You might have misunderstood $JESSE; this is an attempt to bring revenue to the Base chain

TechFlow Selected TechFlow Selected

You might have misunderstood $JESSE; this is an attempt to bring revenue to the Base chain

Content tokens could be an effective strategy to boost revenue for Rollup chains, but their model of combining creator sponsorship with speculative trading, while increasing transaction volume, may fail to truly balance the long-term interests of creators and supporters, ultimately making blockchains and trading platforms the biggest beneficiaries.

Author: Auditless Research

Compiled by: TechFlow

Content Coins might be the only way to make Rollups exciting for creators. But remember, the house always wins.

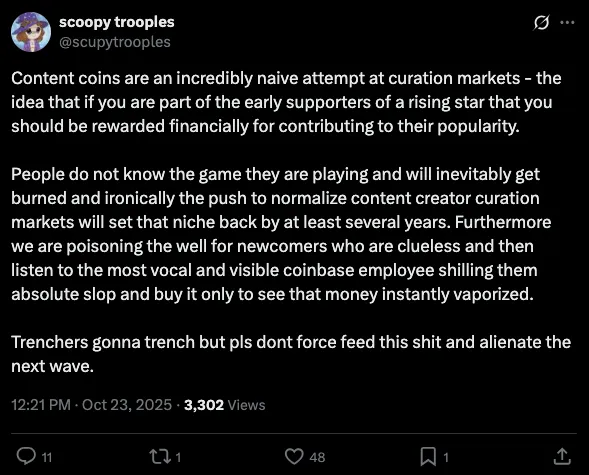

Crypto Twitter's reaction to the launch of $JESSE wasn't friendly:

(The above tweet is actually one of the more rational and grounded criticisms I've seen.)

Others pointed out several issues:

-

Poor timing: The launch coincided exactly with David Phelps’ article, in which he complained that Base is overly focused on creator tokens;

-

Royalty concerns: Some argued that $JESSE extracts a large portion of transaction fees from sales;

-

Sniping issues: Due to $JESSE using Zora x Doppler’s bonding curve auction mechanism, it unexpectedly attracted snipers.

But I don’t agree with these concerns.

The timing issue was indeed unfortunate, but I suspect Jesse had already planned his launch date around his birthday as a symbolic moment.

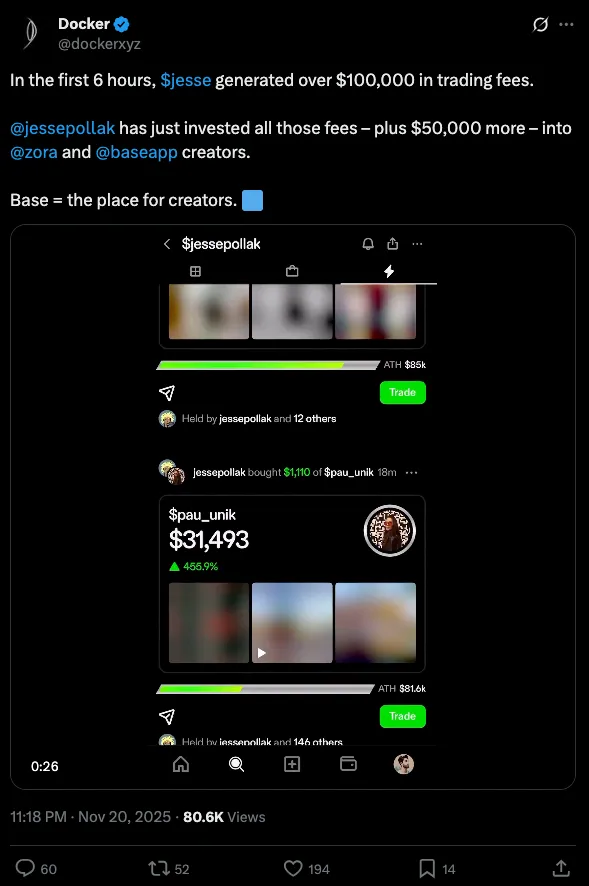

The royalty concern also doesn't hold up. During his birthday livestream, he was able to reinvest fees into other creators on Base. He also claimed he has no intention of selling these tokens.

