The Hidden Winners of the AI Boom—Nonferrous Metals: A Super Cycle Coming in 2026?

TechFlow Selected TechFlow Selected

The Hidden Winners of the AI Boom—Nonferrous Metals: A Super Cycle Coming in 2026?

Whoever controls the bottleneck controls the premium. Memory chips are the bottleneck of the digital world, while non-ferrous metals are the bottleneck of the physical world.

Author: RockFlow

Original Link: https://mp.weixin.qq.com/s/lToo7J6WTQZ6sjf4i7DX2g

Key Takeaways

① Over the past two decades, the internet has reshaped the world—but also lured investors into the “bits devouring atoms” trap. For years, nonferrous metals have been stereotyped as a “traditional sector.” Yet in 2026, industrial metals are no longer passive cyclical stocks riding macro trends; they have become the “first-beneficiary assets” underpinning AI’s physical infrastructure.

② We stand at the singularity of an energy-medium migration: copper—the “vascular system” of computing power—is facing grade deflation; aluminum—“solid-state electricity”—commands substantial premium; tin, embedded in semiconductor packaging miniaturization, functions as a silent tax; and nickel is regaining valuation sovereignty amid the resurgence of high-nickel batteries. A “perfect storm” has formed on both supply and demand sides: a decade-long capital expenditure gap has caused production lags, amplifying the value of existing mineral resources.

③ In 2026, success in investing in nonferrous metals no longer hinges on capturing short-term price swings—but on securing scarce physical resources. Freeport-McMoRan (FCX) anchors itself to ultra-low costs, mirroring early energy giants; Alcoa (AA) fully captures energy arbitrage opportunities. Against a backdrop of volatile U.S. dollar credibility, overweighting the physical world—and embracing nonferrous metals—is not merely a hedge for asset allocation, but the essential entry ticket to the AI revolution.

In the dominant narrative of the past two decades, most investors immersed themselves in the illusion that “bits” would devour “atoms,” firmly believing software defined everything and algorithms alone could reconstruct the world.

Yet standing at the vantage point of 2026, reality compels more investors to recognize: the endpoint of AI is not code—it is electricity; and the endpoint of electricity is not just energy—it is copper, aluminum, tin, nickel, and other nonferrous metals.

As tech giants’ compute races intensify, commodities like copper, aluminum, tin, and nickel are quietly undergoing a long-overdue revaluation. What we’re witnessing is not simply another supercycle for nonferrous metals—but a battle for pricing power over industrial metals.

In this article, the RockFlow research team outlines a 2026 U.S.-listed nonferrous metals allocation strategy for U.S. equity investors, covering paradigm shifts in nonferrous metals, deep-value analysis of copper, aluminum, tin, and nickel, and multidimensional dissection of industry-leading companies.

