Wall Street’s On-Chain Shift: NYSE and Nasdaq Compete to Launch Security Tokenization

TechFlow Selected TechFlow Selected

Wall Street’s On-Chain Shift: NYSE and Nasdaq Compete to Launch Security Tokenization

In this historic transformation, the biggest winners will be the entities and individuals who can transcend the cognitive boundaries between traditional finance and crypto, and who are the first to find optimal solutions amid the dynamic balance of regulation, innovation, and markets.

By FinTax

1. Introduction

On January 19, 2026, the New York Stock Exchange (NYSE) announced it is developing a blockchain-based tokenized securities trading platform, scheduled to launch upon receiving regulatory approval. Meanwhile, Nasdaq’s proposed rule change for tokenized securities—submitted in September 2025—is currently under review by the U.S. Securities and Exchange Commission (SEC).

When two of Wall Street’s largest trading giants simultaneously embrace blockchain—and when cryptocurrency intersects with traditional finance—the question is no longer “whether,” but “how.” To deeply understand the significance of this transformation, this article first clarifies the core meaning of securities tokenization, compares the approaches and strategic logic of the two exchanges, and explores how this trend will impact the crypto market and which variables warrant close attention.

2. The Starting Point of Transformation: What Is Securities Tokenization?

Securities are legal instruments that document and represent certain rights. Securities tokenization refers to the process of converting traditional financial assets—such as stocks, bonds, fund shares, and real estate—into digital tokens using blockchain technology. These tokens represent ownership, income rights, or other related rights over the underlying assets.

Securities serve as proof that their holders are entitled to the benefits specified on the instrument. Their record-keeping methods have evolved several times. Initially, investors held physical stock certificates. Later, the industry transitioned to electronic book-entry systems, where stocks became entries in the Depository Trust Company’s (DTC) database. Today’s discussion of securities tokenization means moving those entries onto a blockchain, creating digital tokens.

DTC is the central clearing and settlement institution for U.S. securities markets; nearly all stocks traded in the United States are ultimately registered and settled through DTC. Its database records information such as holder identities and share quantities, functioning as the “general ledger” of the U.S. securities market. Understanding DTC’s role is critical to grasping the key differences between the two exchanges’ proposals discussed later.

Having clarified the essence of securities tokenization, the next question arises: How do these two exchanges respond differently to the same trend?

3. Two Paths: A Comparison of NYSE and Nasdaq’s Approaches

3.1 NYSE: Building a New On-Chain Trading Venue

The NYSE plans to establish an entirely new, independent tokenized securities trading platform. This platform will operate in parallel with its existing equity trading system but use blockchain technology for post-trade clearing and settlement.

The platform’s core features can be summarized in four aspects:

- First, 24/7 trading. The current U.S. equity market operates only during specific weekday hours (9:30 a.m. to 4:00 p.m. ET), whereas the new platform aims to support uninterrupted trading around the clock, seven days a week.

- Second, instant settlement. The current market uses T+1 settlement—meaning trades executed today settle on the next business day. The new platform aims to achieve immediate settlement upon trade execution, enabling faster capital turnover and lower counterparty risk.

- Third, stablecoin financing. The platform will support fund settlement via stablecoins—a type of cryptocurrency pegged to the U.S. dollar and designed for price stability—allowing investors to transfer and settle funds outside traditional banking hours.

- Fourth, fractional share trading. The platform will allow investors to purchase shares based on dollar amounts rather than whole shares—for example, buying $50 worth of Apple stock instead of paying for an entire share.

The NYSE explicitly states that holders of tokenized stocks will enjoy identical rights to traditional shareholders, including dividends and voting rights. In other words, these are not synthetic assets or derivatives—they represent actual securities rights moved on-chain.

3.2 Nasdaq: Adding a Tokenized Settlement Option Within the Existing System

Nasdaq’s approach differs sharply from the NYSE’s. Rather than building a new trading venue, Nasdaq intends to add a tokenized settlement option within its existing trading infrastructure.

Matt Savarese, Nasdaq’s Head of Digital Assets, explained in an interview: “Investors may choose to hold shares in tokenized form on the blockchain—or continue using traditional account systems. The fundamental nature of the stock remains unchanged: ticker symbols and the unique security identifier (CUSIP) remain identical, making tokenized and traditional forms fully interchangeable and equivalent.”

Specifically, investors trading stocks on Nasdaq will experience no change in the trading process—same order book, same pricing, same trading rules. The only difference lies in the post-trade settlement phase: investors may choose either traditional settlement or tokenized settlement. If they opt for the latter, DTC will register the corresponding shares as blockchain tokens.

Nasdaq’s tokenization functionality will become effective once DTC’s related infrastructure and necessary regulatory approvals are in place—expected as early as the end of Q3 2026.

