What Are the Must-Grab Opportunities on Berachain at the Start of the New Year?

TechFlow Selected TechFlow Selected

What Are the Must-Grab Opportunities on Berachain at the Start of the New Year?

From the continuous emergence of yield opportunities to the inflation model beginning to actively converge, Berachain is entering a new phase characterized by structural optimization and long-term stability.

Author: Black Mario

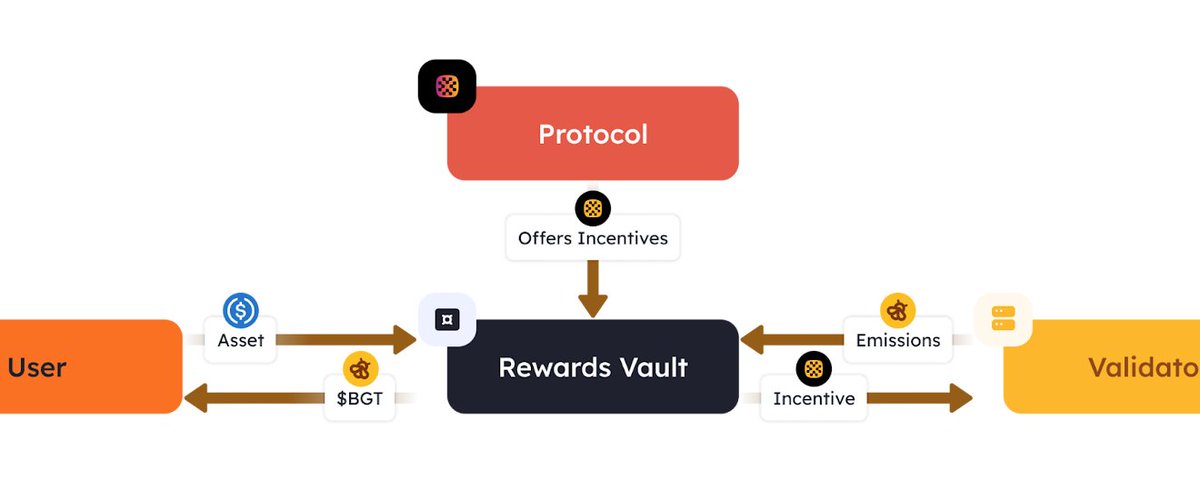

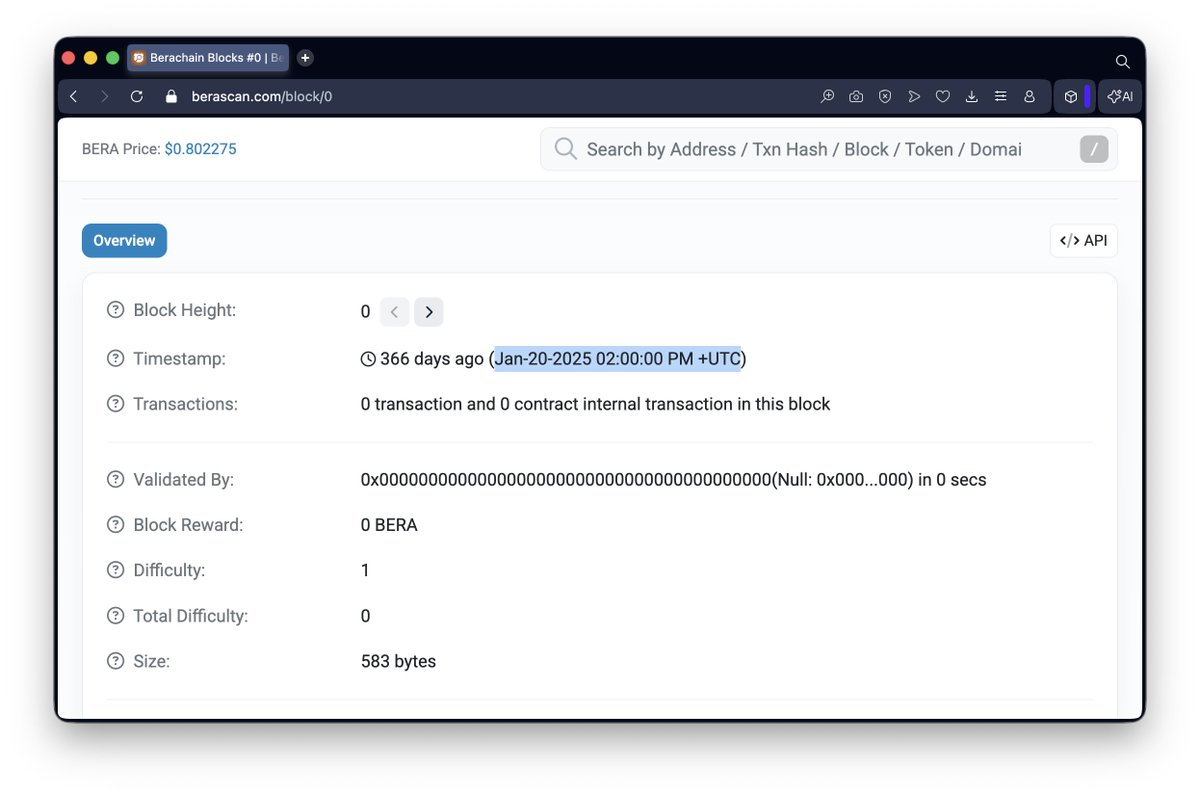

Since Berachain’s mainnet launched in January 2025, it has completed a full one-year cycle. Over this period, its innovative Proof-of-Liquidity (PoL) mechanism has gradually evolved from an early-stage proof-of-concept to large-scale operational deployment—demonstrating increasing maturity as a foundational economic coordination layer.

From a network operations perspective, PoL has established a stable participation base. Currently, over 25 million BERA tokens are staked in PoL—setting a new all-time high. On this foundation, the ecosystem’s Total Value Locked (TVL), powered by PoL, has surpassed $250 million. Supply dynamics within protocols have gradually stabilized: liquidity is no longer driven solely by short-term incentives but has entered a self-sustaining operational range. This shift signals that PoL is evolving beyond a mere incentive tool into Berachain’s long-term operational core.

