BNB's Long-Term Bullish Logic: The Resonant Cycle of Capital, Users, and Narrative

TechFlow Selected TechFlow Selected

BNB's Long-Term Bullish Logic: The Resonant Cycle of Capital, Users, and Narrative

BNB Chain's recent rise is not just a victory of market momentum, but also a self-validation of its ecosystem.

Author: Viee, Core Contributor at Biteye

01 BNB Ecosystem Sees Repeated Boosts, Market Focus Continues to Flow Back

Since mid-October, the BNB Chain ecosystem has maintained its momentum, marked by a series of key developments. Traditional financial institutions are increasingly participating—China Merchants Bank International launched a $3.8 billion USD money market fund on BNB Chain, while YZi Capital announced an investment of approximately $100 million into projects within the BNB ecosystem. These positive moves further solidify BNB Chain’s leading position in the industry. Yesterday, news that CZ received a pardon significantly boosted market sentiment once again. The final cloud of regulatory uncertainty over the BNB ecosystem has lifted. Trust is being restored, marking the starting point for a new round of resonance among capital, users, and narratives on BNB Chain.

At the same time, BNB Chain has integrated with prediction market platform Polymarket, enabling users to make direct deposits and withdrawals via the BNB Smart Chain (BSC), opening up a new “prediction + trading” scenario. Meanwhile, BNB has successively listed on two major centralized exchanges, Robinhood and Coinbase, achieving broader global financial access. On the stablecoin front, StraitsX announced native USDT issuance on BSC, further enhancing on-chain payment and settlement capabilities. A strategic partnership with Better Payment Network (BPN) aims to build a multi-stablecoin-driven global settlement network, strengthening payment functionality on BSC. The Chinese meme token “Binance Life” launched on Binance Futures and Base App, keeping capital flows and attention centered on the BNB ecosystem.

In addition, the ongoing $45 million "Rebirth Support" BNB airdrop campaign by Four.meme in collaboration with the BNB Chain ecosystem has completed its first two rounds, rapidly helping to close the confidence gap left by the October 11 crash.

Looking back at this market cycle, despite the sharp downturn on October 11, BNB was one of the few major assets to quickly recover losses and drive a simultaneous rebound in on-chain activity. From community buzz to capital inflows, BNB Chain is forming a triple resonance of “platform narrative + user growth + capital return.” If 2021 was Ethereum’s golden era, then 2025 could well be BNB Chain’s year in the spotlight.

02 Three Forces Behind the BNB Chain Narrative

2.1 Breaking Boundaries: “Binance Life” Triggers a Chain Reaction

One of the key catalysts behind BNB Chain’s recent surge in popularity is the listing of the meme coin “Binance Life” on Binance perpetual futures. This not only shattered the old belief that “Chinese memes can’t make it onto major exchanges,” but also marks a shift where native BNB Chain project narratives begin flowing into centralized platforms, gaining stronger mainstream acceptance. Moreover, “Binance Life” has now expanded to Base App, extending its narrative influence beyond a single chain. At the same time, Binance recently launched a dedicated Chinese trading pairs section, potentially further boosting visibility for Chinese-language projects.

From an ecosystem perspective, this meme wave rooted in Chinese culture goes beyond mere content jokes—it’s driving product upgrades on platforms and shifting project-level narrative strategies. It boosts on-chain activity while redirecting attention back to other products and sectors within the Binance ecosystem (such as Alpha and Pre-TGE), expanding BNB Chain’s sphere of influence.

2.2 Strong On-Chain Fundamentals: Low Cost, High Performance, Massive User Base

BNB Chain’s ability to attract returning capital and users is inseparable from its performance and cost advantages. Recently, BNB Chain further reduced block times and halved gas fees, fueling a spike in on-chain activity. According to data from DefiLlama and others, BNB Chain’s daily on-chain transaction volume peaked at 30 million in early October. In terms of DEX trading, BNB Chain’s daily volume has even briefly surpassed the combined volumes of Ethereum and Solana.

2.3 Binance Ecosystem Synergy: Launch Platforms + DEX + CEX Ensuring Abundant Liquidity

The breakout of BNB Chain is underpinned by Binance’s liquidity support system. First, Binance Alpha and Aster provide a “mini-Binance” environment, allowing popular on-chain tokens to be quickly listed. Additionally, launch platforms like Four.Meme have greatly enriched the supply of projects on BSC, offering low-cost, one-click token creation, enabling a wide variety of memes to flourish rapidly. Furthermore, Binance’s official wallet recently launched the “Meme Rush” feature, standardizing and guiding the on-chain meme coin issuance process in stages.