3.3 Key Differences Between the Two Approaches

A simple analogy helps clarify the distinction: Nasdaq’s approach is akin to adding a digital book-entry option at an existing bank branch’s teller counter—customers still conduct business at the same location, using the same procedures, except choosing to record their holdings on a blockchain. By contrast, the NYSE’s approach resembles opening a new, 24-hour digital bank adjacent to the existing branch—one built on an entirely new technical system capable of delivering services unavailable at the traditional branch.

More precisely, the primary differences between Nasdaq’s and the NYSE’s proposals lie in the trading layer and the fund settlement layer:

- Trading Layer: NYSE builds a standalone platform; Nasdaq integrates into the existing system

The NYSE adopts a “parallel market” model: tokenized securities will trade on a dedicated new venue, and the same stock may quote simultaneously on both the traditional main board and the tokenized platform.

Nasdaq adopts a “unified market” model: tokenized and traditional stocks share the same order book and price discovery mechanism. This ensures market liquidity remains undivided, and investor trading experience remains identical to today’s.

- Fund Settlement Layer: NYSE enables instant delivery; Nasdaq maintains T+1

This is the most fundamental difference between the two approaches.

Nasdaq fully relies on DTC’s existing tokenization services and uses traditional fiat currency. After trade execution, Nasdaq transmits settlement instructions to DTC—blockchain merely adds a digital record layer atop the existing registration system, without replacing it. This architecture offers clear compliance pathways and controllable system risk, but also means it cannot break through the constraints of the current settlement cycle. Nasdaq has explicitly stated that tokenized securities will maintain T+1 settlement initially.

The NYSE, by contrast, plans to implement instant settlement (T+0) and supports stablecoin settlement—fundamentally eliminating time-bound operational limitations. Traditional markets require T+1 or even longer settlement cycles because processes like fund transfers, securities transfers, and clearing netting take time. The efficiency impact is significant: according to SIFMA data, after the U.S. market shortened settlement from T+2 to T+1, NSCC’s clearing fund size declined by approximately 29% (roughly $3.7 billion). Instant settlement promises considerably greater efficiency gains.

4. Strategic Divergence: Why the Two Exchanges Chose Different Paths

The NYSE and Nasdaq chose markedly different paths for securities tokenization—a divergence reflecting distinct judgments about risk, opportunity, and competitive dynamics. Analyzing these strategic logics helps us understand the core considerations driving traditional financial institutions’ adoption of blockchain technology.

4.1 Differing Trade-offs Between Innovation Space and Risk Isolation

Nasdaq’s choice to integrate into the existing system offers rapid deployment, minimal market disruption, and low initial investment. However, the trade-off is constrained innovation space: the legacy architecture prevents offering differentiated features like 24/7 trading or instant settlement. Fundamentally, Nasdaq is betting on “tokenization as an incremental feature”—it believes most institutional investors won’t abandon familiar trading workflows in the near term, and tokenization’s value lies in providing an optional capability—not disrupting the status quo.

The NYSE’s decision to build a standalone platform prioritizes risk isolation. The new platform operates independently; even if technical issues or regulatory disputes arise, they won’t affect the NYSE’s main board operations. Simultaneously, the standalone platform can be designed from the ground up to support novel capabilities like 24/7 trading and instant settlement—features difficult to realize within the existing architecture. More profoundly, the NYSE is positioning itself for next-generation market infrastructure: should instant settlement become an industry standard, early movers will gain substantial technological and user advantages.

4.2 Compliance Strategies: Differing Regulatory Engagement Approaches

Both exchanges place compliance at the center—but pursue distinct paths.

Nasdaq’s proposal strives to operate fully within the existing regulatory framework. Matt Savarese, Nasdaq’s Head of Digital Assets, emphasized: “We’re not disrupting the existing financial system—we’re advancing tokenization incrementally, within the SEC’s regulatory framework.” Nasdaq maximizes reuse of existing compliance architecture, minimizing regulatory uncertainty to the greatest extent possible.

The NYSE has chosen a more ambitious path. Establishing a new trading venue, introducing stablecoin settlement, and enabling 24/7 trading each raise novel regulatory questions. Yet the NYSE judges the current regulatory window a rare opportunity—to wait for full rule clarity before acting risks falling behind, whereas proactively shaping regulations may yield first-mover advantages. This collaborative, co-regulatory stance could prove advantageous amid an increasingly supportive regulatory environment.

4.3 Ecosystem Positioning: Hub Platform vs. Value-Added Service Provider

Nasdaq positions itself more as a provider of value-added services to existing clients. Its proposal essentially layers a technical option onto current operations, letting investors choose tokenized holding formats. This strategy minimizes client migration costs and adoption resistance—but also implies Nasdaq’s role in this transformation leans more toward “follower” than “definer.”

