The wave of crypto companies going public is coming—how to play Pre-IPO on-chain?

TechFlow Selected TechFlow Selected

The wave of crypto companies going public is coming—how to play Pre-IPO on-chain?

When Nasdaq's Alpha meets blockchain.

By: BUBBLE

In June this year, internet brokerage giant Robinhood launched a new service for European users, offering trading opportunities in "stock tokens" of top private unicorn companies such as OpenAI and SpaceX. Robinhood even airdropped small amounts of OpenAI and SpaceX tokens to eligible new users as a user acquisition tactic.

However, this move was immediately opposed by OpenAI. The company clarified on X that "these OpenAI tokens do not represent equity in OpenAI, and we have no partnership with Robinhood." Under this post, Elon Musk did not directly comment on Robinhood's tokens, but retweeted OpenAI’s statement with a sarcastic remark: "Your own 'equity' is fake." This jab mocked OpenAI’s capital maneuvers after its shift to a for-profit entity, while also highlighting the strong resistance from private companies when they lose control over the "pricing rights" of their shares.

Despite skepticism, traditional brokerages’ attempts reflect strong market interest in on-chain Pre-IPO asset trading. The reason is simple: the massive first-market windfall has long been monopolized by a few institutions and high-net-worth individuals. Many star companies see explosive valuation growth upon IPO or acquisition. For example, design software firm Figma, after failing to complete its acquisition by Adobe due to antitrust concerns, went public independently in 2025 at $33 per share, closing its first day at $115.50—a 250% surge. That price implied a market cap of nearly $68 billion, far exceeding the $20 billion valuation during earlier acquisition talks. Similarly, the recently listed crypto exchange Bullish surged 290% at opening.

These cases show that investing in such companies pre-IPO could yield returns of multiple or even tens of times. Yet traditionally, it's difficult and complex for average investors to access these opportunities. Allowing retail investors via blockchain to participate early in the appreciation of future public stars is precisely what makes the on-chain Pre-IPO concept appealing.

The Scale and Barriers of Private Equity Markets

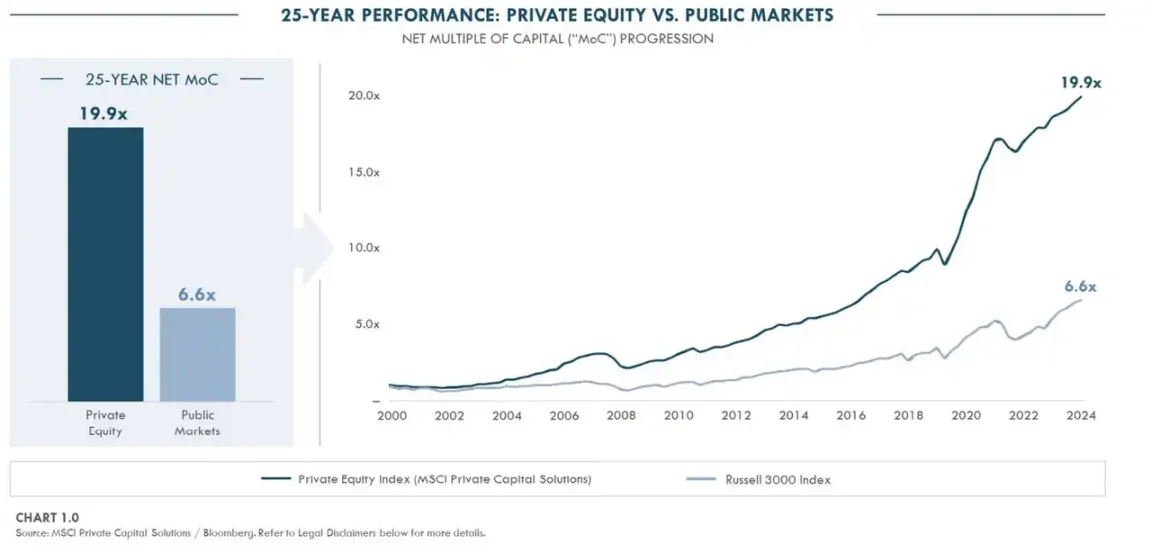

Over the past decades, the global private equity market has been vast, rapidly growing, yet highly closed off. According to research by Yann Robard, partner at Dawson Partners, in his article “Why Private Equity Wins: Reflecting on a Quarter Century of Outperformance,” private markets created about three times more value than public markets over the past 25 years. A large number of excellent companies delay or bypass going public altogether, raising billions through successive private funding rounds. For instance, OpenAI raised $6.6 billion from investors including Microsoft and SoftBank in October 2024, followed by a $40 billion mega-round in March 2025—the largest private financing in history. With ample private capital, many firms can remain private indefinitely or go public much later. As a result, enormous growth gains are realized before IPOs, but only institutional investors can participate—ordinary people are completely excluded.

Comparison chart of value creation in private vs. public markets over the past 25 years, source: Dawsonpartners

Traditionally, a few secondary marketplaces targeting wealthy investors (such as Forge and EquityZen in the U.S.) offered limited channels for Pre-IPO share transfers. But these platforms mostly use peer-to-peer matching models with high entry barriers, typically catering only to accredited investors with minimum investments often starting in tens of thousands of dollars. Such OTC models lead to poor liquidity, lack of price discovery mechanisms, and low trading efficiency. Moreover, many unicorn companies' bylaws heavily restrict share transfers, requiring company approval for employees or early shareholders to sell their stakes.

Under current regulatory frameworks, private equity secondary markets are almost entirely closed to ordinary investors. However, some cracks are beginning to appear—such as in June this year, when Nasdaq Private Market (NPM) launched Tape D, a real-time dataset for private companies, improving pricing transparency and valuation visibility for private and pre-IPO firms. Users can access this data via API, creating a fairer environment for "oracles."

