Up 30%, How Does the Berachain V2 Proposal Enhance $BERA Value Capture?

TechFlow Selected TechFlow Selected

Up 30%, How Does the Berachain V2 Proposal Enhance $BERA Value Capture?

With "revenue-driven main token," Berachain's new proposal gets off to a good start.

Written by: TechFlow

The crypto market is gradually recovering, with BTC and ETH leading the rally. However, many L1 blockchains' native tokens have failed to rebound in tandem—a far cry from the earlier era when hundreds of chains competed to become "Ethereum killers."

Today, most L1s face the challenge of "native token marginalization": circulation unlocks, token dilution, and weak narratives make it difficult for these tokens to capture value from ecosystem growth.

Berachain, an innovative EVM-compatible blockchain, has carved out a niche in the blockchain ecosystem through its unique Proof of Liquidity (PoL) mechanism. Yet its three-token model limits the value capture capability of its native token $BERA, which currently has a market cap of only $270 million.

The current situation of $BERA stems not only from traditional tokenomics issues such as unlock pressure but also from a lack of narrative and product-level applications.

If $BERA remains merely a gas payment tool on the chain, its narrative potential will naturally be limited. However, a recent PoL V2 proposal within the official Berachain community may offer $BERA a turning point in both narrative and functionality:

By reallocating 33% of PoL incentives, the proposal aims to transform $BERA from a marginalized gas token into a core income-generating asset.

After the proposal was released on July 15, the price of $BERA surged 23% within 24 hours, breaking above $2.50, indicating that the market has interpreted this as positive news.

Beyond short-term effects, can PoL V2 bring long-term value to $BERA? Can it reshape the status of the native token through incentive mechanisms and attract institutional and user participation?

Initial PoL: The Hidden Dilemma of $BERA's Value

To answer these questions, we must first understand the position of $BERA under Berachain’s current PoL model.

