Prime Vaults: Building a Safe Haven for Mainstream Assets on Berachain’s Liquidity Prairie

TechFlow Selected TechFlow Selected

Prime Vaults: Building a Safe Haven for Mainstream Assets on Berachain’s Liquidity Prairie

Prime Vaults may currently offer a new, multifunctional participation window.

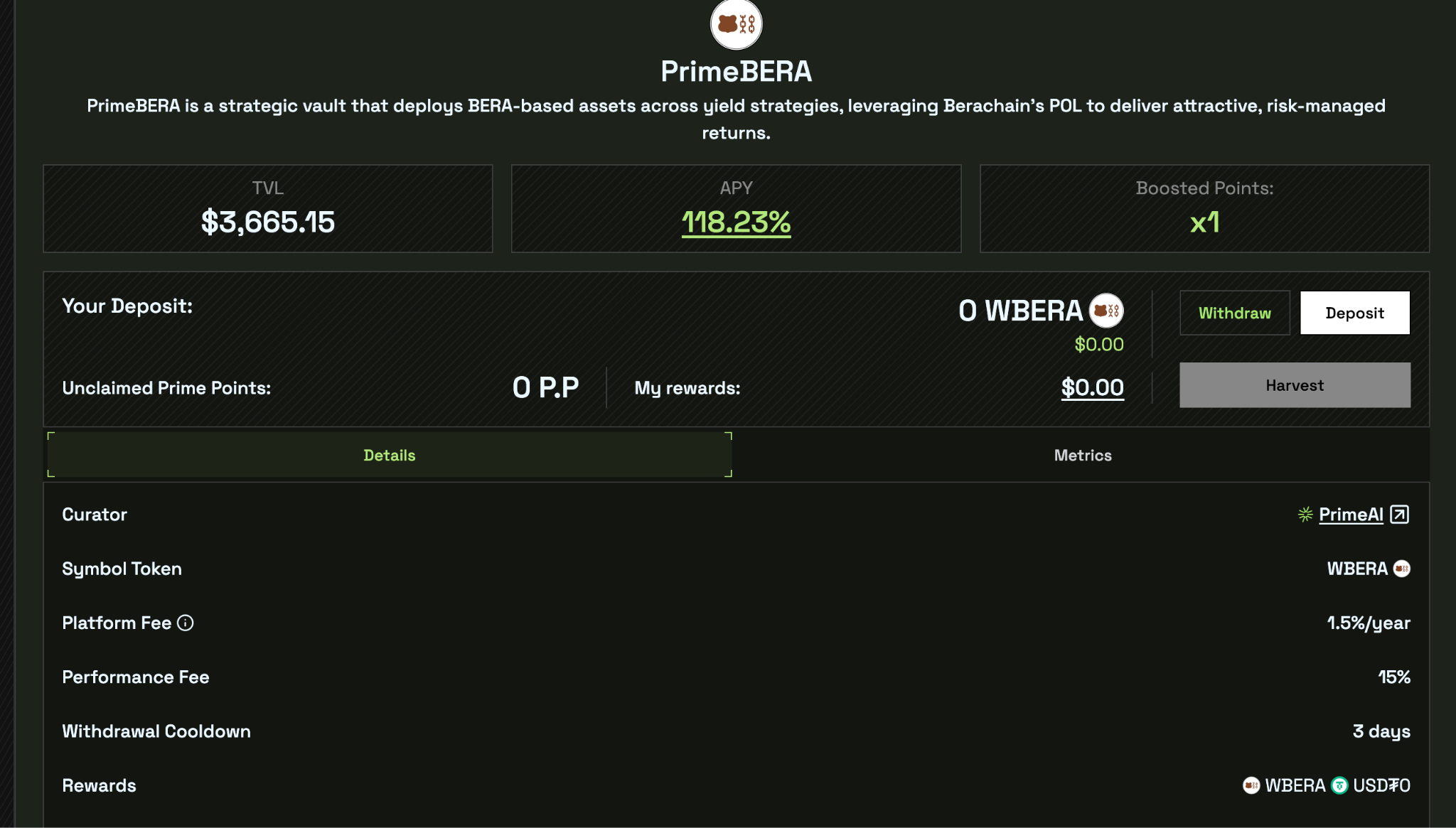

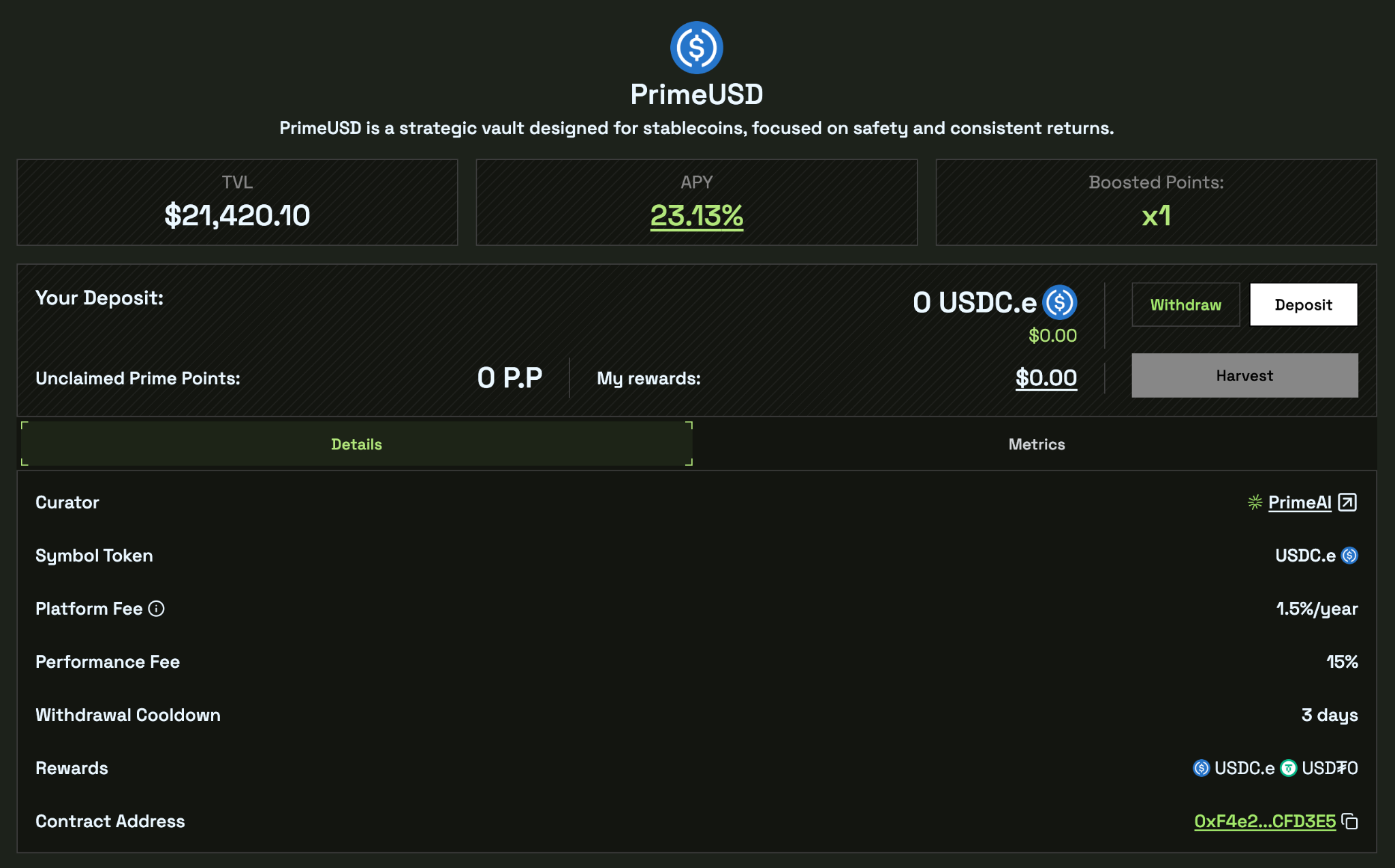

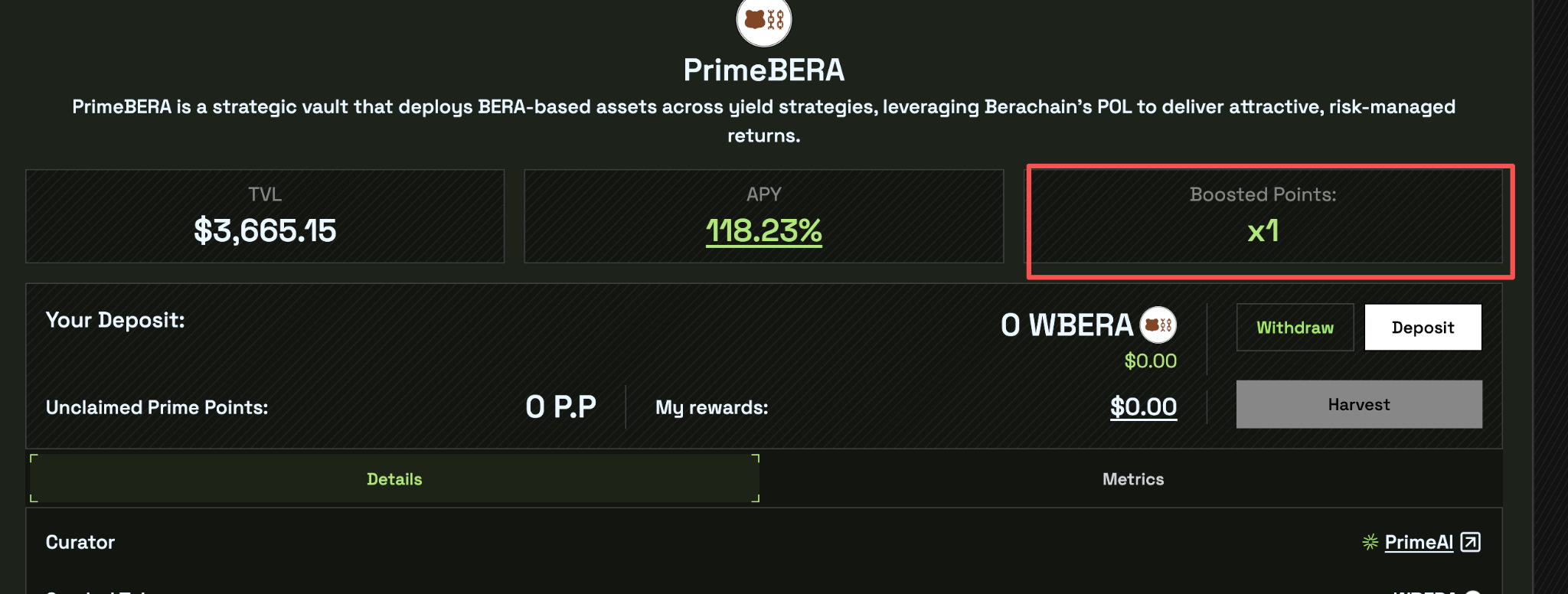

Since the start of 2026, several high-yield vaults have emerged within the Berachain ecosystem. Among them, Prime Vaults’ recently launched Pre-deposit campaign has stood out notably, ranking among the most attractive yield-generating protocols currently available. Although overall yields have declined moderately as Total Value Locked (TVL) continues to rise, the PrimeUSD vault still offers an APY of approximately 23% (supporting deposits of multiple stablecoins), while the PrimeBERA vault delivers an APR as high as 118%—placing it firmly among the top-tier yield offerings in today’s DeFi market.