The NYSE’s strategy reveals stronger ecosystem-building intent. Its platform plans to offer non-discriminatory access to all qualified broker-dealers—indicating the NYSE aims to become a hub connecting traditional finance networks with the digital asset world, activating the entire traditional financial system’s distribution capacity. If successful, the NYSE would evolve from a single trading venue into an infrastructure provider bridging traditional and on-chain worlds—a far more expansive business model.

Neither strategy is inherently superior; success hinges significantly on external conditions—especially the pace of regulatory evolution. This leads directly to the next pivotal question: what shifts are occurring at the U.S. regulatory level, and how will they affect the implementation prospects of both approaches?

5. From Barrier to Catalyst: Shifts in the U.S. Regulatory Environment

The proactive moves by both exchanges into securities tokenization closely correlate with fundamental changes in the U.S. regulatory environment. Improving regulatory expectations have opened the door for traditional financial institutions to embrace blockchain.

5.1 Regulatory Paradigm Shift: From “Enforcement-Driven” to “Rule-Driven”

Over recent years, the SEC’s regulation of crypto assets left the industry with one dominant impression—not “rules,” but “enforcement”: high case volume, ambiguous boundaries, and unstable expectations, with innovation and compliance locked in prolonged tension. But beginning in 2025, the SEC’s narrative shifted noticeably. It began openly discussing “how to bring capital markets on-chain,” and experimented with exemptions, pilot programs, and tiered regulation to explore viable compliance pathways for tokenized securities, on-chain trading, and clearing. This shift stems from three realizations: consensus on blockchain’s settlement efficiency advantage; urgent institutional demand for instant settlement and 24/7 trading; and the crypto industry’s now undeniable economic and political influence.

5.2 Legislative Breakthrough: The GENIUS Act and Stablecoin Compliance

In July 2025, the GENIUS Act was formally signed into law—the first federal legislation specifically targeting stablecoins. It establishes a comprehensive regulatory framework for payment stablecoins, requiring issuers to hold one-to-one reserves in U.S. dollars or other low-risk assets, mandating monthly public disclosure of reserve composition, and requiring certification of disclosures by the CEO and CFO.

Stablecoins are critical infrastructure for achieving instant settlement in tokenized securities ecosystems. The NYSE explicitly identifies stablecoin financing as a core function of its new platform. Passage of the GENIUS Act provides legal certainty for stablecoins, removing major barriers for traditional financial institutions to participate in this domain. This explains why the NYSE feels confident incorporating stablecoin settlement into its plan—the legal uncertainty has largely been resolved.

5.3 Policy Coordination Across Executive and Regulatory Branches

On January 23, 2025, President Trump signed an executive order titled “Advancing American Leadership in Digital Financial Technology,” explicitly supporting responsible growth of digital assets and blockchain technologies across economic sectors, and establishing the Presidential Digital Asset Markets Working Group. At the regulatory enforcement level, the SEC launched a Cryptocurrency Task Force in January 2025, focusing on the full lifecycle of digital assets—including issuance, trading, and custody. From legislation and executive action to regulatory enforcement, the U.S. government’s stance toward digital assets has shifted from cautious observation to active guidance. This policy synergy provides indispensable institutional support for the NYSE’s and Nasdaq’s tokenization initiatives.

Regulatory clarity doesn’t just affect implementation timelines for the two exchanges’ proposals—it will profoundly reshape the entire crypto market’s landscape. How will this trend alter crypto market capital flows, infrastructure, and compliance boundaries?

