WOO X Research: Bear Market Is Here — How to Mine Over 100% APY on Berachain?

TechFlow Selected TechFlow Selected

WOO X Research: Bear Market Is Here — How to Mine Over 100% APY on Berachain?

Berachain POL mechanism goes live.

There remain many uncertainties in the macroeconomic environment, and Trump's implemented tariff policies have further negatively impacted numerous tech stocks in the U.S. market. Meanwhile, Bitcoin has evolved from a niche asset into a focal point for traditional finance since the launch of spot ETFs, indicating that its price movements are increasingly influenced by macroeconomic factors.

The current market has been oscillating between 82,000 and 88,000 for two months, with no new narratives emerging in secondary altcoins and no sustained activity in the primary market. As investors, besides "hodling," putting our blue-chip cryptocurrencies and stablecoins to work in yield farming to earn passive income is also a sound strategy.

Berachain, a public blockchain with built-in DeFi mechanisms, has launched its Proof-of-Liquidity (PoL) mechanism, offering APYs frequently exceeding 100%. Let WOO X Research guide you through yield farming on Berachain!

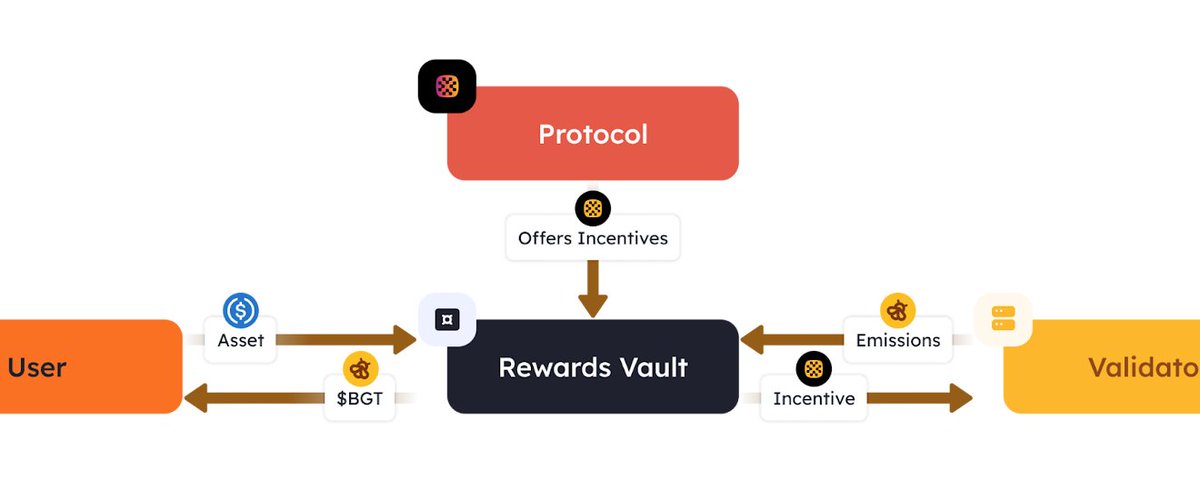

How Does PoL Create a Flywheel Effect?

-

Liquidity Provision: Users deposit assets into dApp liquidity pools, receive receipt tokens, and stake them in reward pools to earn BGT—providing initial liquidity to the ecosystem;

-

Validator Allocation: Validators direct BGT emissions toward the highest-yielding reward pools based on incentives offered by dApps. As more BGT flows into popular pools, user yields increase, further attracting additional users;

-

dApp Competition: To attract validator-directed BGT emissions, dApps enhance their incentives (e.g., increasing native token rewards), deepening liquidity;

-

User Delegation: Users can delegate their earned BGT to top-performing validators, increasing these validators’ block proposal weight and earning higher commission shares. This incentivizes validators to continuously optimize BGT allocation strategies, creating positive feedback;

-

Ecosystem Expansion: As liquidity and user participation grow, trading volume and dApp usage rise, increasing network value and attracting more users and developers—the flywheel accelerates.

This flywheel effect fosters collaboration among dApps, users, and validators, overcoming traditional PoS challenges such as insufficient liquidity and uneven asset distribution.

