Possible Mega IPOs in Global Capital Markets in 2026

TechFlow Selected TechFlow Selected

Possible Mega IPOs in Global Capital Markets in 2026

Wish you all seize your own big opportunities in the capital market.

By David, TechFlow

2026 Will Be a Landmark Year for IPOs. This view was already validated in January.

Before January even ended, crypto custodian BitGo rang the bell on the NYSE, while Chinese AI companies Zhipu AI and MiniMax separately listed on the Hong Kong Stock Exchange. Three companies—across different sectors—all chose January for their listings.

Zhipu AI’s public offering was oversubscribed 1,164 times; MiniMax surged 109% on its first trading day. Capital is truly flooding in.

But these January listings are only the beginning. The pipeline of companies expected to go public this year is far longer. Overseas “super unicorns” continue scaling up, while a wave of Chinese tech firms is advancing through listing procedures on both the Hong Kong and A-share markets...

Which ones might go public this year? At what valuations? When will investors get a chance to participate?

We’ve compiled a list of the most noteworthy IPOs expected in 2026—broken down by sector.

The U.S. $100 Billion Club

Source: Bloomberg, AI-compiled

If 2025 was the year of collective crypto-company listings, 2026 may mark the reopening of the IPO door for tech giants.

This cycle’s most closely watched entrants aren’t startups—but rather the “super unicorns” that have matured for years in the private market.

A shared trait among them is that their valuations have hit the ceiling of what the private market can sustain. Only a handful of institutions remain capable of absorbing further rounds—and raising more capital no longer makes strategic sense.

Some missed earlier windows due to unfavorable market conditions; others deliberately maintained private status at the founders’ discretion.

In 2026, these conditions are aligning simultaneously.

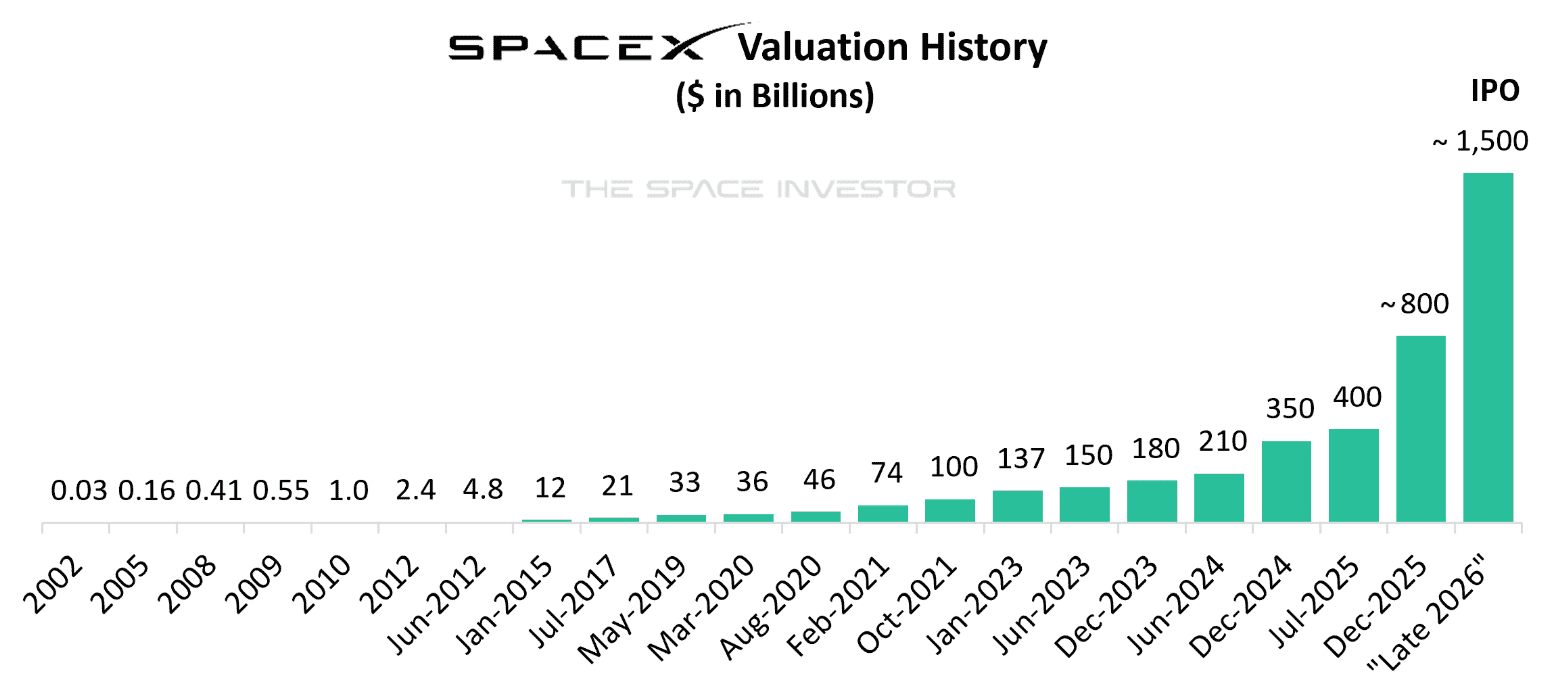

1. SpaceX: Valuing the Cosmos

Estimated Market Cap: $150 billion

Estimated Timing: Q3/Q4 2026

On December 10, Elon Musk confirmed on X (formerly Twitter):

SpaceX plans to go public in 2026.

