Left Hand to Right Hand? Unveiling the Financial Leverage Cycle Behind the AI Boom and Wall Street’s Ultimate High-Stakes Bet

TechFlow Selected TechFlow Selected

Left Hand to Right Hand? Unveiling the Financial Leverage Cycle Behind the AI Boom and Wall Street’s Ultimate High-Stakes Bet

Some people worry that this could resemble the 2008 financial crisis, where large institutions required massive financial support to avert a complete economic collapse.

Compiled & Translated by TechFlow

Podcast source: Bloomberg Originals

Original title: How Circular Deals Are Driving the AI Boom

Air date: January 23, 2026

Key Takeaways

The AI boom is everywhere—but much of it is superficial. Capital is circulating among a handful of unprofitable companies. If this is a bubble—and it bursts—the repercussions could be felt across the entire economy, with serious consequences.

Many warn that if AI ultimately proves to be a bubble and collapses, it could profoundly impact the broader economy. Bloomberg Originals explores circular investment deals among AI firms—and how these deals constitute what some call “the ultimate gamble.”

Summary of Key Insights

The Circular Investment Chain in Detail

- Nvidia plans to invest up to $100 billion in OpenAI—while OpenAI is also Nvidia’s largest chip customer.

- OpenAI leases computing services from Oracle, which itself is also a Nvidia customer—creating a closed-loop flow of capital among several firms.

The Profitability Challenge

- Major AI ventures—including OpenAI and Anthropic—are currently unprofitable; each ChatGPT user session may cost OpenAI money.

- Sam Altman stated the company expects to reach breakeven only between 2029 and 2030.

The Infrastructure Race

- Morgan Stanley estimates total corporate investment in AI data centers will reach $3 trillion.

- A former textile mill spanning one million square feet has been converted into a data center; retrofitting existing facilities can bring operations online in six months, versus two years for ground-up construction.

Lessons from the Dot-com Bubble

- The 2000 dot-com bubble burst erased roughly $5 trillion globally.