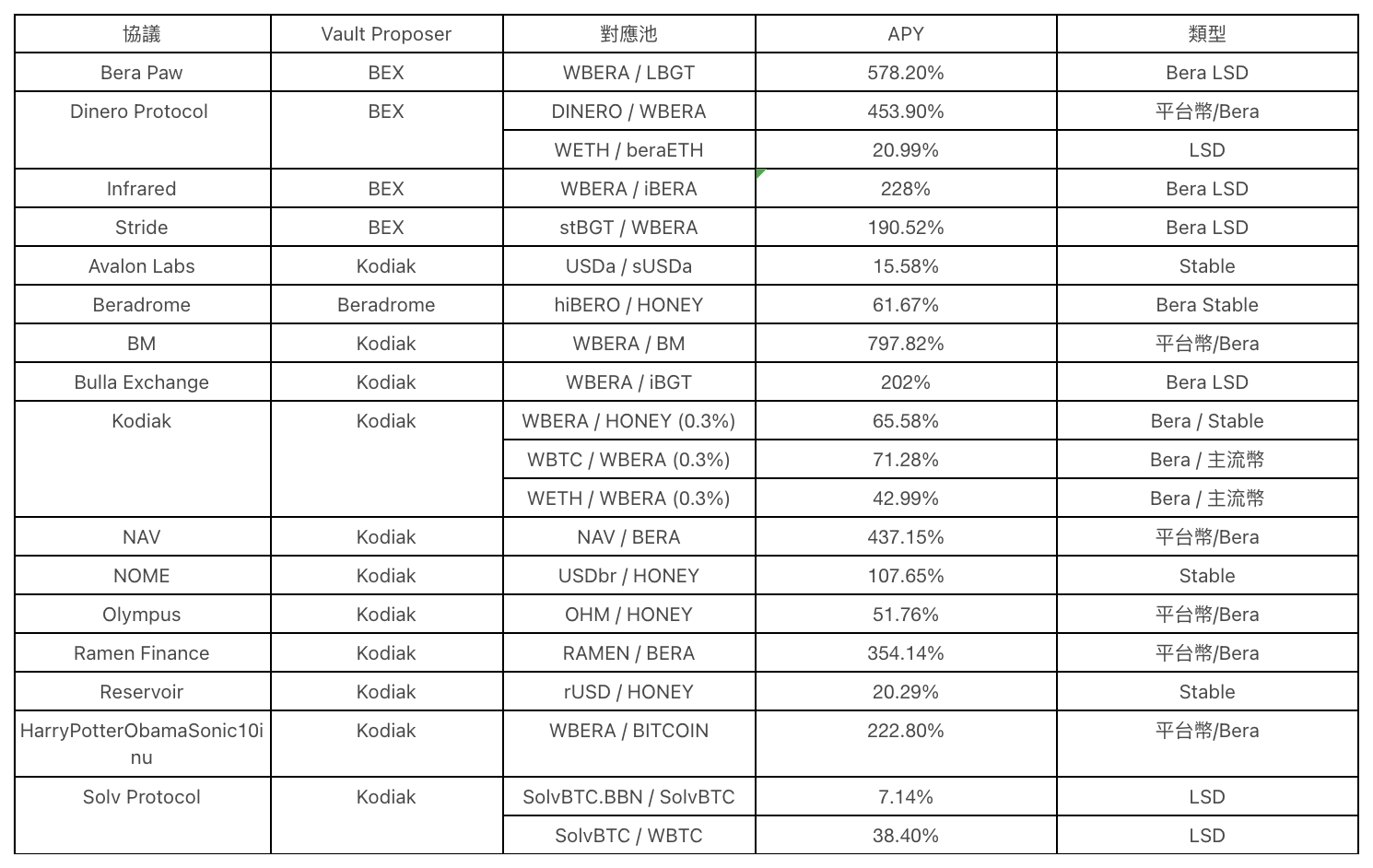

Current PoL Reward Pools Overview

*Data changes rapidly; figures in the table are for reference only. For real-time data, please refer to: https://furthermore.app/

Farming Strategies

"Conservative Strategy" Focused on Core Blue-Chips / LSDs:

Core Idea: Choose relatively central, deeper, and moderately volatile asset pairs on Berachain, such as:

-

WBERA / LSD (e.g., iBERA, stBGT, beraETH, etc.)

-

WETH / LSD (e.g., weETH, ezETH, beraETH, etc.)

