It’s 2026—DAOs Should Be Mature by Now

TechFlow Selected TechFlow Selected

It’s 2026—DAOs Should Be Mature by Now

This is not merely a post-mortem on governance—it is also a prophecy of Web3 organizational evolution in 2026.

Author: Pink Brains

Translation & Editing: TechFlow

TechFlow Intro: 2025 marks a pivotal inflection point for decentralized governance (DAOs). After years of idealistic experimentation, mainstream protocols are now confronting core pain points—power distribution, accountability mechanisms, and sustainability—head-on. This article, authored by veteran DAO delegate Pink Brains, draws on hands-on experience casting 725 votes across top-tier protocols including Aave, Lido, and Gnosis to deeply analyze the DAO’s structural shift—from “community self-governance” toward “hybrid operations.”

The author argues that governance tokens alone are no longer sustainable; instead, DAOs will evolve toward economic alignment, legal entity formation, and AI-assisted decision-making. This is not merely a retrospective on governance—it is a prophetic blueprint for Web3 organizational architecture in 2026.

Full Text Below:

2025 marks a turning point for decentralized governance.

After years of experimentation, major protocols are directly confronting fundamental questions around power distribution, accountability, and sustainability.

The answers aren’t always pleasant—but they are necessary.

What We Achieved in 2025

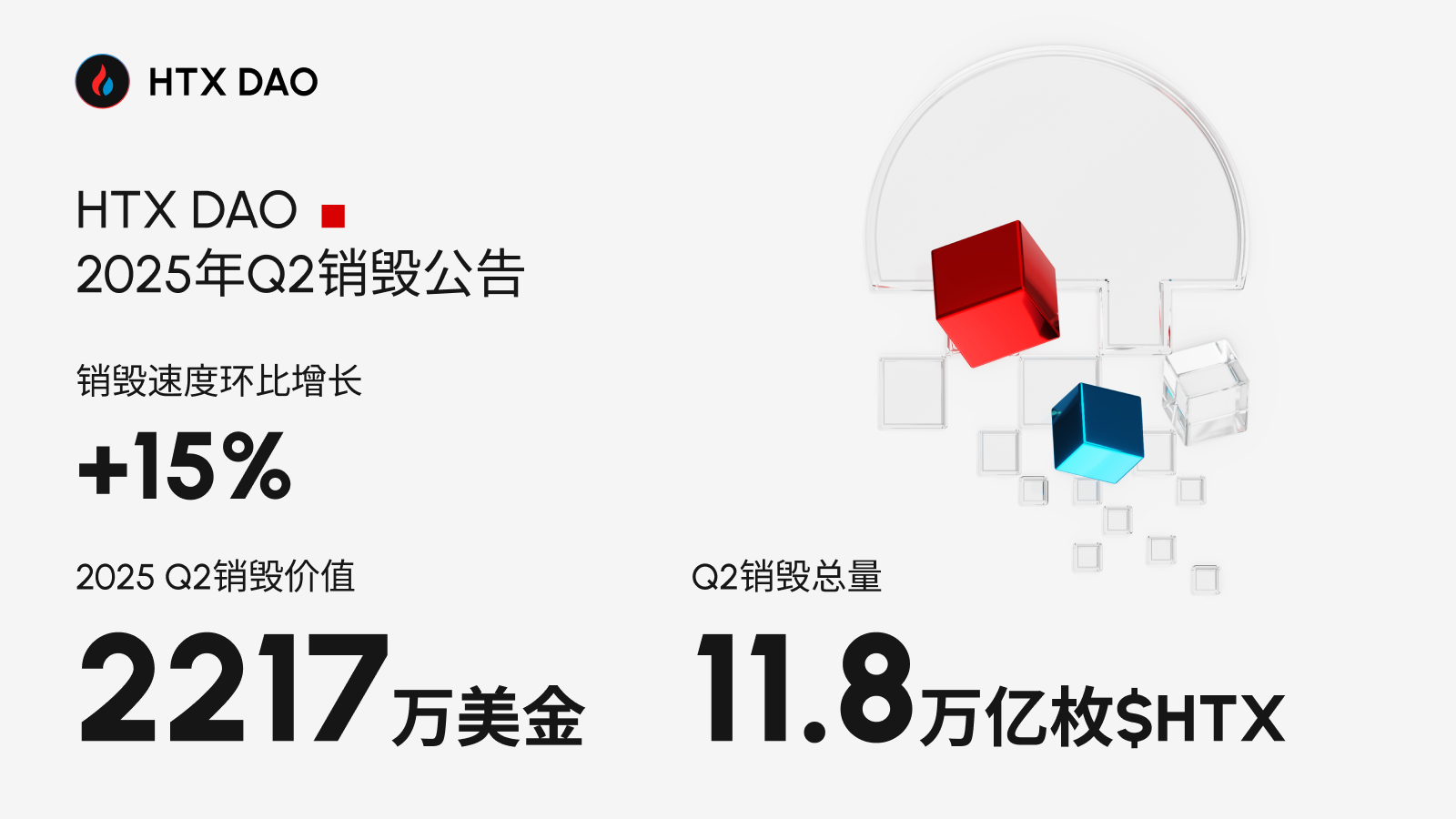

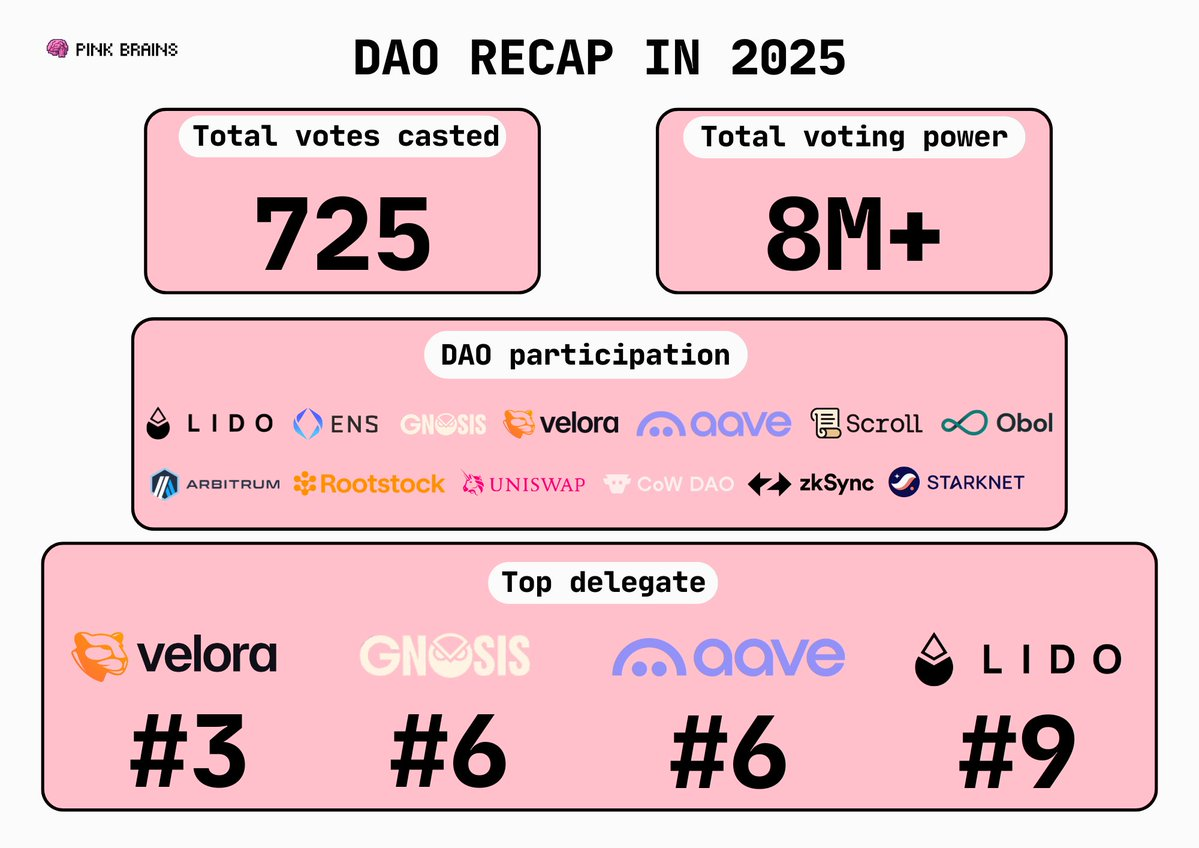

2025 was also our first year operating as an active DAO delegate.

