Can the PoL mechanism be saved? Looking at liquidity games from BERA's new low

TechFlow Selected TechFlow Selected

Can the PoL mechanism be saved? Looking at liquidity games from BERA's new low

Berachain's TVL has dropped 67% from its peak.

By: 1912212.eth, Foresight News

Recently, the BERA token price dropped to $2.66, marking its lowest level since the TGE in February this year. After a continuous decline since March, what exactly has happened to Berachain, once the most talked-about project?

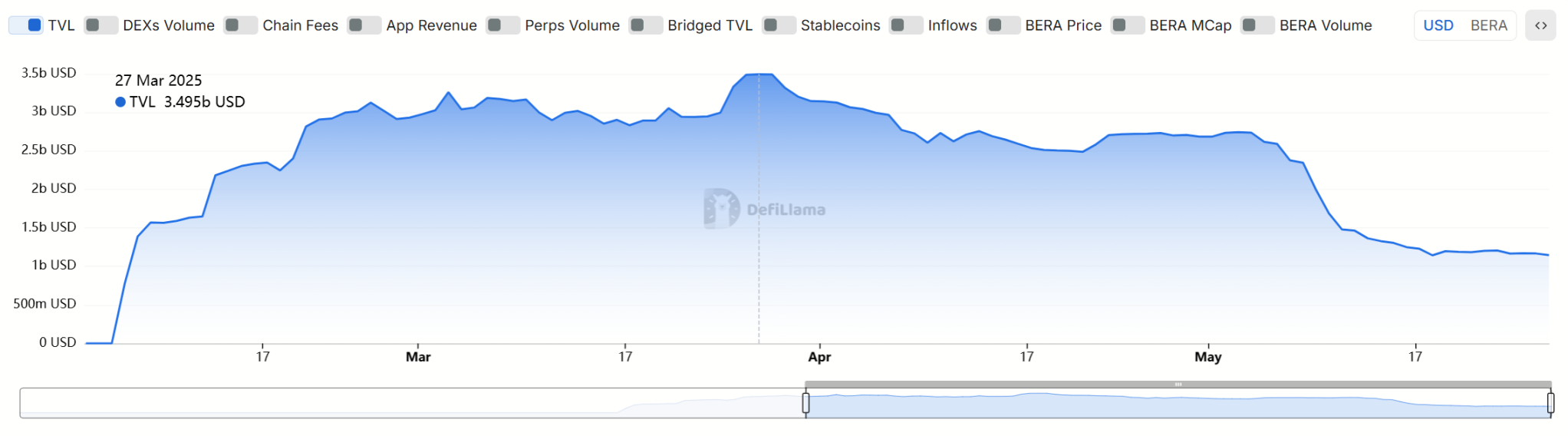

TVL Drops from $3.4 Billion to $1.147 Billion

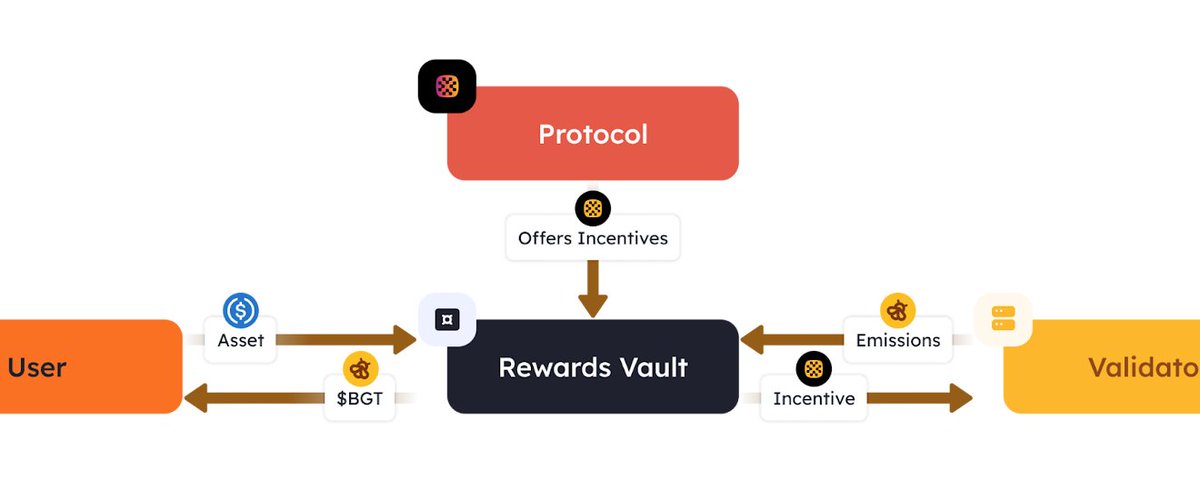

As an emerging public blockchain, Berachain attracted significant market attention even before mainnet launch due to its meme culture, liquidity mechanism, and backing by prominent VCs. Its core innovation lies in the Proof-of-Liquidity (PoL) mechanism, which uses BGT emissions and bribery incentives to drive on-chain liquidity. However, the complexity of this mechanism makes it difficult to attract new users and exposes sustainability issues. PoL relies on continuous liquidity injection, but when market conditions deteriorate or incentives decrease, liquidity providers quickly exit, causing a sharp drop in total value locked (TVL).

According to defiLlama data, its total TVL has fallen from a peak of $3.493 billion on March 28 to the current $1.147 billion—a decline of over 67%.

As early as early April this year, well-known arbitrage KOL Benmo tweeted that Berachain might be facing problems, citing a significant reduction in second-pool TVL share, excessive token emissions, and questioning the viability of its PoL mechanism.

