Sapce Recap|When the Tide Recedes: The Survival Logic of Long-termism and TRON Ecosystem Practices

TechFlow Selected TechFlow Selected

Sapce Recap|When the Tide Recedes: The Survival Logic of Long-termism and TRON Ecosystem Practices

Three Key Conditions for an Ecosystem to Navigate Bull and Bear Markets—and an In-Depth Analysis of TRON’s Practical Implementations and Internal Logic in AI and DeFi

When the rising tide recedes, the market faces its true test. Amid sustained downward price action, short-term narratives gradually lose traction, and an increasing number of projects reveal fundamental weaknesses that prevent them from weathering market cycles. The real test arrives quietly: in the absence of new capital inflows, emotional premiums, and compelling narratives, what enables a project—or an ecosystem—to endure?

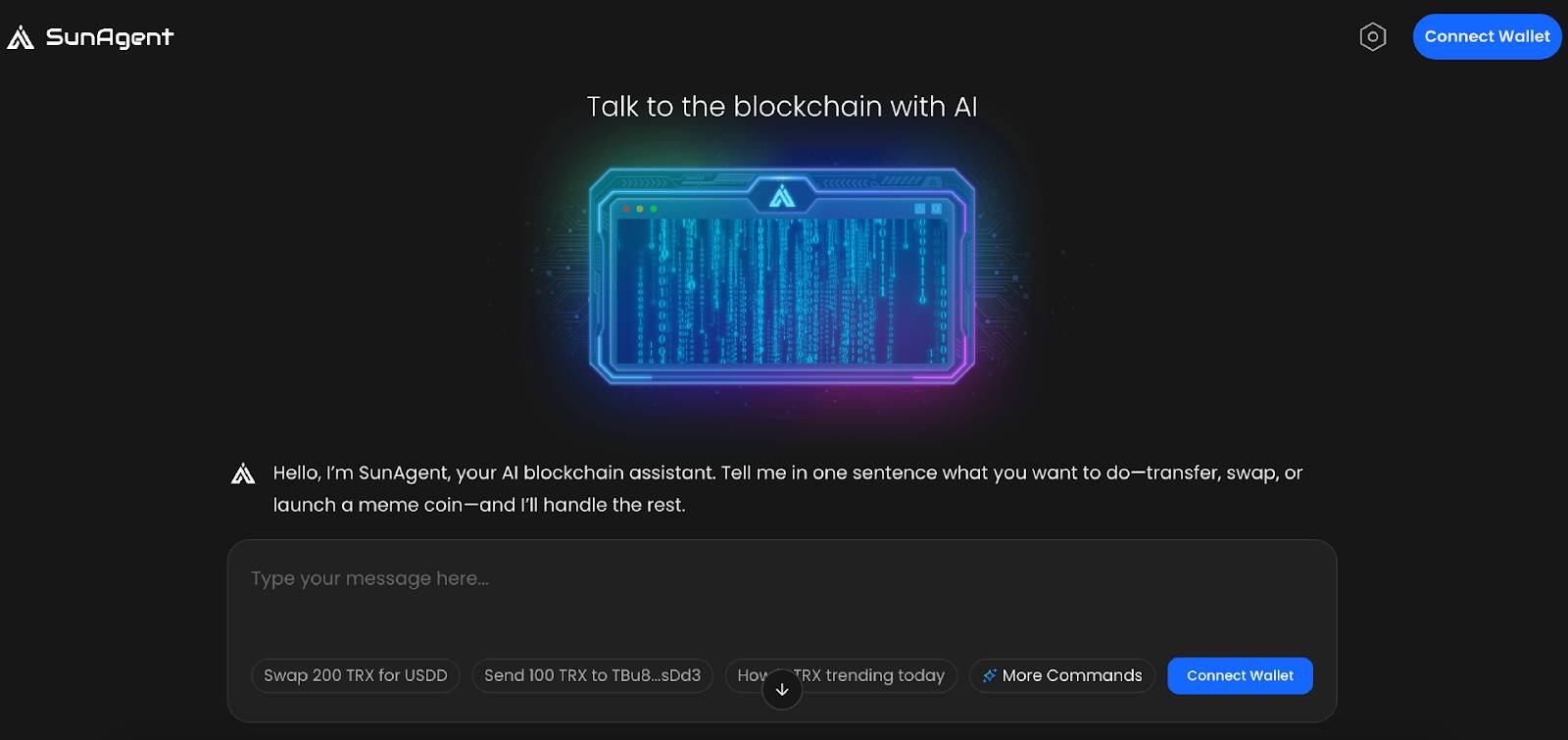

The answer lies in continuous, authentic value creation—value that does not hinge on market sentiment. Even during prolonged bearish conditions, we observe ecosystems actively building. Take TRON as an example: its ecosystem has not paused due to market volatility. From the major launch of SUN’s Chinese brand “Sun Wukong,” to JST’s second token buyback-and-burn event, to the full rollout of the AINFT AI Service Platform, these initiatives collectively paint a picture of an ecosystem that remains proactive and multi-pronged in its development.

TRON’s multi-track execution reveals two critical focal points for long-termism today: the infrastructure-level integration of AI and structural resilience in DeFi. This edition of the SunFlush Roundtable centers precisely on these two dimensions, exploring what conditions an ecosystem must possess to survive bull and bear markets—and examining TRON’s concrete practices in both AI infrastructure and the DeFi sector. Below is a distilled recap of key insights from this Space roundtable discussion.

Three Conditions for Ecosystems to Survive Bull and Bear Markets: Healthy Operations, Cost Advantage, and Endogenous Circulation

Against the backdrop of broad market malaise and liquidity contraction, once-popular phenomena are fading. This forces industry participants to pause and reflect on a core question: when the noise subsides, which ecosystem designs can withstand the cold—and which rely solely on seasonal booms?

