BNB Chain Annual Review: Leading L1 in Daily Active Addresses, Stablecoin Supply Doubles

TechFlow Selected TechFlow Selected

BNB Chain Annual Review: Leading L1 in Daily Active Addresses, Stablecoin Supply Doubles

2025 is an important year for BNB Chain's transition from rapid growth to "ecosystem deepening."

Author: Felix, PANews

2025 has been a landmark year for BNB Chain. Amid multi-chain competition and fragmented users and capital, BNB Chain emerged as one of the fastest-growing networks in the Web3 space in 2025, leveraging its low fees, high throughput, and EVM compatibility. During the "2025 Binance Blockchain Week," it further solidified its position as a multi-chain infrastructure through dedicated sessions, ecosystem project showcases, and partner engagement.

Looking at the data, BNB Chain achieved several milestones in 2025: peak daily active users (DAU) surpassed 5 million, cumulative DEX trading volume exceeded $2 trillion, stablecoin supply surged to $14 billion, RWA projects began forming a substantial ecosystem, and Meme coins drove community vitality through viral growth. This year, BNB Chain evolved beyond being just a "number factory" for transaction volume, transforming into an integrated ecosystem combining DeFi, AI, RWA, and Meme culture, attracting hundreds of millions of global users and developers.

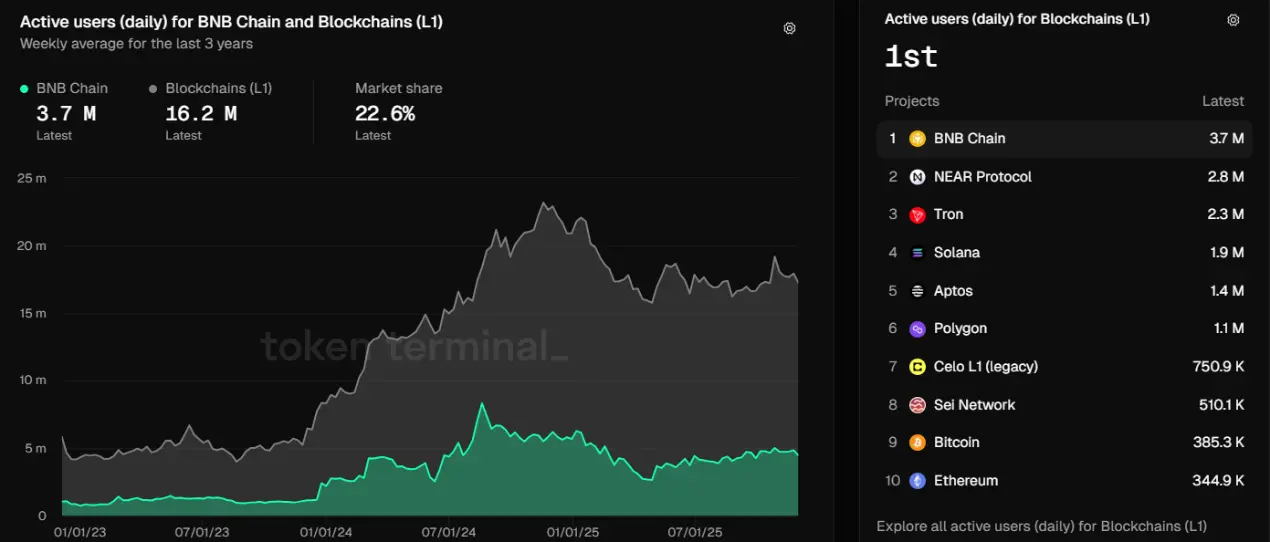

DEX Daily Active Users Rank First

The BNB Chain ecosystem has expanded from a single chain in 2020 into a multi-layered global network, with data clearly reflecting its real growth. Currently, BNB Chain's DAU remains stable at around 3.7 million, peaking at 5 million—the highest among all L1 blockchains—with a market share of 22.6%.