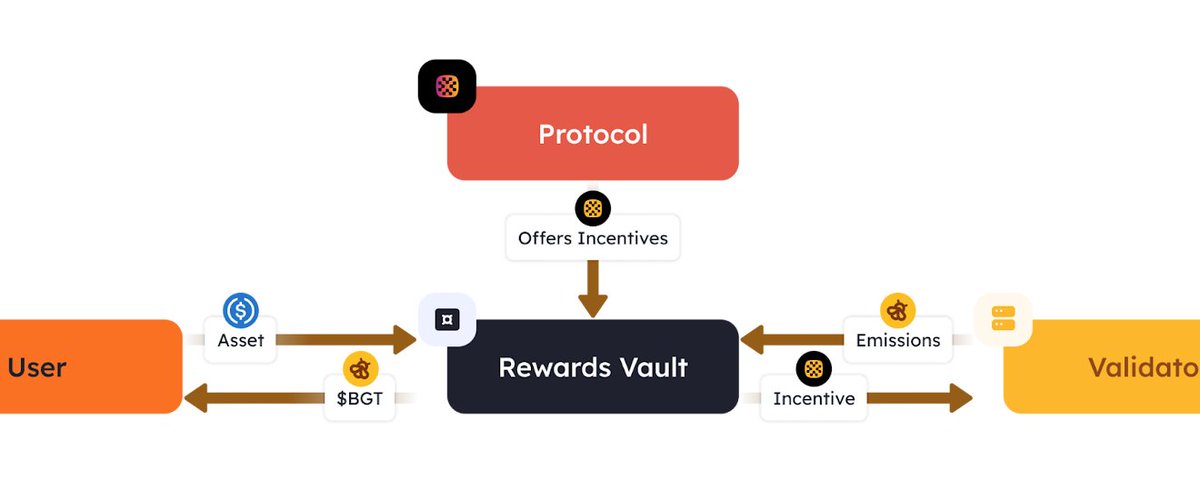

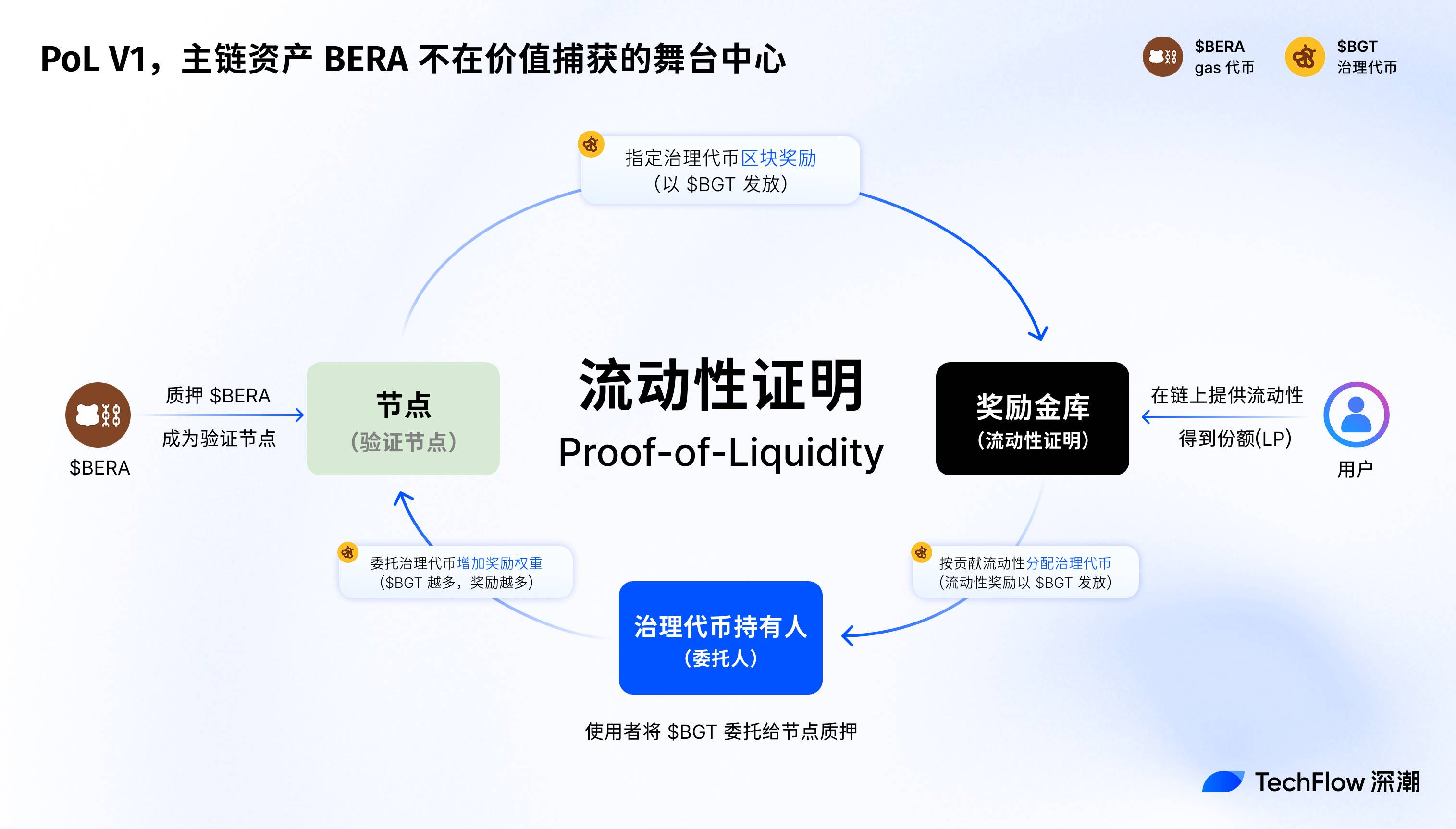

Berachain’s original Proof of Liquidity (PoL V1) mechanism is essentially an economic consensus design that incentivizes liquidity providers (LPs) and dApp development to enhance network security and ecosystem vitality.

Unlike traditional PoS, PoL uses a three-token model ($BERA, $BGT, $HONEY), allocating block rewards to validators and ecosystem participants through bribery auctions.

