Space Review|The Race for Tracks Enters the "Fulfillment Phase," Who Can Complete the Final Piece of the Bull Market Puzzle?

TechFlow Selected TechFlow Selected

Space Review|The Race for Tracks Enters the "Fulfillment Phase," Who Can Complete the Final Piece of the Bull Market Puzzle?

This Space aims to penetrate the fog of the market's differentiation phase, seeking and defining those ecosystem-level engines with a solid value foundation that can drive the next bull market.

After a prolonged period of volatility and stagnation, the recent crypto market has shown signs of stabilization and recovery in mainstream assets, with certain sectors leading the breakout. Market sentiment is gradually awakening from the deep freeze. However, unlike the "mini rallies" of the past driven purely by sentiment or news, this current trend reveals a clearer structure: capital is no longer blindly following trends but is beginning to concentrate in specific sectors along the trajectory of narratives and fundamental validation. The market seems to have entered a more critical watershed: the driving force of the market is shifting from expectations to realization, from broad-based gains to differentiation.

Among the many competing sectors and narratives, which can truly attract capital and achieve value realization, thereby completing the final piece of the bull market puzzle? This edition of the SunFlash roundtable delves into deep discussions on market phase assessment, the logic of sector realization, and future main themes, aiming to clarify the true underlying dynamics of the recovery and attempting to provide participants with a navigation map to traverse cyclical differentiation.

Is the Market Bottoming Out? Which Sectors Have Entered the "Realization Phase"?

Against the backdrop of the recent market's gradual recovery from low-level volatility, the nature of the market movement—whether it is a "brief mini rally" or a "sustainable structural recovery"—has become a focal point for investors. In the discussion of the first topic of this Space session, several guests shared their assessments from different perspectives.

Crypto波段王 first expressed a cautious view. Based on observations of historical cycles, he pointed out that this adjustment cycle has lasted about 6-7 weeks, similar in duration to some historical bottoming phases. Therefore, the current uptrend is more likely a phased rebound. His core argument lies in long-cycle technical indicators; for example, the monthly MACD has formed a death cross. Historically (such as in early 2022), such patterns often indicated that the market might still undergo a prolonged period of adjustment and bottoming after a rebound, rather than directly initiating a new bull market. He emphasized that although negative factors have decreased and some institutional capital has entered the market, risk management remains essential to avoid becoming passive due to excessive optimism in the later stages of the rebound.

小孩RIVER also stated that it is premature to draw conclusions. He pointed out that judging a structural recovery requires focusing on two core signals: first, the stability of mainstream asset prices, meaning gains need to be sustainable rather than characterized by short-term spikes and high volatility. Second, the rationalization of capital flows. A genuine structural recovery would not see capital frenziedly piling into a single hot topic but would instead show orderly rotation among different sectors like Layer2 and DeFi, indicating capital is making long-term allocations. He cautioned that in the current environment, investors should both avoid missing out due to panic and be wary of being misled by short-term sentiment.

As the market enters a more complex phase, investors' focus has shifted from "whether prices will rise" to "which areas are creating real value." In the second topic, the guests discussed sectors that have currently entered the "realization phase" and their core value manifestations.

ChainBitX believes the Real World Asset (RWA) sector exhibits significant characteristics of the "realization phase." He pointed out that RWA, by tokenizing traditional assets like government bonds and real estate, realizes verifiable real cash flows and institutional-level adoption. Its core value lies in providing stable yields of 6%-15%, and the total value locked (TVL) on-chain has experienced explosive growth from tens of billions to hundreds of billions of dollars in 2025, marking the transition of this narrative from concept to actual value capture and scale expansion.

墨鱼, while agreeing with RWA, further emphasized the realization potential of the stablecoin and payment sectors. He believes these two sectors are key bridges connecting cryptocurrency to real-world demand. The launch of products like payment cards is expanding cryptocurrency's application scenarios to daily consumption, while the stablecoin market is expected to reach a settlement scale of trillions of dollars by 2026 and is attracting traditional institutions. These two sectors realize large-scale practical application and massive capital flows.

YOMIRGO turned his attention to more cutting-edge infrastructure areas, expressing greater optimism for AI, particularly the AI Agent sector. He believes decentralized computing is a fundamental requirement for AI development, and Web3 can provide native identity and financial infrastructure for autonomous AI Agents. This sector realizes the underlying protocol capability for future human-machine interaction and value exchange, possessing long-term potential.

Seeking Key Narratives and Ecosystem Practices: What Can Become the "Final Piece of the Puzzle" for the Bull Market?

As the market foundation gradually solidifies, finding the "final piece of the puzzle" that can ignite a comprehensive bull market and absorb massive capital becomes crucial. Under this topic, the guests painted different pictures, but their core demands all pointed towards value carriers that are "large-scale, sustainable, and capable of connecting broader capital and users."

墨鱼 explicitly stated that the driving force for the next partial bull market is likely to come from the "smart economy" or AI sector. He believes AI is currently the only vast field that can simultaneously meet institutions' demands for efficiency and retail investors' demands for new opportunities, representing a new technological revolution. Related projects may have higher return expectations by 2026.

Similarly, guest YOMIRGO also focused on the AI sector, further deconstructing a future vision driven by AI agents. He believes AI can play a key role in two aspects: first, as an "automated investment manager" on-chain, it can analyze markets in real-time, seek yield opportunities in sectors like RWA, thereby enhancing the allocation efficiency of large-scale capital; second, as an "interaction gateway" for users, it can understand natural language instructions and automatically execute complex on-chain operations, significantly lowering the technical barrier for mass participation in Web3.

