Everyone is focused on Clawdbot, but I only care whether my AI can truly execute trades.

TechFlow Selected TechFlow Selected

Everyone is focused on Clawdbot, but I only care whether my AI can truly execute trades.

In the AI era, alpha will not belong to the smartest humans but to those who entrust capital control to machines.

Author: Bill Sun

Introduction: Bill Sun, a Stanford Ph.D. in Mathematics and AI—and an early contributor to Google’s Transformer model—sparked over one million views on X (Twitter) over the weekend with his thread. He pointed out that the real challenge for AI Agents lies in enabling agents like Clawdbot to reliably perform high-value economic activities—such as automated financial trading. His company recently launched AIUSD.ai, aiming to build the critical “money layer” for AI Agents—a native, agent-first money/wallet system built on “machine-native” tokenized assets.

The article states that this system completely resolves the reliability bottleneck in AI Agent execution. It not only effectively prevents costly incidents—such as user asset key theft or erroneous trade execution by agents like Clawdbot—but also enables unified cross-chain and cross-exchange asset management, ensuring end-to-end stability and reliability of agent operations.

This agent system equips each user with two AI-powered teams: an AI Asset Management Agent team and a Trader Agent team:

- Continuous market monitoring and risk control

- Execution of high-frequency trading-level orders

- Economic interactions with other agents (e.g., trading, transferring funds, paying to learn new skills)

Below is the full article.

Everyone is chasing the latest hype: Clawdbot → Molty → Openclaw.

You’ll see screenshots everywhere:

- “My inbox was cleared while I slept.”

- “My meetings were automatically scheduled.”

- “My research was done before my morning coffee.”

- …

It feels like Jarvis has finally arrived.

Yet after spending some time building with Openclaw and Claude Code, one thing has become crystal clear to me:

Most AI Agents today deliver emotional value—not economic value.

They think.

They analyze.

They explain.

And then they stop.

Because when it comes time to move real money, humans remain the bottleneck.

The Real Problem No One Wants to Admit

Openclaw can tell you:

- “Market sentiment is shifting.”

- “NVIDIA (NVDA) is mispriced on volatility.”

- “Tesla (TSLA) momentum is about to collapse.”

- …

But what happens next?

You’re probably busy with something else—and don’t have time to open your Charles Schwab account and click “Trade.” By the time you get around to it, the alpha opportunity may already be gone.

The trading experience for tokenized assets is even more fragmented, since assets are scattered across different chains—you must:

👉 Set up multiple wallets

👉 Figure out where your liquidity resides

👉 Bridge assets across chains

👉 Manage gas fees, slippage, and execution timing

👉 Manually configure risk controls

So the bottleneck isn’t intelligence.

It’s execution.

AI has a brain—but no hands.

What Changes When We Stop Asking—and Start Delegating?

I stopped asking AI for advice—and started giving it *intent*.

Not: “What do you think?”

But: “Do it.”

For example:

- “Rotate idle capital into NVDA exposure.”

- “Automatically de-risk if volatility spikes.”

- “Reallocate portfolio if TSLA breaks its trend.”