Here, $BERA serves as the gas token and foundational network asset, $BGT handles governance and staking rewards, while $HONEY acts as a stablecoin supporting liquidity.

Since the mainnet launch on February 6, 2025, PoL initially drove growth in Berachain’s TVL, peaking at $3 billion by late March this year.

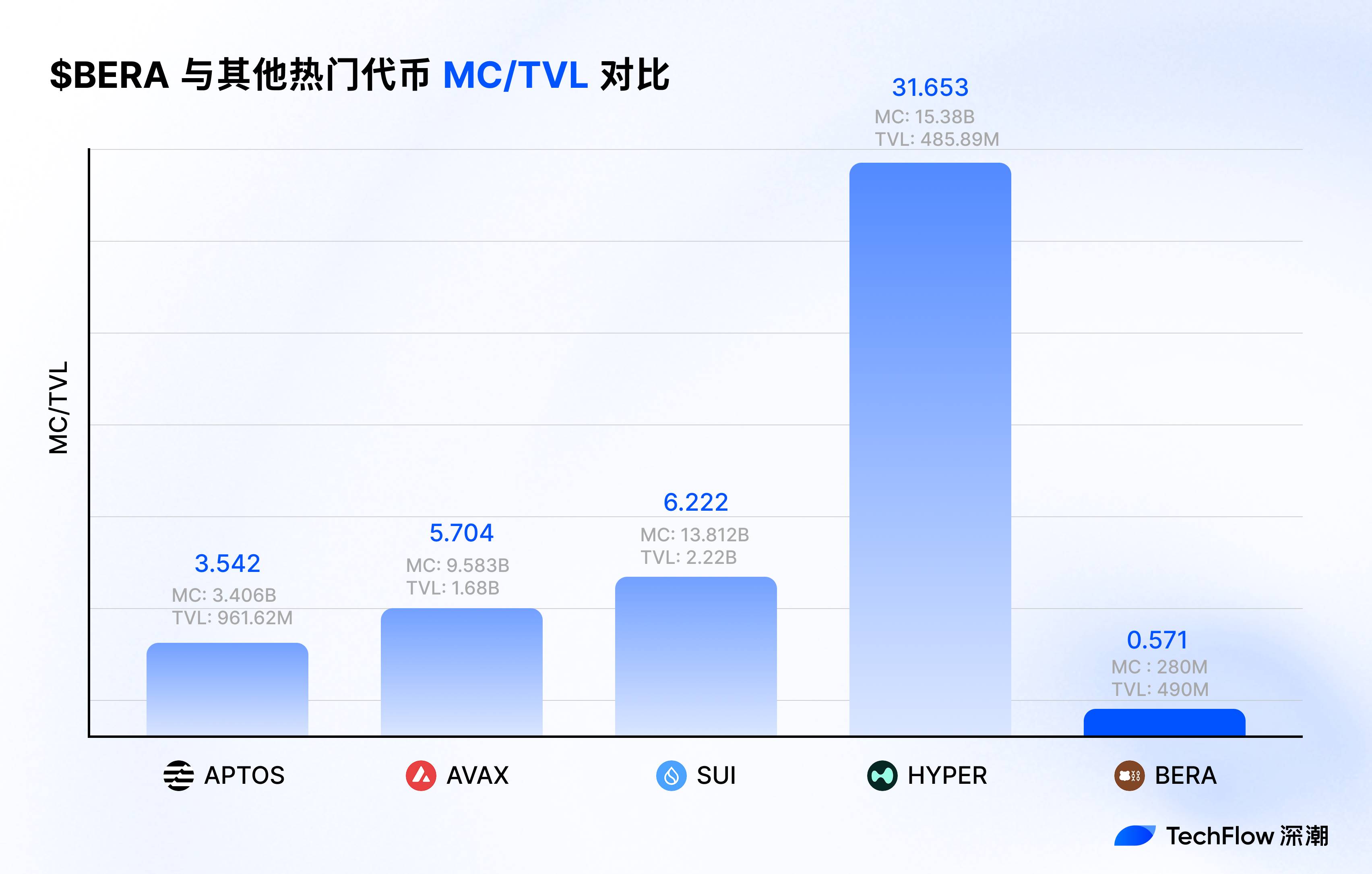

In contrast, during the same period, the market cap of the native token BERA was only $900 million—less than one-third of the MC/TVL ratio, suggesting $BERA did not benefit proportionally from Berachain’s ecosystem appeal.

