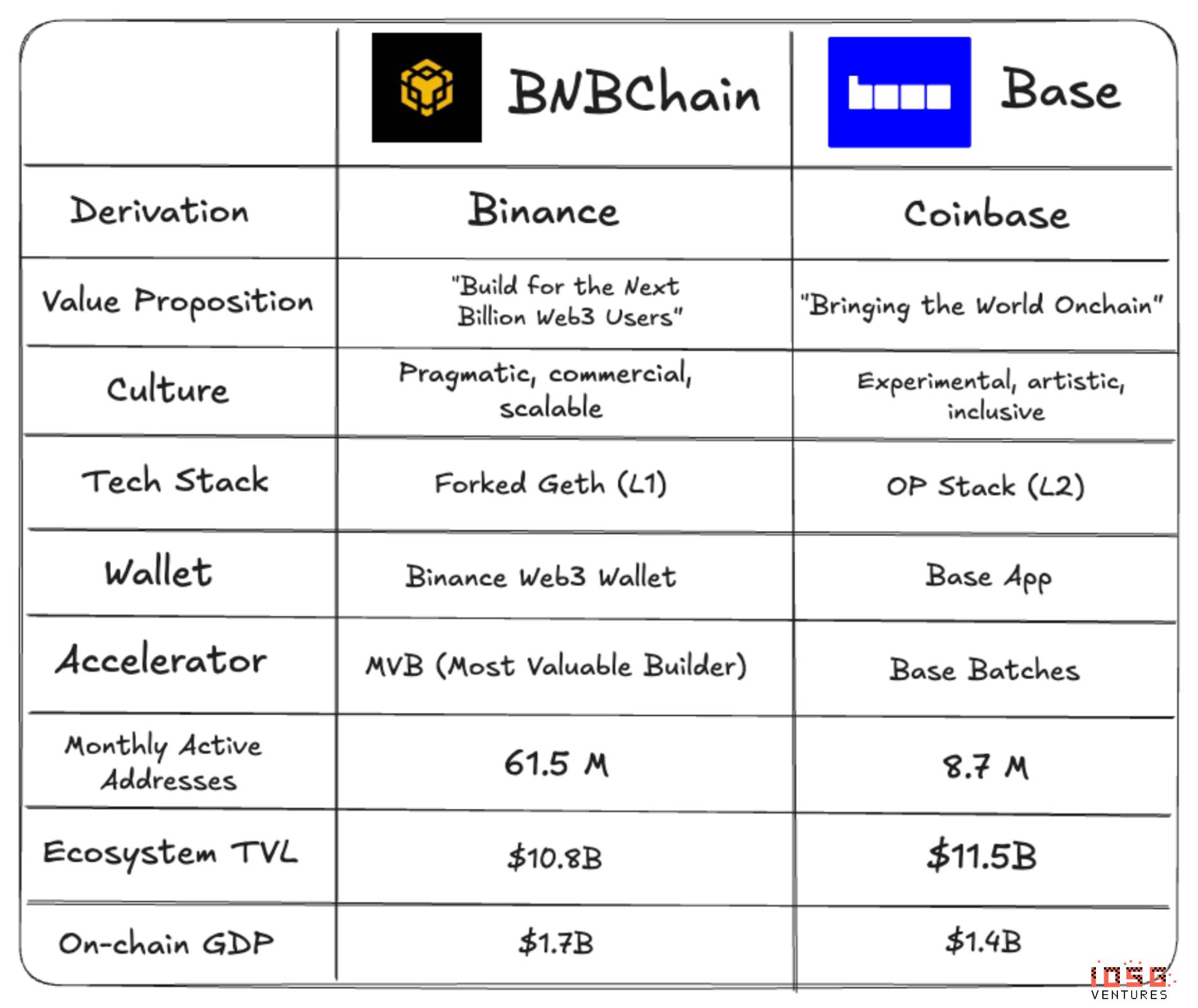

If we place BNB Chain and Base on the same map, they appear to be competing; but shifting the lens to users and culture reveals something closer to two worldviews growing in parallel.

BNB Chain and Base essentially represent two distinct user structures, traffic sources, and growth logics. The former rooted in Asia and emerging markets, the latter grown from Western developer communities. Rather than viewing them simply as competitors, it’s more accurate to see them as outcomes of natural stratification among crypto users.

▲ Source: bnbchain.org

BNB Chain’s user profile is very clear.

