Who Can Catch Pony Ma’s Red Envelope?

TechFlow Selected TechFlow Selected

Who Can Catch Pony Ma’s Red Envelope?

Can other major tech companies handle it?

Author: Ba Jiuling, Wu Xiaobo Channel

“We hope to recreate the boom of WeChat’s red envelopes back in the day.” With this single sentence, Ma Huateng reignited fierce competition across China’s domestic large-model industry.

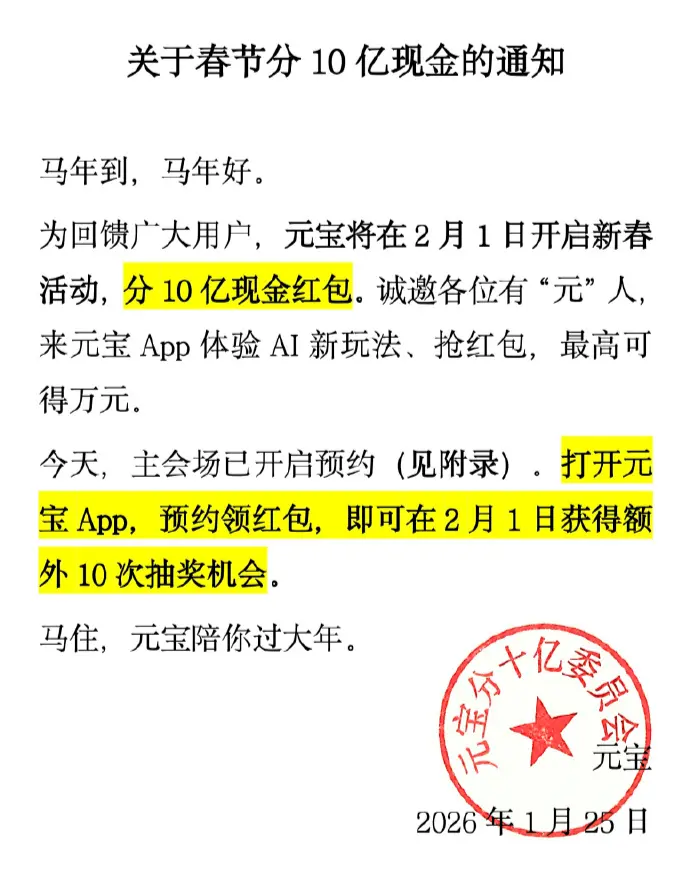

The day before, Tencent Yuanbao announced it would distribute RMB 1 billion in Spring Festival cash red envelopes via the Yuanbao app starting February 1.

Image source: Internet

Rivals had no choice but to brace themselves. The “red envelope rain” launched by WeChat back then—widely regarded as a milestone in China’s internet business warfare—was dubbed by Jack Ma as a “Pearl Harbor-style sneak attack.” In 2015, WeChat Pay secured exclusive cooperation with CCTV’s Spring Festival Gala and distributed RMB 500 million in red envelopes. That night alone, WeChat recorded 11 billion “shake-to-win” interactions and bound over 100 million bank cards—effectively seizing half the online payment market from Alipay in one fell swoop.

Since then, the “red envelope wars among major tech firms” have become an integral part of Chinese audiences’ Spring Festival memories. From Alipay to Douyin (TikTok) and Kuaishou, and then to Taobao, JD.com, and Pinduoduo, no internet giant is considered truly established unless it has appeared on the Spring Festival Gala stage. The total value of red envelopes handed out during the Gala has steadily climbed—from RMB 500 million initially to RMB 3 billion last year.

Thus, the most anticipated segment of this year’s Gala is clear: Which tech giant will be handing out red envelopes?

This year, however, the giants are once again lining up at the same starting point—throwing massive cash budgets and launching wildly creative marketing campaigns. When Ma Huateng steps forward to “hand out red envelopes,” can other tech giants keep pace?

Internet Giants Spark an AI Red Envelope War

On the same day Yuanbao announced its RMB 1 billion initiative, Baidu also officially unveiled its plan to distribute RMB 500 million in “Year of the Horse” red envelopes—and will partner with Beijing Television for its Spring Festival Gala broadcast.

ByteDance, meanwhile, had already secured exclusive partnership with CCTV’s Spring Festival Gala a month earlier, naming its B2B-oriented AI cloud platform VolcEngine as the official exclusive AI Cloud Partner for the 2026 Gala. Its consumer-facing AI assistant, Doubao, will support various interactive features during the event.

