Circle leads, Kraken awaits: decoding the 2025 crypto IPO new cycle

TechFlow Selected TechFlow Selected

Circle leads, Kraken awaits: decoding the 2025 crypto IPO new cycle

The 2025 cryptocurrency IPO wave is poised to launch.

Author: Launchy

Translation: TechFlow

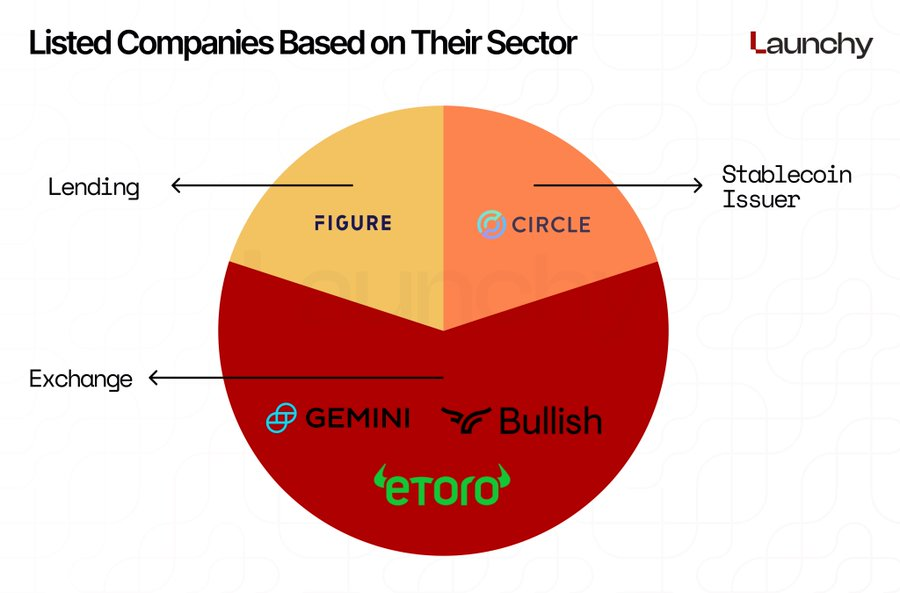

IPOs in the crypto industry are heating up. Circle's major listing has reopened the door to public markets, triggering a wave of potential listings that could last throughout the cycle. Venture capital firms predict three to fifteen companies could go public this quarter, including several asset-holding firms.

It’s not just about timing. Stablecoin settlement volumes now rival Visa’s, many companies generate over $100 million in annual revenue, and Washington is adopting a more open stance toward the sector. IPOs are finally being seen as an exit path on par with token launches. While tokens still dominate due to speed and liquidity, equity listings are forcing investors to think differently.

This article explores the leading companies behind the first wave of 2025 IPOs and the future direction of the crypto market.

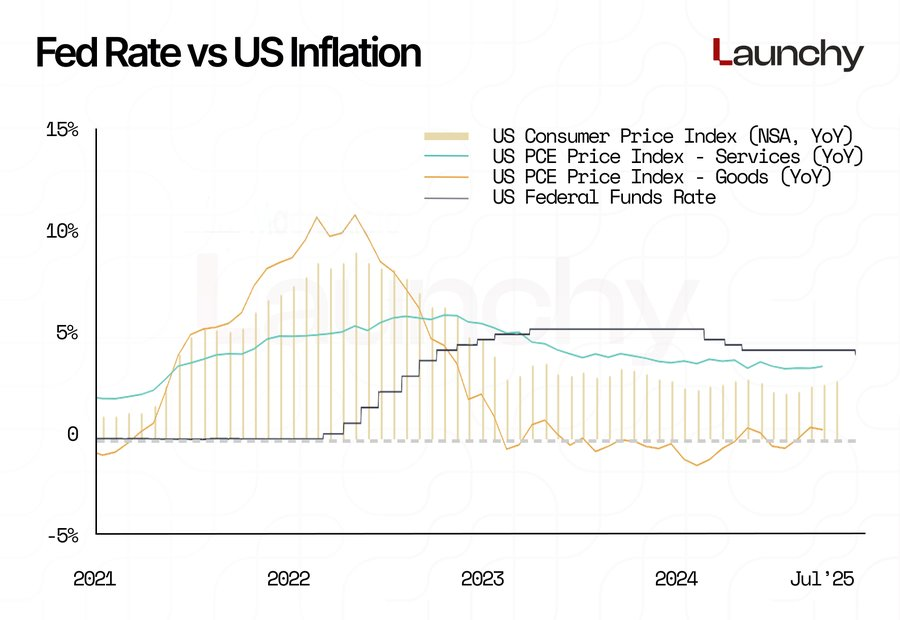

From Bitcoin Cycles to ETFs: Why the IPO Timing Is Right

This wave is no accident. Interest rates are stabilizing, stock markets are strong, and investors are hungry for growth. With audited revenues, crypto companies now appear ready for public markets.