According to Bloomberg, SpaceX aims to raise over $30 billion, with an estimated valuation of ~$150 billion. If realized, this would surpass Saudi Aramco’s $29 billion 2019 IPO—the largest in human history.

SpaceX currently operates two core businesses. First, rocket launches: In 2025, Falcon 9 completed over 160 launches—more than half of global launch activity. Second, Starlink satellite internet: As of 2025, it had over 10,000 satellites in orbit and over 8 million users, generating an estimated $15.5 billion in annual revenue.

Per internal SpaceX documents, once Starlink reaches scale, annual revenue could reach $36 billion—with an operating margin of 60%.

If achieved, a $150 billion valuation implies a price-to-sales (P/S) ratio of ~70x—a very high multiple. Yet for a company growing at over 50% annually, the market may well accept it.

One small but often overlooked fact: Though SpaceX appears to be a space company, 70% of its revenue actually comes from Starlink.

Investors wouldn’t be buying the “Mars colonization” dream—they’d be buying the world’s largest satellite internet service provider, a network infrastructure company wrapped in a space-themed shell.

Why is Musk now open to going public?

According to Ars Technica, the primary driver is fundraising to build orbital data centers—for example, repurposing Starlink satellites as AI compute nodes in orbit.

It sounds like science fiction—but hasn’t nearly everything SpaceX has done over the past two decades sounded just as implausible?

Valuing the cosmos? That’s plenty sexy.