Beyond these two vaults, Prime Vaults also supports staking of BTC and ETH, with the corresponding PrimeBTC and PrimeETH vaults currently offering APRs of 5.87% and 9.22%, respectively—solidly positioned in the upper-mid range of industry benchmarks, balancing both stability and yield performance.

Focusing on the Prime Vaults protocol itself, it positions itself as a smart-strategy “vault-as-a-service” protocol designed to address key pain points of traditional DeFi vaults—such as elevated risk exposure, overreliance on short-term incentives, and asset siloing—by delivering more stable, sustainable yield solutions and enabling users to earn returns via a simple, one-click interface that abstracts away the complexity of DeFi participation.

A Unified Yield Architecture Centered on the “On-Chain Savings Account”

At its core, Prime Vaults is built around the concept of an “on-chain savings account,” aiming to deliver consistent passive returns while safeguarding principal and guaranteeing a minimum baseline yield. In contrast to the fragmented, asset-siloed architecture typical of conventional DeFi vaults, Prime Vaults employs a unified infrastructure for centralized capital management and dynamic allocation—significantly improving capital efficiency and overall risk control capability.

The centerpiece of this innovation is its Unified Yield Model.

Under this model, user deposits—including USDC, WETH, WBTC, WBERA, and other assets—are not locked into any single strategy or isolated pool. Instead, all assets are pooled into a shared liquidity reservoir, where the system dynamically allocates funds across a diversified set of risk-adjusted strategies based on real-time yield and risk metrics. This design enables capital to “intelligently flow” across different assets and strategies, capturing superior yield opportunities without compromising safety.

