In-Depth Analysis of Berachain's Proof-of-Liquidity Mechanism

TechFlow Selected TechFlow Selected

In-Depth Analysis of Berachain's Proof-of-Liquidity Mechanism

By separating gas fees and safety staking from governance and economic incentives, the motivation for holders to conduct large-scale sell-offs is suppressed.

Author: DeFi Cheetah - e/acc

Translation: TechFlow

With the official launch of Berachain's Proof-of-Liquidity (PoL) mechanism, led by @SmokeyTheBera and @codingwithmanny, this article aims to provide readers with the most comprehensive overview of the PoL mechanism and explore its potential impact on the entire ecosystem—especially the $BERA token price. The content covers fundamental mechanics, emission schedules, tokenomics, and strategies for capturing the highest inflationary rewards.

The @berachain Proof-of-Liquidity (PoL) mechanism is designed to solve the misalignment of incentives in traditional Proof-of-Stake (PoS) blockchains. In conventional PoS systems, users lock up assets to earn staking rewards. However, this creates an incentive conflict because DeFi applications built on these blockchains also require capital and liquidity, directly competing with PoS for asset usage. PoL restructures incentives by prioritizing DeFi activity over asset locking, while simultaneously enhancing network security and decentralization.

Core Mechanism

Berachain has two core native assets: $BERA and $BGT:

-

$BERA

-

$BERA serves as gas and staking collateral within the ecosystem; it determines validator eligibility (explained below).

-

-

$BGT

-

$BGT is a non-transferable governance token that can be redeemed 1:1 for $BERA;

-

It also governs how much economic incentive or token issuance is allocated to whitelisted dApp Reward Vaults.

-

Notably, $BGT can be redeemed (or burned) 1:1 into $BERA, but $BERA cannot be converted back into $BGT.

Note: Validators receive higher rewards when producing blocks if they hold more $BGT. However, whether a validator qualifies to be selected for block production depends solely on their amount of staked $BERA.