Bitcoin’s 2024 halving pushed prices above $115,000 by September 2025, improving balance sheets and boosting market sentiment. Bull markets have historically aligned with corporate expansion, and this time is no different.

The regulatory environment has also shifted. The approval of ETFs and a softer stance from the U.S. Securities and Exchange Commission (SEC) have made equity investors more comfortable with crypto. Combined with the trend toward tokenization, the conditions for IPOs appear tailor-made.

Overview of Publicly Listed Companies

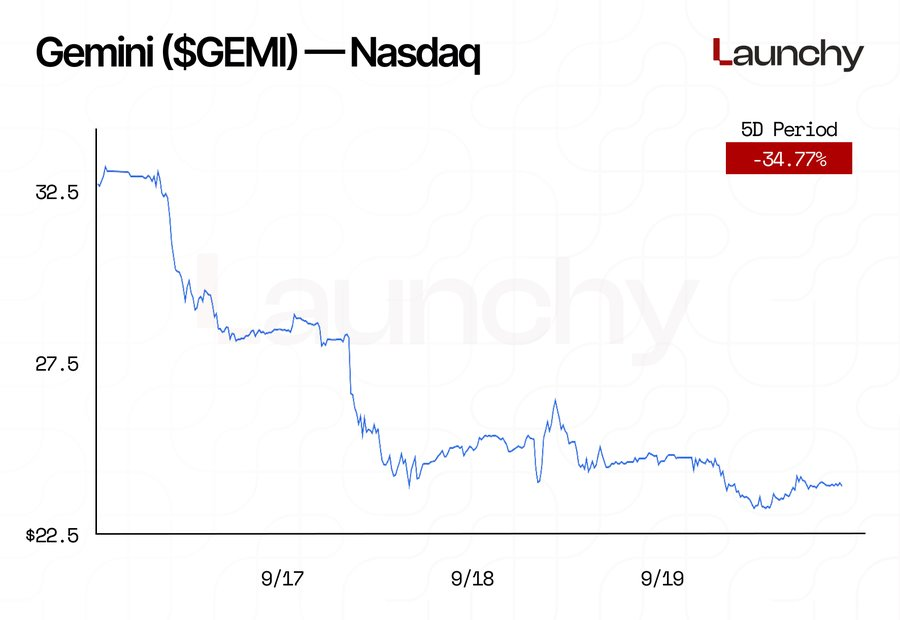

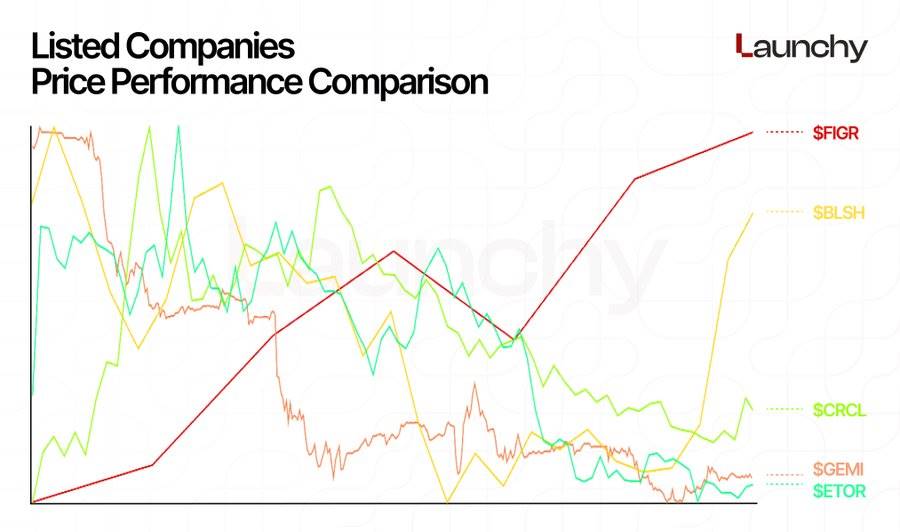

Gemini ($GEMI) — Nasdaq

Listed on September 12, 2025, at $28 per share, raising $425 million. The stock surged above $40 but quickly fell below its IPO price, dropping over 30%. The Winklevoss brothers still control the majority of shares.

Bullish ($BLSH) — New York Stock Exchange

Listed on August 13, 2025, at $37 per share, raising $1.15 billion. Shares climbed to $118 on the first day before settling in the $50 range. However, Q2 net income reached $108 million—a major turnaround from last year’s losses.