Meanwhile, the on-chain stablecoin supply has exceeded $100 million. USDT from BERA has been listed on major centralized exchanges including Kraken, Bybit, and OKX—marking a transition of stablecoins from “liquidity tools” to reusable, transferable foundational asset units across the ecosystem, providing a unified value anchor for trading, lending, and derivatives.

Building on this momentum, Berachain’s application ecosystem is flourishing with rapid, diverse growth.

Infrared Finance (IR) has launched on major CEXs including Binance, Bitget, and HTX; Dolomite (DOLO) has been listed on Binance, Coinbase, and Bybit—and serves as the primary lending venue for USD1 within the WLFi ecosystem; Kodiak (KDK) raised approximately $150 million in subscription demand against a $1 million IDO allocation on Gate, and its DEX has accumulated over $5 billion in spot trading volume and surpassed $1 billion in perpetual futures volume. Meanwhile, projects including CrediFi, Foreverlong, and LiquidRoyaltyX have successfully completed fundraising rounds—the ecosystem’s project architecture is now clearly stratified.

Looking back on this phase, PoL’s success lies less in isolated metrics and more in enabling a replicable, scalable model for ecosystem growth: a closed loop among incentives, liquidity, and applications—rather than a zero-sum competition among them. As we enter 2026, Berachain is launching a new cycle—one that presents users with a series of compelling, ongoing ecosystem opportunities.