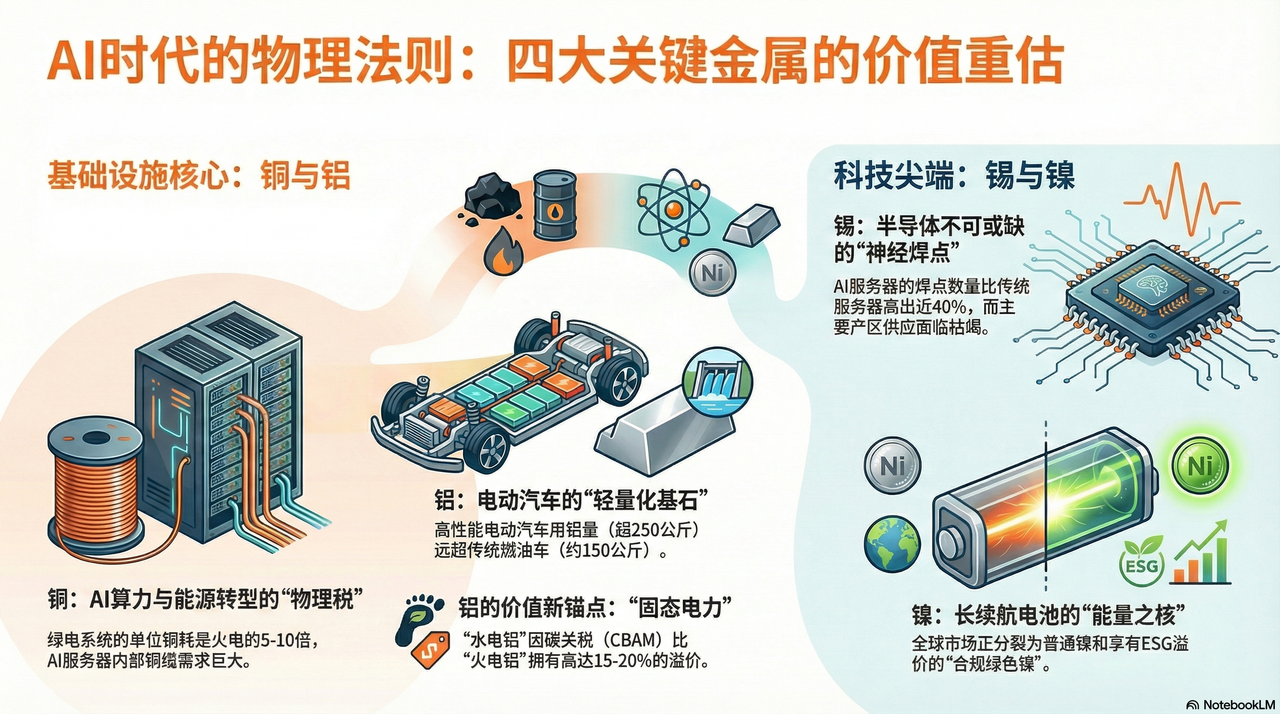

1. Deep Dive on Four Key Nonferrous Metals: Seeking Physical Alpha in the AI Era

For years, nonferrous metals have been pigeonholed as a “traditional sector.” Markets habitually forecast demand by tracking real estate construction starts, infrastructure investment growth, and home appliance shipment volumes.

But in 2026, this old map no longer leads to new routes. We are experiencing a “great migration of energy media”: shifting from molecular-based chemical energy (carbon, hydrogen) to atom-based “physical energy” (copper, aluminum, tin, nickel).

If copper is the irreplaceable “vascular system” of this migration, then aluminum, tin, and nickel respectively form the skeleton, nervous system, and heart of the modern industrial system.

Copper: The “Physical Infrastructure Tax” for AI and Energy Transition

If 2024–2025 saw global players scrambling for GPUs, in 2026, tech giants are fiercely competing for copper mine stakes.

Copper mine development cycles span 10–15 years. Today, major global copper mines—including Chile’s Escondida—are confronting inevitable grade decline. Two decades ago, one ton of ore yielded 10 kg of copper; today, it yields only 4 kg. This means mining companies must extract twice the volume of rock to sustain output—a physically irreversible deflation.

If oil was the lifeblood of the industrial age, copper is the nervous system and vascular network of the digital era. As the only large-scale conductor combining cost efficiency with superior electrical conductivity, copper has become the most formidable bottleneck for AI computing power and the new-energy revolution.

The market once assumed data centers were undergoing “optical dominance over copper,” expecting long-distance optical transmission to supplant copper cabling. But with NVIDIA’s Blackwell (GB200) architecture—and beyond—physics is striking back.

To achieve ultra-low latency and reduce cooling power consumption, server rack interconnects are massively reverting to DAC (Direct Attach Copper) cables. Within ultra-short distances, the latency and energy overhead from optoelectronic conversion have become bottlenecks for AI inference. Inside each GB200 NVL72 rack, copper cable length totals several miles.

This means every time a tech giant purchases a high-performance chip, it pays not only NVIDIA—but also global copper mine owners a “physical infrastructure tax.” The greater the computing power, the stronger copper’s “black hole effect.”

Aluminum: “Solid-State Electricity” in the Decarbonization Era and Structural Premium

If copper’s demand stems from its conductivity, aluminum’s secular bull case rests on its dual role as the “lightweighting cornerstone” and “energy carrier.”

Under the 2026 global decarbonization narrative, aluminum’s demand curve has fully decoupled from real estate. To offset battery weight and extend driving range, electric vehicles (EVs) are undergoing a comprehensive “aluminization” revolution.

