DAO Governance Dilemma: $3.3 Billion in Assets vs Silent Voting Boxes

TechFlow Selected TechFlow Selected

DAO Governance Dilemma: $3.3 Billion in Assets vs Silent Voting Boxes

The ideal of DAO is becoming a castle in the air.

Author: Firefly Researcher

Eleven years ago, the Ethereum whitepaper first outlined the concept of a DAO — a governance utopia where "code is law," with everyone participating and sharing.

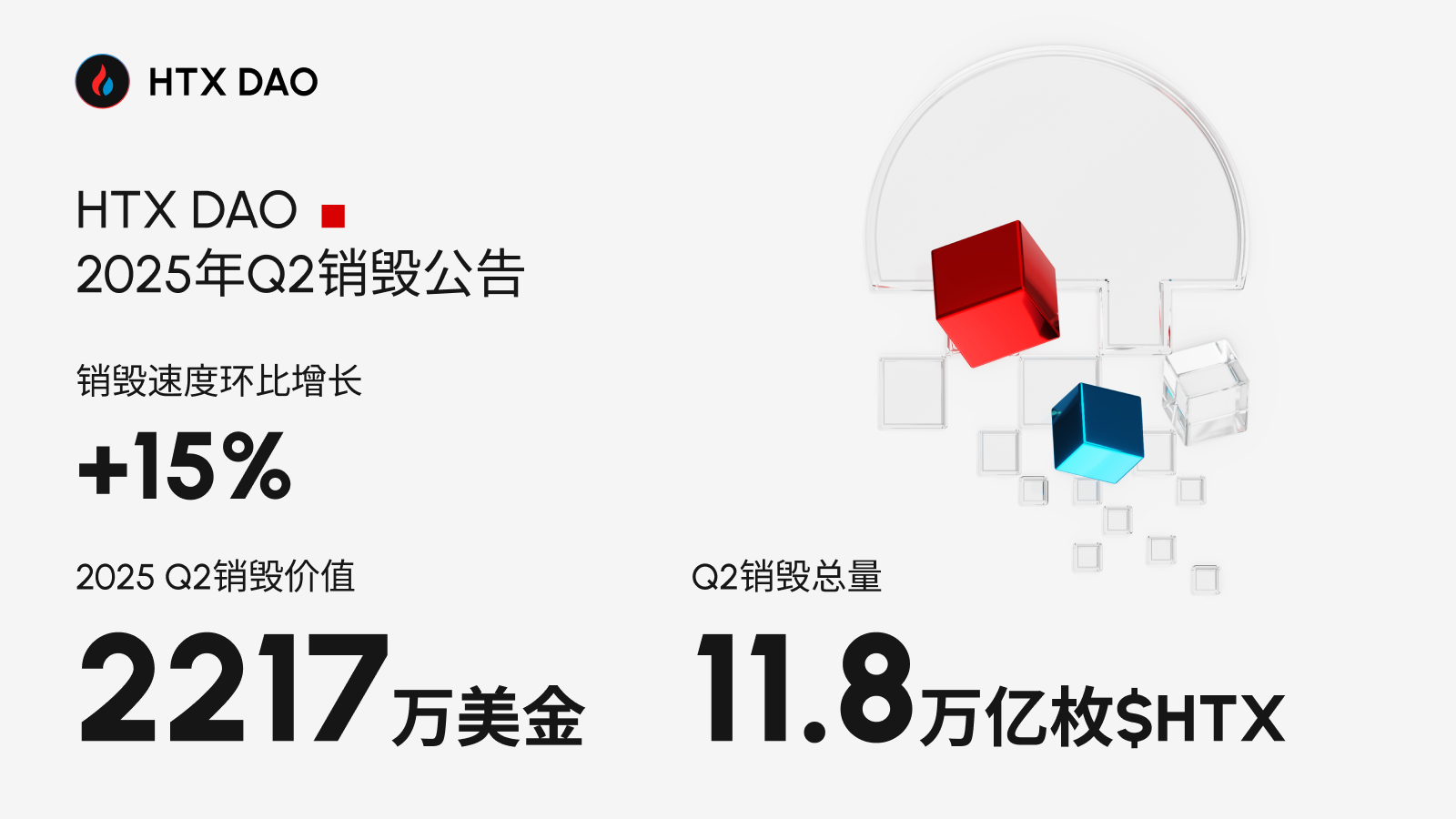

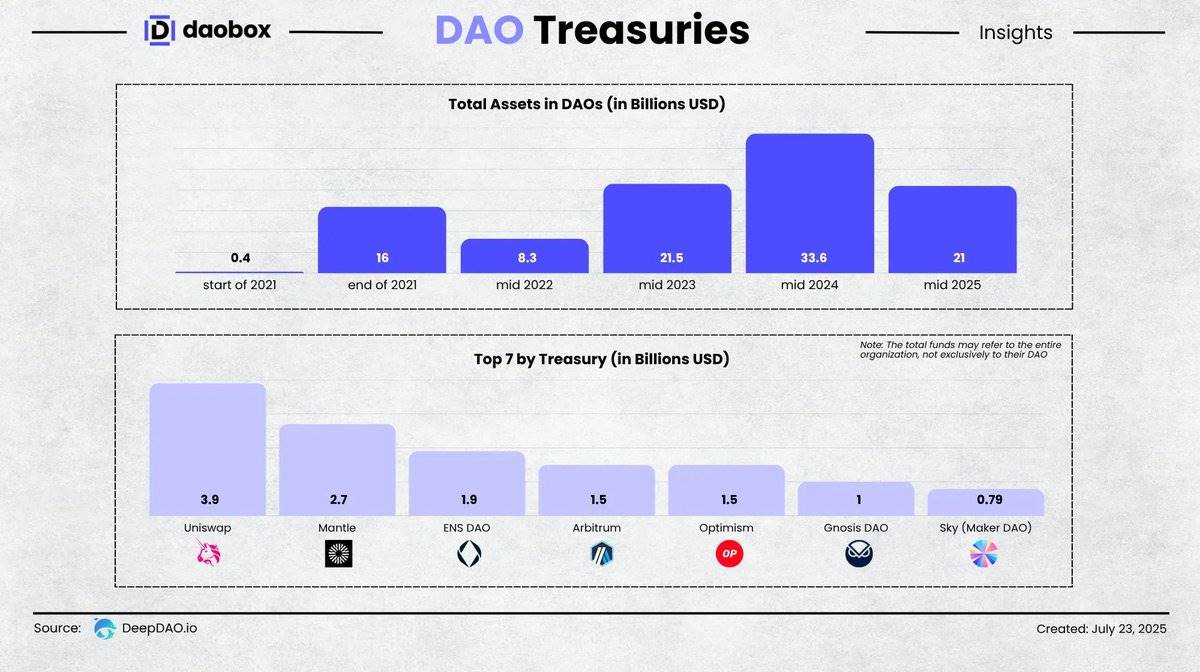

Today in 2025, DAOs have moved from concept to practice: Uniswap, Arbitrum, Lido, Nouns DAO, and others operate daily. The assets under DAO management once peaked at $33.6 billion, and even after market adjustments, they remain around $21 billion.

Data source: @DeepDAO_io

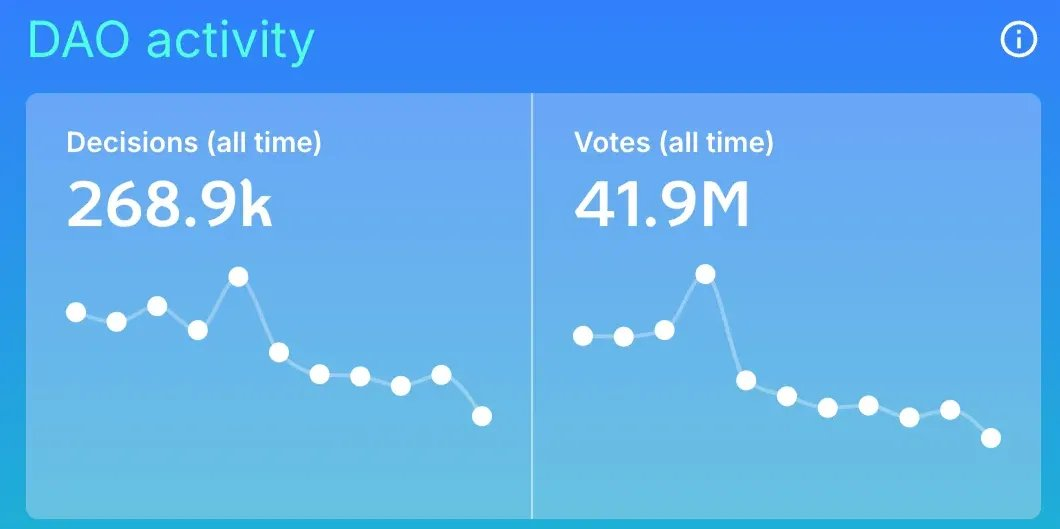