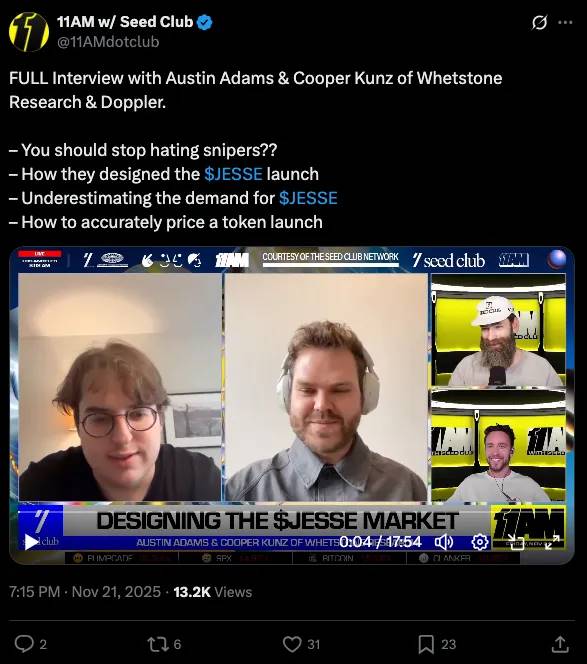

Ultimately, Doppler and 11AM had a fairly solid discussion regarding the sniping issue:

We’ll dive deeper into the pros and cons of different auction mechanisms in next week’s content, but Austin’s research on auction design goes far beyond those complaining about sniping on X (formerly Twitter).

If not malicious, then why did Jesse do this?

The Real Reason Behind Pushing Creator Tokens

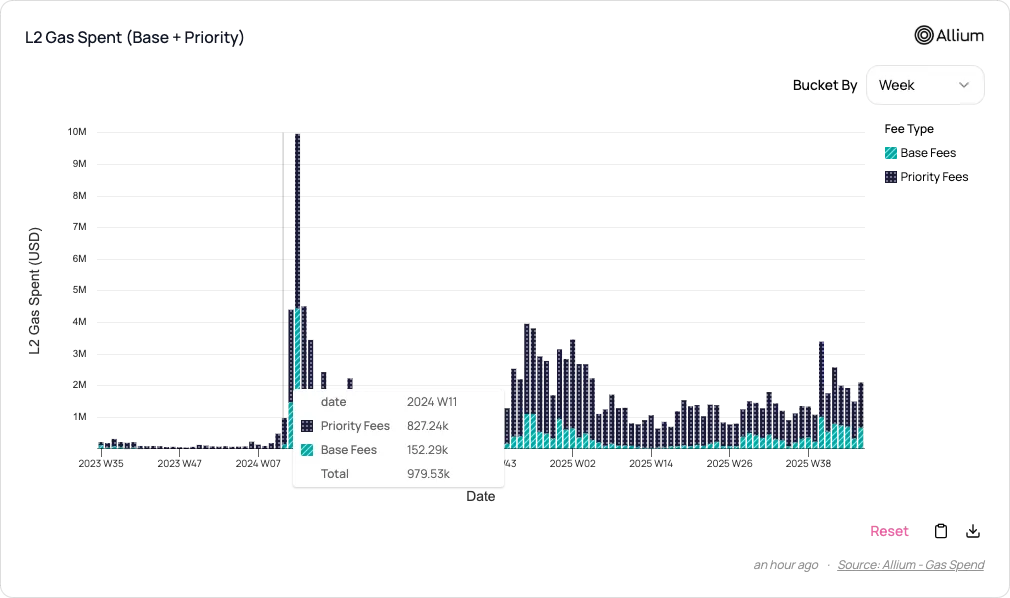

Most of a Rollup’s sequencer revenue comes from transaction fees.

To date, Base has earned more income from meme token trading than from any other activity. Issuing new tokens and the speculative trading volume that follows are key drivers of transaction fees.

Source: Allium

It’s likely that Base is spending more than ever on core teams, grants, events, its own apps (like Base App), and founder support—but these expenses haven’t significantly improved Base’s financial contribution to Coinbase’s bottom line as a Rollup.

Creator tokens and content coins offer a clever solution to this problem:

-

They can be issued even more frequently than meme tokens (token issuance is the main battleground for Rollups);

-

They generate trading and speculative activity;

-

They monetize attention into on-chain fees—almost anything that goes viral can be tied to a content coin;

-

Unlike meme tokens, they don’t even require underlying economic activity, community support, or commitments.

While users may view gas fee spikes negatively, from a Rollup’s perspective, creating excessive demand for block space is actually a sign of success.

No other form of creator monetization achieves the same effect:

-

Payments: Any form of payment (e.g., donations) generates insufficient transaction volume, especially when only a small fraction reaches creators.

