Escaping Leviathan: Epstein, Silicon Valley, and the Sovereign Individual

TechFlow Selected TechFlow Selected

Escaping Leviathan: Epstein, Silicon Valley, and the Sovereign Individual

Whether it’s immortality or interstellar colonization, they are all the latest versions of the “escape plan.”

By Sleepy.txt

For the past century, ultra-wealthy individuals have pursued one singular goal: a lawless haven where money could escape scrutiny by sovereign states.

In the early 20th century, they found it in Swiss bank accounts.

The 1934 Swiss Banking Act mandated strict client confidentiality; violators faced criminal prosecution. The wealthy could deposit assets into accounts whose owners were known only to a handful of senior bankers—evading taxation and legal oversight in their home countries.

This system endured for 74 years—until 2008, when the U.S. Internal Revenue Service (IRS) issued a “John Doe summons,” compelling UBS to disclose account information for approximately 52,000 American clients.

The following year, UBS paid a $780 million fine and surrendered partial client lists.

Once underground vaults ceased to be safe, capital rapidly shifted terrain—flooding into sunlit tax havens.

From the mid-20th century onward, Caribbean offshore centers began rising. The Cayman Islands, Bermuda, and the British Virgin Islands—scattered across the blue ocean—offered zero tax rates and lax regulation, becoming playgrounds for multinational corporations and billionaires to register shell companies and conceal wealth.

This system lasted roughly 50 years—until 2014, when the Organisation for Economic Co-operation and Development (OECD) launched the Common Reporting Standard (CRS), requiring global financial institutions to automatically exchange account information on non-resident clients. By 2024, over 170 million accounts had been forcibly exposed—representing assets totaling €13 trillion—now fully visible within national tax authorities’ systems.

Sunlight pierced through Caribbean palm groves, illuminating treasures long hidden in shadow.

Each generation of offshore havens grows shorter-lived: Swiss banking lasted 74 years; Caribbean offshore centers, 50. As regulatory nets tighten, the ultra-wealthy urgently seek a new hiding place.

In August 2019, Jeffrey Epstein died in a Manhattan jail cell. While the mystery surrounding his death lingers, his legacy serves more accurately as a specimen of an era—precisely illustrating how the wealthy leap from one vessel to another.

In the physical world, he owned Little Saint James Island—a private island equipped with its own port, airport, and independent power grid. It was a classic old-school sanctuary: a tangible, visible lawless zone. And indeed, on that small island, he and others became lawless outlaws.

In the digital realm, he had already begun laying new groundwork. From funding Bitcoin developers to investing in infrastructure and lobbying for favorable regulatory policies, Epstein extended his reach deep into cryptocurrency. Clearly, in his eyes, this virtual sanctuary held far greater promise than any physical island.

The Bitcoin crisis of 2015 and tightening regulation by 2026 mark the latest round in this century-long cat-and-mouse game.

Dirty Money

In April 2015, the Bitcoin Foundation—the organization once hailed as the de facto central bank of the Bitcoin ecosystem—publicly acknowledged in an open letter that it had effectively gone bankrupt.

Founded in 2012 by early Bitcoin evangelists and believers—including Gavin Andresen, widely regarded as Satoshi Nakamoto’s “successor” and Chief Scientist of the Foundation—and Roger Ver, later dubbed “Bitcoin Jesus,” the Foundation aimed to fund core developers’ salaries, organize conferences, promote the technology, and lend official legitimacy to this rapidly evolving digital currency.

Yet this centralized organization operating within a decentralized world collapsed within just three years due to corruption, infighting, and mismanagement.

Mark Karpeles, a founding board member and then CEO of Mt. Gox—the world’s largest Bitcoin exchange at the time—was imprisoned after the exchange collapsed and 850,000 Bitcoins vanished. Charlie Shrem, the Foundation’s vice chairman, was sentenced to two years in prison for money laundering.

As the Foundation crumbled, the livelihoods of five core developers hung in the balance. They maintained code underpinning a market cap worth tens of billions—but received no salaries.

In April 2015, just as the Bitcoin community fretted over this crisis, MIT Media Lab announced the launch of its “Digital Currency Initiative.” It swiftly recruited three key figures: Gavin Andresen, Cory Fields, and Vladimir Van Der Laan.

This interdisciplinary lab—founded in 1985 and renowned for its forward-looking research and tight collaboration with industry and the ultra-wealthy—emerged as the “white knight” for Bitcoin developers.

But this white knight’s money was anything but clean.

At the time, MIT Media Lab’s director was Joi Ito—a prominent Japanese-American investor who had wielded immense influence in Silicon Valley, having backed early successes like Twitter and Flickr.