It sounds like the golden age of DAOs. But behind the data lies a dangerous paradox: funds are accumulating more and more, but participation is decreasing.

Data from @DeepDAO_io shows that after DAO proposal and voting activity peaked at the end of 2024, it has been declining month by month.

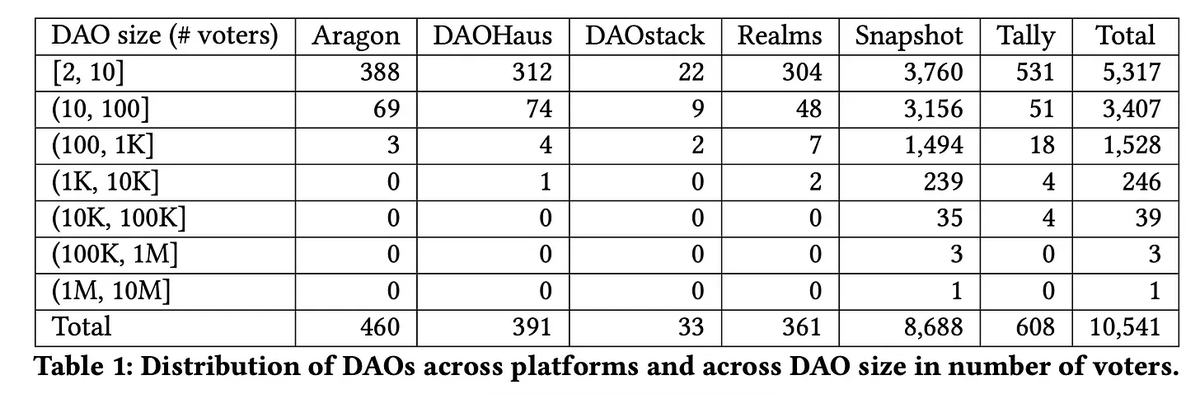

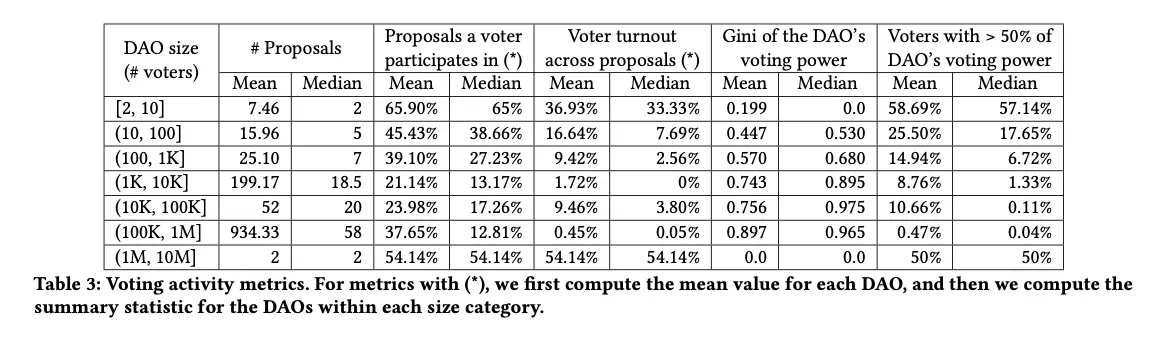

Meanwhile, an academic study published by Complutense University of Madrid in May 2024 also confirmed two core problems with DAOs:

1. Extreme concentration of DAO voters:

-

Approximately 50% of DAOs have fewer than 10 active voters

-

Only 300 DAOs have more than 1000 voters, and only 4 DAOs have over 100,000 voters

2. DAO participation rate is inversely proportional to size:

-

The larger the DAO, the lower the participation rate. In large-scale DAOs, the number of token holders is vast, but most people hardly participate in governance.