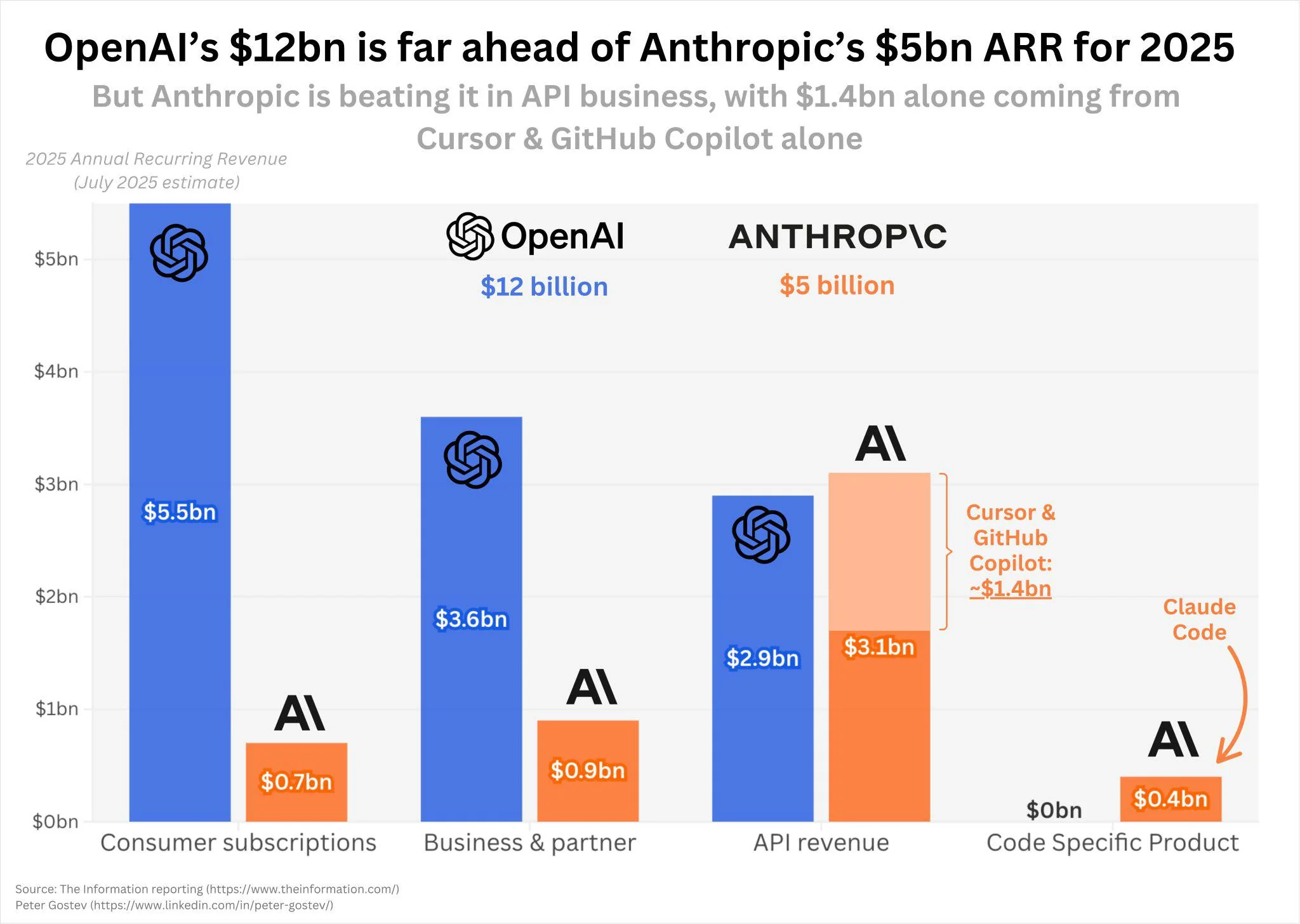

2. OpenAI vs. Anthropic: The Dual AI IPO Race

Estimated Market Cap: $83–100 billion (OpenAI), $23–30 billion (Anthropic)

Estimated Timing: Late 2026–early 2027 (OpenAI), second half of 2026 (Anthropic)

We group these two together—not least because many users toggle between ChatGPT and Claude.

OpenAI is currently valued at ~$50 billion, with annualized revenue exceeding $13 billion (Sam Altman has even hinted it’s significantly higher). Its target IPO valuation is $100 billion.

CFO Sarah Friar has stated the company aims to go public in 2027—but some advisors believe timing could accelerate to late 2026.

Sam Altman put it plainly on a podcast: “My excitement level about being a public-company CEO is zero percent.”

Yet he acknowledged, “We need massive capital—and we’ll inevitably hit shareholder-count limits.” OpenAI recently restructured from nonprofit to for-profit, reducing Microsoft’s stake to 27%, clearing a major IPO hurdle.

Anthropic is moving faster.

According to the Financial Times, the company has engaged Wilson Sonsini—the law firm behind Google’s and LinkedIn’s IPOs—to prepare for its listing, potentially as early as 2026.

Its current valuation stands at $18.3 billion, and it’s raising a new round targeting >$30 billion. Microsoft and NVIDIA may jointly invest $15 billion.

Revenue-wise, Anthropic looks especially promising:

Annualized revenue is ~$9 billion, projected to reach $20–26 billion in 2026 and possibly $70 billion by 2028. Claude’s subscription revenue growth rate is seven times that of ChatGPT—albeit off a smaller base.

It’s hard to declare a clear winner in this rivalry.

OpenAI dominates the consumer side: ChatGPT boasts 800 million weekly active users. But Anthropic is growing faster in enterprise markets.

Who goes first? Anthropic appears better prepared—but OpenAI’s sheer scale means its market impact would be incomparably larger once it moves.

