Has a subprime crisis emerged on-chain? The path to maturity for DeFi structured products

TechFlow Selected TechFlow Selected

Has a subprime crisis emerged on-chain? The path to maturity for DeFi structured products

The rise of OCCA and risk managers is an inevitable result of DeFi entering the structured products phase.

Author: Chaos Labs

Translation: AididiaoJP, Foresight News

The Rise of Risk Managers and Onchain Capital Allocators (OCCA)

DeFi has entered a new structural phase, where institutional trading strategies are being abstracted into composable, tokenized assets.

It all began with the emergence of liquid staking tokens, and Ethena Labs' introduction of tokenized basis trades marked a pivotal turning point for DeFi structured products. The protocol packaged a delta-neutral hedging strategy—previously requiring 24/7 margin management—into a synthetic dollar token that users could access with a single click, redefining their expectations of DeFi.

Yield products once limited to trading desks and institutions have now gone mainstream. USDe became the fastest stablecoin to reach $10 billion in total value locked.

Ethena's success confirms strong market demand for "institutional strategy tokenization." This shift is reshaping market structure and giving rise to a new class of "risk managers" or "onchain capital allocators" (OCCA), who package complex yield and risk strategies into simpler products for end users.

What Are Risk Managers and Onchain Capital Allocators (OCCA)?

There is currently no standardized definition for "risk managers" or "OCCA." These labels encompass various designs, but share one common trait: they all repackage yield-generating strategies.

Translator’s note: OCCA stands for Onchain Capital Allocator, which can be understood as professional fund managers or asset administrators in DeFi. They attract user funds by packaging complex strategies into simple products.

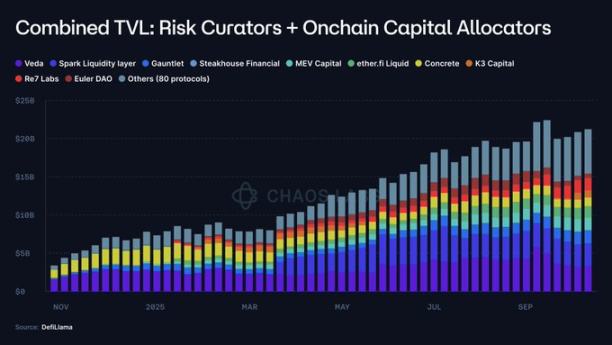

OCCAs typically launch branded strategy products, while risk managers often leverage modular money markets (such as Morpho and Euler), offering yield through parameterized vaults. The total value locked in these products has surged from less than $2 million in 2023 to $20 billion—an increase of roughly ten thousand times.

This growth raises several fundamental questions:

-

Where are deposits actually deployed?

-

Which protocols or counterparties are the funds exposed to?

-

Can risk parameters be flexibly adjusted even during extreme volatility? What assumptions underlie them?

-

How liquid are the underlying assets?

-

What are the exit paths in case of mass redemptions or bank runs?

-

Where exactly does the risk lie?

On October 10, the crypto market experienced its largest altcoin crash ever, affecting centralized exchanges and perpetual DEXs alike, triggering cross-market liquidations and automatic deleveraging.

Yet delta-neutral tokenized products appeared largely unaffected.

These products mostly operate like black boxes, offering little information beyond highlighted APYs and marketing slogans. A rare few OCCAs indirectly disclose protocol exposures and strategy details, but critical data—such as position-level holdings, hedging venues, margin buffers, real-time reserves, and stress-testing methodologies—is seldom made public; when it is, disclosures are often selective or delayed.

Without verifiable on-chain footprints or trading venue records, users struggle to determine whether a product's resilience stems from sound design, luck, or delayed loss recognition. Most of the time, they cannot even tell if losses have already occurred.

We observe four recurring weak points in design: centralized control, re-pledging, conflicts of interest, and lack of transparency.

Centralization

Most yield-generating "black boxes" are managed via multi-sig wallets controlled by external accounts or operators responsible for custody, transfers, and deployment of user funds. This concentration of control makes catastrophic losses highly likely in the event of operational errors—such as private key leaks or coerced signers. It also replicates the common bridge attack patterns seen in the previous cycle: even without malicious intent, a single compromised workstation, phishing link, or insider abuse of emergency permissions can cause massive damage.

