In-depth look at Momentum, a rising DEX representing the Sui ecosystem

TechFlow Selected TechFlow Selected

In-depth look at Momentum, a rising DEX representing the Sui ecosystem

Momentum is not just a DEX, but also a driving force for liquidity integration and ecosystem development.

In this current uptrend of the crypto market, Sui, a Move-based public blockchain, has stood out notably. As the Sui ecosystem continues to expand, various applications within it have drawn significant market attention, among which Momentum, a decentralized exchange (DEX), is one of the fastest-growing and most discussed projects.

Just four months after its launch, Momentum has risen to become the platform with the highest trading volume and liquidity share in the Sui ecosystem. It is also actively expanding into the RWA (real-world assets) space, revealing a more long-term strategic vision. This article systematically examines Momentum’s functional mechanisms, performance data, and future plans, exploring its positioning and potential within the Sui ecosystem.

1. What is Momentum?

Momentum is the fastest-growing decentralized exchange in the Sui ecosystem. Since its testnet launch at the end of last March, it has rapidly accumulated users through differentiated liquidity strategies and product mechanisms, gradually establishing a leading position within Sui.

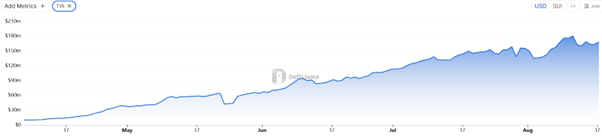

Data confirms its growth trajectory: peak TVL reached $180 million, cumulative trading volume surpassed $8.8 billion, and user count exceeded 1.83 million. For an emerging ecosystem, these figures reflect strong capital inflows and user validation.

Momentum's role in the Sui ecosystem can be understood from two aspects:

First, as the ecosystem's liquidity hub.

Momentum hosts the vast majority of liquidity deployment on Sui, serving as foundational infrastructure for other projects to establish trading and liquidity. As RWA and cross-chain assets enter at scale in the future, its role as a "central liquidity hub" may be further strengthened.

Second, adoption of the advanced ve(3,3) mechanism.

Unlike traditional DEXs that rely on short-term incentives to maintain liquidity, Momentum uses a veMMT governance token design to align long-term stakers with ecosystem development, creating a more stable liquidity environment. This mechanism not only enhances participation but also supports sustainable ecosystem growth.

Overall, Momentum's position in the Sui ecosystem resembles Curve on Ethereum or Velodrome on other chains—not merely a DEX, but a foundational liquidity layer for the entire ecosystem.

2. Core Mechanisms and Features

2.1 Basic DEX Functionality

Momentum adopts a concentrated liquidity (CLMM) model to improve capital efficiency and reduce slippage for large trades. It currently supports trading of major assets within the Sui ecosystem, allowing liquidity providers (LPs) to earn fee revenue while enhancing returns through various strategies.

2.2 ve(3,3) Mechanism

Momentum draws inspiration from and refines Andre Cronje’s ve(3,3) model in its design:

- Lock-up mechanism: The longer MMT is locked, the more veMMT is received.

- Governance voting: veMMT holders determine the allocation direction of liquidity incentives.

- Incentive and bribe system: Projects can offer additional rewards to attract votes, thereby gaining more liquidity support.

- Fee distribution: Platform fees are distributed exclusively to veMMT holders, encouraging long-term locking and governance participation.

Through these mechanisms, Momentum establishes a positive feedback loop of “voting → liquidity → trading volume → token demand,” balancing liquidity stability with token value appreciation.

2.3 Auto-Rebalancing Function

Momentum offers LPs automated rebalancing tools that optimize capital allocation based on predefined strategies, improving yield efficiency and reducing manual operational costs.

2.4 Launchpad Platform TGL

Momentum also plans to launch TGL (Token Generation Lab) to assist high-quality Sui projects with token issuance. All TGL projects undergo rigorous screening, with some backed by exchanges, offering veMMT holders additional participation opportunities and incentives.

3. Technology and Security

As a native Sui DEX, Momentum has invested heavily in security design:

- Multi-sig management: Critical operations require multi-party signatures, reducing single-point risks.

- Code audits: Core contracts have undergone professional audits with reports publicly available, enhancing transparency.

- Security infrastructure: Leveraging the inherent safety features of the Move language combined with real-time monitoring mechanisms to effectively counter potential attacks.

When Cetus previously suffered a security incident, the Sui ecosystem demonstrated rapid coordinated response capabilities. As part of the ecosystem, Momentum inherits this advantage.

4. Team and Investment

Momentum’s core team members possess extensive experience in Sui development and DeFi protocols. CEO and co-founder ChefWEN formerly served as an engineer on Facebook’s Libra project and is a seasoned expert in the Move language field.