Though neither party disclosed the exact sponsorship amount, some reference figures exist: In 2020, Kuaishou’s exclusive partnership with CCTV’s Spring Festival Gala cost RMB 1.3–1.4 billion, with overall marketing investments totaling approximately RMB 2 billion. In 2021, Douyin’s exclusive partnership with the Gala cost roughly RMB 1 billion, plus an additional RMB 1.2 billion in cash red envelopes distributed on Chinese New Year’s Eve.

Throughout 2025, ByteDance’s marketing spend on Doubao has been relatively restrained compared to Tencent and Alibaba. According to media analysis, this year’s Gala sponsorship may represent ByteDance’s largest AI brand-marketing investment of the entire year.

Alibaba’s response was to integrate its ecosystem of apps, positioning its Qwen app as a super traffic hub fully connected to shopping, navigation, travel, and more—leveraging food delivery red envelopes to acquire new users. Prior to this, Qwen had secured the title of exclusive overall sponsor for Bilibili’s New Year’s Eve gala.

According to veteran tech media commentator Zhuang Minghao, this year’s red envelope war signals a pivotal shift: AI competition is expanding beyond pure model capabilities into applications and entry points.

Before this, digital “smoke” had already filled smartphone screens.

Across 2025, the arms race among major tech firms in AI unfolded from multiple angles. Take talent acquisition: Tencent publicly recruited Yao Shunyu, a former OpenAI researcher aged only 27, who now concurrently leads both Tencent’s AI Infrastructure Department and its Large Language Model Department.

Then there’s the hardware battleground. In December last year, ByteDance suddenly launched the “Doubao Phone,” triggering joint resistance from major software vendors due to its deep integration into the smartphone’s underlying operating system. After facing lukewarm reception in the smartphone market, ByteDance pivoted to launch AI-powered earbuds and an AI “recording bean.”

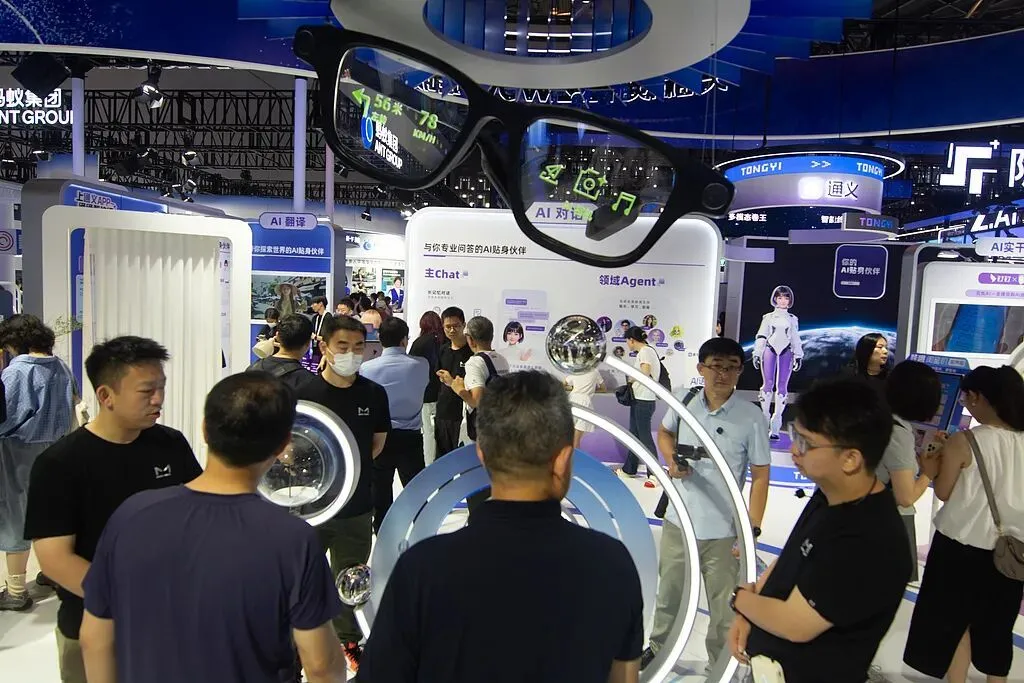

Meanwhile, Alibaba introduced the Quark AI Glasses powered by Qwen, which dominated large-screen advertising in several of Hangzhou’s busiest metro stations.

Quark Smart AI Glasses at the 2025 World Artificial Intelligence Conference

Most directly, there’s the marketing war. According to a report by DataEye Research Institute, in December 2025, the top five native AI products ranked by volume of ad creatives deployed in the Chinese market were Alibaba’s Qwen, Tencent’s Yuanbao, Ant Group’s A-Fu, ByteDance’s Doubao, and AI-powered Douyin—accounting for 96% of all monthly ad creatives deployed domestically.