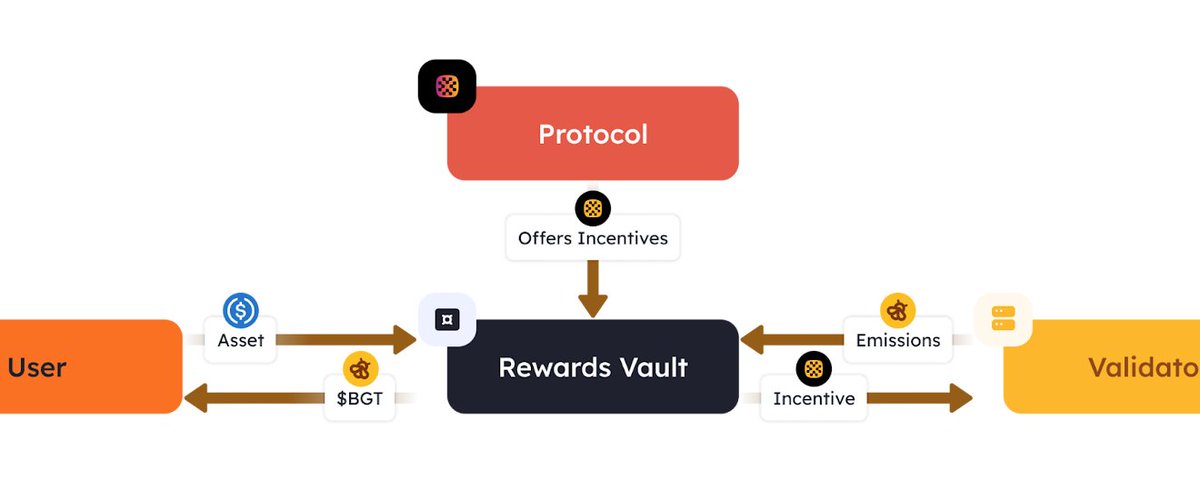

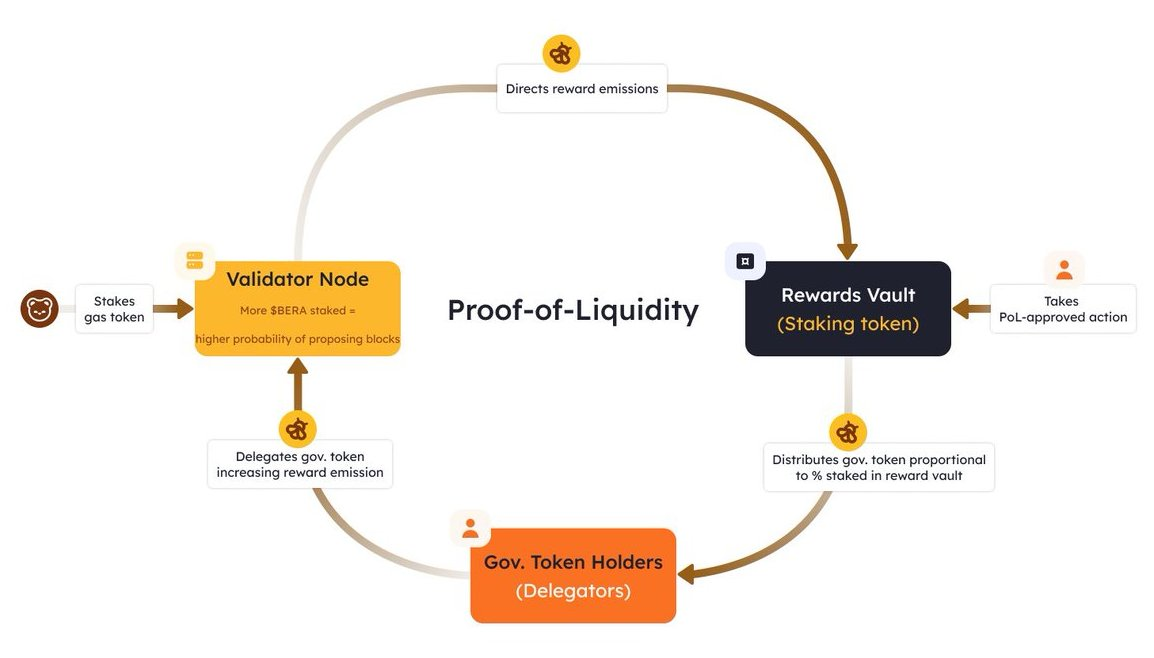

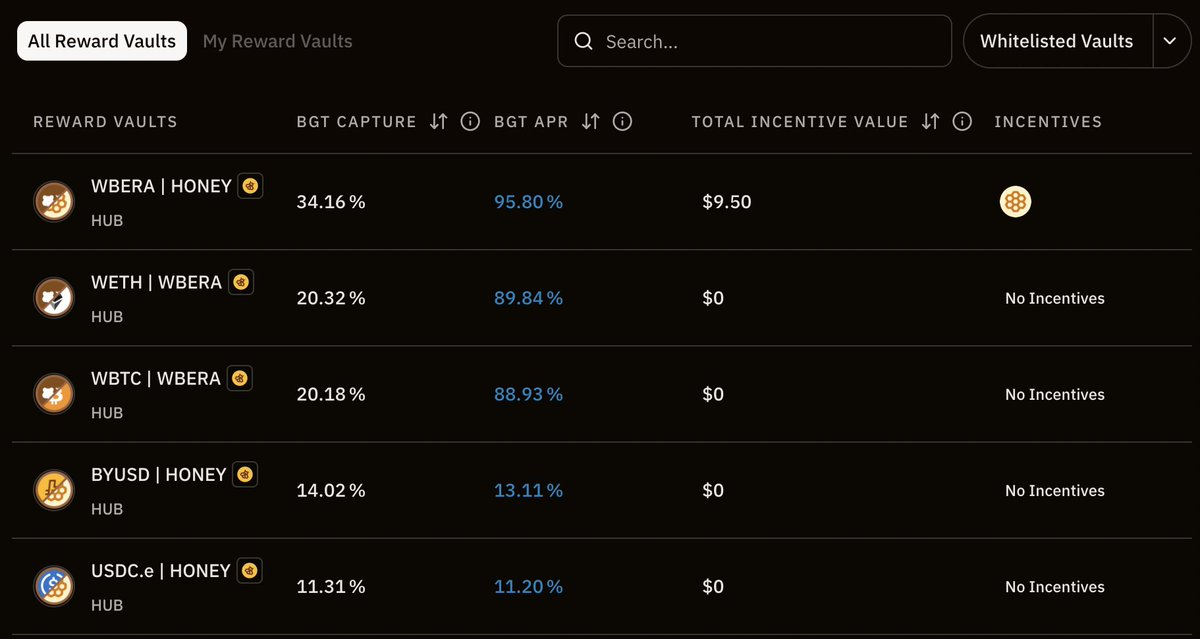

Unlike traditional Proof-of-Stake (PoS), validators on Berachain do not receive direct blockchain-issued rewards for validating transactions, nor do delegators get a share based on stake proportion. Instead, validators earn rewards in $BGT (minted by the BlockRewardController contract and sent to the Distributor smart contract). But most of this $BGT must be directly allocated to whitelisted dApp Reward Vaults (Reward Vaults). Under this model, protocols compete by bribing validators—typically offering various tokens (often their native tokens)—with different incentive rates per $BGT emitted. The more attractive the bribe, the more likely validators are to allocate their $BGT to that dApp’s Reward Vault.