Re-pledging

In some yield products, collateral is reused across multiple vaults. One vault deposits into or lends to another, which then cycles into a third. Investigations have revealed recursive borrowing patterns: deposits are "washed" through multiple vaults, artificially inflating TVL and creating recursive chains of "mint-lend" or "borrow-supply," continuously accumulating systemic risk.

Conflicts of Interest

Even when all parties act in good faith, setting optimal supply/borrow caps, interest rate curves, or selecting appropriate oracles is challenging. These decisions involve trade-offs. Markets that are too large or uncapped may deplete exit liquidity, preventing orderly liquidations and enabling manipulation. Conversely, overly restrictive caps hinder normal activity. Rate curves that ignore liquidity depth may trap lenders’ funds. The issue worsens when curators are incentivized based on growth metrics, creating misalignment between their interests and those of depositors.

Transparency

The October market purge revealed a simple truth: users lack effective data to assess where risks lie, how they are marked, and whether supporting assets remain sufficient. While publishing all positions in real time may be impractical due to front-running or short squeezes, a degree of transparency remains compatible with business models. For example, portfolio-level visibility, disclosure of reserve composition, and aggregated hedge coverage per asset can all be verified through third-party audits. Systems could also implement dashboards and proofs that reconcile custodied balances, locked or custodied positions against outstanding liabilities, provide proof of reserves and permission governance, without exposing transaction details.

A Viable Path Forward

The current wave of wrapped yield products is pushing DeFi away from its original principles of "non-custodial, verifiable, transparent" operations toward models resembling traditional finance.

There is nothing inherently wrong with this shift. DeFi's maturity creates space for structured strategies, which indeed require some operational flexibility and centralized operations.

But accepting complexity does not mean accepting opacity.

The goal should be to find a viable middle ground—enabling operators to run sophisticated strategies while preserving transparency for users.

To achieve this, the industry should move in the following directions:

-

Proof of Reserves: Instead of merely advertising APY, protocols should disclose underlying strategies, supported by regular third-party audits and PoR systems so users can independently verify asset backing at any time.

-

Modern Risk Management: Solutions exist to price and manage risks in structured yield products. Major protocols like Aave already use risk oracles to optimize parameters within decentralized frameworks, safeguarding the health and security of money markets.

-

Reduced Centralization: This is not a new problem. Bridge attacks have already forced the industry to confront issues around upgrade permissions, signer collusion, and opaque emergency powers. Lessons must be applied: adopt threshold signatures, key role separation, role segregation (proposal/approval/execution), just-in-time funding with minimal hot wallet balances, whitelisted withdrawal paths, time-locked upgrades via public queues, and narrowly scoped, revocable emergency permissions.

-

Limit Systemic Risk: Collateral reuse is inherent in insurance or restaking products, but re-pledging should be capped and clearly disclosed to prevent circular mint-borrow loops between interconnected products.

-

Transparent Incentive Alignment: Incentives should be as public as possible. Users need to know where risk managers’ interests lie, whether related-party relationships exist, and how changes are approved—turning black boxes into assessable contracts.

-

Standardization: Onchain wrapped yield assets now represent a $20 billion industry. This segment of DeFi should establish common taxonomies, minimum disclosure requirements, and incident tracking mechanisms.

Through these efforts, the onchain wrapped yield market can retain the advantages of professional structuring while protecting users through transparency and verifiable data.

Conclusion

The rise of OCCAs and risk managers is an inevitable outcome of DeFi’s evolution into structured products. Since Ethena demonstrated that institutional-grade strategies can be tokenized and distributed, the emergence of a professional allocation layer atop money markets was inevitable. The layer itself is not the problem—the issue lies in allowing operational freedom to replace verifiability.

The solutions are not complicated: publish proof of reserves matching liabilities, disclose incentives and related parties, limit re-pledging, reduce single points of control via modern key management and change controls, and incorporate risk signals into parameter governance.

In the end, success hinges on being able to answer three key questions at any time:

-

Are my deposits backed by real assets?

-

Which protocols, venues, or counterparties are my assets exposed to?

-

Who controls the assets?

DeFi does not have to choose between complexity and core principles. Both can coexist—transparency should scale alongside complexity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News