The Pre-IPO market is not new to the crypto space. Over the past few years, constrained by technical limitations, compliance environments, and insufficient investor education, this model struggled to scale. But now conditions are gradually maturing: blockchain scalability and user experience have significantly improved, and infrastructure like custody, KYC/AML is becoming more robust. Meanwhile, AI and crypto companies are increasingly approaching IPO milestones, creating new narratives and investment demand for early exposure to high-growth assets. Compared to betting solely on volatile crypto assets, Pre-IPO tokenized products offer structured investments with predictable exit paths, attracting more capital seeking diversified portfolios.

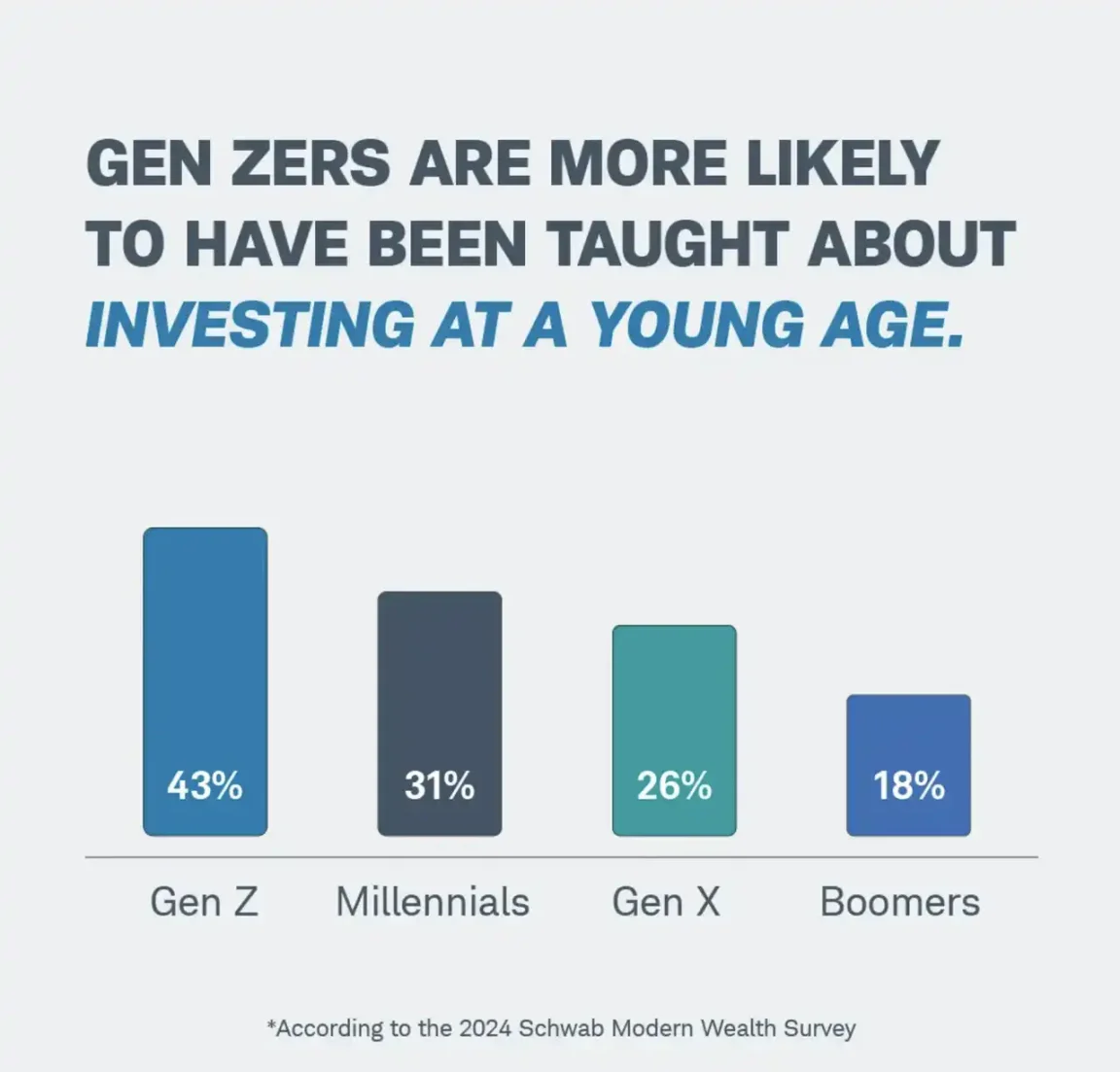

More importantly, millennials and Gen Z are becoming the core investor base. They prefer direct investment, frequent trading, and actively seek high-potential private equity opportunities like SpaceX, OpenAI, and Anthropic. Yet under traditional frameworks, they have almost zero access to these deals. If the Pre-IPO market leverages on-chain tokenization to split unlisted equity into low-barrier fractional units and introduces transparent secondary liquidity mechanisms, it could provide young investors with affordable, self-managed, values-aligned investment entry points—and bring unprecedented pools of global retail capital into private equity.

Gen Z and millennials are more inclined to invest rather than put money into pensions; detailed data available in Jarsy’s Medium report

Through tokenization, expensive and scarce private equity can be divided into small digital tokens traded 7×24 on-chain. Smart contracts can automatically execute rights like dividends and voting, enhancing transparency and efficiency. More importantly, if these tokens trade on DEXs or compliant platforms, market makers and liquidity pools can provide continuous quotes, avoiding the illiquidity of pure P2P trading. In theory, tokenizing private equity allows global retail investors ultra-low-barrier access to top private companies’ growth, while improving price discovery and making valuations more market-driven and transparent.

Of course, the grander the vision, the tighter the reality. Complex regulations, resistance from private firms, and technical integration hurdles remain unresolved challenges for tokenization. Even so, over the past year and a half, as policy winds shift, a wave of projects exploring on-chain Pre-IPO trading has emerged—some focusing on derivatives and leveraged trading, others on tokenizing actual equity transfers.