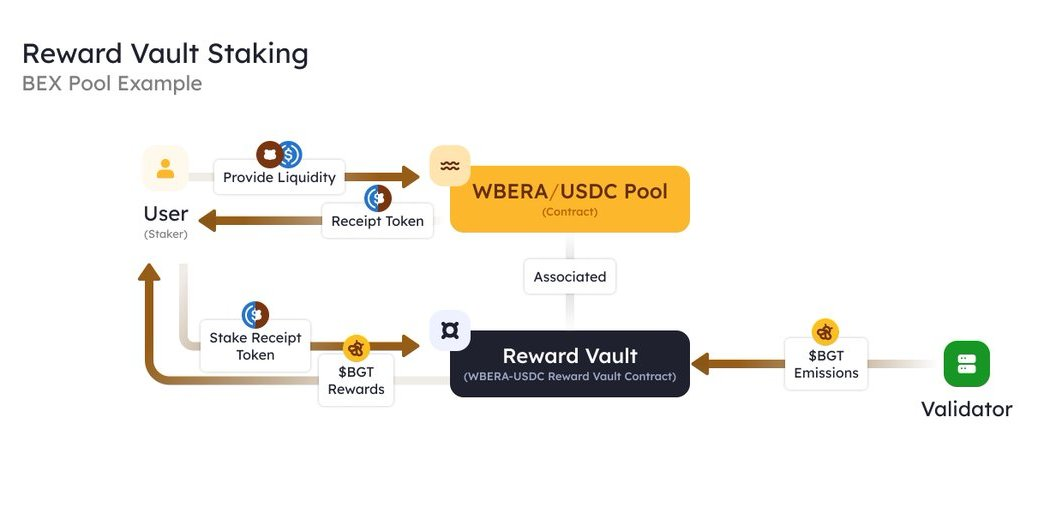

Validators tend to allocate $BGT to the dApp Reward Vaults offering the highest bribes. For example, users can provide liquidity to certain pools on the native DEX to earn LP fees, then deposit their LP tokens into specific pair Reward Vaults to receive additional $BGT rewards. Users may choose to delegate earned $BGT to validators or stake $BERA, thereby increasing a validator’s $BGT emissions.

With PoL now live, there are more whitelisted dApps: https://t.co/EC0LUJKGGk

-

$BGT Delegation: Validators actively or passively decide where to allocate $BGT emissions based on the bribe amounts offered by dApps. As delegators, users can select validators based on strategy and expected returns. Validators delivering the highest returns typically attract more $BGT delegation.