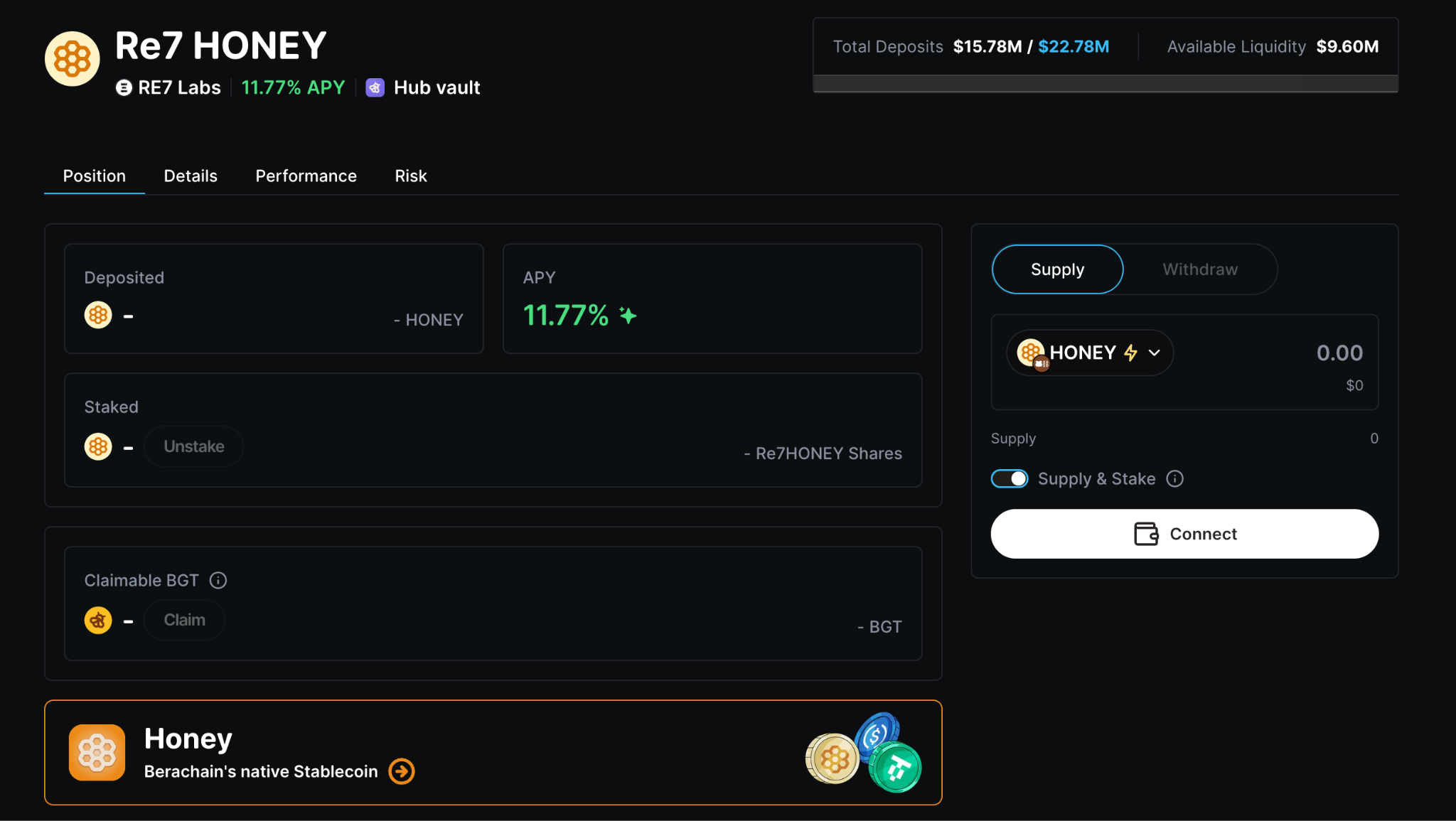

HONEY Stablecoin Staking Yields ~12% APY

HONEY is Berachain’s native on-chain stablecoin—and one of the most critical foundational assets under the PoL mechanism. With the mainnet now operating stably, HONEY’s total circulating supply has surpassed $100 million, placing it firmly within the range of a scalable, production-ready stablecoin. Currently, HONEY can be staked via https://bend.berachain.com/lend, delivering a sustained annual yield of approximately 12%. For users holding HONEY—or those seeking low-risk, stable returns on Berachain—this represents a highly attractive opportunity.

In fact, a defining feature of HONEY staking is its relatively direct, structurally simple yield path on-chain—free from complex layered mechanisms. Users may deposit and withdraw at any time, with no lock-up period or allocation caps. This design positions HONEY closer to a “callable interest-bearing stable asset,” rather than a short-term product requiring precise timing or quota competition.