These components form BNB Chain’s unique “liquidity loop”: tokens launch on Alpha, move to Aster DEX spot, then to Binance Futures, and finally to Binance’s main exchange—each step driving price appreciation.

03 Wealth Creation Spreads Across BNB Chain, On-Chain Activity Remains High

During the meme peak in early October, over 100,000 addresses participated in the BNB Chain meme frenzy, with nearly 70% of early traders temporarily in profit. Several BNB Chain meme coins saw explosive market cap growth. Successful memes shared common traits: narratives aligned with community sentiment, ample on-chain liquidity, and strong community interaction acting as a trigger.

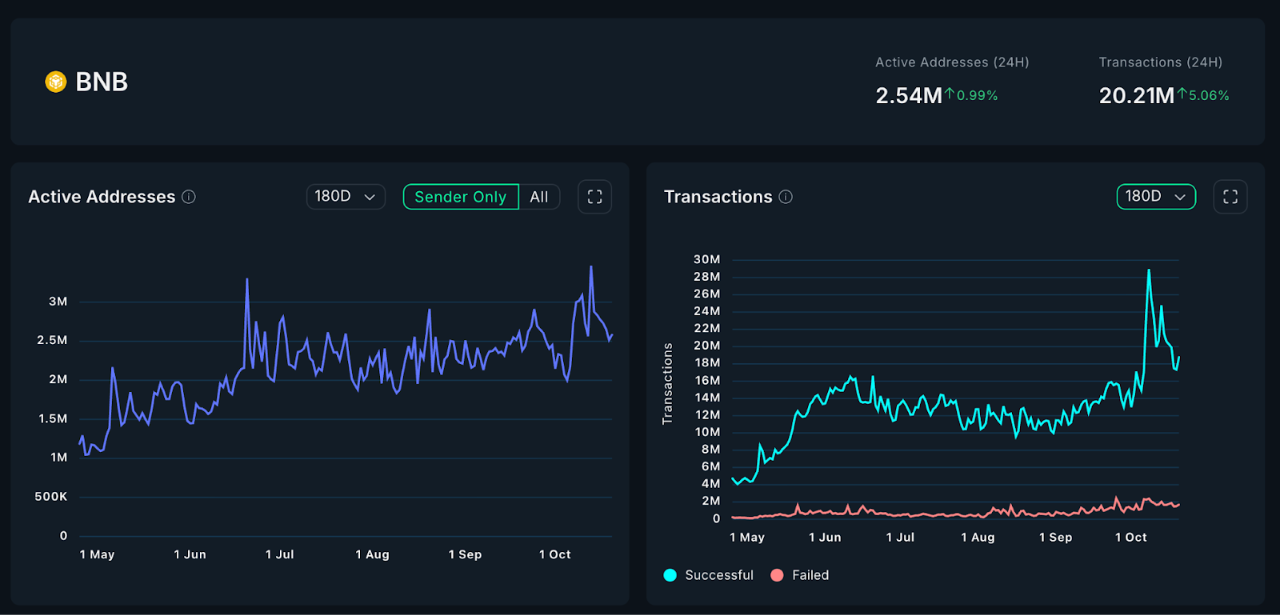

After the significant market correction on October 11, BNB Chain emerged as one of the few blockchains showing “stable prices and improving data.” According to the latest figures, as of October 20, BNB Smart Chain’s daily active addresses exceeded 2.58 million, a rise of over 20% from the monthly low. Daily on-chain transaction count reached 18.77 million, still above early-month levels.

From trend charts, since May, BNB Chain’s active address count has steadily climbed from less than 1.5 million daily, surpassing 3 million in mid-July. Fueled by the meme boom, it saw multiple strong surges. Transaction volume has risen consecutively for three months since June, peaking in early October with nearly 28 million transactions per day. Though slightly down since, it remains in a robust range above 20 million daily.

This data confirms a reality: BNB Chain’s current market heat is not speculative bubble, but reflects synchronized growth in real users and on-chain activity. User retention and interaction frequency both indicate a positive feedback loop—the so-called “second growth curve” of the ecosystem.

04 How to Find the Next Wave of Opportunities on BNB Chain?

Based on insights from this market cycle, here are several key channels and signals to consider.