-

$BERA Staking: Stakers contribute to a validator’s self-bond and thus receive a portion of the validator’s earned $BGT and $BERA rewards.

Block Production & $BGT Emission Mechanics

Validator Selection Criteria: Only the top 69 validators by $BERA staked qualify for block production (minimum 250,000 $BERA, maximum 10,000,000 $BERA). Probability of proposing a block is proportional to staked $BERA, but this does not affect the amount of $BGT allocated to Reward Vaults.

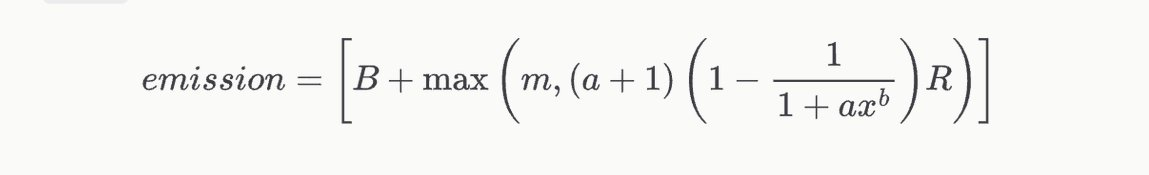

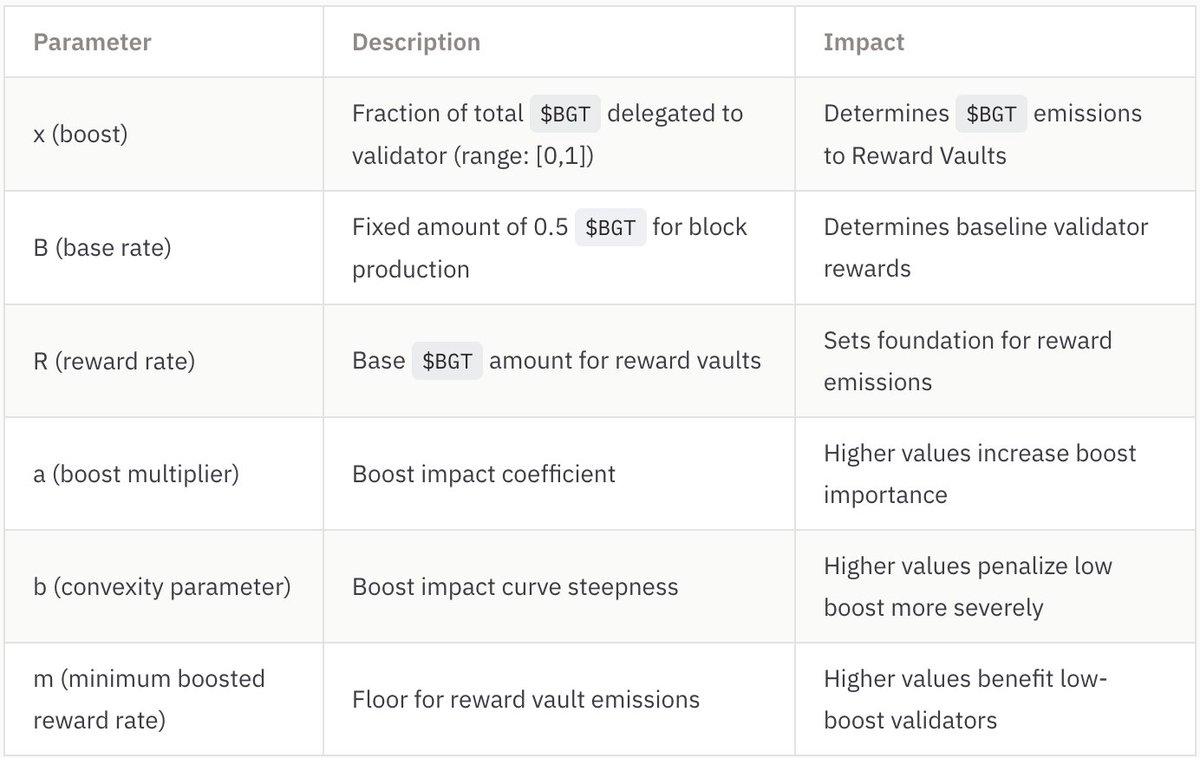

$BGT Emissions: This part is crucial because $BERA lock-up depends heavily on the design of the emission formula.