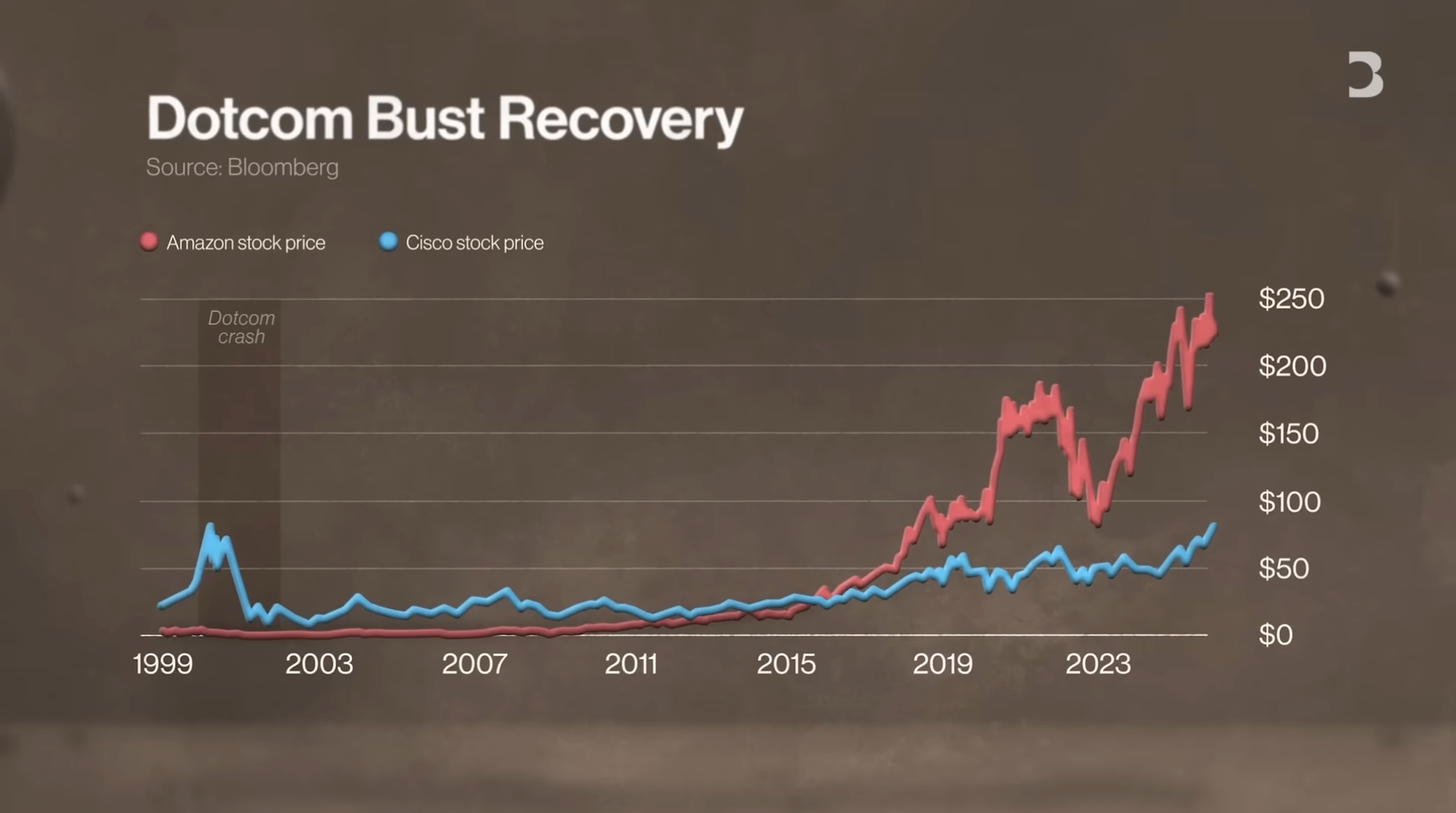

- Amazon’s stock took eight years to recover its pre-bubble peak; Cisco took 25 years.

Fears of “Too Big to Fail”