-

Even in small DAOs (2–10 voters), the average participation rate is only 33.3%

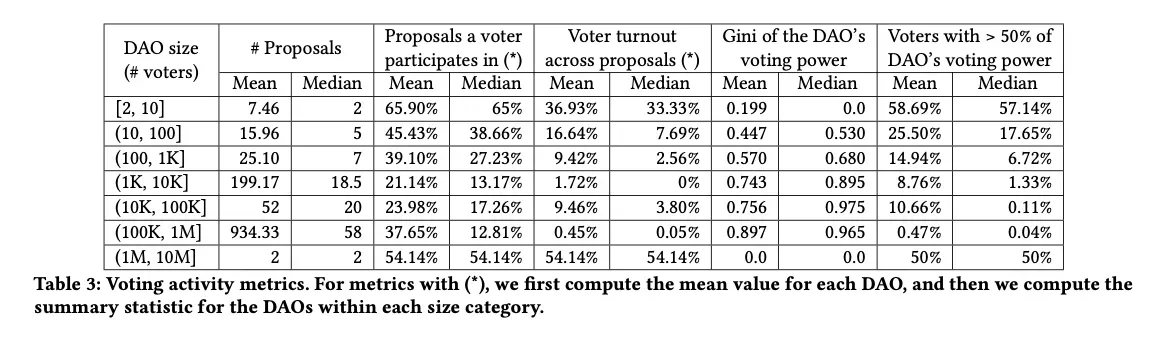

Take Arbitrum as an example. This DAO, with a treasury size of $1.6 billion, 1.2 million token holders, and 487 proposals generated, appears large and active.

Data source: @DeepDAO_io

The reality is: the average number of voters per proposal is less than 3000, with a participation rate below 0.3%.

Data source: Snapshot

This means DAOs are "decentralized" in form but in practice become "well-funded zombies," with governance power highly concentrated, even harboring risks of governance attacks.

2/ The Deep Dilemma of DAO Governance: Calling for Consensus! Do You Copy? Over!

Where exactly does the root of the problem lie? Some simply attribute low voter turnout to "voting being unprofitable," thus proposing a "vote-to-earn" model, using token rewards to incentivize voting (Mitsui, 2024).

However, this line of thinking is fundamentally flawed: the essence of voting is not "mining," but "consensus transmission." If the consensus transmission mechanism itself has already failed, any economic incentive is merely a temporary fix, not a cure.

Therefore, we believe the core issue of DAO governance is not simply a "lack of consensus," but the systematic failure of the consensus transmission mechanism. In other words, users are not indifferent; they are blocked by fragmented participation processes, scattered information, and high cognitive costs.

Theoretically, DAO's governance predicament can be broken down into these three levels:

2.1 DAO: Can You Give Me a Song's Worth of Time?

In today's information explosion, low DAO participation is often not due to member apathy, but because the governance process itself causes attention fragmentation — users' energy is already divided among social media, financial pressures, and daily life.

Research by @DeepDAO_io shows that DAO governance ecosystems exhibit a typical "multi-threaded" pattern:

-

94% of DAOs use X platform for social interaction and promotion;

-

41% use Medium to publish articles;

-

75% use Telegram or Discord for cross-group discussions, while only 9% use forums for systematic governance dialogue.

This means most DAOs lack a true "information hub." Governance information is scattered like fragments across different corners. If members want to participate seriously, they have to constantly jump between multiple platforms:

-

Discovery: Accidentally catching a proposal announcement in X's information feed

-

Discussion: Jumping to Discord/Telegram or forums, struggling to piece together others' views in chaotic group chats.

-

Decision: Opening the Snapshot website, connecting a wallet to vote.

-

Follow-up: Returning to X or the official website to check the final results.

This is like asking someone to simultaneously watch short videos, reply to WeChat messages, write reports, and take notes — it's a complete multi-tasking hell. This fragmented process creates enormous cognitive burden and operational friction, as Nobel laureate Herbert Simon sharply observed: "A wealth of information creates a poverty of attention." Even if users intend to participate, their attention is depleted by platform switching, ultimately forcing them to withdraw.

Furthermore, when DAO governance requires users to invest significant cognitive resources (such as studying complex proposals, verifying on-chain data), most users are often unable to bear the cost, opting instead for shallow participation, blind following, or reliance on delegates.

This precisely hits the "rational ignorance" theory proposed by Anthony Downs and Bryan Caplan: for ordinary token holders, the cost of spending a lot of time researching proposals and then voting far outweighs the benefits. So they rationally "choose not to know," delegating governance power to professionals. This "separation of ownership and control," while seemingly an efficient adaptation, actually harbors centralization risks.