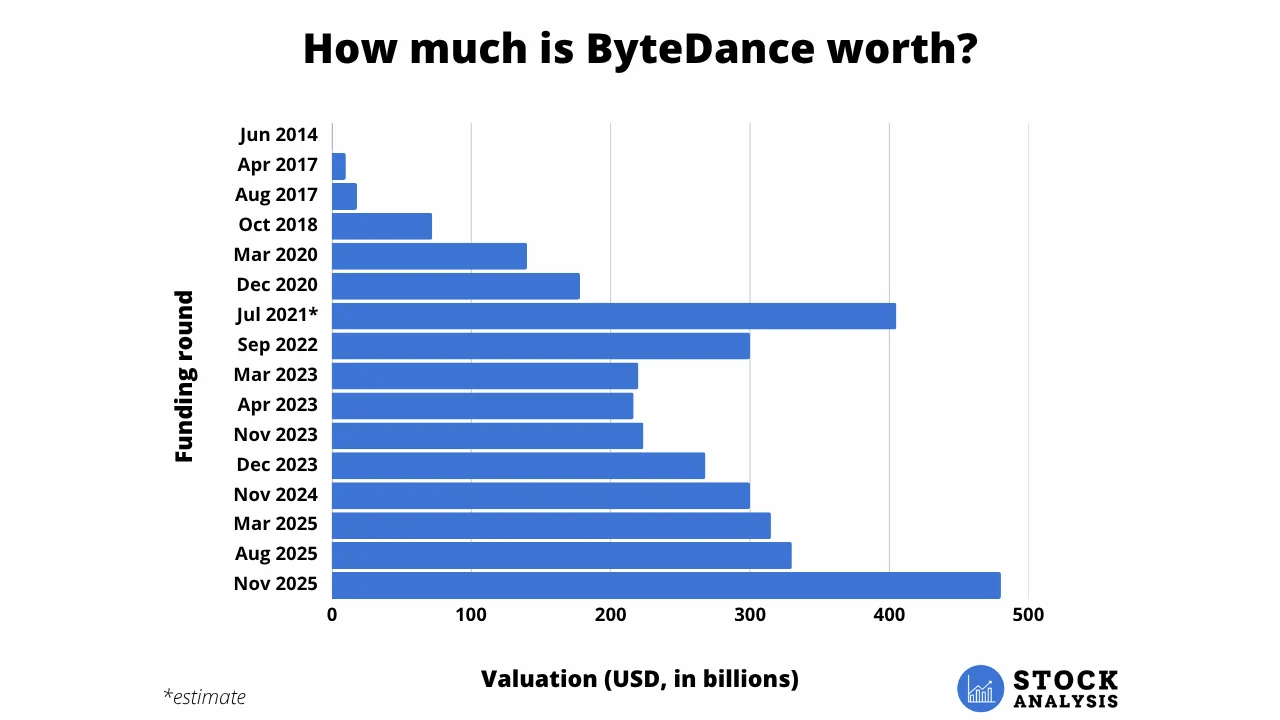

3. If ByteDance Won’t List—Could TikTok?

Estimated Market Cap: $48–50 billion

Estimated Timing: Under consideration—uncertain

ByteDance is the world’s second-most-valuable privately held company—behind only OpenAI.

In November 2025 secondary-market transactions, CDH Investments acquired shares for nearly $300 million, implying a $48 billion valuation.

The company generated $110 billion in global revenue in 2024—a 30% YoY increase. Douyin’s dominance in China needs no elaboration; its Doudou chatbot has surpassed DeepSeek to become China’s top domestic AI assistant by monthly active users.

ByteDance plans $16 billion in capital expenditures for 2026—including $8.5 billion for AI chip procurement.

Yet ByteDance has explicitly stated it has no IPO plans.

However, TikTok presents a wildcard. If the U.S. divestiture ultimately proceeds, market rumors suggest TikTok U.S.’s standalone valuation could rise from $40 billion to $50 billion.

A spun-off TikTok U.S. could thus become one of 2026’s largest tech IPOs.

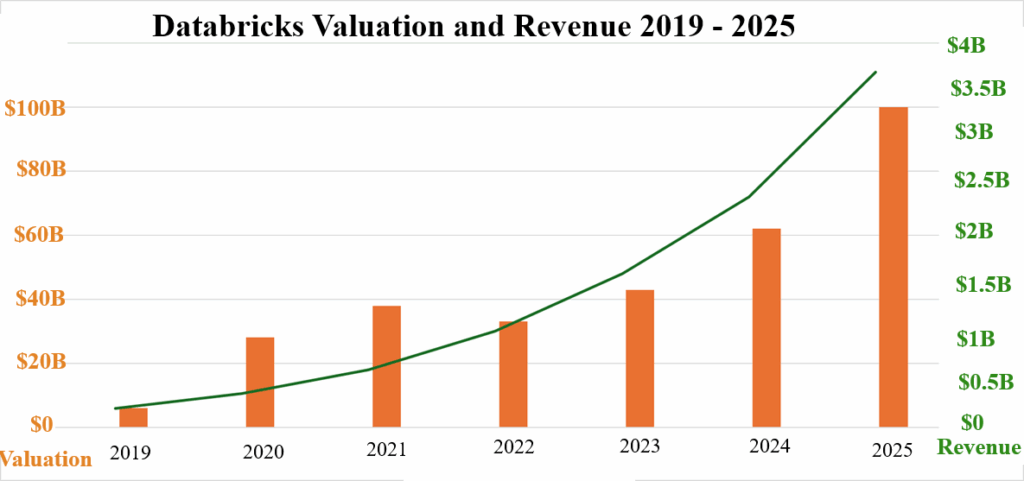

4. Databricks: You Haven’t Heard of It—But Everyone Uses It

Estimated Market Cap: $13.4–16 billion

Estimated Timing: Q1–Q2 2026

Databricks is a company most ordinary people have never heard of—yet virtually every major corporation relies on it.

It provides a unified platform integrating data lakes and data warehouses, enabling enterprises to store, process, analyze massive datasets—and train AI models directly on them.

In December 2025, Databricks closed a $4 billion Series L round, valuing it at $13.4 billion.

For context: Its valuation stood at $10 billion just three months earlier—and $6.2 billion a year ago. Such explosive growth is exceptionally rare in the private market.

Financially, the company generates over $4.8 billion in annualized revenue—up 55% YoY. Its AI product line alone contributes over $1 billion. Its 20,000+ customers include OpenAI, Block, Siemens, Toyota, and Shell. Crucially, Databricks is already cash-flow positive.

Analysts widely expect Databricks to go public in early 2026.

If it does, it will compete head-to-head with Snowflake—whose 2020 IPO valued it at $7 billion, with its stock doubling on day one.

Databricks is larger, growing faster—and market expectations will be correspondingly higher.