Addressing this central theme, Crypto.0824 clarified in the discussion that long-termism is, at its core, the outcome of systemic design. He distilled truly cycle-resilient ecosystems into two simultaneously necessary conditions: First, infrastructure must remain healthy and functional even at low activity levels; its economic model should not depend on high transaction volume to sustain itself—that is the foundational logic of anti-cyclical robustness. Second, its cost structure must be transparent and extremely low—critical competitiveness in bear markets, where users are hyper-sensitive to fees.

OxPink expanded further on ecosystem “stress resistance” and “internal circulation,” arguing that truly resilient infrastructure’s defining trait is its ability to maintain internal functional circulation—even without external sentiment or traffic. He emphasized that what bear markets truly test is not grand narratives, but whether an ecosystem genuinely solves real user needs.

Miya illustrated this mechanism using the TRON ecosystem as a concrete example: Through highly competitive low fees, the TRON ecosystem consistently attracts and retains massive stablecoin flows. These flows not only form the bedrock of network usage but also naturally fuel DeFi activity—further reinforcing trust and generating brand effects. In turn, this creates a self-reinforcing closed loop that continuously converts “real usage” into “network value.” This endogenous engine operates independently of short-term token price fluctuations, instead rooted in sustainable, real on-chain behavior and genuine user demand.

In summary, the three speakers’ insights build progressively upon one another, jointly sketching a complete portrait of a cycle-resilient ecosystem: It begins with systemic design (healthy operations, low costs, high autonomy); it is forged through stress-tested internal resilience and circulation capacity; and it is ultimately validated by the practical, closed-loop conversion of real usage into enduring value. When these elements converge, an ecosystem builds lasting resilience that transcends short-term booms—and endures market volatility.

Counter-Cyclical Construction and Value Discovery: Long-Termist Practice in Bear Markets, Illustrated by the TRON Ecosystem

Building on the theoretical framework above, the TRON ecosystem provides a pivotal case study in practice. Even as the broader market languishes, TRON continues advancing infrastructure development across AI and DeFi. These actions themselves offer the most direct window into how long-termism translates into reality—shifting the discussion from theoretical reasoning to concrete implementation.

