Bitcoin's "IPO era" has arrived: consolidation is not the end, but the starting point for accumulation

TechFlow Selected TechFlow Selected

Bitcoin's "IPO era" has arrived: consolidation is not the end, but the starting point for accumulation

比特币 1% 配置的时代已然落幕。

Author: Matt Hougan, Chief Investment Officer at Bitwise

Translation: Saoirse, Foresight News

The sideways consolidation of Bitcoin marks precisely the arrival of its "IPO moment." Why does this imply a higher asset allocation? The answer follows.

In Jordi Visser's recent article, he explores a key question: despite a steady stream of positive developments—strong ETF inflows, significant regulatory progress, and growing institutional demand—Bitcoin’s price action remains frustratingly flat.

Visser argues that Bitcoin is undergoing a "silent IPO," transitioning from a "far-fetched idea" into a "mainstream success story." He notes that during such transitions, stocks typically consolidate sideways for 6 to 18 months before beginning their upward trajectory.

Take Facebook (now Meta) as an example. On May 12, 2012, Facebook went public at $38 per share. For over a year afterward, its stock price fluctuated in a range, failing to surpass its IPO price for a full 15 months. Google and other high-profile tech startups exhibited similar patterns in their early public trading phases.

According to Visser, sideways consolidation doesn’t necessarily indicate problems with the underlying asset. Instead, it often reflects a transfer of ownership from early stakeholders to new investors. Founders and early employees—who took massive risks when the company was highly speculative—are now cashing out after achieving life-changing returns. This process of insiders selling and institutions buying takes time. Only once this shift in ownership reaches equilibrium does the asset resume its upward momentum.

Visser suggests that Bitcoin today is in a remarkably similar position. Early believers who bought Bitcoin at $1, $10, $100, or even $1,000 now hold generational wealth. Now that Bitcoin has gone mainstream—with ETFs trading on the NYSE, major corporations adding it to reserves, and sovereign wealth funds entering—the early holders finally have a viable exit path to realize their gains.

This is cause for celebration. Their patience has been rewarded. Five years ago, a $1 billion Bitcoin sale might have destabilized the entire market. Today, the ecosystem boasts diverse buyers and sufficient liquidity to absorb such large transactions far more smoothly.

To be clear, on-chain data does not provide a uniform picture of "who is selling," so Visser’s analysis represents only one factor among many influencing current market dynamics. Yet this factor is crucial, and reflecting on its implications for the future holds significant value.

Below are the two key takeaways I draw from this article.

Conclusion One: Long-Term Outlook Is Extremely Bullish

Many crypto investors read Visser’s piece and react with concern: "Early whales are selling Bitcoin to institutions! Do they know something we don’t?"

This interpretation is completely wrong.

Early investor selling does not signal the end of an asset’s lifecycle—it simply marks the beginning of a new phase.

Consider Facebook again. Yes, its stock traded below $38 for a year after IPO, but today it trades at $637—a 1576% gain from its IPO price. If I could go back to 2012, I would gladly buy every single share of Facebook at $38.

Certainly, investing in Facebook during its Series A round would have yielded even greater returns—but that also came with vastly higher risk than investing post-IPO.

Bitcoin today is no different. While the odds of Bitcoin delivering 100x returns in a single year may diminish, once the "asset distribution phase" concludes, substantial upside potential remains. As Bitwise outlined in our Long-Term Capital Market Assumptions for Bitcoin report, we project Bitcoin could reach $1.3 million per coin by 2035—and I personally believe this forecast is conservative.

Moreover, there’s an important distinction between the post-whale-selling Bitcoin market and the post-IPO equity market. After an IPO, a company must continue executing to justify its valuation—Facebook couldn’t jump from $38 to $637 overnight because it lacked the revenue and profits to support such a move. It had to grow earnings, expand into new businesses, and pivot to mobile, all while navigating execution risks.

Bitcoin faces no such requirement. Once early holders complete their exits, Bitcoin doesn’t need to "do" anything. To grow from its current $2.5 trillion market cap to match gold’s $25 trillion valuation, the only requirement is widespread adoption.

I’m not suggesting this will happen overnight, but it could unfold faster than Facebook’s 12-year climb.

From a long-term perspective, Bitcoin’s current consolidation is a gift. In my view, it’s the perfect opportunity to accumulate ahead of the next leg up.

Conclusion Two: The Era of 1% Bitcoin Allocation Is Over

As Visser notes, companies post-IPO are fundamentally less risky than in their startup days. They have broader shareholder bases, stricter regulatory oversight, and greater opportunities for business diversification. Investing in Facebook after its IPO was far less risky than backing a startup run by college dropouts operating out of a party house in Palo Alto.