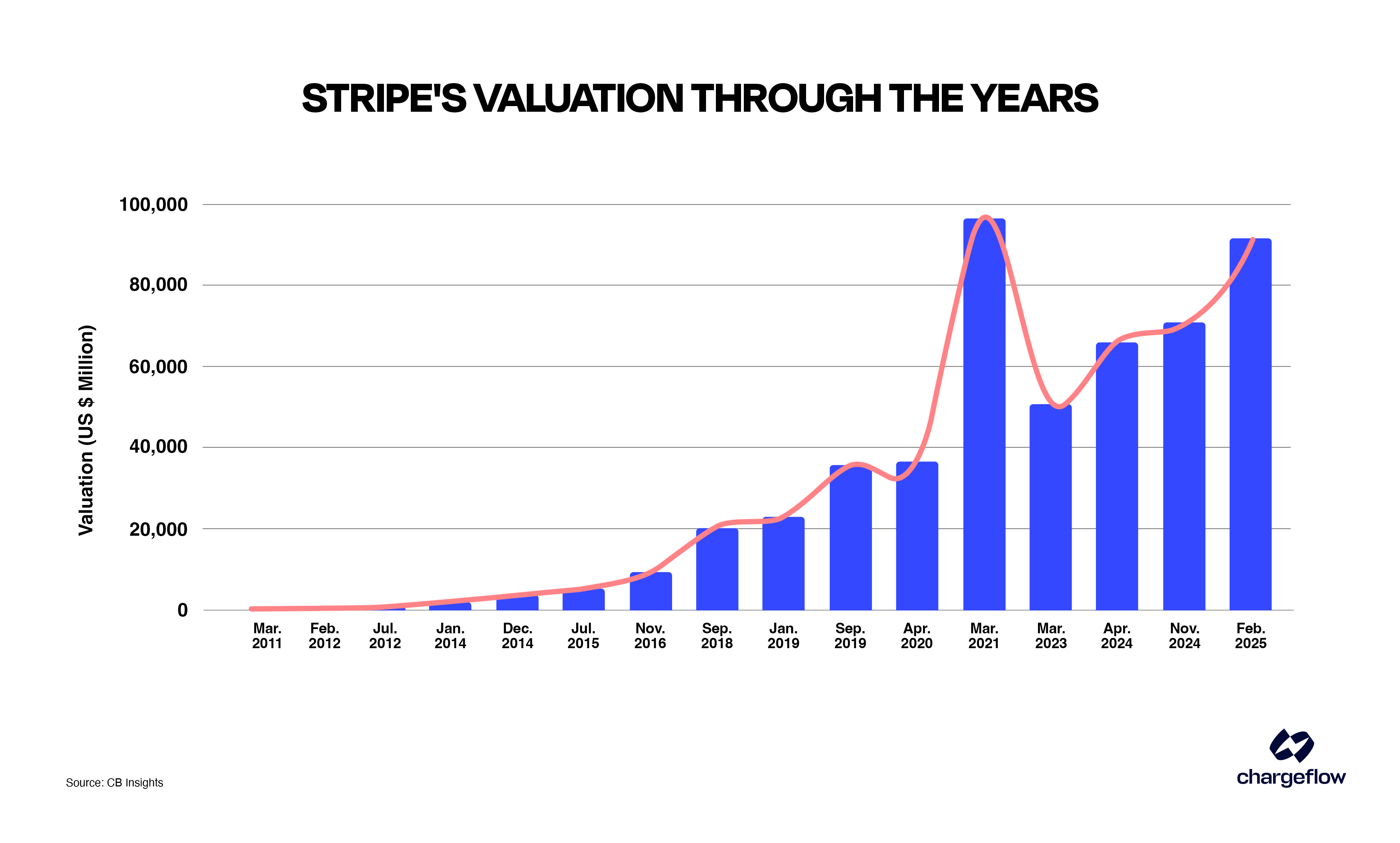

5. Stripe: The Least Rushed of Them All

Estimated Market Cap: $9.15–12 billion

Estimated Timing: Signals possible in H1 2026—but delays likely

Stripe may be the most distinctive among this cohort: best positioned to go public—yet most reluctant to do so.

Valued at $9.15 billion, it generates over $18 billion in revenue—and is profitable. It processes $1.4 trillion in global payments annually, serving clients including OpenAI, Anthropic, Shopify, and Amazon. Financially, it’s the cleanest company in this group.

Yet founders John and Patrick Collison have consistently sidestepped IPO questions. On the All-In podcast in February 2025, they explained:

“Stripe is profitable—we don’t need to raise capital via an IPO. Many financial services firms, like Fidelity, have remained private for decades. Employees gain liquidity through regular share buybacks—not necessarily via public markets.”

How long can this logic hold?

Sequoia Capital has begun exploring ways to allocate Stripe shares to its LPs—a classic VC signal pushing toward IPO. Meanwhile, employees’ 10-year options are expiring en masse, increasing pressure to monetize.

If the 2026 IPO market stays hot, Stripe may ride the wave. But if sentiment cools, the Collisons have every reason—and full optionality—to wait. Unlike others on this list, they hold all the cards.