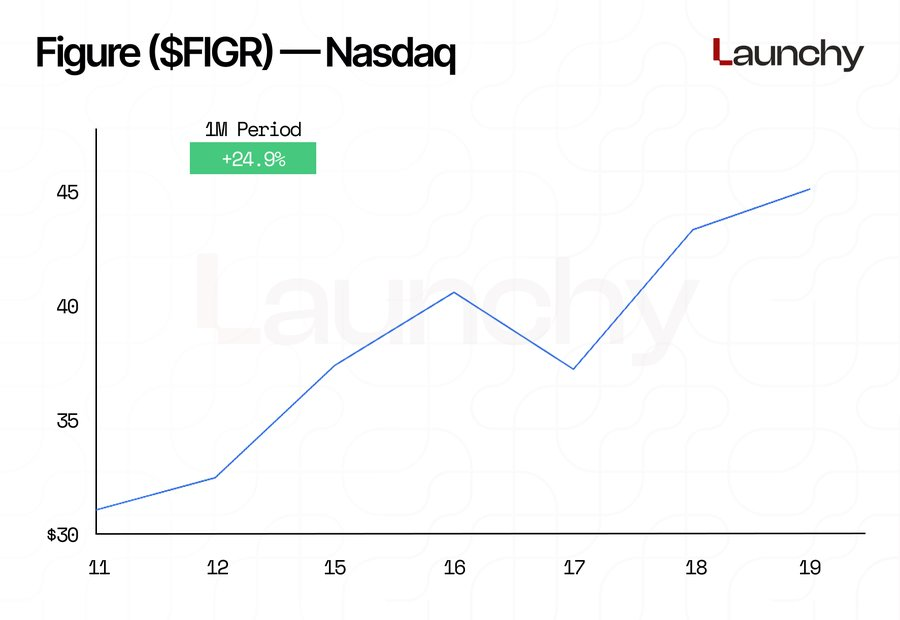

Figure ($FIGR) — Nasdaq

Listed on September 11, 2025, at $25 per share, raising $787 million. Opened at $36 and currently trades steadily in the $40 range.

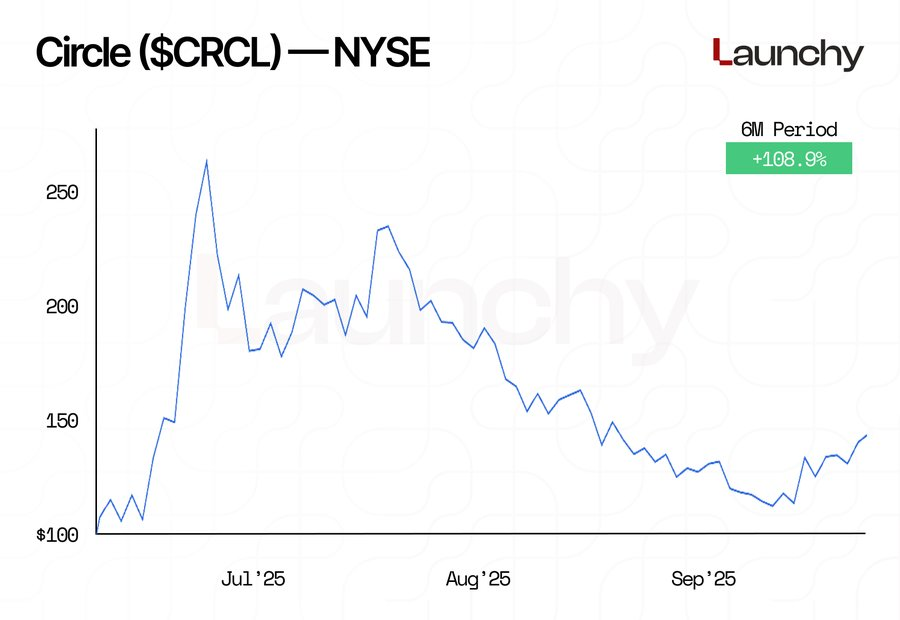

Circle ($CRCL) — New York Stock Exchange

Listed on June 5, 2025, at $31 per share, raising $1.1 billion. Shares surged 235% on the first day and now trade above $140—more than double the IPO price. Circle remains the standout public company.