The Unified Yield Model also natively supports cross-chain execution and concurrent multi-strategy operations. Prime Vaults can allocate liquidity across chains and protocols, deploying capital to the highest-yielding opportunities available—while simultaneously executing lending, liquidity provision, and other yield-generating activities. This approach reduces frictional costs from frequent internal swaps and mitigates liquidity fragmentation, resulting in smoother, more stable yield distribution.

Rather than relying on a single incentive mechanism, Prime Vaults’ yield generation draws from multiple sources—including base interest rates, strategy-specific returns, and cross-chain arbitrage opportunities—all consolidated and distributed to users in a unified settlement process. Structurally, this significantly lowers the risk of volatile, boom-and-bust yield swings.

To illustrate, let’s examine the yield pathways for WBERA and stablecoin deposits on Berachain:

High-Yield Generation Logic for WBERA Deposits (PrimeBERA)

Within the Berachain ecosystem, Prime Vaults’ high-yield capacity is most prominently demonstrated by native-asset vaults such as PrimeBERA.

For example, when a user deposits 1,000 WBERA into the PrimeBERA Vault, those tokens are not simply staked or deployed into a single liquidity pool. Instead, they first enter Prime Vaults’ unified liquidity pool alongside assets like ETH and BTC, participating in cross-strategy allocation. The system then prioritizes deployment into whitelisted Reward Vaults and high-efficiency strategies native to Berachain.

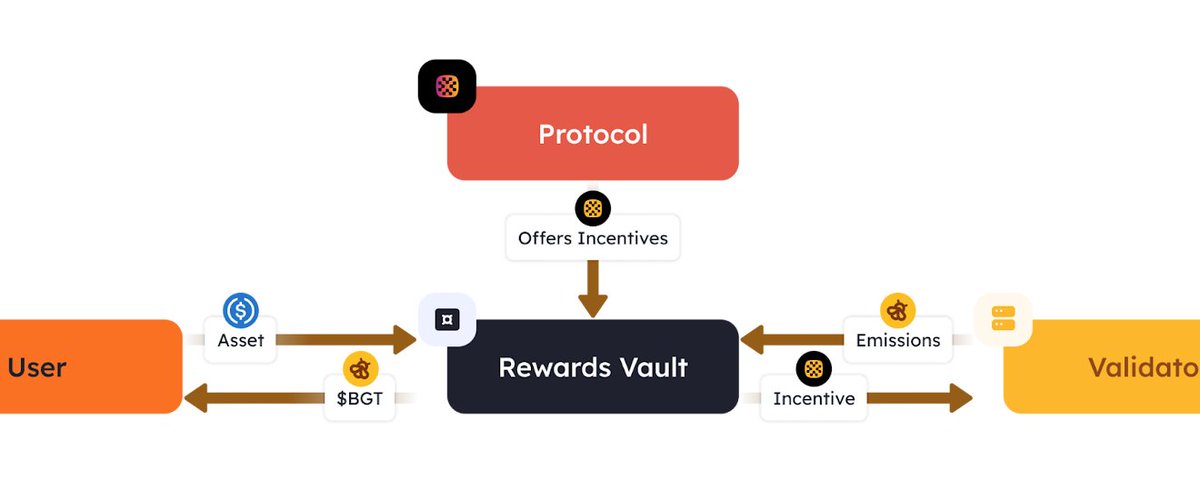

The core yield driver here is Berachain’s Proof-of-Liquidity (PoL) mechanism. As widely understood, PoL does not directly reward trading or staking activity; rather, it incentivizes contributions to network security and ecosystem vitality using governance token BGT.

As a protocol-level participant, Prime Vaults directs liquidity from its unified pool into designated Reward Vaults—such as BERA staking or BERA-related LP positions—and receives approximately 33% of the validator-issued BGT emissions as redirected incentives. Crucially, this BGT is never exposed directly to users: instead, it is converted into WBERA via an auction mechanism and automatically reinvested into users’ shares—generating continuous compounding returns.

In addition, the system routes part of the WBERA liquidity to high-APY LP pairs on Berachain—such as the BERA/USDC pool—to capture both trading fees and PoL subsidies. If local yield opportunities on Berachain temporarily decline, capital may be shifted—in a risk-controlled manner—to higher-yielding strategies on other chains (e.g., Arbitrum) for lending or yield farming. Nevertheless, Berachain remains the primary yield anchor for all such allocations.

