IPOs of Cryptocurrency Companies Expected in 2026

TechFlow Selected TechFlow Selected

IPOs of Cryptocurrency Companies Expected in 2026

The “water sellers” of the crypto industry are collectively heading to the public market.

By David, TechFlow

In 2025, crypto companies raised $3.4 billion in the U.S. stock market.

Circle and Bullish each raised over $1 billion; Gemini surged 14% on its Nasdaq debut. By January 2026, BitGo rang the bell on the NYSE, jumping 24.6% on its first day and achieving a $2.6 billion market capitalization.

These pioneers proved one thing: Wall Street is willing to pay for compliant crypto infrastructure.

The pipeline is even wider in 2026. Kraken, Consensys, and Ledger are all lined up for IPOs, with valuations ranging from several hundred million to $20 billion. Even CertiK—the security auditing firm—announced its IPO plans at the World Economic Forum in Davos.

Exchanges, wallets, custodians, security providers… the “water carriers” of the crypto industry are collectively marching toward public markets.

When will they go public? At what valuations? What risks lie ahead? Let’s examine them one by one.

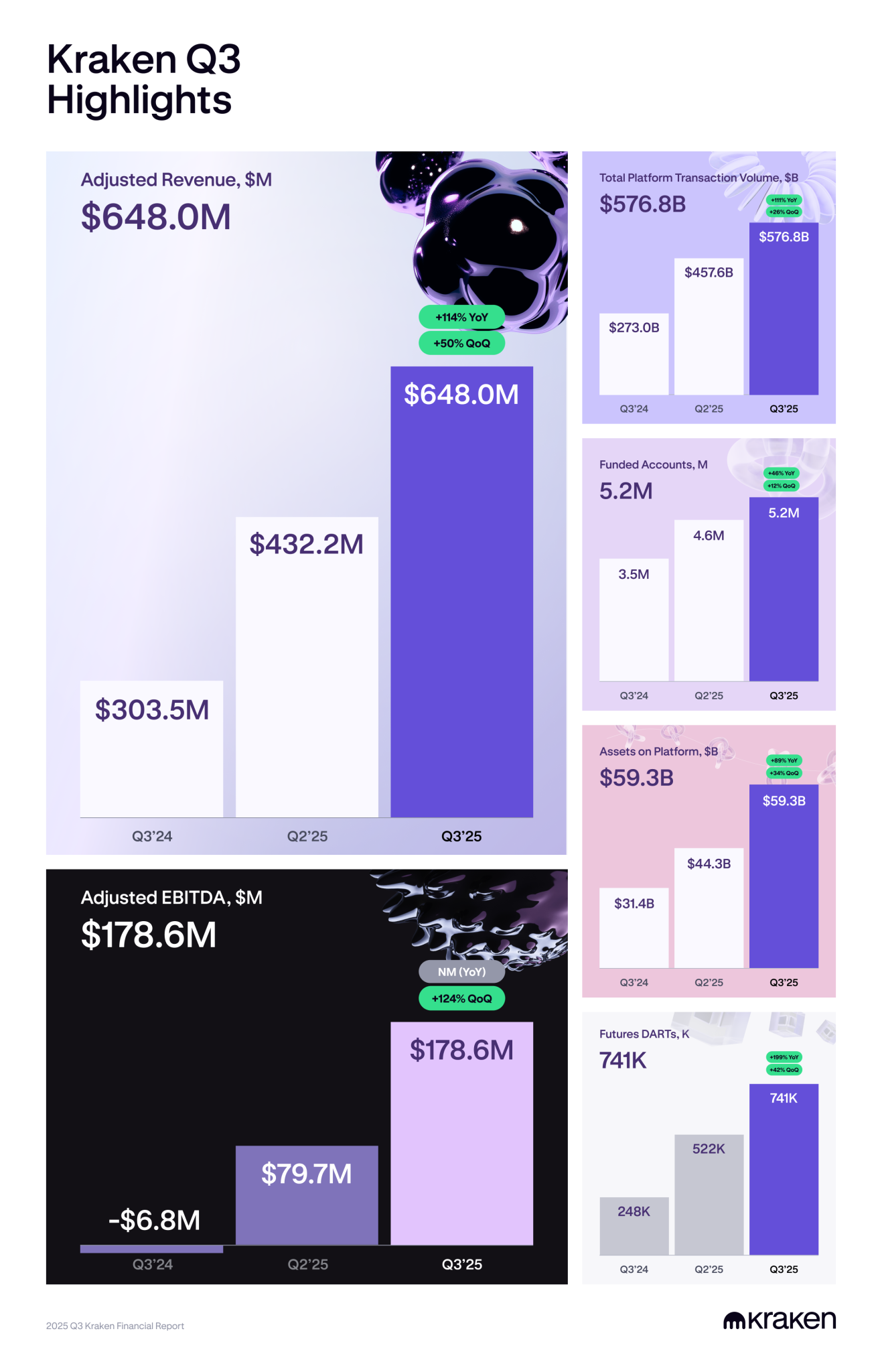

1. Kraken: A $20 Billion Compliance Benchmark

Estimated Market Cap: $20 billion

Estimated Timing: First half of 2026

Kraken is one of the oldest crypto exchanges, founded in 2011—one year before Coinbase. Yet it will list five years later than Coinbase. During that gap, Kraken faced an SEC lawsuit, settlement negotiations, and operational overhauls—ultimately securing dismissal of the SEC’s case in March 2025.

Its financials are solid:

Revenue reached $1.5 billion in 2024, with adjusted EBITDA exceeding $400 million. In Q3 2025 alone, revenue hit $648 million—a 50% year-on-year increase. Assets under management totaled $59.3 billion; quarterly trading volume reached $576.8 billion.

In November 2025, Kraken closed an $800 million pre-IPO round at a $20 billion valuation. Investors included Citadel Securities, Jane Street, and DRW—top-tier traditional market makers signaling their bet that crypto exchanges will become part of core financial infrastructure.