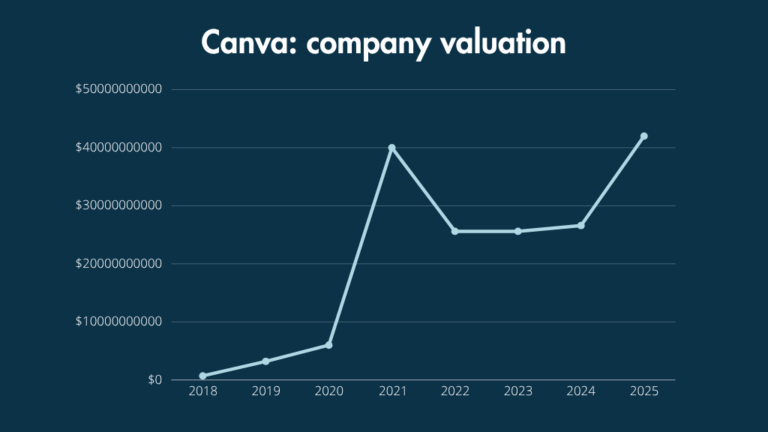

6. Canva: Possibly the Lowest-Risk IPO in This Group

Estimated Market Cap: $5–5.6 billion

Estimated Timing: Second half of 2026

Source: https://www.stylefactoryproductions.com/blog/canva-statistics

Compared to the $100-billion behemoths above, Canva seems quietly unassuming: an Australian design-tool company valued at $4.2 billion, generating over $3 billion in revenue—and profitable.

No geopolitical risk. No AI arms-race burn rate. A simple business model: subscription-based design software.

Last November, Blackbird Ventures told investors Canva would be ready by the second half of 2026. CEO Melanie Perkins has historically resisted going public—but employee liquidity demands may shift her stance.

If you’re seeking the “safest” bet among these IPOs, Canva is likely the closest match. Less glamorous than SpaceX—but also far less volatile.

In summary, this clustering of 2026 IPO preparations is no coincidence.

Consider the AI arms race’s funding needs: OpenAI plans $140 billion in spending over five years; Anthropic pledges $50 billion for data centers; ByteDance spends heavily on chips annually. Private markets simply can’t fill those gaps.

Yet for retail investors, the significance of these IPOs may differ from prior waves.

These companies have grown large and mature enough in private markets that by the time they list, they’re no longer “early-stage.” The juiciest growth phase has already been captured by private investors.

