JST Buyback and Burn Proposal Officially Launched, Driving TRON Ecosystem Value Upgrade through Deflationary Model

TechFlow Selected TechFlow Selected

JST Buyback and Burn Proposal Officially Launched, Driving TRON Ecosystem Value Upgrade through Deflationary Model

The proposal plans to use JustLend DAO's net income, along with over $10 million in excess yield from the USDD ecosystem, to repurchase and burn JST tokens.

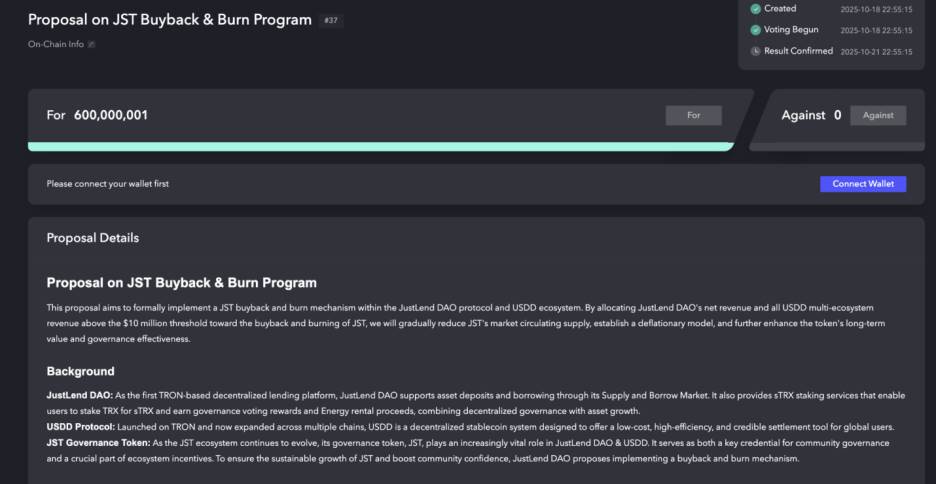

As decentralized finance enters a new phase of value reversion, a deep transformation to build a sustainable economic system is unfolding within the TRON ecosystem. The JST buyback and burn proposal has been officially launched on JustLend DAO's DAO Governance platform and has entered the community voting stage.

The proposal plans to implement a JST buyback and burn mechanism within JustLend DAO and the USDD ecosystem, using JustLend DAO’s net income and all excess earnings exceeding $10 million from USDD’s multi-chain operations to repurchase and burn JST. By gradually reducing the circulating supply, this creates a deflationary effect that enhances the long-term value and governance utility of JST. Through transparent on-chain operations, burned JST tokens will permanently exit circulation, establishing a solid foundation for token value at the supply-demand level.

As the “strategic twin engines” in the TRON ecosystem, the decentralized lending market JustLend DAO and the multi-chain stablecoin system USDD are reshaping the value logic of the governance token JST through this initiative. The innovation lies in creating a closed-loop feedback mechanism tightly linking protocol revenues with token value, directly empowering every JST holder with the benefits of ecosystem growth. Systematic revenues from JustLend DAO and USDD will become the driving force behind continuous JST buybacks and burns. This is not merely an introduction of a deflationary mechanism, but a systemic upgrade toward building a value-sharing ecosystem.

When leading protocols on TRON return real profits to the community, they not only set a benchmark for value distribution within the ecosystem but also foster a virtuous cycle of "ecosystem prosperity—revenue growth—value reversion." This community-driven transformation will reconstruct the value logic of governance tokens and open a new path for the sustainable development of decentralized finance.

JST Buyback and Burn Proposal: Protocol Revenues from JustLend DAO and USDD Drive JST Deflation Model

In today's evolving landscape where decentralized finance continuously reshapes the global blockchain arena, sustainable tokenomics has become a core competitive advantage for long-term project success. As a cornerstone of the TRON ecosystem, the JUST protocol remains committed to building a virtuous cycle of value circulation. The JST buyback and burn proposal has officially entered the community voting phase, marking a strategic upgrade for the JST ecosystem driven by a deflationary model aimed at value growth.

To understand the profound significance of this proposal, one must first clarify the relationship between JST and the core protocols. JST is the governance token of the JUST ecosystem, which comprises two key protocols: JustLend DAO (decentralized lending market) and USDD (decentralized stablecoin). Within this architecture,JST plays three critical roles:

First, as the governance core, JST holders have the right to participate in governance decisions for both JustLend DAO and USDD, including parameter adjustments and feature upgrades, ensuring ecosystem development aligns with community consensus.

Second, as a utility token, JST has diverse use cases within the ecosystem, forming an indispensable foundation for its intrinsic value.

Third, as a value carrier, JST’s fixed total supply gives it a natural deflationary basis, while its essential role across both core protocols establishes a solid foundation for value appreciation.