During the current pre-deposit phase, with relatively low TVL and fixed PoL incentive pools, PrimeBERA’s APR surged to approximately 118%. Roughly 80–100% of this return stems directly from BGT emissions, with the remainder contributed by base interest, trading fees, and cross-chain strategies. All yields are automatically harvested, settled, and reflected in users’ net asset value—no manual claiming required. It should be noted that this elevated APR reflects amplified early-stage incentives; as TVL grows, yields will gradually converge toward more sustainable levels—but their long-term structural support remains anchored in Berachain’s systemic PoL incentive framework.

Stable-Yield Generation Logic for USDC Deposits (PrimeUSD)

Compared to the high-volatility yield path for native assets, PrimeUSD better showcases Prime Vaults’ structural advantages in stablecoin use cases. For instance, when a user deposits 1,000 USDC into the PrimeUSD Vault, those funds likewise enter the unified liquidity pool—not restricted to a single USDC-only strategy. The system prioritizes allocating USDC to Berachain’s on-chain lending markets to generate stable base interest income, typically aligned with supply-rate ranges offered by leading lending protocols (approximately 5–10%).

Building on this foundation, Prime Vaults leverages Berachain’s PoL mechanism to “add a layer of leverage” to stablecoin yields. By directing USDC liquidity into PoL-eligible stablecoin pools or related Reward Vaults, the protocol captures additional BGT subsidies. This transforms USDC from a purely passive interest-earning asset into an indirect participant in Berachain’s liquidity security and governance incentive system. As Berachain’s RWA-related ecosystem matures, this pathway may further incorporate off-chain cash flows mapped on-chain—adding yet another yield dimension.

Moreover, the Unified Yield Model allows the system—within risk-constrained parameters—to combine USDC with ETH or BTC to execute multi-asset strategies (e.g., stablecoin + volatile-asset LP structures), thereby earning both trading fees and incentives. Unlike traditional stablecoin vaults that operate solely within USDC-native strategies, Prime Vaults boosts per-unit capital efficiency through cross-asset synergy.

Currently, PrimeUSD delivers an APY of ~23%, with roughly 10% attributable to base lending rates and the remainder derived from PoL incentives, cross-asset strategies, and cross-chain optimizations. Principal and yield are strictly separated within the system: principal enjoys priority protection, while yield is periodically settled and can be withdrawn flexibly. Compared to traditional vaults—such as those reliant on a single asset or derivative—the multi-source, low-correlation yield structure makes PrimeUSD’s stablecoin returns far more resilient amid market volatility.

Risk Management Framework

While constructing a robust yield architecture, Prime Vaults explicitly anchors its product design in the foundational principle of “security first.”

The system implements multi-layered safeguards to buffer and constrain common DeFi risks—not chasing high APY at the expense of safety.

To protect asset integrity, the protocol strictly segregates user holdings into principal and yield components. Only principal is allocated to rigorously vetted strategies, and any losses—including impermanent loss (IL) or adverse events—are absorbed by an Impermanent Loss Reserve Fund (IL Reserve Fund). Under normal market conditions, this fund aims to preserve full principal value.

Additionally, Prime Vaults enforces minimum yield guarantees for each supported asset class, benchmarked against prevailing deposit rates on major lending protocols (e.g., Aave V3). Even during periods of declining incentives or broader market weakness, user returns will not fall below this industry-standard floor—effectively eliminating the classic “high yield → steep drop” vault risk profile. The IL Reserve Fund’s size and usage are dynamically managed by the protocol to ensure solvency and maintain overall payment capacity while assuming calculated risk exposure.