Data source: Token Terminal

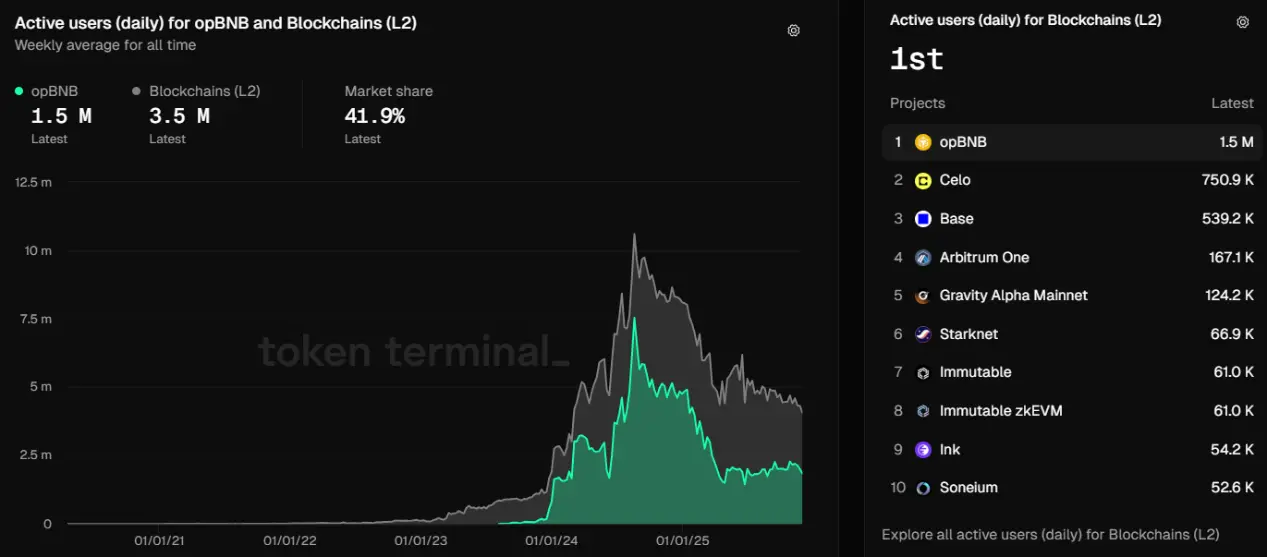

opBNB also ranks first among all L2 blockchains in daily active users, consistently maintaining around 1.5 million, capturing a market share of 41.9%.

Data source: Token Terminal

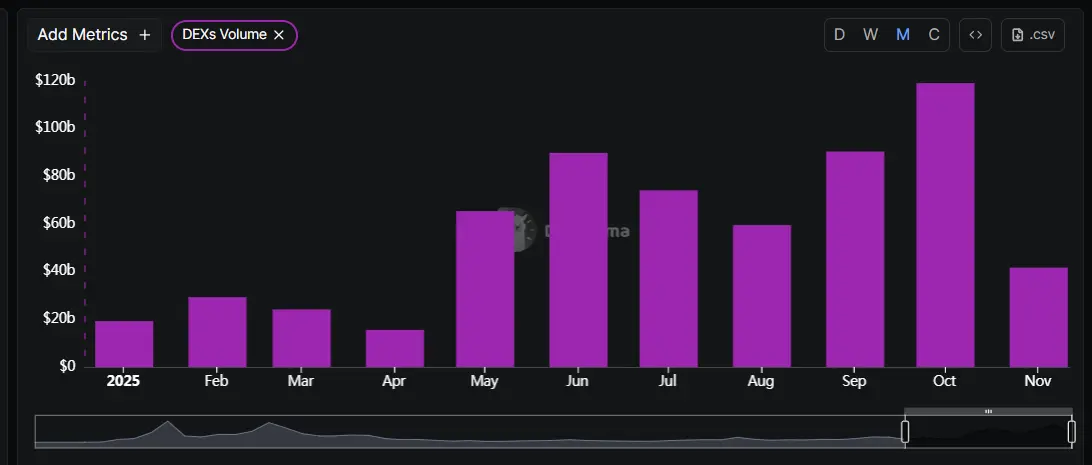

In addition, as of December 8, cumulative DEX trading volume surpassed $2 trillion, with approximately $680 billion traded in 2025 alone, reaching a monthly peak of $119.2 billion in October.

Data source: DeFiLlama

Meme Narrative Becomes the Year's "Traffic King"

Meme coins, serving as catalysts for user acquisition, community interaction, and trading frequency, were undoubtedly the "traffic king" of the year. In 2025, BNB Chain’s Meme ecosystem evolved from infrastructure breakthroughs (Four.meme) to community-wide celebrations (CZ effect), transitioning from a mere "casino" to a "semi-ecosystem"—one of the most active narratives on-chain. In the first half of the year, Meme coin trading volume on BNB Chain briefly surpassed that of Solana and Ethereum. In June alone, it accounted for about 45% of total Meme coin DEX trading volume.