-

Rewards: Base does use reward programs to support its Base App ecosystem, but their impact on revenue is negligible.

-

Ads: On-chain advertising barely exists, so it contributes nothing to sequencer fees.

Are Creator Tokens Really Good?

We now understand why creator tokens are a focus area for Base, but are they truly the best mechanism for users and creators?

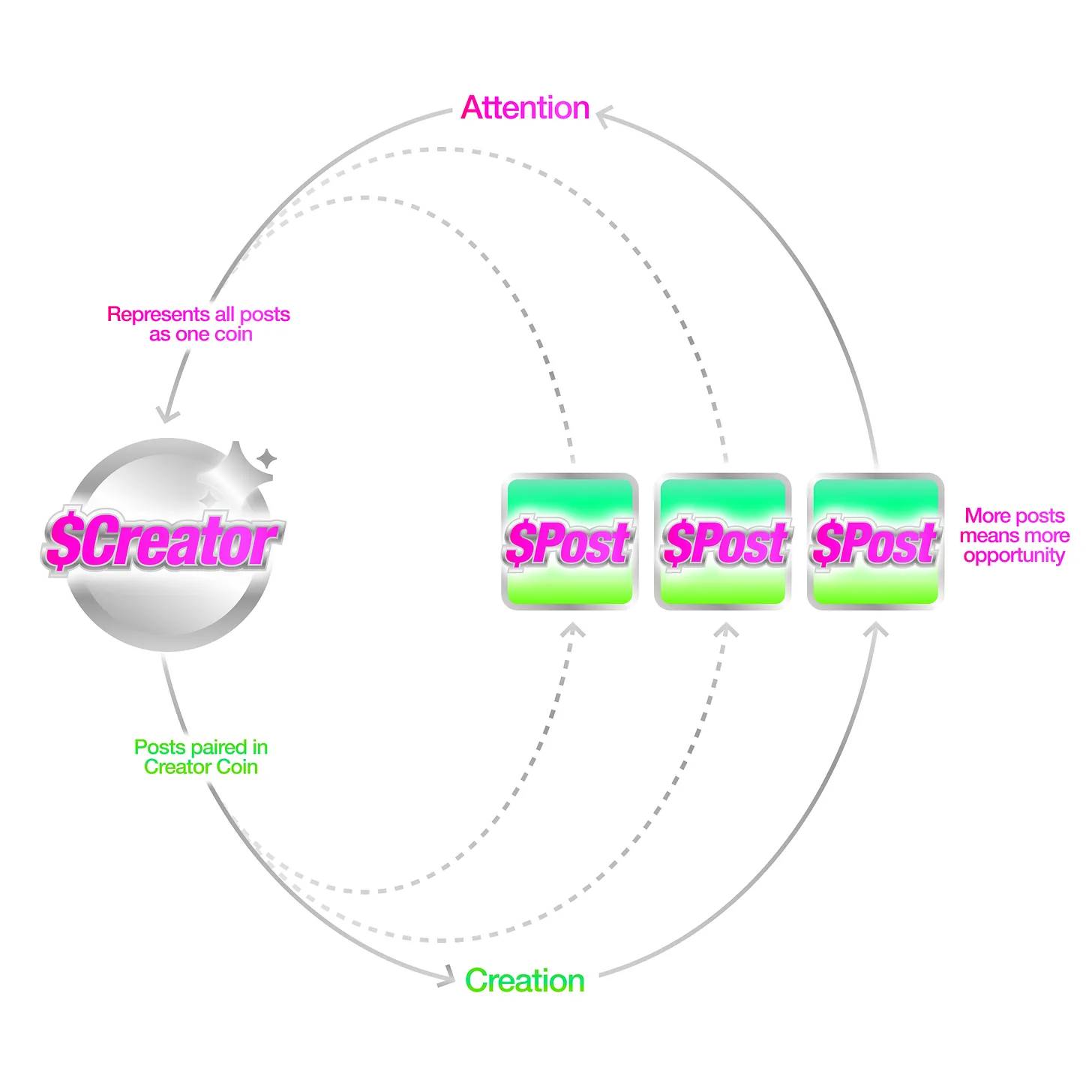

Source: Zora Docs

The flywheel logic of creator tokens is simple:

-

If you post content, a Content Coin is generated, and you own 1% of its supply.

-

Each Content Coin can only be purchased with your Creator Coin. If you issue a Creator Coin, you hold 50% of its supply (gradually unlocked).