To assess whether an Alpha project has breakout potential, watch for four signals:

-

First, rising热度. When a project’s name, logo, or memes appear frequently on X and Telegram, and comment sections show sudden increases in discussion and engagement, it often indicates concentrated market attention.

-

Second, community fermentation. Monitor holder address count, group activity, and user-generated content. Whether a project achieves organic “word-of-mouth” spread depends on whether users actively create content, not just wait for price gains.

-

Third, interactions from influencers like CZ. Likes and reposts serve as the strongest signals.

-

Fourth, capital concentration. When whale addresses accumulate tokens rapidly on-chain, it’s a classic sign of “smart money entering,” typically most intense hours before price movement.

When all four signals align, it means narrative, community, and capital are resonating—this is the critical moment when an Alpha project enters breakout phase.

Operationally:

1. Closely monitor new project announcements on Binance Alpha—they may soon gain trading热度

Binance also introduced the Pre-TGE Prime Sale model, an upgraded version of the original Pre-TGE with larger scale and longer duration. Participation involves three steps: deposit BNB for subscription (over-subscription, open to all), receive tokens proportionally after subscription ends, and trade on Binance Alpha upon TGE.

2. Use XHunt to track real-time updates

XHunt launched a new BNB Feed feature, aggregating key updates from the Binance ecosystem with AI summaries. It supports sound alerts and pop-up notifications, ideal for 24/7 Alpha traders needing rapid response.

3. Participate in early trading on on-chain DEXs like PancakeSwap and Aster

For sharp on-chain traders, spotting newly listed tokens with sudden spikes in trading volume on DEXs like PancakeSwap is an effective way to catch hidden gems.

4. Utilize Binance Wallet’s “Meme Rush” feature

Binance Wallet’s Meme Rush is essentially a Launchpad co-developed with Four.meme. It differs from standard launchpads in two core ways:

First, only users with KYC-completed Binance App Web3 wallets can participate.

Second, higher internal pool migration caps.

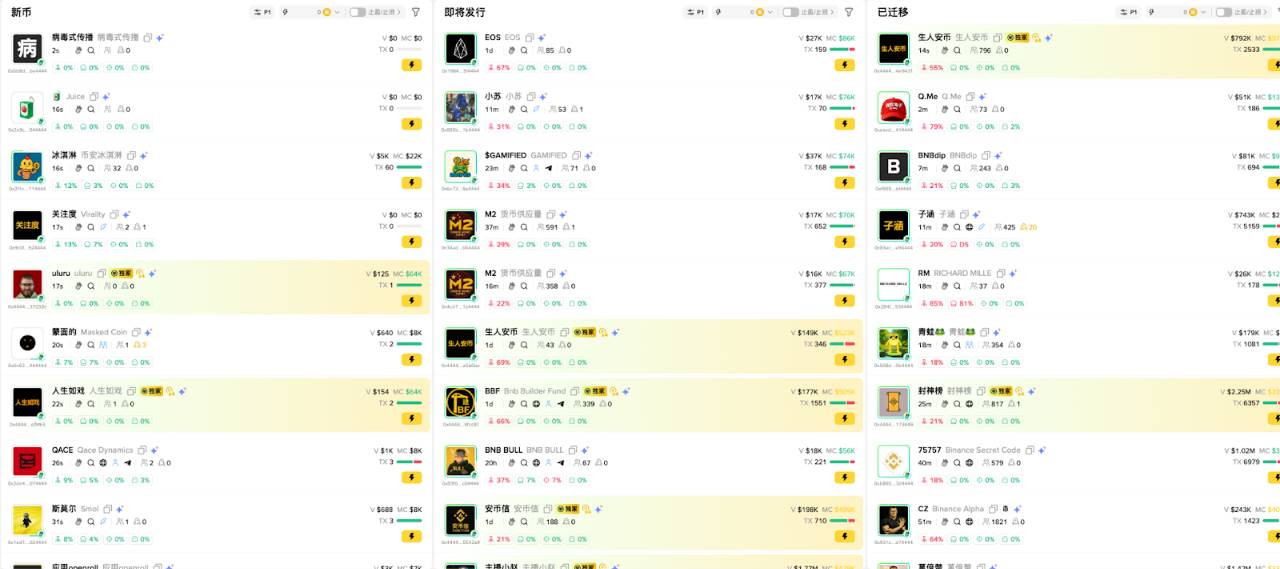

How can we use Meme Rush to find and join early-stage meme projects? Its interface typically divides into three core zones representing different project stages: New Coins, Upcoming Listings, and Migrated.

