JustLend DAO completes first round of JST buyback and burn, ecosystem revenue continuously fuels deflationary cycle

TechFlow Selected TechFlow Selected

JustLend DAO completes first round of JST buyback and burn, ecosystem revenue continuously fuels deflationary cycle

This marks JST's official transition from "fully circulating distribution" to a new phase of development characterized by "sustainable deflation."

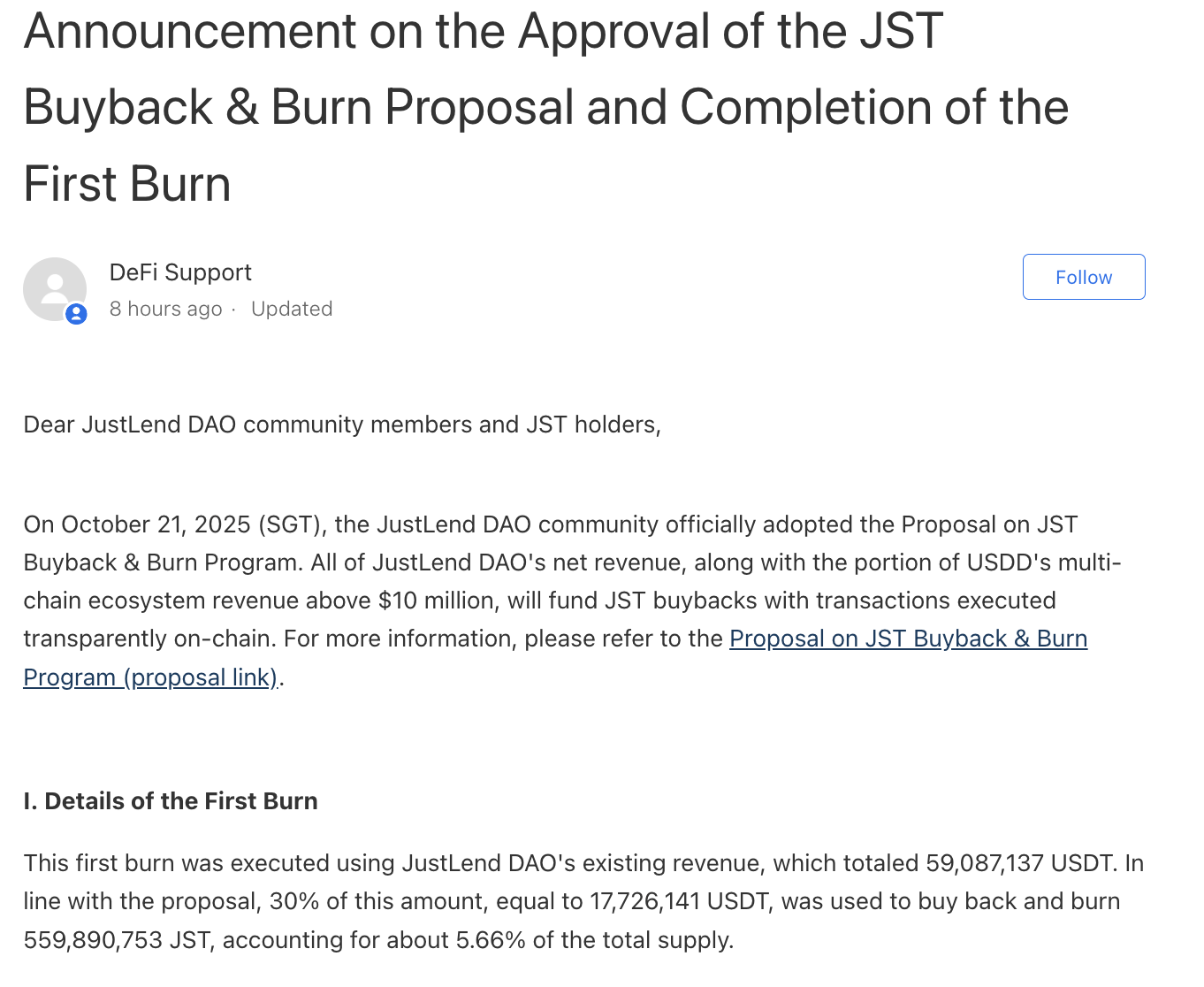

JustLend DAO, a core DeFi protocol within the TRON ecosystem, has reached a milestone moment with the successful completion of the first large-scale JST token burn. This marks JST’s official transition from a fully circulating distribution to a new phase of sustainable deflation.