- Why Has AI Become a Bear-Market Theme? The Counter-Cyclical Insight from TRON’s AINFT

While markets enter a downturn, the AI sector has paradoxically emerged as a focal point. As panelists noted, this is not mere sector rotation—it reflects the market’s active filtering for authentic value amid liquidity contraction. A bear market acts as a litmus test, stripping away narrative-dependent hype and surfacing foundational innovations with durable value.

TRON’s decision to officially launch the AINFT AI Service Platform at this juncture is a deliberate response to this trend. It represents not just a technical move into AI—but a practical answer to a fundamental question: What kind of innovation dares to—and can—persistently build even at the trough of a cycle?

AnDY, Head of HI Labs, remarked: AI’s return to center stage is not simply another shift in market winds—it is the inevitable result of market filtering. When market momentum fades, models reliant on sentiment and subsidies inevitably collapse. By contrast, AI—as a tool that enhances efficiency and reduces costs—reveals its practical utility. Its value doesn’t require bullish validation; its cyclical resilience will be naturally confirmed in a cooled market.

Under this logic, the launch of the AINFT AI Service Platform carries symbolic significance. This platform is not a single model, but an open service network integrating multiple mainstream large language models—designed to deliver stable, accessible on-chain AI capabilities to developers and end users alike. By lowering barriers to entry and reducing costs, it embeds AI tools directly into everyday on-chain interactions, content generation, and data analysis—making AI a genuinely “usable infrastructure” in crypto. This practice, in itself, is the clearest possible embodiment of long-termism: prioritizing tool-based utility over narrative-driven speculation.

- How Can DeFi Survive Cycles? A Deep Dive into Structural Resilience in the TRON Ecosystem

This emphasis on “tool-based value” and “endogenous demand” defines AI’s role in bear markets—and equally underpins the philosophy of DeFi ecosystems. TRON’s DeFi stack, too, demonstrates resilience through sustained operation and authentic user retention—serving as a vivid exemplar of “anti-cyclical” design. Panelists unpacked this case in layers, dissecting its core resilience mechanisms.

Crypto.0824 pointed out that TRON’s DeFi system survives cycles thanks to “low friction and real-scenario-driven design.” He observed that many bull-market DeFi projects rely fundamentally on high APY incentives to attract liquidity—a model resembling a capital game that collapses once sentiment wanes or incentives taper off. In stark contrast, TRON’s DeFi ecosystem is built around real, high-frequency on-chain use cases: stablecoin swaps, staking, and lending. It does not bind users via incentives, but retains them by becoming the most practical and cost-efficient natural choice.

Anc Wang Feng and OxPink added the critical dimension of user experience. They argued that TRON’s DeFi survives cycles because it delivers a “launch-and-use, done-and-go—but come back again and again” frictionless experience. Rather than packaging complex financial models, it focuses squarely on serving massive volumes of real on-chain activity—thus cultivating the most solid user base.

Tian Tian substantiated this structural effectiveness with hard data: Even during periods of market fatigue, TRON protocols maintain stable profitability—generating over $216 million in protocol revenue in January alone. Its flagship DeFi protocol, JustLend DAO, maintains a steady TVL of approximately $6 billion, with borrowing rates consistently remaining within healthy ranges.

Meanwhile, the TRON ecosystem does not settle for financial resilience alone—it channels development gains back to the community via governance mechanisms. To date, governance token JST has completed two rounds of buybacks and burns, totaling over 1 billion tokens destroyed—10.96% of total supply. Additionally, SUN.io has implemented a mechanism to repurchase and burn tokens using protocol revenue. To date, over 650 million SUN tokens have been burned. These ongoing value-return and deflationary measures not only strengthen the token’s economic model but also clearly signal the ecosystem’s commitment to sharing long-term value creation with its community.

From consistent protocol revenue generation to active, multi-token value management across the ecosystem, these facts collectively demonstrate that ecosystems like TRON—which are grounded in real user needs and feature closed-loop value feedback—are not merely surviving bear markets with anti-volatility resilience, but are also laying down solid value foundations at the protocol level—building ample elasticity for market recovery. Thus, the key to surviving cycles lies in constructing structures like TRON’s: deeply rooted in real needs and anchored by value-closed loops. This is not just a survival strategy for bear markets—it is the fundamental logic of sustained value creation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News