$BGT emissions consist of two parts: Base Emission and Reward Vault Emission. Base Emission is fixed (currently 0.5 $BGT per block) and paid directly to the block-producing validator. Reward Vault Emission, however, is closely tied to "boost"—the proportion of total network $BGT delegated to a given validator. The higher the boost weight, the greater the impact on Reward Vault Emissions.

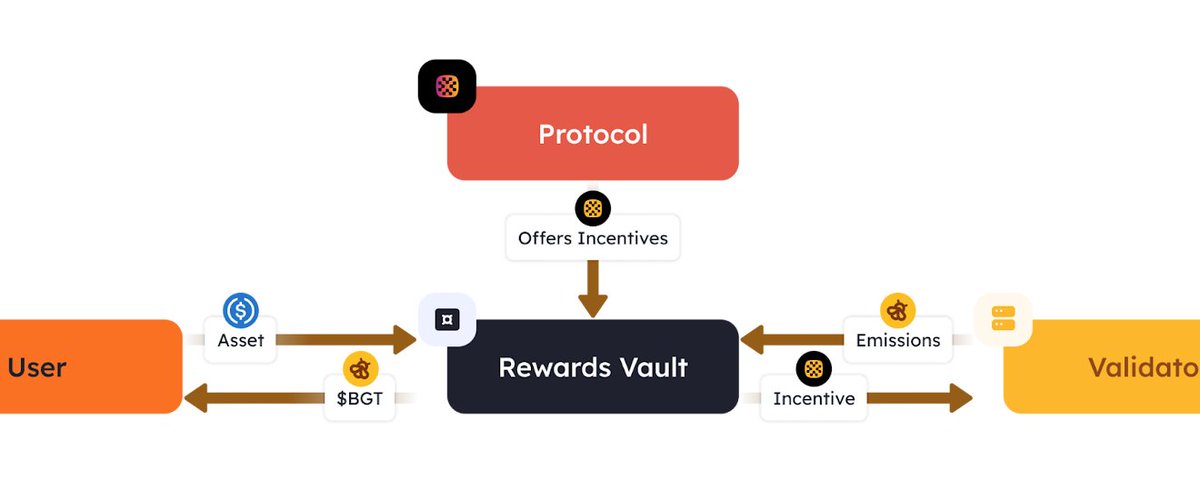

In short, validators who stake more $BERA have a higher chance of being selected to produce the next block; validators who receive more $BGT delegation earn more $BGT emissions, which they allocate across different Reward Vaults—earning more incentives (usually in token form) from protocols via those vaults.

During block production, the top 69 validators participate based on $BERA staking and distribute $BGT emissions to Reward Vaults. Protocols bribe validators through these vaults, who then distribute rewards according to commission rates, with the remainder passed to delegators based on per-$BGT incentive rates. Ultimately, $BGT in Reward Vaults flows to users who provided liquidity to corresponding pools. These users receive non-transferable $BGT, which they can either delegate to validators to earn bribe income from other protocols or redeem directly for $BERA for immediate profit.

Initial Scale of PoL Launch

During Berapalooza 2, bribes exceeded $500,000 within the first 24 hours of RFRV submissions. If this momentum continues and doubles before PoL goes live, weekly bribes could reach $1 million, injecting massive incentives into the Berachain ecosystem.