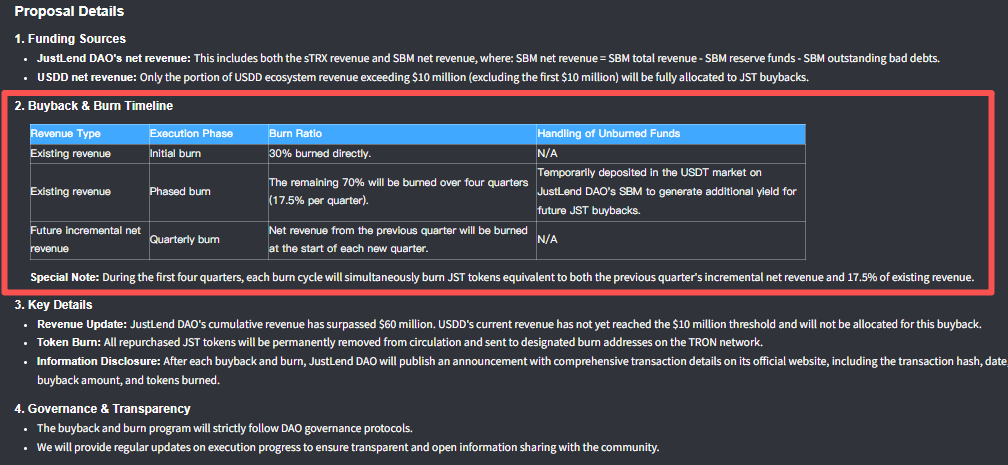

According to the latest burn announcement, over 59 million USDT in accumulated earnings have been withdrawn from JustLend DAO's reserves. Thirty percent of this amount was used for the initial burn, resulting in the permanent removal of as many as 560 million JST tokens—representing 5.6% of the total JST supply. The remaining 70% of reserve earnings will be distributed across four quarters and is currently deposited into the USDT lending market on SBM within JustLend DAO to generate yield.

Burning 5.6% of the total supply right at launch—a move of such magnitude—immediately ignited enthusiasm within the crypto community and triggered positive market reactions.

More importantly, this buyback and burn initiative is not a short-term stimulus but rather the starting point of a “long-term deflationary model” built upon real ecosystem revenues. With an initial foundation of approximately $60 million in earnings from JustLend DAO, ongoing injections of incremental revenue from the multi-chain USDD ecosystem, and comprehensive value support across the entire JUST ecosystem, JST is gradually forming a virtuous cycle: “ecosystem profitability drives deflation → deflation increases scarcity → scarcity enhances value → value feeds back into the ecosystem.” As more ecosystem details are implemented, the long-term value and growth potential behind JST are becoming increasingly evident.

Phased Buyback and Burn Progresses Steadily: Initial Burn Removes 5.6% of Total Supply, Over $41 Million in Earnings Remain for Future Burns

The buyback and burn mechanism recently launched by JST demonstrates unique competitiveness. Rather than relying on short-term, one-off subsidies, it is rooted in the genuine business profits of two key ecosystem pillars: JustLend DAO and USDD. By directly linking JST’s value to ecosystem earnings through a clever design that combines “existing earnings as base funding + future incremental earnings for sustained fuel,” JST establishes a clear, sustainable, long-term deflationary loop—setting it fundamentally apart from the typical “flash-in-the-pan” short-term buybacks seen across the crypto market.

In terms of funding sources, JST’s buyback funds are transparent and highly sustainable, precisely focusing on the profits generated by the two core components of the JUST ecosystem: “JustLend DAO and USDD.” There is no risk of “robbing Peter to pay Paul,” ensuring the stability of the deflationary mechanism at its core.

Specifically, funds come from two main streams: (1) current and future net income from JustLend DAO, covering both “existing reserve earnings + future incremental earnings”; and (2) incremental profits from the USDD multi-chain ecosystem once its earnings exceed the $10 million threshold. All funds from these two sources will be exclusively allocated toward buying back and permanently burning JST tokens. This design deeply ties JST’s value to the revenue-generating capabilities of JustLend DAO—the core lending protocol in the TRON ecosystem—and USDD, TRON’s second-largest stablecoin—creating a positive feedback loop where “a more prosperous ecosystem → higher business profits → stronger deflation,” laying a solid logical foundation for JST’s long-term value appreciation.

According to prior proposal announcements, JustLend DAO has accumulated around $60 million in existing reserve earnings, which will be fully injected into the JST buyback and burn program in batches. Meanwhile, USDD’s incremental earnings will only begin contributing to the buyback pool after its profit surpasses the $10 million mark, providing additional momentum for long-term deflation.

In execution, JST adopts a phased approach of “gradual implementation of existing funds and continuous injection of incremental funds,” ensuring steady progress. This strategy effectively avoids short-term market speculation caused by a single massive burn while maintaining strong immediate deflationary impact and reserving “compounding growth space” for long-term supply reduction.

Regarding existing funds, JustLend DAO has already withdrawn over 59 million USDT in earnings. Per the burn announcement, 30% of this amount serves as the initial burn fund, while the remaining 70% will be burned gradually in quarterly installments.