A large portion of its users come from Binance’s long-accumulated retail base—many experiencing real on-chain products for the first time. They are primarily distributed across Southeast Asia, the Middle East, and other emerging markets. They don’t obsess over whether decentralization is pure; their focus is extremely pragmatic:

Is gas low enough? Are transactions fast enough? Can I join hot projects instantly?

To these users, a blockchain isn’t an ideology—it’s just a tool. As long as it’s usable, cheap, and profitable, centralized or semi-centralized doesn’t matter much. This explains why BNB Chain’s ecosystem has always revolved around efficiency, scale, and application density.

▲ Source: base.org

Base’s user group is different.

They are mostly Coinbase users and overflow from the Ethereum ecosystem, with deeper understanding of blockchain and greater willingness to discuss underlying design issues. These users care about Base’s relationship with Ethereum mainnet, degree of decentralization, L2 technical roadmap, and even whether cultural narratives feel authentic.

To them, blockchain is not merely a transaction tool, but a space for self-expression, community building, and creative experimentation.

It is precisely this difference in user attributes that profoundly shapes the two chains’ contrasting cultural DNA.

BNB Chain has chosen a path closer to Web2 consumer internet: ecosystem integration, concentrating as many functions, apps, and use cases into a single system. For users in emerging markets, this “everything-in-one” model drastically reduces decision-making costs and learning barriers, making on-chain experiences feel familiar and close to conventional internet products.

Base, by contrast, resembles an open experimental ground, reserving ample space and patience for developers and creators. It doesn’t rush to cover every scenario, prioritizing instead the gradual establishment of the right culture and tools.

From this perspective, BNB Chain and Base aren’t fighting for the same users—they’re growing in their respective optimal environments.

They aren’t opposites, but rather two rational answers from the same industry under different cultural contexts.

Parallels and Differences in Vertical Integration

Over the past few years, major exchanges have simultaneously done one thing:

No longer content being just a “matching platform” for trades, they’ve extended their reach into deeper layers like public chains and wallets.

The underlying business logic isn’t complicated.

If an exchange only interacts with users at the moment of “buy” or “sell,” user value remains discrete and fleeting. But once the exchange controls both the chain and wallet, the user journey extends into a multi-touchpoint, repeatable lifecycle.

When users complete fiat onboarding, move onto the chain, use dApps, participate in new projects, and return to trade—all within the same ecosystem—the exchange transforms from an endpoint into both starting and ending point of the entire on-chain journey. Each additional step increases switching costs and strengthens user stickiness. This is the true goal of vertical integration: turning one-off transactions into long-term retention.

More importantly, this structure directly amplifies liquidity and trading volume.

New tokens and projects constantly emerging on-chain represent a capability to “continuously create new assets.” When an exchange controls both the chain and listing/contract pricing rights, this on-chain “coin creation” ability seamlessly translates into spot trading pairs and derivatives, ultimately crystallizing into sustained fee revenue.

From this angle, both BNB Chain and Base are typical examples of exchange-led vertical integration—though each amplifies a different advantage.