In today’s stablecoin yield landscape, HONEY stands out clearly in both yield performance and usability. In contrast, yields on mainstream centralized exchanges have declined markedly: on OKX, standard stablecoin APYs now fall below 2%; while Binance and Bitget still offer comparatively higher rates, these are subject to strict allocation limits—typically only the first $300 USDT qualifies for ~5% APY, with diminishing returns beyond that threshold. Such yields function more like platform-level promotional tools than viable long-term asset allocation strategies.

From Berachain’s broader ecosystem perspective, however, HONEY’s significance extends far beyond yield—it establishes a sustainable, on-chain stablecoin usage paradigm. First, stablecoins are no longer just transactional intermediaries or liquidity buffers; they serve as long-term “parking assets” actively participating in ecosystem operations. Second, their high liquidity and low-friction yield paths encourage users to keep capital on-chain—providing consistent, predictable base liquidity for lending, trading, derivatives, and the PoL system itself.

This architecture creates an endogenous capital retention mechanism for Berachain: capital naturally accumulates and stabilizes during active use—forming a reliable foundational layer supporting the entire protocol network. This is precisely the key prerequisite enabling PoL’s continued scalability—and provides sufficient safety margins and liquidity depth for increasingly sophisticated financial applications.

Prime Vaults Deposit Program Launches—First Strategy Deployed on Berachain

Prime Vaults has now initiated its first-phase pre-deposit program, with the inaugural strategy deployed on Berachain’s high-yield PoL environment. Users can participate in these strategies through Vault structures—without needing to manage underlying DeFi operations manually. Stablecoin pool yields currently exceed 400% APY.

Early participants may join before pools reach capacity, and each Vault features clearly defined upper limits. The defining characteristics of this phase are unambiguous: no principal lock-up, and yields can be claimed anytime—a classic high-efficiency early-entry window.