Where lies the problem?

Looking back at the initial PoL design, the author believes this was an arrangement prioritizing overall interests, where incentive distribution and structural constraints led to the devaluation of BERA.

The initial PoL cleverly structured bribery and emission mechanisms to boost ecosystem activity, benefiting Berachain’s overall development. However, $BERA, as the primary chain asset, did not receive equivalent growth opportunities, reflected in the following:

-

Liquidity providers captured full staking rewards via PoL bribery mechanisms paid in $BGT, while $BERA was used solely for gas payments, lacking independent yield sources.

-

Bribery incentives were prioritized for $BGT holders, neglecting the needs of $BERA stakers, indirectly reducing demand for $BERA.

-

The PoL V1 reward treasury concentrated liquidity incentives on dApps rather than the mainnet asset $BERA.

Overall, Berachain could go viral, its ecosystem could thrive, meme culture could flourish—but $BERA did not. Elevating the "main token" has become urgent for enhancing the chain’s influence in the next phase.

The V2 Proposal: Making $BERA a Core Ecosystem Asset

Understanding how the initial PoL limited $BERA’s value capture helps us appreciate the changes introduced by the PoL V2 proposal.

To state the conclusion upfront, PoL V2 focuses on incentive reallocation and functional expansion, aiming to transform $BERA from a marginalized gas token into a central ecosystem asset.

Specifically, PoL V2 introduces the following key changes:

-

Incentive Reallocation:

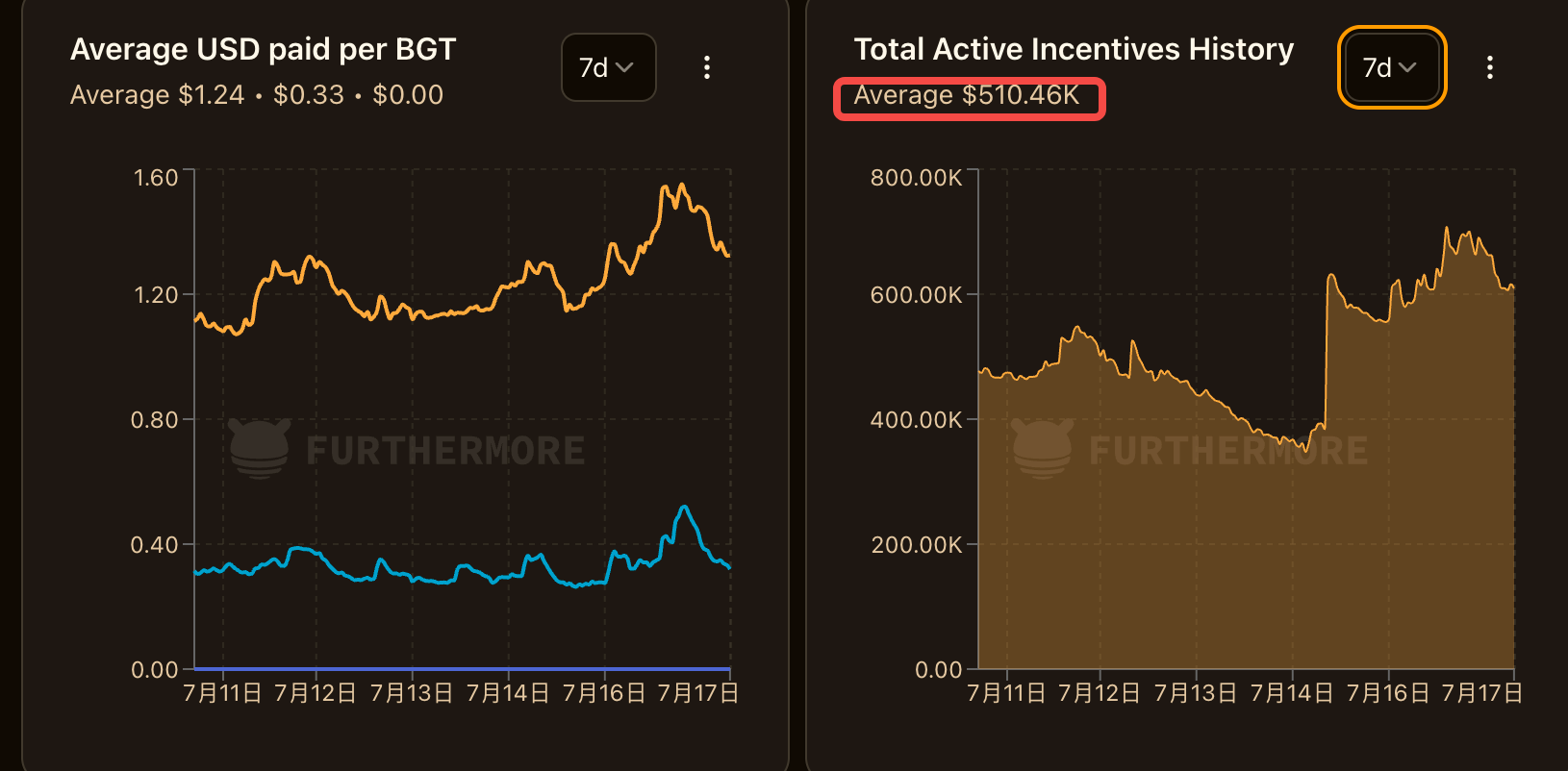

PoL V2 redirects 33% of dApp bribery incentives—from previously being allocated to BGT (governance token) holders—to BERA stakers.

According to furthermore data, Berachain has seen approximately $500,000 in total daily incentives over the past seven days, meaning about one-third ($150,000) will now flow directly into the BERA staking pool, creating sustained buy-side pressure on $BERA.

The remaining 67% continues to be distributed to BGT holders, preserving their liquidity incentive leverage and protecting existing stakeholders’ interests.

Note that this effectively provides additional returns to BERA holders—not through simple BERA inflation, but via structural adjustments that redistribute protocol cash flows, avoiding inflationary risks for $BERA.

-

Functional Module Expansion:

PoL V2 supports liquid staking tokens (LSTs), allowing BERA stakers to earn PoL incentives while still receiving validator rewards. This significantly improves capital efficiency for $BERA.

BERA stakers can now profit directly from protocol revenues (e.g., BEX) without engaging in complex DeFi strategies or holding BGT, lowering the barrier to entry.