Meanwhile, Berachain emits 54.52M $BGT annually—about 1.05M $BGT per week. Since 1 $BGT can be redeemed 1:1 for $BERA, and $BERA is currently priced at $8.43, this equates to approximately $8.8 million in annual distributed incentives. Of this, only 16% is directly allocated to validators, while the remaining 84% (around $7.4 million/year) goes to Reward Vaults. Therefore, for every $1 million in bribes, protocols may gain $7.4 million worth of $BGT incentives—an extremely high return on investment.

How Bribes Enhance Capital Efficiency

For protocols, this bribe-based model is game-changing. Instead of spending large sums to attract liquidity, they can now multiply their incentive impact through the bribe mechanism.

For users, the initial weeks after PoL launch mean extraordinarily high annual percentage yields (APY). As protocols compete fiercely for liquidity, they offer increasingly generous $BGT rewards, creating incredible “yield farming” opportunities. If you aim to maximize returns, now is the perfect time to prepare, calculate, and seize the wave of Berachain PoL incentives.

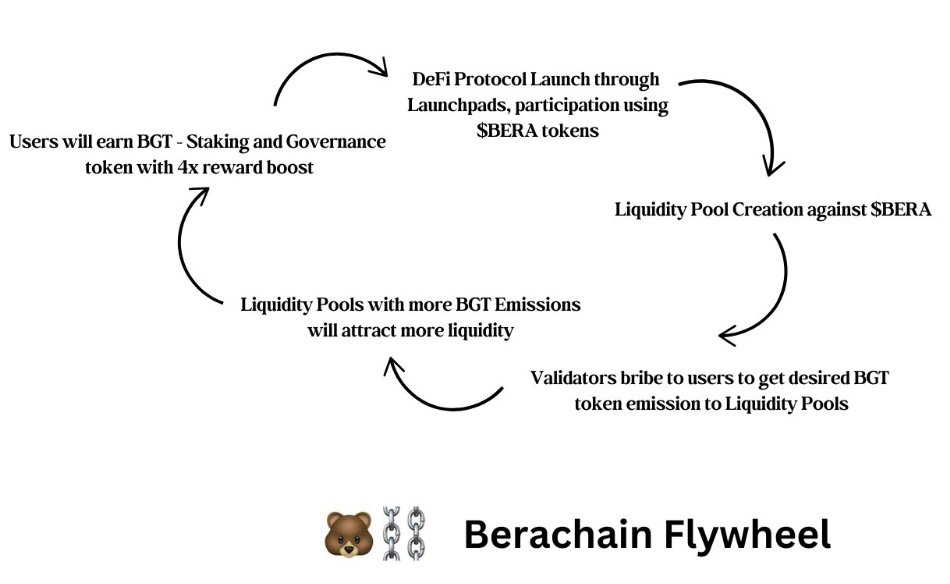

Self-Sustaining Flywheel Effect

Berachain’s ecosystem forms a positive feedback loop: more $BGT delegated due to bribes leads to more $BGT incentives bootstrapping liquidity for trading pairs, attracting more liquidity pool capital, reducing slippage, driving up trading volume, and increasing platform fee revenue. This, in turn, attracts even more $BGT emissions to those pools, forming a self-sustaining growth flywheel.

Berachain’s Proof-of-Liquidity (PoL) mechanism creates a self-reinforcing cycle:

-

More Liquidity → Users Earn More Rewards

-

More $BGT Delegation → Validators Receive Greater Incentives

-

Greater Validator Incentives → Higher Network Security & Synergy with DeFi Growth

PoL Creates a Positive-Sum Economy

Unlike traditional staking models, PoL enhances capital efficiency while continuously expanding economic activity on Berachain. Its operation works as follows:

-

Users provide liquidity → earn $BGT → delegate $BGT to validators;

-

Validators distribute emissions → incentivize DeFi protocols;

-

More liquidity → attracts more users → generates more rewards → repeat the cycle.

Why This Matters?

-

Increased Liquidity: Improves trading conditions, reduces slippage, deepens lending markets.

-

A blockchain with stable and growing liquidity is more attractive to developers.