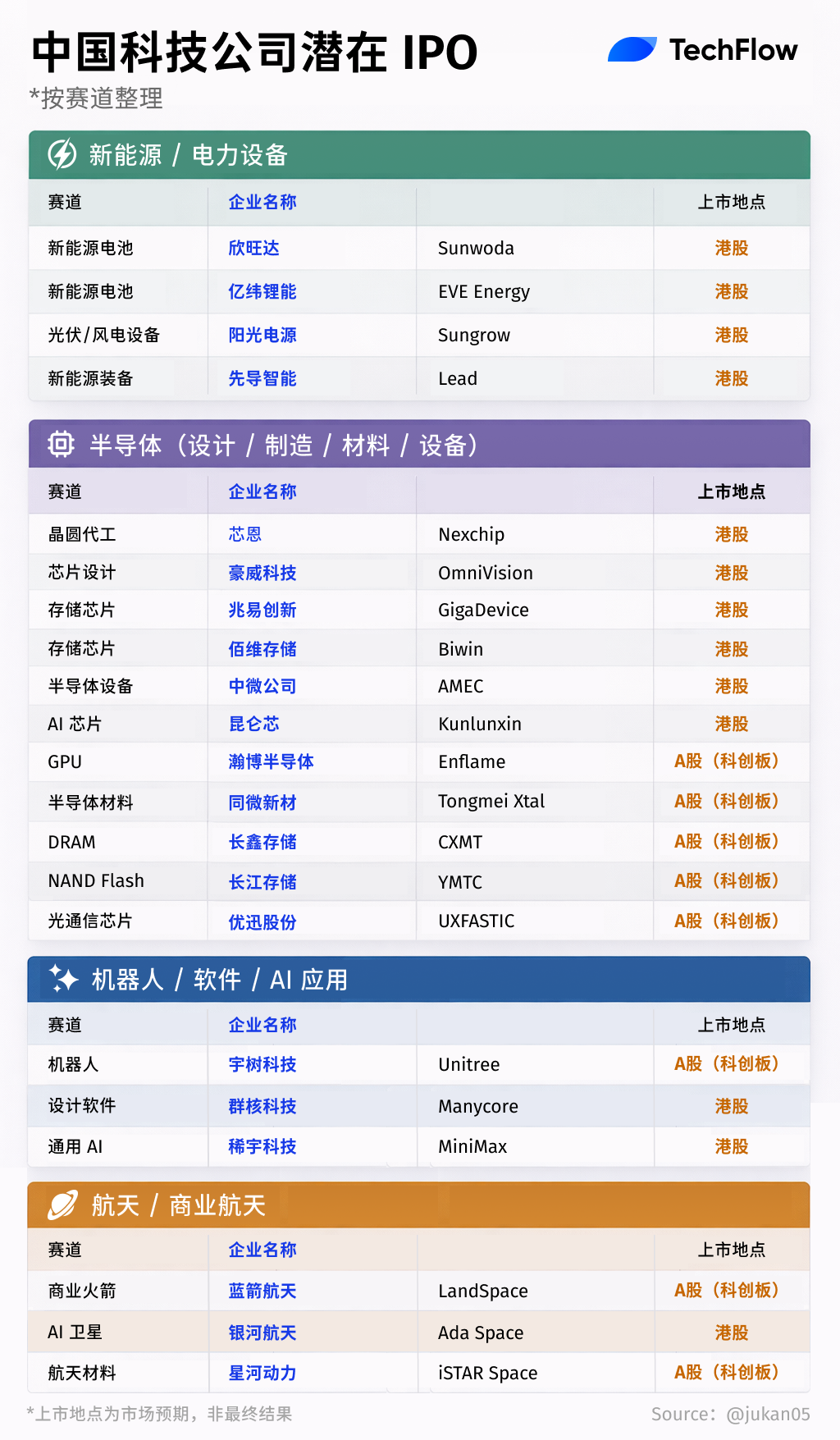

Chinese Tech IPOs: Two Paths—Hong Kong and A-Shares

Zhipu AI and MiniMax raced ahead with January Hong Kong listings—but China’s tech IPO drama has only just begun.

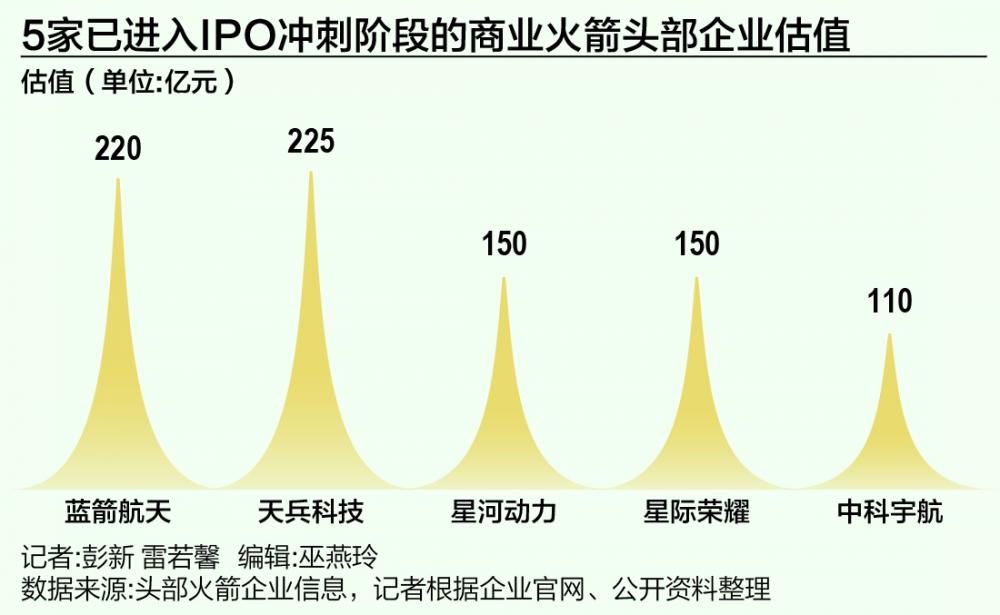

In 2026, commercial aerospace and robotics represent the two hottest themes—with respective targets of the STAR Market (Shanghai) and Hong Kong.

Source: X user @jukan05

Compiled and edited by TechFlow

1. LandSpace: Aiming to Be “China’s First Commercial Rocket IPO”

Estimated Market Cap: RMB 20–22 billion

Estimated Timing: 2026

Listing Venue: STAR Market

On December 31, 2025, LandSpace’s STAR Market IPO application was accepted, seeking RMB 7.5 billion in financing. From initiation of tutoring to acceptance took just five months—rocket speed.

LandSpace is a leading Chinese commercial aerospace player, developing liquid oxygen-methane engines and launch vehicles.

Founder Zhang Changwu has a finance background and launched the company in 2015. Over ten years, it raised 17 rounds from 85 funds. Its latest valuation is ~RMB 22 billion, with early backers including Sequoia China, Matrix Partners, Country Garden Venture Capital—and the National Manufacturing Transformation & Upgrading Fund, which joined last year.

LandSpace opted for the STAR Market’s “Fifth Standard”—originally reserved for biotech firms, but expanded to commercial aerospace last year.

Requirements include “first successful orbital insertion of payload using reusable mid-to-large launch vehicles.” Last December, LandSpace’s Zhuque-3 conducted a recovery test: although its first stage failed to soft-land, the orbital insertion succeeded—barely meeting the bar.

However, on January 5, LandSpace was selected for on-site inspection—the first batch this year. Next steps depend on inspection outcomes.