Over time, attention fragmentation inevitably leads governance power to tilt towards two types of people:

-

"Whale" large holders: Because their stakes are large enough, they are willing to bear the participation costs;

-

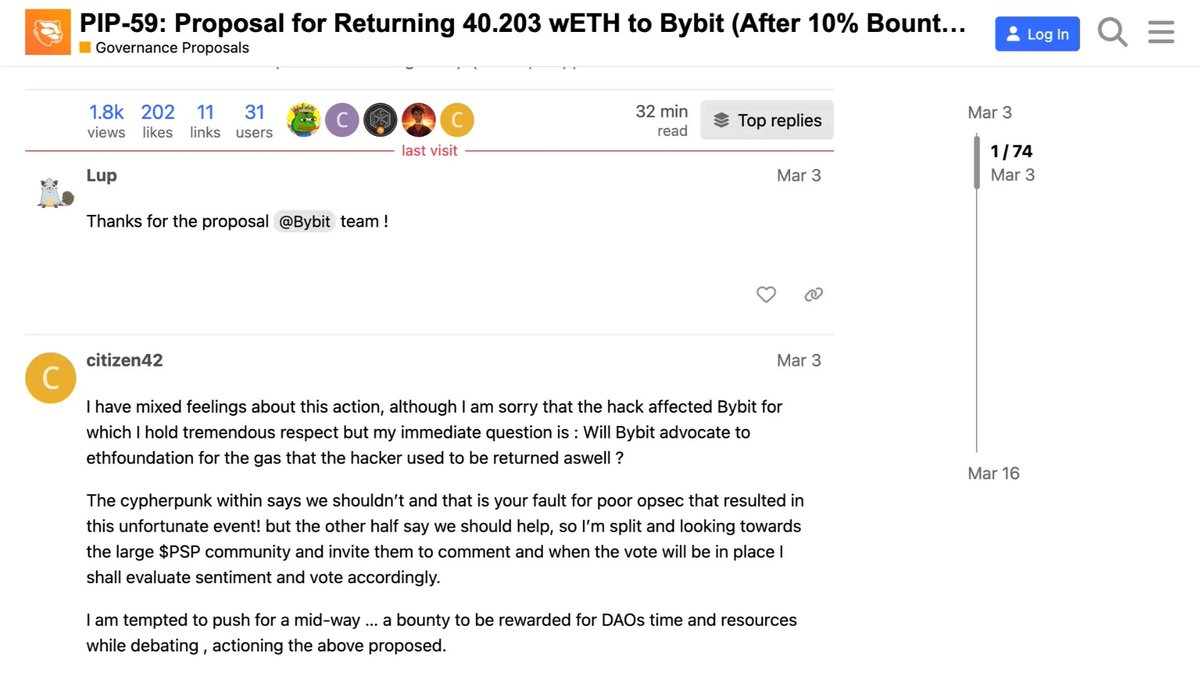

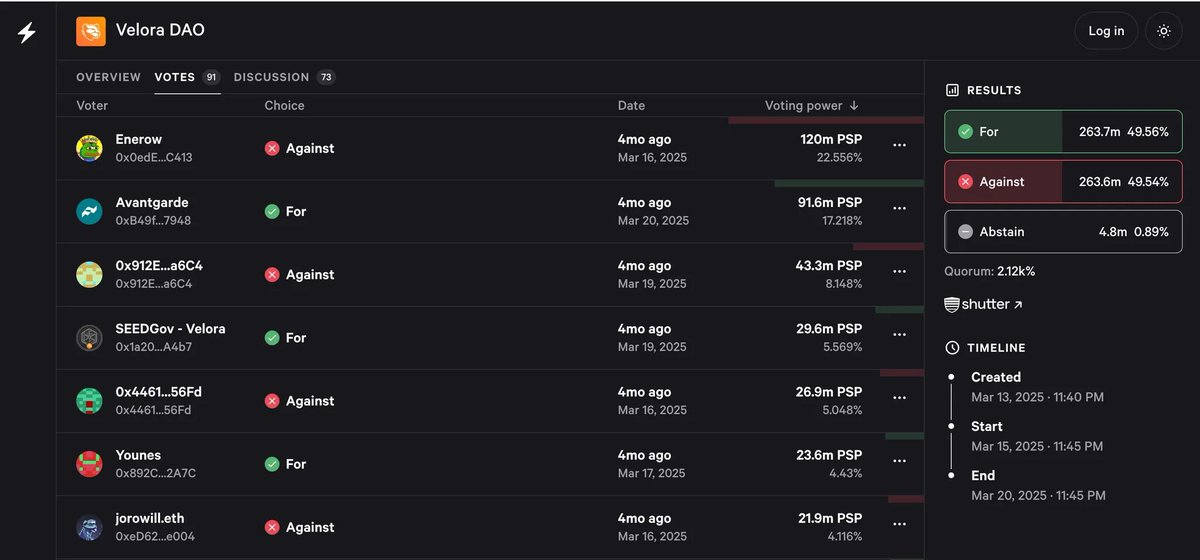

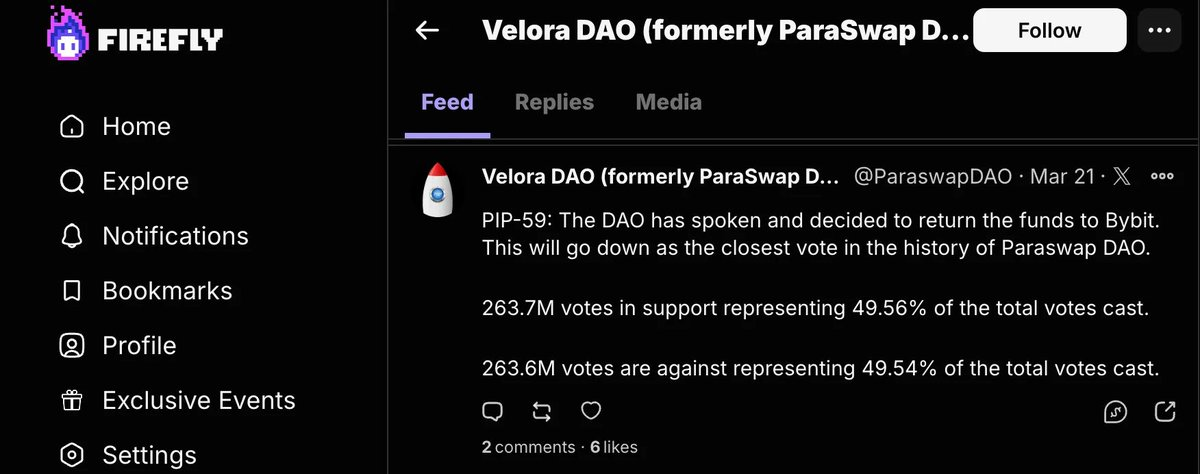

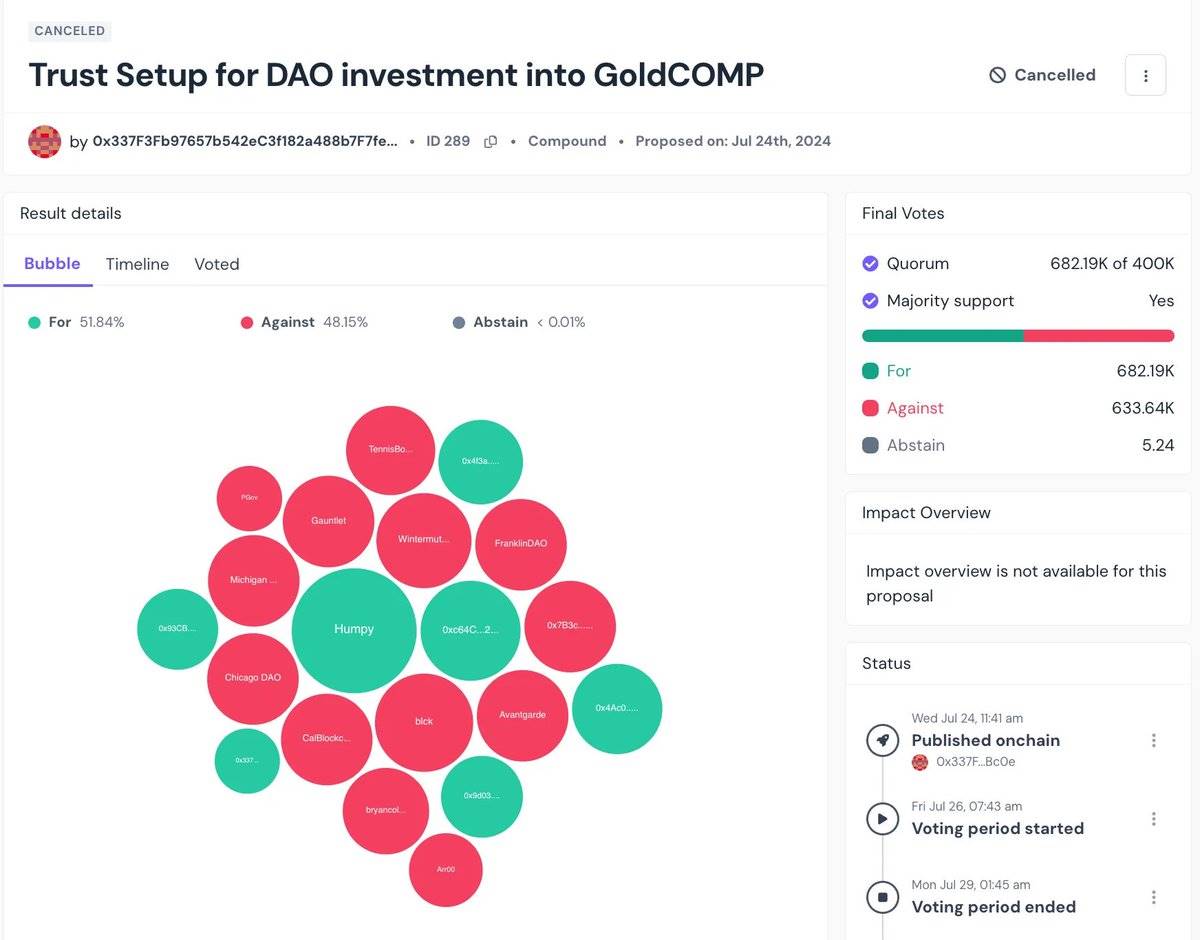

Governance professionals: Those who treat participating in DAO governance as a job, even drawing a salary. The Compound Proposal-289 case is a sobering example. Despite public questioning of the motives behind the operations of "Golden Boys" and "Humpy" by Michael Lewellen from Web3 security company OpenZeppelin, the latter still pushed the proposal to pass with a narrow margin of 51.84% to 48.16%, leveraging their control of 81% of the decisive voting power, in an attempt to transfer nearly 500,000 COMP tokens to their controlled address.

Data source: Tally

Although the proposal was ultimately counterbalanced, the entire process starkly revealed that in a context of extreme attention scarcity, major DAO decisions are easily dominated by a minority. Even if the governance structure appears decentralized on the surface, it still hides significant risks of resource misallocation.

2.2 DAO Voting is More Than Just a Click

Economist Ronald Coase, in his transaction cost theory, made a point: when coordination costs exceed potential benefits, rational individuals tend to opt out. DAO governance reality is trapped in precisely this paradox.

On the surface, DAO voting seems "barrier-free" — everyone can participate. But the real barrier is not the rules, but the "hassle" itself — the ultra-high transaction costs formed by the combination of fragmented processes and cognitive burden. DAO governance requires members to reach consensus on public issues. However, from discovering proposals, participating in discussions, to completing votes, one often needs to traverse multiple platforms, causing the actual utility of governance to be significantly offset by high participation costs, falling into a transaction cost trap.

-

Ordinary users: "Forget it, it's too much trouble. My vote probably doesn't matter anyway." The direct consequence, as predicted by another scholar Mancur Olson: in large groups, the marginal impact of individual effort approaches zero, fostering a widespread "free-riding" psychology. Rational choice drives members to cede decision-making power, waiting for others to bear the costs while they enjoy the benefits. This directly leads to, in large-scale DAOs:

-

Whales and large holders: "Great opportunity! If you all don't vote, then my vote is even more valuable. I'll set the rules."