In the same month, Kraken confidentially filed its S-1 registration statement, targeting a listing in the first half of 2026.

If successful, Kraken would become the second major crypto exchange listed on U.S. markets after Coinbase—and the first to complete the full listing process in the “post-Gensler era.”

2. Consensys: MetaMask’s Parent Company Eyes a Public Listing

Estimated Market Cap: $7 billion (2022 valuation)

Estimated Timing: Mid-2026

Consensys owns some of crypto’s most valuable products: MetaMask, with 30 million monthly active users; Infura, powering the backend infrastructure for most Ethereum dApps; and Linea, a leading Ethereum Layer 2 network. It functions as Ethereum’s “plumber”—nearly every developer relies on its tooling.

Founded by Ethereum co-founder Joseph Lubin, Consensys raised $450 million in 2022 at a $7 billion valuation. It is now working with JPMorgan and Goldman Sachs to prepare for an IPO, aiming for mid-2026.

The prospectus is expected to spotlight revenue from MetaMask Swaps—a feature enabling users to trade tokens directly within the wallet, charging a 0.875% fee per transaction. In 2025, MetaMask added native Bitcoin support, expanding from a purely EVM-based wallet into a multi-chain solution—aiming to keep users within its ecosystem.

The key question surrounding Consensys’ IPO lies in reconciling its MASK token and public listing. Will token holders’ interests conflict with those of shareholders? This may become a landmark case in crypto corporate governance.

3. Ledger: Hardware Wallet Seeks to Tell a Software Story

Estimated Market Cap: $4 billion

Estimated Timing: 2026

Ledger has sold over 6 million hardware wallets, safeguarding more than $100 billion in Bitcoin for users. But it no longer wants to be seen merely as a “hardware vendor.”

Over the past two years, CEO Pascal Gauthier has frequently appeared in New York, pitching investors on Ledger’s vision to become the “Apple of self-custody.”

The pivot centers on Ledger Live—an application integrating hardware wallets, software wallets, staking, and DeFi interactions. The goal: shift from one-time hardware sales to recurring subscription revenue.

Wall Street appears receptive to this narrative.