2. CAS Space: The Second-Fastest Rocket Company to IPO

Estimated Market Cap: >RMB 10 billion

Estimated Timing: 2026

Listing Venue: STAR Market

CAS Space completed IPO tutoring in January—making it the second-fastest commercial aerospace firm after LandSpace to advance toward listing.

Spun out of the Chinese Academy of Sciences’ Institute of Mechanics, CAS Space develops mid-to-large solid-fuel rockets. Its “Li Jian-1” rocket has launched eight times, holding China’s record for consecutive private-sector ton-class payload launches.

On January 12, its “Li Hong-1” completed a suborbital flight test—reaching 120 km, crossing the Kármán line into space, and successfully recovering its payload capsule via parachute.

Unlike LandSpace’s liquid-propellant approach, CAS Space pursues solid-fuel rockets—lower cost and faster response, though with lower maximum payload capacity. The two target distinct market segments.

Founder Yang Yiqiang, 58, hails from the China Academy of Launch Vehicle Technology and served as the inaugural chief commander of the Long March 11 rocket—a rare “national team” pedigree in commercial aerospace.

3. Unitree Robotics: The Spring Festival Sensation Everyone Knows

Estimated Market Cap: >RMB 12 billion

Estimated Timing: 2026

Listing Venue: STAR Market (highly likely)

During the 2025 Spring Festival Gala, 16 humanoid robots dressed in Northeastern Chinese floral jackets danced to “Yang BOT”—the company behind the performance was Unitree Robotics. That segment catapulted Unitree into overnight fame—and triggered a capital frenzy.

Unitree develops quadruped and humanoid robots, with vertical integration as its core strength: motors, gearboxes, controllers, LiDAR, and motion-control algorithms are all self-developed. Founder Wang Xingxing holds 34.76%—making him the actual controller. Founded in 2016, the company now employs over 1,000 people, generates ~RMB 1 billion in annual revenue, and posts several tens of millions in net profit.

On July 18, Unitree appeared on the CSRC’s IPO tutoring list, with CITIC Securities as its sponsor. Insiders confirm the STAR Market is highly likely. At a RMB 12 billion valuation, it would become the new leader of the STAR Market’s robotics sector.

Robotics firms typically choose Hong Kong—due to heavy R&D burn and frequent follow-on financing needs. Unitree’s choice of A-shares signals stronger financial health than its peers.

4. Hong Kong’s “Chapter 18C” Channel: A Wave of Sci-Tech Firms in the Pipeline

In March 2023, HKEX introduced “Chapter 18C”—a dedicated fast-track listing channel for “specialty technology companies.” Its core principle:

You don’t need profitability—or even meaningful revenue—as long as your technology is cutting-edge, R&D investment is substantial, and market cap is high enough.

Two tiers exist. “Commercialized companies” must meet a minimum market cap of HK$6 billion and at least HK$250 million in revenue for the most recent fiscal year. “Pre-commercialized companies” require a minimum market cap of HK$10 billion—but face no revenue requirement.

Zhipu AI and MiniMax’s January listings followed this path. Hong Kong’s advantage lies in flexible thresholds and tolerance for losses; its disadvantage is weaker liquidity and generally lower valuations versus A-shares.

Several other firms are queued for 2026 listings in Hong Kong. Viewed alongside STAR Market candidates, the following sectors stand out:

1) Semiconductors—the Most Crowded Sector.

ChangXin Memory Technologies (CXMT) and Yangtze Memory Technologies (YMTC)—two of China’s “Red Memory” trio—focus on DRAM and NAND Flash respectively, both targeting the STAR Market.

SuYuan Technology, one of China’s “Four GPU Dragons,” is also queued for the STAR Market. In Hong Kong, Kunlun Chip (Baidu’s AI chip unit), OmniVision (image sensors), GigaDevice (memory chips—listed in Hong Kong on January 13), and Biwin Storage are all active. Advanced Micro-Fabrication Equipment (AMEC), a leader in etching equipment, plans a secondary listing in Hong Kong.

2) New Energy Equipment—Concentrated in Hong Kong.

Ample Power (Sunwoda) and EVE Energy are global battery leaders; Sungrow manufactures PV and wind inverters; Liyuanheng supplies lithium-battery production equipment. All aim for Hong Kong listings.

3) Aerospace Goes Beyond Rockets.

Geely’s subsidiary时空道宇 (GeoSat) develops AI-powered satellite internet and has filed for a Hong Kong listing. Aisida Aerospace—focused on rocket composite fairings—is targeting the STAR Market.

Given space constraints, we won’t detail each company here—but a clear trend emerges:

In 2026, China’s tech IPO battleground splits: the STAR Market hosts deep-tech firms (semiconductors, aerospace, robotics), while Hong Kong hosts new energy players and AI companies already generating revenue.

Finally, amid soaring prices for gold and other precious metals—whether you favor U.S. equities or domestic assets—we wish you success capturing your own big opportunity in capital markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News