-

Ultimately, the so-called "consensus" is merely a result negotiated among a few large holders and "professional governance teams," cloaked in a veneer of democracy.

This structural defect makes governance极易脱离理性轨道, easily derail from rationality, sliding towards emotional and public opinion manipulation. As

@bryancolligan pointed out in his article, few people deeply scrutinize details or verify data during the passage of most proposals, and the minority voices raising reasonable questions are often drowned out by the community's "consensus fervor."

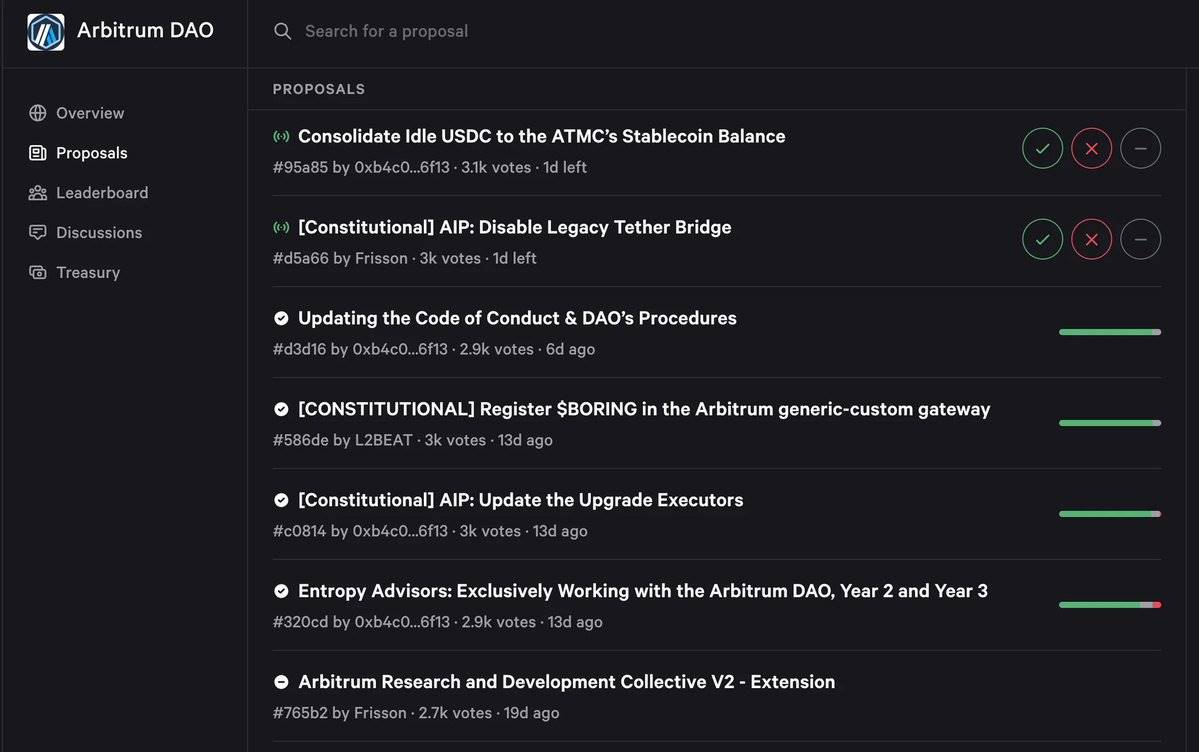

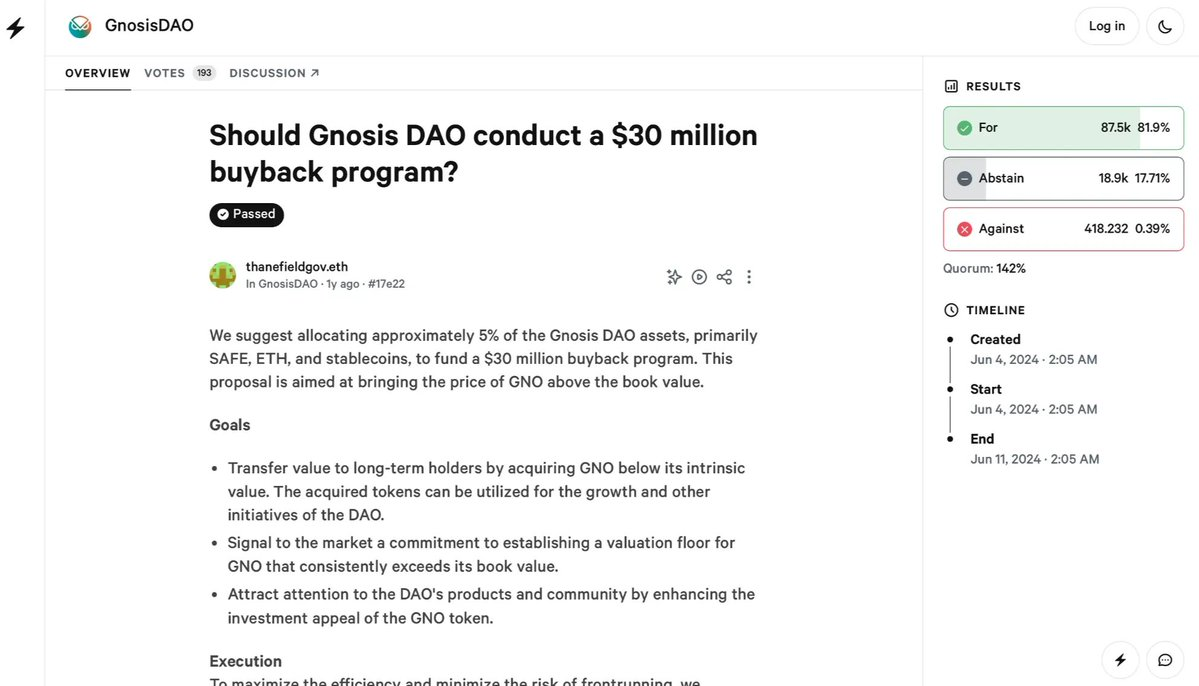

This is not baseless. Gnosis DAO's GIP-128 proposal is a highly representative case, clearly revealing a reality — how to spend $30 million? 94 people decide.