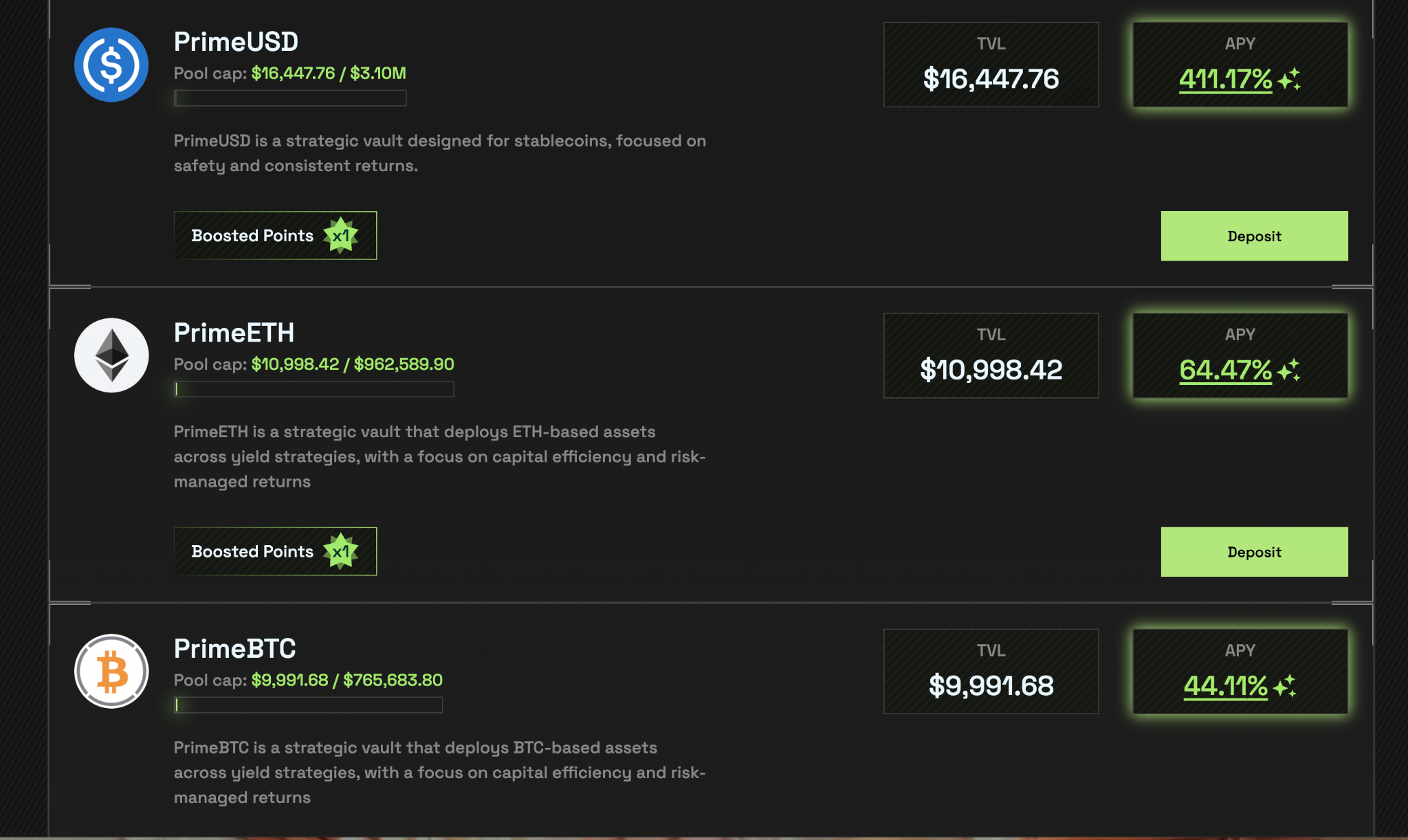

According to real-time data displayed on the protocol’s frontend (with overall TVL still in its very early stage), current yields across core Vaults are as follows:

- PrimeUSD (Stablecoin Pool)

TVL: ~$16,447.76 / Capacity Cap: $3.10M

Current APY: ~411.17% - PrimeETH (ETH Pool)

TVL: ~$10,998.42 / Capacity Cap: $962,589.90

Current APY: ~64.47% - PrimeBTC (BTC Pool)

TVL: ~$9,991.68 / Capacity Cap: $765,683.80

Current APY: ~44.11%

As shown, capital utilization across all Vaults remains extremely low—meaning yields remain at their peak, prior to significant dilution from incentive distribution. Notably, the stablecoin pool delivers returns substantially above market norms during this early phase, while ETH and BTC pool yields also significantly outperform typical rates offered by mainstream lending protocols and centralized platforms for comparable assets.

Prime Vaults targets asset holders seeking sustainable yield while prioritizing principal safety. The protocol aggregates returns from multiple strategies—including lending, liquidity mining, and AMM-based yield—into unified yield pools, mitigating volatility risks inherent in single-strategy exposure. It also separates principal from yield: yield can be withdrawn anytime, while principal remains continuously compounded—balancing liquidity and cash flow flexibility.

The Prime Vaults protocol sets clear long-term benchmark goals: yields must not fall below Aave V3 Core’s supply rate; when strategy performance exceeds expectations, users gain access to additional upside. The strategic focus on Berachain’s high-yield ecosystem during this initial phase is a key factor behind the currently elevated APYs.

Therefore, if you’re a long-term holder of ETH, BTC, or stablecoins—and wish to participate in Berachain’s yield ecosystem without altering your asset composition or accepting lock-up constraints—then Prime Vaults’ current Phase I remains a compelling early-entry opportunity worth close attention.