On-Chain Pre-IPO Trading Platforms

These platforms prioritize trading experience and often don’t hold actual equity in target companies, instead enabling users to bet on private company valuations via derivatives or other mechanisms. The advantage is low entry barriers without complex stock settlement processes; the challenge lies in pricing sources and compliance risks.

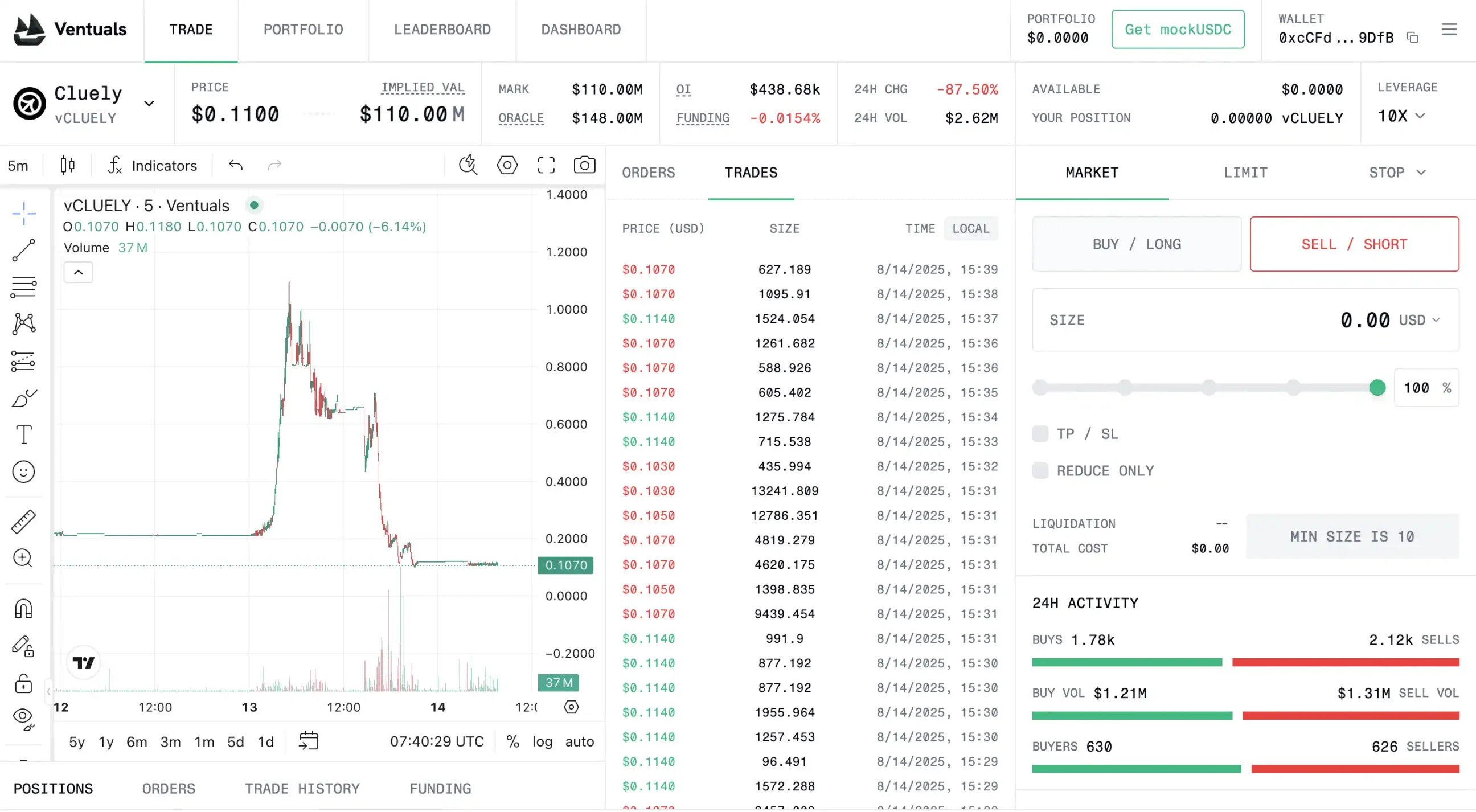

Ventuals: "Perpetual Contracts" for Pre-IPO with 10x Leverage on Hyperliquid

Ventuals is a new project incubated by Paradigm, founded by Alvin Hsia, who also co-founded Subs.fun, a platform that briefly gained popularity, and previously collaborated with Paradigm as an EIR (Entrepreneur-in-Residence) to incubate Shadow, an end-to-end data platform.

Ventuals aims to let users trade perpetual futures of private companies on the Hyperliquid blockchain. This model resembles common derivative trading in crypto markets, except the underlying assets are valuation indices of hot startups. Ventuals’ key advantage is that it doesn’t need to hold underlying stocks to create a marketplace—functionally similar to prediction platforms like Polymarket. This also allows it to bypass many traditional securities regulations (e.g., identity verification, accredited investor requirements).

The platform uses Hyperliquid’s HIP-3 standard to create custom perpetual markets and employs an “optimistic oracle” mechanism to obtain valuation data: anyone can submit a company’s valuation with a deposit; if uncontested, the price stands; if challenged, resolution occurs via on-chain voting. This brings otherwise hard-to-access private valuation consensus onto the chain, providing a basis for pricing.

Ventuals’ pricing method is also unique—it doesn’t use the latest funding round price directly, but divides the company’s valuation by 1 billion to set the token price. For example, if OpenAI’s latest valuation is $350 billion, one vOAI token starts at $350. This lowers trading barriers and makes prices more intuitive. However, private company valuations are inherently opaque and infrequently updated, relying mainly on occasional funding or secondary transaction data. Although Ventuals uses oracles and EMA (exponential moving average) to smooth prices, information asymmetry remains a critical flaw: when base data lags or distorts, derivative trading based on it may amplify market volatility. Platforms like Polymarket using oracles have faced similar issues; at larger scales, rapid trading could cause bigger problems for Ventuals.

