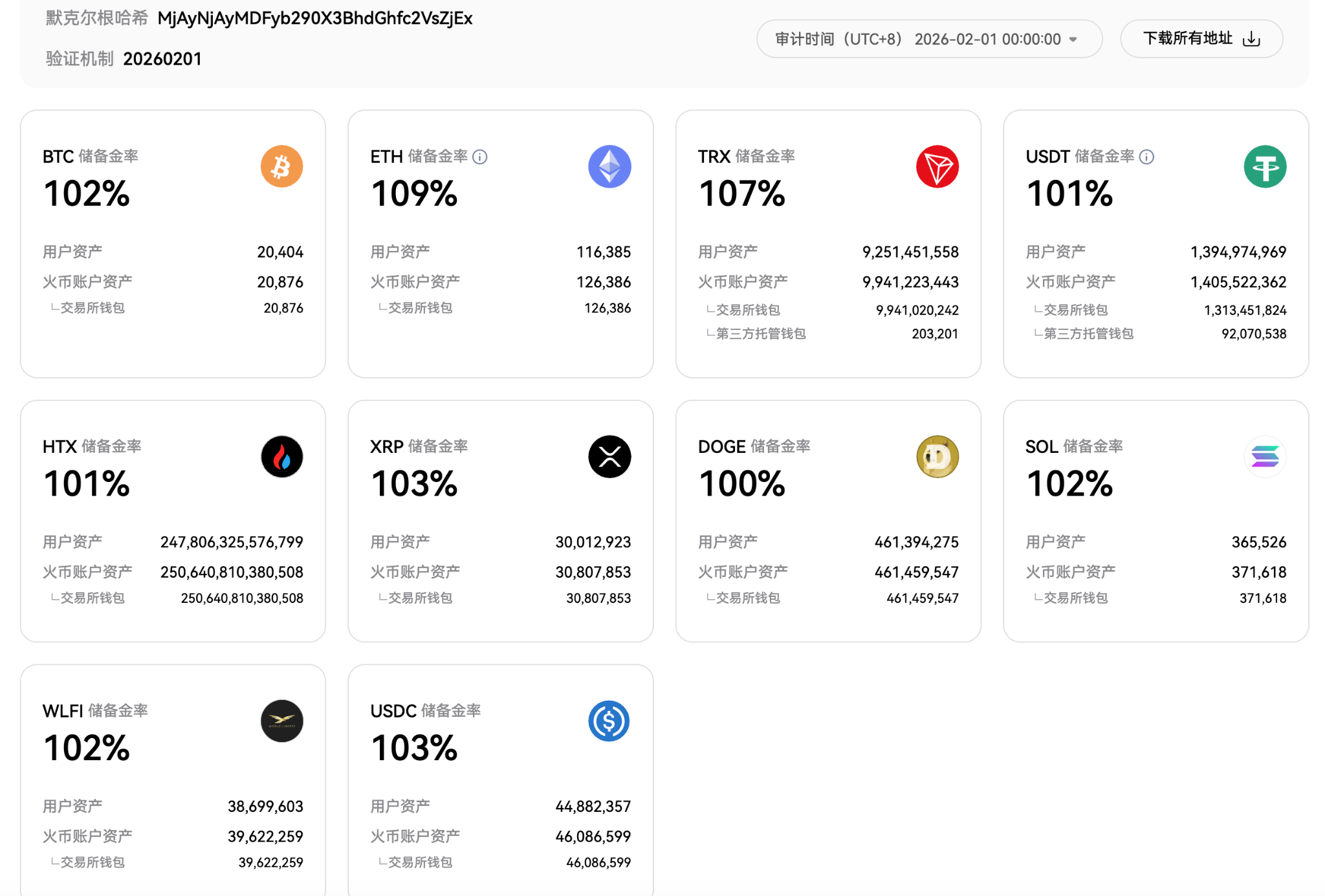

TechFlow News, February 10: According to the latest Merkle Tree Proof of Reserves (PoR) data released by HTX, as of February 1, 2026, the platform’s overall reserve ratio remains above 100%, with core assets maintaining robust coverage.

The latest reserve ratios are as follows: BTC (102%), ETH (109%), TRX (107%), USDT (101%), HTX (101%), XRP (103%), DOGE (100%), SOL (102%), WLFI (102%), and USDC (103%)—all major assets are fully reserved. Notably, the USDC reserve volume increased month-on-month, rising to 44,882,357 tokens in February. Regarding asset composition, the platform’s total asset size declined slightly from January, reflecting recent market volatility and portfolio rebalancing. Demand for stablecoin allocations rose, further optimizing the capital structure and sustaining strong overall risk control capabilities.

HTX has now published its Merkle Tree Proof of Reserves on a monthly basis for 40 consecutive months. Users may visit HTX’s official website “Assets – Proof of Reserves Report” page at any time to view the monthly updated PoR reports. HTX remains committed long-term to high-standard asset reserve management and transparent public disclosure, comprehensively safeguarding users’ asset security.