According to a 2019 New Yorker investigation, it was Joi Ito who decided to fund the Digital Currency Initiative using Epstein’s money.

Between 2013 and 2017, Epstein donated $525,000 directly to MIT Media Lab. But this was merely the tip of the iceberg. Epstein himself claimed he helped raise at least $7.5 million for MIT from other billionaires—including $2 million from Bill Gates. These funds were cleverly labeled “anonymous,” completely obscuring Epstein’s influence.

This money should never have entered MIT in the first place. Epstein had been blacklisted by the university since his 2008 sex offense conviction. Yet Joi Ito exploited MIT’s “gift fund” mechanism to bypass institutional review layers and launder the tainted funds. He even emailed colleagues explicitly ordering that these donations remain anonymous.

Joi Ito understood the levers of power all too well. In another email to Epstein, he pinpointed Bitcoin’s critical vulnerability: though touted as decentralized, ultimate control over its code rested in the hands of just five people—and MIT hadn’t just entered the scene; it had immediately absorbed three of them.

Epstein’s terse, loaded reply: “Gavin is smart.”

His meaning was clear: he’d made the right bet. By controlling people, they quietly seized control over the code itself.

That’s the magic of elite institutions—they can gild the dirtiest money with the brightest gold. A convicted sex offender transformed overnight into Bitcoin’s shadow financier. That “visiting scholar” title granted him full access—to top-tier labs, to the world’s most brilliant minds, to endless rounds of wine-fueled brainstorming.

In 2014, Epstein also invested $500,000 in Blockstream, a Bitcoin infrastructure company founded by other core developers including Adam Back, Gregory Maxwell, and Peter Wieler.

Technology may be decentralized—but funding always has origins. To survive, this decentralized utopia had no choice but to accept centralized patronage. Yet as the saying goes: “He who pays the piper calls the tune.”

Epstein’s logic was simple: first keep Bitcoin alive—then steer it toward his desired direction.

By financing core developers’ salaries, he didn’t just rescue a collapsing technology—he purchased influence over its trajectory. Joi Ito used Epstein’s money to persuade three developers to join MIT. In effect, Epstein’s funding secured majority control over Bitcoin’s technical decision-making.

With influence comes definitional power.

Satoshi Nakamoto designed Bitcoin to emphasize technological decentralization—not relying on banks or central servers.

But once figures like Peter Thiel and Jeffrey Epstein intervened, Bitcoin acquired a far more radical ideological hue—not just a technological innovation, but a direct challenge to nation-state authority, a tool for “sovereign individuals” to escape all constraints.

When you fund those maintaining the code, you gain the power to define what the technology “is.” Technology itself is neutral—but whoever controls the narrative decides whom it serves.

So what, exactly, did Epstein hope to gain by betting on cryptocurrency?

Silicon Valley’s Secret Dinner

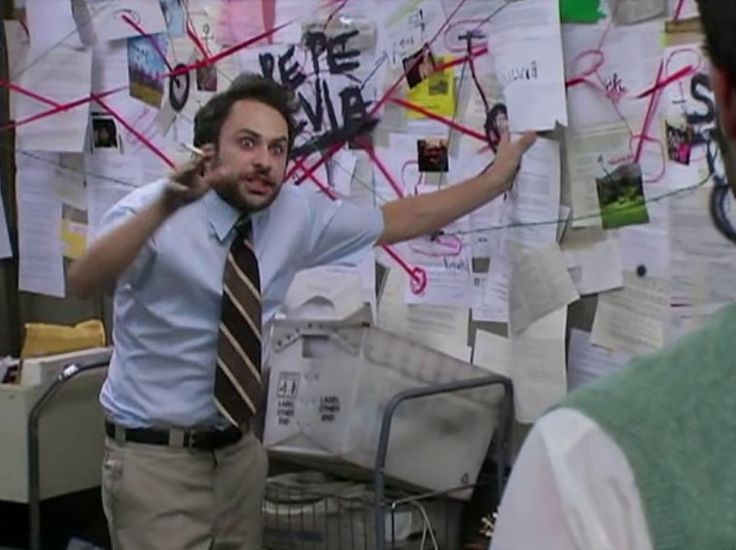

Epstein wasn’t merely making venture investments—he was sniffing out kindred spirits. He keenly sensed a far larger network beneath the surface: a tight-knit circle of global elites.

In August 2015, that circle surfaced at a private dinner in Palo Alto, California.

Organized by LinkedIn co-founder Reid Hoffman, the guest list glittered: Jeffrey Epstein, Joi Ito, Elon Musk, Mark Zuckerberg, and Peter Thiel.

This gathering occurred just months after MIT had used Epstein’s money to recruit Bitcoin developers. Unsurprisingly, every attendee would go on to become a devoted crypto believer. Clearly, this was no ordinary social event.