Thanks to the founding team spending investors’ money on Ferraris, the market slashed its valuation, source: Ventuals

As a trading platform, Ventuals’ biggest selling point is offering up to 10x leverage for long or short positions, enabling users to “bet small, win big.” Currently, the platform is still in testing (running only on testnet). Ventuals takes a fully decentralized derivatives route, leveraging Hyperliquid’s high-performance order matching (capable of 100,000 orders per second), aiming to build a trustless, global Pre-IPO exchange. Of course, compliance challenges remain huge—even without holding real shares, these contracts essentially bet on security prices and could still be deemed securities derivatives by regulators. Questions around who provides liquidity and ensures oracle accuracy remain unanswered.

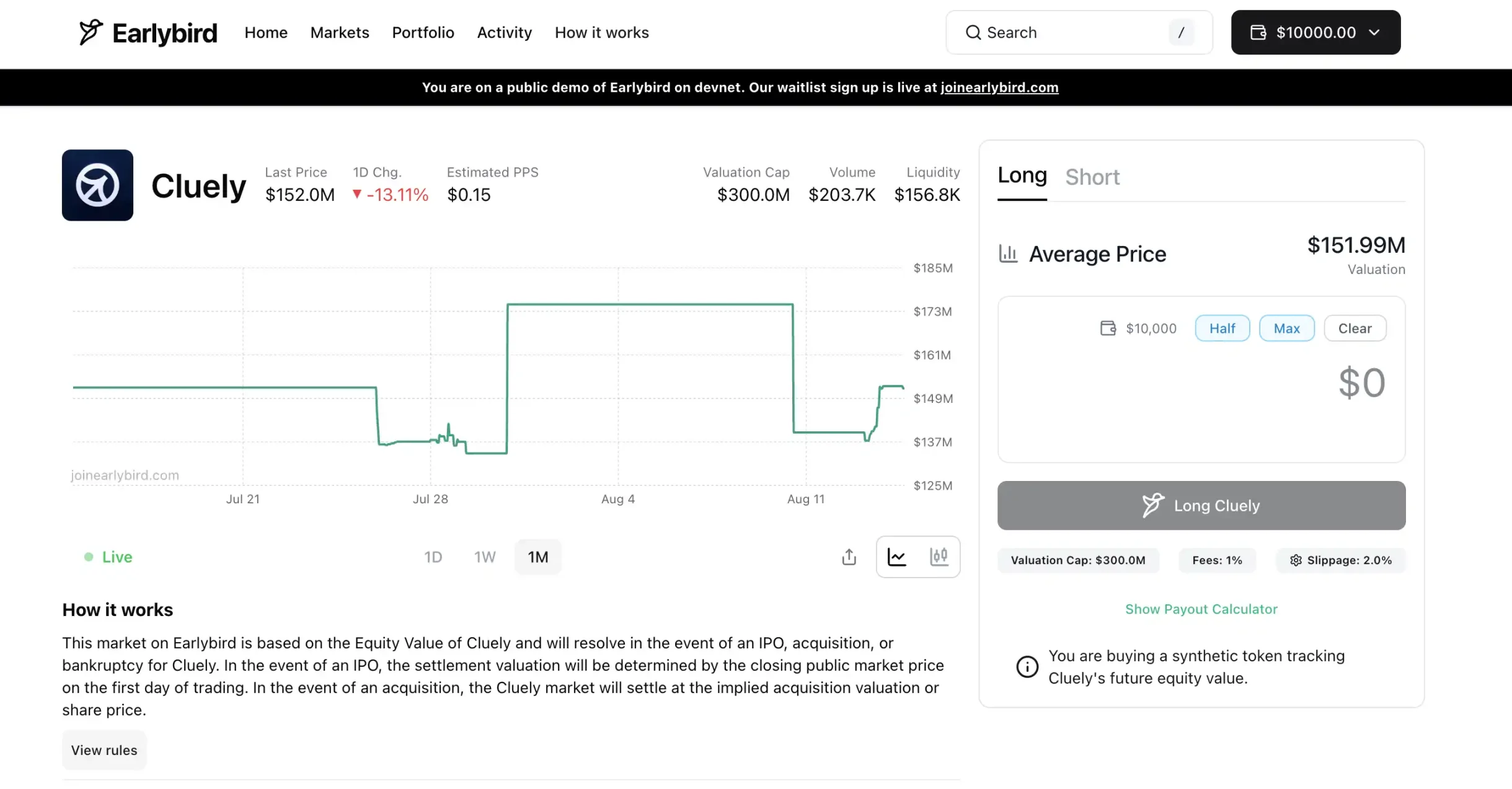

Earlybird: A Long/Short Market for Pre-IPO on Solana

Earlybird was built by the team behind Hyperspace, a former NFT marketplace on Solana (shut down in 2024, with its Twitter handle even changed directly to Earlybird). It similarly enables users to “go long or short on companies before IPO,” positioning itself as the next-generation private equity trading platform for retail investors. The team secured investments from top crypto VCs (like Dragonfly and Pantera) and gained experience in the Solana NFT space before shifting focus to the Pre-IPO sector.

It seems the two platforms’ oracles show different prices—unclear if this will be fixed post-launch. Future integration with Polymarket might enable cross-platform arbitrage

Earlybird’s founding team includes Hyperspace co-founders Kamil Mafoud and Santhosh Narayan. After Hyperspace shut down its NFT operations in 2024, the team reportedly shifted full attention to Earlybird. In fact, a “Pre-IPO platform” may suit them better than an “NFT platform”—both have Morgan Stanley experience and years as investment analysts, where Wall Street connections matter more than crypto networks in this field.