Currently, the first phase of JST burns has been successfully completed. According to TRONSCAN data, 30% of JustLend DAO’s existing earnings have been fully burned, corresponding to approximately 560 million JST tokens—over 5.6% of the total supply. Eliminating more than 5.6% of the total supply in the very first burn is extremely rare among crypto projects, clearly demonstrating the team and community’s firm commitment to driving JST’s long-term value growth.

The remaining 70% of JustLend DAO’s reserve earnings will be used for JST buybacks and burns in four consecutive quarters, each accounting for 17.5%, continuing through Q4 2026. These funds are currently held as jUSDT in the USDT market on SBM within JustLend DAO, generating yield; future returns will also be directed toward JST buybacks and burns.

On the incremental side, all new quarterly net income from JustLend DAO will be fully funneled into the buyback pool. Once USDD’s profits exceed $10 million, its incremental earnings will also be added to the pool. This means that as both ecosystems expand—such as increased lending TVL on JustLend DAO or broader circulation of USDD—the deflationary pressure on JST will continuously strengthen, completely eliminating concerns about “insufficient future momentum.”

Going forward, each quarter’s buyback and burn operation will be managed by JustLend Grants DAO under clear and transparent rules: during the first four quarters, at the beginning of each quarter, they will burn “the previous quarter’s incremental net income from JustLend DAO + 17.5% of the reserve earnings.” This “small but frequent” operational model ensures the continuity of deflation while smoothing market expectations, laying a solid foundation for JST’s long-term deflation.

Beyond executing buybacks and burns, Grants DAO itself is a community-driven institution dedicated to incentivizing developers, contributors, and ecosystem builders. Its core mission includes empowering participants and maintaining market stability. As a key catalyst for the ecosystem, it channels funds from the JUST ecosystem reserve and partner contributions into the Grants Pool, enabling benefits for JST holders, voters, liquidity providers, and all ecosystem participants. Currently, the Grants DAO treasury holds around $130 million, providing robust support for JustLend DAO’s long-term development.

The implementation of this deflationary loop signifies JST’s formal shift from a “fully circulating token” to a “continuously shrinking valuable asset.” The initial burn of over 5.6% of the total supply is just the beginning. As existing funds are released in batches and incremental revenues continue flowing in, the cumulative burn could surpass 20% of the total supply.

Joint Ecosystem Profits from JustLend DAO and USDD Drive JST Value Growth

Of course, JST’s value growth does not rely solely on deflation. It is deeply supported by the “full-stack value loop” of the entire JUST ecosystem—synergistic profits from the two core components, JustLend DAO and USDD, not only provide continuous financial replenishment for the deflation mechanism but also establish a complete transformation path from “supply reduction” to “value enhancement.”

As a core DeFi system in the TRON ecosystem, JUST has built a compound service framework around its flagship lending protocol JustLend DAO, including “lending + staking + energy leasing,” while expanding into a comprehensive DeFi product matrix that includes the stablecoin USDD and cross-chain solutions like JustCrypto. This provides systematic ecosystem-level assurance for transforming JST from “deflation mechanism implementation” to “real value appreciation.”

Among them, JustLend DAO—the central pillar of the JUST ecosystem—has long evolved from a single lending protocol into a comprehensive service platform, now serving as a multifunctional DeFi hub integrating the Lending Market (SBM), liquid staking (sTRX), and Energy Rental. This means JustLend DAO’s profitability is not dependent on a single lending revenue stream but instead built on diversified services with layered income streams, giving it far greater resilience and growth potential compared to peer protocols. This diversity in revenue models and stability in market position ensure that JST’s deflationary “funding pool” remains consistently filled.

This is clearly reflected in JustLend DAO’s operational data. As of October 21, the platform’s total value locked (TVL) surpassed $7.62 billion, with a user base reaching 477,000, firmly securing its position as the leading DeFi protocol in the TRON ecosystem. Even globally, JustLend DAO ranks among the top four lending protocols due to its single-chain deployment advantage, placing it firmly within the “first tier of lending DeFi protocols.”

In terms of profitability, the sustainability of JustLend DAO’s business model has been thoroughly validated by long-term operating data. From disclosed burn figures, the platform has withdrawn approximately $59 million in cumulative earnings. According to DeFiLlama, JustLend DAO captured nearly $2 million in fees in Q3 alone, averaging over $20,000 per day with steady growth. This level of profitability implies that even without tapping into existing reserves, incremental income alone could sustain monthly buybacks approaching $6 million—providing a reliable “floor” of funding for JST’s long-term deflation.