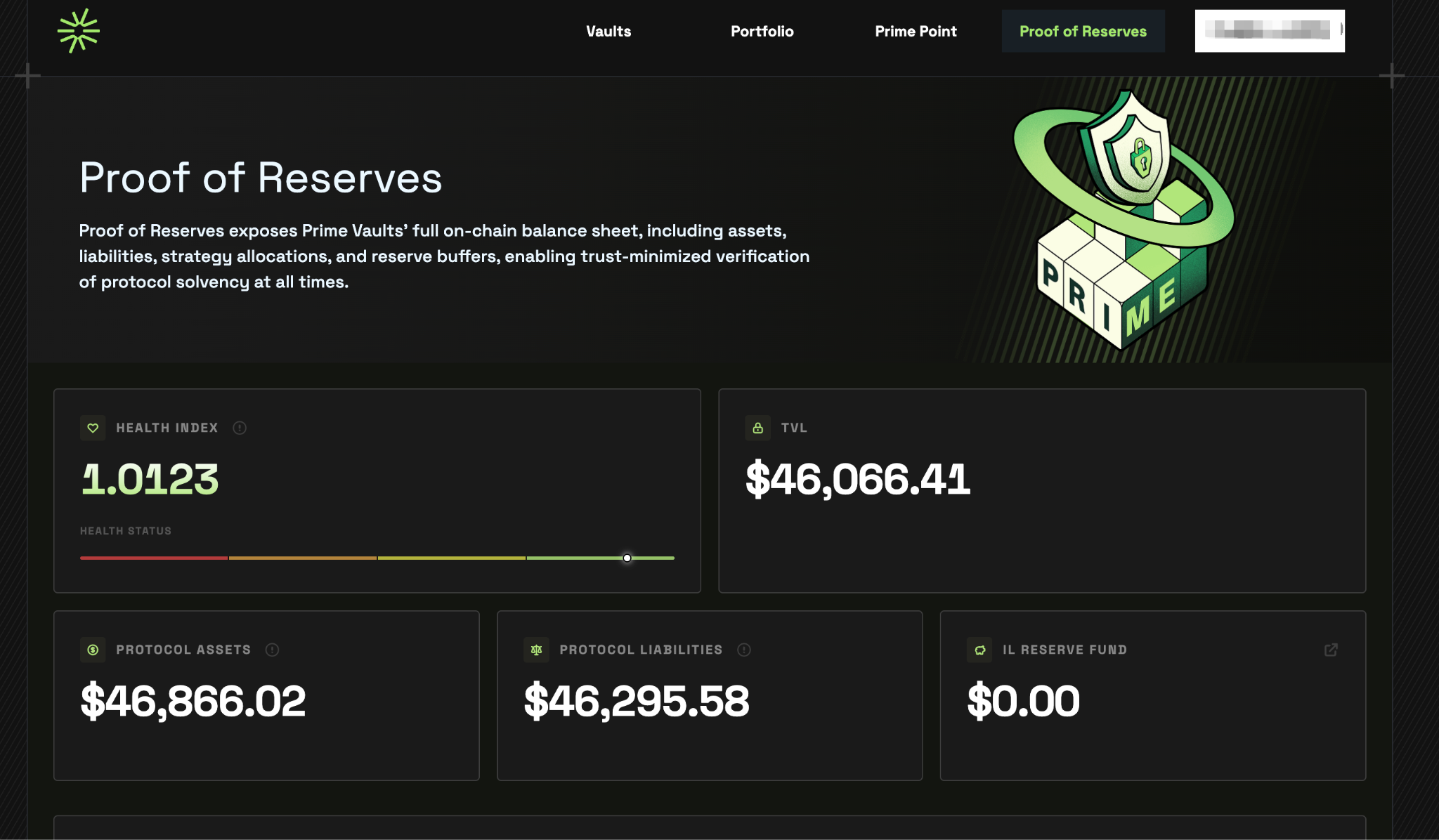

Further reinforcing this, Prime Vaults incorporates several system-level protective measures—including automatic circuit-breaker triggers under extreme market conditions and a real-time Protocol Health Index that monitors capital exposure and solvency. All critical on-chain data—including reserve balances, asset locations, and protocol attestations—is publicly verifiable via On-chain Proof of Reserves (https://app.primevaults.finance/proof-of-reserves).

With this architecture, Prime Vaults positions itself less as a high-risk yield vault and more as a verifiable, composable on-chain savings account. Its structural risk controls and Unified Yield Model make it especially suitable for users seeking reliable returns without needing to constantly monitor positions or manually rebalance strategies—forming the core of its differentiation in today’s DeFi landscape.

Potential Points-Based Incentives

Currently, participants in the Pre-deposit campaign will notice a “Boosted Points” section—indicating that deposits accrue points-based rewards. Users can view their specific point balances and history in the dedicated Prime Points dashboard.

For users familiar with the Berachain ecosystem, this feels like a familiar recipe. Given Prime Vaults’ recent launch and healthy growth trajectory, its points system is highly likely to serve as a key metric for user incentives and rights allocation—especially at critical 2026 milestones such as Token Generation Event (TGE). This introduces potential airdrop expectations. Thus, for Berachain users who missed earlier opportunities like Infrared Finance or Kodiak, Prime Vaults may now offer a new, multi-benefit entry point.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News