Earlybird’s exact product form hasn’t been fully disclosed (the platform remains in invite-only test mode), but developers can access a testnet version (with $10,000 in mock funds lol). Judging from marketing materials, it likely follows a similar path to Ventuals—using on-chain derivatives or synthetic assets to let users bet on private company valuation changes. Solana’s fast, low-cost environment is well-suited for real-time trading markets. The team may adopt orderbook or AMM market-making mechanisms to deliver more continuous liquidity than traditional OTC. Notably, Solana already hosts similar Pre-IPO asset trading experiments, such as PreStocks and earlier synthetic U.S. stock offerings (like mStocks on Mango Markets, now defunct).

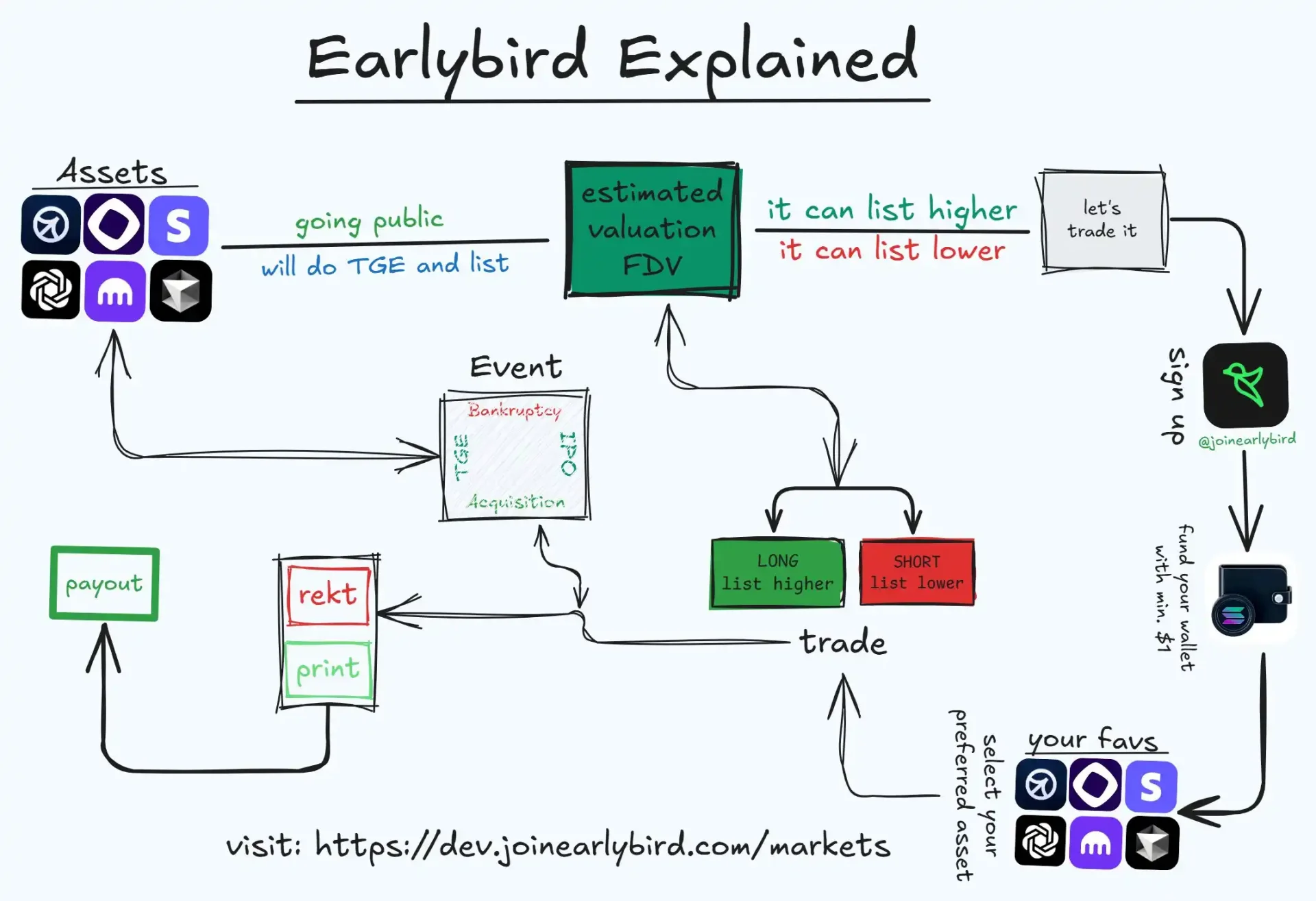

Earlybird’s trading logic, source: @0xprotonkid

In terms of market positioning, Earlybird likely leans toward an open, decentralized approach with relatively loose geographic and qualification restrictions. Overall, Earlybird represents Solana’s active exploration of the Pre-IPO space, adopting the same “avoid real equity, use derivatives to create a market” strategy as Ventuals. Its success hinges largely on solving two core issues: valuation pricing and compliance risk management.

PreStock (backed by Republic): The “Good Kid” Among Equity Token Exchanges

Compared to the “light-asset” models of Ventuals and Earlybird, PreStocks is closer to traditional stock trading—just moved on-chain. Founded by a Singaporean team and backed by the established private investment platform Republic Capital, PreStocks holds real private company shares through special purpose vehicles (SPVs) and issues 1:1 pegged tokens.

In simple terms, if PreStocks acquires a batch of OpenAI shares via an SPV, it mints “pOPENAI” tokens on Solana at a 1:1 ratio for users to trade. Each token is backed by real stock, allowing investors to enjoy nearly identical economic benefits (capital gains, future IPO proceeds, etc.), though without direct legal shareholder status or dividend rights.

PreStocks currently supports token trading for 22 private companies, including well-known unicorns like OpenAI and Canva. Users need only a Solana wallet and as little as a few dollars to buy and sell these tokens, with no investment threshold. Tokens can be freely transferred on-chain, traded or borrowed on DEXs, used to provide liquidity for fees, or serve as building blocks for new structured products. PreStocks integrates Jupiter aggregator and Meteora market makers, enabling 7×24 trading and instant settlement.