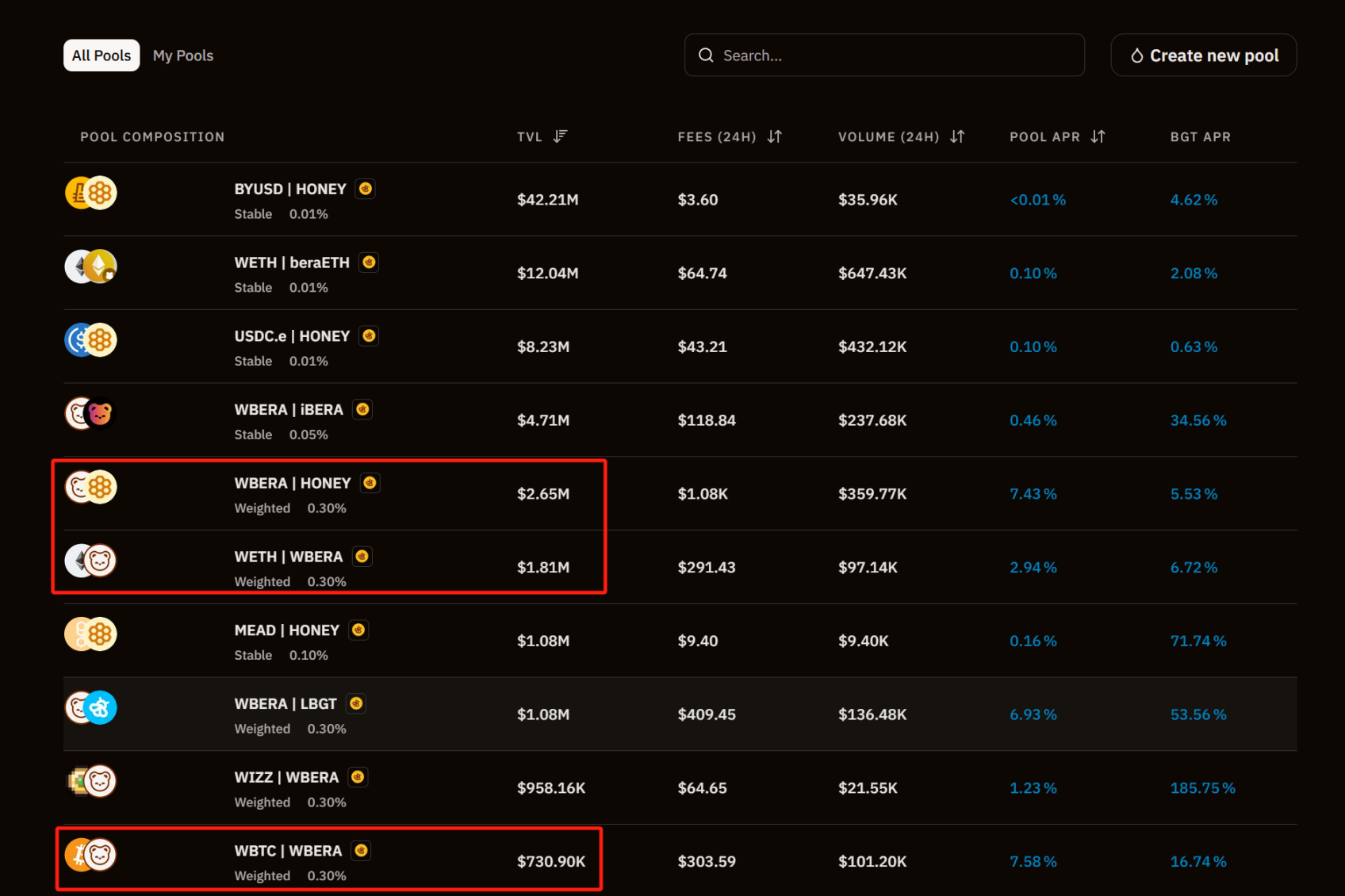

In recent times, the TVL of the liquidity pools shown in the chart above has declined even further.

These three liquidity pools are the core pools of Berachain. Due to reduced token incentive allocation under the PoL mechanism—especially in the "second pool," i.e., non-core pools—liquidity rapidly drained. This reflects three critical underlying issues: lack of long-term confidence among liquidity providers who flee at the first sign of reduced incentives; an ecosystem mechanism overly dependent on token rewards is inherently unstable; and insufficient real demand, with user acquisition relying solely on airdrop farming.

A large portion of BGT emissions have been distributed to vaults holding BERA and BGT liquidity tokens, while other assets see little user engagement or trading volume. Over half of the bribes also come from WBERA, BGT derivatives, and HONEY, raising concerns about the health of the bribe asset structure.

In the long term, if these issues remain unresolved, the mining pools will eventually collapse.

Market Pressure from Unlocking of 10 Million BERA Tokens

Berachain officially unlocked 10 million BERA tokens on May 6, primarily distributed via airdrops. At a unit price of $3, this represents approximately $30 million in selling pressure. As previously mentioned, a majority of Berachain participants are arbitrageurs who quickly exit once incentives shrink. "Mine, sell, and leave" has become standard practice.