-

WBTC / LSD

Purpose:

-

Reduce risks associated with sharp price fluctuations (compared to small-cap or Meme coins);

-

Benefit from better liquidity depth (official or major protocol resources often favor the LSD ecosystem);

-

Stack yields: LSD holdings inherently generate staking returns, which combine with PoL’s BGT rewards.

Potential Revenue Streams:

-

Liquidity Mining (LP Rewards + PoL Rewards)

-

Intrinsic LSD Yield (some LSDs continuously accrue staking rewards, increasing your LSD balance over time)

-

Protocol Bribe Sharing (if the LSD’s protocol actively bribes validators, incentives will be higher)

Risks & Notes: Premium/discount issues between LSD tokens. Tokens like iBERA or beraETH may depeg.

-

Validator Commission and revenue-sharing models require selecting the right validator to capture full mining rewards.

-

For very large or small capital amounts, consider balancing final annualized APR against gas and transaction fees.

"Low-Volatility Strategy" Using Stablecoin/Stablecoin Pairs

Core Idea: Use stablecoin-to-stablecoin pools (e.g., USDa / sUSDa, rUSD / HONEY, or other stable asset pairs) to minimize impermanent loss caused by price volatility.

Berachain already hosts multiple decentralized stablecoins (USDa, sUSDa, rUSD, USDbr, etc.), and many protocols offer bribes to attract more stablecoin TVL. While APR may not match high-volatility pools, the underlying assets are relatively stable.

Potential Revenue Streams

-

PoL Incentives (BGT emissions + protocol bribes)

-

Trading fee revenue (stablecoin/stablecoin pairs sometimes see significant trading volume, with fees distributed to LPs)

-

Additional rewards or airdrops from protocols (some protocols distribute governance tokens to stablecoin providers)

Risks & Notes:

-

Stablecoin credit risk: Ensure the stablecoin’s collateral mechanism, over-collateralization ratio, or algorithmic design is reliable.

-

APR is generally lower; if seeking higher returns, consider allocating part of funds to higher-APR pools.

-

Bribes are unstable: Protocols might spend heavily at launch but reduce incentives quickly if operations falter.

"High-APR Short-Term Strategy" Targeting High-Risk Meme Coins / Emerging Token Pools

-

Core Idea: Select newly launched or highly discussed Meme coins/emerging tokens (e.g., HarryPotterObamaSonic10inu, BM, RAMEN, HOLD, etc.) and their trading pairs with WBERA, HONEY, BGT, or LSDs. These small-cap pools often exhibit exaggerated APRs reaching thousands of percent.

-

Short-term farm-and-dump: Earn rewards during high-APR periods and promptly cash out into blue-chip assets (BERA, ETH, BTC, etc.) or stablecoins to avoid losses from sudden price drops.

Potential Revenue Streams:

-

PoL Rewards: New projects often provide substantial bribes to direct BGT emissions into their vaults.

-

Extremely high APR or airdrops: To rapidly acquire users, protocols typically offer additional token subsidies.

Risks & Notes:

-

Price volatility / Rug risk: Meme coins can surge and crash within minutes; new protocols haven’t been tested over time.

-

Impermanent Loss: If paired with a highly volatile emerging token, extreme price swings in one side of the LP could erase most farming gains.

-

Requires active monitoring: Especially TVL, trading volume, and remaining protocol bribe budgets—all affect actual pool performance.

Conclusion: No One-Size-Fits-All Strategy – Dynamic Monitoring Is Key

The Berachain ecosystem under the PoL mechanism is essentially a “bribery race” among protocols. To attract more TVL and compete for BGT emissions, protocols offer varying levels of bribes—and as market conditions and their own budgets shift, APRs can change rapidly.

The optimal strategy isn't about locking funds into a single pool and ignoring it, but rather “diversification + dynamic adjustment”:

-

Allocate part of capital to relatively stable LSD/blue-chip/stablecoin pools.

-

Deploy smaller amounts into high-risk, high-volatility small-cap or Meme pools for explosive return potential.

-

Regularly track APR across pools, validator commissions, and protocol bribe trends to optimize yield farming returns.

Always prioritize security: Assess smart contract risks of new protocols, evaluate tokenomics rationality, and research team backgrounds. While PoL-driven high APYs are enticing, rug pulls and contract vulnerabilities remain prevalent in early-stage ecosystem projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News