Everything Can Be "Tokenized": The Revelation of Pre-IPO On-Chain Experiments

TechFlow Selected TechFlow Selected

Everything Can Be "Tokenized": The Revelation of Pre-IPO On-Chain Experiments

Decentralized infrastructure now has the capability to support complex financial products, laying the technological and community foundation for the future large-scale tokenization of traditional assets.

Author: ODIG

On-chain, how many types of assets are being traded?

The majority are crypto-native tokens, stablecoins, and so on. This year has seen rapid growth in RWA (real-world assets) such as bonds, stocks, gold, and more.

Innovation continues: recently, Hyperliquid, a leading decentralized exchange, launched perpetual contracts for AI unicorn OpenAI.

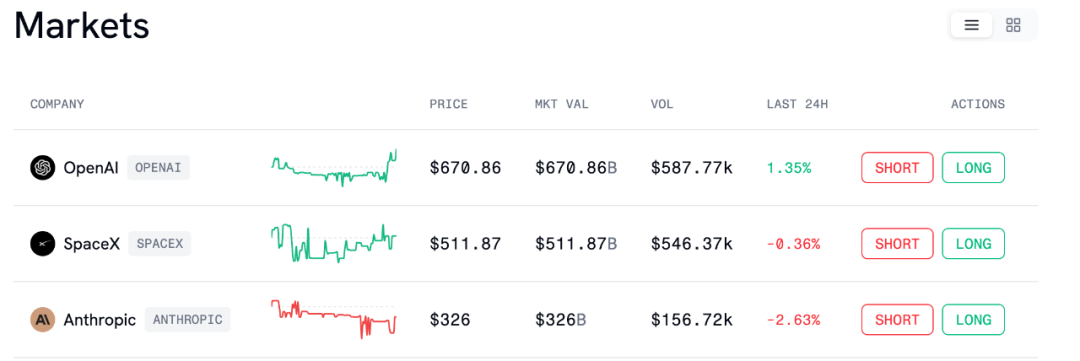

Yes, based on Hyperliquid's HIP-3 infrastructure, the decentralized derivatives platform Ventuals has deployed perpetual contracts for SpaceX, OpenAI, and Anthropic. The platform offers 3x leverage, with the open interest cap increased from $1 million to $3 million.

(*Hyperliquid allows builders to deploy custom perps by staking 500,000 HYPE via the HIP-3 framework. Using economic collateral and validator oversight, it prevents oracle manipulation through slashing penalties, while offering up to 50% fee sharing to deployers—ensuring security and incentivizing third-party innovation. Ventuals can be viewed as a sub-project built on HIP-3.)

These tokens can be seen as the "perpetualization" of Pre-IPO assets.

This concept is highly imaginative. In traditional financial markets, Pre-IPO equity trading is strictly regulated and extremely limited. Combining Pre-IPO valuations with perpetual contracts—without involving actual equity settlement—enables a "contractualized valuation game," allowing illiquid assets to emerge out of nothing and access larger market potential.

The positive sign is that after launch, trading activity has slightly increased, with both volume and price fluctuating within a certain range, reflecting some market demand for Pre-IPO asset trading.

(ventuals.com)

However, early-stage, low-liquidity markets still face numerous challenges: Is the oracle stable? Are risk controls reliable? These remain critical prerequisites for sustained development.

Regardless, the PerpDEX sector has significantly accelerated this year, and Pre-IPO tokens have the potential to reshape the on-chain derivatives landscape.

Jeff, founder of Hyperliquid, estimates the market for perpetual contracts on "any asset": "As finance fully moves on-chain, mobile applications built for non-crypto users will create billion-dollar market opportunities."

How to view the "contractualization" of Pre-IPO Tokens?

Core: authenticity and credibility of price data

As part of the RWA asset spectrum, feasibility depends on the standardization level of underlying assets. Pre-IPO assets have relatively reliable pricing sources to some extent. The key lies in continuously, stably, and verifiably delivering prices closer to true valuations—requiring rigorous scrutiny of oracle mechanisms (third-party tools that retrieve, verify, and transmit external data to blockchain-based smart contracts), which remains crucial for the sector’s long-term viability.

Regulatory arbitrage space

The regulatory environment remains unclear. The U.S. CFTC's Innovation Lab provides a regulatory sandbox for innovative derivatives; the EU's MiCA primarily focuses on spot trading; perpetual contracts still have room for innovation.

Hyperliquid’s HIP-3 enables contractualized, non-deliverable instruments, granting liquidity to unlisted assets—essentially offering an on-chain alternative to restricted trading.

Innovation driven by crypto-native design

On-chain speculation via Pre-IPO tokens can reflect retail investors’ views on private company valuations, potentially creating broader market impact.

If the market evolves further, it could form a "shadow market for restricted tradable assets"—a new market enabled by Web3 technological innovation.

Accelerating competition in the PerpDEX sector

Within the Perp DEX space, exchanges are constantly exploring new, high-growth trading instruments to attract more users and capture market share and liquidity.

Early data shows that trading volumes for Pre-IPO assets like OpenAI remain relatively limited, with primary impact still at the experimental innovation stage. However, if RWA-based perpetual contracts continue to be introduced, they may drive reallocation of liquidity between crypto and traditional assets.

The wave of universal perpetualization

2025 has been a turbulent year: on one hand, the crypto market is in a period of intense events and high volatility; on the other, RWA is rising, and RWA + perpetual contracts are evolving rapidly.

This marks a trend toward the "universal perpetualization" of assets—from crypto to traditional financial instruments. Prior to this, Injective led in tokenized stock perpetuals; by mid-2025, its Helix DEX had accumulated over $1 billion in trading volume, offering up to 25x leverage.

While current trading volumes for RWA perpetuals remain limited, the signal is clear: decentralized infrastructure now has the capacity to support complex financial products, laying technological and community foundations for broader onboarding of traditional assets onto blockchains.

This innovation will force traditional financial institutions to seriously consider leveraging blockchain technology to reduce transaction costs, improve efficiency, and ultimately may accelerate the tokenization of RWAs and the development of on-chain derivatives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News