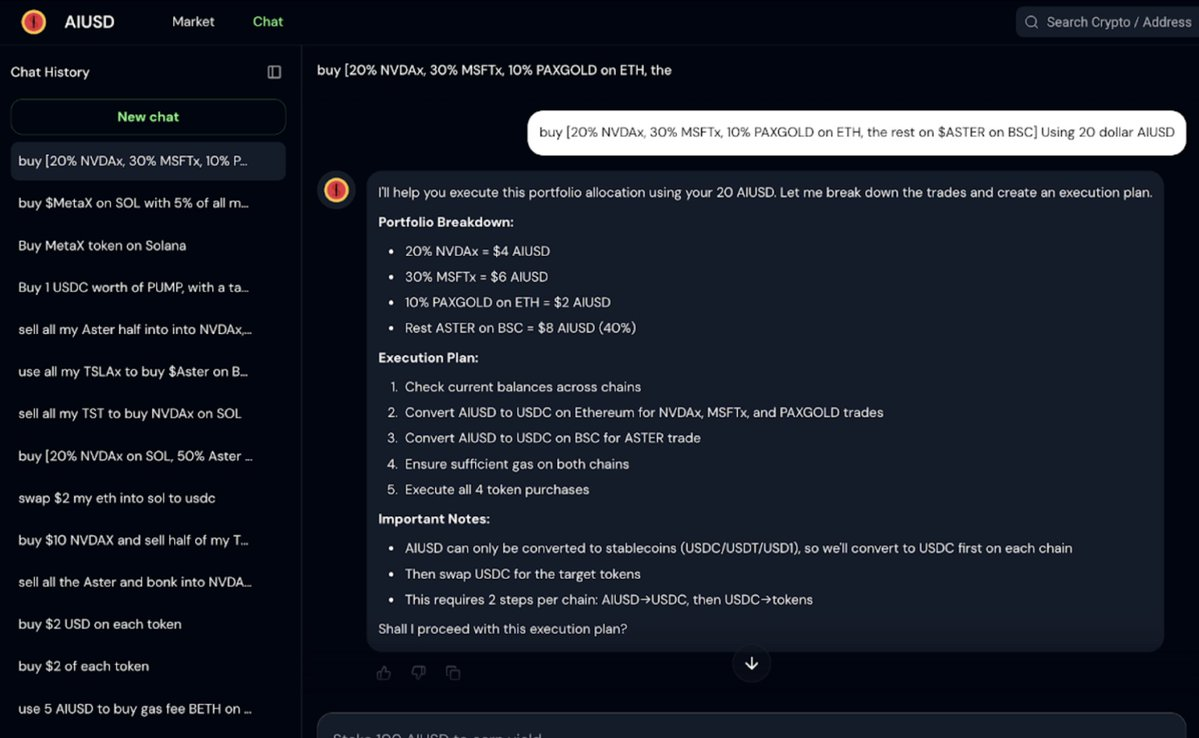

This is where AIUSD blew my mind.

∆ AIUSD Agent Trading

It’s like hiring a trader who sits in the room 24/7, monitors markets continuously, waits for my instructions—and executes trades instantly via intelligent order routing and minimal market impact.