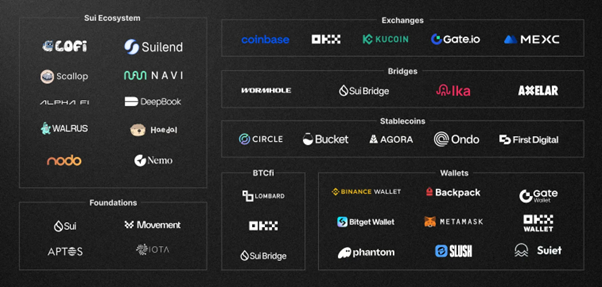

In terms of funding, Momentum has received deep support from the Sui Foundation and Mysten Labs, along with investments from internationally renowned institutions such as Coinbase Ventures, Circle Ventures, and Jump Crypto, as well as leading Asian firms including OKX Ventures and Amber Group. These resources bring not only capital but also assistance in liquidity building, ecosystem collaboration, and token distribution.

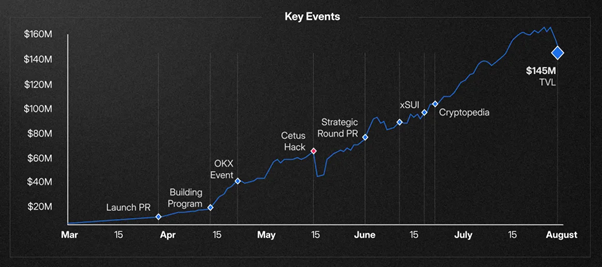

5. Ecosystem Performance

In a short period, Momentum has achieved:

- Peak TVL of $180 million and cumulative trading volume of $8.8 billion, ranking first in the Sui ecosystem;

- User base exceeding 1.83 million, driven by governance participation and incentive mechanisms;

- Clear advantages over similar DEXs in liquidity depth, mechanism design, and ecosystem support.

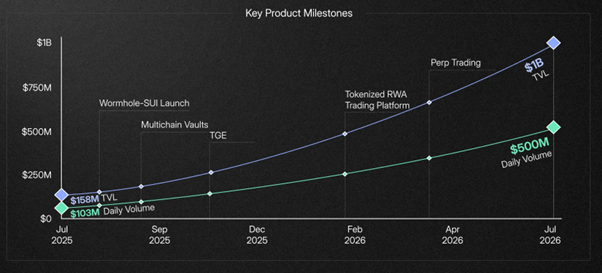

Its strategic goal is to become the "liquidity engine" of the Sui ecosystem, further expanding its reach via TGL and MomentumX.

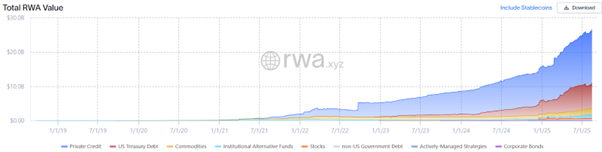

6. Future Plans: MomentumX and RWA

Momentum aims to go beyond being just a DEX by entering the RWA sector through MomentumX.

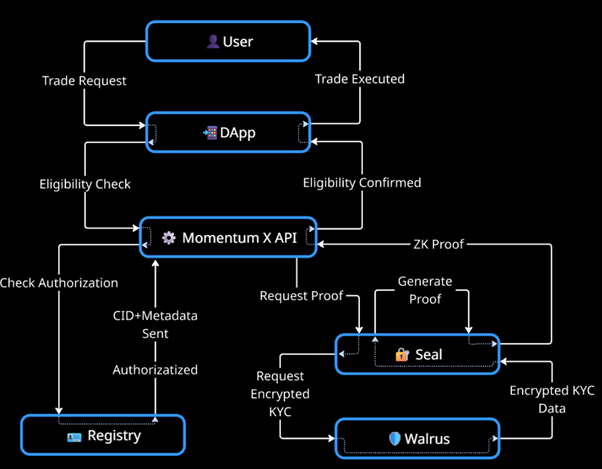

RWA is one of the most watched trends in today’s crypto market. MomentumX seeks to address three major challenges in the current RWA market: fragmented standards, insufficient liquidity, and off-chain compliance risks. Its solutions include:

- Unified identity authentication (based on ZK technology and Walrus);

- Cross-platform interoperability;

- Embedded smart compliance.

With MomentumX, institutional investors can more easily participate in trading tokenized assets, while retail users can use RWA assets for collateralization, liquidity provision, and other activities. The overall goal is to build a global RWA market infrastructure.

7. Conclusion

Momentum has established a clear central position in the Sui ecosystem. Its DEX functionality, ve(3,3) mechanism, auto-rebalancing, and TGL platform together form a comprehensive product suite. As MomentumX progresses, its business scope is expected to expand from DeFi into the RWA market, further strengthening its ecosystem influence.

For the Sui ecosystem, Momentum is not just a DEX but a driver of liquidity consolidation and ecosystem development. Its continuous expansion and mechanism innovations could bring long-term value to Sui and the broader blockchain ecosystem.

Original URL: https://coinness.com/community/opinion/9020

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News