> New Coins: Projects here are mixed quality, high risk and noise—suitable for experienced Alpha hunters to research and filter.

> Upcoming Listings: Projects preparing to migrate from internal to external markets, backed by real buying interest. Worth watching if you’re not ultra-early focused.

> Migrated: Projects that have fully transitioned and are available for all users to buy—essentially the best of the best.

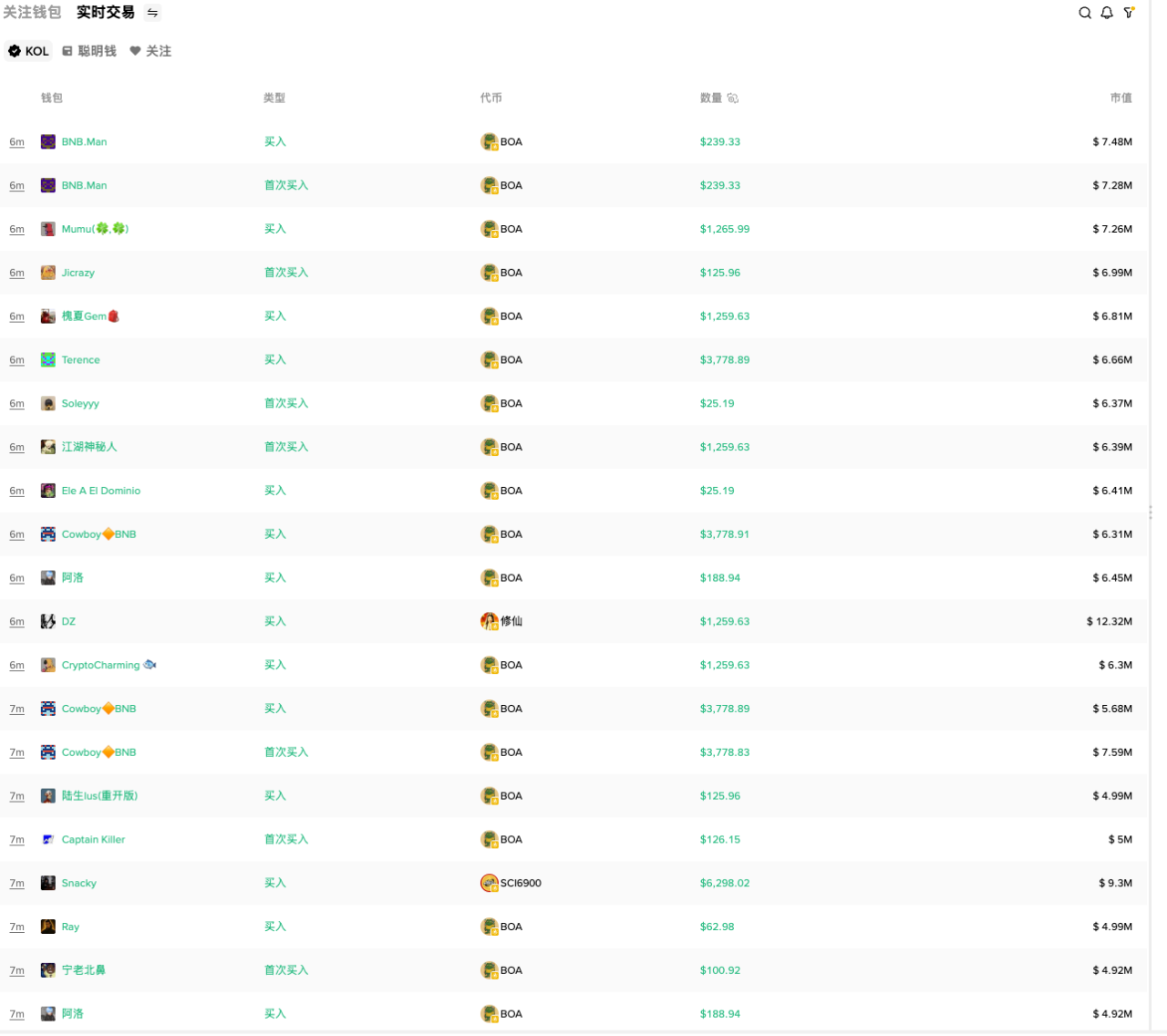

Beyond Meme Rush’s chain-scanning features, Binance Wallet offers a decision-making tool—the KOL Monitoring List.