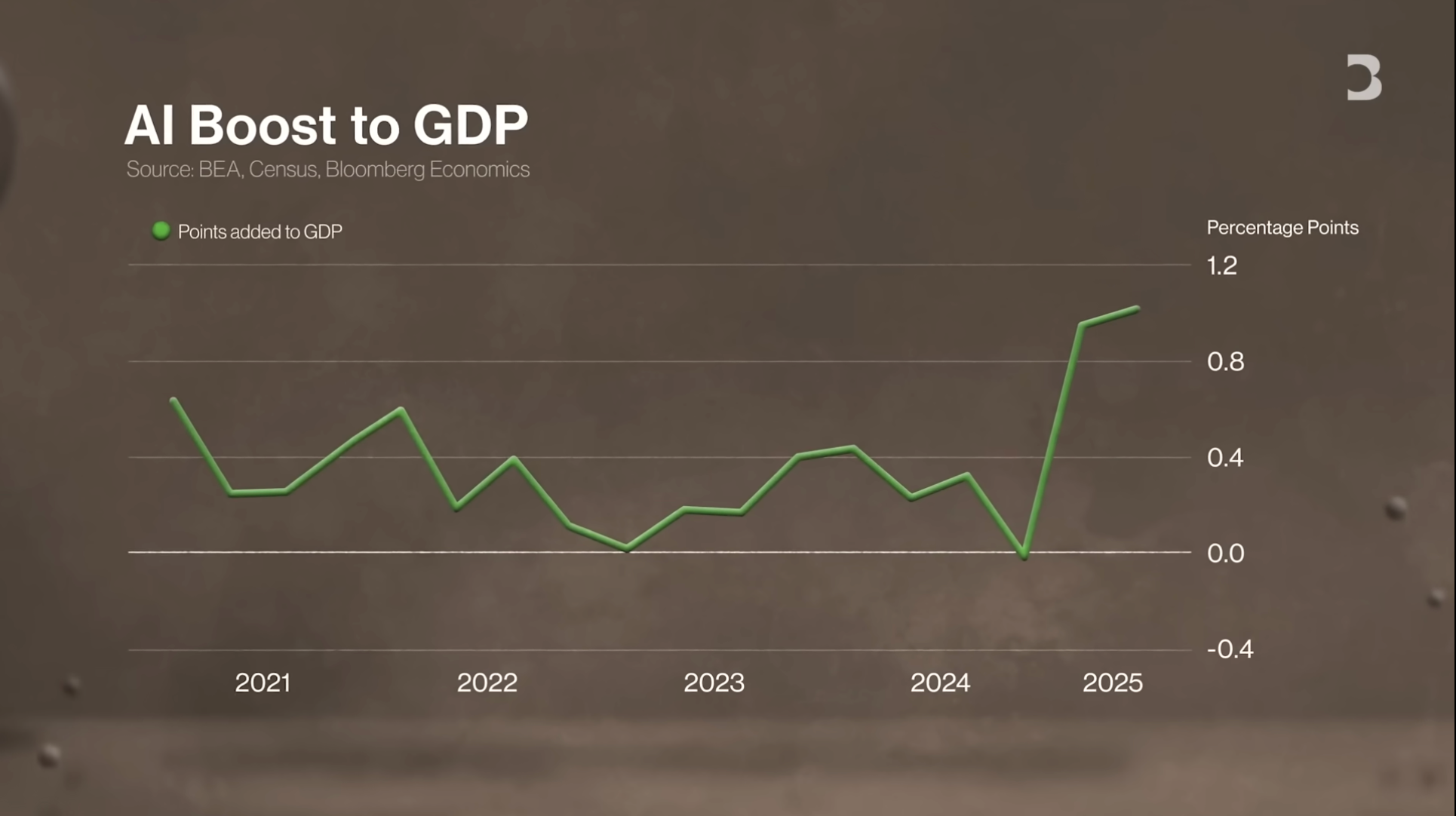

- The AI investment surge has become a key driver of GDP growth.

- Ordinary Americans’ retirement accounts hold indirect stakes in these tech firms—exposing far more people to risk than commonly assumed.

- Some fear this could mirror the 2008 financial crisis—where massive institutions required enormous bailouts to prevent systemic economic collapse.

- In short, AI represents Wall Street’s biggest gamble ever—and Wall Street, famed for its appetite for risk, has dubbed this “the ultimate gamble.”

The AI Boom and Circular Investments

Artificial intelligence (AI) is expanding from Wall Street into rural America, becoming a central engine of economic growth. Markets are confident in AI’s potential, treating it as an infallible miracle. Investor expectations for AI-driven growth remain extremely high: tech giants such as Microsoft, Meta, and Alphabet have already committed tens of billions of dollars in related capital expenditures—and plan to scale those investments further.

The AI boom extends well beyond software development—it’s fueling infrastructure expansion. Supporting AI requires building more data centers, while ensuring adequate energy and water supplies. Yet this rapidly growing sector carries risks—particularly in how capital flows. A new investment strategy is emerging: circular investments totaling billions of dollars. For example, Nvidia plans to invest up to $100 billion in OpenAI, with massive sums circulating among tech titans—forming a carousel-like capital chain.

Nonetheless, AI’s potential remains immense. Roughly 80% of U.S. companies are already using AI—a sign that a structural revolution, comparable to electricity or the internet, is underway.

Bubble Concerns and Complex Capital Flows

While AI holds enormous promise, its profitability remains unproven. Today’s top concern among San Francisco’s tech community is: Are we in an AI investment bubble? If so, how large is it—and what happens when it bursts? This is a critical question. We may be entering a new era of AI-driven growth—or facing an unprecedented investment bubble.