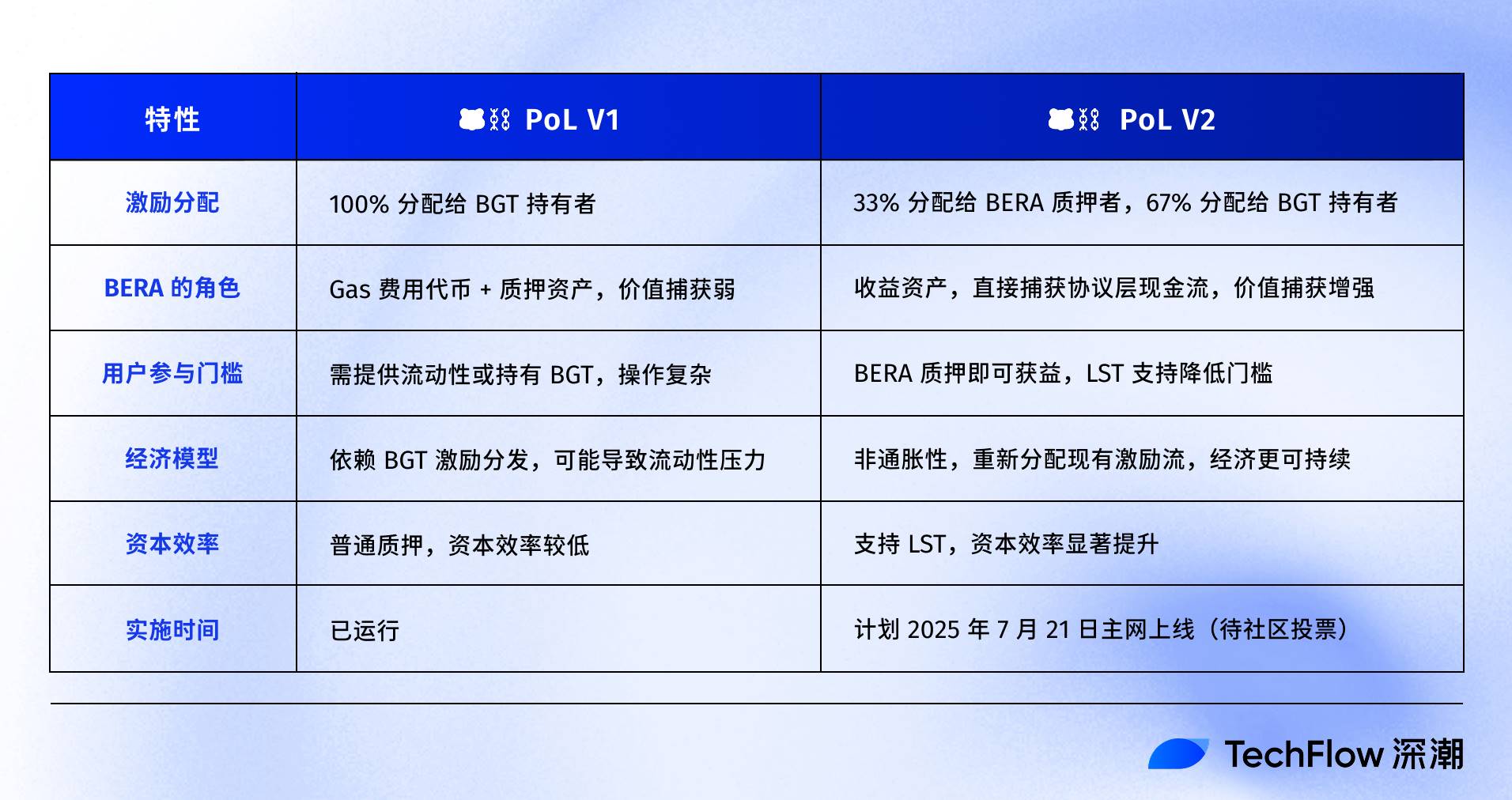

We can clearly compare the differences between PoL V2 and V1 using the table below:

In contrast, PoL V1 functioned more like a stage tailored for $BGT, with most rewards flowing there, leaving $BERA to quietly cover gas fees, relying entirely on indirect ecosystem momentum for value growth.

V2 places $BERA at the center of the stage, simplifying reward acquisition through new allocation models and bonding tools.

Value Capture, Again and Again

Value capture is a buzzword in crypto, but for $BERA, where exactly does it anchor?

When $BERA transitions from a single-purpose gas token to a core income-generating ecosystem asset, its value anchoring undergoes subtle shifts—hidden in mindset positioning and ecosystem dynamics.

The core upgrade of PoL V2 is granting $BERA the ability to directly capture cash flows at the protocol layer, akin to giving $BERA protocol dividend rights, thus reshaping its pricing logic.

Let’s run a theoretical calculation.

Assuming the V2 proposal passes and 33% of dApp bribery incentives are redirected to BERA stakers, with prior data showing around $500,000 in daily total incentives, roughly one-third (i.e., $150,000 per day, ~$1.1 million weekly) becomes income for staked $BERA.

PoL V2 grants $BERA a revenue stream similar to “protocol dividends,” meaning holding $BERA equates to sharing in real income generated across the ecosystem. Under this income-earning asset framework, buying pressure forms; clearly, $BERA’s price is also affected by token unlocks, so actual multiples may vary based on TVL growth, adoption rates, or market cycles. But if the native token offers productive utility beyond gas payment, given $BERA’s current performance, there remains significant room for growth.

For comparison, placing $BERA alongside other major public chains reveals greater potential in its current MC/TVL ratio.

