This year, $100 billion will be invested in AI—Meta goes all-in, while Microsoft gets crushed

TechFlow Selected TechFlow Selected

This year, $100 billion will be invested in AI—Meta goes all-in, while Microsoft gets crushed

Meta surged over 10% after hours, while Microsoft fell 8%.

Author: Facing AI Head-On

Same night, two earnings reports—and two entirely different market moods.

Meta’s earnings report triggered an immediate post-market rally.

Almost simultaneously, Microsoft’s stock declined.

The raw numbers weren’t dramatically divergent. What truly widened the gap was the market’s sentiment toward “the future.”

01 Has Zuckerberg Really Hooked the Market?

Meta’s latest earnings report is genuinely impressive.

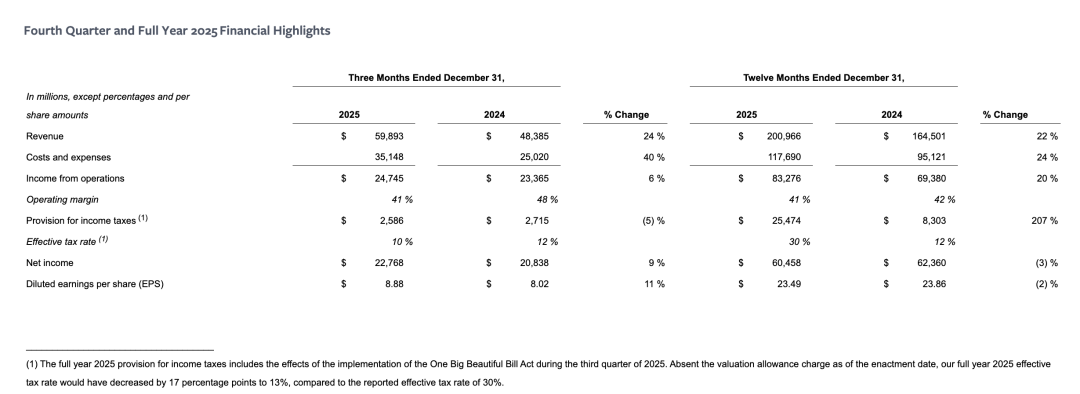

For Q4 FY2025, Meta reported:

· Revenue of $59.893 billion, up 24% year-on-year—significantly exceeding Wall Street expectations.

· Net income of $22.768 billion, up 6% year-on-year.

· Diluted earnings per share (EPS) of $8.88, up 11% year-on-year.

Advertising remained the dominant revenue driver, contributing $58.137 billion—or 97% of total revenue—in Q4. Other businesses generated comparatively modest revenue, yet grew 54% year-on-year.

Operationally, Meta’s family of apps averaged 3.58 billion daily active people (DAP), up 7% year-on-year.

In Q4, ad impressions across Meta’s app family rose 18% year-on-year, while average price per ad increased 6% year-on-year; for full-year 2025, these figures were +12% and +9%, respectively.

Meta consistently attributes improvements in its advertising business to AI—specifically, AI-driven enhancements that lift both ad volume and pricing.

For full-year 2025, Meta’s total revenue reached $200.966 billion, up 22% from $164.501 billion in 2024; net income stood at $60.458 billion, down 3% from $62.360 billion in 2024.

Yet ever since the AI industry blasted off like a rocket, market reactions to tech giants’ earnings have increasingly hinged not on past performance—but on what comes next.

For the past two years, Meta has faced persistent skepticism over its outsized spending—especially its aggressive AI investments. Zuckerberg has gone all-in.

Numerically speaking, this hasn’t changed.

Meta has again raised its capital expenditure forecast: for FY2026, CapEx is expected to range between $115 billion and $135 billion.

Over the past six months, Meta has actively restructured its AI operations, establishing a new “Super Intelligence Lab.”

On the earnings call, Zuckerberg announced that Meta plans to launch its latest AI model within the coming months.

“We’ll showcase our current rapid momentum,” he said, adding that Meta aims to “push the frontier” through its AI R&D.

What Zuckerberg presented was a clear message: Everything is ready—we’re about to ship!