To ensure every token is backed by real stock, PreStocks uses regulated custodians to hold underlying shares and promises regular audit disclosures. However, the team has not yet published detailed proof-of-holdings, merely claiming all tokens are 100% fully collateralized. Given the sensitivity of private company equity, PreStocks faces significant compliance pressure—thus it blocks users from major jurisdictions like the U.S. (KYC is not required for on-chain trading, but is needed for minting or redeeming PreStocks). The company chose Singapore for registration due to its relatively relaxed regulatory environment.

PreStocks founder Xavier Ekkel stated the vision is to make private equity investing as simple as trading public stocks. By offering retail investors zero-barrier access to unicorns, PreStocks has indeed weakened the monopoly of traditional secondary markets. However, this model has clear limitations. First, liquidity: since each company’s share supply is limited (currently, individual company token market caps on PreStocks usually range in the hundreds of thousands of dollars), market depth is shallow—large trades easily impact prices. In contrast, legacy secondary players like Forge handle median trades exceeding $5 million, supported by institutional-grade order systems. PreStocks’ trading infrastructure requires broader user adoption to scale.

Second, scalability is constrained by the “1:1 ownership” model. Adding each new asset requires negotiating real stock purchases offline, involving case-by-case discussions with sellers (employees, VCs, funds), which is time-consuming and dependent on company consent. Third, PreStocks is not a licensed securities exchange and operates in a gray area—any regulatory shift could force asset delisting or shutdown.

Overall, PreStocks takes a more concrete path than derivatives, using real capital to “buy access” for retail investors. Its strength lies in stronger investor protection (real stock backing enables true payout upon IPO), but drawbacks include high operational costs and major compliance hurdles. The author believes Republic intends to develop PreStocks into a high-liquidity on-chain trading venue for distributing mirror tokens, given its operation under Reg CF rules—limiting investments to $5,000 and imposing one-year lockups. These constraints contradict the product’s original intent, especially when paired with limited liquidity on its own compliant centralized platform INX—hence PreStocks represents a strategic detour.

Platforms Focused on Real Equity Tokenization

These platforms directly offer terminal investors opportunities to purchase stakes in private companies—essentially on-chain securities issuance or private crowdfunding. They typically require holding or locking real shares, using tokens as proof of ownership to share future returns. This model closely resembles traditional finance but leverages blockchain for record-keeping and transfer, often operated by traditional financial or fintech firms.

Jarsy: The Group-Buying Site for Equity Tokens

Among numerous Pre-IPO projects, Jarsy stands out as a steady, grounded player. It quietly launched in 2024 on the Arbitrum network. Jarsy, Inc., headquartered in San Francisco, was founded by Hanqin, Chunyang Shen, Yiying Hu, and others—including former Uber China executives and the engineering lead from Afterpay—with deep understanding of internet product operations and regulation. The company raised $5 million from Breyer Capital, with notable angel investors including Evan Cheng (CEO of Mysten Labs), Nathan McCauley (CEO of Anchorage), and Richard Liu (CEO of Huma Finance). Jarsy’s mission is “democratizing private investment via blockchain,” offering ordinary investors access to unicorn equity through strict 1:1 real-asset backing.

Jarsy works by listing Pre-IPO equity products on its platform for users to pre-order (paid in USDC or USD). Once a certain funding threshold is reached, Jarsy negotiates with risk funds, early shareholders, or employees holding shares to acquire real equity using the pooled capital. If successful, it mints an equivalent number of tokens and distributes them to investors; if negotiations fail or fundraising falls short, funds are refunded. This process resembles traditional private share transfers but adopts a “crowdfund-then-buy” model, using on-chain tokens as ownership proofs.

Jarsy places all held stock assets into dedicated SPVs (special purpose vehicles) for custody and offers a real-time on-chain proof-of-reserves page for public verification. Each Jarsy token (e.g., JSPACEX for SpaceX shares) represents one real underlying share. While token holders aren't legal shareholders of the company, they enjoy nearly identical economic rights—such as proceeds from future IPOs or acquisitions, and potentially dividend income. This makes Jarsy distinct from other projects—more like a group-buying site for private equity.

Yet Jarsy drastically lowers entry barriers, with minimum investments starting at just $10. Even more impressively, aside from U.S. investors, global users can participate without accredited investor certification. Jarsy also optimizes Web2 user experience, supporting email sign-up and fiat payments, auto-creating custodial wallets, making the blockchain layer nearly invisible during token purchases. Prioritizing compliance and usability, Jarsy aims to bridge “Web2 front-end + Web3 back-end.” Since launch, Jarsy has rolled out tokenized equity for star companies like Anthropic, Stripe, and Perplexity AI—many of which sold out instantly upon release.