-

Demand for Content Coins naturally drives demand for Creator Coins. This incentivizes you to create quality content while benefiting from holding Creator Coins and earning transaction fees.

In a way, Content Coins behave similarly to Patreon memberships. If you spend $1,000 buying a Content Coin, your opportunity cost is the return you could have earned investing that $1,000 elsewhere. That foregone return effectively acts like a subscription fee paid to the creator. In return, the creator might reward your holdings. These rewards can be tiered like Patreon, proportional, or random (like raffles).

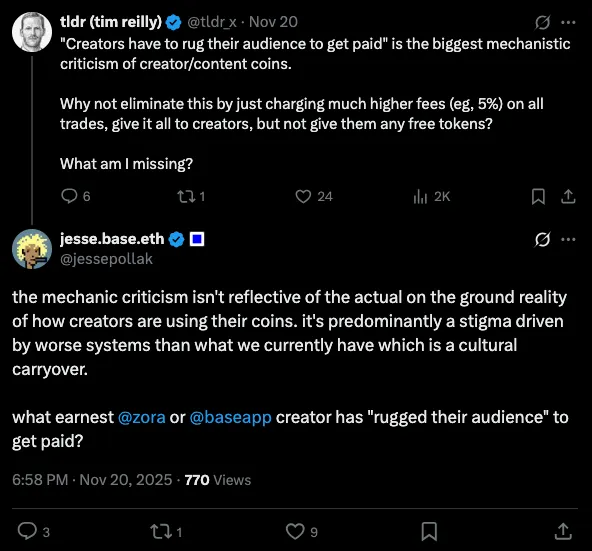

However, creators don’t directly receive this subscription fee unless they sell their Creator Coins. So even though your cost functions like a subscription payment, not all of it effectively transfers to the creator you support—unless they “rug” (i.e., cash out and exit). Jesse himself pointed out this issue:

Additionally, Content Coins also have attributes similar to fan collectibles. As an artist gains popularity, the rewards they can offer “subscribers” become more valuable. Thus, Content Coins carry a speculative element. Even if you don’t care about supporting the artist or receiving rewards, you might still buy a Content Coin purely to speculate on the future value of potential rewards (whether tangible or intangible). This is akin to buying a first-edition CD of your favorite artist—you might resell it later at a higher price.

Yet this very feature of Creator Tokens brings **significant drawbacks**: they’ve effectively become financial instruments, and their markets may attract institutional participants equipped with far more sophisticated tools than ordinary fans.

Just as true fans need vision, patience, and commitment to identify, preserve, and invest in classic CDs or merchandise, real supporters are needed in the Content Coin market. But on the other hand, a savvy trader can profit from Content Coins simply through sniping or other speculative tactics.

When exiting your “membership,” you must sell your tokens, which incurs slippage. Ironically, the lower the liquidity of the Creator Token, or the greater your contribution to the creator, the higher the slippage you face. Content Coins, in a sense, penalize the most generous sponsors.

The House Always Wins

My core issue with the Creator Token model is that it tries to combine sponsorship with curation to maximize trading volume, but risks bringing out the worst aspects of both.

-

True sponsors are forced to deal with price volatility, adversarial market players, and transaction taxes.

-

Curators lack clear guarantees about future rewards, since Creator Tokens aren’t explicitly tied to equity or other value streams from creators. Curators are essentially speculating on uncertain future demand for unknown rewards.

-

The model tends to front-load creator income—potentially generating high transaction fees during early price discovery, but long-term trading volume sustainability remains uncertain ($JESSE’s performance will be a key data point). This mechanism fails to align incentives between creators and token holders.

The end result is that the underlying blockchain and trading venues (in this case, Uniswap) extract far more value than a simple membership-based payment solution would.

You could argue that curation markets do provide an additional function, but the two (sponsorship and curation) cannot be cleanly separated.

As a contrast, consider Craig Mod’s model. He built his own membership system, focusing on keeping it as minimal as possible—and succeeded.

He can proudly say that no one lost hard-earned money by supporting him.

What appeals to me about Craig’s model is that it centers on the work itself (such as books), rather than content or the creator as a persona.

I personally believe that a creator economy centered on interaction is inferior to one based on real value exchange. Content should serve merely as a discovery mechanism and a public window into creation, not as the core product. Ideally, there could be a free base tier for user experience.

I also believe these issues can be solved, and undoubtedly the Zora and Base teams are working on them.

At the very least, Creator Tokens represent a bold new experiment in creator monetization. Even if it ultimately isn’t the optimal solution, it’s still worth trying.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News