- Casted 725 votes across 18 protocols

- Held over 8 million voting rights

- Ranked among the top 10 delegates for both Aave and Lido

- Ranked among the top 3 delegates for Velora

- Ranked among the top 6 delegates for Gnosis

This perspective—grounded in real-world governance work—enables us to clearly identify the patterns reshaping DAOs in 2025 and define their trajectory into 2026.

How DAOs Changed in 2025

Operational Shift: From Pure Community Governance to Hybrid Control

The most notable change in 2025 was the transition from purely community-driven governance to hybrid models with clearer operational control.

- @arbitrum introduced an Operating Company (OpCo), channeling all DAO operations through a unified structure.

- @JupiterExchange temporarily suspended governance entirely for nearly six months to reassess its approach.

- @Uniswap launched the DUNI framework, centralizing operational authority.

- @Gnosis executed a hard fork despite declining community participation. Scroll shifted to a CEO-led structure.

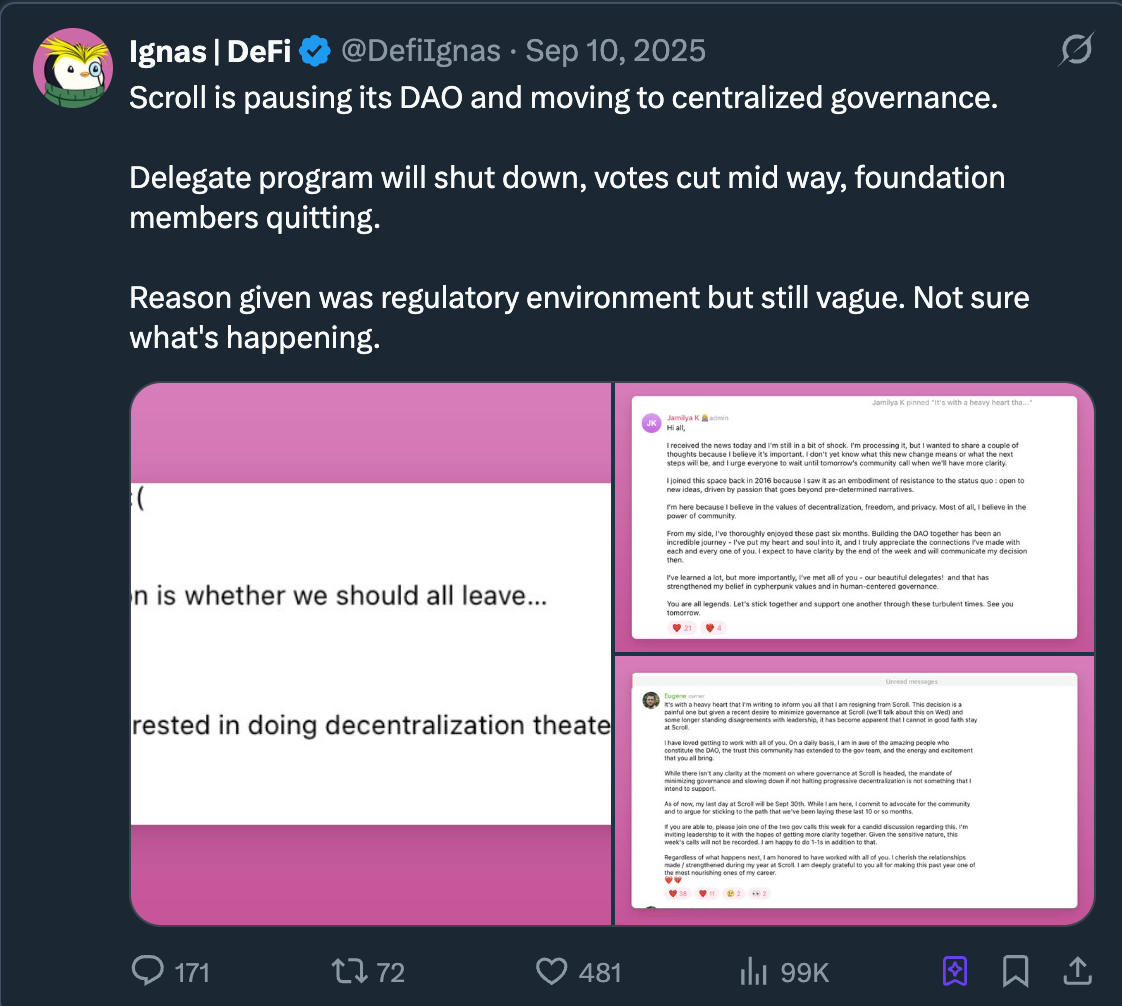

- @Scroll_ZKP paused its DAO to focus on centralized governance.