And the market chose to believe—or rather, to bet—that Meta might finally deliver.

During the earnings call, Meta’s stock surged over 10% in after-hours trading.

02 Is Microsoft Losing Its Edge?

Microsoft stands in sharp contrast to Meta.

All eyes are on Azure—the cloud computing division now experiencing surging demand from enterprises developing and deploying AI services.

In its first fiscal quarter ended September, Microsoft stated that demand for Azure services “significantly” exceeded supply capacity—and projected stronger revenue growth for the division in Q2.

Indeed, the newly released Q2 results show Azure revenue growth at 38%, slightly slower than last quarter. Overall company revenue growth also moderated—from 18% last quarter to 17% this quarter.

Investors are also closely watching growth signals from Microsoft’s Copilot-branded products—the primary channel through which Microsoft sells AI-powered productivity tools to office workers.

With Anthropic’s recent launch of Claude Cowork—a well-received new AI tool—shareholders are growing increasingly anxious that Microsoft’s offerings may be “scooped up” by competitors.

In U.S. after-hours trading, Microsoft’s stock fell over 8%.

Microsoft was among the earliest and most high-profile corporate backers of the AI wave—its massive investment in OpenAI and deep strategic alignment with the startup made it a central player. Last July, Microsoft’s market cap briefly surpassed $4 trillion.

But being first has its downsides—early entry means early scrutiny. While Meta is still iterating and searching for its path, investors have long been waiting for Microsoft’s seemingly confident, well-structured, and heavily funded AI strategy to yield commensurate financial returns.

When those returns arrive slowly—or fall short—the market’s patience wears thin.

Regarding Azure’s decelerating growth, Microsoft devoted significant attention to defending itself during the earnings call.

CFO Amy Hood stated: “If I allocated all newly deployed GPUs from Q1 and Q2 exclusively to Azure, our KPI [growth rate] would already exceed 40%.”

Hood explained that Microsoft’s challenge isn’t weak Azure demand—it’s precisely the opposite: overwhelming demand coupled with constrained supply. GPU resources must be shared across multiple AI initiatives—including Microsoft 365 Copilot and GitHub Copilot—not just Azure.

She even revealed that the bulk of Microsoft’s massive expenditures currently goes toward GPUs and CPUs—underscoring just how tight compute resources are.

Additionally, CEO Satya Nadella directly refuted external rumors during the earnings call—rumors suggesting Microsoft’s AI tools are losing traction amid competitive pressure.

Nadella countered by disclosing that Microsoft 365 Copilot’s daily active users have grown tenfold, paid subscription rates have jumped 160% year-on-year, and paying users now total 15 million.

03 The Future, the Future, and Still the Future

Though ChatGPT turns four this year, tech giants universally stress that we remain in the “early days” of AI industry development.

And their outlook on the future remains uniformly optimistic.

Zuckerberg has explicitly positioned AI-powered smart glasses as the next-generation core computing platform—comparing this shift to the historic transition from feature phones to smartphones.

Meta’s critical next leap is to gradually reconstruct its advertising-centric business model into a new revenue architecture centered around “personal superintelligence.”

By contrast, Microsoft’s vision of the future leans more heavily toward “engineering” and “systems.”

In Nadella’s telling, AI isn’t a single breakout product—it’s an integrated capability upgrade embedded across operating systems, productivity software, developer tools, and cloud infrastructure. Copilot doesn’t need to prove its monetization potential all at once; as long as it persistently boosts engagement and ARPU across Microsoft 365, GitHub, and Azure, commercialization will follow naturally.

The problem? Market patience for “the future” is not evenly distributed.

Meta remains in the phase where heavy spending is still tolerated: its advertising foundation is solid, its cash flow robust—and its AI bets are framed as wagers on the next major interface.

Microsoft, however, has already entered the “deliverables” phase: as the earliest, deepest, and most coherent AI investor, it’s naturally the first to face demands for quantifiable returns.

So when both companies declare “We’re still in the early days,” the statement carries very different implications.

Ultimately, the question isn’t whether AI works—but whose timeline the market favors.

Meta still has room to tell its story. Microsoft, meanwhile, has reached the point where it must turn that story into numbers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News