The rise of the Meme ecosystem was underpinned by strengthened infrastructure. As BNB Chain’s "killer app" for driving Meme narratives, the token launch platform Four.Meme completed a product upgrade, standardizing contract addresses to end with "4444," implementing PancakeSwap V2 liquidity provisioning, and simultaneously burning LP tokens. Additionally, the "0 Fee Carnival" campaign (zero gas transfer incentives) reduced minting costs, further fueling a widespread "everyone mints" trend.

The Meme craze wasn’t limited to English-speaking communities—Chinese communities, previously less influential, made a strong comeback in October with a grand finale. The standout was the self-mocking "$BinanceLife," a name seemingly summarizing the lifecycle of a Binance user: from depositing funds to all-in gambling and ultimately blowing up to zero. After its launch in October, $BinanceLife’s market cap spiked twice—reaching a high of about $458 million early in the month, then surpassing $400 million again on October 21.

Currently, although the Meme hype has cooled and most tokens have sharply declined, this frenzy still left a significant mark on the cryptocurrency history of 2025.

Stablecoin Monthly Active Addresses Rank First

BNB Chain (BSC + opBNB) has particularly excelled in the stablecoin sector, securing its place among the top three blockchains in this domain thanks to low costs, deep integration with the Binance ecosystem, and a series of incentive programs.