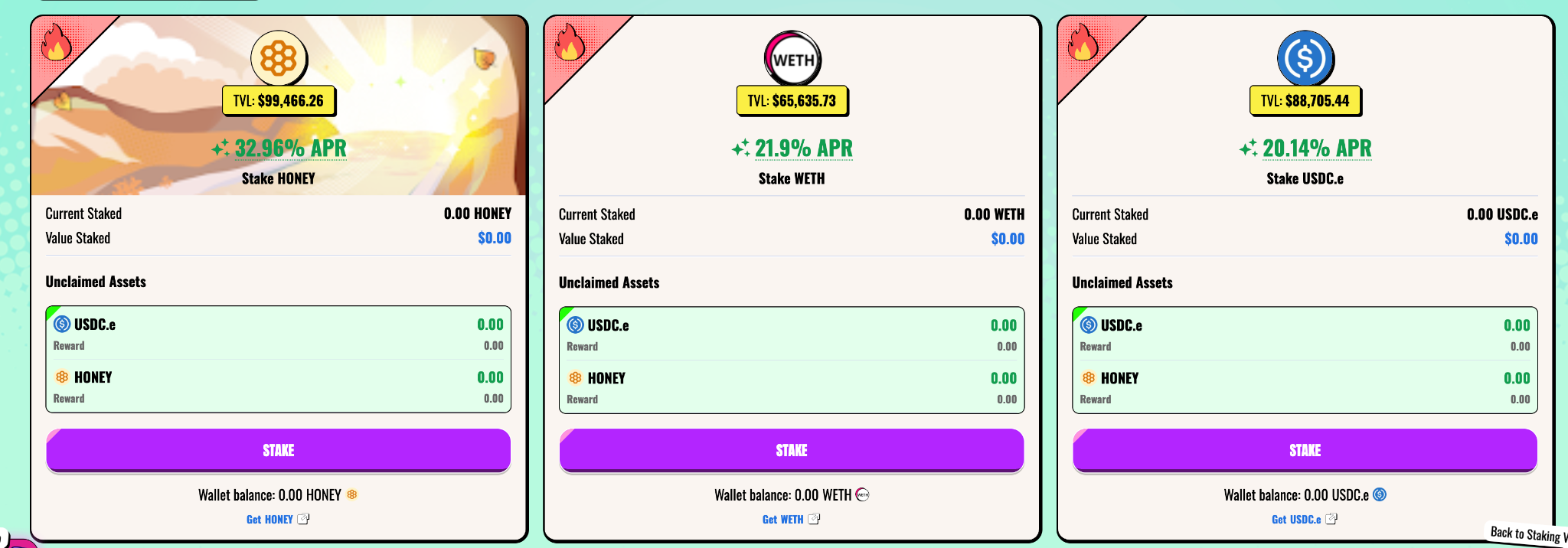

Jiko Finance Launches Time-Bound HONEY Boost Yield Campaign

Jiko Finance—the stablecoin yield protocol native to Berachain—has recently launched a time-bound Boost yield campaign for HONEY. Running for 14 days, the campaign offers participants at least 30%+ APY, making it a clearly defined, time-sensitive allocation opportunity.

This Boost campaign consists of two components: a baseline yield generated directly by the protocol—currently ~20.12% APY; and an additional incentive layer—contributing ~10.07% APY. Combined, these deliver an aggregate APY exceeding 30%. The yield structure is fully transparent and effective throughout the campaign period.

Jiko Finance focuses primarily on building yield products around stablecoins and HONEY—designed to offer users straightforward, low-barrier on-chain yield paths. This time-bound Boost campaign essentially layers temporary incentives atop Jiko’s existing yield model—intended to guide liquidity into HONEY-related pools.

Against the backdrop of broadly declining stablecoin yields across the market, such time-defined, structurally transparent campaigns provide a comparatively reliable short-term yield channel. Given its short duration, the campaign is best suited for tactical allocation or enhancing the utility efficiency of existing HONEY holdings—not as a long-term locked-in strategy.

For users seeking to boost short-term returns on stablecoin or HONEY assets—without introducing complex operational steps or additional structural risk—Jiko Finance’s current time-bound Boost campaign stands out as one of the rare recent opportunities offering high yield with low entry barriers.

$BGT Annual Inflation Rate Reduced from 8% to 5%

Notably, Berachain has proposed—and begun implementing—a reduction in the $BGT annual inflation rate from 8% to 5%. This move sends a strong positive signal in practice. Without compromising PoL’s incentive functionality, the slower inflation pace optimizes token supply dynamics—shifting incentives from pure expansion toward a balanced mechanism supporting both long-term value accrual and ecosystem stability. This adjustment strengthens market expectations around $BGT’s long-term scarcity and incentive efficacy—and bolsters participant confidence in the ecosystem’s sustainable development.

With yield opportunities multiplying and the inflation model proactively converging, Berachain is entering a new phase defined by structural optimization and long-term stability. For the Berachain ecosystem, 2026 remains a fertile ground for long-term value creation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News