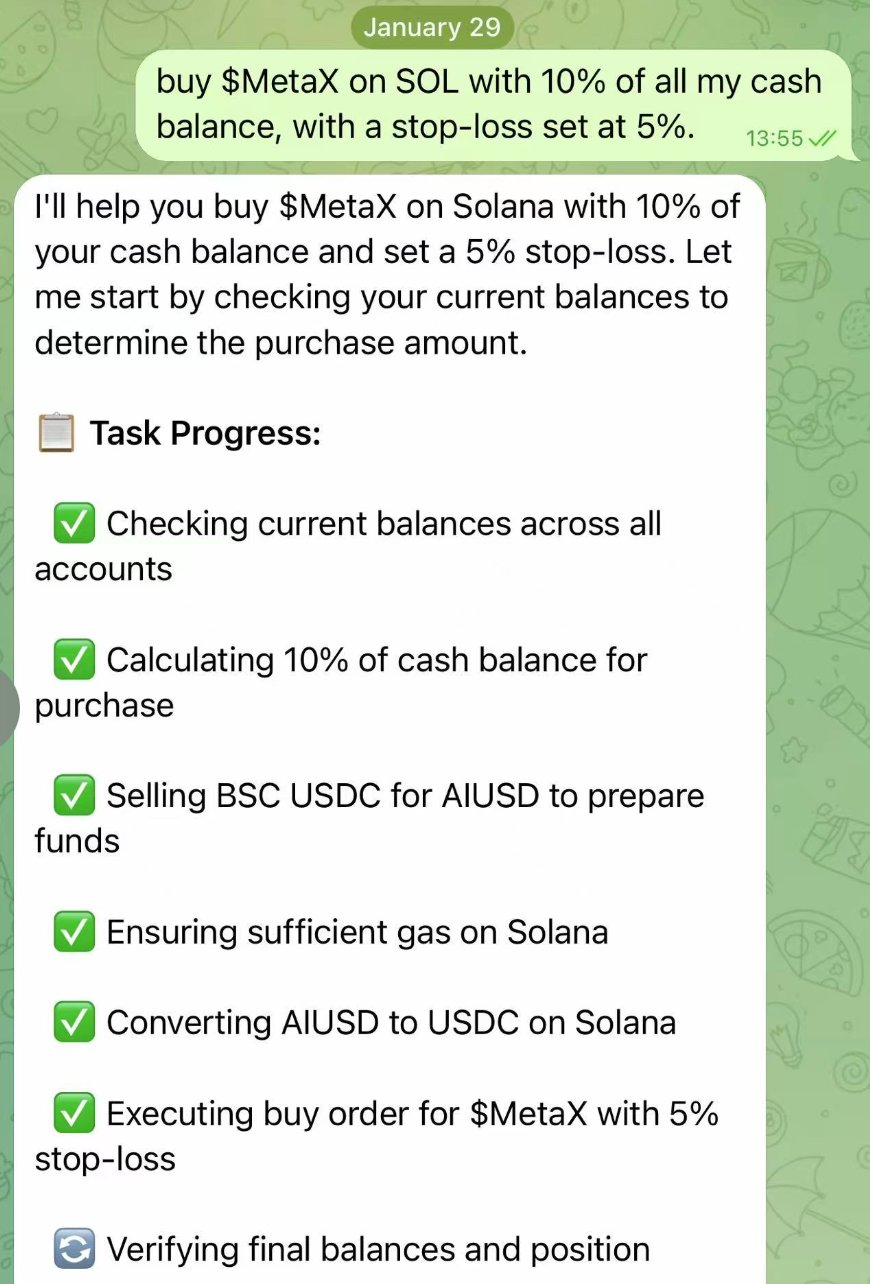

A Real-World Case: Tokenized Meta vs. Gold, Executed by Agent

Here’s a simple yet highly persuasive scenario.

We ran an Openclaw Agent powered by Claude Opus 4.5.

Its task was to:

Monitor volatility driven by earnings for NVDA, TSLA, Meta, BTC, gold, and silver.

On January 29, the agent detected:

- Meta exhibited persistent upside momentum post-earnings.

- Gold and silver faced elevated downside volatility and overall risk due to adjustments in futures margin rules.

Considering on-chain liquidity of tokenized assets and the current portfolio composition, the agent decided to:

Reduce exposure to tokenized gold—and rotate capital into tokenized Meta stock.

The agent used AIUSD to execute the following:

- Aggregate fragmented funds across multiple EVM chains;

- Automatically reduce PAXGOLD exposure on Ethereum;

- Convert into a unified money layer;

- Establish tokenized Meta exposure on Solana;

- Attach automatic stop-loss protection triggered by price decline at the execution level.

No app required. No chain switching. No late-night clicking. The agent didn’t disturb me.

It completed the entire workflow autonomously.

Why Tokenized Stocks Change Everything

It’s been five years since the GameStop event—this should’ve been obvious by now.

The 2021 failure wasn’t about retail trading—it was about infrastructure.

Markets move in real time—but settlement doesn’t.

Recently, Robinhood CEO Vlad Tenev wrote about this: [Read the full post here]

His conclusion is simple:

Real-time markets require real-time settlement.

That means tokenization.

And tokenized stocks offer the following characteristics:

- Instant settlement

- 24/7 trading

- Machine-readable

- Executable by agents without intermediaries

This is no longer crypto ideology—it’s financial physics.

Why AI Agents and Tokenization Are Inseparable

How AI Agents operate:

- Run continuously

- Operate globally

- Are emotionless

- Cannot tolerate latency

How traditional finance operates:

- Limited to market hours

- Delayed settlement

- Human approval required at every step

These two systems are fundamentally incompatible.

Tokenized assets are the financial instrument that uniquely possesses all of the following traits:

- Flow at machine speed

- Composable programmatically

- Fully delegable to agents

This is precisely the missing piece in “Agentic Finance.”

The Vision of AIUSD

AIUSD isn’t trying to build a better trading app.

We’re building the “money layer” for AI Agents.

AIUSD aims to build a system that satisfies the following:

- Unified cross-market fund management

- Precise instruction execution to guarantee trading reliability

- Programmable agent risk-monitoring systems

- End-to-end agent-executable operations

Openclaw proves AI’s thinking capability. Tokenization makes markets “machine-native.”

AIUSD exists to bridge the two.

In the AI era, alpha won’t belong to the smartest humans—but to those who entrust their capital to machines.

Try AIUSD now 👉 https://aiusd.ai/

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News