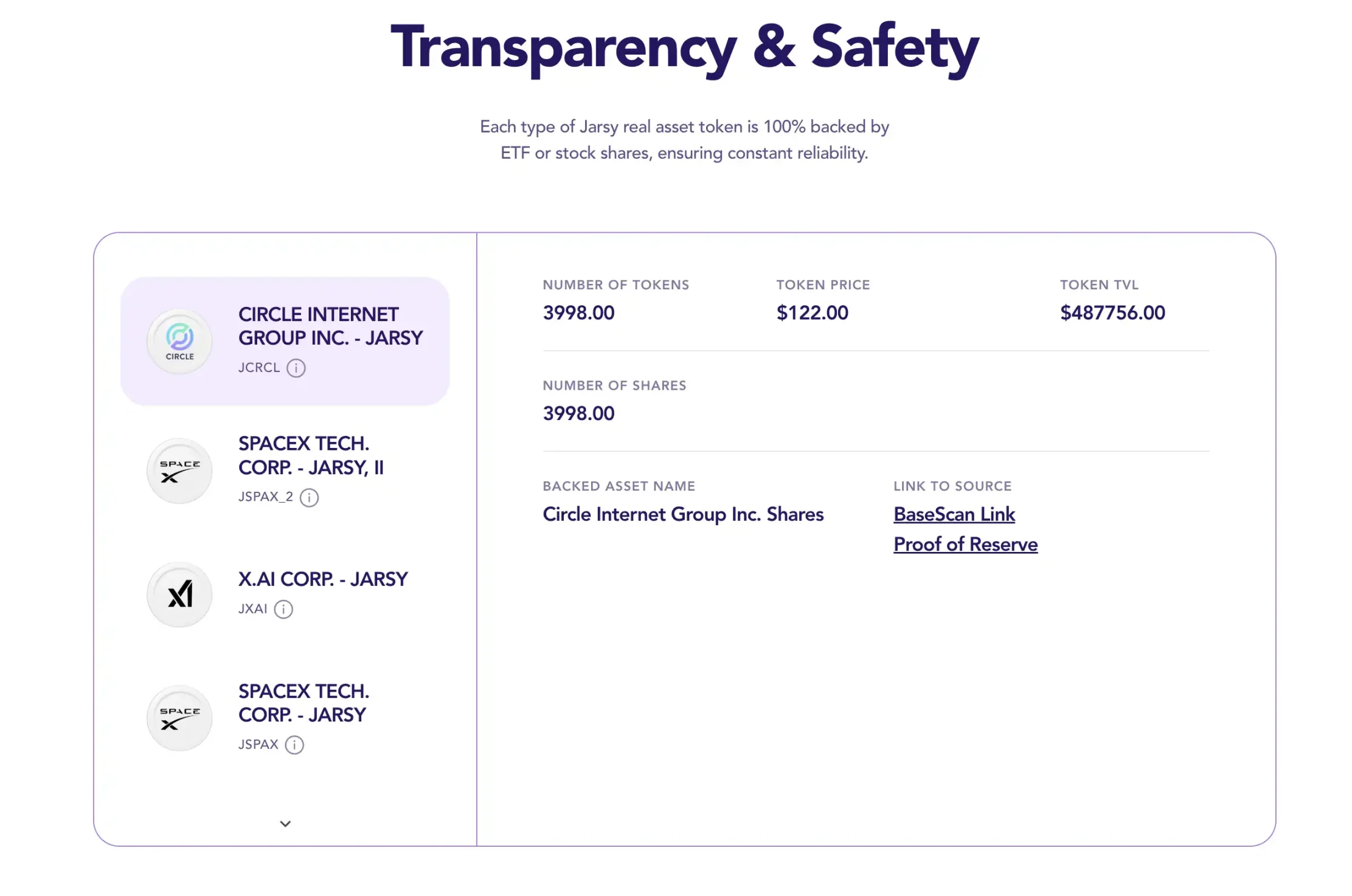

Still, Jarsy faces two major challenges. First, liquidity: since each token’s supply depends on actual acquired shares and private equity lacks public market pricing, large holders dumping tokens can cause sharp price drops or leave no buyers. Jarsy’s largest holdings are X.ai (~$350K), Circle (~$490K), and SpaceX (~$670K)—all relatively small. In such thin markets, a $10K sell order could crash prices, clearly indicating insufficient depth.

Second, expansion bottlenecks plague any “real holdings” project. Jarsy must exert far more effort than derivative-based platforms to add new assets, demanding extensive networks and resources. Additionally, despite claiming “compliance-first,” Jarsy offers unregistered security tokens, leaving uncertainty under U.S. regulation. However, Jarsy has proactively partnered with top law firms like WSGR (Wilson Sonsini, Goodrich & Rosati) to plan a compliant path, signaling intent to seek regulatory exemptions or approvals—making it potentially more attractive to institutions under current conditions.

As CEO Han Qin put it: “We founded Jarsy to bring institutionally monopolized private investment opportunities to ordinary people.” Despite liquidity and compliance challenges, Jarsy has taken a crucial first step and stands as one of the more compliant “equity tokenization platforms” today. With growing users and asset scale, if it gradually gains regulatory recognition, its tokens might eventually circulate in compliant secondary markets—turning “Pre-IPO equity” into a mainstream asset class for the masses.

