Bitget UEX Daily Report | Trump Raises Tariffs on South Korean Goods; Precious Metals Hit All-Time Highs; NVIDIA Increases AI Investment

TechFlow Selected TechFlow Selected

Bitget UEX Daily Report | Trump Raises Tariffs on South Korean Goods; Precious Metals Hit All-Time Highs; NVIDIA Increases AI Investment

U.S. stocks edged higher this week at the start of the tech earnings season, with the Dow Jones and S&P supported by risk-averse sentiment.

Author: Bitget

I. Top News Highlights

Federal Reserve Updates

Probability of holding rates steady in January rises to 96.1%

- Market data shows the probability of a 25-basis-point rate cut has dropped to 3.9%; the cumulative probability of a 25-basis-point cut by March stands at 15.5%, and for a 50-basis-point cut, just 0.4%. Market impact: Stable rate expectations bolster equity market confidence but may cap the upside potential for bond markets.

International Commodities

Precious metals prices retreat slightly after hitting peaks

- Spot gold and silver both hit record highs; silver surged up to 14% intraday, reaching $117.75 per ounce. Analysts note that low liquidity amplified volatility, while silver miners increased selling pressure via futures hedging. Market impact: Strong safe-haven demand may further squeeze industrial-demand-related commodities.

Macroeconomic Policy

Trump raises tariffs on South Korean goods to 25%

- Tariffs on automobiles, timber, pharmaceuticals, and other goods are increased to match reciprocal levels due to the lack of approval for a trade agreement. The European Parliament has postponed deliberation on the EU–U.S. trade agreement. Market impact: Escalating global trade tensions heighten supply-chain risks and could potentially weigh on emerging-market growth.

II. Market Recap

Commodities & FX Performance

- Spot gold: +0.42% to $5,032.46/oz, extending its multi-day record-high trend.

- Spot silver: +3.03% to $107.05/oz; low liquidity contributed to rapid upward movement.

- WTI crude oil: +0.30% to $60.81/barrel, supported by demand outlook and geopolitical factors.

- U.S. Dollar Index: Flat at 97.06; recent downward pressure stems from policy uncertainty.

Cryptocurrency Performance

- BTC: +0.91% over 24 hours, trading near $88,000; intensified capital outflows heightened volatility.

- ETH: +1.97% over 24 hours; subdued market sentiment weighed on performance.

- Total cryptocurrency market cap: +0.96% to $2.98 trillion; ETF net redemptions dampened overall confidence.

- Liquidations: Globally, 84,757 traders were liquidated within 24 hours, totaling $361 million. The largest single liquidation occurred on Hyperliquid – ETH-USD, valued at $38.81 million.

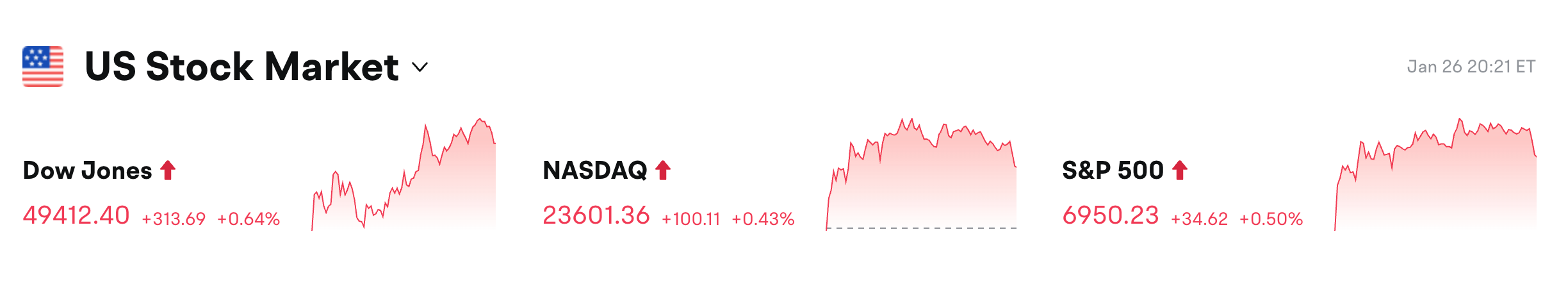

U.S. Equity Index Performance

- Dow Jones Industrial Average: +0.64% to 49,412.40, continuing its modest rebound.

- S&P 500: +0.5% to 6,950.23; supported by financials and consumer discretionary sectors.

- Nasdaq Composite: +0.43% to 23,601.36; driven by divergence among chip and AI-related stocks.

Tech Giants’ Updates

- Apple: +3%, buoyed by expectations of product innovation.

- Meta: +2%, underpinned by a stable advertising ecosystem.

- Google: +1%, led by search business dominance.

- Broadcom: +1%, reflecting renewed semiconductor demand.

- Tesla: −3%, pressured by intensifying competition.

- AMD: −3%, impacted by semiconductor cycle adjustment.