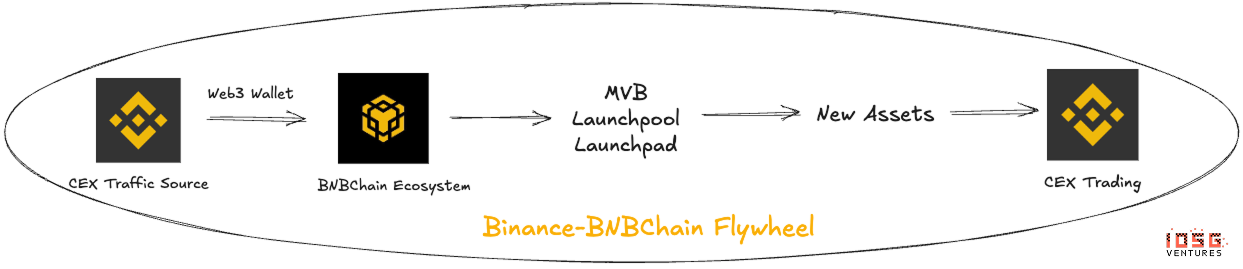

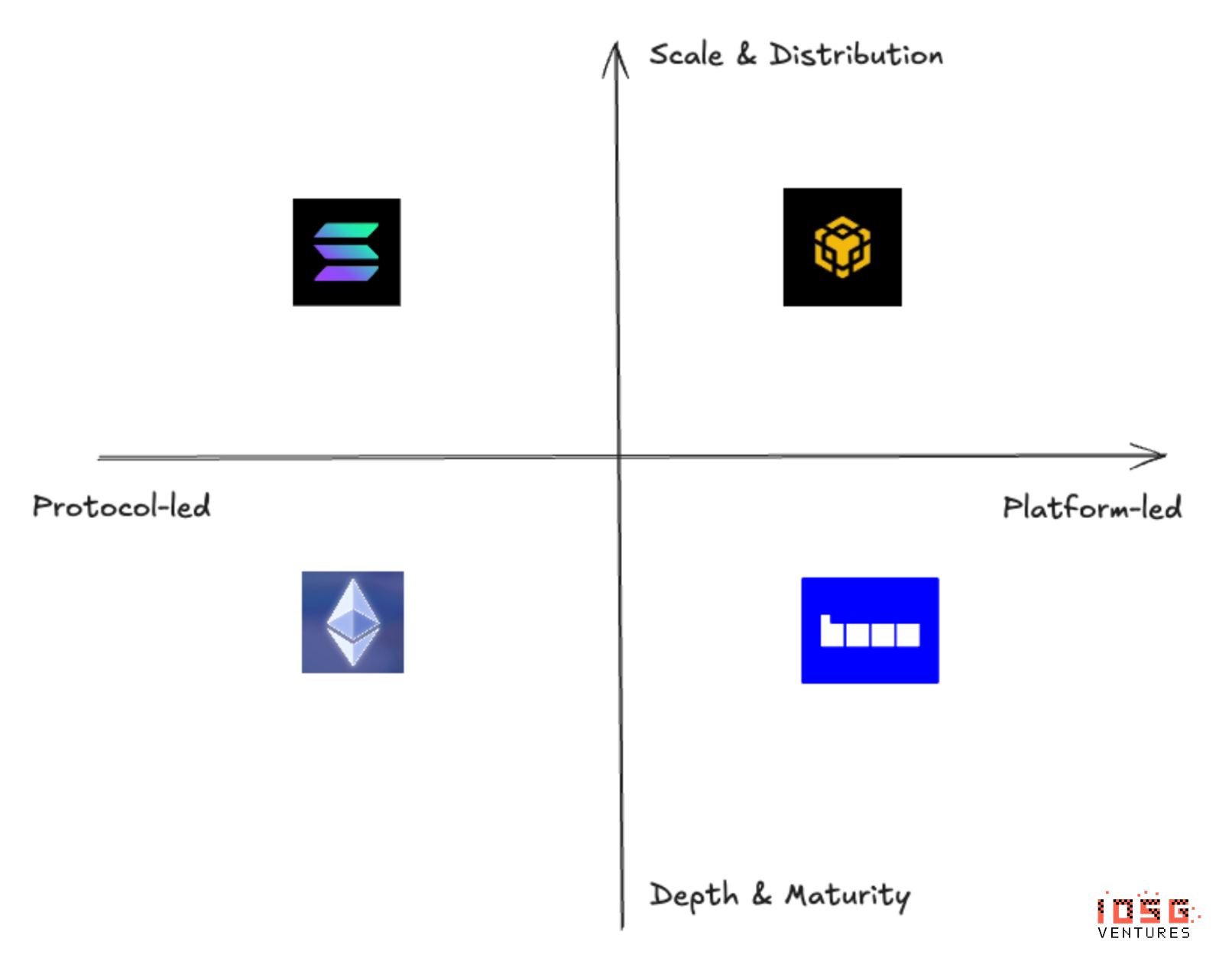

▲ Source: IOSG

BNB Chain’s core competitiveness stems from Binance itself.

As a top-tier exchange in global user scale and trading depth, Binance possesses exceptional capabilities in instant traffic distribution. New projects launched on BNB Chain rarely face cold starts or require market education from scratch. A large number of users can transition directly from the exchange to on-chain participation, then quickly flow back to trade after interaction. This frictionless loop makes BNB Chain resemble a high-speed lane built for applications.

This model reflects Binance’s strong exchange DNA:

Fast response to market trends, deep understanding of user behavior, and highly mature traffic operations. BNB Chain doesn’t pursue slow, meticulous ecosystem development, but excels at scaling a new narrative to maximum size in short time.

▲ Source: IOSG

Base’s path to vertical integration is markedly different.