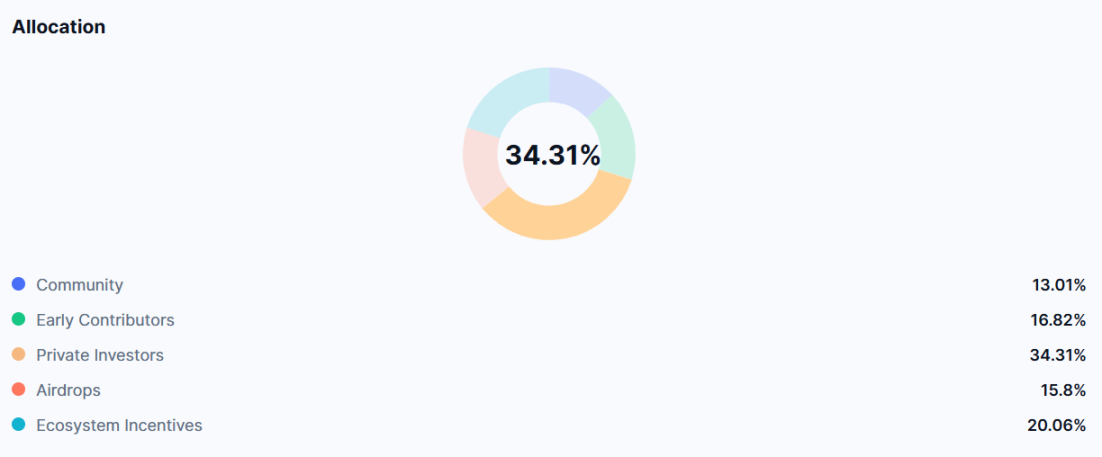

Additionally, BERA has long been criticized as a typical VC coin, with 34.31% of its total supply allocated to private investors. In comparison, VC allocations typically fluctuate around 20%, making Berachain’s near-35% allocation a frequent target of criticism.

Smokey the Bera, Berachain's anonymous co-founder, acknowledged in an interview with Unchained: “I don’t think the criticism is entirely wrong. If we could do it again from scratch, we probably wouldn’t have sold so much of the supply to venture capitalists. Most of the supply was sold during the seed round in early 2022. Back then, we thought it might be an interesting experiment, but didn’t expect it to grow to this scale. So yes, I think the criticism is valid. In fact, over time, we’ve been actively buying back supply from the seed round and subsequent Series A rounds to minimize dilution for the community.”

After market hype and attention quickly faded, demand for BERA weakened, making it difficult for the token price to recover.

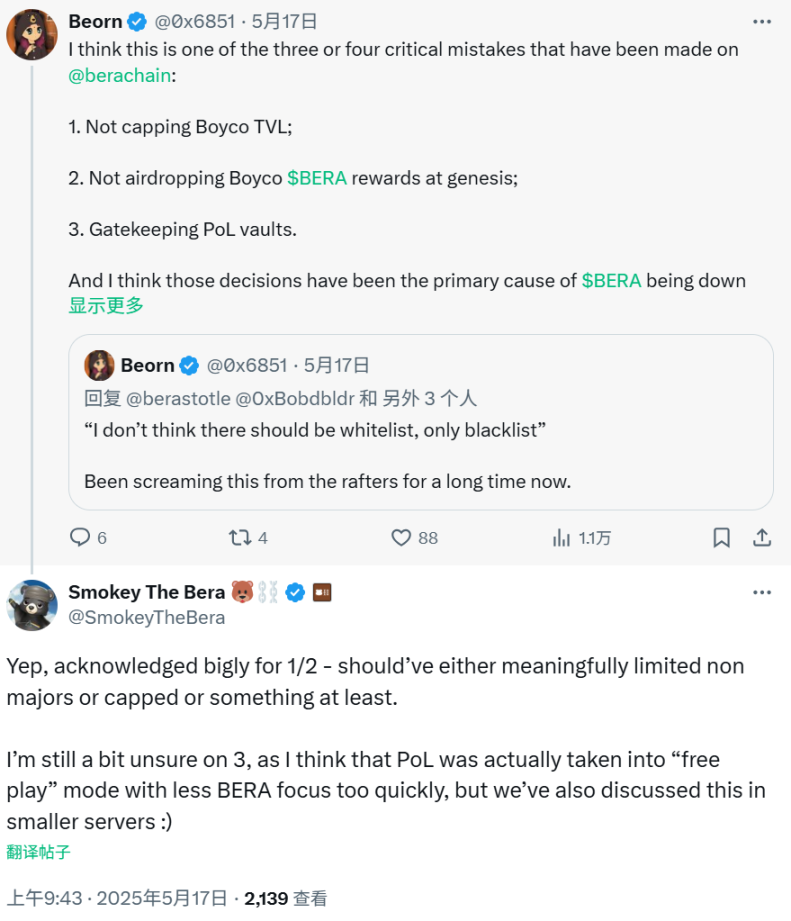

Co-Founder Admits Mistake: 'Failed to Set Boyco TVL Cap'

In mid-May, Smokey the Bera, Berachain’s anonymous co-founder, admitted to making mistakes during a comment section interaction with the community—including failing to set a TVL cap for Boyco and not distributing BERA incentives for participation.