Moreover, positioning $BERA as an income-generating asset could spark broader market imagination.

Externally, companies like MicroStrategy have demonstrated strategic interest in holding Bitcoin. Similarly, SharpLink firms are beginning to accumulate Ethereum, primarily because ETH is a “productive asset.”

If PoL V2 endows $BERA with a stable yield stream and non-inflationary design, making it a true income-generating asset, it creates a suitable environment for today’s “crypto stock” investment approach.

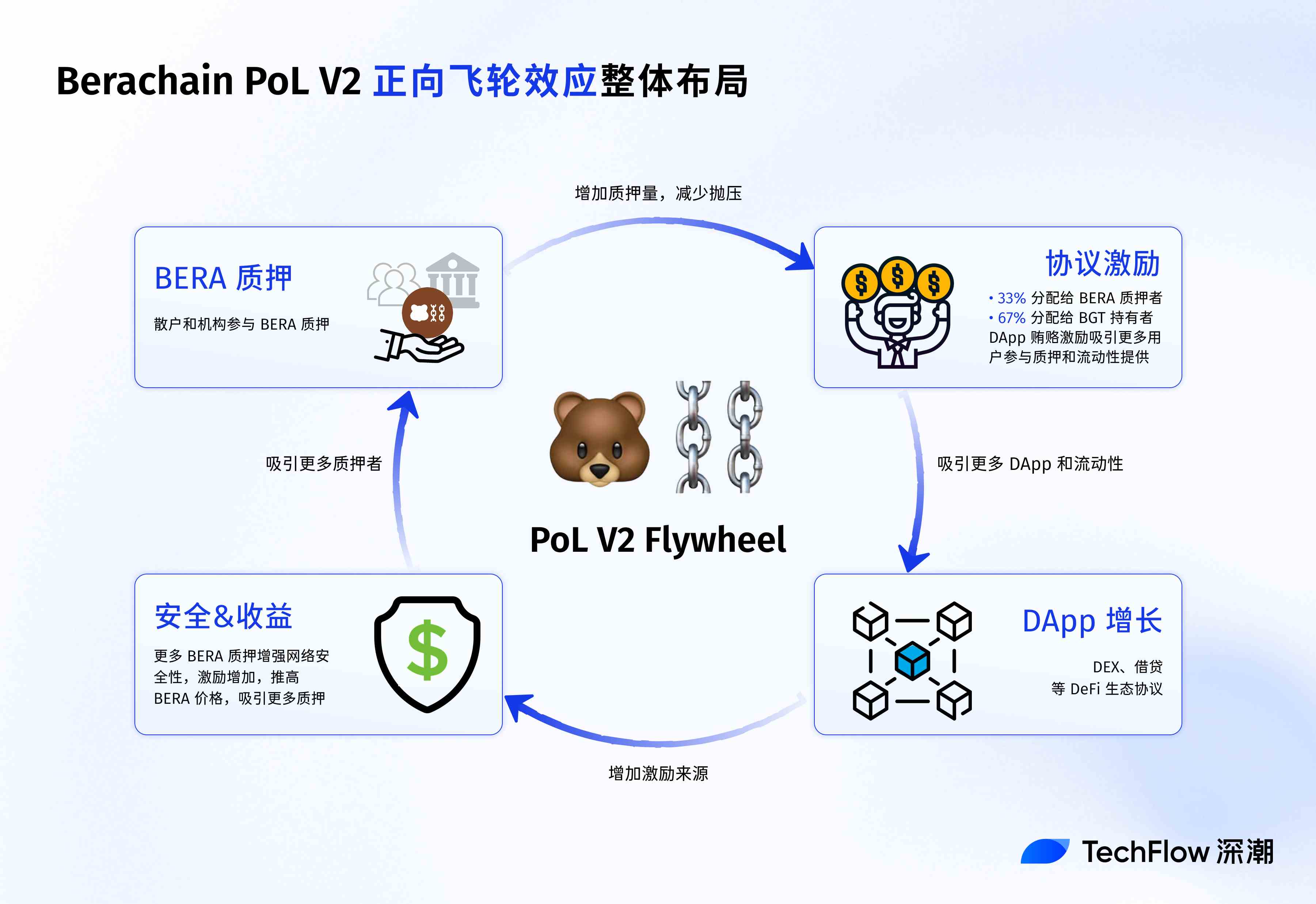

From within Berachain’s ecosystem, PoL V2 catalyzes a positive flywheel effect.