6. Market Impact and Future Outlook

6.1 Capital Flows: A New Channel for Institutional Entry

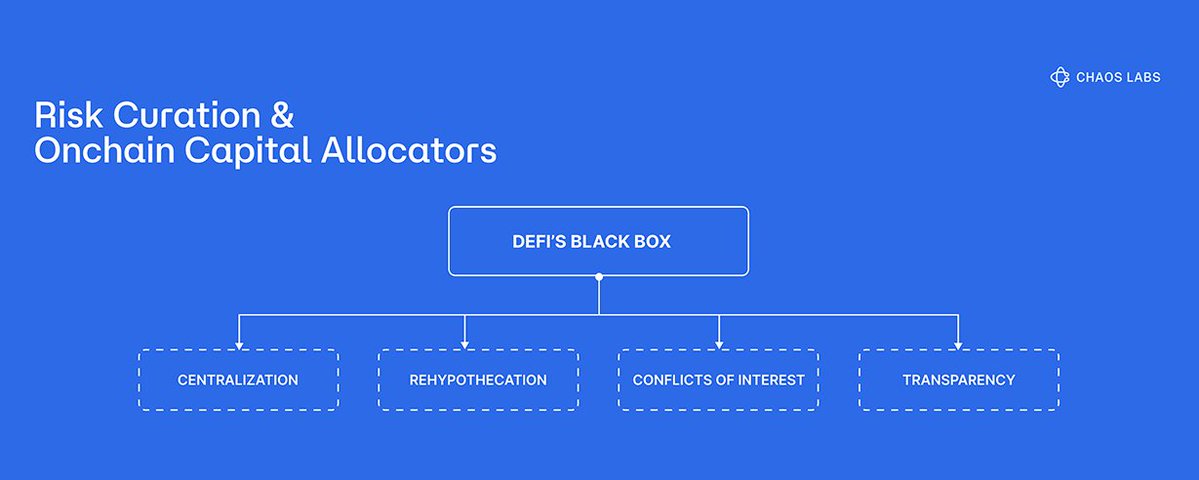

With clearer regulatory expectations, market participants are shifting from defensive to offensive postures, blurring the lines between DeFi and CeFi. For institutional investors, the NYSE’s and Nasdaq’s tokenization proposals provide a compliant, credible entry channel. A tokenized securities trading platform bearing the NYSE’s gold-standard brand and operating fully within the regulatory framework holds strong appeal for institutional capital prioritizing compliance and safety. This means large pools of capital previously on the sidelines due to compliance concerns may accelerate inflows into tokenized assets. Existing crypto exchanges may face short-term pressure. Yet long-term, the NYSE’s move effectively performs a “credit enhancement” for the entire asset tokenization sector—using its own credibility to accelerate regulatory clarity and market maturity.

6.2 Infrastructure: A Paradigm Shift in Settlement and Trading Mechanisms

Real-time settlement will reshape margin calculation models and significantly reduce counterparty risk. Traditional geographic and temporal arbitrage opportunities will shrink; 24/7 trading will transform global market interlinkages. Furthermore, on-chain liquidity aggregation will create new market depth, potentially giving rise to hybrid models combining professional market maker pools, automated market makers (AMMs), and order books.

6.3 Compliance Boundaries: From “Gray Zones” to “Clear Rules”

The entry of traditional financial institutions will drive up industry-wide compliance standards. As strictly regulated entities, the NYSE’s and Nasdaq’s tokenization proposals necessarily conform to existing securities laws—setting a de facto compliance benchmark for the industry. Concurrently, regulators are actively drafting specialized rules for tokenized securities, steadily narrowing the industry’s “gray zones.”

6.4 Risks and Challenges

Technically, seamlessly integrating mature traditional trading systems with blockchain technology is a complex systems engineering challenge. Blockchain network throughput, cross-chain interoperability, and smart contract security each require resolution—risks include immature cross-chain security technology and novel forms of on-chain market manipulation.

Although the regulatory environment has clearly improved, fragmentation risks persist. Jurisdictional delineation between the SEC and CFTC remains under clarification, and cross-jurisdictional regulatory recognition remains pending.

Market habits—shaped over decades—won’t change overnight. Institutional investors’ legal, compliance, and risk management teams need time to evaluate and trust this new model. A never-closing market also implies heightened volatility, demanding higher risk management capabilities from investors.

6.5 Key Variables Investors Should Watch

- Short Term (1–2 Years): Monitor regulatory approval progress. Nasdaq’s solution is expected to go live as early as end-Q3 2026, while the NYSE has not yet disclosed a timeline, stating only that its platform will launch upon regulatory approval. DTC’s tokenization pilot program is set to begin in H2 2026.

- Medium Term (3–5 Years): Track market structure evolution. Tokenized asset volumes are poised for breakthrough growth, and market maker roles will undergo fundamental change. The compliance technology race will focus on programmable compliance protocols, cross-jurisdictional mutual recognition, and privacy-preserving computation.

- Long Term (5+ Years): Monitor regulatory paradigm shifts. Regulatory focus may shift from “institutional regulation” to “protocol regulation,” with code-level compliance becoming standard. Governance models will innovate, including tokenized proxy voting and real-time governance mechanisms.

7. Conclusion

Founded in 1792 beneath a buttonwood tree on Wall Street, the NYSE—over two centuries later—is now migrating from physical infrastructure to the blockchain. As Nasdaq notes in its proposal, the U.S. equity market previously transitioned from paper certificates to electronic book-entry systems; tokenization represents the latest chapter in this evolutionary journey. In this historic transformation, the greatest winners will be those entities and individuals who transcend the mental boundaries between traditional finance and crypto—and who first identify optimal solutions balancing regulation, innovation, and market dynamics.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News