Stablestock partners with Native to launch tokenized U.S. stocks on BNB Chain, ushering in a new era of StockFi

TechFlow Selected TechFlow Selected

Stablestock partners with Native to launch tokenized U.S. stocks on BNB Chain, ushering in a new era of StockFi

Through this collaboration, users can now trade tokenized real U.S. stocks on BNB Chain using stablecoins 24/7 for the first time, experiencing price pegging and settlement security equivalent to traditional brokers, all within a decentralized environment.

The project StableStock, focused on on-chain stock liquidity infrastructure, today announced a strategic partnership with the next-generation decentralized exchange platform Native to launch the first batch of stock tokenized assets worth nearly ten million dollars on BNB Chain. The initial assets are now live and include top-tier "Mag7" tech stocks (sTSLA, sNVDA, sAAPL, etc.), mid-cap popular stocks (sCOIN, sGLXY, sINTC, sCRCL, etc.), and emerging DAT sector stocks (sBMNR, sSBET, sBNC, sALTS, etc.). Additionally, index and thematic assets such as sQQQ, sCOPX, and sBLSH have been introduced, offering users comprehensive on-chain investment options ranging from leading tech companies to commodities and alternative markets.

Through this collaboration, users can now trade real U.S. stock tokens with stablecoins on BNB Chain in a 7×24 non-stop manner, experiencing price pegging and settlement security equivalent to traditional brokers—all within a decentralized environment. These stock tokens are fully backed 1:1 by real shares and can circulate freely and be composed programmatically on-chain, marking the formal integration of traditional stock market liquidity into the DeFi ecosystem.

Users can trade U.S. stock tokens via the Swap page on StableStock's official website or through partners such as Native and OKX Wallet, enabling seamless on-chain buying, selling, and exchanging. StableStock stated that this milestone not only expands its product offering but also marks the beginning of its long-term strategic vision—the realization of "StockFi".