Perhaps due to excessive budgets and overwhelming objectives, many of these marketing efforts took bizarre forms. For instance, aiming to capture lower-tier markets, Yuanbao painted slogans on rural village walls: “Postpartum sow care is difficult—ask Tencent Yuanbao.”

Image source: Internet

The most staggering aspect, however, is the capital war. ByteDance’s projected capital expenditures for 2025 stand near RMB 160 billion. Recently, overseas institutions reported that ByteDance has raised its 2026 capex target from RMB 160–180 billion to RMB 300 billion.

Alibaba announced early in 2025 that it plans to invest RMB 380 billion in AI over the next three years—setting a new record for AI spending among Chinese enterprises—and later noted at year-end that “this figure may prove conservative.”

While Ma Huateng did not disclose specific numbers, he stated at Tencent’s annual meeting: “In 2025, Tencent adopted a steady and pragmatic approach—the only area where we invested heavily was AI.” Analysts estimate Tencent’s 2025 AI capital expenditure approached RMB 100 billion.

“In short, 2025 was a ‘year of certainty’: AI’s value and capabilities have been thoroughly validated. Tech giants clarified their strategies and went ‘all-in’; AI matured into practical utility while infrastructure expansion ran rampant.” Hu Yanping, specially appointed professor at Shanghai University of Finance and Economics, summarized.

By contrast, 2026 will be the “decisive year.”

The Warring States Era of AI

AI industry investor Gao Zhendong likens today’s large-model competitive landscape to China’s ancient Warring States period—each company possesses distinct strengths, making them evenly matched.

Hu Yanping believes that commercially, China’s domestic AI sector currently exhibits a “(3+1)+5+N” structure.

Here, “3+1” refers to ByteDance, Alibaba, Tencent, and Baidu; “5” denotes DeepSeek and the former “Five Little Tigers of Large Models”—Kimi, Zhipu, MiniMax, StepFun, etc.; “N” represents vertical or domain-specific AI companies targeting niche professional markets.

Yet as giants pour massive capital into the space, spotlighted by public attention, three “states” have emerged as front-runners in this Warring States contest.

Gao Zhendong compares ByteDance to the State of Chu—vast in territory, rich in resources, broad in influence, late to enter yet first to achieve dominance, possessing “mother mines” of traffic like Douyin and TikTok.

Tencent resembles the State of Qi—wealthiest among all states, blessed with abundant natural advantages (e.g., salt and fisheries). Owning WeChat’s “social moat” and robust cash flow, Tencent need only safeguard its social entry point—its capital and traffic alone can sway the entire landscape.

Alibaba is akin to the State of Wei—first to enact sweeping reforms, deeply rooted, brimming with talent, and highly organized. As China’s pioneer in cloud computing, Alibaba has vertically integrated the entire AI industrial chain—from chips and cloud infrastructure to models and applications.

These three giants have thus developed distinct strategic approaches.

Alibaba wages an ecosystem war. Leveraging its application ecosystem, the Qwen app is evolving into a “super app” covering every facet of daily life—food, accommodation, transportation, and more—now enabling users to order takeout, book flights and hotels, and check navigation—all within a single interface.

ByteDance relies on short-video scenarios, excelling in AI-driven content creation and entertainment. Beyond its general-purpose assistant Doubao, ByteDance also offers JIMENG AI—a suite of AI creation tools capable of generating videos, webcomics, e-commerce pages, and advertisements.

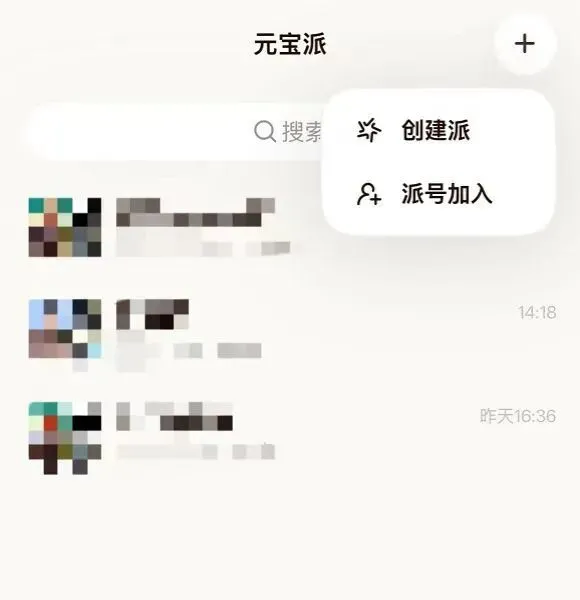

Tencent continues to tighten its grip on social entry points. In the second half of 2025, Yuanbao integrated with Tencent Meeting and QQ. More recently, it launched “Yuanbao Pai”—an AI-social feature embedding Yuanbao directly into group chats and supporting invitations to WeChat friends.