Meanwhile, USDD, the decentralized stablecoin launched by JUST, acts as the “second profit engine” powering JST’s deflation mechanism. Under the current design, once USDD’s multi-chain ecosystem profits exceed $10 million, the excess earnings will be channeled into the JST buyback fund.

As the second-largest stablecoin on TRON, USDD leverages diverse revenue models—including interest income from over-collateralized assets and cross-chain transfer fees—to accelerate its path toward the $10 million profit threshold. Currently, USDD is deployed across multiple chains, including TRON, Ethereum, and BNB Chain, with a circulating supply exceeding $450 million. As USDD’s scale expands and its use cases evolve—from basic transaction medium to DeFi collateral and payment tool—it is poised to become a major source of funding for JST’s deflation.

In terms of overall ecosystem size, the total value locked (TVL) across the JUST ecosystem has reached $12.2 billion, accounting for 46% of TRON’s entire network TVL. This means nearly half of all assets on the TRON chain are actively deposited within the JUST ecosystem—an overwhelming dominance that reflects deep market trust and broad recognition. More importantly, it confirms the ecosystem’s core capability to “consistently generate large-scale, stable profits.” Every future lending activity, staking action, or cross-chain transaction within the ecosystem may ultimately translate into real earnings for JustLend DAO or USDD—earnings that will directly feed into the JST buyback and burn fund, establishing a solid “financial foundation” for the deflation mechanism.

Even more promising, the growth momentum of the JUST ecosystem shows no signs of slowing—it is accelerating. Both JustLend DAO and USDD are expanding rapidly, with their TVL and market share steadily increasing, meaning their revenue base will grow in tandem. This will inject even stronger financial support into JST’s deflation mechanism, creating a powerful cycle of “ecosystem prosperity → profit growth → accelerated deflation → value appreciation,” providing solid, ecosystem-backed support for JST’s long-term value growth.

Deflation Mechanism and Ecosystem Profits Converge to Open New Growth Pathways for JST

With the official execution of JST’s first buyback and burn, its large-scale deflation process has fully commenced. Currently, JST’s deflationary mechanism resonates synergistically with the positive cycles of both JustLend DAO and USDD, reinforcing each other. This combined force could propel JST into a new upward price trajectory.

JST achieved 100% full circulation in Q2 2023, with a fixed total supply of 9.9 billion tokens and no future unlock schedules. This feature ensures that every buyback and burn results in a real reduction of “actual circulating supply,” not just a nominal adjustment. The deflationary effect is thus pure and direct.

In terms of burn scale, the first round removed approximately 560 million JST tokens—reducing the total supply by over 5.6% in one go. With continued quarterly buybacks, and based solely on JustLend DAO’s existing earnings, the cumulative deflation rate is expected to approach 20%. A continuously shrinking supply will significantly enhance token scarcity, providing strong support for JST’s price.

Notably, JST’s high burn ratio stands out in the industry. Currently, JST’s market cap is around $300 million, while JustLend DAO’s existing reserve earnings alone amount to $60 million—equivalent to 20% of JST’s market cap. In contrast, most comparable tokens in the crypto market have buyback budgets representing less than 5% of their market cap (for example, Aave announced only $24 million in buyback funds in March this year). JST’s planned burn exceeding 20% sets a new “industry benchmark.” Even more crucially, this figure does not yet include future incremental earnings. As profits from JustLend DAO and USDD continue to grow, the deflationary impact will only intensify.

Looking deeper at product fundamentals, as TRON founder Justin Sun previously noted, the underlying product logic supporting JST has undergone a fundamental shift. JST is no longer just a single-purpose lending tool but an integrated DeFi platform combining functionalities of “lending (comparable to Aave), stablecoin (MakerDAO), and staking (Lido).” It consolidates the core strengths of three leading industry products into one, giving it a fundamental strength far beyond any single-function protocol.

Particularly, JustLend DAO—the primary backbone of JST—has achieved significant breakthroughs through years of深耕 since its 2020 launch. Starting as a simple lending protocol, it has expanded into staking, energy leasing, and innovative features like GasFree, building a diversified revenue structure that boosts both risk resilience and profit potential. On security, it maintains a flawless operational record with zero incidents—rarity and reliability that stand out in the industry.

At the same time, JustLend DAO benefits from strong backing by the full TRON ecosystem—including being home to the world’s largest USDT circulation center and a user base exceeding 340 million. These advantages not only provide foundational support and value amplification for its diverse services but also continuously translate into core value support for the JST token, solidifying its long-term growth foundation.

While many crypto projects remain fixated on short-term gains and chasing market trends, JST has established a durable deflationary logic through its “buyback and burn mechanism.” Leveraging dual profit engines from JustLend DAO and USDD, along with full-stack ecosystem support from JUST, JST has carved out a differentiated development path centered on “value-driven growth”—a sharp contrast to the market’s prevalent short-term profit-seeking behavior.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News