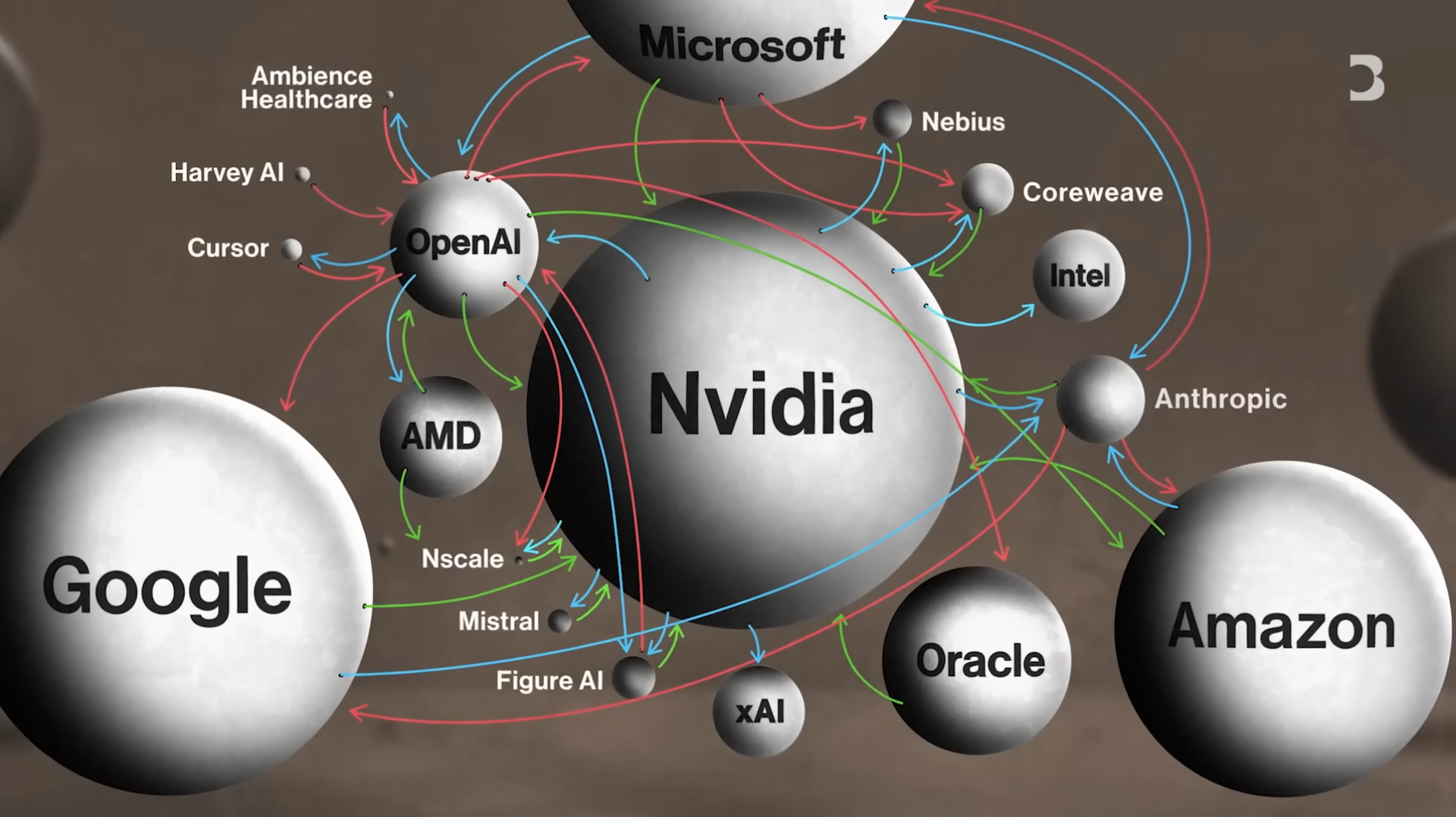

“Circular investment” refers to reciprocal flows of capital, products, and services among companies. For instance, Nvidia plans to invest up to $100 billion in OpenAI—while OpenAI is also Nvidia’s largest chip customer. These capital flows also involve intermediaries like Oracle: OpenAI sometimes leases computing services from Oracle, which itself is a Nvidia customer. Such complex interdependencies turn the industry into an intricate web linking numerous prominent enterprises.

Concerns Over Industry Interdependence and the Infrastructure Arms Race

Frequent capital circulation among these firms raises no fundamental issue—but when transaction sizes grow excessively large, overexpansion becomes a real risk. The core worry is: Does this symbiotic relationship render the entire system fragile? Could underperformance or failure at one firm destabilize the whole industry?