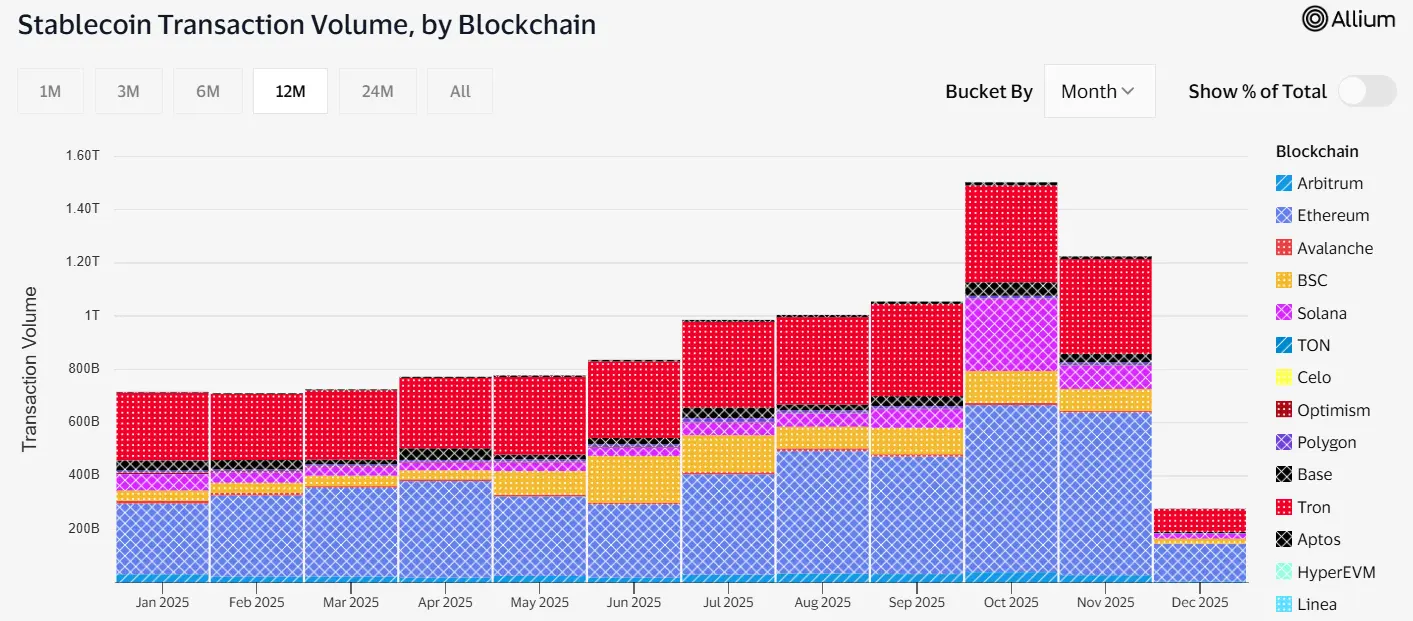

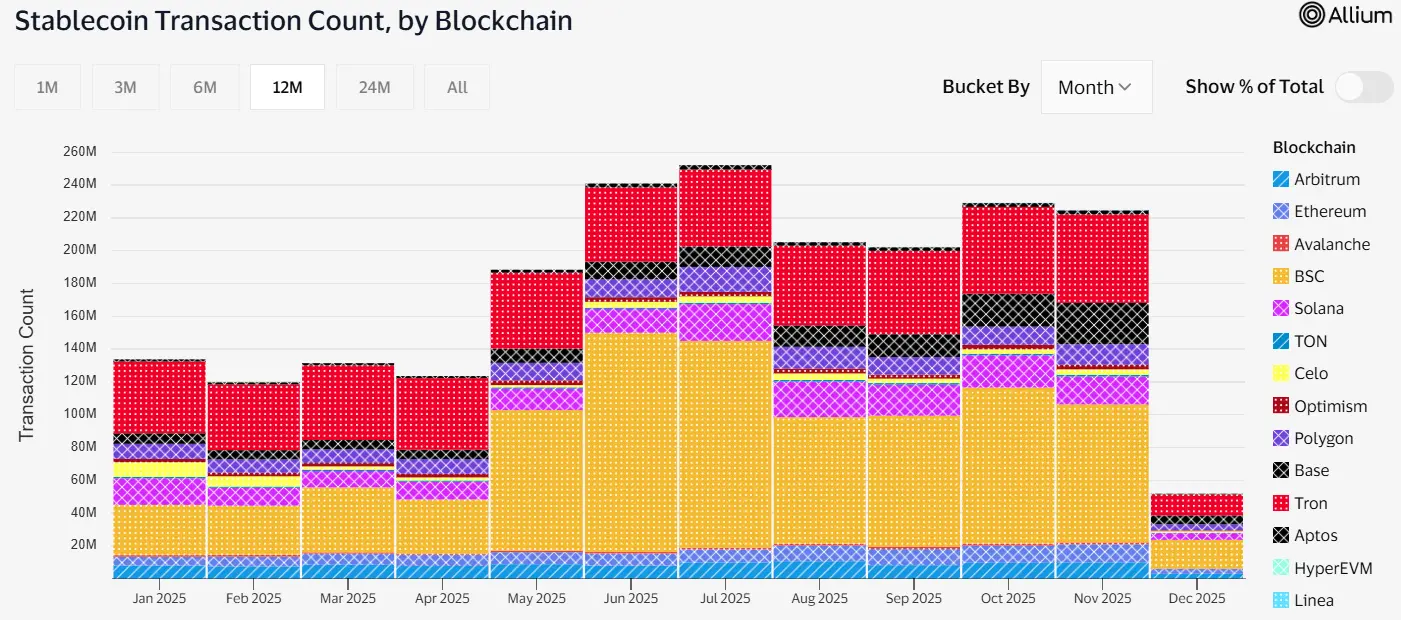

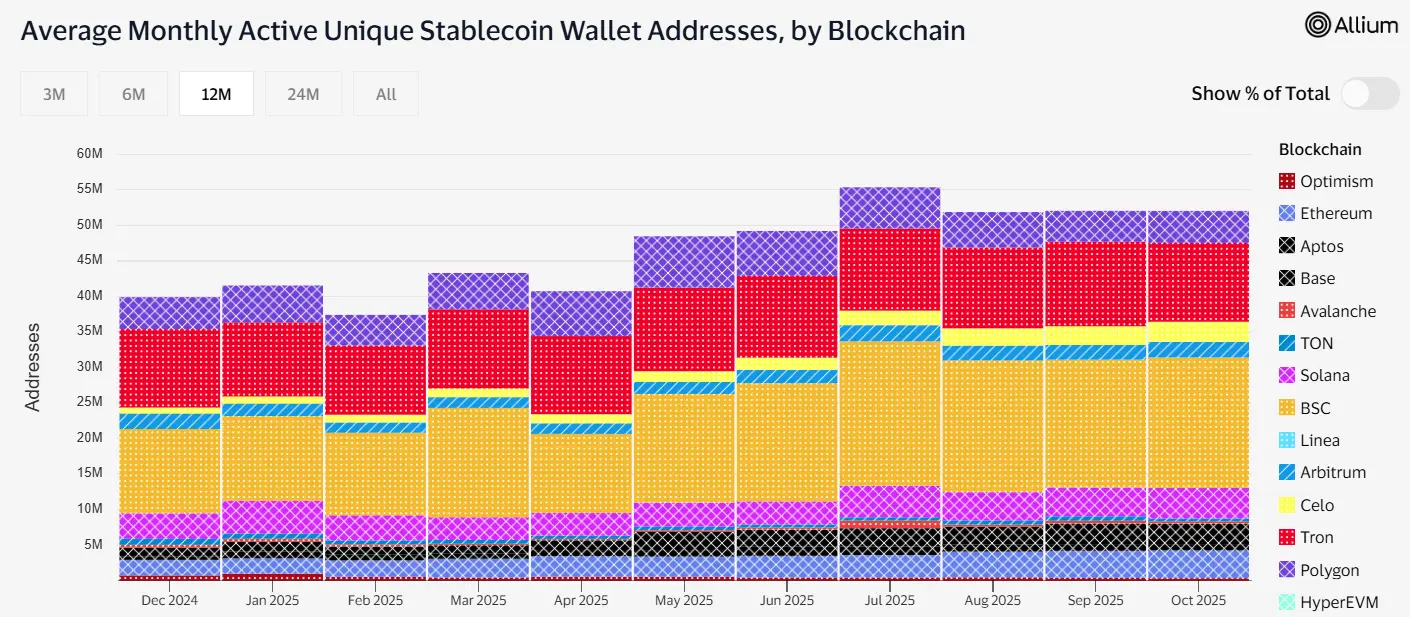

As of December 6, the total circulating supply of stablecoins on BNB Chain reached approximately $14 billion, representing a year-on-year increase of about 102.9% (starting from around $6.9 billion at the beginning of the year). Total transaction volume reached about $953.8 billion, with an average monthly volume of roughly $85 billion from January to November. Transaction count has ranked first across all blockchains since May, while monthly active addresses have consistently held the top spot throughout the year.

Stablecoin supply year-to-date; Data source: Artemis Terminal

Monthly transaction volume; Data source: Visa Onchain Analytics

Monthly transaction count; Data source: Visa Onchain Analytics

Monthly active addresses; Data source: Visa Onchain Analytics

Growth in the stablecoin sector stems from BNB Chain’s own network development. First was the "0 Gas Fee Carnival," which was extended multiple times in 2025 and covered multiple currencies including USDT, USDC, and USD1, directly stimulating stablecoin transfers, withdrawals, and bridging, and becoming a key driver for retail and institutional capital inflows.

Secondly, BNB Chain underwent three major technical upgrades in 2025, primarily via hard forks, focusing on enhancing scalability, transaction speed, and security. The Maxwell upgrade implemented on June 30 reduced BSC block time from 1.5 seconds to 0.75 seconds, achieving sub-second confirmation, lowering median gas fees to $0.01 per transaction, and improving network efficiency by 20%.

Furthermore, deep integration with communities and institutions (such as World Liberty Financial) has transformed BNB Chain from a "trading chain" into a "stablecoin payment hub."