Within this group, Peter Thiel stood unchallenged as the spiritual leader. As co-founder of PayPal, Facebook’s first outside investor, and founder of big-data firm Palantir, he was already a Silicon Valley legend.

In 2017—when Bitcoin hovered around $6,000—Thiel’s Founders Fund quietly entered the space, investing $15–20 million. By the time it exited ahead of the 2022 crypto bear market, the fund had reaped roughly $1.8 billion in returns. In 2023, Thiel doubled down again—investing $200 million across Bitcoin and Ethereum. Each move landed precisely on the cusp of bull markets.

Profit was incidental. What truly captivated Thiel was Bitcoin’s political symbolism. In his view, this was PayPal’s true successor—finally realizing that wild dream: a new world currency entirely beyond government control.

This ideology traces back to a 1997 book later canonized by Silicon Valley elites: The Sovereign Individual.

Co-authored by James Dale Davidson and William Rees-Mogg, the book argues that the Information Age heralds the twilight of the nation-state. True “cognitive elites” will shed geographic boundaries entirely, evolving into “sovereign individuals” transcending national authority. Not only did it prophetically foresee “digital, encrypted currencies,” it declared outright the death sentence on state monetary power—predicting such currencies would utterly dismantle national sovereignty over money creation.

For Thiel, this was his spiritual totem. He confessed to Forbes that no book had reshaped his worldview as profoundly as The Sovereign Individual. In a 2009 essay, he wrote: “I no longer believe freedom and democracy are compatible.”

If existing systems were irredeemable, total exit was the only option. This obsession explains why Thiel fixated so intensely on every tool capable of escaping state power.

Before embracing Bitcoin, he heavily funded the “Seasteading” project.

Launched by Milton Friedman’s grandson, this initiative sought to build floating cities on international waters—creating a fully ungovernable utopia where people could freely shop for laws and governments like groceries. Though it sounded fantastical, Thiel poured in $1.7 million without hesitation. Ultimately, the project stalled due to technical bottlenecks, funding shortfalls, and local opposition.

Since building a physical Noah’s Ark proved impossible, they turned to the digital realm to discover new continents.

In 2014, introduced by Reid Hoffman, Epstein met Peter Thiel. In 2016, Epstein invested $40 million into Thiel’s other venture firm, Valar Ventures.

That same year, Thiel made a bold gamble—openly endorsing Donald Trump at the Republican National Convention. This high-stakes wager catapulted him directly into the heart of the presidential transition. Overnight, he transformed from a Silicon Valley investor into the critical bridge linking tech and the White House.

Behind these dinners and investments lay a mysterious organization: Edge Foundation.

Founded by John Brockman, this nonprofit played a classic insider-circle game. In a 2011 leaked email list, Epstein’s name appeared alongside Jeff Bezos, Elon Musk, Google’s co-founders (Sergey Brin and Larry Page), and Mark Zuckerberg.

Under the banner of scientific and intellectual exchange, it gathered the world’s top minds. In reality, it functioned as an exclusive elite club. Members exchanged intelligence and aligned positions via private emails and offline gatherings—far from public view—completing strategic coordination behind closed doors. If Davos was the stage show for the world, Edge Foundation was the backstage.

All major tech bets and political alignments were pre-negotiated here. To them, Bitcoin wasn’t just an asset—it was a weapon.

Sovereignty Fantasy

Whether private islands or Bitcoin, both represent the same ideology manifest across different dimensions: escape from democratic-state constraints. The former constructs a lawless zone in physical space; the latter builds a sovereign domain in digital space.

From Swiss bank accounts to Bitcoin public-key addresses, the ultra-wealthy have persistently sought new cryptographic keys to hide wealth. Swiss bank privacy relied on banking secrecy laws and professional ethics; Bitcoin address anonymity relies on cryptography and decentralized networks. Both promised privacy—and both ultimately succumbed to regulatory reach.

The “freedom” Peter Thiel extols has nothing to do with you or me.

According to the World Inequality Report, released at the end of 2025, the world’s top 0.001%—fewer than 60,000 people—control three times the combined wealth of the poorest half of humanity (roughly 4 billion people). In 2025 alone, global billionaire wealth grew by 16%, tripling the average annual growth rate over the prior five years, reaching a record $18.3 trillion.

This is the true face of their “freedom”: a world where wealth and power concentrate infinitely among a few “sovereign individuals,” while billions are left behind.

They champion Bitcoin not to improve ordinary people’s lives—but to absolve themselves entirely of social responsibility and wealth redistribution.