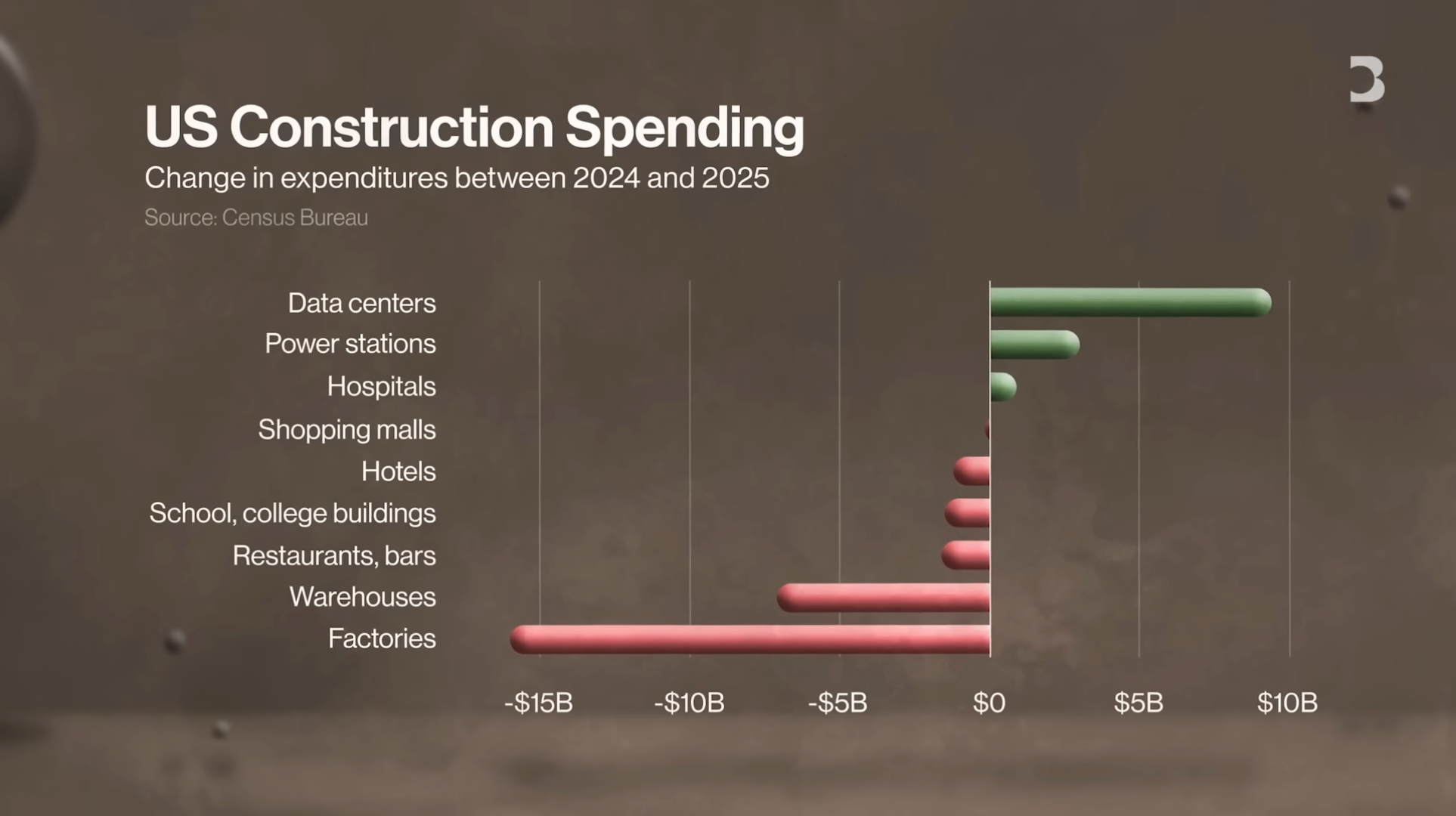

Meanwhile, massive investment is flooding into data center construction—driving nationwide infrastructure expansion. We’re witnessing an infrastructure “arms race.” While construction spending declined across most sectors in 2025, spending on data centers and power plants rose sharply. Many firms are stepping up as “infrastructure builders” for the AI industry, actively investing in these projects. According to Morgan Stanley’s latest estimate, total corporate investment in AI data centers is projected to reach $3 trillion.