Why were these two errors problematic? Rewards should decay nonlinearly or have a cap as TVL increases, to prevent capital concentration and reward "raids." Without a cap, higher TVL directly translates into more tokens, allowing large players like Boyco to infinitely recycle and extract BERA incentives. This mechanism effectively defaults to "the one with more money dominates," completely undermining fairness.

Rewards should use PoL to encourage diverse ecosystem participation, but instead led to key tokens like BGT and HONEY being overwhelmingly captured by a few individuals, triggering community dissatisfaction and a trust crisis. Once other users realize that rewards are monopolized by whales, they either exit or go passive, creating a liquidity avalanche effect.

The failure to distribute BERA incentives for participating in the Boyco airdrop became another point of community frustration. If a protocol defines an incentive model but the team skips distribution without notice, it fundamentally violates on-chain principles and makes large participants uneasy: Could my rewards be arbitrarily canceled too?

Well-known farming KOL Bingwa commented on the incident: “Months have passed. Berachain keeps admitting mistakes, but never learns how to fix them?” He further questioned: “This only shows they’ve known all along. They heard the community feedback. They knew where the problems were. But from start to finish, they never intended to change.”

So, has Berachain actually taken meaningful action to improve recently? At least not regarding airdrop incentives.

However, recently the official team announced a protocol-level upgrade introducing configurable BGT reward duration. Vault managers can now set reward cycles between 3 to 7 days, with a 1-day cooldown period between changes. All newly created vaults will default to a 7-day cycle. This change offers greater flexibility, aligning emission pacing better with vault strategy and user experience.

In addition, upgrade proposals surrounding PoL are currently underway.

BERA Value Capture Needs Strengthening

BERA serves as the gas token for all transactions and smart contract executions on the Berachain network—an entirely consumable asset. The protocol’s incentive model essentially extracts value from Berachain through highly efficient bribery mechanisms.

Moreover, BERA holds no governance rights; governance is instead granted to BGT holders, further weakening BERA’s value proposition.

BERA urgently needs stronger value capture mechanisms.

On May 11, a Berachain co-founder unveiled the POL V1.1 proposal, aiming to strengthen BERA’s value capture while maintaining incentive efficiency. Key elements include: the protocol would collect a small portion of application-level bribery incentives and deploy them into Protocol-Owned Liquidity (POL), used to establish core BERA trading pair LPs (such as BERA-HONEY, BERA-wBTC on BEX), thereby achieving:

-

Improved depth and stability of core on-chain trading pairs,

-

Reduced BERA circulation,

-

Increased long-term fee revenue sources (initial revenues prioritized for core pairs; later可用于 staking at foundation-operated validator nodes, targeted BGT issuance to RVs of native apps, delegation to nodes run by innovative app teams, forming new LPs with major assets, or deployment into other native protocols such as Bend and Berp)

The proposal suggests initially charging a fixed 20% reinvestment fee from incentives, gradually transitioning to a dynamic rate model:

-

High application bribe efficiency → lower fee rate

-

Low application bribe efficiency → higher fee rate

-

Fees adjusted dynamically within a 10%-30% range based on market conditions. This mechanism encourages efficient resource use and creates a feedback loop tied to actual app performance.

Recently, Smokey hinted that a new PoL proposal v1.2 will be released soon, incorporating broad community feedback to further enhance token value capture.

Summary

The quieter it is now, the noisier it once was. After prolonged price stagnation, the Berachain community has quickly fallen silent. It remains unclear how Berachain will truly resolve these issues—but time waits for no one. If the team continues to move slowly, it risks being abandoned by the community.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News