Opening Bell: Pioneer in On-Chain Stock Transformation

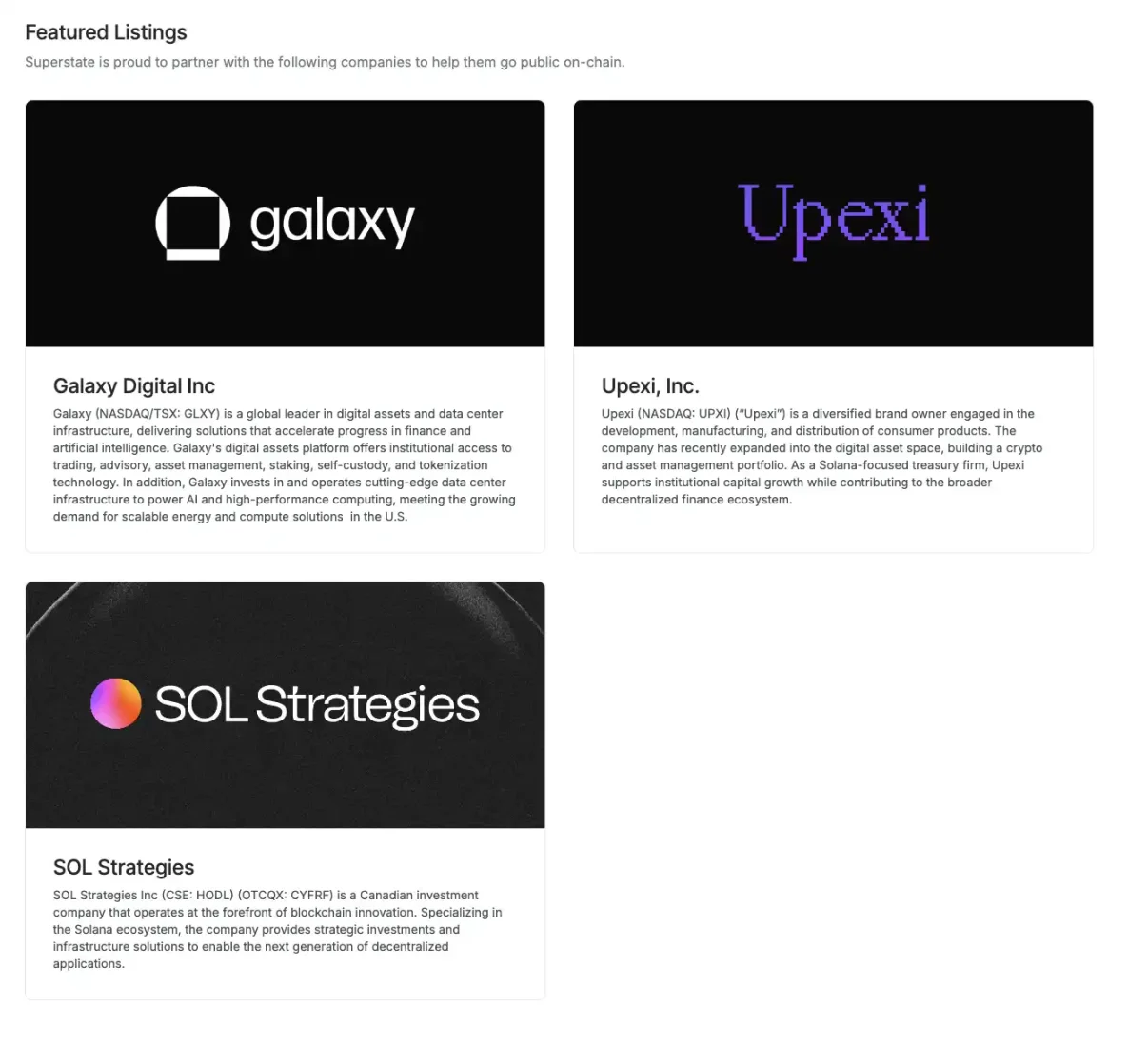

Launched by Superstate, Opening Bell offers another path—directly enabling companies to move their own stocks onto the blockchain. Unlike previous third-party models buying shares and issuing tokens, here the company itself becomes the issuer. In May 2025, Superstate—a compliant fintech firm founded by Compound creator Robert Leshner and others—announced Opening Bell, allowing SEC-registered stocks or qualified private companies to trade 7×24 on the Solana blockchain. Simply put, public or private companies can issue on-chain stock tokens via Opening Bell that represent actual legal equity (not synthetic mirror tokens).

The first adopters include Nasdaq-listed Upexi (ticker UPXI) and Canadian firm SOL Strategies. Galaxy Digital, recently discussed due to its Ethereum stock-token structure, also participated (though only SOL Strategies’ case isn’t yet listed on Nasdaq). This requires rigorous legal architecture—for example, Superstate is registered in the U.S. as a digital transfer agent, ensuring on-chain shareholder registries sync with traditional records.

Opening Bell marks deeper integration between traditional finance and blockchain. Through this platform, company stocks can trade in real-time, 24/7—offering unprecedented flexibility and transparency, making stocks as “always-on” as cryptocurrencies. Private companies also gain early liquidity opportunities: firms planning IPOs or not急于going public can use on-chain stocks to reach global investors for fundraising or shareholder exits. Superstate explicitly states that Opening Bell targets both listed companies and “late-stage private firms” seeking liquidity.

Naturally, regulatory approval remains essential. Current on-chain plans by SOL Strategies and others have submitted filings to the SEC, but all note “pending regulatory approval.” Still, the trend shows regulators are engaging more openly on asset tokenization. The U.S. SEC held a dedicated roundtable in 2025 discussing securities tokenization, with public support voiced by leaders like Blackstone’s CEO and Robinhood’s CEO. Superstate, already experienced in stablecoins (USTB) and on-chain treasury funds, is well-positioned to expand into equities at this opportune moment.

For Pre-IPO purposes, Opening Bell offers a quasi-IPO alternative—companies can skip the lengthy traditional IPO process and achieve public trading via blockchain during private stages. For example, a unicorn could first issue partial equity tokens on Opening Bell, then formally IPO or merge later when ready. This resembles past OTC markets but, with blockchain, achieves far greater transparency and efficiency.

In a sense, if this model gains acceptance, future IPOs may no longer need Wall Street underwriters but could happen entirely on-chain. Viewed this way, Superstate is like Nasdaq’s “Binance Alpha.”

Has the Era of Investment Democratization Arrived?

Making private company investment opportunities more open and efficient is undoubtedly an exciting trend for the average investor. From a wealth opportunity standpoint, it helps narrow the gap between the public and institutional investors. Yet the current on-chain Pre-IPO landscape remains a mix of promise and risk. “Regulatory compliance” and “resistance from target companies” loom as Damocles’ swords over these projects.

Embracing regulation and collaboration should be the main direction for on-chain Pre-IPO trading. Increasingly, traditional financial institutions and investors are showing interest. For example, Hong Kong Exchange and Nasdaq are researching tokenized securities; prominent VCs may consider partnering with these platforms to release partial shares on-chain without affecting company control. This new LP-GP collaboration model, if successful, could greatly accelerate the adoption of private equity tokenization. Undoubtedly, on-chain Pre-IPO trading is a promising blue ocean. The “Trojan horse” of freely trading private equity might ultimately unlock the gates to the ultimate form of capital markets—perhaps we’re just a few steps away from those gates.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News