The Data Center Construction Boom: “Pick-and-Shovel” Infrastructure

Data center construction is now accelerating rapidly. If your business provides infrastructure or services to data centers, you’re in an exceptionally advantageous position. Demand vastly exceeds supply capacity, funding is abundant, and the industry outlook is highly favorable. For example, the facility we’re in today was once a textile mill covering approximately one million square feet—later repurposed as a data center.

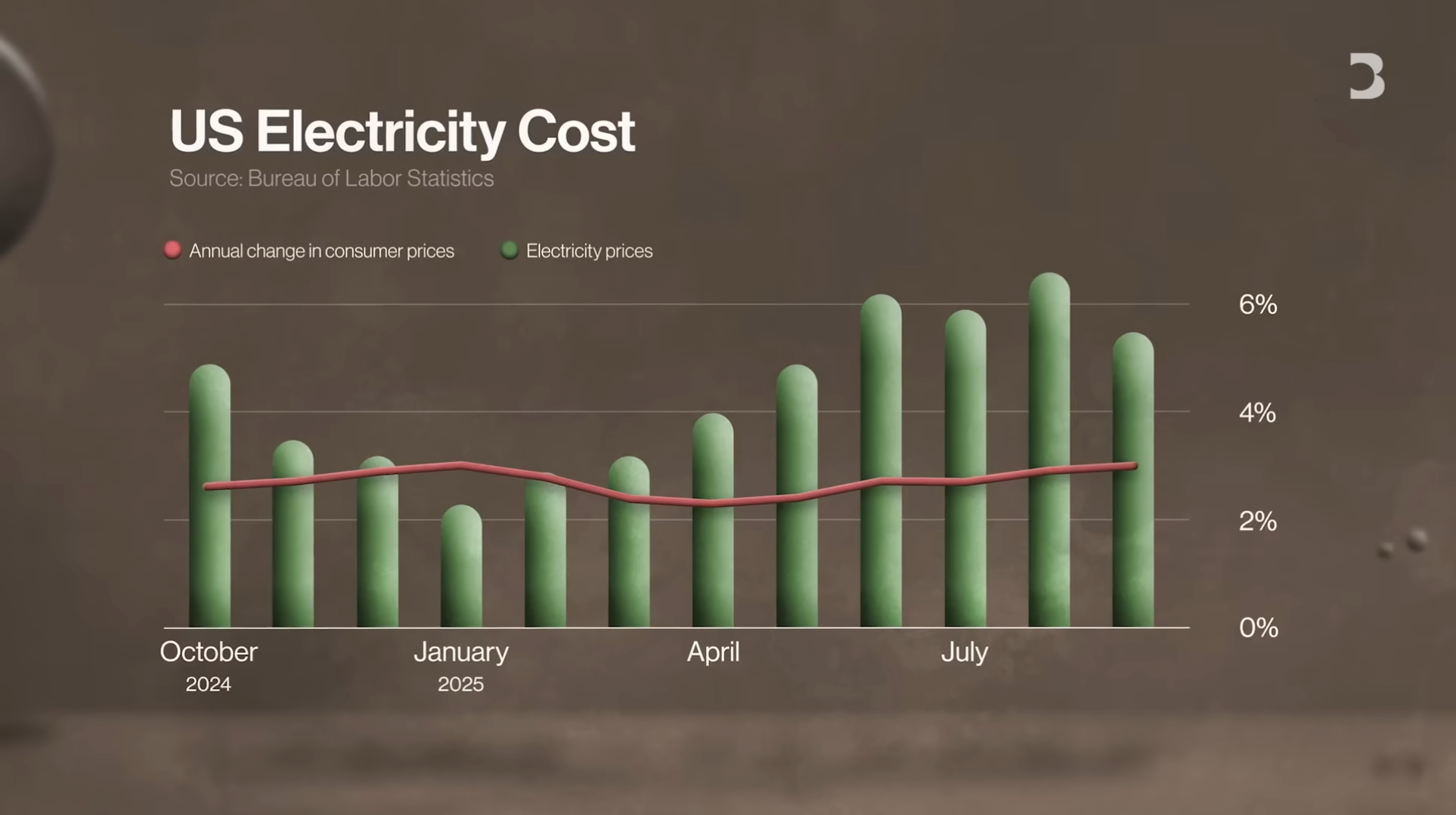

Demand for data centers is virtually insatiable—spanning power supply, infrastructure build-out, and specialized technical support. These needs won’t ease anytime soon. Time is critical for the AI industry: retrofitting existing facilities to go live within six months is far preferable to the two-year timeline required for ground-up construction. Simultaneously, surging power demand from data centers is driving utility costs upward faster than inflation—especially for utilities and construction firms dedicated exclusively to serving data centers.

The Profitability Puzzle: Challenges and Risks Facing AI Ventures

Yet rapid data center construction doesn’t guarantee profitability. Sustained investment is needed to keep technology running smoothly—or else clients quickly lose interest. To date, major AI ventures remain unprofitable. Each ChatGPT user session may cost OpenAI money; companies like OpenAI and Anthropic are still not turning a profit.

OpenAI CEO Sam Altman stated the company expects to achieve breakeven between 2029 and 2030—but given current massive cash burn and future capital requirements for data center construction and compute resources, that target appears challenging. There’s concern whether these AI startups can shoulder such enormous costs—especially as they commit huge sums to building data centers. These data center operators serve as early warning signals for shifts in industry demand. Should AI product demand suddenly weaken, the entire sector could be affected. Though all firms currently claim robust demand for AI products, problems would surface immediately if demand wanes.

Historical Parallels: Comparing the Dot-com Bubble and Today’s AI Boom

To grasp the potential risks of today’s AI boom, look back to the 2000 dot-com bubble. Then, internet companies promised a hopeful new era—but ultimately triggered massive losses: savings wiped out, office parks left vacant, and roughly $5 trillion erased globally. Tech stocks bore the brunt—especially internet firms. Even the strongest survivors took years to recover. Amazon, the iconic survivor, required eight years for its stock to regain its pre-bubble peak. Cisco—a foundational infrastructure provider—took a full 25 years to restore its share price.