- Most recently, the Celo Foundation merged with @cLabs into a unified core contributor organization.

This shift stems from DAOs hitting scalability limits. Execution has become a bottleneck. Full-community voting is typically too slow for operations, too noisy for technical nuance, and too fragile for security-sensitive actions.

As a result, governance authority is concentrating within smaller, high-context groups, while broader communities increasingly assume oversight roles—a theme explored further below.

Fewer Voters, but More Concentrated Power

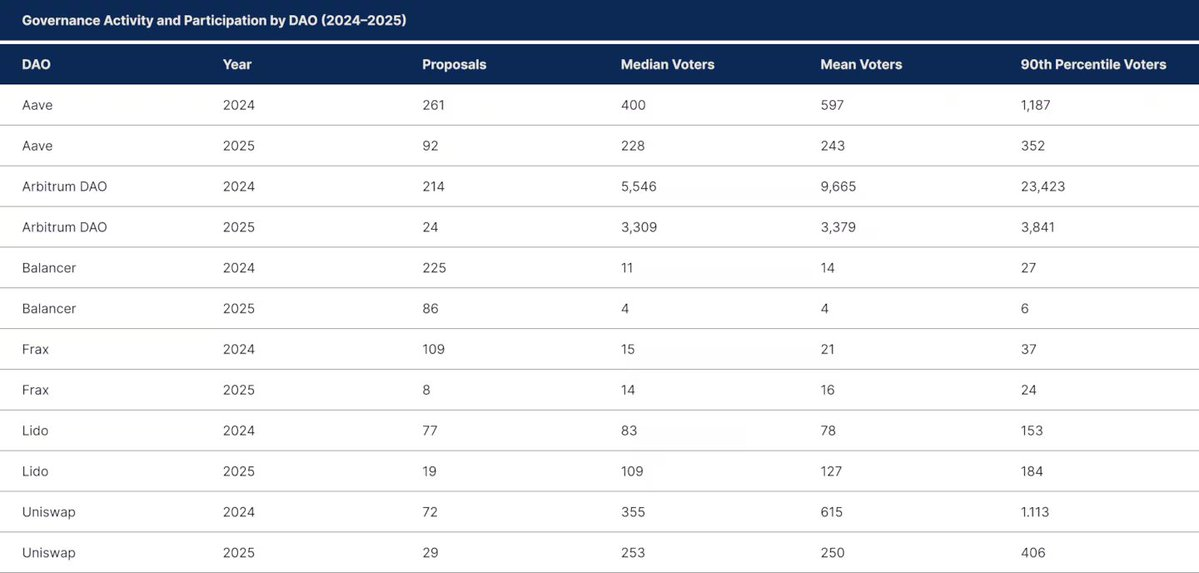

In 2025, proposal volume and voter turnout declined sharply across major DAOs. Yet voting power behind each proposal remains robust.

- Lido saw improved participation after adopting its dual governance framework.

- Arbitrum and Uniswap maintained the highest overall participation rates—but both saw reduced numbers of individual voters.

Caption: 2025 DeFi Landscape Report from DeFiLlama

This does not signal governance failure. Rather, governance has become more bundled, operationally abstracted, and less frequent.