This flywheel effect ensures that as liquidity enters the ecosystem, it draws in more users, developers, and capital—strengthening long-term network security and sustainability.

The "Magic" of Berachain’s Tokenomics

No matter how teams design or present their tokenomic models, the ultimate goal always comes down to one thing: minimizing sell pressure and optimizing early-stage capital accumulation. This can be analyzed along two dimensions:

-

Inflationary Faucets

-

Partial conversion of $BGT into $BERA (partial because the funds received are subsidized by incentive tokens from other protocols within the Bera ecosystem).

-

-

Deflationary Sinks

-

Staking $BERA to qualify for block production and increase chances of being selected;

-

Delegating $BGT to validators for higher returns;

-

Irreversibility of $BGT redemption (especially since $BGT cannot be obtained on secondary markets, this mechanism deters holders from selling);

-

Bootstrapping more liquidity via PoL improves market depth, lowers slippage, increases transaction volume, generates more fees, and further strengthens deflationary pressure.

-

In traditional PoS staking models, validator selection and reward scaling are typically determined by the amount of native token staked relative to total staked supply. Berachain introduces a clever twist: separating gas payment and security staking from governance and economic incentives. The key innovation lies in assigning economic incentive distribution to a non-fungible token. This raises the barrier to accessing incentives (people cannot simply buy the token on the open market), thereby discouraging mass sell-offs.

Take vote-lock tokens like $veCRV as an analogy—but $BGT goes further. While $veCRV can be obtained by locking $CRV, and $CRV can be bought on secondary markets, $BGT cannot be acquired on any exchange nor converted from $BERA. This design creates a stronger deterrent for $BGT holders: if a user holding a large soulbound $BGT balance chooses to sell off most of their position, re-entering the incentive economy later will be extremely costly. They would need to provide liquidity to specific pools linked to whitelisted Reward Vaults just to regain $BGT and access economic benefits.

Additionally, Berachain’s dual-token split PoS model deserves attention: validators must stake $BERA, but this only determines their eligibility for block production. Thus, validators stake more $BERA to increase their probability of producing the next block. At the same time, they must secure more incentive tokens from protocols to attract $BGT delegators and maximize $BGT delegation. This dynamic generates strong deflationary pressure, effectively absorbing the massive sell-side impact from the initially high-inflation $BGT emission schedule. Validators must continually stake more $BERA to improve block production odds, while users must hold and delegate $BGT to achieve high yields.

However, one potential critical risk remains: if the intrinsic value of $BERA exceeds the yield from holding $BGT, $BGT holders might queue to redeem and dump $BERA. Whether this occurs depends on a strategic game theory calculation—$BGT holders must weigh the profits from continued yield against the immediate gains from redemption and sale. This, in turn, hinges on the vitality of the Bera DeFi ecosystem: the more competitive the incentive market, the higher the yield for $BGT delegators, and the lower the likelihood of such a sell-off.