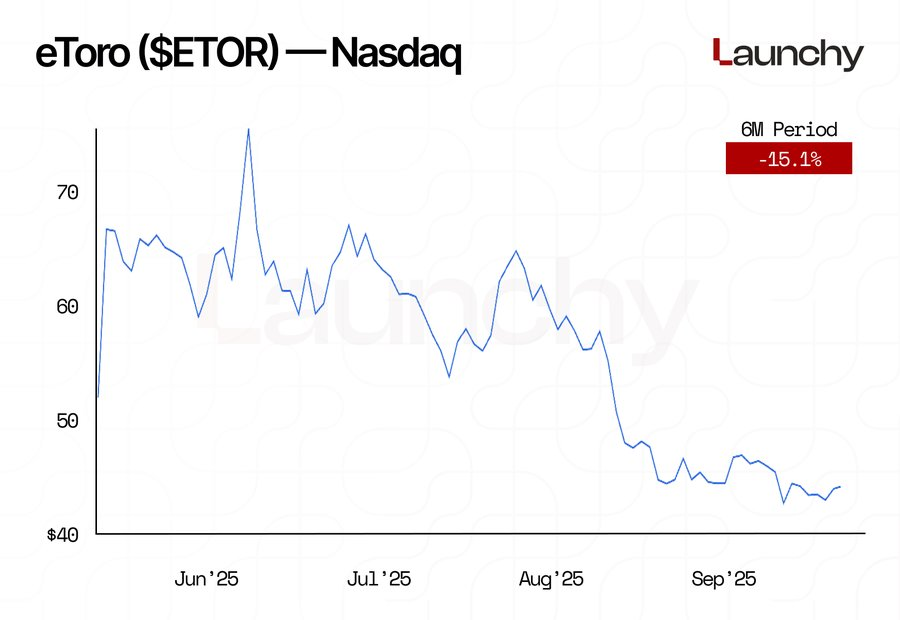

eToro ($ETOR) — Nasdaq

Listed on May 14, 2025, at $52 per share. Closed its first day at $67 but later dropped into the $40 range.

Report Card: Winners and Losers

Circle is clearly the biggest winner, still trading over 100% above its IPO price. Bullish had a strong debut but gave back most of its gains. Figure has shown steady performance with gradual price increases. Gemini faced setbacks immediately after listing, while eToro’s stock continues to decline.

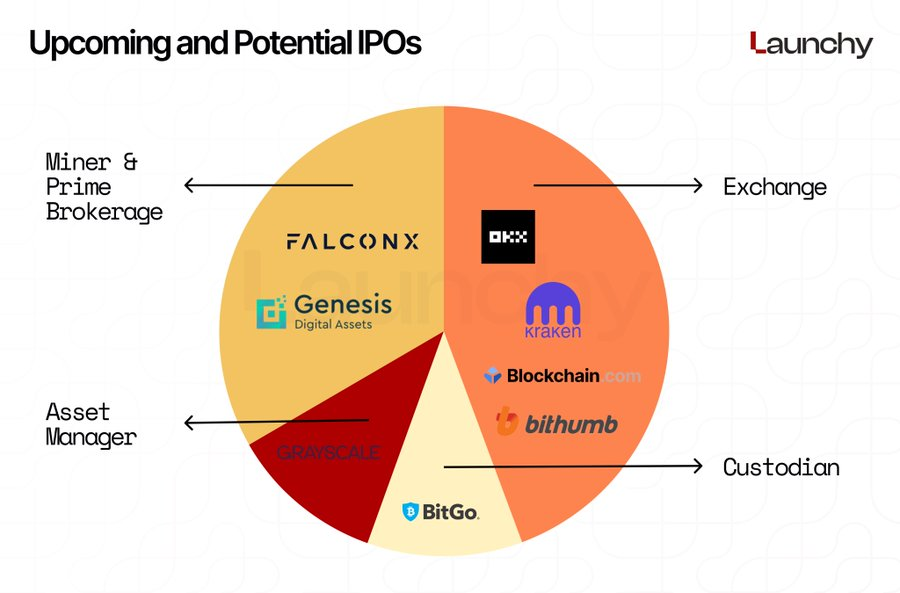

The Next Wave: Upcoming and Potential IPOs

-

BitGo has filed confidential documents.

-

Grayscale has also submitted an application, though specific data remains undisclosed.

-

Uphold is weighing IPO versus sale options.

-

OKX is relaunching its U.S. operations and considering a listing.

-

Kraken plans to go public in 2026 after resolving SEC issues.

-

Genesis Digital Assets aims to list following expansion in mining hardware operations.

-

FalconX is testing the market after achieving an $8 billion valuation.

-

Bithumb is restructuring for a potential listing on Korea’s Kosdaq.

-

Blockchain.com is preparing under new management.

Risks and Red Flags

Valuations may be inflated, earnings remain closely tied to trading cycles, and legal risks continue to plague parts of the industry. Insider selling could add further pressure. The real test will be whether these companies can deliver consistent quarterly growth.

Lessons from Past IPO Waves

The dot-com bubble and SPAC boom showed how quickly markets can overheat. Today’s crypto companies are different—they have real revenue and mature user bases, giving them stronger justification to present themselves to public investors.

Outlook

This year’s window may only be the beginning. Custodians, brokers, and exchanges are lining up, with giants like Consensys, Ledger, and Ripple potentially following. Hybrid equity-token offerings might emerge in the future, though likely not in the U.S. anytime soon.

The real question is performance. If these companies can prove their sustainability, IPOs may become as common as token launches. If not, this window could close rapidly.

Click here to read the full report

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News