On January 23, the Financial Times reported that Ledger is in talks with Goldman Sachs, Jefferies, and Barclays regarding a NYSE IPO, targeting a valuation above $4 billion—nearly triple its $1.5 billion valuation in 2023.

This ambitious valuation is backed by performance.

In 2025, Ledger’s revenue reached hundreds of millions of dollars, according to Gauthier, who called it the company’s “record-breaking year.” After the FTX collapse, the slogan “Not your keys, not your coins” regained traction, driving both institutional and retail adoption of self-custody solutions.

Last year, crypto theft hit a record $17 billion—ironically strengthening Ledger’s value proposition.

Still, hardware wallets remain too complex for mainstream users. Ledger’s growth ceiling hinges on whether it can meaningfully lower that barrier to entry.

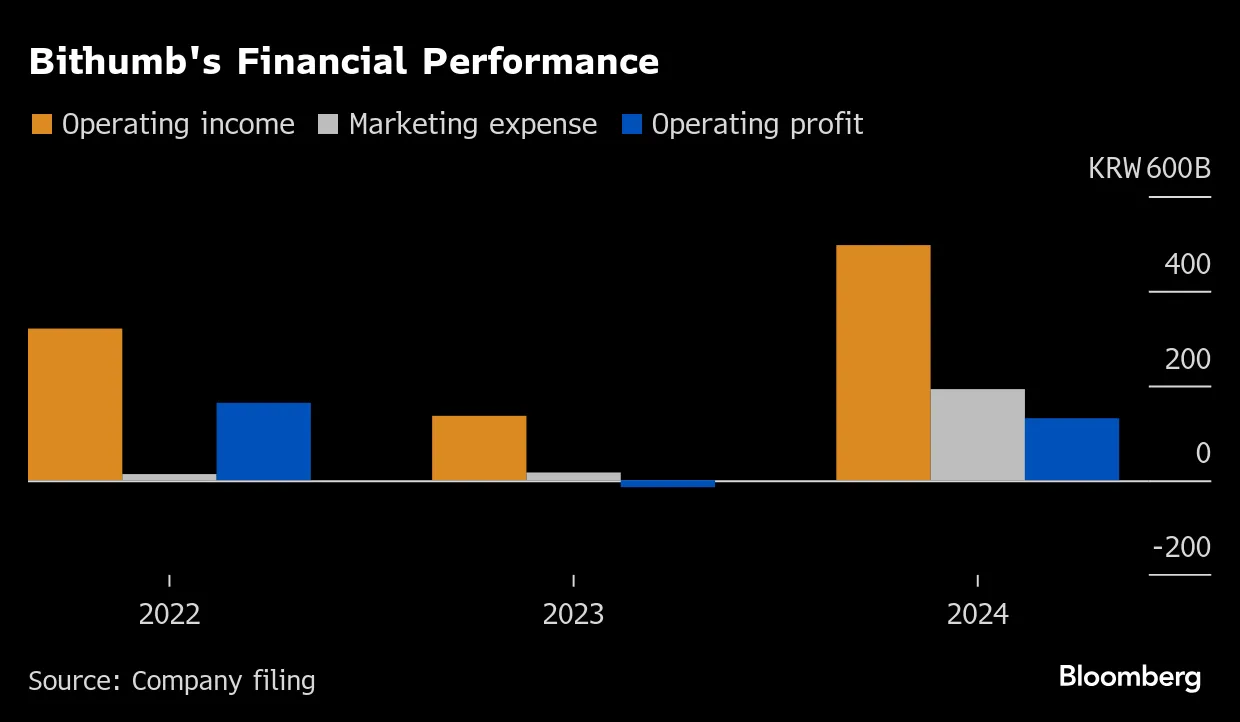

4. Bithumb: Korea’s Veteran Exchange Stages a Comeback

Estimated Market Cap: Undisclosed

Estimated Timing: 2026

Listing Venue: Korea’s KOSDAQ (Nasdaq also considered)

Bithumb was once Korea’s largest crypto exchange—until it was overtaken by Upbit. Today, Upbit commands over 80% of the Korean market, while Bithumb holds only 15–20%.