It is precisely based on this ecosystem structure that the current buyback and burn proposal becomes particularly significant. The proposalcreates a direct value feedback mechanism by using real revenues generated from JustLend DAO and USDD to buy back and burn JST. The brilliance of this mechanism lies in its seamless linkage between protocol growth and token value: the more mature JustLend DAO and USDD become, the higher their revenues, the greater the amount of JST bought back and burned, and the stronger the deflationary effect. This not only provides direct value returns to existing JST holders but also establishes a self-reinforcing positive cycle for long-term value discovery of JST.

Therefore, this buyback and burn proposal is far more than a simple market maneuver—it represents an inevitable strategic choice at this stage of the JUST ecosystem’s evolution.It marks a pivotal transition in ecosystem development from scale expansion to value deepening, injecting fresh momentum into the sustainable growth of JST and the broader TRON ecosystem by directly channeling the fruits of protocol advancement to the governance token.

Strategic Upgrade: Explaining the Value Blueprint and Execution Path of JST Buyback and Burn

The core of this proposal is to establish a clear, sustainable, and highly transparent JST buyback and burn mechanism. Its specific design reflects principles of executability, longevity, and community-first orientation, outlining a detailed roadmap for enhancing JST’s value.

First, the buyback mechanism is backed by reliable funding sources, primarily drawn from two streams:one being JustLend DAO’s net revenue, including sTRX business income and SBM business net profit; the other being any USDD multi-chain earnings exceeding $10 million (excluding the first $10 million), with the entire surplus allocated to JST buybacks. These funds, representing tangible outcomes of platform operations, ensure the most direct and immediate value return to JST holders.

More importantly, the proposal deeply integrates the buyback mechanism with the ecosystem’s long-term growth: future net revenues from JustLend DAO and excess profits from the USDD system will continuously feed into the buyback fund pool, ensuring that buybacks and burns are not one-off events but a sustained value-building initiative aligned with ecosystem expansion.

Second, the execution mechanism for JST buyback and burn is designed to be meticulous and efficient. Currently, JustLend DAO has accumulated over $60 million in total revenue, while USDD earnings have not yet reached the $10 million threshold. Therefore, this round of buybacks will focus solely on JustLend DAO’s net income,with burns executed in phases: 30% will be burned initially, and the remaining 70% will be gradually completed over the next four quarters, with 17.5% burned each quarter.

Future net earnings will be handled quarterly, with each quarter’s prior period net income burned at the beginning of the next quarter. This arrangement ensures a smooth and controllable burn process while establishing a continuous channel for new revenue buybacks, forming a compound deflationary model combining existing and incremental reductions.

Finally, regarding the burn method,repurchased JST tokens will be transferred directly from a dedicated holding address to TRON’s black hole address, ensuring permanent removal from circulation. This process is fully on-chain, transparent, and irreversible, guaranteeing complete elimination from supply and achieving genuine deflation.

The entire process strictly follows the principles of decentralized governance. After the formal proposal launch, a 3-day community voting period begins, with the final outcome determined by votes from JST holders. Upon approval, the execution team will promptly and regularly disclose detailed data on each buyback and burn event to the global community, ensuring full transparency at every step and building a strong foundation of trust.

Launching the Value Flywheel: JST Buyback and Burn Injects Sustainable Momentum into the TRON Ecosystem

Once the proposal is activated, it will function like installing a powerful "value engine" into the JST ecosystem, significantly enhancing its attractiveness and value capture capability as a digital asset.This will not only attract more long-term investors and institutional capital to JST but also positively impact other high-quality assets within the broader TRON ecosystem, elevating overall valuation levels and resilience. More top developers and users will join the TRON ecosystem, collectively building a more prosperous and robust decentralized financial landscape, greatly strengthening market confidence in TRON-based assets.

More critically, this move sets an exemplary standard for value distribution within the TRON ecosystem. As leading protocols, JustLend DAO and USDD carry strong示范 effects. By using real protocol revenues to buy back governance tokens, they clearly demonstrate a more advanced development philosophy to all projects within the ecosystem:protocol success must resonate in tandem with the success of token holders.This could spark a wave of "value reversion," encouraging more projects to consider and implement better ways to give back to their communities, thereby improving the overall health and appeal of the TRON ecosystem.

Ultimately,this will generate a powerful flywheel effect, propelling the ecosystem into a virtuous cycle. Rising JST value will incentivize more users to hold and actively participate in the governance of JustLend DAO and USDD. In turn, a more active and widespread community will further drive protocol innovation and growth, generating even greater protocol revenues. These increased earnings will then flow back via the buyback mechanism to further boost JST value, creating a reinforcing loop of "ecosystem development → revenue growth → value reversion → community expansion → further ecosystem advancement." Once set in motion, this flywheel will provide continuous momentum for the TRON ecosystem.

In summary, the current JST buyback and burn proposal is far more than a simple economic model adjustment. It signifies the maturity and confidence of the JustLend DAO and USDD ecosystems—a strategic declaration for the future. It heralds a new era of ecosystem development centered on shared value, bringing concrete value expectations for JST holders and injecting strong certainty into the prosperity and sustainable growth of the entire TRON ecosystem. This community-driven value transformation is gathering momentum, poised to embark on a grand new journey.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News