Image source: Internet

Beyond the giants’ diverse tactics, the market share remaining for other competitors appears increasingly narrow.

In Gao Zhendong’s view, only Baidu and DeepSeek remain capable of standing shoulder-to-shoulder with the “Big Three” as Warring States hegemonies. Baidu resembles the State of Zhao—making massive investments in autonomous driving and foundational large models, boasting solid technical foundations, functioning as a military powerhouse. DeepSeek, though dwarfed by major tech firms in terms of data volume and compute scale, matches Google and OpenAI’s latest models in computational efficiency—akin to the State of Han, famed for finely crafted weaponry and mastery of “statecraft.”

Meanwhile, more SMEs seek alternative paths toward differentiation. For example, among the “Five Little Tigers of Large Models” that surged to prominence in 2024, Baichuan Intelligence—founded by former Sogou CEO Wang Xiaochuan—and 01.ai—founded by Kai-Fu Lee—have both abandoned training foundational large models, shifting instead toward healthcare- and legal-domain AI applications. Zhipu AI and MiniMax listed on the Hong Kong Stock Exchange early in 2026, hoping capital-market funding will sustain future R&D and marketing efforts.

According to digital economy scholar Liu Xingliang, second- and third-tier models still hold significant depth in niche segments like education, healthcare, and enterprise services—but likely face insurmountable odds competing head-on with giants for mass-market entry points and traffic.

Zhuang Minghao emphasizes “full-stack capability”: Today’s AI competition is no longer just about models—it spans cloud infrastructure, models, applications, and even extends to chips and hardware.

Hu Yanping outlines four dimensions for observing future competitive dynamics:

◎ First, technological progress—coding ability has become a critical central capability.

◎ Second, capital investment. Major tech firms are multiplying their AI capital expenditures; smaller but leading startups must secure at least RMB 5 billion in cash reserves and investment in 2026—or risk falling out of the second tier.

◎ Third, user base. Either possess a user base approaching 1 billion, or forge strategic alliances with ecosystem partners commanding hundreds of millions of users; otherwise, customer acquisition costs become prohibitively high, undermining monetization potential.

◎ Fourth, diversification of revenue streams—rapidly scaling to generate RMB 10 billion+ annually from AI-powered e-commerce, advertising & marketing, enterprise solutions, and API tokens—because China’s market features widespread free services, making subscription-only models unsustainable.

Therefore, as Liu Xingliang notes, although the current tripartite equilibrium appears stable in the short term, the competitive landscape remains fluid—subject to disruption from technological breakthroughs, explosive growth in vertical niches, or policy guidance.

App download page in mobile app stores

No Winner Yet

The internet industry is no stranger to titanic battles among giants.

From the “Hundred Groups War,” the “Online Payment War,” the “Hundred Models War,” to the “Food Delivery War,” each wave of technological or business-model innovation has triggered massive capital-intensive contests—yet most ended with more losers than winners, and champions often shifted unpredictably.

Today’s battlefield resembles the mid-phase of the Warring States era—numerous vassal states rising simultaneously, hegemonies constantly changing hands, continuous institutional reform and innovation—yet no new order has yet crystallized.

In other words, whether giants or small players, though their battle tactics and circumstances differ, one fact stands out: none have yet discovered a viable business model—and all remain deeply unprofitable.

Liu Xingliang observes that the current large-model war still relies on “subsidies + traffic entry points” to capture users—an effective tactic for early market education, but unsustainable long-term. Real profitability hinges on establishing stable revenue sources such as paid subscriptions, enterprise AI solutions, and industry-customized services.

As Zhuang Minghao puts it: “The industry’s current competition leaves no room to contemplate the sustainability of burn-rate models—it’s a prisoner’s dilemma.”

Yet precisely because no new order has crystallized, the ultimate winner remains uncertain—and may not even have entered the arena yet.

Hu Yanping believes that in the next phase, opportunities exist for large firms, mid-tier enterprises, and even “little dragons” and “little tigers.” In the short-to-medium term, multi-player competition benefits both industry development and consumer choice.

He also forecasts that the inflection point for AI monetization is imminent. From intense head-to-head technology and product competition to tightly contested marketing battles, all signal that 2026 will be the “inaugural year of AI value harvest.” This year, domestic AI will undergo three major shifts: massive technological investment, pronounced competitive divergence, and large-scale market segmentation.

It’s foreseeable that before this war concludes, red envelopes will continue falling in myriad forms. And perhaps the answer to this epic battle lies right in your hands: Whose red envelope did you just receive?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News