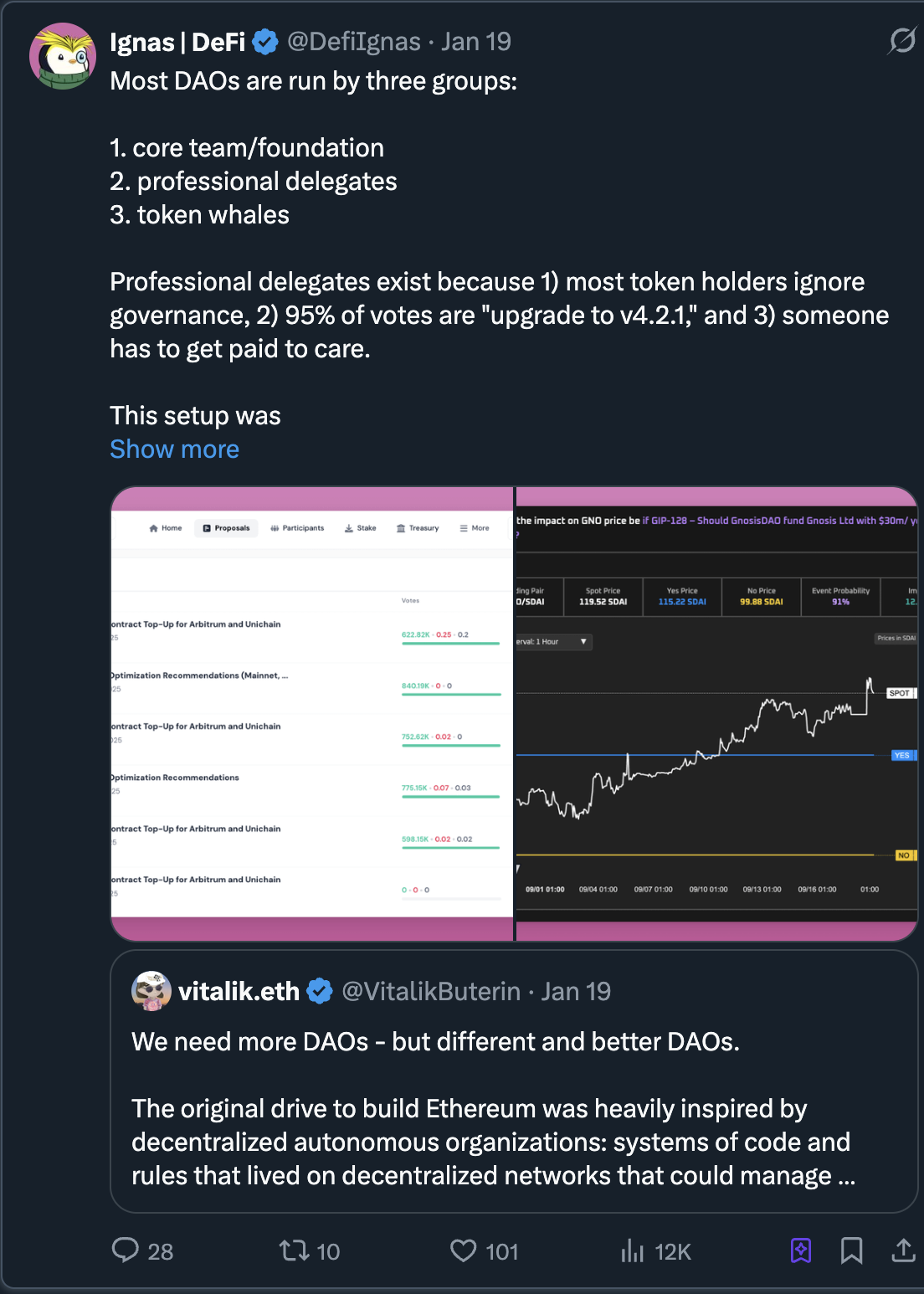

Governance influence has migrated to a small cohort of highly active delegates and large-capital stakeholders.

Value Accrual for Token Holders

“Token buybacks,” “buy-and-burn,” and “fee switches” emerged as defining themes of 2025.

For years, token utility centered narrowly on voting rights and incentive distribution—delivering minimal economic value to holders. 2025 changed that equation.

- Lido adopted a buyback framework.

- Uniswap DAO activated its long-awaited fee switch, committing to burn nearly $600 million worth of UNI tokens.

- Aave implemented a token buyback mechanism. Optimism launched its own buyback program.

- CoW Protocol increased solver profitability in ways that directly benefit token holders.

This trend addresses a critical challenge in tokenomics. Buybacks and burns reduce circulating supply, increasing scarcity. If demand remains stable, price appreciation follows. When token holders can meaningfully benefit from protocol success, they gain stronger incentives to buy, hold, and remain engaged in governance decisions.

Who Truly Owns a DAO?

Two major controversies forced DAOs to confront structural weaknesses head-on.