RWA Emerges as a Mainstream Institutional Battlefield

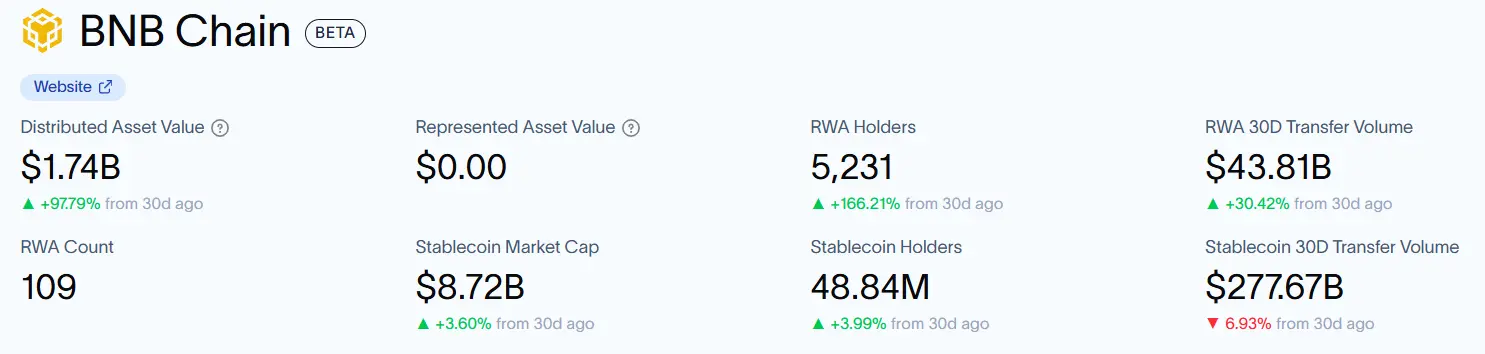

In 2025, BNB Chain became a leading platform in the RWA tokenization space through technological upgrades and ecosystem integration. As of December 8, its total RWA market cap reached $1.74 billion, accounting for approximately 9.46% of the overall RWA market; hosting over 100 projects; and growing holder numbers significantly to 5,231 from the start of the year.

In November, TVL surpassed $1.005 billion, marking a 55.1% monthly increase and a staggering quarterly surge of 1,510%, rising from $75 million to $1.208 billion—the fastest growth rate in the industry. USYC reached $903 million, and the CASH+ money market fund grew to $712 million, forming a dual-engine growth model.

Data source: Rwa.xyz

BNB Chain’s rapid rise in RWA tokenization is largely due to its provision of end-to-end solutions—including compliant issuance (KYC/AML tools), secondary market liquidity (integration with DEXs like PancakeSwap), and DeFi utility (lending)—which minimizes cross-chain friction.

Besides, dedicated RWA incentive programs played a crucial role. In January, BNB Chain launched an initial $50 million exclusive RWA incentive fund, offering tailored support—including TVL incentives, liquidity subsidies, and compliance guidance—for RWA projects building or migrating onto BNB Chain, marking the starting point of RWA’s explosive growth this year.

Driven by these factors, positive developments in RWA continued to emerge. First, Kraken and Backed Finance’s xStocks alliance officially launched over 60 tokenized U.S. stocks and ETFs on BNB Chain in July, enabling ordinary users to trade traditional equities 24/7 on-chain for the first time. Then, Ondo Finance’s "Global Markets" launched on BNB Chain in October, rapidly expanding tokenized assets beyond 100 types, further bringing stocks, ETFs, and commodities into DeFi.

Most notably, on November 14, BlackRock’s BUIDL fund went live on BNB Chain via the security token platform Securitize and cross-chain protocol Wormhole. This marked the flagship RWA product of the world’s largest asset manager going live on BNB Chain for the first time. Additionally, China Merchants Bank International (CMBI) and Circle also partnered with BNB Chain. CMBI tokenized its $3.8 billion U.S. dollar money market fund as CMBMINT and CMBIMINT on BNB Chain, while Circle deployed its tokenized money market fund USYC to BNB Chain. These listings signify BNB Chain’s emergence as a mainstream institutional-grade battlefield for RWA.

Aster Rises Rapidly, Perps Mature Gradually

Although platforms like Hyperliquid still dominate the Perp market, BNB Chain achieved doubling growth this year through flagship projects such as Aster. Data shows that as of December 8, BNB Chain’s Perp monthly trading volume increased steadily month-on-month, peaking in October at approximately $22.483 billion, significantly raising its global Perp market share from about 1% at the beginning of the year to around 2.05%. Perps became the third-largest narrative after Meme coins and stablecoins.

Data source: DeFiLlama

In 2025, multiple perpetual trading protocols emerged on BNB Chain, with popular projects including Aster and MYX Finance. Aster, the leading Perp platform on BNB Chain, supports unified cross-chain liquidity, offers hidden orders, stock Perps, and extremely high leverage (up to 1001x). CZ has also publicly purchased ASTER, contributing to its rapid rise.

Outlook

2025 was a pivotal year for BNB Chain’s transition from high-speed growth to "ecosystem deepening." Leveraging its advantages in performance, low fees, and large user base, it achieved diversified success in areas like Meme coins, stablecoins, and RWA, firmly establishing itself as a core Web3 infrastructure.

However, challenges remain. BNB Chain must shift from "short-term traffic" to "long-term value," while navigating inter-blockchain competition and macroeconomic uncertainties. How BNB Chain will further prove itself as more than just a blockchain—and serve as the global engine bringing the next billion users on-chain—remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News