Data shows that conventional internal-combustion vehicles use ~150 kg of aluminum per vehicle, while high-performance EVs now exceed 250 kg. Especially notable is Tesla’s leadership in “gigacasting,” which consolidates dozens of steel chassis components into a single massive aluminum casting. This is not merely a process upgrade—it is aluminum’s cross-dimensional substitution for steel. By 2026, aluminum demand growth from the automotive sector alone will fully offset declines in traditional construction demand.

On the supply side, aluminum production is extremely electricity-intensive—producing one ton consumes roughly 14,000 kWh—earning aluminum the moniker “solid-state electricity.”

In 2026, global electricity prices are swinging wildly due to geopolitical and energy-transition pressures. At this juncture, aluminum producers with self-sufficient clean energy (e.g., hydropower)—such as Alcoa (AA)—have built formidable moats. With the EU’s Carbon Border Adjustment Mechanism (CBAM) officially implemented, “hydropower aluminum” commands a ~15–20% premium over “coal-power aluminum.”

Aluminum price increases, in essence, represent cost compensation for the disappearance of cheap electricity.

Tin: The “Nerve Endings” Behind Semiconductor Prosperity

If copper is the vascular system, tin is the solder joint—the neural synapse—of the electronic world. It serves as indispensable “glue” for all electronic components, making it a direct beneficiary of semiconductor cycles.

Globally, 50% of tin is used in electronic solder. In 2026—the inaugural year of AI inference—hardware architecture complexity has triggered a “second wave” of tin consumption. High-performance servers, for instance, adopt Chiplet packaging (as seen in NVIDIA’s Blackwell architecture), geometrically increasing logic interconnect density per processor.

Industry surveys indicate AI servers contain nearly 40% more solder joints than traditional general-purpose servers. This implies that regardless of underlying architectural evolution, so long as electron migration continues, tin remains an unavoidable “silent tax.”

Meanwhile, tin supply is highly concentrated in Indonesia, Myanmar, and Peru. In 2026, Wa State in Myanmar—a historic source of 10% of global tin output—faces resource exhaustion due to prolonged over-mining, causing output to collapse precipitously. Simultaneously, Indonesia, emulating its nickel export ban, has tightened raw tin exports across the board.

Under this mismatch of “historically low inventories + explosive demand renewal,” tin prices are surging independent of macroeconomic cycles. It is currently the most supply-tight and highest-upside nonferrous metal.

Nickel: The “Energy Core” of EV Batteries

Nickel’s narrative fell into a trough in 2024–2025 amid Indonesian overcapacity—but in 2026, with the return of high-energy-density requirements, nickel has reclaimed its valuation sovereignty.

Although LFP (lithium iron phosphate) batteries dominate mid- and low-end markets, high-nickel NCM811 batteries remain the “long-range pillar” in the 2026 global premium passenger vehicle segment.

To achieve 1,000 km of range per charge, automakers must continually increase nickel content. Each long-range EV consumes 50–70 kg of high-purity Class 1 nickel. This extreme pursuit of “energy density” has effectively eliminated any downside risk to nickel demand.

In 2026, nickel’s pricing power is undergoing a second shift.

Western majors—including Vale (VALE)—are leveraging ESG criteria to erect non-tariff barriers. Western governments are imposing carbon tariffs on Indonesian nickel produced using coal power and associated high pollution. This bifurcates the global nickel market into two parallel worlds: one dominated by low-cost, high-carbon primary nickel; the other comprising premium-priced, “compliant green nickel” approved for Western supply chains.

This structural shortage grants compliant producers with top-tier mining rights unprecedented pricing power.

2. Dissecting Industry Giants: Who Controls the “Physical Moat”?

At this unique inflection point—where resource inflation converges with the AI compute revolution—investing in nonferrous metals is no longer about simple “cyclical trading.” The RockFlow research team believes investors must deeply understand industry leaders to identify true “physical moat” Alpha opportunities.

Freeport-McMoRan (FCX) vs. BHP

In U.S.-listed copper exposure, FCX and BHP are indispensable twin pillars. Yet a penetrating analysis of their FY2025 annual reports and Q1 2026 outlook reveals a sharp divergence in underlying logic.

FCX: An Extreme “Cost Anchor” and Operating Leverage

The core reason markets are aggressively chasing Freeport-McMoRan (FCX) in 2026 lies not in its increased copper output—but in its exceptional cost-control capability amid inflationary turmoil.