First, higher yields for BERA stakers attract more long-term holders, increasing token lock-up and reducing sell pressure;

Second, stable $BERA prices and enhanced network security attract more developers to deploy dApps, further expanding sources of bribery incentives. In turn, more incentives flow to $BERA and $BGT holders, forming a closed loop of “staking-incentives-dApp growth.”

For example, trading volume on BEX (Berachain’s core DEX) may grow due to optimized incentives, boosting usage of HONEY (the native stablecoin) and strengthening overall ecosystem stickiness.

Compared to other Layer 1s that rely on token emissions to incentivize users, Berachain’s model resembles “protocol dividends,” offering long-term stability to the ecosystem.

Finally, from the user perspective, the impact of PoL V2’s value capture varies across different groups.

For retail investors, BERA staking offers a low-risk “crypto savings” income path, attracting more long-term holders. For DeFi users, the introduction of LSTs enables higher capital efficiency and strategic flexibility—such as providing liquidity on BEX using LSTs while stacking PoL incentives.

For institutional users, $BERA’s income-generating nature and non-inflationary design make it a potential strategic reserve asset, akin to stablecoins or high-yield bonds.

The current PoL V2 proposal was published on July 15, 2025, on Berachain’s public forum and is currently in the community feedback phase, with a deadline of July 20, 2025.

If approved by majority vote, the mainnet will implement the proposal on July 21, 2025, at which point the shift in $BERA’s value capture will become evident.

However, it should be noted that no single proposal alone can solve the challenges of a blockchain’s development or token appreciation. At this stage of the crypto market, pure concept hype has been debunked—only projects with real applications, revenue streams, and solid fundamentals will stand out in the next phase of competition.

As a complement to the PoL V2 mechanism, when the ecosystem becomes more active, returns tied to $BERA will rise. More protocols bidding for $BGT means higher bribes, which translates into better staking yields for $BERA.

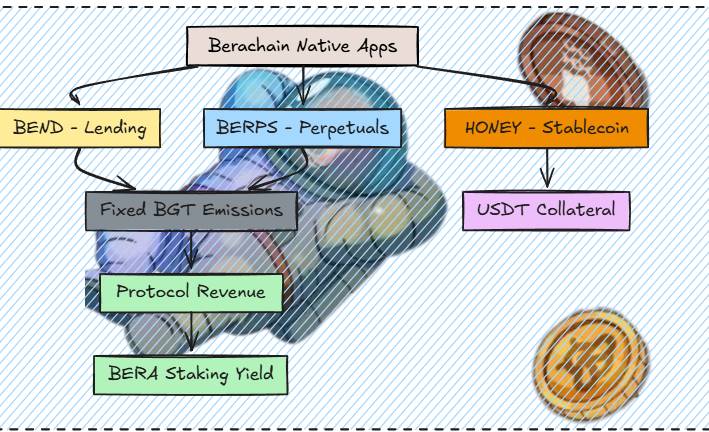

Upcoming developments include more native DeFi protocols launching on Berachain—for instance, the native lending protocol Bend will go live in four weeks; Berp, a derivatives DEX, has confirmed its upcoming release and is still in development; HONEY will expand its collateral options to include more stablecoins, going live within three weeks, enhancing its utility as a stablecoin.

(Image source: @0xRavenium)

In addition, the new Berahub page has recently gone live, featuring upgraded UI design, a new asset portfolio interface, and one-click vault operations. This explore page makes it easier for users to navigate the Berachain ecosystem and participate in various PoL earning opportunities—not just liquidity provision.

Perhaps projects are increasingly realizing that a blockchain must first make itself valuable before its ecosystem can become valuable.

With “revenue driving the native token,” Berachain’s new proposal has made a strong start.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News