- Gnosis voted to terminate Karpatkey’s treasury authorization due to disputes over fees, underperformance, and a ~$700,000 loss tied to liquidity issues.

- Aave DAO vs. Aave Labs tensions escalated when it was revealed that ~$10 million annually in swap fees from the CoW Swap integration flowed to Aave Labs—not the DAO. The brand ownership vote failed, leaving a harder question unanswered: What does “DAO-owned” actually mean when core teams retain control over development and distribution?

These conflicts pushed protocols to fill gaps in accountability and governance structure.

Legal Infrastructure Is Adapting to DAOs

Despite DeFi’s growth, most DAOs still lack clear legal structures—creating escalating liability and regulatory risks as protocols scale.

While jurisdictions like Wyoming have introduced DAO LLC frameworks—and Switzerland offers mature legal pathways—most DAOs remain in legal gray zones.

Trends Forecast for 2026

Centralized DAOs as an Emerging Practice

Protocols will develop clear frameworks distinguishing “community decisions” from “operational decisions”—moving beyond the false binary of “fully decentralized” versus “fully centralized.”

- Operational execution: Will be handled by Labs teams—not foundations.

- Community oversight: DAO delegates and the broader community will steer treasury strategy, long-term direction, and major structural decisions.

Governance Evolving Into Risk Management Infrastructure

Future DAOs will no longer resemble chatty forums. More teams will bifurcate decisions into concave and convex categories.

Concave problems require:

- Prior-approved guardrails and automated execution.

- Professional oversight (risk service providers, auditors, security teams).

- Responsive frameworks for emergencies and market shocks.

- Fewer proposals—but each decision carries higher economic impact.

Convex problems (e.g., product direction) demand decisive leadership, with the DAO serving as a “brake” or “checkpoint”—not the “steering wheel.”

By 2026, this will become standard for lending protocols, stablecoins, perpetuals (“Perps”), and any protocol where financial risk can compound rapidly.

The End of Governance-Only Tokens? Value Capture Is Non-Negotiable

Carrying forward into 2026, tokens offering governance rights alone will struggle to sustain long-term engagement.

If there’s no path to economic upside, delegates, whales, and strategic holders won’t consistently protect the system. Protocols will increasingly adopt at least one value-creation pathway:

- Token buyback frameworks.

- Fee diversion or revenue sharing.

- Staking tied to protocol cash flows.

- Treasury strategies explicitly designed to support token value.

When holders profit directly from protocol success, they’re incentivized to stay attentive, participate, and defend the system.

Legal Structure: From Optional to Essential

Regulatory pressure and real-world legal challenges will push DAOs toward formal entity formation, balancing decentralized governance with legal clarity.

Professional Delegation

As governance complexity increases, token holders will delegate more frequently to full-time professional delegates. While this concentrates voting power, it may improve decision quality. Meanwhile, weaker delegate organizations unable to achieve economic viability will face collapse—governance work is becoming increasingly professional, political, and costly.

Privacy, AI, and Futarchy

Public governance is a social game. When every vote is visible, decisions get swayed by reputation, peer pressure, and alliances—not pure protocol interest. Hence, governance privacy will grow increasingly vital.

AI will alleviate decision fatigue. It can help analyze proposals and automatically vote on routine upgrades based on user-defined preferences—reserving human intervention only for disputes or high-impact decisions.

Futarchy markets will also play a larger role in DAOs. They use market signals to predict which options are likely to create value. Gnosis is piloting this model, using retail prediction markets to gauge sentiment around proposals.

Crypto Is Maturing—and So Are DAOs

The shifts we observe—in DAO operations, economic alignment, accountability conflicts, and professionalization—represent maturity, not the end of DAOs.

DAOs are evolving from ideological experiments into organizational architectures that balance “decentralized oversight” with “proven operational efficiency.” We believe that if teams align closely with community interests, DAO governance becomes more meaningful: moving swiftly when action is needed, ensuring growth benefits token holders, and holding all participants—including core teams and delegates—accountable.

As Vitalik put it: We need more DAOs—but different, better DAOs.

If you believe in the value of DAOs, we can be your voice.

Effective delegation is about more than casting a vote—it means doing real work: reading proposals, staying active in forums, understanding risks, and voting “no” against flawed decisions—even when it’s unpopular.

This is how we operate as delegates: growing protocols through clear communication and educational content—while staying aligned with community incentives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News