This narrative—framing technology as an “anti-government tool” rather than a “public-interest tool”—is widespread among Silicon Valley’s libertarian circles.

In fact, blockchain technology could have taken another path. It could serve as a truth-telling mirror—tracking how governments spend budgets, monitoring how votes are cast. But when this elite clique treats it as a private backyard, a technology meant to benefit the masses gets hijacked into a privileged pipeline for the few.

Reality soon delivered a heavy blow: complete escape is impossible. Whether hiding on the high seas or buried in code, gravity from the real world remains inescapable. These brilliant minds quickly realized—if you can’t run, change tactics. Rather than evading rules, buy the rule-makers instead.

In February 2018, an email sent to Steve Bannon sounded the charge.

Bannon—the former “White House strategist”—had just left Trump’s inner circle but still wielded considerable clout in Washington.

Epstein approached him bluntly, demanding in the email: “Will Treasury respond—or do we need another path?”

Epstein’s urgency stemmed from a proposal masquerading as regulatory cooperation but operating as a Trojan horse: the “Voluntary Disclosure Form.”

On the surface, he claimed it would help the government “catch bad actors,” exposing criminals. In reality, it was a customized get-out-of-jail-free card for the elite. By voluntarily reporting gains and paying back taxes, he sought to grant amnesty—legitimizing vast sums of illicit crypto wealth.

In another email, Epstein wrote in alarm: “Some bad stuff. Very bad.”

He knew better than anyone how many dark transactions lay buried beneath his own and his circle’s wealth. He desperately needed a “voluntary disclosure” ticket—to complete final whitewashing before the regulatory guillotine fell on him and his friends.

This tactic wasn’t novel in Washington. After the UBS case in 2009, the IRS launched the Offshore Voluntary Disclosure Program (OVDP), allowing taxpayers with undeclared offshore accounts to avoid criminal prosecution by voluntarily disclosing, paying back taxes, and accepting a penalty. Between 2009 and 2018, roughly 56,000 taxpayers participated, helping the IRS recover about $11.6 billion.

Epstein’s plan was simply to transplant this pay-to-whiten logic wholesale into crypto. His voluntary disclosure scheme aimed to trade tax payments for legalization of illicit funds. This is the elite’s favorite game: as long as you can capture the rule-makers, any black history can be scrubbed onto the whitelist.

Peter Thiel operated at a higher level—he treated Washington like a startup to invest in.

In 2016, he pledged $1.25 million to Trump’s campaign, successfully installing his protégé Michael Kratsios into the White House as Deputy Assistant to the President for Technology Policy.

In 2022, he escalated further—contributing $15 million to elect J.D. Vance to the Senate. This newly minted senator isn’t just Thiel’s ally—he personally holds hundreds of thousands of dollars’ worth of Bitcoin.

Do you see it now? This has long surpassed ordinary political donations. These “sovereign individual”-believing tech elites are systematically placing their own people into core positions—step by step seizing control of the state apparatus.

Yet regulatory force inevitably arrived.

On New Year’s Day 2026, the “global crackdown” on crypto—formally titled the Crypto Asset Reporting Framework—took effect. Over 50 countries launched it simultaneously; another 20+ followed closely. It directly turned exchanges and wallets into informants for tax authorities. They collect detailed customer information and report it to domestic tax agencies—which then share it automatically with the customers’ tax-resident countries via cross-border exchange systems.

A global, all-encompassing net targeting crypto-related tax evasion was thus deployed.

Epilogue

From Swiss banks to Bitcoin, this nearly century-long cat-and-mouse game has finally hit a wall—under the iron curtain of globalized regulation.

Now that digital escape routes are blocked, where will the next sovereignty fantasy take root?

This time, their ambitions grow even grander. Peter Thiel is funding anti-aging and life-extension technologies—attempting to escape death’s ultimate constraint. Elon Musk dreams of colonizing Mars—betting humanity’s future on an entirely new planet.

These seemingly fantastical visions share the same core DNA as The Sovereign Individual’s prophecy. They aim to use technology to forge a new world transcending nation-states and democratic systems. Whether immortality or interplanetary colonization, they’re all updated versions of the “escape plan.”

Epstein’s story is merely a footnote in this grand narrative—an ugly, yet brutally honest footnote. It reveals what monstrous fruit technology bears when torn from the public-interest track and repurposed as a tool for a few to pursue absolute freedom.

Today, we must confront this harsh reality head-on: when the blueprint for our future is drawn up at private dinners where none of us hold a seat, all rules cease to concern us.

When a tiny clique of elites—answerable to no one—can arbitrarily define our money, our society, even our very lives, solely through the capital in their hands… what, then, are we?

That is the real question this story leaves us with—a question with no answer, yet one each of us must grapple with.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News