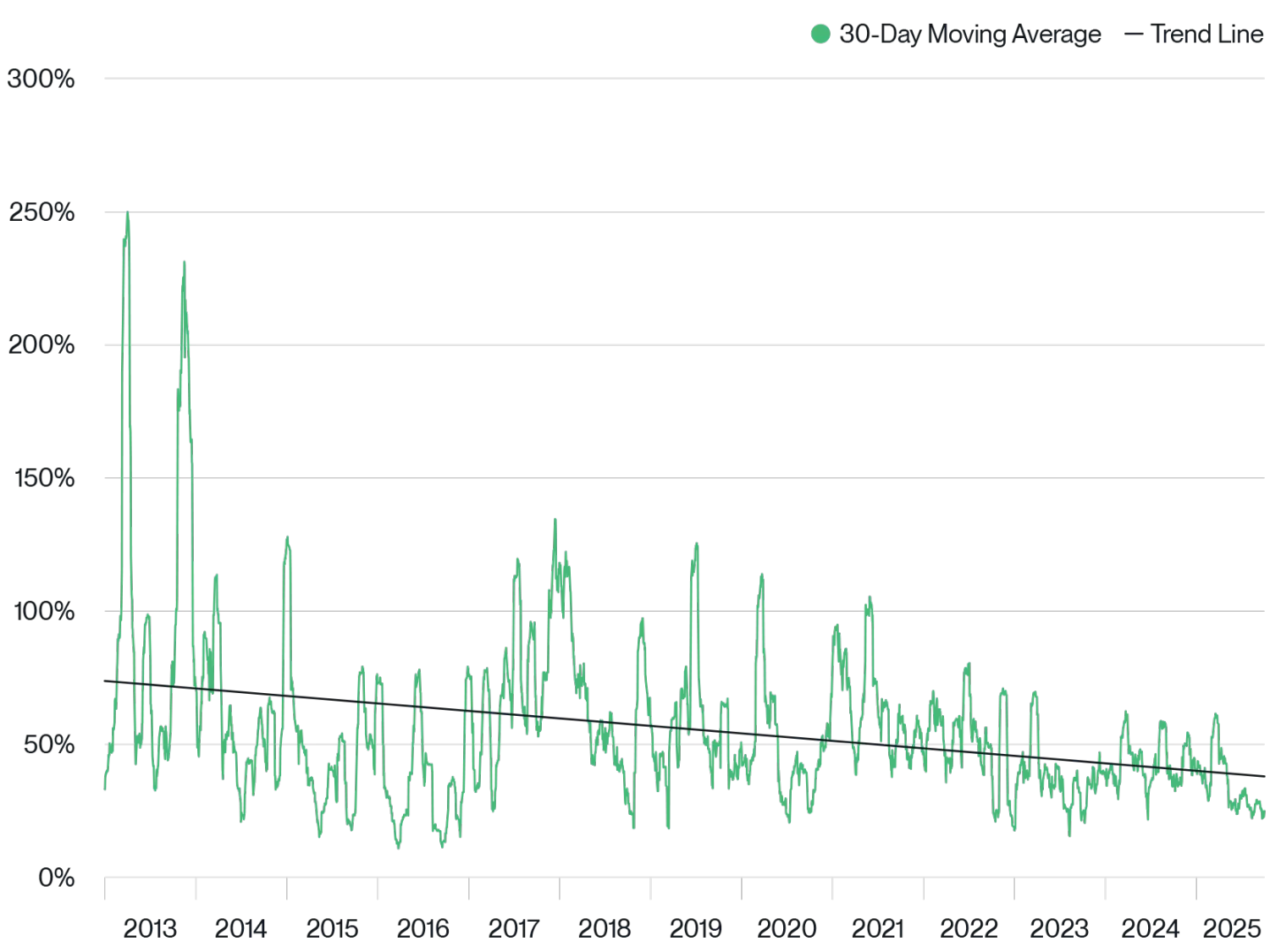

Bitcoin today is in a similar situation. As ownership shifts from early adopters to institutional investors and its technology matures, Bitcoin no longer faces the existential risks it did a decade ago. It has evolved into a mature asset class. This shift is clearly reflected in Bitcoin’s volatility—which has declined significantly since Bitcoin ETFs began trading in January 2024.

Bitcoin Historical Volatility

Source: Bitwise Asset Management. Data range: January 1, 2013 to September 30, 2025.

This evolution presents a critical insight for investors: while future returns may moderate slightly, volatility is set to decline substantially. As an allocator, my response to this change isn’t to sell—after all, we expect Bitcoin to be one of the top-performing asset classes globally over the next decade. Instead, my response is to buy more.

In other words, lower volatility means it’s safer to hold a larger position.

Visser’s article confirms a trend we’ve already observed: over the past few months, Bitwise has held hundreds of meetings with financial advisors, institutions, and other professional investors, and a clear pattern has emerged—the era of allocating just 1% to Bitcoin is over. More and more investors now see 5% as the appropriate starting point.

Bitcoin is experiencing its IPO moment. If history is any guide, we should respond by increasing our exposure to welcome this new era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News