The biggest innovation here is linking wallet addresses directly to KOL identities. While other tools let you track anonymous addresses, Binance Wallet lets you follow KOL portfolios directly. It clearly displays each KOL’s full holdings and detailed transaction history, enabling intuitive analysis of their portfolio, win rate, and investment style.

05 Long-Term Outlook: Sustained Momentum Driven by BNB and BNB Chain Flywheel Effects

As this BNB Chain cycle unfolds, a critical question arises: Can this momentum driven by capital, users, and narrative resonance evolve into a long-term bull market for the BNB ecosystem?

5.1 Flywheel Effect: A Positive Feedback Loop from Trading to Price

Fundamentally, BNB Chain is building two powerful “flywheel effects” that support sustained momentum:

(1) Trading-Burning Flywheel

Surging on-chain trading volume directly supports BNB’s price. As the native gas token of BSC, BNB’s economic model includes dual deflationary mechanisms: quarterly BNB auto-burns by Binance, and BEP-95 real-time burns on BSC, which destroy part of transaction fees to reduce supply. Amid the current meme trading frenzy, large amounts of BNB are continuously consumed. This demand-driven burn enhances BNB’s scarcity. Thus, BNB’s current price rise isn’t just sentiment-driven—it reflects the unique intrinsic value and deflationary mechanics of the BNB Chain ecosystem. Every time users trade meme coins on-chain, they indirectly boost BNB’s intrinsic value, creating a virtuous cycle of “higher usage → more burns → rising price.”

(2) Ecosystem-Capital Flywheel

The capital return fueled by BNB Chain’s ecosystem expansion is equally significant. On one hand, the constant emergence of new projects draws investors in—participation in hot BSC opportunities requires holding BNB as gas or base trading pair, generating consistent buy pressure. On the other hand, many meme coin winners, after cashing out profits, reinvest part of their gains back into BNB or other BNB ecosystem projects, ensuring capital circulates largely within the BNB Chain. Looking ahead, as BNB Chain continues technical upgrades, the range of supported applications and user scale will expand further, injecting new growth drivers. As long as the wheels of ecosystem growth and capital inflow keep spinning, BNB’s price and overall ecosystem valuation can maintain strong upward momentum.

5.2 Long-Term Value and Bullish Case for BNB Chain

If the flywheel explains the “mechanics” behind BNB’s price rise, the long-term bullish case for BNB Chain lies in its ability to generate sustained ecological momentum.

On-chain data shows BNB Chain’s rise isn’t built on bubbles, but on real activity. As previously noted, key metrics like active addresses, transaction volume, and TVL have all hit record highs simultaneously, indicating that the underlying force of this meme cycle stems from genuine user participation and capital flow—not mere speculation.

From an ecosystem standpoint, this Meme Season’s success showcases concentrated community power: CZ and “Sister One”’s interaction acted as a catalyst; the cohesion of the Chinese-speaking community gave narratives greater vitality; and traditional top-tier brokers and institutions embracing BNB boosted adoption. Together, these three factors form the true foundation of BNB Chain’s long-term bull case—a resonant cycle of capital, users, and narrative.

Meanwhile, BNB has made breakthroughs in institutional adoption: listings on major platforms Robinhood and Coinbase, and several public companies announcing BNB purchase plans.

More importantly, this BNB ecosystem boom shows a healthier internal cycle—capital stays within the ecosystem, users grow genuinely, and narratives are supported by cultural depth and community consensus.

Therefore, BNB Chain’s rise may be entering a long-cycle phase of positive feedback development.

06 Conclusion

BNB Chain’s current resurgence is not just a market victory, but a self-validation of its ecosystem. It demonstrates that across long crypto cycles, users and liquidity remain the strongest moat.

Whether through meme热度, on-chain activity, or capital flows, BNB Chain is forming its own “resonance system”—trading drives热度,热度 attracts traffic, traffic feeds back into price. This is the natural selection of market forces and the inevitable echo of community consensus.

Of course, BNB’s long-term bull run cannot rely solely on short-term sentiment, but must continue to rest on real trading, robust mechanisms, and user trust. Only when these fundamentals are solid does price appreciation carry real meaning. From this perspective, BNB Chain’s second half is not just about sustaining past热度, but entering a new phase: from short-term explosion to long-term construction; from wealth creation myths to sustainable ecosystem value.

The BNB cycle may have only just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News