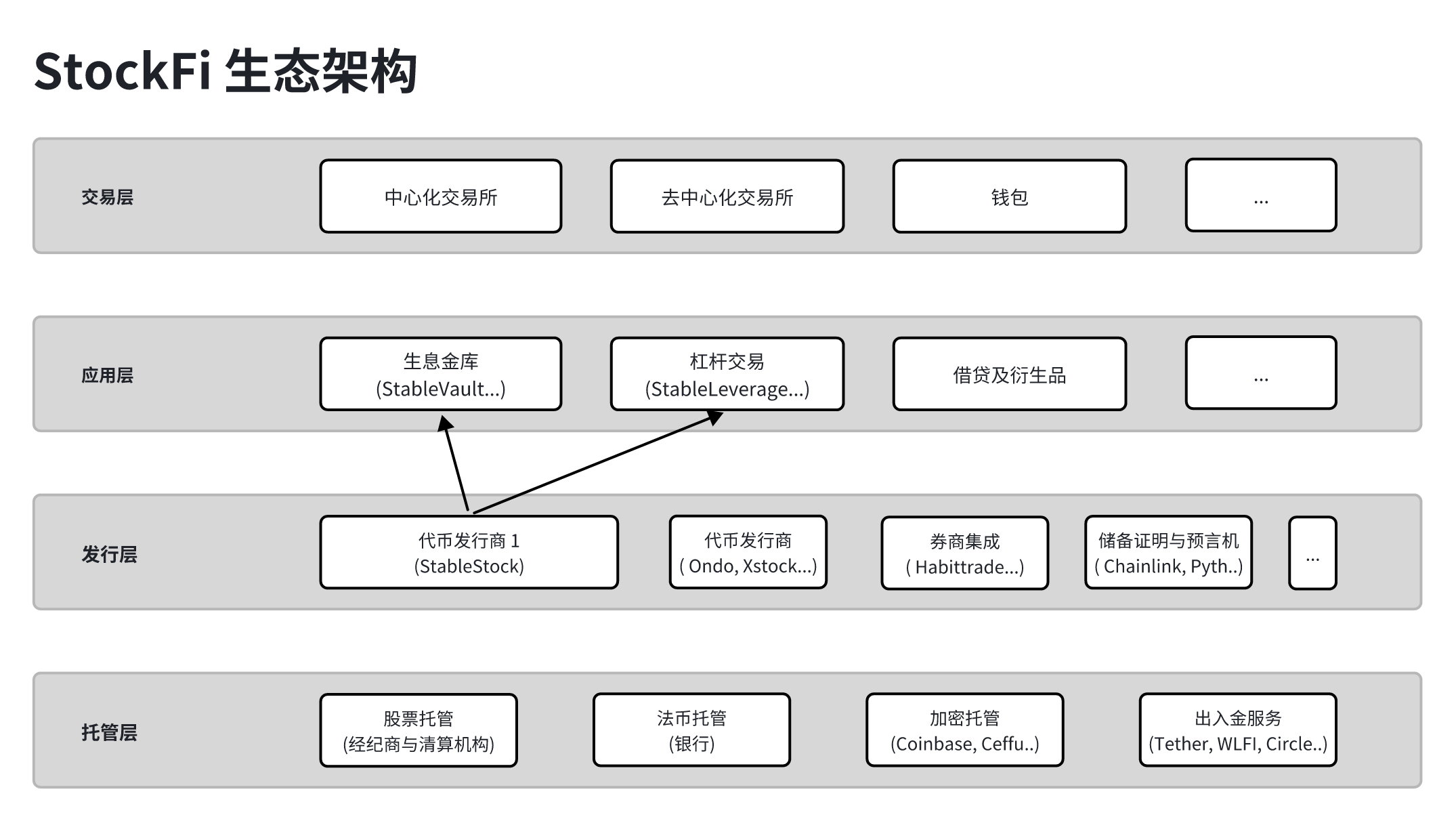

"StockFi": A New Chapter in Stock Financialization

The term "StockFi" was first coined by StableStock, meaning Stock + DeFi, representing a new financial system that enables stock assets to become financialized, programmable, and globalized through decentralized technology. Over the past decade, money, commodities, and credit have gradually moved onto blockchain; StableStock believes that stocks—one of the world’s largest asset classes—will be the next financial layer to undergo transformation.

From Vision to Reality: StableStock's Three-Phase Roadmap

To advance the StockFi vision, StableStock has established a clear three-phase strategic plan:

In Phase One, StableStock will build infrastructure connecting TradFi and DeFi, allowing users to directly purchase real stocks using stablecoins, while launching a transparency dashboard and Proof of Reserves (PoR) mechanism. The current collaboration with Native is a key milestone in this phase, providing deeper liquidity for on-chain stock trading.

In Phase Two, StableStock will roll out two flagship products—StableVault and StableLeverage—in November and December, transforming sTokens from passive holdings into yield-generating assets and bringing traditional margin trading on-chain to create an efficient liquidity flywheel.

In Phase Three, the protocol and liquidity will be fully opened, enabling external institutions and developers to build stablecoins, perpetual contracts, options, and structured products based on sTokens, fostering a global "StockFi" ecosystem.

"We believe stocks will become the most promising asset class in the blockchain world after stablecoins." said the StableStock team. "StockFi is not just a concept, but a structural shift already underway. As real stocks achieve circulation and yield generation on-chain, the boundaries of the global financial system are being redefined."

About StableStock

StableStock is a project dedicated to on-chain stock liquidity infrastructure, aiming to make real stocks as liquid, composable, and programmable as stablecoins. The project has integrated licensed brokers, custodians, and stablecoin deposit/withdrawal channels, striving to build an on-chain network for stock trading and yield generation bridging TradFi and DeFi. StableStock has completed the YZi Labs Easy Residency incubation program and successfully raised several million dollars in seed funding. The seed round was co-invested by YZi Labs, MPCi, and Vertex Ventures.

About Native

Native is a new type of decentralized exchange, a PMM DEX, utilizing an RFQ (Request for Quote) pricing mechanism and settling trades through on-chain liquidity pools to deliver highly efficient on-chain market-making liquidity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News