- NVIDIA: +0.5%, benefiting from AI infrastructure investment tailwinds.

Overall gains prevailed, primarily driven by deepening AI-focused investments and broad tech optimism.

Sector-Specific Observations

Precious Metals Mining Sector: +8%

- Representative stock: Gold Fields Ltd., +12%; catalyst: record-high gold and silver prices boosted mining companies’ earnings expectations. Health insurance sector: −5%

- Representative stock: UnitedHealth Group, −4%; catalyst: Trump’s proposal to freeze premium rates exceeded Wall Street expectations, pressuring major insurers.

III. In-Depth Stock Analysis

1. NVIDIA — Adds $2 Billion Investment in CoreWeave

Event Summary: NVIDIA announced an additional $2 billion investment in CoreWeave to support its expansion of over 5 gigawatts of AI compute infrastructure by 2030. This move continues NVIDIA’s strategic expansion in the AI space and accelerates infrastructure upgrades to meet surging market demand. Market Interpretation: Institutional views suggest this investment strengthens NVIDIA’s dominance across the AI supply chain, though rising competitive pressures may translate into cost headwinds. Investment Implication: AI-themed equities show strong potential; investors should consider opportunities linked to supporting infrastructure providers.

2. OpenAI — Launches Premium-Priced Advertising Business

Event Summary: OpenAI has entered the advertising arena with pricing comparable to NFL events—significantly higher than social media competitors. However, it currently does not provide granular response analytics or conversion metrics. Future plans include developing advanced tools to enhance service capabilities. Market Interpretation: Analysts point out that building a mature advertising system will take time, and competing against giants like Meta poses significant challenges. Yet, its data insights hold promise for revenue diversification. Investment Implication: High short-term uncertainty, but long-term growth prospects for the AI advertising ecosystem remain promising.

3. Zijin Mining — Plans $28 Billion Acquisition of Allied Gold

Event Summary: Zijin Mining intends to acquire Allied Gold Corporation for RMB 28 billion, aiming to expand its gold resource reserves and increase overall mining capacity. If completed, this transaction would further solidify its position in the global mining industry. Market Interpretation: Institutional analysis indicates the acquisition supports resource integration, though the impact of gold price volatility on returns warrants careful assessment. Investment Implication: Elevated gold prices benefit mining firms’ valuations; investors should monitor post-merger integration progress.

4. CoreWeave — Receives Additional Investment from NVIDIA

Event Summary: CoreWeave surged over 15% intraday and closed up 5%, propelled by NVIDIA’s $2 billion investment toward AI infrastructure expansion—a milestone signaling its transition from startup to large-scale provider. Market Interpretation: Views suggest this partnership enhances CoreWeave’s competitiveness, yet reliance on a single major customer remains a risk factor. Investment Implication: Cloud-based AI stocks stand to gain significantly; they merit consideration as a thematic allocation within the broader technology sector.

IV. Cryptocurrency Project Updates

- MicroStrategy acquired 2,932 BTC for approximately $264.1 million, at an average price of ~$90,061 per BTC.

- A dormant Ethereum whale address—inactive for nine years—was reactivated, transferring $145 million worth of ETH.

- Japan plans to approve its first cryptocurrency ETFs by 2028, accelerating Asia’s regulatory race.

- Digital asset investment products recorded their largest outflow since mid-November 2025, totaling $1.73 billion.

- The Ethereum Foundation has formed a post-quantum cryptography team to address potential quantum-computing threats to blockchain security.

V. Today’s Market Calendar

| 09:00 | U.S. | S&P CoreLogic Case-Shiller 20-City Home Price Index (Nov) | ⭐⭐⭐ |

| 10:00 | U.S. | Consumer Confidence Index (Jan) | ⭐⭐⭐⭐ |

| 10:00 | U.S. | ISM Non-Manufacturing New Orders Index (Jan) | ⭐⭐⭐ |

*Times listed above reflect local time of the reporting country.

Key Upcoming Events

- Fed Rate Decision: January 28 — Watch for confirmation of unchanged rates and forward guidance.

- U.S. Senate Crypto Bill Hearing: January 29 — Potential implications for market structure and regulation.

Bitget Research View:

U.S. equities posted modest gains this week amid the early stage of the tech earnings season, with the Dow and S&P supported by safe-haven sentiment. Gold broke above $5,100/oz, while silver also hit new highs, largely driven by geopolitical tensions, tariff threats, and U.S. government shutdown risks—spurring inflows into safe-haven assets. Crude oil prices edged higher on improved demand expectations, though volatility in oil markets intensified. The U.S. Dollar Index declined under pressure, as policy uncertainty eroded its appeal. Overall market sentiment leans defensive; investors are advised to increase gold allocations to hedge against trade friction, while remaining vigilant about the ripple effects of Bitcoin ETF outflows on broader crypto assets.

Disclaimer: The above content was compiled via AI-powered search and verified manually prior to publication. It does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News