The proposal planned to allocate $30 million to support ecosystem development for Gnosis Chain, Safe multi-signature wallet, and CoW protocol. Despite numerous questions in the community forum — who manages the money? Are the projects reliable? Is it overspending? — the proposal still passed with 102% of the required quorum.

On the surface, it appears to reflect high community consensus, but the data reveals another reality: out of over 202,000 GNO holders, only 94 addresses participated in this vote.

Data source: Snapshot

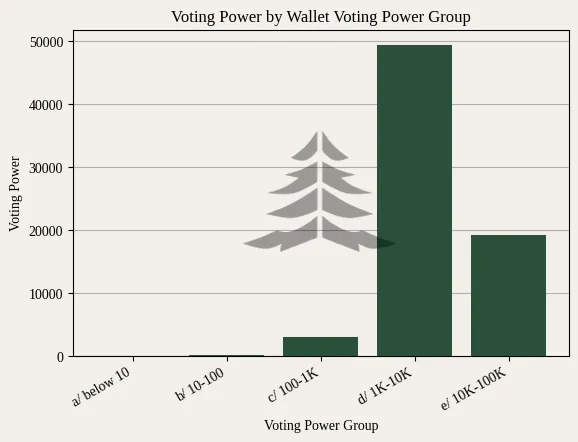

The top 4 wallet addresses by token quantity accounted for over 50% of the total voting power.

Data source: @PineGovBot

This is not a victory of community consensus, but a $30 million "oligarchic democracy" performance decided by less than 0.05% of members. More alarmingly, Gnosis's governance threshold (quorum) is set at 75,000 GNO — similar to most DAOs, intended to "lower participation barriers," but inadvertently exacerbating the risk of voting power concentration: cooperation among just a few large holders can determine the flow of tens of millions of dollars.

This situation of "superficially high consensus, actually low participation" is the direct consequence of high participation costs — most people find it too troublesome and opt out, ultimately forming a pseudo-consensus situation of "minority decision-making," breeding a type of zombie DAO that is "treasury-rich, participation-poor," severely deviating from the original intent of decentralized governance.

So, perhaps the biggest enemy of DAO governance is not malicious attackers, nor overly complex mechanism design, but humanity's innate "aversion to hassle." When governance becomes a burden, democracy becomes a privilege for those with money and time. We are only one sentence away from true decentralization: "Can you please not make it so troublesome?"

2.3 Re-centralization of Power: I Seem to See Yuan Shikai

When most members choose to exit governance because participation is too troublesome, DAOs inevitably fall into an awkward situation of "a few people calling the shots."

The academic study from Complutense University of Madrid clearly reveals this trend: DAO size and power concentration are significantly positively correlated — the larger the organization, the more members, the more concentrated the power.

-

In most DAOs with over 1000 voting members, over 50% of decision-making power is actually held by less than 1% of large holders.

This "superficially democratic, actually centralized" model often further deforms in practice. As @bryancolligan revealed in his article, many proposals are already internally decided in Telegram groups, Discord channels, or even private chats long before entering formal voting. The so-called community vote is just a formality.

This causes DAOs in practice to increasingly resemble "rebranded companies": lacking transparency, unclear rights and responsibilities, yet still claiming democratic consensus. This is not always a conspiracy; it's often an inevitability under systemic failure. To avoid the inefficiency and risks of public governance, core participants turn to backroom negotiations, rendering transparency nominal.

The Solend DAO's "SLND1" case in 2022 sounded the alarm. To prevent a potential market crash triggered by the liquidation of a whale account, the DAO initiated a proposal to take control of that user's assets. On the surface, the proposal passed with an overwhelming majority of 1.1 million yes votes to 30,000 no votes. However, the truth was that over 1 million of those yes votes came from a single user holding a massive amount of governance tokens.

This event sparked widespread criticism in the crypto community: Is the DAO practicing the ideal of decentralization, or serving the interests of a few? Although Solend later voted again to overturn the original proposal, this "illusion of decentralization" had severely eroded the DAO's public credibility at a critical moment.

3/ Bitcoin is at $100k, Why Haven't DAOs Broken Through Yet?

Over the past few years, many projects have tried to optimize DAO governance, but they generally fail on one core issue: governance has not been integrated into users' daily behavioral flow.

-

Mirror: Once achieved explosive growth through a content+DAO model, but eventually diluted its core functions, becoming an ordinary blog. Governance and content were not deeply integrated.

-

Matters: Designed a comprehensive governance mechanism (clap rewards, citizen representative voting), but creators cared more about payment, and governance became an empty exercise.

-

Paragraph: Attempted to build a "creator DAO" by acquiring Mirror and developing the Kiosk app based on Farcaster. However, its governance is still added in a "patchwork" manner, failing to integrate into social scenarios, making it difficult to reach mainstream users.

They collectively illustrate one thing: If governance cannot naturally grow within daily actions like liking and sharing, it will never escape the predicament of low participation.

So, what is the governance experience we expect?

Ideally, governance should:

-

Be as smooth as watching short videos: scroll to a proposal → participate casually → swipe to vote;

-

Require no app switching, no repeated checking of information, with records automatically synced.

There are indeed some current attempts to lower the voting barrier, such as utilizing the social application Warpcast based on Farcaster and its frames feature to complete proposals and voting within one interface. This improves operational fluency and reduces participation friction — but it mostly optimizes the "click," not the "consensus."

The real challenge has never been just "making voting easier," but how to make every vote truly carry the user's attention and identification?

Therefore, what DAO governance needs is not monetary incentives, nor UI tweaks, but a reconstruction of the behavioral path.