ChainBitX, from the perspective of asset and payment integration, emphasized the strategic significance of the "RWA + stablecoin" combination. He believes this combination perfectly aligns with the core characteristics required for the "final piece of the puzzle": it provides verifiable cash flows and compliance anchors through real-world assets, while leveraging stablecoins to achieve efficient on-chain circulation and value stability. This model can systematically lower the barriers and concerns for traditional capital entering the crypto space, thereby potentially opening a compliant, sustainable, and massive incremental capital channel.

Finally, 小孩RIVER further defined it from the underlying logic of market structure and capital capacity. He pointed out that the true "final piece of the puzzle" must be a direction with enormous capital capacity, such as "financial infrastructure" or "compliant derivatives." The core lies in simultaneously meeting the essential needs of different participants: providing institutions with compliant, transparent, and risk-controllable investment tools, and offering retail investors low-barrier participation opportunities and significant profit potential.

In the grand visions conceived by the guests, whether it's the AI-driven smart economy, the combination of RWA and stablecoins, or financial infrastructure carrying massive liquidity, their successful implementation requires a foundational ecosystem with strong synergy capabilities, a deep user base, and the ability to efficiently connect various elements as support.

Against this backdrop, the SUN.io ecosystem on TRON is demonstrating the potential to become this "key piece of the puzzle." Through the deep synergy of core products like SunSwap (decentralized exchange), SunX (decentralized perpetual contracts), and SunPump (Meme fair launch platform), the SUN.io ecosystem has already built an efficient internal value cycle. More notably, it has strategically undergone comprehensive upgrades and iterations for the AI agent SunAgent, which constitutes a key part of realizing the ecosystem's synergistic vision.

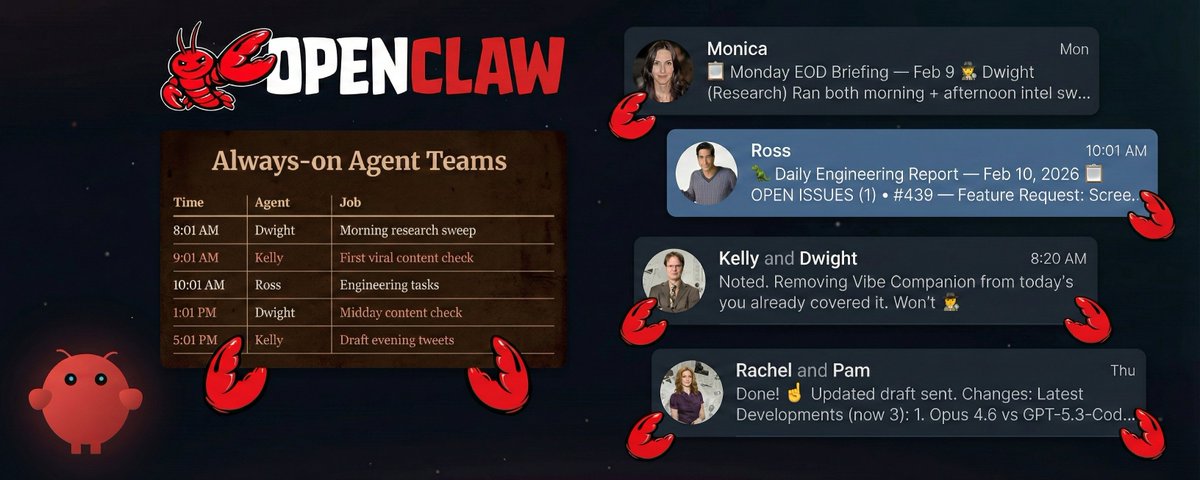

SunAgent perfectly responds to the guests' outlook on the AI sector. Its core functions are mainly reflected in two levels: First, as a universal intelligent interaction gateway, users can directly complete complex on-chain operations through natural language instructions, such as asset allocation, cross-chain transfers, or participating in liquidity mining, thereby greatly lowering the usage barrier and technical friction of Web3. Second, as an automated strategy tool for on-chain capital, it can analyze market data in real-time, autonomously seek optimal yield opportunities among DeFi protocols, and execute refined operations, thereby improving the utilization efficiency and return rate of large-scale capital. By deeply embedding the AI agent into TRON's DeFi ecosystem, SunAgent aims to become a bridge connecting user intent with complex on-chain financial operations.

This means the SUN.io ecosystem is integrating multiple key narratives envisioned by the guests—AI agents, stablecoins, derivatives, financial infrastructure—into an organic whole capable of achieving value cycles and synergistic enhancement. The SUN.io ecosystem is no longer merely a collection of products but a "value operating system" designed to streamline the entire process from capital entry, to intelligent interaction and management, and finally to value capture. Its core mission is precisely to assemble the various "puzzle pieces" into gears that drive each other, collectively constructing an "value flywheel" that accelerates the entire crypto market.

In the discussions of this Space session, a consensus gradually became clear: the market's evolution path is shifting from broadly driven narratives fueled by sentiment towards a "realization phase" validated by real cash flows and user value. In this screening process, sectors like RWA, stablecoin payments, and AI have already demonstrated solid value capture capabilities. However, a more forward-looking insight is that the explosion of a single sector may struggle to bear the full imagination of the next bull market. Ecosystem-level practices like SUN.io, which organically integrate technology, assets, users, and capital through a "value operating system," might point towards a more certain future. The final piece of the bull market puzzle may not be an isolated technology or asset, but a complete ecosystem capable of continuously generating synergistic effects and driving value cycles.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News