In 2024, Bithumb launched a zero-fee campaign, pushing its market share back to ~25%. This was a capital-intensive user-acquisition battle—possibly intended to bolster its IPO prospects.

Samsung Securities serves as lead underwriter. An initial plan targeted a KOSDAQ listing in the second half of 2025—though Nasdaq was also considered. As of now, the timeline has slipped to 2026.

Crucially, Bithumb says this IPO is *not* about fundraising. The company holds over ₩400 billion (~$300 million) in financial assets—so liquidity isn’t the driver. Rather, the aim is to “build market trust” by subjecting internal governance and finances to public audit.

This rationale stems from Bithumb’s turbulent history.

In 2023, Korean tax authorities raided its offices over suspected fraudulent trading. Multiple executives were investigated for alleged bribery related to token listings; former CEO Lee Sang-jun stepped down. A 2017 service outage led to a six-year legal battle, culminating in court-ordered compensation to users.

To prepare for the IPO, Bithumb restructured leadership: Former Chairman Lee Jung-hoon rejoined the board—having recently been acquitted of fraud charges linked to an acquisition deal. The new CEO is his close ally.

Korea has 18 million crypto users—its daily crypto trading volume regularly exceeds that of the domestic stock market.

Bithumb’s IPO signals institutionalization of Korea’s crypto market. Yet given its legacy baggage, investors will scrutinize governance issues closely.

5. CertiK: Security Audit Leader Amid Controversy

Estimated Market Cap: $2 billion

Estimated Timing: Late 2026 – Early 2027

On January 23 at the Davos Forum, CertiK CEO Gu Ronghui announced the company is advancing toward an IPO.

Founded in 2018 and headquartered in New York, CertiK is the largest blockchain security auditing firm—serving over 5,000 clients and auditing code protecting roughly $600 billion in digital assets.

Its investor roster is formidable: Binance was its earliest and largest financial backer; SoftBank Vision Fund, Tiger Global, Sequoia Capital, and Goldman Sachs have all invested. Its $2 billion valuation was set during its Series B3 round in 2022.

Yet CertiK remains one of crypto’s most controversial firms.

Last year’s Kraken incident drew wide attention. CertiK discovered a vulnerability allowing arbitrary account top-ups during testing—and transferred approximately $3 million. CertiK labeled it a “white-hat operation”; Kraken accused it of extortion. The two publicly clashed before CertiK returned the funds—but its reputation suffered.

Earlier, CertiK had audited Huione Guarantee, a Cambodian platform used for money laundering, trading hacking tools and personal data—even selling electric shock devices to scam compounds across Southeast Asia. CertiK later apologized, but the episode exposed serious gaps in its own risk controls.

Gu Ronghui describes the IPO as the “natural next step” following continuous product and technology expansion.

Yet once the prospectus goes public, investors will inevitably revisit these controversies. Rebuilding trust is CertiK’s greatest challenge on its path to listing.

Overall, the 2026 wave of crypto IPOs is likely no coincidence.

Regulatory conditions are shifting. SEC Chair Gary Gensler has departed; his successor takes a more crypto-friendly stance—leading to dismissals of both Kraken’s and Consensys’ lawsuits. With the window open, everyone is rushing through.

Capital structures have also reached a breaking point. These firms have raised multiple private rounds—accumulating growing numbers of shareholders and increasingly illiquid employee options. Coinbase’s five-year track record proves crypto firms can thrive in public markets. Those waiting in line see little reason to delay further.

For retail investors, however, this IPO cohort demands careful differentiation.

Kraken and Ledger generate real revenue with clear business models; Consensys boasts MetaMask—a gateway product—but faces unresolved tensions between token holders and shareholders. CertiK enjoys brand recognition yet carries reputational risk; Bithumb tells a purely domestic Korean story.

Before buying in, understand exactly what you’re buying.

For the companies themselves, going public is just the beginning.

Surviving in public markets depends on whether they can shed the “crypto” label—and earn recognition as “financial infrastructure.” It took Coinbase five years to convince Wall Street it’s more than just a speculative trading platform.

For the rest, the road ahead remains long.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News