It doesn’t attempt to replicate BNB Chain’s speed. Instead, leveraging Coinbase’s long-standing compliance brand, fiat on-ramps, and institutional credibility in the U.S. market, it builds an entirely different trust structure. As the first publicly listed cryptocurrency exchange in the U.S., Coinbase’s experience navigating regulatory frameworks is itself a scarce resource—making Base naturally carry a “regulation-friendly” label.

For institutional investors, enterprise applications, and developers sensitive to compliance boundaries, Base offers a safe environment for experimentation and long-term development. Combined with Coinbase’s deep, ongoing involvement in the Ethereum ecosystem and sustained investment in developer tools and infrastructure, Base has gradually cultivated a clearly “builder-friendly” culture.

If BNB Chain resembles an efficient commercial testing ground, Base is closer to a future-oriented infrastructure platform.

The former excels at turning traffic into scale; the latter at turning trust into sustainable ecosystem growth.

From an exchange perspective, neither approach is right or wrong—they simply amplify their respective strengths.

And it is precisely this divergence that makes BNB Chain and Base the most noteworthy and representative cases in today’s landscape of exchange vertical integration.

Wallets—The Endgame?

▲ Source: IOSG, TokenTerminal

Judging from community sentiment, Binance Web3 Wallet isn’t particularly popular—but it undeniably leads in top-tier traffic. For many Binance users, the first use of a Web3 Wallet often arises from a specific need: wanting to mint, claim airdrops, or join a trending project not yet available on the exchange.

Thus, the exchange-integrated wallet appears.

You don’t need a seed phrase, nor do you need to understand complex account models—or even realize explicitly that “I’m now using a standalone wallet.”

From depositing funds and swapping coins to bridging, authorizing, and interacting, the entire process is seamless and effortless.

This reflects Binance’s consistent strength: simplifying complex financial operations.

Because of this, Binance Web3 Wallet naturally aligns with BNB Chain’s ecosystem traits—

Fast-moving trends, high project density, and user behavior heavily concentrated in short cycles.

In a 2025 on-chain statistic, Binance Wallet’s daily trading volume briefly reached approximately $92.6 million, capturing nearly 57.3% of the decentralized wallet trading market share—a figure exceeding the combined total of all independent wallets.

Users can complete cross-chain transfers, swaps, mining, and airdrop participation without memorizing seed phrases or leaving the app—an frictionless experience many standalone wallets struggle to replicate.

Coinbase Wallet (Base App), by contrast, has an entirely different character. According to recent market data, Base App has reached around 11 million users, ranking among the top globally in the self-custody wallet ecosystem.

It was designed from the start as a product capable of existing independently from the exchange. This results in a noticeably higher learning curve.

But once users overcome this hurdle, their mindset shifts: this is “my wallet,” not just “using Coinbase.” This design aligns closely with Base’s overall direction. Base doesn’t rush all users toward a breakout app, but cares more: will anyone stay long-term, using the same wallet and address to gradually build their on-chain identity?

Hence, deep users of Base App are often also: early adopters of Base-native applications, core participants in NFTs, social protocols, and creator tools—people more sensitive to product experience and long-term narratives.

Within the Binance Web3 Wallet ecosystem, applications that thrive tend to be: highly financialized, short-cycle, high-frequency, capable of rapidly absorbing exchange traffic. In contrast, within the Base App + Base ecosystem, the products that grow best are: focused on user retention, more sensitive to UX, community, and long-term relationships, not急于 monetization but willing to slowly accumulate genuine users.

Conclusion

▲ Source: IOSG

The author believes the industry is most likely to evolve into two types of ecosystems:

-

CEX-led super ecosystems (Binance, Coinbase)

-

Community-led large-scale public infrastructures (Ethereum, Solana)

BNB Chain and Base will not replace each other.

Global crypto users have never been a homogeneous group. Emerging markets demand low barriers, high efficiency, and strong applications; Western markets prioritize compliance, developer-friendliness, and cultural alignment. These needs won’t disappear anytime soon.

A more realistic future: infrastructure like wallets, cross-chain solutions, and account abstraction will gradually erase usage disparities; users will no longer “belong to a single chain” but freely flow across ecosystems.

From this view, BNB Chain and Base are less rivals than two nodes within the same system—one driving Web3 toward broader scale, the other pushing Web3 toward greater maturity.

If early public chain competition resembled a race for the “one operating system,” today’s competition is more like “multiple platforms co-building an internet ecosystem.”

The real winners may not be any single chain, but rather the applications and teams that deeply understand both ecosystems and can seamlessly operate across them.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News