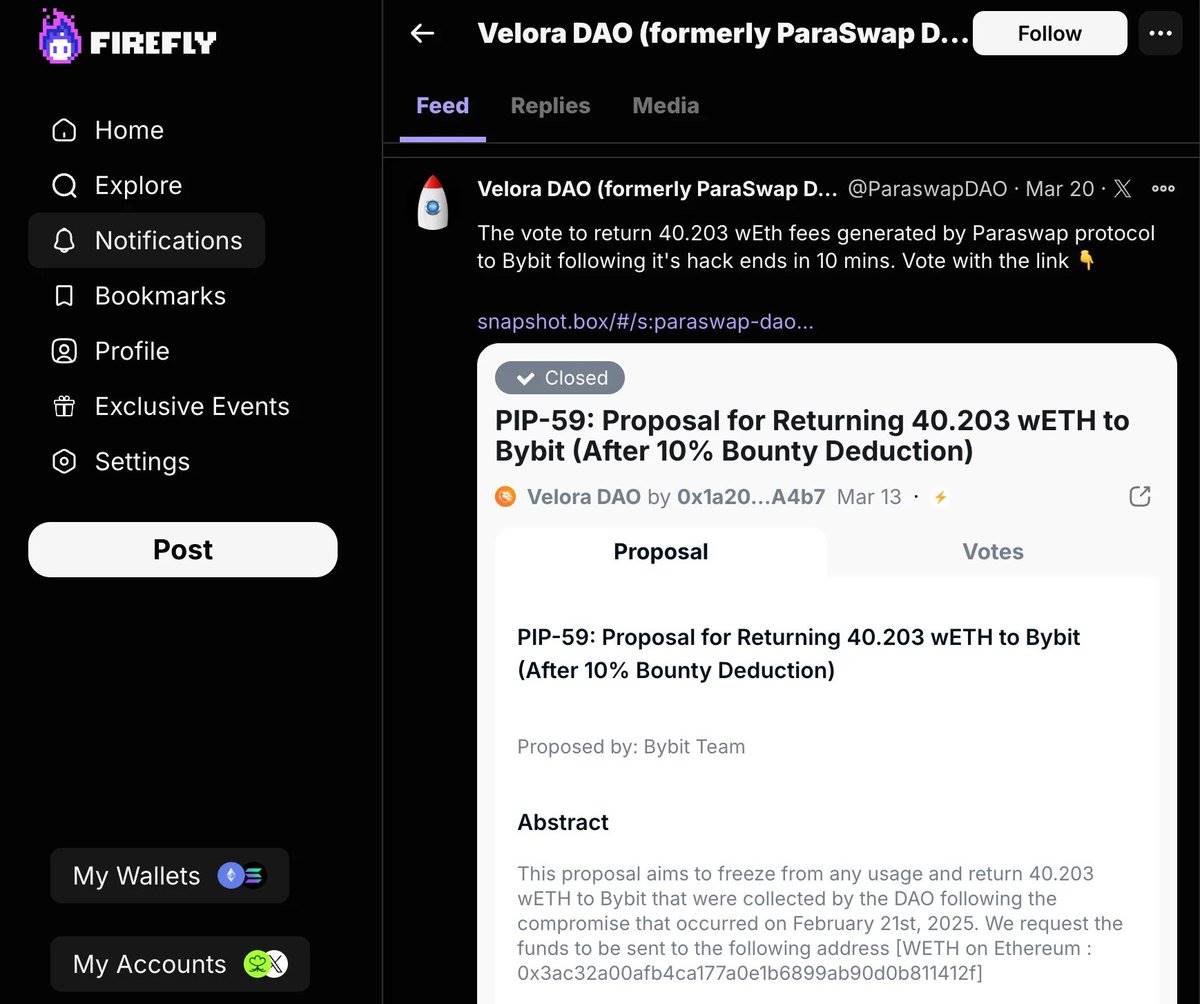

4/ DAO's Prince Charming: Firefly, Completing Your Governance Actions in One Stop

Firefly is not building a new platform, but becoming a "governance behavioral flow engine." It reconstructs not functions, but the participation path — you no longer need to jump around; in one interface, you can see friends' updates, proposal votes, and content interactions, as simple as scrolling through your social feed!

Three key features for you:

-

[One Wallet to Rule Them All] Using the wallet address as a unified ID, automatically aggregating voting, transaction, and other records. Users can review and track governance dynamics anytime, eliminating the friction of multi-platform hopping.

Video link:

https://x.com/i/status/1958801901803511879

-

[Articles That Speak] Content is directly linked to proposals; reading is participating. Users can directly understand proposal backgrounds and vote while browsing articles, without needing to jump to Snapshot.

Video link:

https://x.com/i/status/1958801901803511879

-

[Following Friends into DAOs] Discovering proposals through trusted friends or KOLs, gradually building a Web3 social graph, making governance not an isolated task but a natural extension of social interaction.

Firefly's core idea is not to change the interface, but to change habits, making governance a natural action of scrolling through your feed. Users don't need to learn complex rules; they just need to read updates and vote casually, like scrolling through their social feed.

This "habit reconstruction" transforms governance from an "extra task" into a daily behavior, significantly lowering the participation barrier.

5/ Save DAOs! We Need Intelligent Tools That Can "Work Automatically"!

The bottleneck for DAOs has shifted from "fund management" to "consensus conversion." Future competition is not just about asset size, but about whose community is more active — how many people can casually handle governance within their daily interactions?

Governance should not be an extra task for DAOs, but a natural product of social interaction and collaboration. Only when voting, proposing, and discussing become as easy as liking and sharing will the silent majority truly start to move.

📲 What Firefly reconstructs is precisely this layer of "behavioral infrastructure" — making governance grow directly within social scenarios. Here, you are no longer a bystander of a DAO, but a naturally flowing participant. Experience Firefly now and unlock the infinite possibilities of DAO governance!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News