Certain parallels exist between the two booms—including circular investment deals. The key question is: Will the AI boom transcend normal tech-sector volatility to exert deep, broad-based effects on the wider economy?

Economic Impact and “Too Big to Fail” Concerns

The dot-com bubble severely damaged the economy—but if the AI boom collapses, the fallout could be even deeper. The AI investment surge has become a vital engine of GDP growth—bolstering the U.S. economy amid tariff and inflation pressures. Yet this also exposes ordinary Americans to risk indirectly: many retirement and investment accounts hold shares in large tech firms participating in AI investments.

Does this mean the AI boom has become “too big to burst”? Current concerns center on whether these firms have grown “too big to fail.” Their failure wouldn’t just trigger economic problems—it could spark broader systemic disruption. Some even fear a scenario akin to the 2008 global financial crisis, where massive financial institutions required colossal bailouts to avert total economic collapse. If the AI boom truly implodes, the U.S. economy could face even greater challenges.

Long-Term Outlook: Cautious Optimism for AI’s Future

Despite the risks, many remain optimistic about AI’s long-term trajectory—because the technology continues advancing. During the dot-com bubble, companies invested heavily in laying fiber-optic cable—then widely seen as excessive and wasteful. Yet those very fibers became the backbone of broadband internet. Unused fiber laid in the 1990s later proved indispensable to internet growth. Similarly, today’s data centers—even if temporarily overbuilt—may eventually be fully utilized.

Of course, AI’s maturation may take longer than expected. During this process, while financially resilient firms survive, their valuations may fluctuate significantly. Still, AI itself won’t pop like a bubble. Though some firms may falter, the AI industry isn’t a phantom bubble. It has already delivered tangible products—and demonstrated extraordinary potential. In short, AI is Wall Street’s biggest gamble ever—and Wall Street, renowned for its risk appetite, has branded this “the ultimate gamble.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News