Grasberg, located in Indonesia, ranks among the world’s largest gold-copper mines. In 2025, FCX completed its automation-driven transition from open-pit to full underground mining—drastically reducing unit energy and labor costs.

According to financial disclosures, FCX has successfully locked in its Unit Net Cash Cost. Amid broad-based global increases in labor and energy costs in 2026, this amounts to an “anti-inflation privilege.”

Owing to its fixed cost structure, FCX’s operating profit elasticity surges sharply as copper prices rise. It is currently the U.S.-listed equity with the highest copper-price sensitivity and the cleanest balance sheet.

BHP: The Curse of Scale and Iron Ore Drag

As the world’s largest mining company by market cap, BHP’s financial report reveals an awkward “internal hedge.”

While BHP’s copper business expands steadily in Chile and Australia, its iron ore operations—which account for ~50% of revenue—face systemic crisis. Excess profits generated by BHP’s copper division are largely offset by weak iron ore margins.

For investors seeking the “AI compute fuel” premium, buying BHP is akin to purchasing a “copper call option” bundled with a “traditional infrastructure put option.” This impurity severely limits its Alpha generation relative to FCX.

Alcoa (AA): The Undervalued “Energy Arbitrage” Giant

The decisive factor for aluminum producers is energy cost.

In 2025, AA executed a strategically prescient move: decisively shutting down inefficient smelters in high-electricity-cost regions and scaling up hydropower-based aluminum production in Iceland, Norway, and Australia. Against the backdrop of CBAM’s formal implementation in 2026, low-carbon aluminum (hydro-produced) commands a 15–20% green premium over coal-power aluminum.

Financial forecasts indicate AA’s earnings exhibit extraordinary sensitivity to energy prices. Financial modeling shows that for every $0.01/kWh decline in average energy cost, EPS expectations rise by 12%. As global renewable energy grid-integration costs continue to amortize, AA is silently enjoying an “energy dividend.”

3. 2026 Portfolio Strategy: Reallocating from “Paper Assets” to “Physical Sovereignty”

In 2026, industrial metals are no longer passive cyclical stocks—they are the “first-beneficiary assets” underpinning AI’s physical infrastructure. Under dual pressure from volatile U.S. dollar credibility and explosive physical demand, investor strategy must shift from “capturing price spreads” to “securing scarcity.”

In the view of the RockFlow research team, the current nonferrous metals price surge is not a replay of prior cycles. Three long-term bullish drivers exist:

1. A Ten-Year CapEx Gap: Over the past decade, miners prioritized balance-sheet repair, cutting exploration spending to just 30% of 2011 levels. Physical output lags possess rigid, 3–5-year irreversibility.

2. The Physical Hedge Against Dollar Hegemony: Central banks worldwide are undergoing “asset physicalization.” Metals are no longer merely industrial inputs—they are regaining reserve-currency attributes.

3. ESG as a Reverse Moat: Stringent environmental approvals render new mine development virtually impossible. This renders existing compliant mines “limited-edition assets,” commanding enduring premiums.

We recommend the following U.S.-listed portfolio strategy:

Core Holdings (Ballast): FCX + RIO

- Freeport-McMoRan (FCX): A pure-play copper leader, capturing absolute premium from compute infrastructure build-out.

- Rio Tinto (RIO): Though it holds iron ore assets, RIO acquired significant secondary copper and lithium assets in 2025. Its exceptionally robust cash flow and high-dividend policy make it the optimal choice for macro volatility resilience.

Offensive Position: AA

- Alcoa (AA): Captures upside from energy arbitrage and lightweighting demand explosion—the highest earnings elasticity in the nonferrous sector.

Defensive Position: VALE

- Vale (VALE): Markets still categorize it as an iron ore producer. Yet VALE holds globally premier nickel resources. With high-nickel batteries returning as the long-range solution, VALE stands at the inflection point of value re-rating.

Conclusion: Embrace “Atoms,” Overweight the Physical World

Memory investment teaches us one principle: whoever controls the bottleneck controls the premium. Memory chips are the bottleneck of the digital world; nonferrous metals are the bottleneck of the physical world.

In 2026, nonferrous metals have become the physical world’s “HBM.” The RockFlow research team believes that favoring nonferrous metals and overweighting the physical world will be a major investment theme this year—serving simultaneously as both an inflation hedge and an entry ticket to the AI revolution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News