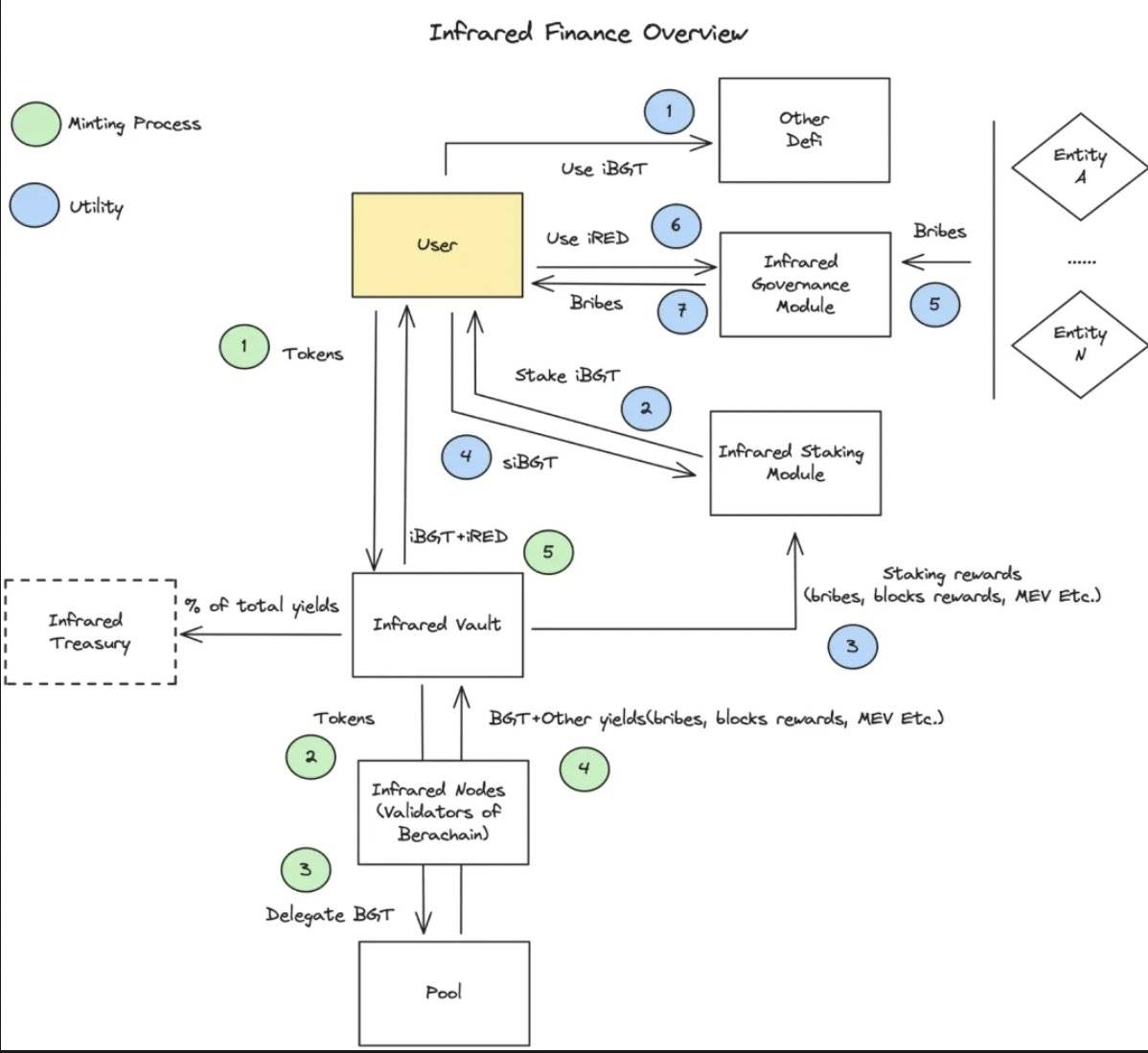

Infrared Finance — A Leading Liquid Staking Protocol Targeting Over $2 Billion TVL

In simple terms, it offers $iBGT and $iBERA—the liquid versions of staked $BGT and $BERA—allowing users to earn staking rewards while maintaining liquidity for other DeFi activities, such as trading on DEXs or participating in lending markets.

$iBGT is backed 1:1 by $BGT. Notably, unlike $BGT’s soulbound nature, $iBGT is fully transferable. @InfraredFinance operates as a validator, allowing users to deposit PoL assets into vaults to earn $iBGT, which can be used throughout Berachain’s DeFi ecosystem. Users can further stake $iBGT to obtain staked $iBGT ($siBGT), capturing amplified $BGT yield. $siBGT magnifies $BGT returns because $iBGT holders trade yield for liquidity, creating a compounding benefit for $siBGT holders. Meanwhile, $iBGT aims to develop monetary premium reflecting its utility as a liquid token.

While we won’t dive into every protocol in the ecosystem, Berachain’s design clearly shows its deep focus on DeFi. Since the collapse of the Luna ecosystem, whether @AndreCronjeTech's @soniclabs and Bera can revive DeFi’s former glory will be a story worth watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News